Sep 12, 2016 | coins, commentary, grading

Over the last few years there have been many numismatic writers who have taken to their keyboards to complain about the state of coins grading. Aside from your intrepid blogger there was a series of articles that appeared in Coin World by Q. David Bowers. In his articles, Bowers notes that even though the American Numismatic Association grading standards have not changed in quite some time, coins in older holders usually are graded higher today than they were when originally graded.

Over the last few years there have been many numismatic writers who have taken to their keyboards to complain about the state of coins grading. Aside from your intrepid blogger there was a series of articles that appeared in Coin World by Q. David Bowers. In his articles, Bowers notes that even though the American Numismatic Association grading standards have not changed in quite some time, coins in older holders usually are graded higher today than they were when originally graded.

One area where this is hurting the hobby is when trying to buy coins using online auctions. In a less than scientific study, I have noticed that while looking for a specific coin that coin once graded by the Professional Coin Grading Service in their old green holders (OGH) tend to sell at a price half-way to what it would be if it was the next grade higher. Coins in older Numismatic Guarantee Corporation holders sell close to a similar price.

It is not known how many coins are cracked out of their holders and submitted to the grading services are submitted as raw coins. Most of these “crack out artists” do not turn in the labels for the grading services to adjust their population reports. Some coins could be counted several times by all of the major grading services while collectors fish for better grades.

Part of the problem is with the concept called market grading. Rather than looking at the coin and determine the technical state of preservation, the grading services take that grade and try to rank it within the market of similar coins. In the mean time, they participate in forums that teach technical grading without explaining market grading.

Could there be a better way? On the CDN Publishing Blog is a post by Rick Snow suggesting a different type of grading system based on a 15-point technical scale. Coins would be graded on a 0-5 scale for the condition of the planchet, state of the die as struck, and the strike. In this notation there would be no “Full Bands,” “Full Head,” or similar designations. Those coins would receive a strike score of 5. If that Jefferson nickel does not show all six steps, then the strike would be a 4. A final column would be a color designator with either a percentage of color loss from the original strike or RD (red), RB (red-brown), or BN (brown) for copper coins.

Rather than seeing a grade like XF, AU, or MS and trying to figure out why the coin received the grade, a coin would receive a grade like:

“Adjectival grade” (“Qualifier”: “Factor for Planchet”, “Factor for Die”, “Factor for Strike”, “Color Designation”).

As an example: Gem AU (13: 4, 4, 5, 10%)

The “Qualifier” would be the sum of the factors for the planchet, die, and strike.

It is an interesting idea especially for the current bullion coins. Honestly, can anyone really tell the difference between an American Silver Eagle graded MS69 versus one graded MS70? Yet, just because a grading service can allegedly tell the difference, there could be a two-to-three times difference in the price. However, I wonder if those coins were cracked out of their holders and resubmitted would they maintain their grades?

Could you tell the difference if they were not in the holders?

-

-

2016 American Silver Eagle graded MS-69 by NGC

-

-

2016 American Silver Eagle graded MS-70 by NGC

Although the grading services claim that they are doing what is best for the hobby, they are for-profit corporations that has to satisfy a market that seems to be more interested in the plastic and the label than the coin it holds. Even these verification services are for-profit corporations that has owners and investors to answer to. One is even into “market making” by doing arbitrage-like trading of its own stickered coins. This type of market making questions their independence because it appears that they are using their influence to drive up the price of those coins.

Would this type of grading be better for the hobby by providing the collector with more information? Is there an alternative that would fix the current system? Or is the current system just fine? Read the article on the CDN Publishing Blog and leave comments there and/or here!

Sep 10, 2016 | coins, commentary, news, US Mint

The U.S. Mint announced that they will hold a one-day forum to “share perspectives on the past, present, and future of the numismatic hobby.” It is part of their preparation for the U.S. Mint’s 225th anniversary in 2017. The agenda will be the future of the Mint and the numismatic environment as a whole.

The U.S. Mint announced that they will hold a one-day forum to “share perspectives on the past, present, and future of the numismatic hobby.” It is part of their preparation for the U.S. Mint’s 225th anniversary in 2017. The agenda will be the future of the Mint and the numismatic environment as a whole.

“It seems only appropriate that, while we as a bureau are celebrating our history, the Mint is also looking for ways to improve the way we engage our customers and invigorate our relevance into the future,” said United States Mint Principal Deputy Director Rhett Jeppson.

It will be interesting to hear the discussion and to observe the outcome of this forum because of the limited things the U.S. Mint can do without an act of congress. Although the U.S. Mint can create medals without an act of congress many of the medals they produce are required by law such as the duplicates of the awards to congressional gold medal recipients. As for legal tender coins, most of what the U.S. Mint does is governed by legislation. Although there is some leeway in areas like special finishes for proof and other non-circulating legal tender (NCLT) coins, what the U.S. Mint is allowed to produce is governed by law (see 31 U.S. Code §5112).

One area that they U.S. Mint has had a lot of freedom is the with the 24-karat gold special issue coins. As part of the bill that created the Presidential $1 Coins, there was a section (31 U.S. Code §5112(q))) that allowed the U.S. Mint to string $50 gold bullion coins of .9999 purity (24-karat). The law says that only the first issue must resemble the 1913 Type 1 Buffalo Nickel. Subsequent designs are at the discretion of the Secretary of the Treasury with designs reviewed by the Citizens Coinage Advisory Committee and the U.S. Commission of Fine Arts.

Subsequently, the U.S. Mint used this law to issue the 2009 Saint-Gaudens Ultra High Relief Gold Coin, 2014 Kennedy Half Dollar 50th Anniversary Gold Coin, 2015 American Liberty High Relief Gold Coin, and the 2016 Centennial Gold Coins. Even though the coins are popular and their low mintage does help generate interest, these coins are not affordable to the ordinary collector.

One way to make these available to the average collector is to strike a version as a medal, similar to the First Spouse medals that resemble their gold counterparts without a denomination. First Spouse medals are struck on the same planchet as the modern dollar coins.

The U.S. Mint does not have the freedom other world mints have. It is highly regulated by a congress with a parochial view on its constitutional obligation to coin money (Article I, Section 8). Remember, the U.S. Constitution says that “The Congress shall have Power… To coin Money, regulate the Value thereof, and of foreign Coin,” not micro-manage the process.

From a collector’s perspective, I am not sure what the U.S. Mint can do. They can take notes and recommendations from this forum and ask congress to make changes. However, given the behavior of the members of congress does anyone really think that they will craft any reasonable legislation?

Shortly after the press release landed in my Inbox I responded to the U.S. Mint expressing my interest in attending.

Those interested in attending should submit requests to USMintNumismaticForum@usmint.treas.gov by no later than Sept. 15, 2016. Individual requests to attend should include the person’s affiliation (e.g., hobbyist, coin dealer, coin grader, etc.). Seating is limited and submitting a request does not guarantee admission. Attendance will be at the cost of the participant. Detailed information will be provided to confirmed attendees. For those unable to attend or who do not receive an invitation, any formal presentations made by the Mint during the forum will be made available online as soon as practicable after the event.

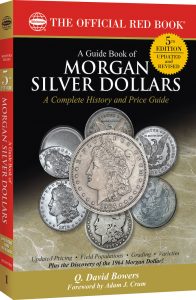

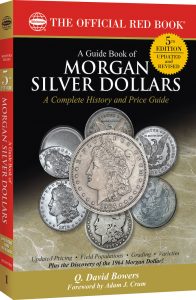

Aug 30, 2016 | books, coins, commentary, dollar, Morgan

That explosion you might have heard was the collective minds of the numismatic community when it was revealed that a 1964 Morgan Dollar exists, or at least once existed.

That explosion you might have heard was the collective minds of the numismatic community when it was revealed that a 1964 Morgan Dollar exists, or at least once existed.

The press release issued by Whitman Publishing for the new fifth edition of A Guide Book of Morgan Silver Dollars, by Q. David Bowers, that included the following paragraph:

The pricing, text, and certified population data in the fifth edition have been edited and updated. New research covers counterfeit error coins and other topics, including a numismatic bombshell: recent discoveries and photographs revealing the previously unknown 1964 Morgan silver dollar. (emphasis added)

Whitman included an image of the cover as part of its promotion of the book and features this coin. Its grey matte appearance with some flatness on Liberty’s face gives the appearance of a circulated coin.

No other information has been provided.

Close-up of the alleged 1964 Morgan Dollar from the cover of A Guide Book to Morgan Silver Dollars 5th Ed. by Q. David Bowers

Without seeing the evidence that is published in the book, the condition of the coin can lead one to question its authenticity. If the coin was a trial or experimental strike that coincides with the striking of the 1964 Peace Dollar, then should the coin appear uncirculated?

What if this coin was part of a rogue like the 1974-D Lincoln cent struck on an aluminum planchet? Did it really exist as a legitimate coin?

We will find out on September 27, 2017 when the book is scheduled to be released to retail outlets (or preorder on Whitman’s website). Until then, we are left to wonder if this is legitimate or a great fish story to sell books?

Cover photo courtesy of Whitman Publishing.

Jul 28, 2016 | commentary, dollar, US Mint

Like almost every business and government agency, the U.S. Mint has been leveraging social media to engage collectors and possibly attract new collectors to purchase coins. One of the places that the U.S. Mint engages the public is on Facebook.

Like almost every business and government agency, the U.S. Mint has been leveraging social media to engage collectors and possibly attract new collectors to purchase coins. One of the places that the U.S. Mint engages the public is on Facebook.

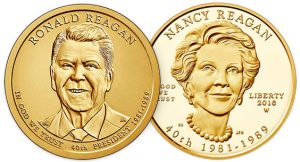

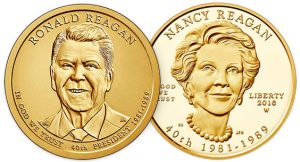

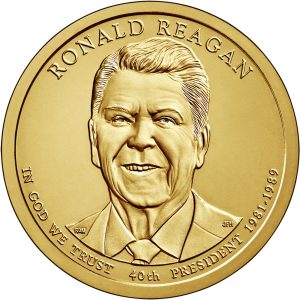

During the last few weeks the U.S. Mint has been appropriately promoting their products but interspersed between their posts are quite a number of posts have been several posts talking about the history of the president featured on the last coin issued in the Presidential $1 Coin program.

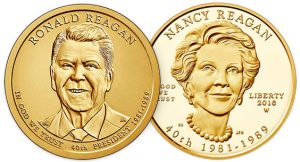

2016 Ronald Reagan dollar & 2016-W Nancy Reagan $10 gold coin

Aside from their over promotion of Reagan on social media, the U.S. Mint has a special section about Reagan’s life on their website. The information rivals something that would appear something on a history-related website or the Reagan Library.

Regardless of how one feels about Reagan, a federal agency should never favor one president over another. If the U.S. Mint has done the same for each of the presidents, then this would not be a problem. But to single out Reagan is counter to the nonpartisan mission of the U.S. Mint.

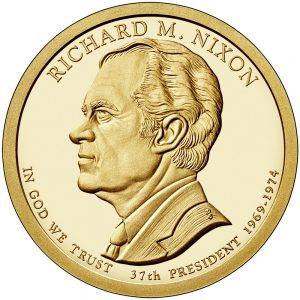

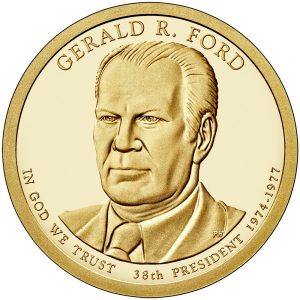

Why did the U.S. Mint pick Reagan for this type of treatment? Aside from the partisan issues, Reagan’s presidency would not be considered the most historic of those honored on dollar coins released in 2016. Gerald Ford was appointed Vice President in 1973 upon the resignation of Spiro Agnew. This was the first time that someone was appointed Vice President under the terms of the 25th Amendment to the U.S. Constitution. Prior to becoming Vice President, Ford was the House Minority Leader at the time and was well respected by both sides of the aisle.

Ford became the 38th president following the resignation of Richard Nixon marking the first time a president rose to the office without being elected to a national office. Using the 25th Amendment, Ford appointed Nelson Rockefeller (R-NY) as the Vice President.

Aside from presiding over the nation’s bicentennial, his transition from House Minority Leader to President not only tested the constitution but helped prove its strength in society. Although it was a difficult period for economic and world history, Ford was a significant figure in maintaining the union during this time.

Political rhetoric and correctness may have been a driver for the U.S. Mint to single out Reagan. Reagan was just another president compared to the tumultuous rise of Ford. If one president had to be honored for 2016, Ford’s presidency was more historic and deserves recognition.

2016 Presidential Dollar Releases

2016 Richard M. Nixon dollar coin

2016 Gerald R. Ford dollar coin

2016 Ronald Reagan dollar coin

All images courtesy of the U.S. Mint.

Jul 8, 2016 | coins, commentary, dollar, Federal Reserve, US Mint

2016 Ronald Reagan dollar & 2016-W Nancy Reagan $10 gold coin

On the Friday before the Independence Day celebration weekend, the U.S. Mint released the Ronald Reagan dollar and Nancy Reagan first spouse coin marking the end of the program.

The Presidential Dollar program has had an interesting history. Passed by congress in December 2005 and later signed by President George W. Bush, the Presidential $1 Coin Act (Pub. L. 108-145) ordered the U.S. Mint to create a $1 coin to commemorate the Nation’s past Presidents and an accompanying $10 gold coin to commemorate the President’s spouse (First Lady). Coins appeared in order that the president served and the president must be deceased for two year prior to the coin’s issue. Since Jimmy Carter is still living, he was bypassed and the last coin was for Ronald Reagan.

2012 First Spouse coin featuring Alice Paul

For the first time in the modern era the date, mintmark, and mottos “E Pluribus Unum” and “In God We Trust” struck into (incuse) the edge of the coin. The last time edge lettering was used on circulating U.S. coinage was in the 1790s.

With the edge lettering a new process for the U.S. Mint, it was no surprised that coins left the Mint without the mottos stamped in the edge. Dubbed the “godless dollar” the error caused an uproar over some people suggesting that the government was conspiring against religion by leaving the motto off of the coin. This was described as either a willful omission or a way to attack religion. There was no narrative that accepted that this was just a mistake.

Our national nightmare ended when congress updated the law (Pub. L. 110-161) to move the motto from the edge to the obverse of the coin. E Pluribus Unum, the date and mintmark was left on the edge.

Then there was the breathless story by National Public Radio that decried the tax dollars being wasted by the approximately $1.4 Billion of dollar coins being stored in the Federal Reserves’ vaults. The story was filled with partial truths and did not properly explain the situation. When I tried to reach out to NPR, I was rebuffed by a reporter who decided a low-level Treasury staffer who did not have the first clue about reality was more credible

While the media was blaming the U.S. Mint and the Federal Reserve, they forgot to read the law. According to the law, there were mintage minimums that congress wrote into the law including the one that said the Sacagawea dollar was to comprise one-third of the dollar coin production. As part of the legislation, the U.S. Mint and Federal Reserve were supposed to promote the coin’s use and provide educational materials for the public.

Congress, who wrote and passed the original legislation, was tripping all over themselves to introduce bills to end the program while pounding their collective chests claiming they were acting in the public interest.

This nightmare ended when then Treasury Secretary Tim Geithner ordered a reduction in the production of all dollar coins. None of the bills introduced to eliminate the dollar coin were ever heard in committee and died at the end of the 113th congress.

But the series couldn’t continue without one more controversy. The way the law was written, it was interpreted that it would end with the first living president. In this case, the program would have ended with the coin honoring Gerald Ford since Jimmy Carter is still living. This did not sit well with the fans of Ronald Reagan who have spent the time since his convalescence and death trying to plaster his name all over everything including an airport that employed air traffic controllers he fired placing the nation’s skies at risk.

The same members of congress that introduced bills to eliminate the program were now demanding the program be extended by one president. Ironically, they waited until after the resignation of Mint Director Edmund Moy and approached the acting Director Richard Peterson. Although Peterson was named acting director, he was a career government employee with impeccable credentials but had to have a different relationship with the politicians than an appointed director would. The matter was deferred to Treasurer Rosie Rios and Secretary of the Treasury Jack Lew who approved the extension of the program.

Presidential Dollars

- 2007:

- George Washington, John Adams, Thomas Jefferson, James Madison

- 2008:

- James Monroe, John Quincy Adams, Andrew Jackson, Martin Van Buren

- 2009:

- William Henry Harrison, John Tyler, James K. Polk, Zachary Taylor

- 2010:

- Millard Fillmore, Franklin Pierce, James Buchanan, Abraham Lincoln

- 2011:

- Andrew Johnson, Ulysses S. Grant, Rutherford B. Hayes, James Garfield

- 2012:

- Chester A. Arthur, Grover Cleveland, Benjamin Harrison, Grover Cleveland

- 2013:

- William McKinley, Theodore Roosevelt, William Howard Taft, Woodrow Wilson

- 2014:

- Warren Harding, Calvin Coolidge, Herbert Hoover, Franklin D. Roosevelt

- 2015:

- Harry S Truman, Dwight D. Eisenhower, John F. Kennedy, Lyndon B. Johnson

- 2016:

- Richard M. Nixon, Gerald Ford, Ronald Reagan

First Spouse Gold $10 Coins

- 2007:

- Martha Washington, Abigail Adams, Thomas Jefferson’s Liberty,† Dolley Madison

- 2008:

- Elizabeth Monroe, Louisa Adams, Andrew Jackson’s Liberty,† Martin Van Buren’s Liberty†

- 2009:

- Anna Harrison, Letitia Tyler,‡ Julia Tyler,†† Sarah Polk, Margaret Taylor

- 2010:

- Abigail Fillmore, Jane Pierce, James Buchanan’s Liberty,* Mary Lincoln

- 2011:

- Eliza Johnson, Julia Grant, Lucy Hayes, Lucretia Garfield

- 2012:

- Alice Paul,¶ Frances Cleveland (first term), Caroline Harrison,‡ Frances Cleveland (second term)

- 2013:

- Ida McKinley, Edith Roosevelt, Helen Taft, Ellen Wilson,‡ Edith Wilson††

- 2014:

- Florence Harding, Grace Coolidge, Lou Hoover, Anna Eleanor Roosevelt

- 2015:

- Elizabeth Truman, Mamie Eisenhower, Jacqueline Kennedy, Claudia Taylor “Lady Bird” Johnson

- 2016:

- Patricia Ryan “Pat” Nixon, Betty Ford, Nancy Reagan

Footnotes:

- †

- President was widowed prior to inauguration

- ‡

- First Spouse died during the president’s term

- ††

- Married the president during the president’s term

- *

- James Buchanan was the only bachelor president

- ¶

- President Chester Arthur was widowed prior to inauguration. However, the authorizing law gives the coin honor to Alice Paul, a suffragette who was born during Arthur’s administration

When the Reagan dollar was issued, 39 presidents representing 40 terms were issued.

Along with Nancy Reagan, 35 other first spouses were honored (Frances Cleveland appeared twice), four different Liberty coins were issued, and one was issued to honor suffragette Alice Paul.

President Reagan horseback riding at Rancho del Cielo with Freebo (his daughter’s dog) and Victory the golden retriever following.

As the program now quietly rides off into the proverbial sunset, maybe it is time to let the America the Beautiful Quarters® complete their run through 2021 and give the circulating commemoratives a rest.

Credits

- Coin images courtesy of the U.S. Mint

- Reagan on horsback “April 4, 1986 photo courtesy Ronald Reagan Presidential Library and Museum.” Downloaded from PresidentialPetMuseum.com

May 21, 2016 | ANA, commentary, shows, technology

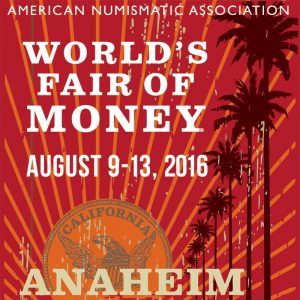

I received a note in my email from the American Numismatic Association asking for members to propose a Money Talks session at the World’s Fair of Money in August. Although I have several ideas for a Money Talks session, I will not propose a talk because I may not be able to attend the show.

I received a note in my email from the American Numismatic Association asking for members to propose a Money Talks session at the World’s Fair of Money in August. Although I have several ideas for a Money Talks session, I will not propose a talk because I may not be able to attend the show.

Later in the list of incoming email was a note telling me that I can register online for Summer Seminar. I have wanted to attend the classes in Summer Seminar for some time. In this case, the problem is timing since it always is held at the end of June or the beginning of July, the change of a fiscal quarter.

I know that the ANA has to create a schedule that suits the greater organization and includes the availability of facilities for these events but there are some of us who will be left out because of scheduling conflicts.

There are also the travel issues. Aside the expense of travelling to Anaheim or Colorado Springs, there are people who cannot travel because of time, economics, or physical limitations.

Now is the time for the ANA and any other organizations that provides educational sessions to consider adding online access to their shows.

Anyone who has visited the new money.org has seen that the ANA has revamped the site and the services to be modern, flexible, and has new resources that were not available years ago. It supports a vibrant community and provides new resources.

Now it is time to take the next step: Live coverage of shows, the broadcast of courses and lectures, and virtualize the conventions.

Now it is time to take the next step: Live coverage of shows, the broadcast of courses and lectures, and virtualize the conventions.

There are technologies that can help support the bringing the lectures, courses, and other activities to an online community. There are a number of web-based conferencing system that requires a minimal amount of technology to broadcast these activities to collectors everywhere.

This can also be employed for other shows. Convention centers, hotel conference rooms, and other venues are almost all connected.

I recognize that there are some courses that cannot be taught in this manner. Classes that require physical access to materials, such as coin grading, will have a difficult time in this environment. However, a grading “light” class using high quality images to show the differences on the screen can be taught.

In other words, instructors would have to rethink their approach to some of these classes.

Virtual shows cannot replace the advantages of being there. I like the ability to see and talk with the people and dealers; looking through some of the more esoteric numismatic items like medals and tokens; or just walking by a table to find something interesting and unexpected you would not find online.

Virtual shows can be recorded, stored, and enjoyed for some time to come. Classes and talks becomes long term references for the community and can be used to help promote future shows.

Although the ANA does have some recording of the Money Talks lectures its available after the fact at the will of the commercial organization that is providing the recording services. Not only should these videos be made available to members but should be broadcast live. If they are broadcast using web-based conferencing software, the online audience can participate.

Numismatics has the problem of being too young to have influence or too old to adapt to the new ways of the world. Moving more to online access will help bring in the that Lost Generation between those being a Young Numismatist and us older collectors

Looking at the demographics of the hobby’s future the first wave of the GenXers are now becoming AARP eligible with their children, the Millennials, 20 years away from being regular participants. Why not meet them where they hangout: online! Not only will virtual shows help those of us with travel and time restrictions but will attract new members.

Growing the hobby is like growing a business; you have to look at what your target market’s demographics are and figure out how to reach them. For hobbies like numismatics, the new target is online where the current generation is moving and where the next few generations will be. Not adapting to those new markets will hurt the numismatic market in a way that it may not recover.

Panorama of the 2013 National Money Show bourse floor at the Ernest N. Morial Convention Center in New Orleans

May 16, 2016 | coins, commentary, nickels, poll

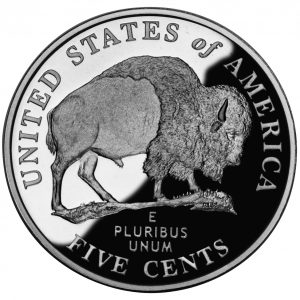

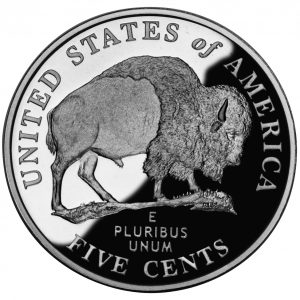

After reporting about the petition to return the Buffalo nickel to circulation, I thought I would ask my readers. Since I have not updated the polls for a while, I thought this was a good topic to begin this week.

After reporting about the petition to return the Buffalo nickel to circulation, I thought I would ask my readers. Since I have not updated the polls for a while, I thought this was a good topic to begin this week.

While I love the design by James Earle Fraser and have starting hoarding Buffalo nickels during my estate finds, I am not sure that this is a design that would work on today’s nickel. Collectors of Buffalo nickels can tell you that while a great design the elements do not wear well especially on critical high points, such as the buffalo’s horn.

Possibly a better idea is to bring back the design of the 2005 Westward Journey American Bison nickel. Aside from having a better portrait of President Thomas Jefferson than the one currently in use, the bison on the reverse appears to work better on modern coins. Maybe the bison can be given a new look, but it would be a better version for today’s market.

-

-

-

2005 Westward Journey Nickel Reverse

What do you think?

Loading ...

Westward Journey nickel imaged courtesy of the U.S. Mint.

Apr 25, 2016 | ancient, coins, commentary, policy

Over the last few years, I have asked readers to sign various petitions and write to the Department of State to stop restrictions on ancient coins.

Over the last few years, I have asked readers to sign various petitions and write to the Department of State to stop restrictions on ancient coins.

Once again, the Ancient Coin Collectors Guild (ACCG) needs your help. This time, the Greek government has requested changes to the Memoranda of Understanding that can hurt ancient coin collectors.

Please read the following letter that was sent by ACCG President Peter Tompa. If you would like to help, please use the links in his letter. Thank you!

Dear Fellow ACCG Member:

The State Department’s Cultural Property Advisory Committee is soliciting public comments for the upcoming renewal of a Memorandum of Understanding with the Hellenic Republic. Current restrictions exempt certain ancient Greek Trade coins, including Athenian Tetradrachms, Corinthian Staters and Tetradrachms of Alexander the Great and his father, Philip, as well as later Roman Imperial and Byzantine coins. On the other hand, many other ancient Greek coins are restricted, including larger denomination coins of many Greek City states and smaller denomination silver and bronze coins of Alexander and his successors.

Please write CPAC expressing concerns about the current restrictions and any effort to expand the current designated list. Comments should focus on how import restrictions have damaged collecting, the preservation of coins, the study of the history they represent, the appreciation of other cultures, and the people to people contacts collecting brings.

While it’s easy to be cynical that public comments are ignored, silence will be taken as acquiescence about the State Department’s actions which have already diminished the supply of ancient coins available on the market.

Comments are due on or before 11:59 PM on May 9th. For a direct link to comment on the government website, go to https://www.regulations.gov/#!documentDetail;D=DOS-2016-0009-0001 and click on the blue “comment now” button in the upper right hand corner of the screen.

For additional background along with suggestions on what to say, see http://culturalpropertyobserver.blogspot.com/2016/03/please-comment-on-proposed-renewal-of.html

For details about what coins are currently restricted, please see https://www.gpo.gov/fdsys/pkg/FR-2011-12-01/html/2011-30905.htm

Sincerely,

Peter K. Tompa

Apr 23, 2016 | advice, coins, commentary, legal

If you have not visited Etsy, you will find a shopping site where you can find unique items that are not available elsewhere. Most of the sellers on Etsy sell handmade designs, vintage items, repurposed vintage items, supplies, and unique low volume goods. It would not be farfetched to call Etsy an Internet craft fair and a neat place to go shopping.

One of the more interesting items on Etsy are coin jewelry. Coin designs are themselves a form of art but can become ordinary when repeated over millions of coins. Take a meaningful design and add it to a bezel, attach it to a pendant, or hammer it into a ring and these artists take the coins to the next level.

Many of these artists will take requests for the type of coin for their creations. Some will even let you send a special coin or a coin they cannot obtain to create your design.

A quick search on Etsy for coin jewelry found over 100,000 different jewelry items including bracelets, rings, earrings, bracelets and more. Aside from the different types of jewelry the artists will also use coins from all around the world including the United States, United Kingdom, Canada, Norway, and more.

Resin ear rings made by InspiringFlowers using Roosevelt dimes

1996 Half Dollar Ring by LuckyLiberty

Hummingbird cut from a Trinidad and Tobago penny by SawArtist

Click on the image to visit artist’s store

Coin jewelry hunters may be unknowingly accessories to a crime. According to an article in The Straits Times, it is illegal to make jewelry using coins from Singapore.

Like many other nations, Singapore takes pride in the art on their coinage. Aside from being their means to promote commerce, they are used to represent their culture and society. However, the Monetary Authority of Singapore (MAS), the Singapore equivalent of the U.S. Treasury Department, has said that under Singapore’s Currency Act, it is illegal to “mutilate, destroy or deface” their money. Offenders can be fined up to $2,000.

If you search for “Singapore coin jewellery” (the British spelling of “jewelry”) on Etsy, you will find around 200 different jewelry items returned as part of the search. It is common to see Singapore flower series coin or older coins that featured seahorses.

Painted Singapore Dollar coin ring by Monedus

1990 Singapore Horse bullion coin 1/20 oz. in a ring by BritanniaJewelry

Pendant made using a cutout 1979 Singapore coin

Click on the image to visit artist’s store

None of these artists are based on Singapore

While United States law allows for people to use coins for jewelry or other purposes as long as there is no attempt to use them as legal tender currency (18 U.S.C. § 331), this might not be the same for other countries. Although European laws are similar to those in the United States, there is some question as to whether the laws of Canada and Australia can be interpreted to have the same restrictions as Singapore.

When I asked an attorney, he questioned whether an international buyer would convicted of a crime. We both agreed that if you buy jewelry with an international coin, leave it home if you plan to visit that country.

Etsy was asked for a comment but attempts to contact them via email has not been answered.

All images are courtesy of their respective artists on Etsy.

Apr 22, 2016 | commentary, gold, US Mint

Obverse of the Mercury Dime 2016 Centennial Gold Coin

Although I was in a meeting, I tried to purchase this coin using the U.S. Mint app on the iPhone. Basically, the U.S. Mint app on the iPhone does nothing more than distill the mobile version of the U.S. Mint website on the iPhone. Since the app was not working properly, I opened Safari and tried to use the website directly. By the time I was able to get the system to respond, the coin sold out.

Even though the U.S. Mint revamped the website, hired a new integrator, and added more capacity to the communications lines that lead to the server, the website failed to be able to handle the requests. The U.S. Mint hired a new contractor to make these improvements but still cannot get it right. Their website is not programmed to handle the crush of a popular product.

As someone who has worked in the government for many years, we usually have to undergo a review of recent events to learn about what went wrong in order to fix the problems for next time. These reviews look at every aspect of the process and recommend changes. It appears that if the U.S. Mint performed these after action reviews they did not learn their lessons from past mistakes.

Now is the time for the U.S. Mint to get out of the e-commerce business and hire a company that understands how to manage peak volumes. Services like Amazon and eBay have figured out how to manage users flooding their systems. I am sure that sales related to the U.S. Mint would not approach the traffic that comes on shopping holidays like Cyber Monday.

Does Ticketmaster sell e-commerce solutions? The software they use that adds you to a queue to wait until you can order because the system has been flooded. In the cases when I used Ticketmaster or Live Nation, their sister site, to buy tickets to popular shows, I was forced to wait on the virtual line before being able to purchase tickets.

Regardless of the model the U.S. Mint uses, they must do something. Either they need to figure it out or maybe a discussion with the Treasury Office of Inspector General may be worth the effort.

NOTE: The U.S. Mint sent a note to the media saying that they would have a statement regarding the sellout on Friday (today). At the time of this writing the U.S. Mint has not released a statement.

Over the last few years there have been many numismatic writers who have taken to their keyboards to complain about the state of coins grading. Aside from your intrepid blogger there was a series of articles that appeared in Coin World by Q. David Bowers. In his articles, Bowers notes that even though the American Numismatic Association grading standards have not changed in quite some time, coins in older holders usually are graded higher today than they were when originally graded.

Over the last few years there have been many numismatic writers who have taken to their keyboards to complain about the state of coins grading. Aside from your intrepid blogger there was a series of articles that appeared in Coin World by Q. David Bowers. In his articles, Bowers notes that even though the American Numismatic Association grading standards have not changed in quite some time, coins in older holders usually are graded higher today than they were when originally graded.

Now it is time to take the next step: Live coverage of shows, the broadcast of courses and lectures, and virtualize the conventions.

Now it is time to take the next step: Live coverage of shows, the broadcast of courses and lectures, and virtualize the conventions.