Sep 13, 2010 | education, gold

With gold climbing to record levels, there seems to be as many people who want to sell their gold as well as people who want to buy your gold. The problem is that there are buyers looking to maximize their profit at your expense. When it comes to the gold trade, knowledge is the most powerful defense you have from getting a bad deal. I recently helped a friend sell old gold jewelry, pieces that my friend described as gold scrap. It was an eye opening experience.

Like a lot of people, my friend looked online and saw that the price of gold was around $1,200 per ounce and decided to sell gold items he had around the house including some pieces that belonged to his grandmother. He gathered his items and went to a local store that offered to buy his gold at a fraction of what he thought it was worth. My friend did not understand the reasons the dealer provided and came to me to explain what he heard.

How much gold do you have?

As he spread the gold trinkets on the table in front of us, he asked why the gold dealer was weighing his gold in grams. Grams are a convenient measure for calculating the weight and cost. I set my scale on the table, set it to display the weight in grams, and weighed 246.4 grams of gold. The first thing my friend ask that if he had 226.4 grams of gold (about 8.7 ounces), then why was he not offered around $10,440 (using a spot price of $1200). I told him that the pile of gold jewelry was not a full 226.4 grams of gold.

After my friend gave me a quizzical look, I picked up a larger piece of the jewelry, my loupe, and started look for the maker’s mark and the content information. After a moment, I found an “18K” mark declaring that the item was made from 18 karat gold. I explained that the piece was made from 18-karat gold meaning that it was made using an alloy of 75-percent gold and 25-percent something else. Unless the “something else” is platinum, what is the alloy is usually irrelevant. I explained that the purity of gold is measured in karats (or carats). Karats are based on a 24-point scale used to express the percentage of gold (or other precious metals) in the item. Typically, you will find that most gold jewelry is represented by one of the following purity designations:

| Karat |

Fineness |

| 24 |

.999 |

| 22 |

.916 |

| 18 |

.750 |

| 14 |

.585 |

| 10 |

.417 |

I weighed the item and found it weighed 21.2 grams. Since it is made from 18 karat (75-percent) gold, the piece really contains 15.9 grams of gold. A conversion program told me that the piece has 0.56 ounces of gold. If the spot price is $1,200, the item has $672 worth of gold, right?

One fact that most people do not realize is that the price of gold is stated in Troy Ounces. The Troy weight system has been adapted from the Roman monetary system that was based on their standard bronze bar and 12 smaller bars that made up a fraction of that larger bar. Thus, there are 12 Troy ounces in a Troy pound. When weights and measures were standardized, the Troy ounce was standardized as 31.1034768 grams.

When we weigh items in the United States, we normally use the avoirdupois system which we sometime call the English system. Avoirdupois weight is an adaption of the British monetary system (pound, shilling, and pence) and is heavier than the Troy weight system. According to the standard, the troy pound is 5,760 grains while the avoirdupois pound is heavier at 7,000 grains.

To find out how much the gold in piece weighs in troy ounces, we divide 15.9 grams by 31.1 (rounded). The result was a weight of .5112 troy ounces. With gold worth $1,200 per troy ounce, the item actually contains $611 worth of gold.

After removing the gold coins from his pile (gold coins will be discussed in a later post), we started to identify each item by the purity. All of the items were 10, 14, or 18 karat gold in fineness. The piles were weighed and the totals calculated. When we were finished, we calculated that he really had 90.6 grams of gold. That is close to 2.91 troy ounces of gold or $3,192 with gold closing at $1,200 per troy ounce.

What is a fair price for the gold?

When you look up the spot or market price of gold, the price given is the trading price for one troy ounce of gold. This is a wholesale price that dealers use to sell to each other. When looking at prices, this is sometimes called the bid price. The bid price is the highest price someone is willing to pay for gold while the ask price is the offer price. The spot price is the last successful bid on the trading market. When negotiating with dealers, they will use the spot price from the last time the market closed. They will rarely use intra-day prices since it may be too volatile.

The first thing you will have to remember that if you are selling to a dealer, you are not selling your item at a retail price. You are not selling at a wholesale price, either. You are selling to the first person in a long processing chain where everyone is looking to make a profit from the transaction. The chain could look like:

- The dealer buys the gold from you and then sells the gold to a gold refiner.

- The gold refiner will process the item by removing adornments that are not gold. This could be anything from stones in the item to stainless steel pins. While they do not do a perfect job, there is a lot of labor involved in the process.

- The gold refiner melts the items separating the gold from everything else. The leftover metal is refined and will be used to change the purity of the final product.

- Some refiners make their own wholesale products including gold wire, gold leaf, smaller gold bars used by jewelers, or collectible gold bars and medallions. Other refiners sell their gold to manufacturers who will make the wholesale gold products or mass manufacturers, such as those who make jewelry for chain stores.

- Wholesale gold products are usually sold to distributors who will resell them in their niche markets. For example, edible gold leaf would be sold in the food industry while other gold leaf will be sold to art supplies or directly to artists.

There are costs involved in every process. Refining has one the highest costs because of the resources required to refine gold, remove the chaff, and the equipment to do this. Costs plus profit can add up to 20-percent to the price of the gold.

Every time the gold is processed and sold the business costs and profits add to the costs. By the time the physical gold is purchased it is possible that the cost of gold will be more than the spot price. That cost is justified because the item has some value added. Jewelry items add additional stones, other metals, the artist’s craftsmanship, and profit. Coin and medals also have similar value added to the final product.

Before your gold travels this road, the gold dealer looks to maximize his profit. If the dealer is working out of a hotel, they will have to earn enough to cover their rental fees and other expenses. Dealers with established storefronts may be able to offer better prices since they already have a revenue stream they can count on for expenses.

Testing the Waters

To determine what dealers consider a fair price for the gold, my friend and I tried an experiment. We went to six dealers to get their quotes and compare our findings. We went to the same dealers on different days by one trying to sell the gold in bulk by putting everything in a signal bag and bringing it to the dealers. Then we tried to sell the gold buy sorting by quality of the gold (e.g., 14 karat, 18 karat, etc.). Since we wanted their input, my friend and I agreed not to negotiate with the dealers.

One Saturday, my friend picked up the bag of gold and went to six different types of dealers. Two had storefronts, one temporarily rented the first five feet of a storefront in a local mall, and the others we met in a hotel conference rooms. On Sunday, I went to the same dealers but with the gold sorted by fineness in different envelopes. We went to dealers neither of us had any previously association. We also went to the Baltimore area to avoid D.C.-area coin dealers, most of whom I have met before.

What We Observed

With the spot price of gold closing at $1,220 on Friday afternoon, the gold was worth $3,550.20 retail. The offers were varied and interesting:

| Dealer |

Bulk Offer

(pct of spot) |

Sorted Offer

(pct of spot) |

| Dealer 1 (jewelry store) |

$2,300 (64.7%) |

$2,500 (70.4%) |

| Dealer 2 (coin shop) |

$2,500 (70.4%) |

$2,700 (76.1%) |

| Dealer 3 (hotel #1) |

$1,500 (42.2%) |

$1,500 (42.2%) |

| Dealer 4 (hotel #2) |

$1,750 (49.2%) |

$1,700 (47.8%) |

| Dealer 5 (hotel #3) |

$1,300 (36.6%) |

$1,450 (40.8%) |

| Dealer 6 (temp mall shop) |

$1,600 (45.1%) |

$1,600 (45.1%) |

Although we agreed not to negotiate with the dealers, neither of us could help ourselves. My friend kept a sheet with out calculations handy to talk with the dealers and the envelopes I used to carry the separated gold had weights and estimates.

Because we went to the hotel dealers with information at hand, we think we received higher offers than others. It was common to watch the dealers pour the envelopes onto a try, weigh the items, then calculate a cost. It appears that the dealers are assuming all gold is an average of 12 karat and offer about 30-percent of the spot price.

Both the coin shop and jewelry store were more honest with their transaction. Both explained the differences in the quality of the gold and how it is calculated. While they did not take the care to weigh and calculate the costs as my friend and I did, I thought both were doing their best to give us the best price. In fact, the jewelry storeowner asked about consigning a few pieces to sell as jewelry and not as bulk gold.

The three hotel dealers were the least friendly. They had a take-it-or-leave-it attitude and did not like it when we started to question their offer. Their offers were the lowest and even if I did not prepare before going, I would not do business with them. The mall shop clerk did not know what he was doing. He was trained in the process but did not understand anything other than the process.

Interestingly, the Dealers 3 and 4 recognized the jewelry the next day when I brought them in. After I told Dealer 4 he offered $50 less than he offered my friend, he sarcastically said he should offer $100 less or call the police.

The Final Result

After our discussion with the jeweler, we went to a local estate jewelry dealer to show him the items. Rather than selling the items in bulk, the dealer purchased three pieces as jewelry for resale and the rest as scrap gold. One of the pieces had other precious stones my friend thought were not real because that is what his grandmother had said. The jeweler knew better!

While discussing our experiment, the jewelry dealer said that he has heard the story before. The hotel dealers are usually out of town buyers who try to buy as low as possible. They have higher costs because of their travel and shipping of the gold. A brick-and-mortar store with an established supply chain has a lower cost structure for moving products and transferring the gold to refiners through established business channels. Also, jewelers can opt to purchase older jewelry for resale, which will pay more money than spot gold prices.

When we walked out of the jewelry shop, my friend felt that the only way he would get a better deal was to try to sell the gold using an online auction site. We both agreed that selling to the estate jeweler was easier.

Recommendation

Based on our experience and the anecdotal evidence from others, do not try to sell your gold to a dealer in a hotel or one with a temporary storefront. These people are looking for the maximum profit in the least amount of time regardless of what you are trying to sell.

Coin dealers are a good middle-range buyer. But it is better to bring them coins than scrap gold.

Nothing could compare with the treatment by the jewelers, especially the one that specializes in estate jewelry. You may think you have old scrap items from grandma’s estate, but the jeweler can tell you otherwise. I would recommend taking jewelry you think is just scrap gold to an estate jewelry dealer. My friend did very well.

Whatever you decide to do, educate yourself before trying this on your own. I am convinced that we would have received lower offers if we just walked in off the street without the research.

Aug 30, 2010 | commentary, education, gold, investment

At least once every month a reader will send an email note asking about the worth of coins they bought from a television shopping channel or from a company that advertises on cable television. Last week, someone asked specifically about coins bought from a company that sells gold on the show of a nationally known cable television personality.

At least once every month a reader will send an email note asking about the worth of coins they bought from a television shopping channel or from a company that advertises on cable television. Last week, someone asked specifically about coins bought from a company that sells gold on the show of a nationally known cable television personality.

I was surprised to learn what was being sold as investment quality coins. The person who I was corresponding with was sold Swiss and French gold coins whose values are a few percentage points over the melt value of the coin. My correspondent paid much more than the coins value. Unfortunately, the spot price of gold would have to climb over $1,500 per ounce for this person to break even on these coins.

Another email asked about the worth of State Quarter sets purchased from a television shopping channel. This person bought these sets as part of a subscription and paid three-to-five times the numismatic value for these coins. Even though the coins had nice presentation packaging, I was able to show the user online auctions where the coins are not selling for a premium that would allow him to break even.

Over a month ago, someone wrote to ask about a coin set sold by a large mail order coin dealer. As with other coins sold by this dealer, they were quality coins but were overpriced when compared to other dealers and price guides. Although the coins were in special packaging creating the illusion of a set, the price of the coins was 15-25 percent above the retail prices published in price guides.

The common denominator in these stories is that these people bought the sizzle and not the stake. They bought the special packaging or the promise of value trust the person on television, the other end of the telephone, or the pretty advertisement in a magazine. It breaks my heart to tell these people they overpaid!

Each of these people would not have made these mistakes if they had done a little research. Research is not that difficult. It starts with some basic questions: What is this coin really worth? Is this a good investment item? Who is this person I am buying from?

Over the last 10 years, there has been a surge in the publication of numismatic resources, whether it is in print or on the web. Books are being published by traditional hobby publishers and other general purpose publishers that can teach you about any coin type, how to invest in coins, and now there is a book that discusses how to sell the coin collection your grandfather left for you.

Other resources include online price guides, hobby magazines, and various websites that can help you in almost any topic in numismatics.

If that is not enough, ask questions. No question is too basic. When I taught college courses, I would remind my students that there is no such thing as a stupid questions—the only stupid question is the one not asked! Ask your favorite blogger. Ask your favorite dealer. Ask your question in a public forum that caters to coin people. Just ask!

The axiom that if the deal sounds too good to be true, it probably is not true. If you talk with someone about purchasing coins and they try to pressure you into buying immediately, do not give in to the pressure. It is your hard earned money and it is your prerogative to understand everything about how you spend that money.

Before I make any significant purchase, I will analyze the cost of the item before attempting the purchase. I select specific vendors to negotiate with and then contact them to open the conversation. When I negotiate I remember that I have the power. I may want the item, but it is my money the vendor wants. If the vendor wants my money then that person has to work with me. Otherwise, I am prepared to walk out.

If the vendor cannot answer my questions, I walk out unless they say they will find the answer. If the vendor will not answer my questions, I will walk out. If they negotiate in bad faith, I will walk out. If they treat me like they are doing me a favor, I stand up, shake their hands, thank them for their time, and then will I walk out.

Remember, you can say “no” as often as necessary. You can say “yes” only once. Make it count. Do not let the slick talking sales person sell you something that is not in your best interest. Know what you are buying and know how to just say NO!

Aug 2, 2010 | BEP, coins, currency, Federal Reserve, fun, gold, technology, US Mint

It has been said that the dog days of summer is when it is very hot causing a period where there is a lot of inactivity or stagnation. There has been little of the dog days here in the nation’s capital. Aside from a lot of work to do, severe storms can wreak havoc with electrical lines—which causes computers not to work. July has been an interesting month and I hope August is more like the dog days without the same heat and humidity!

For something a little different we turn to the technology website CNET. CNET is a long time resource for the consumer technology community that was acquired by CBS Interactive last year. With the commitment of growth from CBS, CNET has been expanding their technology coverage in a number of interesting ways. For CNET, reporter Daniel Terdiman, writer of the Geek Gestalt blog, is taking another road trip. Road Trip 2010 brings Daniel to the east coast where he has visited a few sites of numismatic interest.

While in Washington, D.C., Daniel stopped at the Bureau of Engraving and Printing where he was given a tour Behind the scenes with the next-gen $100 bill. Daniel opens up his trip report by saying, “I’m staring at $38.4 million in cash, and it’s hard not to drool.” It is a nice look behind the scenes at the BEP from the eyes of someone who is not a collector. Do not forget to check out the stacks of money in the photo gallery.

After making other stops, Daniel was in Philadelphia and visited the US Mint. Daniel opens his article talking about the gold-colored planchets that will be struck into dollar coins. Aside from watching the minting process, he spoke with the U.S. Mint’s Chief Engraver John Mercanti about the technology used in creating coins. Daniel spoke with Engraver Joseph Menna about the digital production process—do not forget to watch the YouTube video. When you check out the pictures and when you get to picture 18 imagine the amount of money you could make on the error market if you had access to this bin!

Finally, stopping in New York City required a stop of the Federal Reserve Bank of New York. Located at 33 Liberty Street in lower Manhattan, it is the branch of the Federal Reserve that distributes U.S. currency worldwide. Eighty feet below the bedrock that the building is constructed on is the gold vault where 36 countries have deposited $255 billion worth of gold. More gold is stored at the New York Fed than anywhere in the world including the U.S. Bullion Depository at Fort Knox, Kentucky. Since photography is not allowed at the N.Y. Fed, they did provide pictures that Daniel used in his report.

Although Daniel did not get much of a tour through the New York Fed, the series of numismatic-related articles are still a good read from someone without a numismatic background. You may want to check out stories on some of his other stops, including the one place I want to visit!

Jul 7, 2010 | coins, currency, Euro, foreign, gold, RCM, video

Not all coin news comes from the United States. Here are three interesting non-U.S. stories from the last few weeks:

Foggia, Italy—A truck in southern Italy carrying €2 million in one and two euro coins crashed and spilled its load on the highway. Feeling they hit the jackpot, drivers stopped and started to scoop up the coins. On the scene, it was estimated that €10,000 was taken. A later count upped that estimate to €50,000. No arrests were reported.

Foggia, Italy—A truck in southern Italy carrying €2 million in one and two euro coins crashed and spilled its load on the highway. Feeling they hit the jackpot, drivers stopped and started to scoop up the coins. On the scene, it was estimated that €10,000 was taken. A later count upped that estimate to €50,000. No arrests were reported.

Driver of the truck and the two cars in the accident were not seriously injured, but they were not the focus of many of the stories. With coins strewn on the roadway and the median, the company responsible for the transport of the coins will be spending the next few days trying to sweep up the coins that motorists did not take.

Zimbabwe—In a country where runaway inflation caused their currency to become worthless and the government made U.S. currency legal tender, Zimbabweans are washing their U.S. dollars so that they can be used.

Zimbabwe—In a country where runaway inflation caused their currency to become worthless and the government made U.S. currency legal tender, Zimbabweans are washing their U.S. dollars so that they can be used.

In this poor country, low-denomination U.S notes are used until they fall apart. But in order to protect currency in crime-ridden areas, notes are carried in shoes or underwear. The obvious sanitary and malodorous issues has made it a problem causing banks and many merchants to refuse to take currency that is dirty and smelly. Some people gently hand-wash their notes and some laundry services have discovered that they can wash notes in the gentle cycle then hang the notes to dry.

Apparently this works for the poor in Zimbabwe since the notes outlive the Bureau of Engraving and Printing’s estimated life span of a $1 Federal Reserve Note of 20-months.

Vienna—Spanish gold dealer Oro Direct S.L.U. bought the world’s largest gold coin at auction for &euro3.27 million (approximately $4.02 million). The 100 kilogram coin with a face value of C$1 million was made by the Royal Canadian Mint in 2007. This coin currently holds the world’s record for being the largest coin ever made.

Vienna—Spanish gold dealer Oro Direct S.L.U. bought the world’s largest gold coin at auction for &euro3.27 million (approximately $4.02 million). The 100 kilogram coin with a face value of C$1 million was made by the Royal Canadian Mint in 2007. This coin currently holds the world’s record for being the largest coin ever made.

Gold was trading at $1,253.55 per troy ounce in London at the time of the auction.

“We believe that this is a way to demonstrate our opinion that gold is the ultimate store of wealth,” Oro Direct spokesman Michael Berger was reported as saying. “As long as central banks continue to print enormous amounts of paper money, we believe physical gold will be a fantastic investment.”

The following news video is from Reuters:

About the coin in a video by the Royal Canadian Mint:

Images from Italy and Zimbabwe are courtesy of the AP.

Image of the C$1 Million Maple Leaf courtesy of Reuters.

Dec 31, 2009 | bullion, Eagles, gold

On the NGC Forums, there was a discussion about collecting gold dollars where someone asked about their composition. Being curious, I looked up the composition information. What I found was that there were different compositions that was tied to the evolution of US coinage.

After posting the basic information, I thought it would be interesting to look up which series of gold coins were made from each of the different compositions. The rest of this posting is what I found after consulting a few references.

The Coinage Act of 1792, the First Coinage Act, set the standard for gold coinage to be .9167 fine with the balance of silver and copper. Gold coins struck 1792-1834 were made of this composition. These coins include:

- Turban Head $2½ Quarter Eagles (1796-1807)

- Capped Bust $2½ Quarter Eagles (1808-1834)

- Capped Bust to the Right $5 Half Eagles (1795-1807)

- Capped Bust to the Left $5 Half Eagles (1807-1812)

- Capped Head to the Left $5 Half Eagles (1813-1834)

- Capped Head to the Right $10 Eagles (1795-1804)

The Coinage Act of 1834, the Second Coinage Act, set the price of gold at $20.67 and changed the composition to .8992 fine with the balance of silver and copper. Gold coins struck from 1834-1839 were made of this composition. These coins include:

- Classic Head $2½ Quarter Eagles (1834-1939)

- Classic Head $5 Half Eagles (1834-1838)

The Coinage Act of 1837, also called the Bland-Allison Act, put the US on a bimetal monetary standard mostly to help the silver industry following the Panic of 1873. Originally, President Rutherford B. Hayes vetoed the bill only to have congress override the veto. Gold coins struck from 1839-1933 were made of .9000 gold and the balance was silver and copper. These coins include:

- Liberty Head One Dollar (1859-1854)

- Indian Princess Dollar (1854-1889)

- Liberty Head $2½ Quarter Eagles (1840-1907)

- Indian Head $2½ Quarter Eagles (1908-1929)

- Indian Princess 3 Dollars (1854-1899)

- Liberty Head $5 Half Eagles (1839-1908)

- Indian Head $5 Half Eagles (1908-1929)

- Liberty Head, No Motto Above Eagle $10 Eagles (1838-1866)

- Liberty Head, Motto Above Eagle $10 Eagles (1866-1907)

- Indian Head $10 Eagles (1907-1933)

- Liberty Head $20 Double Eagles (1849-1907)

- Saint-Gaudens $20 Double Eagles (1907-1933)

All gold commemoratives, both prior to 1933 and since 1982, are struck using .9000 gold. Commemorative struck before 1933 was filled with 1-part silver and 2-parts copper. Commemorative coins struck since 1982 use a 2-part copper to 1-part nickel filler.

The $4 Stella patterns were an attempt to create a standard coinage composition for international trade. The composition called goloid was made of 6 grams of gold, 0.3 grams of silver, 0.7 grams of copper. A Flowing Hair and Coiled Hair Liberty Head patterns were struck in 1879 and 1880.

American Gold Eagle bullion and proof coins are .9167 gold (22 carat). The one ounce gold Eagle contains one troy ounce of gold plus .0909 troy ounces of filler consisting of 2-parts nickel to 1-part copper.

The American Buffalo gold coin contains one troy ounce of .9999 fine gold (24 carat) with copper as the filler.

I hope someone finds this useful.

Nov 9, 2009 | bullion, foreign, gold, silver, US Mint

My motivation for recommending the restructuring of the US Mint was when they announced that proof silver and gold American Eagle coins will not be produced in 2009. The logic of the decision in the context of what we know of the US Mint’s operations was unpalatable.

Restructuring the bullion program is to first acknowledge that it is a profit center for the US Mint. Its sole purpose is the buy precious metals and create bullion coins for sale at a significant profit. In the 2008 Annual Report, the profit on bullion issues was 22-percent over all costs, more than circulating currency or commemorative coins.

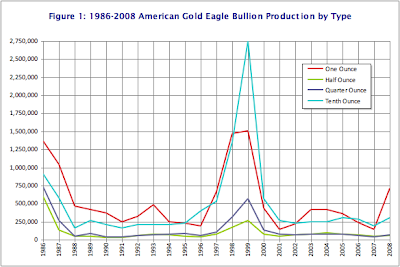

The anchor of the bullion program are the American Eagles, which has been the most successful bullion program since its inception in 1986. The program started with silver and gold American Eagles. Platinum bullion Eagles were first struck in 1997. American Silver Eagle coins are one troy ounce of 99.9-percent pure silver. American Gold Eagles contain 22-karat (91.67-percet) of gold balanced with silver and copper struck in 1/10 ($5), ¼ ($10), ½ ($25), and one ($50) troy ounces. American Platinum Eagles are struck using 99.95-percent platinum in 1/10 ($10), ¼ ($25), ½ ($50), and one ($100) troy ounces. This program will not change and the US Mint will continue striking coins to meet the demand.

Under the current law, it is not required that the US Mint strike proof versions of these bullion coins. This restructuring will change this to require a minimum mintage of these coins. For the future, the US Mint will strike proof coins to meet the demand with a maximum number in ounces of metals used. For this policy, it is proposed that 1 million troy ounces of silver be used for proof coins meaning the production will be limited to 1 million coins. Gold will be limited to 500,000 troy ounces of gold across all sizes. Finally, platinum will be limited to 100,000 troy ounces in proof coins.

I am not proposing changes to the 24-karat (.999 fine) Gold Buffalo program.

To complete the transformation, the First Spouse program will be transfered to bullion issues and continue using the same rules as it does today.

This year, the US Mint introduced the 2009 Ultra High Relief Coin. This coin brings to life the Augustus Saint-Gaudens proposed high relief design for his $20 Double Eagle design that 1909 technology could not create. The coin has been praised for its beauty and should be a future Coin of the Year candidate.

The concept of creating special bullion coins like the Ultra High Relief coin is something that a new bullion program can do. The US Mint, with direction from the CCAC acting as the US Mint’s Board of Directors can authorize new bullion coins that will allow the US Mint to create new collectibles that could be marketed to a wider audience. In addition to special strikes, the new bullion program can include coins with privy marks, special reverses, enameled coins, even coins made from multiple materials.

Examples of what could be accomplished can be seen in the 2007 Coin of the Year and 2008 Coin of the Year candidates. Although there are wonderful single metal coins, there are some wonderful coins using other design elements. In fact, the the 2009 Coin of the Year award was given to the 2007 Mongolia Wolverine coin with diamonds for eyes that is very intriguing when seen in hand!

It is not my intent to tun the US Mint into the non-circulating legal tender (NCLT) producer like the Royal Canadian Mint who is known to produce a large number of bullion-related issues. The CCAC should limit the introduction of bullion issues to a few a year and limit the number of coins that could be produced for each type. But if the US Mint can find influence in more areas than classic US coinage to produce beautiful collectibles using bullion metals.

Before I forget, these coins are bullion collectibles sold as a profit for the US Mint. They are not commemorative coins and not subject to the fundraising considerations proposed for commemorative coins.

Although the US Mint has been the focus of this series, we cannot reform America’s currency without considering paper money. Next, I will look at the Bureau of Engraving and Printing and what to do with Federal Reserve Notes.

Oct 19, 2009 | bullion, Eagles, gold, silver, US Mint

I am sure you heard that the US Mint has announced that they will not produce American Eagle gold and silver proof coins “[because] of unprecedented demand for American Eagle Gold and Silver Bullion Coins.” Is there really an unprecedented demand?

What We Should Have Learned

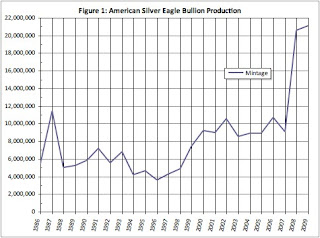

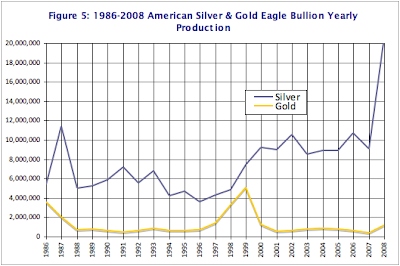

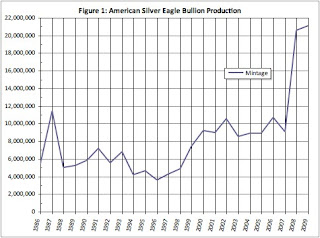

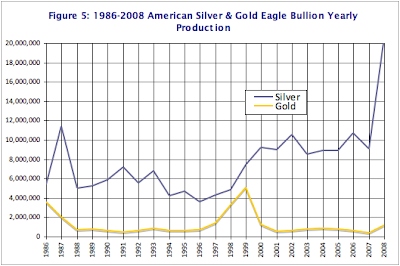

In an analysis posted here last April, production totals for 2008 showed that the US Mint experienced an extraordinary increase in demand for American Silver Eagle bullion coins striking over 20 million ounces of silver for the first time. This was a 128-percent increase over the 2007 production and almost twice as large as 2006, the second highest production total.

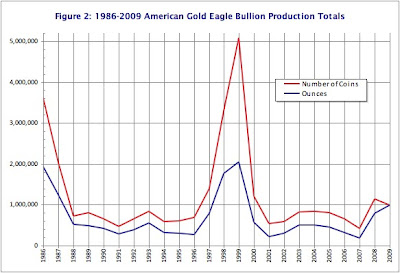

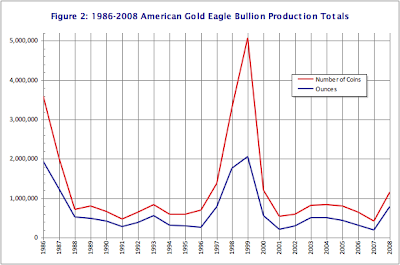

Gold production totals revealed a different story. There was an unprecedented demand in 1998-1999 where the number of American Gold Eagle coins and the ounces of gold used has not been matched by the US Mint. In addition to striking over 5 million coins using over 2 million ounces of gold, the US Mint also struck over 4.4 million 50 State Quarters in the program’s first year of issue. The production of 1.1 million coins using 788,500 ounces of gold was only a bit above average but the most in the 21st century.

Since the start of the current economic crisis that experts say began in December 2007, it was clear that the US Mint was unprepared when investors turned to purchasing American Eagle coins looking for safe investments. In fact, the US Mint admitted that the US Mint knew they were experiencing shortages as early as June 2008. By October, the US Mint had to announce that there is a shortage of bullion because the US Mint could not purchase enough material at market prices to meet the demand. After a year, the US Mint announced that “the United States is lifting the allocation process,” ending the rationing of bullion issues.

Whoever said no news is good news has never met the politicians running the US Mint.

Where We Stand Today

With the announcement by the US Mint, I downloaded the 2009 bullion production totals and added it to the previous analysis to see if there has been an unprecedented demand.

If the demand for silver in 2008 was any indication, it would be matched or exceeded by the demand in 2009. Through the first week in October, the US Mint has struck over 21 million one-ounce American Silver Eagle bullion coins. That is more coins than the 20.5 million struck in 2008. Figure 1 shows that if the trend continues, 2009 will exceed all silver production totals for American Silver Eagle coins.

Click image to enlarge

Click image to enlargeAlthough there was a dip in the monthly production for September (see Figure 2), trends show that American Silver Eagle coins struck in the fourth quarter (the first quarter of the fiscal year) can outpace production in earlier in the year. It is possible that the US Mint could produce another 10 million silver coins by the end of the year, especially if collectors plan to buy bullion coins to fill in the whole made by the 2009 discontinuance of the proof coin.

Click image to enlarge

Click image to enlargeGold Glitters, But…

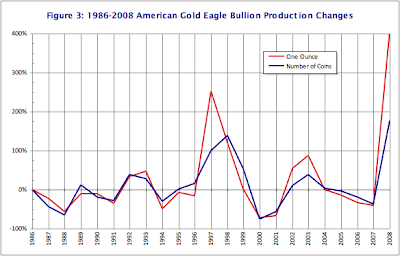

Although production for the 2009 American Gold Eagle is outpacing production for 2008, this cannot be said about gold. While gold will surpass last year’s production totals, the US Mint will not produce the amount of coins or strike the amount of gold that they did in 1998 and 1999 (see Figure 3). And while the US Mint may strike more than the 1.3 million coins that marked 1997, they will do so by striking only one-ounce coins.

Click image to enlarge

Click image to enlargeEven with the production increases in 2009, the combined unit production of the gold and silver American Eagle coins will be less than it was a decade ago.

So What Is The Mint Doing?

At the end of April, it was reported that US Mint ceased production of nickels and dimes that would last for six months because of the reduced demand from the Federal Reserve. They continued the production of other coins with changing designs, such as the Bicentennial Lincoln Cent, DC & Territories Quarters, and Presidential Dollars. Recent reports show that the US Mint has not continued striking nickels and dimes while producing fewer quarters than any series since the start of the 50 States Quarter program began in 1999.

The Philadelphia Mint has also ceased production of Kennedy Half Dollars. In fact, Denver has out produced Philadelphia by 26.5 million coins.

As part of the announcement of the temporary cessation of production, the US Mint said that workers will participate in a six-month productivity maintenance program and capital maintenance in order to keep the rank-and-file workers employed.

According to the US Mint’s Annual Reports, American Eagle coins are struck at both Philadelphia and West Point. Bullion issues do not include mint marks making it difficult for collectors to determine where the coins were struck.

If there are idle coin presses at the Philadelphia Mint and employees not working on the production of business strikes, why has management not allocated the appropriate resources to meet the demand for bullion as well as the demand for collector American Eagle coins?

Between 1998 and 2001, the US Mint was running at full production including the new 50 State Quarters and was able to meet the bullion and collector demand for American Eagle coins. In fact, between the two years, the US Mint was producing half-dollars for regular circulation and changed the production of dollars from the Susan B. Anthony dollars to the Sacagawea design. Even with the economic slowdown, the US Mint produced a record number of coins in 2001.

With coin presses silent and the lack of sell outs for this year’s commemorative coins, why can’t the US Mint keep up with the investor and collector demand for American Eagles?

It Does Not Make Sense

Even though there was a coin shortage in the mid-1960s, production at the US Mint exceeds what it is today. In order to find production totals as low as they are this year, we would have to look over 50 years ago when the Philadelphia Mint was in its third building and only producing five types of coins with no commemoratives.

Today, the Philadelphia Mint is in a larger building with more state of the art equipment. The same facility that helped produce record numbers of coins less than ten years ago while striking bullion that included platinum American Eagle coins.

The only answer is the incompetence of the US Mint’s management.

It is very clear that the leadership of Director Edmund Moy and Deputy Director Andrew Brunhart must be questioned. Moy was a patronage appointee who has no experience managing a manufacturing operation or in any other type of position where workflow and resource management is critical. Brunhart, who was hired for his “expertise in organizational change,” appears to be changing the US Mint the same way he changed the Washington Suburban Sanitary Commission (WSSC), for the worse.

I know that the country has issues that may be more important than who is running the US Mint. But the US Mint is a profit center for the federal government and those profits (seignorage) are being hurt by its leadership’s inability to manage its resources properly. Therefore, it is time that President Obama set aside a few moments to replace these political hacks before they destroy one of America’s oldest bureau.

Will You Help?

If you are a collector, investor, or have an interest in seeing the US Mint successfully carry out its mission, I ask that you write a letter (addressed to 1600 Pennsylvania Ave NW, Washington, DC 20500-0001), send an email, or go to the White House website contact form and tell President Obama that Director Moy and Deputy Director Brunhart are damaging this venerable institution.

Hopefully, we can convince the President to act now before US Mint management tries something insipid, like blame collectors for their problems as they tried to do in the mid-1960s.

Sep 20, 2009 | coins, gold, legal, US Mint

Thanks to an article that appeared in The New York Times, the case of Langbord v. U.S. Mint was back in the news. Apparently, the order [PDF] for the government to turn over the ten 1933 Saint-Gaudens Double Eagle coins to the Langbord family was posted to the website for the US District Court for Eastern Pennsylvania.

Thanks to an article that appeared in The New York Times, the case of Langbord v. U.S. Mint was back in the news. Apparently, the order [PDF] for the government to turn over the ten 1933 Saint-Gaudens Double Eagle coins to the Langbord family was posted to the website for the US District Court for Eastern Pennsylvania.

In the order, Judge Legrome D. Davis, Jr. agreed with the plaintiff (Langbord family) that the coins were illegally seized and order the government to turn over the coins or initiate a judicial forfeiture procedure by September 28, 2009. There has been no comment issued by the US Mint or the Department of the Treasury. It is expected that the government would file a forfeiture procedure that would have to prove the coins were stolen from the US Mint. Since the alleged crime occurred 75 years ago and none of the principals are still alive, the government has a very high standard to meet.

The 1933 Saint-Gaudens Double Eagle coins has been the source of legends. After the sale of the Farouk-Fenton Coin for $7.59 million in 2002, its story became the inspiration for two books, Illegal Tender and Double Eagle, and inspired legislation to protect older coins and patterns that left the Mint under allegedly nefarious conditions.

But would the addition of ten coins reduce the value of the Farouk-Fenton specimen?

Along with condition and rarity, any special story or provenance of a coin will affect its price. The story and provenance of the Farouk-Fenton specimen is extraordinary. It was the subject of international intrigue including the overthrow of King Farouk of Egypt and the chase by the US Secret Service for the coin that lead to the sting at the Waldorf Astoria Hotel where British coin dealer Stephen Fenton was arrested trying to buy the coin.

Two books, a court case, and a sale by Southeby’s for $6.6 million (plus the 15-percent buyer’s fee making the total $7.59 million) makes it a one-of-a-kind coin.

Even if the Switt-Langbord coins enter the market they may never reach the status of the Farouk-Fenton example. The only factor that could bring down the price of the Farouk-Fenton coin would the be effect of the economy. Otherwise, it will stand alone as the first 1933 Saint-Gaudens Double Eagle that comes with a very unique story.

Image courtesy of the US Mint and NY Times.

Jun 27, 2009 | bullion, coins, foreign, gold, silver

Fans of the Chinese Panda can look forward to a special edition bullion coin to commemorate 30 years of producing bullion coins. Although the Panda began its production in 1982, The People’s Bank of China has been producing bullion coins since 1979.

The basic design of the coin will be the same as the regular 2009 issue. The obverse of the coin features the Hall of Praying for Good Harvest of the Temple of Heaven in Beijing, the title for the Peoples’ Republic of China in Chinese, and the year. Added to the lower half of the edge will be “30th Anniversary of the Issuance of the Chinese Modern Precious Metal Commemorative Coins” in Chinese.

The basic design of the coin will be the same as the regular 2009 issue. The obverse of the coin features the Hall of Praying for Good Harvest of the Temple of Heaven in Beijing, the title for the Peoples’ Republic of China in Chinese, and the year. Added to the lower half of the edge will be “30th Anniversary of the Issuance of the Chinese Modern Precious Metal Commemorative Coins” in Chinese.

The reverse will feature the panda design for 2009 with a border that will include “30th Anniversary of the Issuance of the Chinese Modern Precious Metal Commemorative Coins” in English. The weight and fineness of the metal will be placed at the bottom of the design just above the border.

This commemorative series will consist of a one-quarter ounce gold coin and a one-ounce silver coin. The gold coin will be made of one-quarter troy ounces of .999 gold, 22 millimeters in diameter, and have a face value of 100 Yuan. The silver coin will be made of one troy ounce of .999 fine silver, 40 millimeters in diameter, and have a face value of 10 Yuan. Mintage is limited to 10,000 gold and 300,000 silver coins.

Coins will be struck at the Shenzhen Guobao Mint and officially distributed by China Gold Coin, Inc., a corporation of the People’s Bank of China.

It looks like I will have to add the silver coin to my want list in order to keep up with the series.

Image courtesy of China Gold Coin, Inc.

Apr 27, 2009 | coins, gold, silver, US Mint

Last year, the US Mint has been under a lot of scrutiny for how they handled gold bullion sales. I tried to find any positive story for the US Mint’s handling of bullion coins. Regardless of the search string I fed into several search websites, I did not find any positive article. Even though the US Mint continues to have problems supplying bullion to the market, I began to wonder if there was a deeper reason that may explain the situation.

Starting with the hypothesis that the shortage of American Gold Eagle bullion coins was because of record high mintage demands, I started by collecting the mintage totals for all American Eagle bullion coins from the US Mint’s website. I am limiting my study to bullion coins because of the difference in striking, handling, and selling collectible versions. I am also not including Gold Buffaloes since they make up less than one-percent of the total number of gold coins produced by the US Mint.

The US Mint does not make downloading mintage data easy. While the numbers are nicely displayed on their website, they do not provide a way to easily import that number into a database or spreadsheet. Using my programming skills, I was able to download the HTML files and extract the numbers. It would be nice if the US Mint would provide a way to download the raw numbers.

Counting Gold Coins

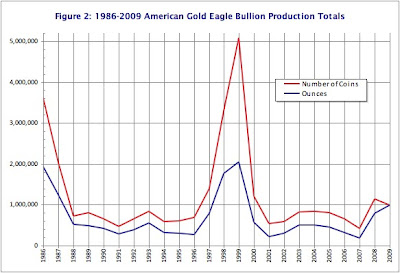

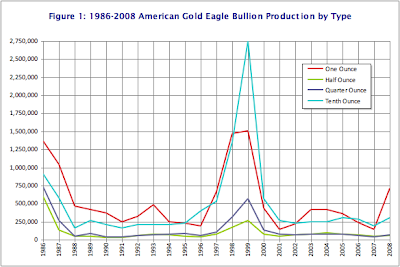

In 27 years of production the US Mint produced over 28.4 million American Gold Eagle bullion coins using over 15.1 million ounces of gold. Over 12 million, or 42.5-percent of the production has been one-ounce coins while more than 10.8 million, or 38-percent are in tenth-ounce coins. Half and quarter-ounce coins combined make up less than 20-percent of the total production of American Gold Eagles. Figure 1 graphs the sales of American Gold Eagle coins.

As with most new coin series, the first year of issue started strong then trailed off the next few years. Our graph in Figure 1 shows that significant changes started in 1998 and continued until 2000. This was the time of the Internet boom when companies were spending money on technology related projects when budgets swelled in fear of the dreaded Y2K Bug. Technology company sprung up like weeds with no business plan, went public with initial public offerings whose prices prompted then Federal Reserve Chairman Alan Greespan to call the run up irrational exuberance, only to crash by 2001.

The economy began to slow after Y2K fizzled but not that slow as the technology industry focused on the potential Leap Day Bug. Usually, every 100 years there will be no leap day on the last year of a century except every 400 years and the last year of a millennium. The threat of the Leap Day Bug continued technology spending but at a slower pace. The economy showed tentative strength through the end of the quarter before showing a slowdown as technology spending slowed.

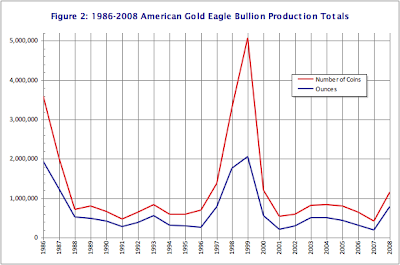

With all of the money entering the market, people were looking for areas for investment. Aside from the irrational exuberance, there were a significant number of investors looking to buy assets to hedge against potential tragedy. Since gold has always been a safe haven from potential disaster, the US Mint increased their production to meet the demand. From 1997 through 2000, the US Mint struck 10.9 million gold coins representing 5.16 million ounces of gold. Considering gold bullion coins are a generic investment, I thought it would be a good baseline to use the number of coins struck and the amount of gold used as a generic comparison from year to year. Figure 2 shows this comparative bullion production.

Graphs in Figures 1 and 2 illustrate that the US Mint produced a significant number of American Gold Eagle Bullion coins during the 1997-2000 economic run. At the time, the US Mint was under the leadership of Philip N. Diehl (1994-2000) and Jay Johnson (2000). Diehl and Johnson guided the US Mint in the production of 48-percent of all gold coins struck between 1986 and 2000. Although this does not take into consideration the total coin production at the US Mint, the time included the introduction of the 50 State Quarters program which caused a significant increase in the number of quarters produced.

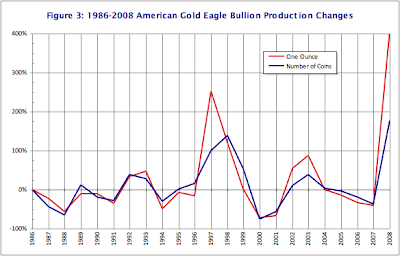

Both graphs show an uptick in production for 2008 where the US Mint reports that they struck over 1.14 million gold coins using 788,500 ounces of gold. This is comparable to the 2000 American Gold Eagle bullion production. But the increase may tell another story. I wanted to figure out what was the difference in production from year to year to see what that says. Figure 3 shows the percent change from year to year.

In 2008, the US Mint produced over 400-percent more gold coins than in 2007 using 178-percent more gold. Since the start of the American Gold Eagle bullion program, there has never been this significant of a change from year to year. But this change was for the year. Was this a steady increase or was there a immediate demand?

Assessing the Demand

Market watchers were greeted on September 8, 2007 with an editorial from the Wall Street Journal saying that 2008 would bring a recession. Citing the credit crunch that began that past July, the editorial said that “tighter credit conditions mean that the drag on the U.S. economy will soon spread beyond the housing sector to affect consumption and investment decisions.” By January 2008, it was reported that Goldman Sachs said that they “[believe] the housing slump and recent credit market turmoil will spill over into the broader economy this year.”

As a result, the spot price of gold rose to over $830 in December 2007, and almost to $930 by the end of January 2008.

According to the US Mint, their best sales month in 2007 was January with sales of 1,650 coins representing 1,208 ounces of gold. As the economy began to turn, the US Mint saw sales increase from 100 coins in September to 1,000 coins in October, and 1,350 in November. There was only a modest increase in sales to 1,400 coins in December 2007 as the US Mint was gearing up for 2008 production.

In January 2008, they reported selling 26,000 coins representing 23,650 ounces of gold. In one month, the US Mint exceeded the sales of gold bullion for all of 2007! Figure 4 graphs the gold bullion production for both 2007 and 2008.

But was this a steady increase or was the growth really a surprise?

Although there were reports we were in a recession, the Dow Jones Industrial Average was still over 12,000 points and gold had a once-per-month spike around $940 per ounce before dropping to $840 with an over $1,000 per ounce spike in March. Sales of American Gold Eagles averaged around 33,000 coins leading up to the summer. Compared to other years, these statistics are unremarkable for the US Mint.

By August, gold dropped to $780 for a brief period and the DJIA dropped to 11,000 points while the financial industry was starting to show significant weakness. Investors started to run for cover in July causing an increase in sales of American Gold Eagles by over 200-percent and an additional 72-percent in August. The rush to buy bullion was too much for the US Mint to handle causing the Mint to suspend bullion sales in mid-August. In September, the markets began to decline, banks and investment houses began to fail, the term “bailout” became prominent in our vocabularies, and the rush for gold strengthened.

We were given our “no kidding” moment when the National Bureau of Economic Research issued a report in December declaring we were in a recession for all of 2008.

Reaching Capacity

In the US Mint’s 2008 Annual Report, they allege that “Production capacity and the volume of precious metal blanks our suppliers can timely provide limit the number of bullion products the United States Mint can produce and sell.” However, the US Mint also noted that there was a decline in the number of business strikes sold as well as a decline in numismatic sales, including the drop in sales of the First Spouse gold coins. There are reports noting even lower production of business strikes this year.

If the US Mint can be accused of modesty in any area it is their assessment of production capacity of bullion coins. According to reports, the US Mint knew that they were experiencing shortage of silver blanks as early as June. Apparently, the US Mint did not tell anyone that 2008 was their best sales year for American Silver Eagle bullion coins. In 2008, the US Mint struck over 20.5 million American Silver Eagle bullion coins. That is a 127-percent increase over 2007’s production and just under twice the previous record of 11.4 million coins in 1987. Figure 5 graphs the dramatic difference in silver production over that for gold.

With the exception of a brief dip in demand during February, production of American Silver Eagle bullion coins remained high as can be seen in Figure 6.

Although the US Mint does not advertise how many coins they can produce over any given period of time, it appears that a significant effort was placed into striking American Silver Eagles over their gold counterparts.

Why Silver Really is King

To understand why the US Mint prioritizes silver over gold is to dig into the how they operate, which is revealed in the 2008 Annual Report. Although the narrative in the report suggests that the net margin for gold is greater than silver, you have to dig deeper to understand the bigger picture.

According to 31 U.S.C. §5116 gold and silver purchased for coinage must be “mined from natural deposits in the United States, or in a territory or possession of the United States, within one year after the month in which the ore from which it is derived was mined.” Gold must be bought from the market at the “the average world price.” If the US Mint cannot purchase the necessary gold, “use gold from reserves held by the United States.” This means that in the event of a gold shortage, the US Mint can use the gold reserves held at Fort Knox to carry out the law.

Silver must also be purchase at the average costs on the world market. However, 31 U.S.C. §5111(b) allows the US Mint to maintain a Coinage Metal Fund to allow the Mint to “invest” in metals in order to maximize profits using dollar cost averaging.

In the FY2008 Annual Report, the US Mint discusses their “Hedging Fund” (Notes to Financial Statements Section 20. Hedging Program, p. 58) that it uses to trade silver shares with partners in order to raise additional capital. The report says that US Mint maintains custody of the silver while the trading occurs. This trading activity yielded $932,000 in profit for FY2008 and $1.3 million in FY2007.

There is no similar program for gold.

The silver trading program makes silver more profitable for the US Mint since they can make a profit by selling lease shares on their non-coinage inventory before making collecting the seigniorage when silver coins are sold.

But We Own A Lot of Gold

According the US Mint’s annual report, the United States is holding 245,262,897 ounces of gold at the United States Bullion Depository in Fort Knox, Kentucky. It has a statutory value of over $10.3 billion dollars (“42 and two-ninths dollars a fine troy ounce” according to 31 U.S.C. §5117(b)).

If there was a shortage of material and the law allows the US Mint to draw from deep storage to make up for the difference, then why did the Mint not withdraw gold to strike coins? Because 31 U.S.C. §5117(b) requires the transfer of gold to the Mint has to be approved by the Secretary of the Treasury, overseen by the Board of Governors of the Federal Reserve, and replaced at the statutory value of “42 and two-ninths dollars a fine troy ounce” when supplies become available. Given the current state of the market, the Mint would not be able to purchase gold for the statutory price $42.2222 fine troy ounce.

What Caused the Shortage

Evidence suggests that the higher demand for silver was a factor in the shortage. However, since the US Mint saw the demand for gold increase as the economy turned in December 2007, and since the US Mint does not keep a large working stock of gold, they were caught without the same safety net as they have with silver and was unable to catch up.

According to reports, the US Mint knew that they were experiencing shortages as early as June. By October, the US Mint announced a shortage of gold and platinum. With the prices rising and the worldwide demand increasing, the US Mint could not purchase enough material at market prices to meet the demand. In other words, the US Mint as unprepared for market demand.

Fixing the US Mint

In 1999, the US Mint announced that not only the Mint experienced increased demand for the American Gold Eagle but announced measures to ensure that the supply would keep up with the demand. In 2008, the US Mint did not adjust their business practices to keep up. Other than changing management at the US Mint, something must be done.

One idea is to change the law to allow the US Mint to have a Hedging Fund for gold. In this program, the US Mint would sell shares for gold in storage on the open market while holding on the physical metal. If the Mint could make an average of $1 million for silver, this would allow the US Mint to leverage stored gold in the same way they leverage stored silver.

In addition to creating a Hedging Fund for gold, the law should allow the US Mint to use the money earned in this program to purchase gold on the open market from any source in the event of a shortage, regardless of where mined. This will allow the US Mint to buy gold from any source to strike bullion coins and maintain their business.

I understand that there may be political implications for this proposal. But when the laws protecting US mining interests were first enacted in the 19th and early 20th centuries, the United States had an abundance of resources and congress passed laws to protect the mining companies, especially as consumer consumption saw a lot of metal leave our shores and not return. The market in the 21st century is more global and the amount of gold resources is not as it was in 1849. Precious metals are globally traded with markets centered in London or New York. It may be time to modernize the laws to allow the Mint to do its business without being held hostage to market forces.

Click on any graph to show larger versions.