May 19, 2020 | currency, news

Feb 17, 2012 — Mercury astronaut John Glenn and his wife, Annie, pose during a luncheon Feb. 17, 2012, celebrating 50 years of Americans in orbit, an era which began with Glenn’s Mercury mission MA-6, on Feb. 20, 1962.

Photo credit: NASA/Kim Shiflett

Annie Glenn was an advocate for those with speech disorders and child abuse. She grew up with a severe stutter that she hid from the public. After undergoing an intensive program at Hollins College, she learned to control her stutter. It gave her the confidence to be an advocate for those who could not speak.

After many years of advocacy, The Annie Glenn Award was created to honor individuals who overcome communications disorders.

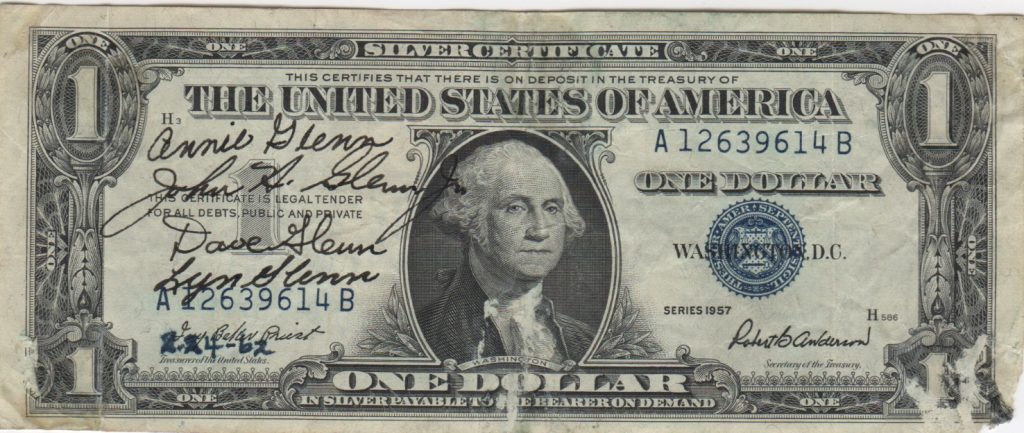

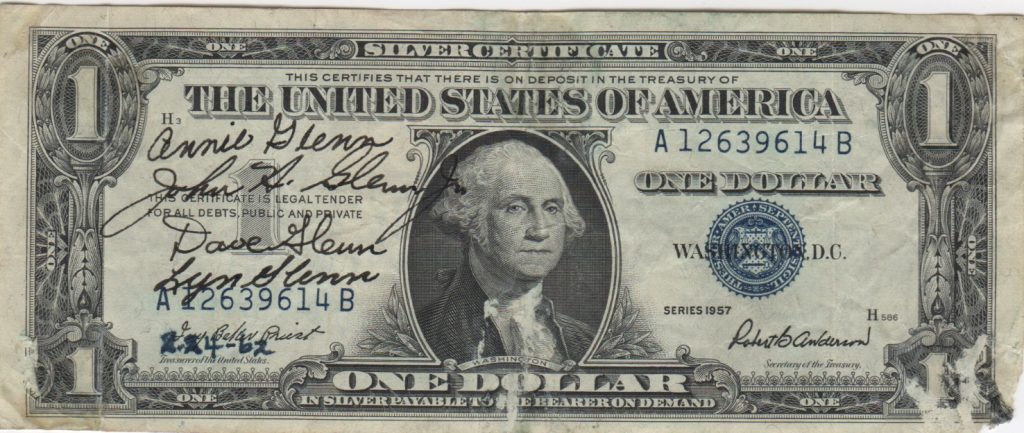

Although there have been many deaths during this pandemic, a few have touched the numismatic community. Aside from being the spouse of a famous American, I own a numismatic collectible with her autograph. The $1 silver certificate may not be worth much as a numismatic collectible, but with the passing of John and Annie Glenn, it becomes more precious.

Glenn family autographed “Short Snorter” dated February 24, 1962, four days after Glenn orbited the earth in Friendship 7

Rest in Peace, Annie Glenn.

Mar 23, 2020 | currency, news

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.

There has been concern about spreading the virus on our currency. According to the Associated Press, “Experts say cash does carry a risk of transmitting the virus, but the risk from cash so far is small compared with other transmission routes.”

Is it possible that a virus-contaminated banknote could transmit the virus? Scientists are not sure. Even considering the studies that show currency could be as dirty as your smartphone, there is no definitive answer.

“It’s not impossible that there might be traces of virus on dollar bills but if you wash your hands it should provide adequate protections, you shouldn’t need anything else,” said Julie Fischer, a professor at the Center for Global Health Science and Society at Georgetown University, on C-SPAN according to the AP.

While countries like South Korea and Poland have withdrawn paper money and has gone as far as burning it, banks in the United States are reporting the opposite effect. Fear has led some customers to make substantial cash withdrawals at banks and ATMs. Some banks are raising withdrawal limits.

The run on the bank is similar to the experiences in 2001 following the attacks of 9/11. Banks reported that customers were withdrawing cash at a higher rate than before the alleged Y2K crisis. Although reports have not reached that level, it is possible to exceed the 2001-2002 withdrawals if the COVID-19 crisis continues for very long.

The Bureau of Engraving and Printing publishes its production numbers monthly. It will be interesting to see if they had to increase production in March to meet increased demand. It proves that cash is still king, and the thoughts of a cashless society can be put away for a while.

And now the news…

March 15, 2020

Precious metals sellers never let a good crisis go to waste, using people’s fears of market turmoil to convince them to invest in an asset like gold or silver coins. These investments may seem safe, but some sellers price their coins at double their actual value, and that can leave the investor poorer.

→ Read more at

qz.com

March 19, 2020

NEW YORK (AP) — In a world suffering a pandemic, cash is no longer king. A growing number of businesses and individuals worldwide have stopped using banknotes in fear that physical currency,…

→ Read more at

apnews.com

March 21, 2020

Why You Should Invest in the $5 Gold Coin Commodities / Gold & Silver 2020 Mar 20, 2020 – 03:34 PM GMT

→ Read more at

marketoracle.co.uk

March 21, 2020

Roman relic: The coin is one of a record number of treasures ( )

→ Read more at

standard.co.uk

Jun 18, 2019 | BEP, commentary, currency, policy

Mockup of the $20 note featuring Harriet Tubman

Aside from my interest in the nuance of politics, beyond reports on cable news, it is why there is a monthly report on legislation that would effect numismatics. Whether it is a proposal for a commemorative coin or the creation of a commission to celebrate something in history, every bill introduced in Congress has the potential to change numismatics.

Paper currency is less regulated than coins. Coining money is mentioned in Article I Section 8 of the United States Constitution. The federal regulation of currency began with the National Bank Act of 1863. Whereas the Constitution says, “Congress shall have Power…to coin Money, regulate the Value thereof, and of foreign Coin,” there is no provision for paper currency.

The Constitution does not say that Congress should design the coins, but they do, sometimes to the detriment of the final result. But the design of the currency is left to the Department of the Treasury.

There is no set process that the Treasury goes through to decide on the design of the nation’s currency. The process changes for each new Secretary that heads the department. In the previous administration, Secretary Jacob “Jack” Lew, went through his version of the process to decide that the portrait of Andrew Jackson on the $20 Federal Reserve Note will be replaced with Harriett Tubman by 2020.

According to sources, although the Bureau of Engraving and Printing would have preferred a little more time to create the master engraving plates to make this change, the timing of the announcement would not present a significant problem.

Lew resigned as the 76th Secretary of the Treasury on January 20, 2017, with the inauguration of a new administration. Steven T. Mnuchin was sworn in as the 77th Secretary of the Treasury on February 13, 2017.

Steven T. Mnuchin, the 77th Secretary of the Treasury

The paper $5 note was a more significant focus for the BEP. In working with the U.S. Secret Service, they were finding that many counterfeiters were using bleaching products to remove the ink from the paper to use it to print higher denominations, predominantly $20 bills. One internal report suggested that the criminal would see a net gain of $14 for each $20 note they could produce.

Although it costs more to counterfeit $20 bills this way, it is a lower risk for the criminal. As we have seen, few people pay attention to the problem and those that do find that the currency passes the iodine pen test. After all, it is currency paper.

An example of a $100 Federal Reserve Note printed on a bleached $5 note (Image courtesy of Prescott Police Department via AOL.com)

Interference from Mnuchin came after his first three months in office. It started with a question from a reporter who asked the president about the change. The president’s statement was followed by a cabinet meeting where the president said something to Mnuchin about the change. Then, a source reports that the president said something to Mnuchin who agreed to do something without raising concerns.

Mnuchin did not directly interfere with the process. Instead, he used the budgetary process to direct funds away from the development of the proposed change in portrait.

Mnuchin was able to hide the change from the public because of the nature of Treasury’s budgetary process. Since the BEP is self-funded by the profits (seigniorage) that is deposited in its Public Enterprise Fund, all Treasury had to do was obtain Congress’s permission to use a set amount from the fund without providing details.

Treasury and BEP were able to hide the changes in the CFO’s Annual Report by using internal reorganization to obfuscate where the spending was going.

In short, Mnuchin ordered the BEP, which is lead by a career professional and not a politician, to move the resources away from the redesign and prioritizing other aspects of currency redesign. Mnuchin purposely slowed the redesign process in a way that gives Treasury and the BEP deniability.

A statement published on the BEP website, BEP Director Len Olijar wrote in response to the news reports, “BEP was never going to unveil a note design in 2020.” That was not the policy of the Treasury Department and the BEP when Secretary Lew announced the change. Mnuchin changed it at the request of the president.

The story of the “delay” of the redesign with Tubman’s portrait appeared in The New York Times. In the story, the Times used an image from the original announcement that depicted Tubman superimposed on the $20 bill. Sources suggested that Olijar, under orders from Mnuchin, was to try to discredit the story in any way possible. Rather than continue with the fact, albeit flawed compared to previous reports, the statement went on to pick on an inconsequential aspect of the story, the image published by the Times.

“The illustration published by the New York Times was a copy of an old Series note with the signatures of former officials, with a different image superimposed on it.”

As my source said, “let’s attack the messenger and not the message.”

Unfortunately, Olijar, a career government employee, is caught in the middle having to work with the politicians. He loses credibility by contradicting the previous reporting, which is unfortunate because sources have suggested that some other than Mnuchin “ordered” Olijar to issue the statement.

There is an old expression that one should never discuss politics, religion, and sex/money/pick something in polite company. It is impossible to be polite when talking about coins and currency before their manufacture. It spreads through the entire process. Or as George Orwell aptly said:

In our age, there is no such thing as ‘keeping out of politics.’ All issues are political issues, and politics itself is a mass of lies, evasions, folly, hatred, and schizophrenia.

May 26, 2019 | cash, coins, currency, news

In the argument as to whether to get rid of cash in favor of credit cards and electronic payments just took an interesting twist this week. According to a study by LendEDU.com, a website that specializes in loan comparison and education, credit and debit cards are dirtier and carry more germs than currency and coins.

LendEDU reported that they “used a scientific device that tests for bacteria on a given surface.” Their publication did not disclose the device that they used. And based on the results, the tests were performed in New York City.

On average, NYC CitiBike (a bicycle sharing service), McDonald’s door handles, a park bench, and a parking meter had more bacteria than the average credit card. But they did find that the credit card was dirtier than a Penn Station bathroom, cash, coins, and a subway pole.

With all due respect to LendEDU, did they find the most remote bathroom in Penn Station and test it after someone did their quick wipe down? And did they test the pole on the subway car after someone used that bathroom and washed their hands if the sink worked?

Aside from being a proponent for using the products produced by the Bureau of Engraving and Printing and the U.S. Mint, I am a native New Yorker and one-time commuter from Long Island. These findings are difficult to believe, especially the low score for the subway pole. I have taken the A Train. I would not have a sandwich without washing my hands after getting off the train!

It is a fun story but hardly a credible test.

If you would excuse me, I have to check the level of the big bottle of hand sanitizer next to the cash register!

And now the news…

May 22, 2019

That credit or debit card in your wallet is apparently dirtier than you might have suspected.  → Read more at foxbusiness.com

→ Read more at foxbusiness.com

May 23, 2019

MONTREAL, May 23, 2019 /PRNewswire/ – In 1969, Plastic Ono Band (John Lennon and Yoko Ono) recorded Give Peace A Chance, an anti-war anthem for generations of pacifists and music fans around the world. The song was recorded live from Lennon and Ono’s Queen Elizabeth Hotel suite in downtown Montreal  → Read more at finance.yahoo.com

→ Read more at finance.yahoo.com

May 24, 2019

The recent discovery of two ancient Spanish coins near Halls Crossing excited archaeologists at Glen Canyon National Recreation Area, who wondered whether they offered evidence that Spanish explorers, possibly in search of mythical cities of gold, passed through Utah centuries ago.  → Read more at sltrib.com

→ Read more at sltrib.com

May 25, 2019

A US-made collectable coin lists Britain and France among the honored US allies in WWII, but, strangely, the Soviet Union, whose Red Army delivered a crushing blow to the Nazis in Europe and fought Japan, is omitted.  → Read more at rt.com

→ Read more at rt.com

May 25, 2019

Apparently, the Soviet Union, whose soldiers hoisted a red flag over the Reichstag marking the liberation of most of Europe from the Nazis during World War II, is not a country that contributed to securing the "liberties" the Western states "enjoy today", per a US company which issued a souvenir commemorating the victory's upcoming anniversary.  → Read more at sputniknews.com

→ Read more at sputniknews.com

Oct 11, 2018 | currency, education, exonumia, medals, tokens

I was going to stop doing the LOOK BACK series after the summer, thinking I would have time to create new content. But we all know that real life has a way of changing even the best-laid plans. While fighting off a severe sinus infection thanks to the mold spores that thrive in this damp weather, business picked up. I am ecstatic that my new business is catching on but the infection put a damper on things.

I need a week to catch up. While doing so, I will publish two more LOOK BACK articles and try to finish a few of the new posts I started. For today’s LOOK BACK, I want to remind everyone that numismatics is more than coins. You can satisfy your collecting urges with exonumia as well as with coins.

Although the dominant area of numismatics is the collection and study of legal tender coins, numismatics is more than just coins. Numismatic is the collecting and study of items used in the exchange for goods, resolve debts, and objects used to represent something of monetary value. This opens up numismatic collecting to a wide range of items and topics that could make “the hunt” to put together the collection as much fun as having the collection.

Exonumia is the study and collection of tokens, medals, or other coin-like objects that are not considered legal tender. Exonumia opens numismatics to a wide variety of topics that could not be satisfied by collecting coins alone. An example of exonumia is the collection of transportation tokens. You may be familiar with transportation tokens from your local bus or subway company who used to sell tokens to place into fare boxes. Others may have used tokens to more easily pay in the express lanes at bridges and tunnels. A person who collects transportation tokens is called a Vecturist. For more information on being a Vecturist, visit the website for the American Vecturist Association.

Token collecting can be the ultimate local numismatic collection. Aside from transportation tokens, some states and localities issued tax tokens in order to collect fractions of a cent in sales taxes to allow those trying to get by in during down economic times to stretch their money further. Some communities issued trade tokens that allowed those who used them to use them like cash at selected merchants. Some merchants issued trade tokens that were an early form of coupons that were traded as coupons are traded today.

While tokens are items used to represent monetary value, medals are used to honor, commemorate, or advertizing. The U.S. Mint produces medals that honor people, presidents, and events. Medals produced by the U.S. Mint are those authorized by law as a national commemoration including the medal remembering the attacks of 9/11.

Commemorative medals are not limited to those produced by the U.S. Mint. State and local governments have also authorized the producing medals on their behalf that were produced by private mints. Many organizations also have created medals honoring members or people that have influenced the organization. Companies have produced medals to honor their place in the community or something about the company and their community.

Many medals have designs that can be more beautiful than on coins since they are not limited to governmental mandated details and their smaller production runs allows for more details to be added. Medals can be larger and thicker than coins and made in a higher relief than something that could be manufactured by a government mint.

Exonumia collecting also involves elongated and encased coins. You may have seen the machines in many areas where you pay 50-cents, give it one of your cents, turn the wheel and the cent comes out elongated with a pattern pressed into the coin. Elongated coins have been used as advertisements, calling cards, and as a souvenir.

Encased coins are coin encircled with a ring that has mostly been used as an advertisement. One side will call the coin a lucky coin or provide sage advice with the other side advertising a business. Another form of encased coins are encased stamps. Encased stamps were popular in the second half of the 19th century and used for trade during times when there were coin shortages.

Other exonumia includes badges, counter stamped coins, wooden money, credit cards, and casino tokens. Counter stamped coins are coins that have been circulated in foreign markets that were used in payment for goods. When the coin was accepted in the foreign market, the merchant would examine the coin and impress a counter stamp on the coin proclaiming the coin to be genuine based on their examination. Although coins were counter stamped in many areas of the world, it was prevalent in China where the coins were stamped with the Chinese characters representing the person who examined the coin. These Chinese symbols are commonly referred to as “chop marks.”

One type of counter stamped coins are stickered coins. Stickered coins were popular in the first half of the 20th century; they were used as an advertisement. Merchants would purchase stickers and apply them to their change so that as the coins circulated, the advertising would reach more people. Some stickered coins acted as a coupon to entice the holder to bring the coin into the shop and buy the merchandise.

Remember the saying, “Don’t take any wooden nickels?” If you are a wooden money collector, you want to find the wooden nickels and other wooden denominations. Wooden nickels found popularity in the 1930s as a currency replacement to offer money off for purchases or as an advertisement. Wooden nickels are still being produced today mostly as an advertising mechanism.

We cannot end the discussion of exonumia without mentioning Love Tokens and Hobo Nickels. Love Tokens became popular in the late 19th century when someone, usually a man, would carve one side of a coin, turn it into a charm for a bracelet or necklace, and give it to his loved one. The designed are as varied as the artists who created them. Hobo Nickels are similar in that hobo artists would carve a design into a Buffalo Nickel to sell them as souvenirs. While there are contemporary Love Tokens and Hobo Nickels, collectors have an affection for the classic design that shows the emotion of the period.

Currency collecting, formally called notaphily, is the study and collection of banknotes or legally authorized paper money. Notes can be collected by topic, date or time period, country, paper type, serial number, and even replacement or Star Notes (specific to the United States). Some consider collecting checks part of notaphily. Collectors of older canceled checks are usually interested in collecting them based on the issuing bank, time period, and the signature. For the history of currency and their collecting possibilities, see my previous article, “History of Currency and Collecting”.

Scripophily is the study and collection of stock and bond certificates. This is an interesting subset of numismatics because of the wide variety of items to collect. You can collect in the category of common stock, preferred stock, warrants, cumulative preferred stocks, bonds, zero-coupon bonds, and long-term bonds. Scripophily can be collected by industry (telecom, automobile, aviation, etc.); autographs of the officers; or the type of vignettes that appear on the bonds.

Militaria: Honorable Collectibles

Collecting of military-related items may be considered part of exonumia but deserves its own mention. It is popular to collect military medals and awards given to members since the medals themselves are works of art. Families will save medals awarded to relatives and even create museum-like displays to honor or memorialize the loved one.

Militaria includes numismatic-related items that represent the various services. One of the growing areas of collectibles is Challenge Coins. A challenge coin is a small medal, usually no larger than 2-inches in diameter, with the insignia or emblem of the organization. Two-sided challenge coins may have the emblem of the service on the front and the back has the emblem of the division or another representative service. Challenge coins are traditionally given by a commander in recognition of special achievement or can be exchanged as recognition for visiting an organization.

Over the last few years, civilian government agencies and non-government organizations (NGO) have started to create and issue challenge coins. Most of those agencies have ties to the military, but not all. Like their military counterparts, a manager or director can give challenge coins in recognition of special achievement or for visiting an organization.

Another area of military collectibles is Military Payment Certificates (MPC). MPC was a form of currency that was used to pay military personnel in foreign countries. MPC was first issued to troops in Europe after World War II in 1946 to provide a stable currency to help with commerce. MPC evolve from Allied Military Currency (AMC) to control the amounts of U.S. dollars circulating in the war zone and to prevent enemy forces from capturing dollars for their own gain. Prior to World War II, troops were paid in the currency of the country where they were based. With the ever moving fronts and the allies need to control the economies to defeat the Axis powers, AMC was issued to allow the military to control their value.

After the war, MPC replaced APC in order to control the currency and prevent the locals from hoarding U.S. dollars preventing the building of their own economies. When military officials discovered that too many notes were in the circulation, being hoarded, and thriving on the black market, series were demonetized and reissued to military personnel. Those holding MPC notes, not in the military received nothing and were encouraged to circulate their own currency.

MPC were printed using lithography in various colors that changed for each series. From the end of World War II to the end of the Vietnam War there were 15 series printed with only 13 issued. Although the two unissued series were destroyed, some examples have been found in the collections of those involved with the MPC system. Amongst the 13 series that were issued, there are 94 recognized notes available for collectors. Most notes are very affordable and accessible to the interested collector.

The original article can be read here.

Oct 7, 2018 | BEP, coins, currency, news

Couple’s two-year-old shreds over $1,000 in cash! (Photo courtesy of KSL-TV by Tanner Siegworth)

In a case where real-life intersects with “oh my gosh,” the toddler took an envelope of cash and passed it through the shredder. All the child knew is that mommy was passing paper through the shredder, it made a cool noise, and created small pieces. What the child did not understand was that mommy was shredding junk mail (a good idea) and he did not know the difference between junk mail and paper money.

The money was to be used to pay the husband’s parents back for season tickets to the Univerity of Utah football games. The Utah Utes are currently 3-2, 1-2 in Pac-12 play after defeating Stanford 40-21 in Palo Alto.

All is not lost for the family. The Bureau of Engraving and Printing has a Mutilated Currency Redemption program. It is a free service that the family can use to recover from this incident.

According to the BEP, the programs handles approximately 30,000 claims each year and recovers over $30 million in cash. But the process can take time. With the limited resources that the BEP has to work with and the time it would take for the BEP’s team to reconstruct the shredded notes, the family may have to wait at least two years.

They do not call it the “terrible twos” for nothing. Next time the family may either want to hide the cash in safer location or write a check. A check can be rewritten more quickly than sending the money to the Mutilated Currency Redemption program.

And now the news…

October 2, 2018

The Australian Royal Mint has issued AC/DC 50 cents, $1 and $5 coins to celebrate the band’s 45th anniversary. The band was formed in November 1973 by Malcolm and Angus Young in Sydney. The original lineup included bassist Larry Van Kriedt, vocalist Dave Evans, and one-time Masters Apprentices member Colin Burgess on drums.  → Read more at themusicnetwork.com

→ Read more at themusicnetwork.com

October 2, 2018

If you have a social media account like Instagram, chances are you would have been offered up to US$10,000 (RM41,400) for old notes and coins by collectors. Does it sound too good to be true? The Royal Malaysia Police (PDRM) says it is and warns that you may end up losing your money as it could be another scam.  → Read more at thestar.com.my

→ Read more at thestar.com.my

October 2, 2018

The story of Armistice Day. Credits: Images courtesy of Alexander Turnbull Library, Wairarapa Archive, Palmerston North Libraries, Archives New Zealand and the Auckland War Memorial Museum. From this month you may find a colourful new coin in your change.  → Read more at newshub.co.nz

→ Read more at newshub.co.nz

October 3, 2018

The owner of a Vancouver coin shop allegedly defrauded customers out of $1.3 million, according to a federal indictment announced Wednesday. Blue Moon Coins owner Aaron Michael Scott, 40, of Portland was indicted by a grand jury on 11 counts of wire fraud and five counts of mail fraud, according to a statement released by U.S.  → Read more at columbian.com

→ Read more at columbian.com

October 3, 2018

"The products in our R+D Lab Collection are tried, tested and true examples of forward-thinking technology that could re-define the future of domestic and foreign coins," said Dr. Xianyao Li, Chief Technology Officer at the Royal Canadian Mint.  → Read more at prnewswire.com

→ Read more at prnewswire.com

October 4, 2018

The Japanese love their cash. Cash as in physical notes and coins. Not the electronic variety that floats around in cyberspace instead of bouncing about in purses and pockets. Surveys show that we are totally behind the times in our attachment to the ¥10,000 and ¥1,000 notes and the way…  → Read more at japantoday.com

→ Read more at japantoday.com

October 5, 2018

A Holladay family is figuring out how to replace more than $1,000 in cash that their 2-year-old son sent through the shredder.  → Read more at ksl.com

→ Read more at ksl.com

Aug 8, 2018 | BEP, coins, commentary, currency, Federal Reserve, US Mint

Following the introduction of the Presidential $1 Coin program and the discussion about replacing the Federal Reserve Note with a coin,

I wrote an article explaining how the situation will not change. Not much has changed in 10 years!

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Regardless of the questions asked, the only way to increase the circulation of the dollar coin is to stop printing the one-dollar Federal Reserve Note and begin to withhold it from circulation. It is a move that will force the people to use the coin as the population of the paper currency is reduced.

There are many emotional arguments on both sides of the issue. Whether one is for or against the printing of the one-dollar note, the US is one of the extreme few first-world countries issue its unit currency on paper. Looking beyond the emotional arguments, each side has dominant arguments to support their positions.

Those who want to eliminate the one-dollar note use at the cost of is production and the savings to the government as the dominant reasons. According to the Bureau of Engraving and Printing, 95-percent of all Federal Reserve Note printed for circulation are used to replace damaged and worn notes that are being taken out of circulation. Using BEP’s 2017 production report, 2,425,600,000 one-dollar notes were printed. With 95-percent being replacement notes, 2,304,320,000 notes were printed just to maintain circulation levels. With it costing 4.385-cents to produce one note of any denomination, the cost to just replace notes removed from circulation was $100,422,265.60 in 2017.

Rather than printing paper dollars, if the US Mint strikes coins the cost to replace those 2.4 billion notes would cost 21-cents per coin (according to the U.S. Mint’s 2014 Annual Report, the last documenting seigniorage for the dollar coin). The total production cost would be $483,907,200.

But do not let the 381-percent increase in cost fool you. For the real picture, the costs have to be predicted over time. According to the BEP and the Federal Reserve, the lifespan of a one-dollar Federal Reserve Note is 5.8 years. When the U.S. Mint makes plans for circulating coinage, they accept that the lifespan of a coin is 30-years. To help with the calculation, it will be assumed that the price of manufacturing coins and currency s will stay constant. In order to keep the $2.4 billion of one dollar notes in circulation for 30 years, it will cost the BEP $522.6 million dollars.

By comparison, since the U.S. Mint will be striking new coins for circulation and (theoretically) not replacement coins (not including the coins already in storage), the U.S. government would save about $117 million over 30 years. The following table illustrates these costs:

| Denomination |

Production Total |

Number of Replacement Notes |

Cost of Production for Replacements |

Cost of Replacements over 30 years |

| Paper Dollar (2008) |

4,147,200,000 |

3,939,840,000 |

$177,292,800 |

$1,772,928,000 |

| Paper Dollar (2018) |

2,425,600,000 |

2,304,320,000 |

$101,044,432 |

$522,643,614 |

| Coin Dollar (2008) |

N/A |

3,939,840,000 |

$626,434,560 |

$626,434,560 |

| Coin Dollar (2018) |

N/A |

2,425,600,000 |

$509,376,000 |

$509,376,000 |

While this might be a compelling argument to stop printing one dollar notes, such a move has political ramifications for some powerful members of Congress. With over 1500 people working in the Eastern Currency Facility in downtown Washington, DC, they are represented by several leaders of both parties. When it comes to jobs in their districts, members of Congress will not allow anything that will reduce the production capacity of the Bureau of Engraving and Printing and where constituents could lose jobs.

Before Congress changes the law to stop the printing of the one-dollar note (31 U.S.C. §5115(a)(2)), the BEP will have to supplement production in order to protect jobs. The way this could be done would be to print foreign currency. However, it seems that the BEP is having problems selling their services to foreign governments.

Although the Bureau of Engraving and Printing has experimented with polymer notes and other printing substrates, the Federal Reserve has said that it does not consider these alternatives viable for United States currency. However, the Federal Reserve and Bureau of Engraving and Printing has been testing rag-based paper from companies that can produce new anti-counterfeiting features.

If there was a change to the supplier of currency paper, that would raise concern by the Massachusetts congressional delegation whose constituents include Crane Currency, the subsidiary of Crane & Company. Crane has been the exclusive supplier of currency paper to BEP since 1879. Although BEP has tried to open the competition for purchasing currency paper (see GAO Report GAO-05-368 [PDF]), the cost of entry into the market has prevented other manufacturers from competing for the business. If BEP would stop printing over 2 million one dollar notes without replacing it with similar paper production, the Massachusetts-based company could lose significant business.

Regardless of the measures taken by the US Mint to increase the circulation of the one-dollar coin, public perception is that the one-dollar paper note is easier to use than the coin. Unless key congressional leaders agree that ending the printing of the one-dollar note is in the best interests of everyone, including their political careers, the political reality is that printing of the one-dollar note is here to stay until a significant event causes a change in policy.

The original post can be read

here.

Jul 21, 2018 | cash, coins, commentary, currency, markets, technology

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

The latest technology that is being touted as being the doom for physical money, which can also be the end of numismatics, is cryptocurrency.

There are two aspects of cryptocurrency that its fans say are its biggest strength. First, it is not bound by the traditional means of generating wealth. You can think of cryptocurrency as digital gold. It is mined using computers and a lot of complex arithmetic to generate one unit of the currency, sometimes referred to as a bitcoin. Like physical gold, there is some work required to mine for these bitcoins. It lies in the ability to create a computing environment capable of performing these intensive mathematical operations. You may not be panning for gold but you might spend as much on equipment and travel.

The other aspect about cryptocurrency is that the blockchain technology allows for both anonymous and secure transactions. Think of the blockchain as a giant ledger that is copied wherever bitcoin is accepted with regular updates. There is no single source that could control the ledger nor is there a single point of failure.

However, both its strengths are its greatest weaknesses.

While the value of money is regulated by their respective government there are no blockchain regulations. There is no regulation on the number of generated bitcoins but is arbitrarily set by the creator of the cryptocurrency. There is no guarantee of value as a state-sponsored currency. Bitcoin investors are betting on the value of electronics and math, something many of these investors does not fully understand.

The blockchain also provides its own problems. In order to use the cryptocurrency, you have to have your own copy of the ledger and be able to pass the information to the party you want to pay. Think about having a checkbook with everyone’s information. You cannot read the information because it is encrypted but you have to have a copy. Then you need to pay someone. You hand over the checkbook in order to complete the transaction.

Think about the amount of data that would be if the blockchain supported 1,000 people. What would it take to support 1 million people? What if the government decided that everyone would do their business in bitcoin and everyone would have to have a way to deal with the blockchain in order to facilitate payments. How cumbersome will that ledger be if all 325.7 million people in the United States had to carry that around?

Each blockchain is its own entity. While you can trade in bitcoins on the same blockchain, you may have to participate in more than one blockchain if you want to accept bitcoins from several different people. It is like different currencies today. I can go anywhere in the United States and use dollars. But if I wanted to go to Canada, I can either arrange an exchange or find someone who will trade.

Cryptocurrency that has to operate across different blockchains is just like going to Europe and having to change your dollars for euros.

As with anything that is computer-based and managed, there is always the security issues. Blockchains have been hacked. Although most of the hacks are based on compromised passwords, each hack yields millions of dollars in stolen cryptocurrency to the hackers and everyone who then does business with them on the same blockchain.

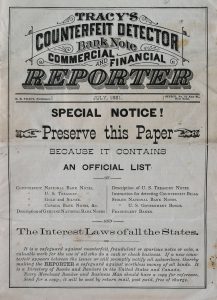

Eventually, this will lead to a cryptocurrency version of a Bank Note Reporter and Counterfeit Detector as was popular during the broken banknote period. Then it will be followed by a Cryptocurrency Act similar to the Currency Act that ended the broken banknote period proving George Santayana right as we repeat history.

Cryptocurrency is the darling of the technology industry and those in the financial industry that trade in high-risk investments. Even traditional financial services companies are spending a limited amount of risk capital on cryptocurrency investments. However, by all statistics, the number of consumers using cryptocurrency for transactions is less than 1-percent.

If Not Cryptocurrency The What About Credit Cards

Credit and debit cards remain the primary target that proponents of a cashless society use to promote their agenda. However, when faced with the realities of life in the United States, there are three statistics that work against their arguments:

- The Bureau of Engraving and Printing, the printer of United States currency, reports a year-over-year increase in production of just over 4-percent.

- The U.S. Mint, the manufacturer of United States coinage, is reporting a year-over-year increase of 6-percent striking circulating coinage.

- According to CreditCards.com, “In 2013, 20 percent of whites did not have access to a credit card compared with 47 percent of African-Americans and 30 percent of Latinos.”

The primary customer for the Bureau of Engraving and Printing and U.S. Mint is the Federal Reserve. If the Federal Reserve needs the money for its operations, they buy it from these government bureaus. The Federal Reserve only orders what it needs. If it does not need the money, then it is not produced.

Aside from the over 50-percent of the population without access to credit cards, there continues to be a demand for physical currency. Whether the currency is used in a vending machine or to buy other items, cash is still king and shows no sign of slowing.

While there continues to be a demand for the products from the U.S. Mint and Bureau of Engraving and Printing, these bureaus will continue to produce coins and currency giving us more opportunity to collect their products.

Jul 12, 2018 | BEP, currency

Summertime is a busy season for everyone. There is a lot going on. For me, I just opened my new business and have been busy trying to make sure it begins smoothly. So that I have more time to work on the business, once per week I will be looking back at articles I wrote in the past that are still relevant today. I will edit the article but point to the original.

Our first look back returns to April 2006 where I was able to examine the design changes of the $20 Federal Reserve Note following a visit to the ATM.

Money has always been a fascination because the design can reveal something about history. It interesting to look at a series of the same denomination and see the evolution as the times change. I had the chance see the evolution first hand when my bank’s ATM gave me three generations of $20 Federal Reserve Notes (FRN). Although I am not a banknote collector, I find their images and devices interesting.

First, I found is the Series 1990 note with the signature of Treasury Secretary Nicholas F. Brady and Catalina Vasquez Villalpando, the Treasurer of the United States. Both Brady and Villalpando were appointed by President George H. W. Bush and served until the end of his term. Brady also served for six months under President Ronald W. Reagan.

The second is a Series 2001 note with the signatures of Treasury Secretary Paul M. O’Neill and Treasurer Rosario Marin. They were appointed by President George W. Bush during his first term. The third note is from Series 2004 with Marin’s signature along with Treasury Secretary John W. Snow, who succeeded O’Neill.

The $20 FRN was first designed for the Series 1929 small notes as an evolution of earlier designs for large currency. There is a lot of ornate and fine engraving with a green hue. The fine engraving has been a staple of bank notes since their inception as a means to prevent counterfeiting. The “greenback” was used to prevent copying using new photographic technologies which had a difficult time reproducing the green color. Although modern technology does not have the same reproduction issues, the green color remains out of tradition.

The newer notes do not feature a lot of fine engraving. The portrait of President Andrew Jackson appears on all of the notes but was enlarged on the newer notes with the border around the portrait removed on the Series 2004 notes. Another difference is the addition of color with a darker green hue and peach on the front.

The reverse on all of the notes features the White House. The Series 1990 note uses an image taken from the south lawn near the ellipse while the newer notes use an image from the north lawn that could be seen from Pennsylvania Avenue. The engraving of the White House is smaller on the new notes and the borders removed to allow the watermark and security thread to be easily seen.

I like the front of the latest note, but I don’t like the color. I also miss the indication of the Federal Reserve Bank for which the notes were printed. Although the designation of the issuing Federal Reserve Bank is not relevant anymore, it adds to the collecting pursuit for some people.

I like the south lawn portrait better than the one from the north lawn. I am disappointed with the starkness of the reverse. I am not sure that BEP can change this given the nature of the security features.

Finally, the attempt to colorize the notes is not working. It looks cheesy. If BEP colorizes the note, it should be more than just a gradient on the background. Many countries use color in their banknotes as part of the devices, not just to splash some color around to say “look at the color.” I think BEP can do better.

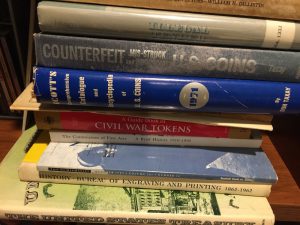

Jun 25, 2018 | books, coins, currency, poll

While shipping several packages of Red Books to customers, I was thinking about the number of people who buy these and other guides. With the state of the industry changing from an IRL (in real life) experience to one more online, I wonder how many people are still using printed guides.

While shipping several packages of Red Books to customers, I was thinking about the number of people who buy these and other guides. With the state of the industry changing from an IRL (in real life) experience to one more online, I wonder how many people are still using printed guides.

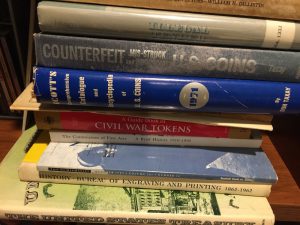

As I thought about doing this as a poll, I started gathering some of the resources that could be considered. That is when I realized that on my overflowing bookshelf I have many of these publications! I never thought I had an extensive numismatic library but the numismatic books outnumber my tech books. Now that I am retired from the tech industry, it might be time to let the tech books go, especially the out of date books.

This list serves two purposes. One is to list the general resources for numismatic pricing of mainly coins and currency. The other purpose is to provide a list of resources that others can use to build their own library. It also will serve as the categories I will use for the poll, below.

Here are is a list of pricing references that I either own or found online:

Annual books for United States coins

Annual books for foreign coins

Periodical Pricing Guides

- Coin Dealer Newsletter

- NumisMedia Weekly Market Price Guide

United States Currency Guide Books

Foreign Currency Guide Books

Online Guides

Today’s question is…

Loading ...

NOTE: The links for all the books (except the Lighthouse Euro Catalog) leads to Abe Books. They are affiliate links. If you buy from Abe Books I make a few cents on the sale. Whatever affiliate money I earn from Abe Books is used to help pay the bills I receive for the blog including hosting and keeping the domain name registered. Of course you can buy your books from any source. However, using the affiliate link would be appreciated.

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive. → Read more at

→ Read more at

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins. With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

While shipping several packages of Red Books to customers, I was thinking about the number of people who buy these and other guides. With the state of the industry changing from an IRL (in real life) experience to one more online, I wonder how many people are still using printed guides.

While shipping several packages of Red Books to customers, I was thinking about the number of people who buy these and other guides. With the state of the industry changing from an IRL (in real life) experience to one more online, I wonder how many people are still using printed guides.