Nov 15, 2019 | coins, commentary, education

Someone walked into my shop today with a box full of items he said that he wanted to consign to one of our auctions. He said that someone mentioned that I was knowledgeable about coins and wanted me to help liquidate his collection.

Someone walked into my shop today with a box full of items he said that he wanted to consign to one of our auctions. He said that someone mentioned that I was knowledgeable about coins and wanted me to help liquidate his collection.

I have to admit I was excited as he held a box that you would pack books in and not carry coins. We put the box down and opened the box and was instantly disappointed.

On the top was a complete set of the State Quarter packages from one of the television shopping networks. It was the type of stuff that was over-hyped by touting their “limited production” by the U.S. Mint.

Looking at a few of the packs, they contained two quarters for each state on a card. They appear that if they were graded, they would probably average MS-64 and be worth $5-7 each. If they grade higher, the coins could be worth more. It is not worth my time and money to have them graded. Further, in the liquidation auction business, I would doubt these would sell for more than $5 per card.

The look on his face when I told him was as if I kicked his dog. He then gave me the same familiar story: they cost so much; the guy on television said they were a limited run; they should be worth more; and many other tales as seen on TV.

Anyone who has worked in a coin shop or handled second-hand property has heard the stories. Someone with a slick marketing presence appears on television and spins the tale to sound better than it is. Sure, the State Quarter was a limited production, but the Mint produced hundreds of millions of each of those coins.

In addition to the State Quarters, he had coin sets produced by companies like the Franklin Mint and the National Collectors Mint. While I try not to promise what could happen in an auction and avoid asking how much they paid, he pulls out a Buffalo Nickel display still offered by one of these companies.

The display is a round wooden stand that can rotate on a base. Around the edges is a space for 25 Buffalo Nickels. The nickels on his stand looked to be in extra fine (XF) to almost uncirculated (AU) condition. On top of the stand is a pewter figure of a buffalo (bison) modeled after James Earle Fraser’s image.

It is a lovely display, but one that is not popular. A previous consignor had the display without the coins. We finally were able to sell it for $1.00 to someone who was going to take it apart and repurpose the wooden stand. Selling the nickels in today’s market should allow him to break even.

For the last 25 years, this gentleman bought these coins and medals at a premium above their value. The box had gold plated medals with micrograms of gold that are nearly worthless in the collector market. He did have some older sterling silver sets that he bought when silver was under $8 per ounce. He can make money on those items to make up with some of the losses.

After going through the box, I said that he would be lucky if I can get $500 for everything. That lead to the look as if I kicked his other dog.

He asked how these people get away with overcharging for their merchandise. Unfortunately, there are few laws regarding price gouging except in an emergency (like overcharging for gas during a crisis) or if done fraudulently. But these television hucksters are practiced and can afford the lawyers to tell them how far they can go before they cross the line.

There are no laws to prevent companies from calling themselves a mint. There are credible companies that use “Mint” as part of their business name (e.g., I have been a customer of Miller’s Mint from Long Island and highly recommend them). Others use the moniker to make their products sound more official than they are.

If you like the packaging and are willing to pay the premium for it, then enjoy your collectible. While the Buffalo Nickel stand is not my style, I can understand the appeal. But when it comes time to sell, the packaging has little to do with the numismatic value of the coins or medals.

Anything plated has less than a gram of the metal. There is so little plating that it is not worth the cost for someone to have melted.

Which reminds me, the “1933 Double Eagle Tribute Proof” plated with 14 micrograms of 24 karat gold is not worth the $19.95 they charge on television. Even at the current price of gold, the item contains less than 1-cent worth of gold ($0.00047).

It bothers me that I have to disappoint people like this. It is worse when I have to tell an older person, like the octogenarian gentlemen who was in my shop this week, that the collection he thought was an investment is not worth a lot.

I am not sure what can the industry can do to prevent this from happening. These are legitimate businesses whose marketing practices may be less than ethical but are legal.

Some might suggest that this is something the American Numismatic Association should try to deal with. The ANA may not be the right organization for this. Maybe a consortium that includes the Professional Numismatic Guild (PNG), the Industry Council for Tangible Assets (ICTA), and the ANA could work together to find a solution.

Until then, I am open to suggestions!

Sep 3, 2019 | ANA, coin design, coins, commentary, education, technology, US Mint

Although it has been a while since I have posted something outside of the Weekly World Numismatic News, it does not mean that I have been idle. Here are some random thoughts:

2019 Glenn B Smedley Medal

ANA President Steve Ellsworth asked me to continue as Chair of the Technology Committee. I accepted his appointment. Steve has a different vision for how to move forward. Change is a good thing and will work with him and the Board to do what is best for the ANA.

There continues to be work to do for the ANA to add technology to the numismatic experience. One of the areas I would like to include more technology are the exhibits. After speaking with one person familiar with the exhibiting process, I think there are ways to add technology without technology overshadowing the numismatic content. I will have a proposal shortly. Stay tuned.

2007 Somalia Motorcycle Coins

I love these coins but is this the direction the U.S. Mint should go?

There are many collectibles whose values have declined over the last year, including some collector coins. One area that remains low are those collector sets produced by the television hucksters or the private mints. These firms overhype the value of their wares to convince buyers that they should purchase them as an investment. Recently, I handled an estate with several items purchased from QVC and the Franklin Mint. All of the coins were overpriced. The family was upset when I provided my valuation. I will talk about this more in a future post.

Another article idea that is inspired by my business is the difference between collecting and investing. Although some people like to try to mix the two, most of the time, the result is that the investor does not create a compelling collection while most of the collectors create value without trying.

I sold my silver Pandas. I lost interest after the composition was changed but the hype has kept the prices up. Hype is not a long-term strategy.

Finally, I am still waiting to find a “W” quarter in change. I have yet to see one. Most of the people I know that are looking for these quarters are roll hunting. If I were into conspiracies, I would suggest that the Mint did this on purpose to increase the demand for quarters. People would demand rolls of quarters, forcing the Federal Reserve to order more.

Considering the U.S. Mint is a government agency, I bet they are storing most of the quarters in Area 51! After all, if we are going into conspiracy theories, we might as well go all of the way!

Jan 29, 2019 | coins, education, Euro, foreign

After my last post about the Staatliche Münze Berlin, the Berlin State Mint, a few German readers provided a lesson in the political structure of Germany to understand the institution’s role in the country’s coin production.

Unlike what I wrote previously, the Berlin State Mint is a government mint but for the government of the Federal State of Berlin.

Berlin is one of two cities that is also designated as a state. The other is Hamburg. The divisions trace back to the many small states that existed in the region during the days Holy Roman Empire. In short, it was an attempt to bring unification to the region by attempting to allow each smaller states, kingdoms, principalities, cities, etc. to provide their own rule for the common good. Some reference suggests that there were over 300 individual governments with their own governing rules at the height of the Empire.

Arguments, wars, and Napolean brought about many changes where many of the smaller states merged into larger ones and others changed by conflict. Following the Treaty of Versailles that ended World War I, Germany was forced to give up territories that left the current state boundaries were mostly set as they are today.

Before I hear from our German friends, I am leaving out a lot of history on purpose. I just want enough to bring context to the discussion. If anyone wants a more detailed discussion about the history as it pertains to the German mints, I recommend reading the article “

Why Germany has Five State-Owned Mints.”

Although the Third Reich tried to unify the country around a federal government, there were a number of administrative functions left to the states including the minting of coins and printing of currency. Even Adolph Hitler learned that to keep his version of an orderly government, he had to work with each of the states.

Following World War II, the concept of the confederation of states continued with the formation of the Federal Republic of Germany (West Germany) and the German Democratic Republic (East Germany). Although the federal government has evolved with more central power, the states continue to have a degree of independence in their operations that a person with a background in United States history would consider a confederation.

As the country evolved and times mandated change, many of the mints were closed. Production consolidated with the changes in the political structure of Germany. Following the unification of Germany in 1990, only five state mints remained:

NOTE: First letter on the line is the mintmark associated with the mint.

-

-

Berlin State Mint

-

-

State Mint of Baden-Wuerttemberg, Munich

-

-

Barvarian Main Mint, Stuggart

-

-

State Mint Baden-Wuerttemberg, Karlsruhe

-

-

Hamburg Mint

When the euro was introduced, German law mandated that the minting of the euro coins would be distributed evenly among the five mints. Any production beyond the federally mandated requirement to produce the euro is between the mint and the Finance Minister of the state.

As for the currywurst coin, although it is produced by the Berlin State Mint, it is a product of that mint and not a product endorsed by the German federal government.

If you are confused you are in good company. Even after spending parts of three days looking into the history, I am not sure I am right. It is more confusing than the structure behind the U.S. Mint!

Images of the Germany state mints are courtesy of the mints via their websites.

Oct 11, 2018 | currency, education, exonumia, medals, tokens

I was going to stop doing the LOOK BACK series after the summer, thinking I would have time to create new content. But we all know that real life has a way of changing even the best-laid plans. While fighting off a severe sinus infection thanks to the mold spores that thrive in this damp weather, business picked up. I am ecstatic that my new business is catching on but the infection put a damper on things.

I need a week to catch up. While doing so, I will publish two more LOOK BACK articles and try to finish a few of the new posts I started. For today’s LOOK BACK, I want to remind everyone that numismatics is more than coins. You can satisfy your collecting urges with exonumia as well as with coins.

Although the dominant area of numismatics is the collection and study of legal tender coins, numismatics is more than just coins. Numismatic is the collecting and study of items used in the exchange for goods, resolve debts, and objects used to represent something of monetary value. This opens up numismatic collecting to a wide range of items and topics that could make “the hunt” to put together the collection as much fun as having the collection.

Exonumia is the study and collection of tokens, medals, or other coin-like objects that are not considered legal tender. Exonumia opens numismatics to a wide variety of topics that could not be satisfied by collecting coins alone. An example of exonumia is the collection of transportation tokens. You may be familiar with transportation tokens from your local bus or subway company who used to sell tokens to place into fare boxes. Others may have used tokens to more easily pay in the express lanes at bridges and tunnels. A person who collects transportation tokens is called a Vecturist. For more information on being a Vecturist, visit the website for the American Vecturist Association.

Token collecting can be the ultimate local numismatic collection. Aside from transportation tokens, some states and localities issued tax tokens in order to collect fractions of a cent in sales taxes to allow those trying to get by in during down economic times to stretch their money further. Some communities issued trade tokens that allowed those who used them to use them like cash at selected merchants. Some merchants issued trade tokens that were an early form of coupons that were traded as coupons are traded today.

While tokens are items used to represent monetary value, medals are used to honor, commemorate, or advertizing. The U.S. Mint produces medals that honor people, presidents, and events. Medals produced by the U.S. Mint are those authorized by law as a national commemoration including the medal remembering the attacks of 9/11.

Commemorative medals are not limited to those produced by the U.S. Mint. State and local governments have also authorized the producing medals on their behalf that were produced by private mints. Many organizations also have created medals honoring members or people that have influenced the organization. Companies have produced medals to honor their place in the community or something about the company and their community.

Many medals have designs that can be more beautiful than on coins since they are not limited to governmental mandated details and their smaller production runs allows for more details to be added. Medals can be larger and thicker than coins and made in a higher relief than something that could be manufactured by a government mint.

Exonumia collecting also involves elongated and encased coins. You may have seen the machines in many areas where you pay 50-cents, give it one of your cents, turn the wheel and the cent comes out elongated with a pattern pressed into the coin. Elongated coins have been used as advertisements, calling cards, and as a souvenir.

Encased coins are coin encircled with a ring that has mostly been used as an advertisement. One side will call the coin a lucky coin or provide sage advice with the other side advertising a business. Another form of encased coins are encased stamps. Encased stamps were popular in the second half of the 19th century and used for trade during times when there were coin shortages.

Other exonumia includes badges, counter stamped coins, wooden money, credit cards, and casino tokens. Counter stamped coins are coins that have been circulated in foreign markets that were used in payment for goods. When the coin was accepted in the foreign market, the merchant would examine the coin and impress a counter stamp on the coin proclaiming the coin to be genuine based on their examination. Although coins were counter stamped in many areas of the world, it was prevalent in China where the coins were stamped with the Chinese characters representing the person who examined the coin. These Chinese symbols are commonly referred to as “chop marks.”

One type of counter stamped coins are stickered coins. Stickered coins were popular in the first half of the 20th century; they were used as an advertisement. Merchants would purchase stickers and apply them to their change so that as the coins circulated, the advertising would reach more people. Some stickered coins acted as a coupon to entice the holder to bring the coin into the shop and buy the merchandise.

Remember the saying, “Don’t take any wooden nickels?” If you are a wooden money collector, you want to find the wooden nickels and other wooden denominations. Wooden nickels found popularity in the 1930s as a currency replacement to offer money off for purchases or as an advertisement. Wooden nickels are still being produced today mostly as an advertising mechanism.

We cannot end the discussion of exonumia without mentioning Love Tokens and Hobo Nickels. Love Tokens became popular in the late 19th century when someone, usually a man, would carve one side of a coin, turn it into a charm for a bracelet or necklace, and give it to his loved one. The designed are as varied as the artists who created them. Hobo Nickels are similar in that hobo artists would carve a design into a Buffalo Nickel to sell them as souvenirs. While there are contemporary Love Tokens and Hobo Nickels, collectors have an affection for the classic design that shows the emotion of the period.

Currency collecting, formally called notaphily, is the study and collection of banknotes or legally authorized paper money. Notes can be collected by topic, date or time period, country, paper type, serial number, and even replacement or Star Notes (specific to the United States). Some consider collecting checks part of notaphily. Collectors of older canceled checks are usually interested in collecting them based on the issuing bank, time period, and the signature. For the history of currency and their collecting possibilities, see my previous article, “History of Currency and Collecting”.

Scripophily is the study and collection of stock and bond certificates. This is an interesting subset of numismatics because of the wide variety of items to collect. You can collect in the category of common stock, preferred stock, warrants, cumulative preferred stocks, bonds, zero-coupon bonds, and long-term bonds. Scripophily can be collected by industry (telecom, automobile, aviation, etc.); autographs of the officers; or the type of vignettes that appear on the bonds.

Militaria: Honorable Collectibles

Collecting of military-related items may be considered part of exonumia but deserves its own mention. It is popular to collect military medals and awards given to members since the medals themselves are works of art. Families will save medals awarded to relatives and even create museum-like displays to honor or memorialize the loved one.

Militaria includes numismatic-related items that represent the various services. One of the growing areas of collectibles is Challenge Coins. A challenge coin is a small medal, usually no larger than 2-inches in diameter, with the insignia or emblem of the organization. Two-sided challenge coins may have the emblem of the service on the front and the back has the emblem of the division or another representative service. Challenge coins are traditionally given by a commander in recognition of special achievement or can be exchanged as recognition for visiting an organization.

Over the last few years, civilian government agencies and non-government organizations (NGO) have started to create and issue challenge coins. Most of those agencies have ties to the military, but not all. Like their military counterparts, a manager or director can give challenge coins in recognition of special achievement or for visiting an organization.

Another area of military collectibles is Military Payment Certificates (MPC). MPC was a form of currency that was used to pay military personnel in foreign countries. MPC was first issued to troops in Europe after World War II in 1946 to provide a stable currency to help with commerce. MPC evolve from Allied Military Currency (AMC) to control the amounts of U.S. dollars circulating in the war zone and to prevent enemy forces from capturing dollars for their own gain. Prior to World War II, troops were paid in the currency of the country where they were based. With the ever moving fronts and the allies need to control the economies to defeat the Axis powers, AMC was issued to allow the military to control their value.

After the war, MPC replaced APC in order to control the currency and prevent the locals from hoarding U.S. dollars preventing the building of their own economies. When military officials discovered that too many notes were in the circulation, being hoarded, and thriving on the black market, series were demonetized and reissued to military personnel. Those holding MPC notes, not in the military received nothing and were encouraged to circulate their own currency.

MPC were printed using lithography in various colors that changed for each series. From the end of World War II to the end of the Vietnam War there were 15 series printed with only 13 issued. Although the two unissued series were destroyed, some examples have been found in the collections of those involved with the MPC system. Amongst the 13 series that were issued, there are 94 recognized notes available for collectors. Most notes are very affordable and accessible to the interested collector.

The original article can be read here.

Sep 4, 2018 | education, foreign, tokens

Now that I am running a collectibles business, I see a number of interesting items coming into the shop.

Last week, someone came into the shop with items that she wanted to sell in order to downsize prior to moving. One of the items was a small plastic bag of foreign coins. The bag contained a lot of low-value base metal coins that would trade for under one dollar from a dealer’s junk box.

Although I do not keep a large inventory of coins, I have a basket I fill with foreign coins for anyone who wants to look through them. I will sell the coins for 25-cents each even if they are worth more. When parents come into the shop with their children, I will let the kids pick out a coin. I challenge them to go online and learn what they can about the coin.

Sometimes, my assistant and I will look through the basket for something interesting. While my assistant is not a collector, she knows I am and looks for specific items I am looking for (more on that another time) and anything that looks interesting.

After moving furniture in the warehouse, I returned to my desk and found a small pile of coins. Some were part of the coins I was looking for and a token with the date of 1895. What is this coin?

-

-

Obverse of a token from Hacienda El Altar and La Caridad. The plant in the center is likely a cane that was popular in the region.

-

-

Reverse of a Hacienda El Altar and La Caridad token declaring they were owned by Ramón González Espinosa from San Sebastián and is worth 1 Real.

On the obverse and above the date is a tree. The legend around the coin says “EL ALTAR, LA CARIDAD.” On the reverse, it gives the denomination of “1 REAL” and the legend says “RAMON GONZALEZ ESPINOSA” and “SAN SEBASTIAN.” Immediately, I think this is a Spanish coin.

San Sebastián is a coastal city in the Basque region of northern Spain close to the French border. Although there is evidence of human settlement from at least 24,000-22,000 BCE, the earliest recorded evidence dates to 1014 and the monastery of St. Sebastián.

But there was no reference of a 1 real coin being issued in the region in the late 19th century or anyone in the region named Ramón González Espinosa.

Who was Ramón González Espinosa? Trying an Internet search of that name finds people with that name in California, Texas, and elsewhere around the world. Searching for Espinosa and San Sebastián also lead to a lot of irrelevant results.

Next was to figure out what El Altar and La Caridad represent. El Altar is “The Alter” in Spanish and La Caridad translates to “The charity.” Could this have been a token used to try to raise money in Spanish speaking country other than Spain?

Just to see what would happen, rather than using google.com, I went to google.com.mx, the site that serves Mexico and Latin America. I entered the information for all of the legends and searched. When too many items came up and my rudimentary Spanish found that they were irrelevant, adding quotes around each phrase lead found an interesting page.

On a blog that is written by a Venezuelan numismatist, there was an article with an image of the same token. Using translation software, I was able to obtain enough information to learn more about the token.

During the late 19th century, Venezuela was undergoing a financial crisis that caused a severe coin shortage. The situation became so bad that the haciendas, plantations in Venezuela, could not pay their workers. To help solve the problem, hacienda owners would create their own tokens to act as promissory notes. They would pay their workers using these tokens. When coins were available, the hacienda owner would pay the merchants.

These tokens circulated as money throughout the region.

The token we found was from the Hacienda El Altar and La Caridad, both were the properties of Ramón González Espinosa. Espinosa’s properties were located in Aragua State

The haciendas were in San Sebastián de los Reyes (Saint Sebastian of the Kings) in Aragua State. The town is located on the Guárico River that leads to the Caribbean Sea. El Altar and La Caridad were livestock farms.

It is unusual for the names two haciendas to appear on a single token. According to references about other tokens from this era, when the same person owned multiple haciendas they had tokens made for each of their properties to distinguish the accounts from each other. Since there were no other references for tokens with more than on hacienda, it is not known as to why Espinosa created only one token.

Most tokens from this era were made using a copper-nickel alloy that ranged from 40-60 percent nickel. Most were thin discs and had different shapes. Hacienda tokens ranged in value from ½ Real to 5 Reales. Tokens from Hacienda El Altar and La Caridad were issued in ½, 1, 2, and 4 Reales.

The Venezuelan government continued to have a difficult time producing enough coinage. After Cipriano Castro seized the government in Caracas, he contracted with the Mexico City Mint to produce low denomination copper coins. In 1902, Venezuelan government contracted with the U.S. Mint to produce lower denomination silver coins.

Slowly, there was enough of a coin supply that it ended the need for hacienda tokens. But they continued to circulate because hacienda owners used it as a way to control their workers. When Juan Vicente Gómez overthrew Castro, who left Venezuela in 1908 for medical treatment in Germany, he instituted a rule to end the circulation of these tokens by ordering the hacienda owners to buy back the tokens using state currency.

It is estimated that over 10,000 tokens were once in circulation. After the order was given to redeem the tokens most were melted and used for other purposes.

Although it is rare to find one, they are not worth much in the numismatic market. However, finding one allowed me to learn more about its origin, hacienda tokens, and how the United States helped in ending this practice.

In other words, yet another reason why numismatics is a fun hobby!

Apr 10, 2018 | coins, commentary, education, US Mint, values

I write this blog from the perspective of a collector. I champion the collector. I think that collectors are the most qualified to determine the direction of the hobby. The collector is the consumer and the consumer is almost always right.

When it comes to helping with the direction of the hobby dealers should also have a say. Their input is important. But they should be there to support the collector because without collectors the dealers have no business. Dealers should not be dictating the direction of the hobby.

Are these sets hurting the hobby? Should the U.S. Mint stop producing them? (U.S. Mint image)

Regular listeners to The Coin Show knows that Matt is not a fan of modern coins and the products of the U.S. Mint. In fact, during the last show, he admitted to not carrying American Eagle coins because he does not want to support the U.S. Mint in damaging the hobby.

During the podcast, Mike came to the defense of U.S. Mint collectors but that defense was tempered when he said that collecting U.S. Mint products was for beginner collectors and that it was a way to start before the collector “graduate” to other collectibles.

I have questioned Matt and Mike in the past on Facebook but this time I felt their statements crossed a line. My regular readers know I can get hyperbolic but I try to remain respectful. As it happens on Facebook and anywhere else on the Internet, people cannot take the words at face value and have to read something into them.

This time I emphasized that not only do I collect U.S. Mint items but have not “graduated” to the type of collectibles Mike and Matt proclaim to be real collectibles. New readers can go through this blog and see how my collection can be classified as normal to eclectic.

After a lot of angry discussions (you will see a sample below) and some churlish responses from others (not Matt or Mike), I finally coaxed out the reasons for Matt’s hatred of modern U.S. Mint products. Unfortunately, it seems his reasons have more to do with the industry than the U.S. Mint.

According to Matt, the U.S. Mint is harming numismatics by selling annual sets like proof and mint sets at the prices they set. During the Facebook discussion, Matt and Sam Shafer, another Indianapolis-area dealer, said that they believe the U.S. Mint’s prices are too high.

From their perspective as dealers, they claim it is the U.S. Mint’s fault for the differences between the manufacturer’s suggested retail price the secondary market.

Using that logic, can I blame Chevrolet for the secondary market price of the 2014 Silverado I just purchased? If I tried, General Motors would laugh me under the tonneau cover of the truck! Yet, coin dealers are applauded for applying the same logic. This does not make sense.

How can you blame the manufacturer for the secondary market’s reaction?

Matt wrote, “I feel like the depreciation seen in modern sets is much more harmful to potential collectors or beginning collectors.”

I guess if General Motors followed that logic, they would stop making trucks!

But we are talking about collectibles. In that case, Topps, Fleer, and Upper Deck should stop producing baseball cards.

This is only an argument by dealers who would rather sell what they like and not take a broader view of the collecting market. In my new life, I am a collectibles and antiques dealer. The items I buy are either from the secondary market or I buy new items from manufacturers such as comic book and baseball card publishers.

This 1901 $10 Dollar Lewis and Clark Bison note (Fr# 122) was sold by a dealer at an antiques show by a dealer not complaining about the collecting market.

The vast majority of dealers are very good and very reasonable. Many do understand the view of the collector and work with them. However, there is a subset of dealers that can be some of the most stubborn business people I know. They refuse to change with the market. Even if the market is not looking for their niche, they will not adapt to the market. Their mind is made up do not confuse them with facts.

They are also the most vocal in their opposition to market forces. Their usual retort is “you don’t understand, you’re not a dealer!”

With all due respect, I do not need to be a dealer to know that not changing with the times is doing more to hurt the hobby than the U.S. Mint is by doing its job.

Did you know that the Pobjoy Mint struck this coin under the authority of the British Virgin Islands. Is this good for the hobby? (Pobjoy Mint image)

The U.S. Mint does not offer dozens of non-circulating legal tender (NCLT) coins. U.S. Mint coins are struck and not painted. The U.S. Mint does not offer piedfort version of circulating coins or even coins guilt in gold or palladium. The U.S. Mint does not make deals with movie production companies, comic book publishers, or soft drink manufacturers to issue branded coins.

Every coin that the U.S. Mint offers for sale has an authorizing law limiting what they could produce. According to those laws, the U.S. Mint has to recover costs and is allowed to make a “reasonable” profit.

But what is reasonable? This is a question that has a lot of valid arguments on both sides. However, the U.S. Mint is subject to oversight by the Treasury Office of the Inspector General (OIG) and, occasionally, review by Congress’s Government Accountability Office (GAO). Neither oversight agency has produced a report saying that the U.S. Mint’s prices are unreasonable.

The U.S. Mint is selling what they manufacture at a price that the competent oversight agencies have not complained about. The only one complaining is by the dealers in the secondary market.

Why are these dealers complaining?

We get to the crux of the problem when Sam Shafer responds, “I would rather sell a customer a Morgan dollar than a set of glorified shiny pocket change.”

It does not take a rocket scientist to understand why a dealer would write that. A dealer makes more money selling Morgan dollars than modern coins. It is about business, not about what the U.S. Mint is doing. It is also a very reasonable response if the dealer would own up to the fact that it is about the impact to their business. Blaming the U.S. Mint is like crashing into a wall and blaming the wall for being there!

But Sam must have had some bad experiences: “How about you come down from your pedestal, put your loudspeaker up your rectum and work in a shop for a few years where you can witness the devastation of families first hand for a few years.”

This is a strong statement, even if you discount the placement of inanimate objects into bodily orifices they do not belong. What has the U.S. Mint done to cause “devastation?” The U.S. Mint sells products to those who want to buy them. You are not forced to buy from the U.S. Mint.

Sam continues, “While your [sic] at it maybe you can take up your glorious cause of finding homes for the 50 billon [sic] sets the government produced and bulk sold over the years to the collectors who assumed that 5 sets would better than 1.”

By Sam’s logic, it is the U.S. Mint’s fault that someone speculated and the investment did not pan out? Whose fault is that? Who told someone that buying these sets would be a good investment? Not the U.S. Mint! Where does the U.S. Mint say in any of its publications or website that coins make a solid investment? How could these speculators have come to this conclusion?

2018 Fiji Coca-Cola Bottle Cap-shaped coin is not a U.S. Mint product. It contains 6 grams of silver (about $3.20) and costs $29.95. Is this good for the hobby? (Modern Coin Mart image)

The U.S. Mint does not even acknowledge historical and aftermarket pricing for the items they manufacture.

The U.S. Mint sells collectible coins. They do not sell investments.

Over the years, I have received more complaints about dealers than allegedly worthless State Quarters or the U.S. Mint’s annual sets. But why are coins allegedly worthless?

Did the U.S Mint make claims that these one-time-only coins are really special and that they would be the greatest thing since sliced bread?

This is not a U.S. Mint Product! (Danbury Mint image)

Did the U.S Mint create books, boards, folders, albums, maps, touting this as a once-in-a-lifetime way to collect?

All this came from the secondary market. Who runs the secondary market? DEALERS!

DEALERS set the values for the coins based on what they sell them for.

DEALERS take coins and entomb them in sonically sealed plastic holders saying that this is how you should be collecting. They tell you one encapsulating service is better than another and then make you pay different prices if you use a service they do not like even if the number assigned as a grade is the same on both pieces of plastic.

DEALERS have convinced an entire class of collectors that if they do not have a plastic holder with this new, whiz-bang label that their collection is not complete.

Tragedy grips the industry when a Pawn Star is featured on a plastic holder’s label! (NGC image)

DEALERS genuflect when someone puts a shiny green sticker on a plastic holder as if it was blessed by some deity. They prostrate themselves if the plastic holder is granted that divine gold sticker! After preaching this gospel to their flock, you are considered a heretic if you question the validity of the sticker and the motives of the sticker maker.

While the U.S. Mint is not perfect, the problems with the numismatic market have not been created by a tightly regulated government bureau. The problems come from the secondary market whether they are overstating the values of these items or demeaning collectibles that they cannot make a hefty profit on.

Maybe it is time for dealers to look in the mirror and ask whether the U.S. Mint is hurting the hobby or maybe they are refusing to recognize the problem is right in front of them.

Apr 7, 2018 | advice, education, security

The American Numismatic Association and Numismatic Guarantee Corporation recently issued press releases notifying the public that there have been attempted phishing scams by trying to impersonate a hotel service or someone who works for NGC. Since this is back in the news, I am taking an article I had previously written on the topic and updating it to be more current.

The American Numismatic Association and Numismatic Guarantee Corporation recently issued press releases notifying the public that there have been attempted phishing scams by trying to impersonate a hotel service or someone who works for NGC. Since this is back in the news, I am taking an article I had previously written on the topic and updating it to be more current.

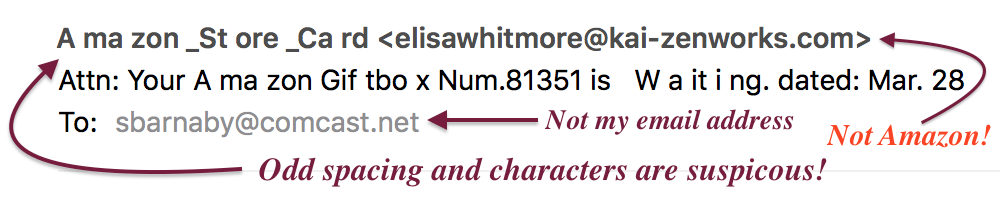

Phishing is the term used to describe the attempt to convince someone to reveal personal information by sending them an email that looks like it came from a legitimate source. Unfortunately, it is so easy to spoof (trick) the Internet’s email system that all it takes is someone with attention to detail to get past spam and other security filters.

Last year, I retired as an information security professional where, for the last 25 years, was contracting to the United States government. I saw many attempted and successful attacks against both government and commercial systems. However, the one attack that is the most difficult to defend is those where humans are convinced to act against their own best interest. The technical industry calls them phishing attack but they are forms of social engineering.

A social engineering attack tries to use something about you or something you care about to convince you to do something that could potentially harm you. For example, an attacker looking to scam someone who collects rare coins may know about NGC’s business. Knowing that the people who might be using NGC’s services are collectors with a lot of disposable income, they could use the weaknesses of the email system in order to fool the recipient into a situation where they can be taken advantage of.

To help you stay safe, the following are rules you can follow to keep safe online:

Rule #1: Unless you are 100-percent certain that the email is legitimate, do not click on the link!

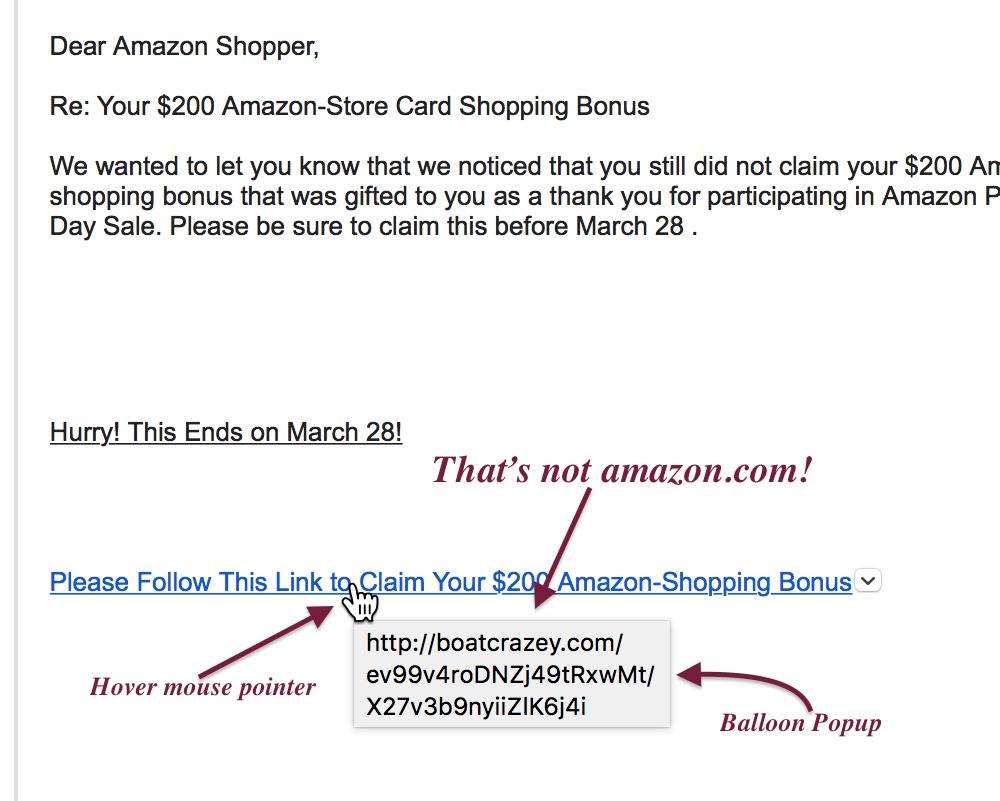

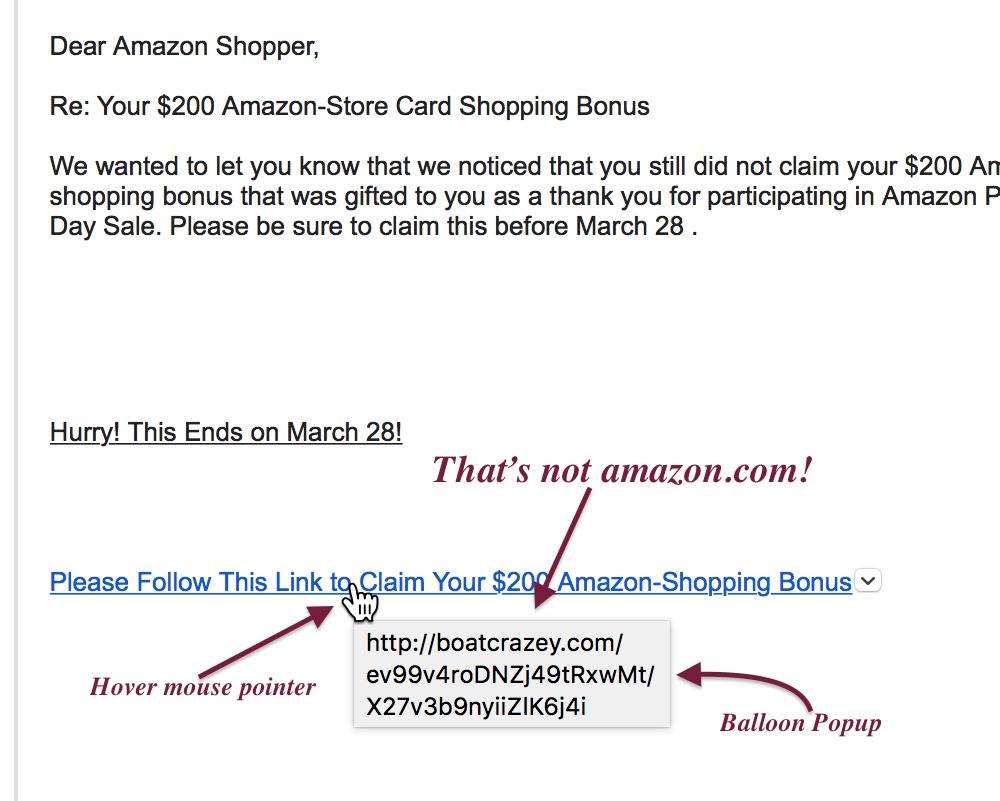

You will be never 100-percent certain that any email you receive is legitimate. Thus, make sure that you are as close as 100-percent certain as possible. One thing you can do is to move your pointer over the link, stop, and wait for the tooltip to show you the address.

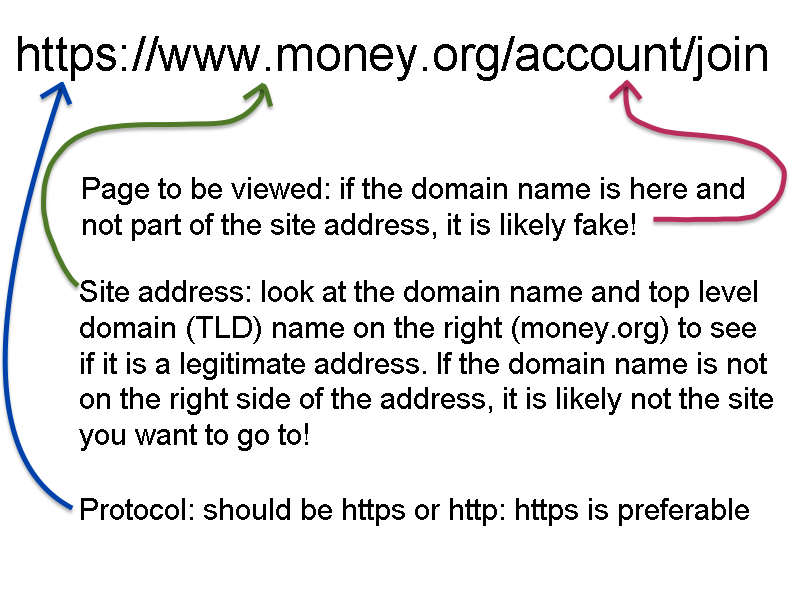

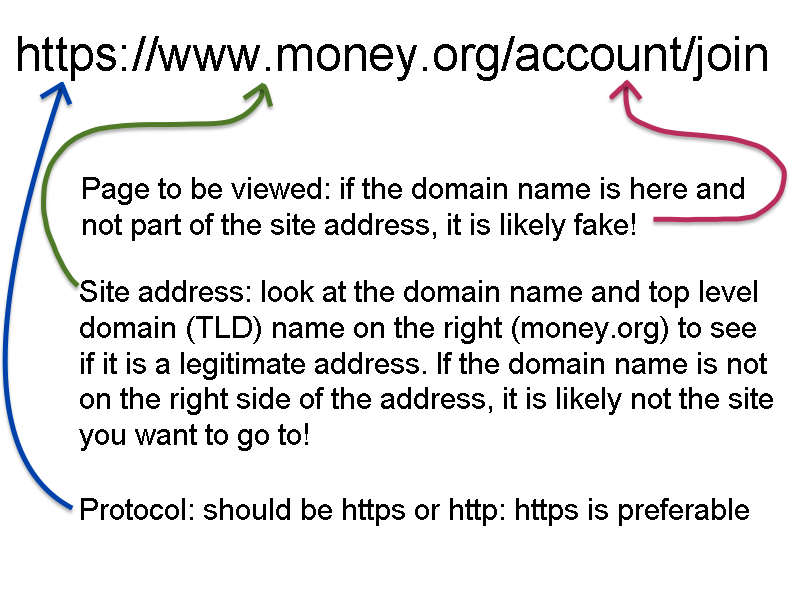

Tooltips are those balloon-like popups that will tell you something about the link or element before you press the mouse button. One way to tell that a link is bad is that if the address is not what you think. For example, if the link is supposed to send you to the ANA website, the tooltip better say that it will send you to money.org. If it does not, then do not click on the link.

Place your mouse pointer over the link and let the tool tip appear. What does it say?

When you check the link, the address of the server is the first part of the address. If what should be the server name is not in that area at the beginning of the address, do not click on the link.

One trick the phishers use is to show you what looks like a complicated address in the message, but the link behind it will send you to another website. This is where tooltips can help. If you hover over the address and they do not match, it is an attempt to trick you and you should not click on the link.

If you are using a web-based email client, such as Gmail, you can check the address on the status line at the bottom of your browser window. Check to see if the address makes sense. For example, if the email claims to be from Amazon, the link should say “amazon.com” and nothing else. Sometimes phishers will try to write a link using something after the address like “amazon.com.anothersite.co” to fool you. Do not be fooled. A link like this is trying to send you to “anothersite.co” and not Amazon.

Understanding the part of a typical URL and what to look for

If you are unsure about the link, then go to your browser and type in the address yourself.

As with everything in life, there is an exception to the rule. Organizations, like the ANA, will use mailing list services to send out notices to members and anyone else who have signed up for these emails. Unfortunately, the URL you will click on will be one associated with the mailing list service. The service uses this to provide engagement statistics to whoever is sending out the email. For example, for the service that the ANA uses all of the links are to r.listpilot.com.

Mailing list services are great resources for many organizations and their tracking service is necessary to understand the effectiveness of the communication. If you are not sure, continue to visit the organization’s site without clicking on the link.

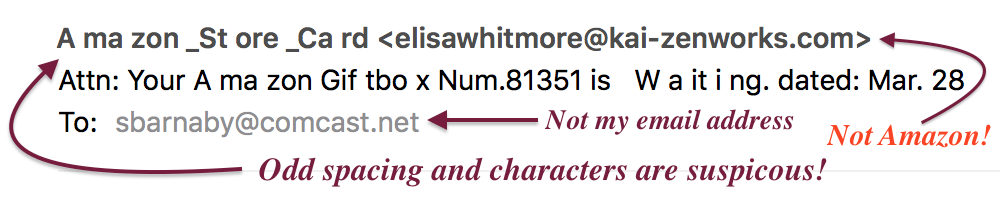

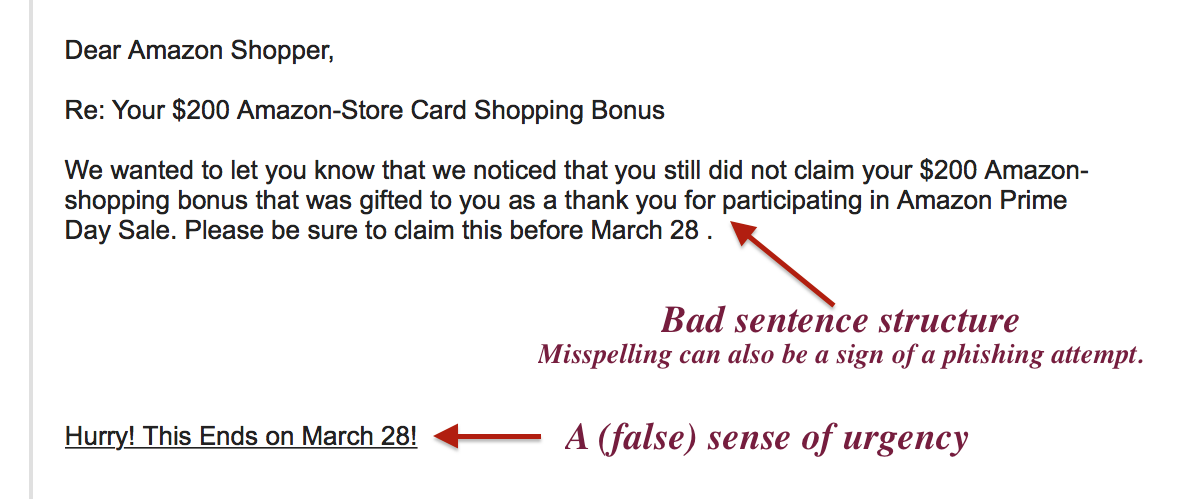

An example of an email message showing what to look for to understand how to identify it as a phishing attempt.

Examine the envelope information, also referred to as the headers of the message, for signals that this could be a phishing attempt.

Even though a lot of email contains grammatical errors, businesses have proof readers that will prevent the most egregious errors. Look for bad spelling and even using numbers instead of characters, such as using a zero instead of a capital “O.”

Rule #2: No legitimate company or organization will ask for information to be sent via email

One of the tactics that the phishers use to try to trick you into giving them your personal information is to create a form that looks like it is legitimate. Just as it is easy for someone with moderate skills to fake a web page they can also create a counterfeit form. Not only will the form be counterfeit, but they could also embed programs in that form to steal your information.

Embedded code in documents is called macros. Macros are used to command programs to do something for the user. When used in productive environments, macros can be a wonderful tool to create dynamic documents and provide input validation. But the same instructions that can make macros a productive tool can also be used to do bad things.

Unless you are certain about where the document came from, do not open a document. If you open the document and the program asks if you should enable or run macros, do not enable macros.

This is not just a problem with word processing document. PDF documents can also deliver very nasty malware (malicious software). Not only can an attacker add macros to a PDF document, but someone can embed Flash in those PDF. Flash is the technology that helps you watch online videos and add enhancements to the visual interface of some websites. But Flash can be used to attack your computer system. Opening a PDF file sent by someone you do not know can be as dangerous as a word processing document.

Rule #3: Do not open suspicious attachments

Another trick the attackers try to use is adding an attachment named in a way to entice you to open the file. File names consist of the name of a file followed by a period followed by a file extension. The file extension is used to tell the computer the type of program to execute to allow you to work with the file. There are three file extension that very dangerous and should never be opened unless you are absolutely sure who sent them: .zip, .exe, and .dmg for Mac users.

The .zip file extension tells the computer that the file is something called a Zip archive. A Zip archive is a file that is formatted to allow it to store many files that are compressed. Zip files are used for many legitimate purposes including being the default format of Microsoft Word’s .docx file. Unfortunately, it can contain programs and files that can be used to attack your system.

One of the types of file that can be included in a Zip archive is a .exe or executable file. Simply, these are programs in the same way that Microsoft Word is a program. Once an executable file is opened, it will do whatever it is programmed to do. Among the things that the program can do is keylogging. A keylogger reads what you type on your keyboard, what you click on the screen, and in some cases, what is displayed on your screen. The keylogger will be able to capture the username and password you entered when you visit any website including your bank’s website. The problem is that when a key logging program is run, you do not know it is watching what you type. Nor do you know that it connects to a server somewhere on the Internet to send the information to the attacker. Keyloggers and other malware can infect your system in a way that allows it to continue to exist, even if you reboot the computer.

You may ask about anti-virus software helping stop malware. Anti-virus software is programmed to understand what is known about attack vectors. It cannot protect you if it does not know how the virus works. Remember that the government warned that last year’s flu vaccine was not effective for the version of the virus infecting people? Anti-virus software is similar that if it doesn’t know about the strain it cannot protect you. Hackers are always looking for ways to fool anti-virus software.

For Windows user, you should consider running Windows Defender. Windows Defender is built into Windows but cannot be run if you have another anti-virus software. I use Windows Defender and have been happy with the results. If you want more information about Windows Defender visit this page on Microsoft’s support site.

While Macs are more difficult to attack they are not immune. Mac users should never open a file with a .dmg file extension unless you know who sent the file. The Macintosh .dmg file is a disk image stored as a regular file. A disk image file is formatted to look and acts like a disk so that when you double-click the icon, it will mount on your computer as if you plugged in an external disk drive. Because .dmg files are commonly used to install legitimate software, sometimes the installation can be automatically started. If you allow the installation to continue, you can install software as dangerous as what I described for the Windows .exe file.

OS X is a different type of operating system where if you are careful you can get away without running an anti-virus program. However, if you want to be paranoid (along with me) you might want to run the free anti-malware software from Malware Bytes.

Regardless of the operating system and software you use, ALWAYS KEEP IT UP TO DATE! Patching your computer may be an annoyance but the dangers, if you do not apply security patches, will hurt more and last longer!

Rule #4: When in doubt, throw it out!

While all this seems simple to me after having worked in this industry for nearly 40 years, I have seen how these concepts are confusing to the non-technical user. The problem with email is that it was developed as a way for researchers to communicate by plain text across Arpanet, the forerunner of the Internet. Email, as a text-based service, \ has been extended in so many ways that it has created a complicated series of standards that require a degree in computer science to analyze. While these complications make it easier to communicate via email it also makes it difficult to secure.

While all this seems simple to me after having worked in this industry for nearly 40 years, I have seen how these concepts are confusing to the non-technical user. The problem with email is that it was developed as a way for researchers to communicate by plain text across Arpanet, the forerunner of the Internet. Email, as a text-based service, \ has been extended in so many ways that it has created a complicated series of standards that require a degree in computer science to analyze. While these complications make it easier to communicate via email it also makes it difficult to secure.

Even if you cannot fully analyze whether the message is spam or legitimate, if you have any doubt, then just press the delete button. If the message came from a source you know, contact them off-line and ask if the mail is legitimate. If you think the email is from your bank, call the bank and ask. If you think the email is from your credit card company but not sure, call the credit card provider and ask. If you think the email sent from the ANA or NGC is suspicious, call them and ask.

A little intuition and some due diligence can be of great help in these circumstances.

Stay safe online!

Apr 3, 2018 | advice, currency, education, web

Last week, I posted an article about online resources that I use when I want to begin research on a numismatic topic. The list provided a number of resources but a reader wrote to me and noted that I forgot to include paper money resources beyond the Bureau of Engraving and Printing.

Last week, I posted an article about online resources that I use when I want to begin research on a numismatic topic. The list provided a number of resources but a reader wrote to me and noted that I forgot to include paper money resources beyond the Bureau of Engraving and Printing.

Paper Money Sources

When it comes to searching for information on paper money, I always start at one of the following three sites:

The opening line at USPaperMoney.Info says that it is the “home of everything you ever wanted to know about U.S. currency. (Well, almost….)” This is truth in advertising. Even with the page of unanswered questions, the site has everything you could ever want to know about U.S. currency. I just wish the author would organize the site better.

Don and Vic’s World Banknote Gallery is one of those sites that looks like it was created by a seventh grader in 1998 but has a tremendous amount of very useful information. It is one of the best sites I have found to identify world banknotes.

They have a companion site named World Coin Gallery that is similar. I have used this site and have added it to the original bookmarks file. If you downloaded the original bookmarks then right-click (Control-click for Mac users) and select the option to add worldcoingallery.com to your bookmarks.

Last, but definitely not least, is Banknote News by Owen Linzmayer. If you want to know anything about the production of world paper money, this is the site you need to read. In addition to the information, which a lot of it is in blog form and consistently tagged for easy navigation, Linzmayer has also compiled one of the best references on world paper money called The Banknote Book. He said he did this because he and other collectors were frustrated with the “many errors, omissions, and poor-quality images” in the Standard Catalog of World Paper Money.

The Banknote Book can be purchased as a physical book as a three-volume set complete through 2014 or you can buy individual chapters corresponding to the country of your interest.

If you want to check it out for yourself, download 17 Free Sample Chapters and judge for yourself.

Currency Bookmarks

Do you want to add these links to your browser’s bookmarks? Right-click (or Mac users can CTRL-Click) on the following button and select whatever option your browser requires to save the file to hard drive. Import the file as an “HTML Bookmark” file to add these links to your bookmarks.

Mar 29, 2018 | coins, currency, education, technology, web

I am often asked what resources I used for online research when writing articles for the Coin Collectors Blog. For more than 12 years of writing this blog, I have found hundreds of websites that I have used to various degrees. However, there are a few that have provided the best information.

I am often asked what resources I used for online research when writing articles for the Coin Collectors Blog. For more than 12 years of writing this blog, I have found hundreds of websites that I have used to various degrees. However, there are a few that have provided the best information.

No single website can provide all of the information available. This is why I keep many sources at hand. The problem is that I do not keep them in one neat location. Some of them I remember and then there are snippets of text, bookmarks, and even computer code that I refer to when I have to start looking up information. Not only will this provide you with research starting points but it also gives me a chance to organize my bookmarks!

Before I list my sources, there is one tool that must be included in any online reference: Google. Google is a great search tool because it is the only search engine that really tries to add context of the search. For example, if you are searching for something to do with coin dies you will get related items and not information about games with dice or something about death.

When searching for information using Google is to try to be as exact as possible with the search term including using characters with diacritic (accent) marks. Using the proper diacritic marks will help find foreign language sources that could provide additional information not found in English. Also, Google can search using terms that are entered using non-Latin characters including Arabic, Cyrillic, Greek, Hebrew, and Asian languages.

If you find a non-English site or a site in a language you are not familiar with, Google Translate (translate.google.com) is a great tool for translating this information. You can either enter phrases into Google Translate or enter a URL for it to download and translate pages.

Primary Sources

When it is time to find information about modern coins, currency, production totals, and images, the primary source are the government bureaus that manufacture the money.

United States Mint: www.usmint.gov

Bureau of Engraving and Printing: www.moneyfactory.gov

There is a lot that goes into the money manufacturing process in the U.S. An overview of the bureaus and other agencies can be found the U.S. Coin and Currency Production page.

Trusted Sources

Although there is quite a bit of numismatic information available online, one of the biggest benefit of being a member of the American Numismatic Association is to have access to The Numismatist in electronic form. The $28 per year basic membership gives you access to this resource electronically.

The Numismatist

For other historical publication and a lot of information, consider using the Newman Numismatic Portal at Washington University in St. Louis. Aside from being a rich source of information, many of the publications they index are located in the Internet Archive. Clicking through to the site will allow you to download many of the publications as a PDF or ePub for your tablet reader.

Another archive you may also want to search is Google Books. The advantage of Google Books is that they offer more formats for the books that have been imaged including a version that has been processed using an optical character recognition (OCR) program. While the OCR versions are far from perfect, it is wonderful if you are looking to copy-and-past quotes into your own writing. Google Books may not have the full text of every reference found because of copyright restrictions but once you find the book you can either buy the book or borrow it from a library making it a great for doing index searches.

ANA members can borrow books from the Dwight N. Manley Numismatic Library. There is no cost to borrow books but you will have to pay for shipping. The Library can also provide research and copy services for a fee. Although research services are fee-based and open to anyone, the fees are lower for ANA members.

Archived Publication Sources

Guides

Online guides are resources for individual coins. Each of the resources listed have their strengths and weaknesses making it important that you consult more than one when looking for information. The following list are the guides I consult in alphabetical order:

Price Guides

Whether you are a casual collector, more expert, or someone looking at coins, the one question that is always ask is “What is that coin worth?”

Coin values are subjective and based on a lot of factors. It can be so confusing that I wrote a two part series How Are Coins Priced (Part I and Part II). Even if you understand the principles, there is a need for price guides.

Price guides are not perfect. They have their own formula and their own biases for what makes up prices. For example, the price guides sponsored by the grading services are the prices for coins in their holders. This is why I consult a few price guides when doing research. The following are the price guides I have used:

One of the key aspect of pricing is the level of conservation or the grade of the coin. When it comes to be able to judge the grade of the coin there is only one website I use:

Bullion Values

Another aspect of pricing is the value of the coin’s metals. There are many sites that can provide spot prices, I have found the following very helpful:

Communities

There are quite a few online communities that discuss numismatics. Some of them are very good while others can be a bit harsh for the average collector. For general knowledge and access to a wide range of knowledge I recommend the following:

The E-Sylum has been called the best free numismatic resource on the Internet. After being a subscriber for the last five years, it is difficult to argue with that statement. Many of the contributors are a Who’s Who of the numismatic industry. While you can read the E-Sylum online, you should subscribe. Better yet, if you are an ANA member you will receive a copy in email. Do not delete it! Read it! It gets a PR-70DCAM rating from this reviewer!

Mobile Apps

If we are talking about online access to sources there has to be a mention of mobile apps. Since I am an Apple iPhone user, I use the iOS version of these apps. However, all of them have Android equivalents. Some also have versions the run on Windows Mobile. Here are the apps I have installed on my iOS devices (in alphabetical order):

▸ Universal Apps (iPhone and iPad)

- Coinflation

- NGC

- PCGS Coin Cert Verification

- PCGS CoinFacts

- PCGS Photograde

- PCGS Price Guide

- XE Currency

▸ iPad Only

- The Numismatist HD (2009 – present)†

- The Numismatist Magazine (All editions)†

- Kcast Gold Live! (Kitco)‡

▸ iPhone only

- CDN Coin & Currency Pricing

- EyeNote (BEP)

- Gold Live!+ (Kitco)‡

- NantMobile MoneyReader

NOTES:

† Both apps are available for the iPhone

‡ Note that there are different versions for the iPhone and iPad. The “+” is not a typo.

▸ Website Links

Website Links are bookmarks on the phone’s Home Screen. On the iPhone open Safari and go to the page you want to bookmark the press the sharing icon (the box with the arrow pointed up). In the popup select “Add to Home Screen” from the set of icons on the second line.

Bookmarks

Do you want to add these links to your browser’s bookmarks? Right-click (or Mac users can CTRL-Click) on the following button and select whatever option your browser requires to save the file to hard drive. Import the file as an “HTML Bookmark” file to add these links to your book marks.

Feb 22, 2018 | commentary, counterfeit, currency, education, scams, security

It is difficult to turn on the television, read the news, or visit social media without the tragedies of the day smacking us in the face. Although crime statistics are the lowest it has been in generations, there are some crimes that have seen a rise. Those are the crimes that are given the headlines and the most airtime on the news.

Unfortunately, the news extends beyond the mainstream but extends to Main Street.

Numismatics has not been a stranger to the criminal element. If it is not embezzlers using coins to defraud people and governments, there are the counterfeits primarily coming from China. Now there are two new scams that the industry has to watch.

Counterfeiting currency is definitely not a new issue. Counterfeiting the currency that is supposed to be the most secure is something that is now hitting the mainstream, especially in countries that have adopted the use of polymer notes, is important news.

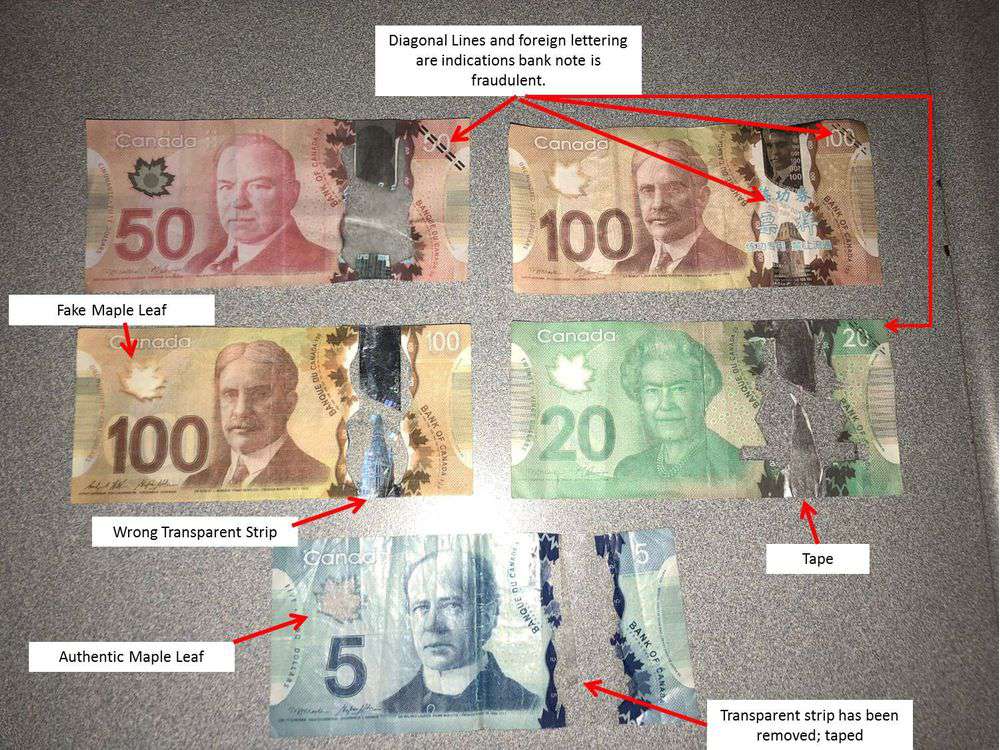

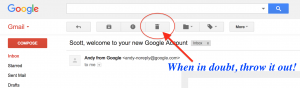

Police in Saskatoon, Saskatchewan has reported the confiscation of 72 bogus Canadian banknotes. Counterfeiters are using a combination of printed plastic sheets and physical cut-and-paste of lower denomination notes to mimic higher denomination notes.

Image released by the Saskatoon Police showing the counterfeit currency (Image courtesy of the Saskatoon Police via the Saskatoon StarPhoenix)

Within the same news feed, the Bank of England issued warnings and additional guidance after counterfeit notes were used for purchases at pubs in Lincolnshire. Many stories from the U.K. suggest that the people do not seem to like the new polymer notes, but this does not seem to help.

Bank of England wants people to watch for the color shifting ink in the quill (Bank of England image)

The Reserve Bank of Australia (RBA), Australia’s central bank and the primary developer of the polymer substrate used around the world, has found that their currency is under attack by industrious forgers. One particular forger found a plastic substrate similar to the polymer developed by the RBA. The forger bought one high-quality commercial printer from the used market and rented two others to print Australian $50 notes.

According to the reports, the $50 note was picked because it provides is common enough to be used in daily transactions (AU$50 is equivalent to US$39.06 as this is being written) and high enough of a denomination to be cost-effective for the forger. Remember, forgery may be a crime but it is a business.

A counterfeit Australian $50 note has the wrong security stripes and the star field on the right is supposed to be clear (Image courtesy of The Sydney Morning Herald)

Although these issues have not directly affected the collectible currency market, it has had an effect on the dealers when their customers pay in cash. Even with the rise of electronic transactions, many European dealers continue to do over-the-counter sales using cash. In some countries, like Germany, cash is still king even when purchasing rare coins.

While discussing these issues with a dealer based in Germany, it was reported that he will not accept large sums of cash from customers he has not done business with in the past. This dealer does not accept credit card payments over 200€ or for any bullion-based transactions. His regular customers can directly wire the funds to a special account the dealer set up. Others must use certified bank checks.

This is not to suggest wire transfers are safe. In a blog post on Kovels.com, they have been contacted by antique dealers that reported money stolen by wire transfers. According to the blog post:

The fraudsters hack your emails and insert their own email, cloned to look like an email from a trusted person, into your email stream. They then request a wire transfer — providing all needed wire instructions — for something that looks legitimate. Once a bank wire is sent, it is extremely difficult, if not impossible, to get the money back. If you need to send a wire, be sure to use “old” technology and confirm on the telephone with someone that you know!

Even though I am no longer in the information security business, it is still my obligation to remind you that EMAIL IS NOT A SECURE FORM OF COMMUNICATION! Email is the electronic equivalent of a postcard. Any message you send, unless it is encrypted, can be read, scanned, snooped, and even altered by anyone, anywhere, at any time.

“Oh, it cannot happen to me!”

I used to hear that line when I taught a senior-level college class on information security. Using a laptop connected to an overhead projector, I was able to show the class how easy it was not only to create spam but to make it look like an email was sent by someone else. I was also able to demonstrate how to read the email traffic on the local network with a few keystrokes. Are you using wireless connections? You just made stealing your information easier for the hacker.

Counterfeiting and wire fraud are not just problems for dealers. When dealers are defrauded by these criminals, they have to recover the money in some way. Insurance does not cover all losses or the extra security that will be required to protect their transactions. Prices will have to go up to cover the losses and the future costs of doing business.

The cost of doing business in this environment is not a trivial subject. While dealers of all types of collectibles want you business, fraudsters are making it difficult for dealers trust the off-the-street buyer. This makes counterfeiting and fraud a problem for everyone.

Someone walked into my shop today with a box full of items he said that he wanted to consign to one of our auctions. He said that someone mentioned that I was knowledgeable about coins and wanted me to help liquidate his collection.

Someone walked into my shop today with a box full of items he said that he wanted to consign to one of our auctions. He said that someone mentioned that I was knowledgeable about coins and wanted me to help liquidate his collection.

The

The

Last week, I

Last week, I