Mar 17, 2016 | cents, coins, commentary, legal, news, US Mint

1974-D Experimental Lincoln cent pattern made using an aluminum planchet (J2151)

In 1974, as part of the effort to find a composition that would replace the 95-percent copper planchet for the one-cent coin that was used at the time, the U.S. Mint struck 1.4 million as patterns with the intent on destroying all of the coins struck when completed.

Congress did not like the concept fearing that their silver color would confuse them with other coins. Additionally, the aluminum composition could not be detected in vending machines nor would show up on an x-ray if swallowed. The coins were melted down.

Patterns that were struck for this test were made entirely in Philadelphia.

Which brings us to the story of the 1974-D cent pattern in this story.

Harry Lawrence who retired as deputy superintendent of the Denver Mint in 1979 owned this coin. Lawrence died in 1980. Harry’s son, Randall, discovered the coin in 2013 after moving to La Jolla from Denver and selling a bag of his father’s old coins to Michael McConnell at the La Jolla Coin Shop.

McConnell had the coin graded by Professional Coin Grading Service as MS-63 and determined it to be a genuine pattern. They were going to offer the coin for auction when the government stepped in to stop the sale and demanded its return.

Michael McConnell (left) and Randy Lawrence (right) returned the rare 1974-D penny made from aluminum back to the U.S. Treasury Department Thursday afternoon. — Nelvin C. Cepeda

There is one caveat to this story: there is no record of Denver ever striking such a coin. According to Randy Lawrence, the coin was given to his father when he retired from the Denver mint.

When Lawrence and McConnell sued the government to end the demand order, it is reported that Alan Goldman, former interim Mint director who headed the aluminum cent project, speculated in his deposition that the coin might have been made as part of a practical joke. Goldman allegedly named a suspect whose name was not released but is reported to be deceased.

The ensuing lawsuit lasted about two years and was settled today with McConnell returning the coin to the U.S. Mint on March 17, 2016.

The precedence this ruling is more dangerous for the hobby than people think. The most important issue is that it puts into jeopardy the status of the five 1913 Liberty Head nickels. Created under allegedly similar circumstances, the U.S. Mint has no record that these coins were ever produced. Although the government has tacitly agreed not to pursue that coin, there may be a time when someone with a more parochial view might use this situation to recover alleged chattel as property of the state.

Rulings like this will likely keep any surviving 1964-D Peace dollars hidden from the public. This will partially bury the history of turmoil in the coinage markets of the early 1960s. Hiding history is never good for anyone.

Mar 9, 2016 | bullion, coins, commentary, Eagles, economy, silver

What began as an English proverb as “March comes in like a lion and goes out like a lamb” may become a relic of history. Aside from the weather implications the markets are experiencing a lion-like robustness that even has the governors and branch presidents of the Federal Reserve issuing conflicting statements about the future of interest rates.

What began as an English proverb as “March comes in like a lion and goes out like a lamb” may become a relic of history. Aside from the weather implications the markets are experiencing a lion-like robustness that even has the governors and branch presidents of the Federal Reserve issuing conflicting statements about the future of interest rates.

While the professionals are attempting to figure out what the economic numbers are saying, one thing is clear that the U.S. Mint is on pace to break its 2015 sales for American Silver Eagle bullion coins. March opens with the U.S. Mint announcing that it has another 1 million silver coins ready for sale. This is the fifth time in 2016 that the U.S. Mint has made this type of announcement.

Year to date, gold prices are up about 17-percent and silver prices are up 11-percent. This has not stopped the buying of bullion coins. One Canadian dealer recently informed me that they sold out of a specific silver issue from the Royal Canadian Mint because of high demand, especially from the United States.

This is reaching beyond collectors. While the numismatic world was focused on Dallas for the National Money Show, my business kept me in the D.C. area as a vendor at one of the largest antiques shows in the mid-Atlantic region. Although coins are a very minor part of the show, some dealers that were selling silver coins had high volumes of sales. One dealer reported that he sold out of the 30 American Silver Eagle bullion coins graded MS-70 by the middle of the show’s second day.

An informal poll of attendees to the National Money Show suggests similar sales performances.

Even though there may be areas of the economy that has not caught up to the current economic trends, it is difficult to find an analyst or pundit that does not believe that the current trends will end in the short term.

It is likely that March will go out like a raging bull, even if I could not find a one-armed economist to disagree!

Jan 20, 2016 | coins, commentary, news, policy, US Mint

United States Branch Mint in Denver. In 2015, Denver produced over 8 billion coins, more than any other mint!

On January 11, 2016 the U.S. Government Accountability Office (GAO) release a report (GAO-16-177) about the “Implications of Changing Metal Compositions.” The GAO, an agency of the Legislative Branch, is supposed to be an independent, nonpartisan agency that investigates how the government spends taxpayer dollars and reports their findings to congress. It is important to remember that the GAO does not investigate for the sake of investigating agencies. They are asked by members of congress for a report about the implementation of specific policies. This report was requested by Rep. Bill Huizenga (R-MI), Chairman of the Subcommittee on Monetary Policy and Trade under the Finance Committee.

NON-NEWS FLASH: The U.S. Mint spends more money on the metals used to strike one- and five-cent coins than their face value.

“Wait,” you say. “That’s not news.” Of course you are right because you are an astute collector and a reader of the Coin Collectors Blog! Unfortunately, those who write news stories point to this GAO report to show that they are correct for proposing their narratives supporting changes to be made at the U.S. Mint. By focusing on the metals costs misses the entire story.

Experimental test strikes of the 5-cent denomination using Martha Washington/Mount Vernon nonsense dies were produced on planchets of the same copper-plated zinc composition used for the current Lincoln cents.

Changing coinage metals will not translate into instant savings. In fact, for the first two-to-three years it might show a loss greater than if congress would leave the metals composition the same. It is not clear whether the current die making and coining presses would work with a different planchets. And we are not talking about a few presses. Can you imagine how many presses were needed in Philadelphia and Denver to produce over 8 billion coins in each location in 2015?

If I remember correctly from my last visit to the Philadelphia Mint, there were 20 presses in one row of presses in Philadelphia. Four rows were used to strike one-cent coins in three 8 hour shifts. There were two rows striking five-cent coins. Change the composition of these coins and that means the U.S. Mint will have to make changes to 120 presses!

That only covers the physical changes to the presses. Since most of the alternative alloys are harder than the current cupronickel alloy, dies will have to be replaced more often, the presses will require additional maintenance, and the processing will have to change. There are annealing machines, upsetting mills, and internal transportation systems that would have to be changed for the new alloys.

I spoke with a friend who works for a major manufacturer with facilities all over the world. During the discussion I was reminded of the usual changes in manufacturing that causes interruptions but are significant to think about. For example, oil refineries can close for two-weeks to a month in order to be retooled in order to change the production of fuel blended for cold weather driving to those for warmer weather driving. These costs are built into the prices you pay at the gas pump.

Similarly, an automobile manufacturer that changes model designs have to close to retool and retrain employees on the new designs. Making simple changes are easy. Change a body style and the entire line has to close at a cost to manufacturing.

Coining machines striking one-cent coins at the U.S. Branch Mint in Philadelphia.

The other story missed is that the GAO claims that the coin-operated industry over estimated their estimation on the costs to the industry if change is changed. The GAO report cites a 2014 study provided to the U.S. Mint by the National Automatic Merchandising Association (NAMA), the $45 billion per year vending industry trade association in the United States, which says it will cost from $100 to $500 per machine to convert them to accept new coinage while the old coinage continues to circulate.

While trying to justify the over estimation claim, the GAO actually strengthens the NAMA argument by not controverting the per machine cost.

The GAO does not consider that the NAMA does not represent the entire coin-op industry. The American Amusement Machine Association (AAMA) represents coin-op games (video, pinball, etc.), fair operators, gum ball machine manufacturers, jukebox manufacturers, and similar businesses. When the report was first discussed, then AAMA President John Schultz was reported to have said to leave the coinage alone “because it works, rather than risk the costly consequences.” AAMA has not provided an estimate for those costly consequences.

Another consequence would be changes that the government would have to undergo to support new coinage alloys. Any location that the government relies on cash transactions would have to be updated accordingly. While the Postal Service has eliminated most of their vending machines in favor of automated kiosks, this change will hasten a complete removal of those vending machines that continue to operate in areas where electronically connected kiosks cannot be supported. This could leave people in remote communities without particular services they rely on.

Aside from parking meters, how many vending machines, coin-op washers and dryers, change machines, even vending machines will have to be updated at your expense?

Someone my say to just eliminate the one-cent coin. Why not? Canada did it, why can’t the U.S. do the same? The most significant problem is that this would change an economy that is over 9-times the size of the Canadian economy. Using the Gross Domestic Product (GDP), the total cost of goods and services, as a benchmark converted to U.S. dollar, the World Bank reports that the GDP of $1.5183 trillion in 2010, the last year statistics are available. Similarly, the U.S. GDP in 2010 was $13.9631 trillion.

Even if someone was able to figure out how this change will impact an economy that produces over $15 trillion in goods and services (2014 data), there are also the ancillary costs of changing machines, systems, services, and anything else that could be impacted.

Although it might seem easy to change the alloys used for coins or eliminate the lowest denominations, the impact reaches far beyond all analysis including that of the GAO. To tell everyone to “just deal with it” is an expensive proposition that will have to be paid for. Are you ready to pay more taxes for governments to “just deal with it?” More fees for services? Or dealing with a loss of services because in order to “just deal with it” because the service provider decided that it is better to stop providing the service than convert?

Credits

- Image of Denver Mint courtesy of Wikipedia.

- Image of Martha Washington trial strikes courtesy of the U.S. Mint via Coin World.

- Image of the Philadelphia Mint was published in a Numismatic Bibliomania Society E-Sylum newsletter provided by Sandy Pearl.

- Parking meter image courtesy of Parkifi.

Dec 19, 2015 | commentary, policy, US Mint

The day after announcing the end to mail order purchasing, the U.S. Mint issued a statement saying, “The United States Mint is currently analyzing a policy change to discontinue the distribution of mail order forms in 2016.”

The day after announcing the end to mail order purchasing, the U.S. Mint issued a statement saying, “The United States Mint is currently analyzing a policy change to discontinue the distribution of mail order forms in 2016.”

Product brochures that will be mailed in January will not contain a mail order form, probably because the production has been completed and would be too expensive to change at this time.

Word on the street says that a few people complained to their member of congress who then contacted the U.S. Mint. Although there are rumors as to the congress person that made contact with Treasury officials, there are no reports confirming the identity of the suspect.

Once again, congress proves that you cannot run the government like a business because in a business, the Board of Directors can demonstrate a modicum of common sense.

Dec 18, 2015 | commentary, grading, news, other

Exonumia are numismatic items that are items that represent money or something of value that is not considered legal tender coin or currency. When originally coined in 1960 by the founder of the Token and Medals Society (TAMS) Russell Rulau, the intent was to describe tokens, medals, and scrip. Over the course of time, other items have been added to exonumia category including some award medals and empherma like cancelled checks.

NGC John Mercanti Signature Label sample

Earlier this week, Numismatic Guaranty Corporation (NGC) announced that John Mercanti, the former 12th Chief Engraver of the U.S. Mint, has agreed to individually hand sign certification labels exclusively for NGC. Mercanti will autograph labels for coins bearing his design.

Last week, NGC announced that they struck a deal with Edmund C. Moy, the 38th Director of the U.S. Mint and currently the last full-time director, to autograph labels.

1982-S Washington Half with Elizabeth Jones Signature

In addition to signature labels, NGC has a primary brown label and lables for First Releases, Early Releases, Detailed Grade, 100 Greatest Modern Coins, Top 50 Most Popular Coins, and many others. Not to be outdone, the Professional Coin Grading Service (PCGS) has its own labels for First Strike, U.S. Marshals Service commemorative and 50th Anniversary Kennedy Half Dollar.

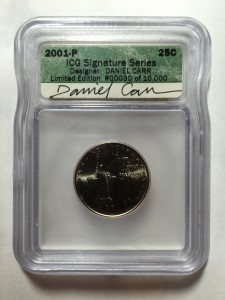

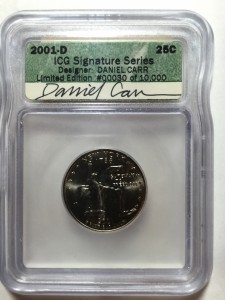

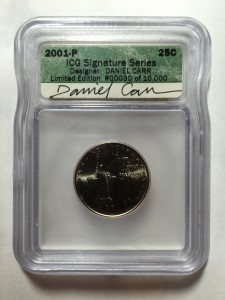

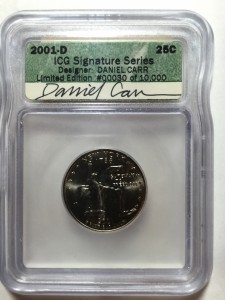

Even Independent Coin Graders (ICG) has been in the label business. Aside from their various label options, they also issued an autographed series as part of the 50 States Quarters program including the New York quarter designed by artist Daniel Carr that is part of my New York Hometown collection.

2001-P New York quarter with Daniel Carr’s autograph on ICG label

2001-D New York quarter with Daniel Carr’s autograph on ICG label

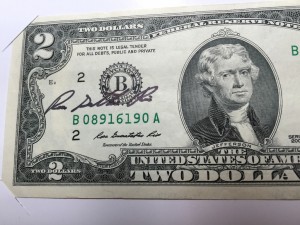

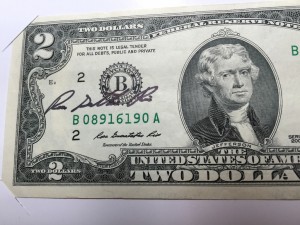

Autographs are not just limited to labels. Since becoming Treasurer of the United States, Rosie Rios has been a fixture at many numismatic events autographing Federal Reserve Notes that has her printed signature. Since Rios is a prolific signer, Rosie Dollars, as she as called them, are so common that her signed notes are not worth much more than face value.

Series 2009 Federal Reserve Note autographed by Treasurer of the U.S. Rosa Gumataotao Rios

Collecting numismatic-related souvenirs are not just limited to autographs, which also appear in books. Collectibles include show programs, badges, buttons, ribbons, tags, and other souvenirs related to shows, clubs, and other collecting endeavors.

Autographed slabs, money, books, programs, and other items that are collected because they are numismatic-related but not real numismatic items can be fun collectibles. As an effort to me more inclusive with all aspects of collecting items related to numismatics, it needs a name. Marketing folks will tell you that a good name helps promote your product.

I have an idea. We can call these collectibles numismentos. Numismento is a portmanteau of numismatic + memento.

For example, let’s say you have a collection of programs from the World’s Fair of Money shows you have attended? That would be a numismento. Are you a collector of the labels from the third-party grading services or their sample slabs? You are collecting numismentos. Collecting nametags, buttons, or other items from shows? These are also numismentos!

Numismentos. Numismentos are collectibles that demonstrate the culture of numismatics but are not numismatic items.

Happy numismentos collecting!

NGC Signature Series Holder images courtesy of NGC.

Other images are the property of the author.

Nov 24, 2015 | coins, commemorative, commentary, legislative, policy, US Mint

While reviewing my notes I noticed that I had this draft in my queue. Although drafted in July, I think the topic is still relevant.

In 2009, I wrote a six-part series “Reforming America’s Currency” out of frustration with how behind the United States is in its currency production process (not economic policy) as compared with the rest of the world. After all, the U.S. Mint and the Bureau of Engraving and Printing are the largest money manufacturers in the world. In Part 4, I wrote that the “first reform in commemorative coinage would be that no commemorative would be struck for the sole purpose of raising money for any organization. Regardless of how worthy the organization may be, the association of the commemorative with fundraising taints the process.”

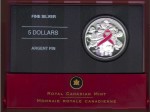

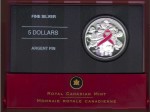

2006 Canada silver $5 Breast Cancer Commemorative Coin

In an astounding partisan move, some members of congress have chosen to display their political umbrage to try to derail a commemorative coin that has bipartisan support.

If you are not aware, the original version of H.R. 2722 would have given the proceeds to the Susan G. Komen for the Cure and the Breast Cancer Research Foundation. The argument was whether money raised by the commemorative should go to Komen. As a not-for-profit charitable corporation, Komen supports education and research to fight breast cancer. The organization, founded in 1983, has been one of the more successful organizations in education and providing research funds in the fight against breast cancer.

Komen is not without controversy. Most have been within the last 10 years when the organization has grown to such size and scope that some feel it may be more corporate driven than focused on its original mission. One of its controversies is its association with Planned Parenthood. Komen, who gives grants to organization for women cancer screenings, had been proving grants to Planned Parenthood earmarked for cancer screenings. Since Planned Parenthood has also had its share of controversies, social conservatives balked at the association.

More recently, Planned Parenthood has been accused of unethical practices regarding their medical-related practices. A video surfaced that claims someone at Planned Parenthood would be selling fetal tissue following abortions. It was a hidden camera video whose contents have not been verified. Although the video has some disturbing conversations, it is unknown whether this is an isolated incident or a policy followed by some.

Because of the politics surrounding the abortion issue, the policies of Planned Parenthood, and Komen’s support of Planned Parenthood’s cancer screening programs, Komen was open to attack by right wing demagogues looking to score political points rather by using the concept of guilt by association rather than rational thinking.

Canada’s non-controversial 2007 25-cent Breast Cancer circulating coin

Komen may have its controversies but the debate on this issue is beyond the pale. Their mission is for education and cancer research. Their mission should be as non-partisan as anything in this country. Cancer does not discriminate. Cancer will attack anyone at any time for any reason regardless of affiliation outside of being a sentient being.

To bring any other issue into the discussion, regardless of where you fall on the political spectrum, shows congress’s immaturity and that the basic function of raising money using commemorative coins should be discontinued immediately.

Some will be upset over my discussion of politics, but politics are part of the coin making process since the U.S. Mint cannot do much without permission. I also both sides of the issue, but for this debate, I do not care. When you have to go three-degrees of separation to dig up an issue in an unrelated political debate, it gets frustrating. It is yet another illustrations as to why I am against using commemorative coins to raise money for any cause regardless of how I feel about the cause—and I have personal reasons for being in favor of cancer research and education. This debate should have NEVER devolved into a discussion about abortion. The fact that it did stoop to those depths proves that congress needs to get out of the commemorative coin business. It will be one less area they can mess up.

Nov 18, 2015 | BEP, cents, coins, commentary, currency, dollar, economy, Federal Reserve, US Mint

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Series 1935 $1 FRN Reverse Early Design

Every so often an article is written, usually by the political elite, about ending lower denomination coins for many reasons including the high cost of mintage or the inconvenience of their existence. Others point to rise of non-cash transactions and the rise of digitally created currencies as the future.

Those of us who work in areas outside the larger commercial world has experience with a cash economy that is not tied to economic status. One of those is the numismatics industry. While many dealers will take credit cards, and will pass along the fees along to the customer, many dealers have said that most of their off-line business is a cash-based business. While larger purchases are done using checks, most will leave shows with more hard currency than other types of payments.

1909-VDB Lincoln Cent

There are people who are leery of using credit and debit cards for every transaction. We use cash to limit our exposure. In this connected world, the credit and debit card leaves a digital breadcrumb that is available to be hacked. I cannot tell you how many times I watched people in local convenience stores punch in their codes in a matter I could see them and then leave their receipts behind. This could be used to steal your money and your debit cards are not covered the same as credit cards. But the public does not see this.

A week does not go by without a report of the hacking of personal information that should not be made public. Unfortunately, it is getting to be like rain on the hot-tin roof, after a while the sound blends into the background.

According to the Federal Reserve, there was approximately $1.39 trillion in circulation as of September 30, 2015, of which $1.34 trillion was in Federal Reserve notes. That represents a lot of money that would have to be accounted for if we were to go into a cashless society. It would take a significant effort that would not make for good public policy.

The calls to make changes to change are beginning to drone on as background noise like rain on a hot-tin roof.

Nov 13, 2015 | coins, commentary, counterfeit, news

The counterfeit quarter-ounce Krugerrand in a counterfeit NGC holder that was purchased in Fullerton, California.

The biggest threat to the numismatics industry is not the lack of participation by younger people, women, or people of color, all of which are problems, the threat that counterfeits pose will drive away potential collector and investors. Anyone that collects scarce or rare coins should be very concerned about counterfeits.

Industry heavyweight Dwight Manley issued a statement after his company was fooled by a counterfeit Krugerrand in a counterfeit third-party grading service holder. Here is the statement:

Beware of Frighteningly Deceptive Counterfeits

Statement By Dwight Manley

Prominent rare coin dealer and collector Dwight Manley, owner of Fullerton Coins & Stamps in Fullerton, California and Managing Partner of the California Gold Marketing Group, who assisted a quarter-century ago in breaking up a counterfeit coin and counterfeit holder scheme, has issued the following statement.

“A frighteningly deceptive counterfeit has been encountered, and the world needs to be told about it. We recently realized that a 2005-dated quarter-ounce South African Krugerrand labeled NGC Proof 70 is not only a counterfeit coin, it is housed in a counterfeit Numismatic Guaranty Corporation holder that has the same certification number on the label as a genuine 2005 PF 70 one-quarter ounce Krugerrand listed in the NGC data base.”

“The fake was purchased on October 23, 2015 by a knowledgeable employee of Fullerton Coins & Stamps over the counter from a semi-regular customer. Before making the purchase, the employee checked the NGC website to see if the certification number and coin description matched. They did: cert number 3676849-006.”

“I recently examined the coin, and it just didn’t look quite right. I did a side-by-side, inch-by-inch comparison between the encapsulated coin the store purchased and the obverse and reverse photos on the NGC website. The reproduction of the NGC hologram on the fake is almost dead on the same; however, there is one distinct difference between fake and genuine on the left side of the front insert label. On the fake coin, the circle in the NGC logo (an encircled balance scale) goes almost entirely around the P in the grade PF 70. On the genuine coin’s label, the P is outside the logo circle.”

“An amazing amount of effort obviously went into creating a fake coin and a fake holder with a cert number and description that match a genuine coin. I’ve notified NGC, but in the meantime, I caution collectors and dealers to watch out for any similar, deceitful and dangerous counterfeits.”

Sep 6, 2015 | coins, commentary, legislative, policy

Usually, I open the month with a report on the coin-related legislation from last month. In August, congress went on their summer vacation and did not work on any legislation. There are many who think that given the way congress has done little to nothing over the last few years, this may have been a good thing. When congress returns after Labor Day, there is work on their schedules. While I expect the same level of non-work as before their vacation, there are the issues that have a high probability of being worked on.

Usually, I open the month with a report on the coin-related legislation from last month. In August, congress went on their summer vacation and did not work on any legislation. There are many who think that given the way congress has done little to nothing over the last few years, this may have been a good thing. When congress returns after Labor Day, there is work on their schedules. While I expect the same level of non-work as before their vacation, there are the issues that have a high probability of being worked on.

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

Sponsor: Rep. Carolyn Maloney (D-NY)

• Introduced: June 10, 2015

• Passed the House: July 15, 2015

• Received by the Senate: July 16, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

• Summary:

- 2018 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 400,000 silver $1 coins with $10 surcharge

- 750,000 clad half-dollars with $5 surcharge

- Surcharge paid to Breast Cancer Research Foundation for the purpose of furthering breast cancer research

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

Aside that this would be a swan-song for an a long-serving representative that is retiring, even after the argument about who should receive the money the concept is popular in congress. It is likely to pass the Senate either as a formality or under a suspension of the rules with only a voice vote taken. If there are any votes against this bill, it will be from the senators who have said that they are against using commemorative coins as a fundraising mechanism (see H.R. 3097).

H.R. 1698: Bullion and Collectible Coin Production Efficiency and Cost Savings Act

Sponsor: Rep. Bill Huizenga (R-MI)

• Introduced: March 26, 2015

• Passed the House of Representatives on June 23, 2015 by voice vote

• Received in the Senate on June 24, 2015 and referred to the Committee on Banking, Housing, and Urban Affairs

Track this bill at https://www.govtrack.us/congress/bills/114/hr1698

Back in February, I wrote that congress was being lazy and that as members and their staffs were writing commemorative coin acts, they were copying from old legislation. While this makes it easy for them to deal with, the U.S. Mint has asked that this be changed to save money. Time and again, congress has been told that the U.S. Mint could save money if they standardized gold coins to 24-karat coins and silver to at least .999 fine quality. Aside from making the coins more attractive to more buyers including investors, the U.S. Mint does not have to pay more for someone to “dirty” the metals to create planchets that contain 90-percent of the metals.

This bill should be easy for congress to deal with. It does not spend any taxpayer money and has the ability to add money to the General Treasury. Since H.R. 1698 has passed the House under suspension of the rule (voice vote), it should not have problems in the Senate.

An issue that is likely to be raised that has been a part of a lot of bills is the elimination of the paper $1 note. This came up again when Sen. John McCain (R-AZ) was unequivocal about seeing the $1 note retired in favor of a coin. McCain has supported this type of legislation in the past but his going out of the way to emphasize this as an issue makes it interesting. As one of the oldest members of congress, his opinion is a minority of those of his generation. Surveys have shown there is a clear generational divide as to who supports this measure. When, the Baby Boomers (those born before 1964) and those older are overwhelmingly not in favor of eliminating the the paper note. The GenXers, those born 1965-1980, are almost evenly divided while the Millenials, those born since 1980, do not care because they are mostly tied to their credit and debit cards.

For the longest time, the Massachusetts delegation have held these types of bills back. This is because the Dalton, Massachusetts based Crane & Co., the maker of currency paper, has been the exclusive currency paper supplier to the Bureau of Engraving and Printing since 1879. Although Elizabeth Warren (D-MA) has become a more powerful figure in the Senate, she does not have the gravitas of a previous holder of that seat, the late Sen. Ted Kennedy (D). Additionally, with John Kerry now the Secretary of State and other changes in the House, like the retiring of Barney Frank (D-MA), the Massachusetts delegation does not have the same power as it once had. The only power the Senators have would be to filibuster any measure that would eliminate the $1 note. Whether they will do this remains to be seen.

Aug 26, 2015 | bullion, coins, commentary, gold, investment, silver, US Mint

Reference price of metals for this post (does not update)

Watching the price of gold has been interesting. Since the release of the 2014 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin when the price of gold was set based on the $1,290.50 spot price, the trend of gold prices has been to go lower. Gold spot hit a low almost one year to the day of the release of the Kennedy gold coin on August 5, 2015 at $1,085.10. It has taken three weeks to bounce back a little.

Gold Chart for August to date (does not update)

I call silver the precious metal for the masses. Aside from being less expensive it is still considered a valuable commodity. Aside from the aesthetics of the color (I love the look of chrome on cars) you can really see a great design on a larger silver coin than a gold coin for a lower cost. For example, I like the look of the larger Silver Panda over the yellow gold Panda—and it is cheaper!

While my interest is more of aesthetics and the costs between purchasing the different types of coins, you can get into a situation where the composition determines the price of a coin. After all, the most expensive coin to sell at auction was a 1794 Flowing Hair silver dollar with a rare die variety. For a non-precious metal coin, you can always look at the 1913 Liberty Head Nickels whose composition is 75-percent copper and 25-percent nickel. Sales of these coins have averaged around $3-5 million in the last few auctions.

Rare and key date coins notwithstanding, more people can afford silver than gold. As a result, we have seen a rise in the collecting of silver non-circulated legal tender (NCLT) coins. Although I am not a fan of many of these designs, the various mints creating them would stop if there was not a market for them. Since this is what people are buying, the mints are striking.

To some degree, the price of silver may be inconsequential to the cost of some of these NCLT sets. Coins like the Looney Tunes and DC Comics sets from the Royal Canadian Mint; Star Wars, Disney, and Dr. Who sets from the New Zealand Mint are priced to include royalties that will have to be paid to their respective copyright holders.

-

-

Royal Canadian Mint’s $100 Looney Tunes 14-karat Reverse

-

-

Could this Looney Tunes Silver Kilo coin be on your list?

Then there are the countries of Somalia, Niue, Tuvalu, and the Marshall Islands that do have their own mints but license their names or contract other mints to strike coins for them. Even though these coins may not require licensing fees, many are made with popular themes to entice collectors to purchase them. Seigniorage then goes to both the mint striking the coins and the general treasuries of country whose name is on the coin.

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Most mints will float the price of their bullion coins to reflect market forces but not the price of NCLT coins. Even the U.S. Mint does not adjust the price of commemorative coins if the price of the metals drops.

While there are collectors that view their collection in terms of its value and others collecting as an investment of those of us who collect for the sake of collecting, the dropping of metals prices can be seen as an opportunity to buy some nice collectibles cheaper than otherwise. However, never underestimate the greed of some of these mints and the companies that sign agreements with them that will keep your prices high.

I wonder how these coins will fare on the aftermarket in the future?

Image Credits

- Charts courtesy of Kitco.

- Looney Tunes coin images courtesy of the Royal Canadian Mint.

- Somalia motorcycle and sports car coins from author’s personal collection.

The day after

The day after

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Usually, I open the month with a report on the coin-related legislation from last month. In August, congress went on their summer vacation and did not work on any legislation. There are many who think that given the way congress has done little to nothing over the last few years, this may have been a good thing. When congress returns after Labor Day, there is work on their schedules. While I expect the same level of non-work as before their vacation, there are the issues that have a high probability of being worked on.

Usually, I open the month with a report on the coin-related legislation from last month. In August, congress went on their summer vacation and did not work on any legislation. There are many who think that given the way congress has done little to nothing over the last few years, this may have been a good thing. When congress returns after Labor Day, there is work on their schedules. While I expect the same level of non-work as before their vacation, there are the issues that have a high probability of being worked on.