Jan 2, 2018 | commemorative, policy, US Mint

Each two-year term of congress is marked by sessions that begin every January 3rd at noon. When the House and Senate gavel into session on January 3, 2018, it will be the second session of the 115th Congress.

Each two-year term of congress is marked by sessions that begin every January 3rd at noon. When the House and Senate gavel into session on January 3, 2018, it will be the second session of the 115th Congress.

Political watchers have called the 115th congress everything from contentious to partisan to dysfunctional to names that cannot be repeated to a family audience. One thing they have not called this congress: boring.

For numismatists, Congress did pass The American Legion 100th Anniversary Commemorative Coin Act (Public Law No. 115-65) making it the second commemorative coin program for 2019. The Apollo 11 50th Anniversary commemorative is the other. Also, two bills passed the House and have been sent to the Senate for their consideration:

- Saint-Gaudens National Historical Park Redesignation Act (H.R. 965)

This bill redesignates the Saint-Gaudens National Historic Site, in New Hampshire, as the “Saint-Gaudens National Historical Park.”

- Naismith Memorial Basketball Hall of Fame Commemorative Coin Act (H.R. 1235)

This bill creates the first commemorative coin program in 2020 in recognition and celebration of the Naismith Memorial Basketball Hall of Fame in Springfield, Massachusetts.

In between the partisan wrangling, there were three bills were introduced in Congress last month. They are as follows:

H.R. 4539: Plymouth 400th Anniversary Commemorative Coin Act of 2017

Referred to the House Committee on Financial Services. — Dec 4, 2017

S. 2189: Plymouth 400th Anniversary Commemorative Coin Act of 2017

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Dec 4, 2017

H.R. 4732: National Law Enforcement Museum Commemorative Coin Act

Referred to the House Committee on Financial Services. — Dec 21, 2017

In the meantime, the nomination of David Ryder to be the next Director of the U.S. Mint is now 73rd on the Senate Executive Calendar, down from 70th last month. A few nominations for key administrative positions were added to the calendar in front of Ryder. It is possible that his nomination will be confirmed within the next two months.

PN1082: David J. Ryder — Department of the Treasury

Date Received from President: October 5, 2017

Summary: David J. Ryder, of New Jersey, to be Director of the Mint for a term of five years, vice Edmund C. Moy, resigned.

Received in the Senate and referred to the Committee on Banking, Housing, and Urban Affairs. — Oct 5, 2017

Committee on Banking, Housing, and Urban Affairs. Hearings held. — Oct 24, 2017

Committee on Banking, Housing, and Urban Affairs. Ordered to be reported favorably. — Nov 1, 2017

Reported by Senator Crapo, Committee on Banking, Housing, and Urban Affairs, without printed report. — Nov 1, 2017

Placed on Senate Executive Calendar. Calendar No. 458. Subject to nominee’s commitment to respond to requests to appear and testify before any duly constituted committee of the Senate. — Nov 1, 2017

Nov 17, 2017 | commentary, legislative, policy

The Industry Council for Tangible Assets (ICTA) issued an alert warning that a provision on the House of Representatives’s tax plan has the potential to hurt the numismatic industry and asked its members to contact their representatives to let them know of the issue.

The Industry Council for Tangible Assets (ICTA) issued an alert warning that a provision on the House of Representatives’s tax plan has the potential to hurt the numismatic industry and asked its members to contact their representatives to let them know of the issue.

Like many legislative actions, the bill was probably not targeted at the numismatic industry but at others where alleged abuses have allowed some to avoid paying taxes or reducing their tax burden. Some suggest that it is aimed at the burgeoning crypto-currency or Bitcoin economy.

In a bill that is supposed to be business-friendly, under Title III, Subtitle D (Reform of Business-Related Exclusions, Deductions, Etc.), Section. 3303 (Like-Kind Exchanges of Real Property) has an innocuous statement that says:

Section 1031(a)(1) is amended by striking “property” each place it appears and inserting “real property”.

Section 1301(a)(1) refers to 26 U.S.C. §1301(a)(1) that currently says:

No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held either for productive use in a trade or business or for investment.

In plain English, this is the basis of the bartering economy. If I trade goods and services for goods and services, they are assumed to be a trade of even value and no taxes are paid on the transaction. The new bill (H.R. 1) will tax the barter economy.

In numismatic terms, a collector walks into to a coin shop with 10 Mercury dimes graded by one of the third-party grading services worth about $475 on the retail market. While talking to a dealer you see a nice 1928 Peace Dollar that he has marked $460 rather than selling the Mercury dimes for cash, you work out a trade with the dealer for the Peace Dollar. You make the trade and everyone is happy.

Under the current tax law, that is a “like kind” trade of items of value and not taxed as income.

If the bill that just passed the House is enacted, the dealer will be required to pay a tax on that that transaction.

The amount of the tax will be based on an interpretation of the law by the IRS which is where this could get very tricky.

If the dealer is taxed on the retail value of the trade, the dealer could be taxed on $15 of income if based on the dealer’s valuation of the transaction.

If the IRS requires the dealer to make a valuation based on prevailing market values, who sets those market values? Can the dealer use any price guide to determine the value of the coins? For example, if a price guide determines the Mercury dimes are worth $475 on the retail market as we assumed earlier, but the Peace dollar is worth $450 on one price guide but $480 on another, which guide does the dealer use? The dealer will either make $25 on the transaction, which is subject to taxation or lose $5 that will lower the dealer’s overall tax liability.

But the dealer does not buy at retail valuation. The cost of the inventory would be based on market values of the coins. Does the IRS allow the dealer to base the transaction on the “buy” cost of the coins? Based on the “buy” valuation the transaction may be closer to break-even.

The result will be more bookkeeping for the dealer and a tougher set of accounting rules when managing inventory. Managing inventory for a coin dealer is not like a regular retail store. Each coin is its only item and may be given its own identification (stock keeping unit, or SKU).

Most coin dealers are small businesses that are either sole proprietors or have a few employees. They either work at coin shows or have a few thousand square feet of retail space. Some are family operated business while others hire from the local community. Dealers make a living but it may not be enough to support the necessary change to their inventory management under the new tax law.

Eventually, this will make you, the collector, the loser.

First, it will eliminate the possibility of a trading because of the accounting problems. The dealer who has the Peace dollar in inventory that is not selling but can trade it for Mercury dimes that will sell quicker will not be able to happen. Of course, the dealer could buy the Mercury dimes for the same price as you buy the Peace dollars. The dealer could also be accused of a tax avoidance scheme which will make matters worse. Even if the accusation is not true, the IRS is notorious for treating these cases as “guilty until proven innocent.”

This can also drive dealers out of business.

If this drives small dealers out of business, then there will be no dealers to participate in local, small coin shows. With no dealers, those shows will end and so will your access to dealers to help you with your collection. With no smaller shows, you will have to travel further to find shows or will have lesser access to quality collectibles. Sure, you can purchase coins and currency online, but who will be there to answer questions? What happens if you are not happy with the purchase and you have to ship the coin back to the seller?

Ironically, the change proposed in H.R. 1 strengthens the trading of real estate and real property as “like kind” transaction.

This change in the tax law is not good for small business or the numismatic industry. Please contact your member of the House and Senators to let them know that the side effects of Title III Section 3303 will hurt the hobby we love!

If you do not know your member of Congress, you can call the Capitol switchboard operator at (202) 224-3121. They can transfer you to the appropriate representative.

If you are not sure what to say to the staffer who answers the phone, try the following:

Please tell the Representative/Senator that in H.R. 1, the new tax bill, Section 3303 of Title III may have the unintended consequences of hurting the barter economy and the numismatic industry. It will place a heavy accounting burden on coin dealers who are mostly small businesses that will damage the industry. I cannot express in any stronger terms how this change in the tax law will hurt this sector of the small business economy. Thank you for passing this message along.

Please call! Make your voice heard!

Oct 25, 2017 | news, policy, US Mint

David J. Ryder at the hearing regarding his nomination to be the 39th Director of the U.S. Mint

As part of his opening statement, Ryder had noted that he worked for Secure Products, a company focused on developing anti-counterfeiting solutions for currency and branded products. When the company was bought out by the Honeywell Corporation in 2007, he continued to work in that division with Honeywell. What was interesting was that Ryder testified that he was involved in the development of the Royal Mint’s new 12-sided one-pound coin. He said:

Interestingly, one of my last duties while at Honeywell was a joint project with The Royal Mint of the United Kingdom where we assisted them in the development of the new UK One Pound Coin, which was introduced earlier this year. This new circulating coin is considered to be the most advanced and secure coins in circulation today.

Two takeaways from the hearing:

- It appears that Ryder should be confirmed by the Senate when the nomination is sent to the floor for a vote.

- When questioned by Sen. Thom Tillis (R-NC), Ryder addresses coinage security issues specifically with bullion coins and Chinese counterfeits. Addressing his awareness of these issues is good for both the U.S. Mint and the entire numismatic industry.

Video of the nomination hearing and the opening statements can be found on the committee website.

Hearing Video Notes

- The video opens with a silent billboard. The hearing starts at 16:44 of the video.

- Committee Chairman Mike Crapo (R-ID) gives his opening statement

- Committee Ranking Member Sherrod Brown (D-OH) gives his opening statement

- Opening statements by the nominees are offered, starting with David J. Ryder at 23:40 on the video

- 48:45-51:22 Sen. Richard Shelby (R-AL) asks about an Inspector General report expanding technology at the U.S. Mint.

- 1:39:40-1:40:30 Sen Tom Cotton (R-AR) “What are the biggest changes have you seen at the Mint from when you were the director 25 years ago”

- 1:47:05-1:49:22 Sen Thom Tillis (R-NC) Question on the future of the Mint and security.

PN1082: David J. Ryder — Department of the Treasury

Date Received from President: October 5, 2017

Summary: David J. Ryder, of New Jersey, to be Director of the Mint for a term of five years, vice Edmund C. Moy, resigned.

Received in the Senate and referred to the Committee on Banking, Housing, and Urban Affairs. — Oct 5, 2017

Committee on Banking, Housing, and Urban Affairs. Hearings held. — Oct 24, 2017

Oct 22, 2017 | commentary, news, policy

The Coin Collectors Blog has been and always been about collecting numismatics in all forms from a collector’s point of view. As I am coming up on my 12th anniversary of writing this blog, I would like to address a few comments I have received via email.

The Coin Collectors Blog has been and always been about collecting numismatics in all forms from a collector’s point of view. As I am coming up on my 12th anniversary of writing this blog, I would like to address a few comments I have received via email.

As a reminder, a blog is short for “weblog” which, according to Wikipedia, “is a discussion or informational website published on the World Wide Web consisting of discrete, often informal diary-style text entries (“posts”).” It is not a news site or a site that adheres to certain editorial form. Although news organizations now use blogs and blogging platforms, the Coin Collectors Blog is not pretending to be a news outlet.

When I started writing the Coin Collectors Blog in 2005, not only were there few coin collecting resources on the web, but there were no blogs. I wanted to provide some information, discussions, and (yes) opinions on every topic in the world of numismatics that I thought a collector would be interested in hearing about.

I also have made my interests clear. I will discuss everything that affects numismatics including the monetary policy that concerns the circulation of coins and currency and the people involved. This includes the politicians, both elected and appointed, that have direct involvement in any area that affects numismatics.

One of those politicians is Secretary of the Treasury Steven T. Mnuchin. As Secretary of the Treasury, he is in charge of every bureau in the Treasury Department including the U.S. Mint and Bureau of Engraving and Printing. Thus, what happens to Mnuchin can affect those bureaus. As far as I am concerned, that makes Mnuchin fair game for coverage on the Coin Collectors Blog.

After I reported about Mnuchin’s visit to Fort Knox, a U.S. Mint-managed facility, that both the Office of the Inspector General and a public interest group were looking into the travel and its costs. Since the story concerns the Secretary of the Treasury visiting a U.S. Mint facility, I felt it was my right and responsibility to report on.

Although there have been other issues with Mnuchin reported, they did not involve his department leadership as it pertained to the U.S. Mint or Bureau of Engraving and Printing. I did not feel it was appropriate to write about it on the Coin Collectors Blog.

-

-

Steven T. Mnuchin, the 77th Secretary of the Treasury

-

-

Secretary of the Interior Ryan K. Zinke

More recently, I wrote about Secretary of the Interior Ryan K. Zinke having his own challenge coin. Although Zinke is not in charge of anything regarding the U.S. Mint or Bureau of Engraving and Printing, the fact that he has a challenge coin is significant. Collecting challenge coins is part of numismatics and any government agency official that decides to have his own challenge coin should be fair game.

In both cases, I was accused of stepping into politics in a bad way.

I know political discourse has changed, but I am still the same blogger who has covered numismatic bills in Congress, which there is a monthly status posting; nominations of Directors and Treasurers; defended the ancient coin collectors from the State Department; and posted a tribute to Mike Castle, the former Republican Congressman from Delaware who introduced many numismatic-related bills including that law that became the 50 State Quarters Coin Program.

It has and always will be my policy to keep the content of the Coin Collectors Blog on topics related to numismatics, numismatic production, collecting, and the conditions that affect this world, including the action of the government officials with oversight of the related organizations, especially if there is a direct effect on the industry.

Comments are welcome and encouraged, but I wish some of you would comment on the posts—and remember, comments are moderated to prevent spam only. Sometimes the email I receive is very creative but have been asked not to share. I hope that you reconsider next time.

Now for the news…

October 15, 2017

Currency modernization will help secure our financial futures and save billions of dollars for taxpayers.  → Read more at cnbc.com

→ Read more at cnbc.com

October 15, 2017

(ArtfixDaily.com) Richmond Hill, ON – Thursday, October 26 marks 888 Auctions’ inaugural auction dedicated to numismatic items with a special focus on Chinese gold and silver panda coins. The 426-lot auction will also be featuring rare coins from all over the world and will also be accompanied by 888 Auctions’ usual complement of Asian fine and decorative arts, including finely carved jadeite objects, porcelain ceramics, furniture and jewelry.  → Read more at artfixdaily.com

→ Read more at artfixdaily.com

October 17, 2017

Share During the Western Han Dynasty (206 B.C. – A.D. 9), the question of monetary freedom was vigorously debated. There were as yet no banks or paper money in China — money consisted solely of coin.  → Read more at cato.org

→ Read more at cato.org

October 18, 2017

Summary Harry Dent used to say gold will fall to $250, then $400, now he says $700. What are we to believe?  → Read more at seekingalpha.com

→ Read more at seekingalpha.com

October 18, 2017

Archeologists regularly stumble over troves of gold coins dating back centuries, proving that money is as old as civilisation itself. Cash, however, brings practical limitations when it comes to how much we can physically move about, which is why currencies also depend on a system of trust to allow easier representations of physical coins, gold etc.  → Read more at thenational.ae

→ Read more at thenational.ae

October 20, 2017

BENGHAZI, Libya, Oct 20 (Reuters) – Authorities in eastern Libya will circulate their own coins for the first time to ease shortages of money, a central bank official said on Friday, in another sign of disunity in the country that has two rival governments in east and west.  → Read more at af.reuters.com

→ Read more at af.reuters.com

October 20, 2017

Noma Bar for Reader's DigestWhen Joan Langbord found ten gold coins in a family safe-deposit box in 2003, she knew she’d unburied a treasure. Langbord, then 75, had worked in her late father’s Philadelphia jewelry store her entire life, and she was fairly sure that the coins were 1933 double eagles.  → Read more at rd.com

→ Read more at rd.com

October 20, 2017

The coins went out of circulation on October 15 but can still be deposited at banks, building societies and post offices  → Read more at burtonmail.co.uk

→ Read more at burtonmail.co.uk

October 21, 2017

Chief of Staff of the Army Gen. Mark Milley stands beside the design for the back of the World War I commemorative coin, dubbed “poppies in the wire,” after he unveiled it Oct. 9, 2017 at the Association of the U.S. Army Annual Meeting and Exposition.  → Read more at aerotechnews.com

→ Read more at aerotechnews.com

Sep 6, 2017 | news, policy

Being Secretary of the Treasury does have its perks.

On August 21, Secretary of the Treasury Steven T. Mnuchin traveled to Louisville, Kentucky to speak at a luncheon sponsored by the Louisville chamber of commerce. Joining him on the flight was his wife, actress Louise Linton.

Later in the day, Mnuchin, Senate Majority Leader Mitch McConnell (R-KY), Rep. Brett Guthrie (R-KY), and Kentucky Governor Matt Bevin (R) visited the United States Bullion Depository at Fort Knox, Kentucky becoming the first civilians to visit the facility since 1974. The U.S. Mint posted a picture of Mnuchin holding a gold bar in front of a balance scale.

Conspiracy theorists have comment, “is that’s all that’s left?”

On August 21, 2017, was the total eclipse of the sun that stretched from Oregon to South Carolina. Although the path of the total eclipse passed over part of Kentucky, the Fort Knox area experienced only 96-percent of the eclipse.

During the trip, Linton posted a picture of her departing a government plane on Instagram noting her attire. In the context of a diva actress, this type of braggadocio is expected. But as someone flying at government expense during what is supposed to be a government-sponsored trip.

When a concerned citizen questioned her choices in the context of a government trip, Linton responded in a way that one would expect of a diva, self-centered actress. But as someone traveling using government-sponsored transportation, Linton’s comments were not well received.

A day later Linton apologized for her comments, removed the Instagram post, and made her profile private.

Days following the trip, Citizens for Responsibility and Ethics in Washington (CREW) filed a Freedom of Information Act (FOIA) request with the Department of the Treasury asking for information about the trip. CREW is questioning the use of government resources for what they claim is a personal trip. Sen. Ron Wyden (D-OR), the Ranking Member of the Senate Finance Committee, also wrote to the Treasury Department asking for records of justification for Mnuchin’s use of a government plan for the trip.

Because of the outrage about the trip, The Washington Post is reporting that the Treasury Office of the Inspector General will be looking into the trip “… to determine whether all applicable travel, ethics, and appropriation laws and policies were observed.”

Cabinet officials can request to use government flights under specific criteria. These flights are flown mainly using Air Force resources and are costlier than a commercial flight. It is recommended that cabinet officials use military resources only in the case of national security or for employees whose security could not be guaranteed in the commercial environment.

A source has suggested that Mnuchin may have violated government policy by using the government plane for this trip. Mnuchin does not face a threat that requires additional security that would justify his using government resources. Further, since Linton is not a government employee, her travel is not reimbursable by the government. It was predicted that Mnuchin will be required to pay the difference between a commercial flight and the cost of the government flight. He will also be required to reimburse the government the full cost of Linton’s portion of the trip.

Aug 12, 2017 | policy, US Mint

Following the sell out of the 225th Anniversary Enhanced Uncirculated Coin Set, a few readers asked if I was going to post a comment. I declined to let the rest of the industry have this discussion. I would rather have a discussion about a different issue related to the U.S. Mint: the lack of leadership.

Following the sell out of the 225th Anniversary Enhanced Uncirculated Coin Set, a few readers asked if I was going to post a comment. I declined to let the rest of the industry have this discussion. I would rather have a discussion about a different issue related to the U.S. Mint: the lack of leadership.

Since the resignation of Edmund Moy as of January 9, 2011, the U.S. Mint has not had a permanent director. Even though Moy’s term would have expired on September 5, 2011, there has been no permanent leadership as required by law.

Since Moy’s departure, there have been three people acting as director and two attempts at nominating a director that was not acted upon in the Senate.

-

-

Bibiana Boerio was nominated in Sept 2010 but never acted on by the Senate.

-

-

Rhett Jeppson was nominated in July 2015 and even had a hearing, but his nomination was not acted on in the Senate.

As of this post, the U.S. Mint has not had a permanent director for 2,407 days or 6 years, 7 months, 3 days and counting. This appears to the longest vacant position in the federal government.

In the past, this seemed to be a good thing because the government professionals taking the reigns of leadership seems to have made decisions that did not appear to hurt collectors. That was until the 225th Anniversary Enhanced Uncirculated Coin Set was sold without household limits.

Given the current state of the government where it is estimated that over 40-percent of the positions open for appointments, including those that do not require Senate confirmation, maybe this is something we have to live with regardless of consequences.

Aug 1, 2017 | coins, commemorative, news, policy

As part of my bill tracking, I am including the status of the Saint-Gaudens National Historical Park Redesignation Act even though it does not have numismatic content. Given the impact of Agustus Saint-Gaudens to the numismatic world, it seems fitting to watch the status of this bill. Converting it from a National Historic Site to a National Park is being done for funding reasons. Although it will continue to be operated by the National Park Service, as a National Park there will be more money available for its operations.

As part of my bill tracking, I am including the status of the Saint-Gaudens National Historical Park Redesignation Act even though it does not have numismatic content. Given the impact of Agustus Saint-Gaudens to the numismatic world, it seems fitting to watch the status of this bill. Converting it from a National Historic Site to a National Park is being done for funding reasons. Although it will continue to be operated by the National Park Service, as a National Park there will be more money available for its operations.

H.R. 965: Saint-Gaudens National Historical Park Redesignation Act

Introduced: February 7, 2017

This bill redesignates the Saint-Gaudens National Historic Site, in New Hampshire, as the "Saint-Gaudens National Historical Park."

Referred to the Subcommittee on Federal Lands. — Feb 23, 2017

Ordered to be Reported (Amended) by Unanimous Consent. — Jul 26, 2017

S. 312: Saint-Gaudens National Historical Park Redesignation Act

Introduced: February 6, 2017

This bill redesignates the Saint-Gaudens National Historic Site, in New Hampshire, as the "Saint-Gaudens National Historical Park."

Read twice and referred to the Committee on Energy and Natural Resources. — Feb 6, 2017

Committee on Energy and Natural Resources Subcommittee on National Parks. Hearings held. — Jul 19, 2017

S. 1568: President John F. Kennedy Commemorative Coin Act

Introduced: July 17, 2017

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jul 17, 2017

H.R. 3274: President John F. Kennedy Commemorative Coin Act

Introduced: July 17, 2017

Referred to the House Committee on Financial Services. — Jul 17, 2017

Jul 28, 2017 | bullion, coins, commemorative, commentary, legal, legislative, policy, US Mint

A while ago, I received the following question from a reader:

Why do coins that were made NOT for circulation, like Silver Eagles, Commemoratives Productions, etc have any value other than their face value? I do not see the value of collecting something that was never meant for circulation.

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

The American Silver Eagle Program was the result of the Reagan Administration wanting to sell the silver that was part of the Defense National Stockpile to balance the budget. Originally, the plan was to auction the bullion. After intense lobbying by the mining industry warning that such an auction would damage their industry, the concept was changed to selling the silver as coinage.

Changing the sales to coinage allowed for market diversification. Rather than a few people attempting to corner the market at an auction, selling coins on the open market allows more people to have access to the silver as an investment vehicle.

As codified in Title II of the Statue of Liberty-Ellis Island Commemorative Coin Act (Public Law 99-61, 99 Stat. 113), the “Liberty Coin Act” defines the program as we know it today including the phrase “The coins issued under this title shall be legal tender as provided in section 5103 of title 31, United States Code.”

As a legal tender item, the coin’s basic value has the backing of the full faith and credit of the United States government. Regardless of what happens in politics and world events, the coin will be worth at least its face value. Being minted by the U.S. Mint is a guarantee of quality that is recognized around the world making worth its weight in silver plus a numismatic premium.

Coins are perceived by the market as being more desirable than medals. Medals have no monetary value except as an art object. When it comes to investments, they do not hold a value similar to that of a legal tender coin. This is because medals are not guaranteed by the United States government, a key factor in determining its aftermarket value.

Once the coin has been sold by the U.S. Mint, its value is determined by various market forces. For more on how coins are priced, see my two-part explanation: Part I and Part II.

Why do American Silver Eagles have a One Dollar face value? Because the law (31 U.S.C. Sect. 5112(e)(4)) sets this as a requirement.

Why are the coins worth more than their face value? Because the law (31 U.S.C. Sect. 5112(f)(1)) says that “The Secretary shall sell the coins minted under subsection (e) to the public at a price equal to the market value of the bullion at the time of sale, plus the cost of minting, marketing, and distributing such coins (including labor, materials, dies, use of machinery, and promotional and overhead expenses).”

Can you spend the American Silver Eagle as any other legal tender coin? In the United States, you can use any legal tender coin in commerce at its face value. This means that if you can find someone to accept an American Silver Eagle, it is worth one dollar in commerce. However, it would be foolish to trade one-ounce of silver for one dollar of goods and services.

Commemorative Coins

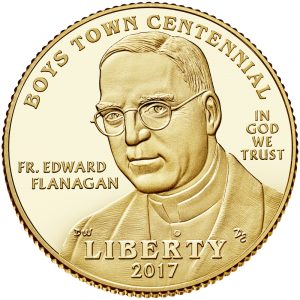

Commemorative programs are different in that the authorizing laws add a surcharge to the price of the coin to raise money for some organization. Using the 2017 Boys Town Centennial Commemorative Coin Program (Public Law 114-30) as an example, Rep. Jeff Fortenberry (R-NE) introduced a bill (H.R. 893 in the 114th Congress) to celebrate the centennial anniversary of Boys Town. As with all other commemorative bills, the bill specified the number, type, composition, and denomination of each coin.

The Boys Town Centennial Commemorative coin features Fr. Edward Flanagan, founder of Boys Town

As with other commemorative, the coins will include a surcharge. Each gold coin will include a $35 surcharge, $10 for a silver dollar, and $5 for each clad half-dollar coin. When the program is over, the surcharges “shall be paid to Boys Town to carry out Boys Town’s cause of caring for and assisting children and families in underserved communities across America.”

The 2017 Boys Town Centennial Uncirculated $5 Gold Commemorative Coin is selling for $400.45 and the proof coin is selling for $405.45 suggesting that the process of producing a proof coin costs the U.S. Mint $5 more than the uncirculated coin.

What goes into the price of the coin? After the face value of $5, there is a $35 surcharge added that will be paid to Boys Town, there is the cost of the metals used. Here is a workup of the cost of the gold planchet using current melt values:

| Metal |

Percentage |

Weight (g) |

Metals Base Rate |

Price (g) |

Metal Value |

| Gold |

90% |

7.523 |

1259.00/toz |

40.48 |

$ 304.52 |

| Silver |

6% |

5.015 |

16.57/toz |

0.53 |

0.27 |

| Copper |

4% |

3.344 |

2.83/pound |

0.006 |

0.00 |

| Total metal value |

$ 304.79 |

Even though the melt value of the coin is $304.79, there is a service charge the U.S. Mint has to pay the company that creates the planchets. Thus, before the labor, dies, use of machinery, overhead expenses, and marketing is calculated into the price, the coin will cost $344.79 even though the legal tender face value of the coin is $5.

Taking it a step further, the average profit the U.S. Mint makes from gold commemorative coins is 8-percent (based on the 2015 Annual Report). If they are charging $400.45 for the uncirculated gold coin, the coin costs $368.41 to manufacture, $373.41 for the proof version.

Why collect these coins?

Why not?!

American Silver Eagle bullion coins were created for the investment market even though the authorizing law saw the benefit of allowing the U.S. Mint to sell a collector version. All of the Eagle coins are sold for investment or because people want to collect them for their own reasons. Some collect the collector version as an investment.

Commemorative coins are collected for their design or the buyer’s affinity for the subject and to support the cause which is being sponsored by the sale of the coin. Some collect commemorative coins like others collect series of coins.

Even though modern commemorative coins are sold for more than their face value, that does not mean they are not worth collecting. After all, can you buy a Morgan Dollar, Peace Dollar, Walking Liberty Half-Dollar, or a Buffalo Nickel for its face value?

Collecting bullion, commemorative, and other non-circulating legal tender (NCLT) coins is a matter of choice. If you choose to collect these coins, know that they will be worth more than their face value. And while they are legal tender coins, they are not meant for circulation. They are collectibles.

If you like these collectibles, enjoy your collection. Along with coins produced for circulation, I own American Silver Eagle coins, commemoratives, and other NCLT because I like them.

Some of the NCLT coins in my collection

-

-

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

-

-

2015 March of Dimes Commemorative Proof set

-

-

2014 National Baseball Hall of Fame commemorative proof dollar graded by PCGS PR70

-

-

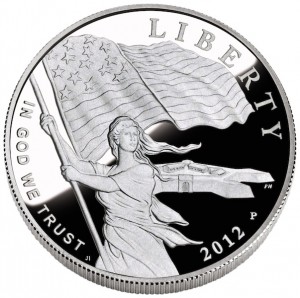

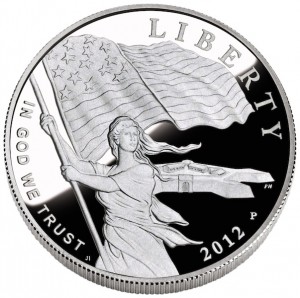

2012 Star-Spangled Banner Silver Commemorative Obverse depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background. Designed by Joel Iskowitz and engraved by Phebe Hemphill.

-

-

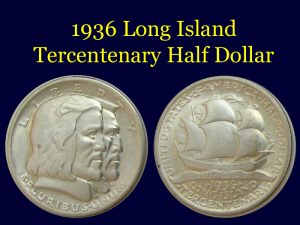

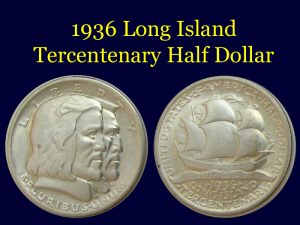

1936 Long Island Tercentenary Half Dollar

-

-

Reverse of the 2016 Chinese Silver Panda coin

-

-

2006 Canada silver $5 Breast Cancer Commemorative Coin

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Boys Town commemorative coin image courtesy of the U.S. Mint.

Jul 3, 2017 | BEP, news, policy, US Mint

Treasury Secretary Steven Mnuchin, right, administer the oath of office to Jovita Carranza, left, as the 44th Treasurer of the U.S., Monday, June 19, 2017, at the Treasury Department in Washington. Jovita Carranza’s daughter Klaudene Carranze, holds the Bible and her goddaughter Lily Hobbs stands second from right. (Carolyn Kaster/Associated Press)

Since the appointment of Georgia Neese Clark by President Harry S. Truman in 1949, there have been 16 women appointed as Treasurer of the United States. Carranza is the seventh Latina to hold the job and the fourth straight since the appointment of Rosario Marin in 2001 by President George W. Bush.

Carranza will oversee the Bureau of Engraving and Printing and U.S. Mint. Since there have been problems reported with Cabinet secretaries getting senior officials to be accepted by the head of the presidential personnel office, the current structure at the U.S. Mint will stay in place. Carranza will take an active role overseeing the mint until a director is appointed.

Dec 2, 2016 | coins, news, policy, US Mint

Coins found in the recycling stream.

The mutilated coin redemption industry is a multi-million dollar business. Most of the businesses involved with this industry are recyclers that find coins in cars and machines that are recycled. Recycling these metals require the use of heavy machinery that takes apart the items and compresses them to transport to processors. Six compressed cars can take up the same amount of space as one full-size car. More can fit in the same space if the metal is shredded.

Although some of the coins are removed from the cars, others end up in the machinery. After processing through high pressure and high heat, the found coins are in no condition to be sent to banks for redemption. Most of the time, these coins are cut, bent, or badly scorched making them impossible to process using normal coin counting mechanisms. According to an industry representative, recyclers can find an average of over $2 per car and over $10 in coin-operated machines as they are taken apart and crushed.

Coin-operated machines are not as well made as people suspect. For every time you might have had a coin “stuck” and lost in the machine, the coin might have dropped into an area outside of the coin bin and between internal parts. When the machines are serviced, the coins are usually dumped into bags and taken back to the company to be placed into coin counting machines. In many cases, the count between the expected amount of money and the number of items sold are not exact. This type of “shrinkage” is part of their business risk plans.

Coin-operated machines are not as well made as people suspect. For every time you might have had a coin “stuck” and lost in the machine, the coin might have dropped into an area outside of the coin bin and between internal parts. When the machines are serviced, the coins are usually dumped into bags and taken back to the company to be placed into coin counting machines. In many cases, the count between the expected amount of money and the number of items sold are not exact. This type of “shrinkage” is part of their business risk plans.

When the coin-operated machines are taken out of service, many are cleaned and inspected for loose coins. But the way the machines are designed, it is common that many coins are missed. They will continue to stay within the machine until it is discarded for scrap.

Cars and other machines sometimes gain a second life overseas. Machines are sold as surplus, repaired by their new owners and put into service around the world. These machines end up in the recycle system when they fall beyond the ability to be repaired. International recyclers recover U.S. coins from these cars and coin-operated machines. This is not including the scrap cars that are shipped overseas for recycling. Brokers buy the coins from recyclers and ship them to the United States. Currently, there is an estimated $1 million in mutilated coins being held by Customs and Border Patrol (CBP) while the redemption program is suspended. It is also estimated that more than $50 million in mutilated coins are being stored overseas while shipments are suspended.

As the mutilated coins accumulate, recyclers are now paying for storage and security over and above their regular business expenses. Some have sold their mutilated coins to other recyclers and brokers at a discount to avoid paying the storage costs. Those accumulating these mutilated coins are hedging on the mutilated coin-recycling program being restarted soon.

Brokers handling the import of these coins have filed suit against the CBP for blocking and holding the shipments of mutilated coins. Plaintiffs cite a report from a company called FormerFeds Group, a company made up of former federal lawyers and other senior officials, that said the accusation of importing mutilated coins from China is not true and that the amount of “junk” (non-coins in the batch) are within tolerances of the program. They are requesting that the court grants an order to release the coins and to compel the U.S. Mint to resume the Mutilated Coin Redemption Program.

Hong Kong-based Wealthy Max Ltd. publicly opened and sampled 13 tonnes of mutilated U.S. coins waiting for shipment in Hong Kong. The coins come from piles of metal generated by automotive shredders and via incinerated waste streams.

Without fanfare, the U.S. Mint published a request in the Federal Register (81 FR 75922) asking for comments regarding the Mutilated Coin Exchange Program to supplement the information it has already gathered. The notice was published on November 1, 2016, without a follow up from the U.S. Mint press office. The U.S. Mint allowed for a two-week comment period that ended on November 15, 2016.

According to the Federal Register, the “Mint is considering include requiring participant certification, coinage material authentication, chain of custody information, and annual submission limitations.” They were seeking comment on that and other possible factors to better secure the program. There is no indication as to whether this is tied to the case brought by the brokers handling foreign recycling.

Coins make up a very small minority of the amount of scrap in the recycling stream. But with the problems caused by the U.S. Mint’s refusal to properly deal with this issue, it is taking up a lot of time and money both here in the United States and with long time business partners abroad.

Each two-year term of congress is marked by sessions that begin every January 3rd at noon. When the House and Senate gavel into session on January 3, 2018, it will be the second session of the 115th Congress.

Each two-year term of congress is marked by sessions that begin every January 3rd at noon. When the House and Senate gavel into session on January 3, 2018, it will be the second session of the 115th Congress. The

The

The Coin Collectors Blog has been and always been about collecting numismatics in all forms from a collector’s point of view. As I am coming up on my 12th anniversary of writing this blog, I would like to address a few comments I have received via email.

The Coin Collectors Blog has been and always been about collecting numismatics in all forms from a collector’s point of view. As I am coming up on my 12th anniversary of writing this blog, I would like to address a few comments I have received via email.

→ Read more at

→ Read more at

Following the sell out of the 225th Anniversary Enhanced Uncirculated Coin Set, a few readers asked if I was going to post a comment. I declined to let the rest of the industry have this discussion. I would rather have a discussion about a different issue related to the

Following the sell out of the 225th Anniversary Enhanced Uncirculated Coin Set, a few readers asked if I was going to post a comment. I declined to let the rest of the industry have this discussion. I would rather have a discussion about a different issue related to the

As part of my bill tracking, I am including the status of the

As part of my bill tracking, I am including the status of the