Nov 12, 2016 | BEP, legislative, news, policy, US Mint

Rhett Jeppson, nominated to be the 39th Director of the U.S. Mint

The immediate impact of the election results is that Rhett Jeppson will not be confirmed to become the Director of the U.S. Mint. Even though the Senate Banking Committee held a hearing for his nomination on March 15, the chance of the GOP-led Senate confirming any of President Obama’s appointment nominations are non-existent.

Jeppson was hired in January 2015 as Principal Deputy Director. Jeppson was hired as a member of the government’s Senior Executive Service (SES) program. In July, it was announced that Jeppson would be nominated as the Director. Since the nomination will likely die in committee, Jeppson will remain on the U.S. Mint staff as a government employee. Although he has not announced his intentions, Jeppson is likely to continue as Principal Deputy Director.

It is unlikely that the next administration will nominate Jeppson or anyone in the near future. Considering that there has not been political appointee running the U.S. Mint since January 2011, maybe President Obama could use his power to convert the term appointment into a permanent government employee. This way, the U.S. Mint can be run by competent managers rather than a pol who might do something like not ordering enough planchets to maintain a major bullion program.

The Bureau of Engraving and Printing is not affected by a change in administrations because the position of the director is a permanent government employee. Len Olijar will remain Director of the BEP as long as he is a government employee in good standing.

As for any of the pending legislation, do not count on anything being passed. Given the results of the election, sources say that the partisan rancor is so fervent that even the most cordial relationships have turned icy. These feelings are not limited to cross-party relationships. There is a growing divide between ideological members in both parties that could almost split the congress into four parties.

To suggest that the partisan bickering to escalate during the lame duck session would be an understatement. Remember, congress passed a continuing resolution, not a real budget, in late September that will expire on December 9. If a budget is not passed by December 9 then the government will have to be shutdown.

The 114th congress will adjourn being one of the most ineffective congress on record.

For the 115th congress that will convene on January 3, 2017, there will be 239 Republicans and 193 Democrats with three runoffs pending (two in Louisiana). Although the Republicans lost 7 total seats, they continue to hold a majority. Currently, Rep. Jeb Hensarling (R-TX) is the Chairman of the House Committee on Financial Services. Although it is not known if Hensarling will remain as chair of this committee, it is likely the new leadership will continue the previous policies. If the attitudes of this committee do not change, there may be very few commemorative coin programs that get through this committee.

Although revenue generating bills are required to be introduced in the House of Representatives (U.S. Constitution, Article I, Section 4), the Senate has been known to introduce commemorative coin bills without argument from their House counterparts. For the 115th congress, the Senate will have 51 Republicans and 48 Democrats with a runoff in Louisiana scheduled for December 10. However, Senate rules make the composition somewhat irrelevant because of their ability to filibuster.

Under the Senate’s filibuster rules (Senate Rule XXII), a senator can inform the presiding member that they intend to filibuster the debate. At that point, the presiding member will set the bill aside to allow other business to continue because the Senate can only work on one item at a time. This means that a filibuster stops all other floor actions. By setting the bill aside and not bringing it to the floor, this allows for other senate business to continue while the leadership tries to gather support for a cloture vote.

Cloture, or closure, is the act to end the free-flow debate of the senate and apply restrictions, such as a 30 hour limit on debate. Cloture requires a three-fifths vote of the senate (60 votes) to agree on cloture. Anyone who remembers some of the past discussions on the composition of the senate, when one party controls 60 seats, they called that a “filibuster-proof majority.” Otherwise, any senator can threaten a filibuster and have that measure buried.

Although it is unlikely that the senate would filibuster the vote on a commemorative coin bill, but it would be obstructed by the another bill ahead of it in the queue.

Even though I would like for the Apollo 11 50th Anniversary Commemorative Coin Act (H.R. 2726 and S. 2957) to pass, I will not be holding my breath during the lame duck session this year or a new version introduced anytime next year.

Sep 19, 2016 | ancient, coins, legal, policy

Here we go again… the government want to take your ancient coins away from you.

Here we go again… the government want to take your ancient coins away from you.

This is different from other conspiracy theories because since there is no mechanism for them. Here, foreign governments are working in collusion with the United States Department of State Cultural Property Advisory Committee (CPAC). The problem with CPAC is that it is not a real committee. They are largely a rubber-stamp part of the State Department’s Bureau of Educational and Cultural Affairs kowtowing to any foreign government who feels that items found in their country have been stolen from regardless of the evidence. This includes common ancient coins or coins that were removed from circulation long before the existence of the 1970 UNESCO Convention that created this situation.

If you want to read a more extensive discussion on the problems facing collectors of ancient coins, read my post “An ancient dilemma” from 2014.

The information comes from the Ancient Coin Collectors Guild (ACCG). Even if you are not a collector of ancient coins you should appreciate that the problems with governments wanting to stop your hobby. If they go after the ancients, what is to prevent these countries from trying to recall obsolete money? We need to support the ACCG and the community to prevent overreach by foreign governments and a committee who does not care what the coin collectors think.

Here’s the current issue as outlined by ACCG Executive Director Peter Tompa

Dear Fellow ACCG Member:

The State Department’s Bureau of Educational and Cultural Affairs and its Cultural Heritage Center have announced a comment period for a proposed extension of a Memorandum of Understanding (MOU) with Cyprus. See https://www.federalregister.gov/articles/2016/08/10/2016-19018/notice-of-meeting-of-the-cultural-property-advisory-committee

The U.S. Cultural Property Advisory Committee will review these comments and make recommendations based upon them with regard to any extension of the current agreement with Cyprus.

According to U.S. Customs’ interpretation of the governing statute, import restrictions authorized by this MOU currently bar entry into the United States of the following coin types unless they are accompanied with documentation establishing that they were out of Cyprus as of the date of the restrictions, July 16, 2007:

1. Issues of the ancient kingdoms of Amathus, Kition, Kourion, Idalion, Lapethos, Marion, Paphos, Soli, and Salamis dating from the end of the 6th century B.C. to 332 B.C.

2. Issues of the Hellenistic period, such as those of Paphos, Salamis, and Kition from 332 B.C. to c. 30 B.C. (including coins of Alexander the Great, Ptolemy, and his Dynasty)

3. Provincial and local issues of the Roman period from c. 30 B.C. to 235 A.D.

You may ask, why bother to comment—when Jay Kislak, CPAC’s Chairman at the time, has stated that the State Department rejected CPAC’s recommendations against import restrictions on Cypriot coins back in 2007 and then misled both Congress and the public about its actions? And isn’t it also true that although the vast majority of public comments recorded have been squarely against import restrictions, the State Department and U.S. Customs have imposed import restrictions on coins anyway, most recently on ancient coins from Bulgaria?

Simply because, our silence allows the State Department bureaucrats and their allies in the archaeological establishment to claim that collectors have acquiesced to broad restrictions on their ability to import common ancient coins that are widely available worldwide. And, of course, acquiescence is all that may be needed to justify going back and imposing import restrictions on more recent coins that are still exempt from these regulations.

Under the circumstances, please take 5 minutes and tell CPAC, the State Department bureaucrats and the archaeologists what you think.

How do I comment? Go to https://www.federalregister.gov/articles/2016/08/10/2016-19018/notice-of-meeting-of-the-cultural-property-advisory-committee to submit short comment just click on the green box on the upper right hand side of the above notice that says “submit a formal comment” and follow their directions.

If you are having trouble, go to the Federal eRulemaking Portal (http://www.regulations.gov), and enter Docket No. DOS-2016-0054 for Cyprus, and follow the prompts to submit comments. What should I say? The State Department bureaucracy has dictated that any public comments should relate solely to the following statutory criteria:

- Whether the cultural patrimony of Cyprus is in jeopardy from looting of its archaeological materials;

- Whether Cyprus has taken measures consistent with the 1970 UNESCO Convention to protect its cultural patrimony;

- Whether application of U.S. import restrictions, if applied in concert with similar restrictions by other art importing countries, would be of substantial benefit in deterring a serious situation of pillage and that less drastic remedies are not available;and,

- Whether the application of import restrictions is consistent with the general interest of the international community in the interchange of cultural property among nations for scientific, cultural, and educational purposes.

(See 19 U.S.C. § 2602 (a).) Yet, collectors can really only speak to what they know. So, tell them what you think within this broad framework. For instance, over time, import restrictions will certainly impact the American public’s ability to study and preserve historical coins and maintain people to people contacts with collectors abroad. (These particular restrictions have hurt the ability of Cypriot Americans to collect ancient coins of their own culture.) Yet, foreign collectors—including collectors in Cyprus—will be able to import coins as before. And, one can also remind CPAC that less drastic remedies, like regulating metal detectors or instituting reporting programs akin to the Treasure Act and Portable Antiquities Scheme, must be tried first. Finally, Cyprus is a member of the European Union, so why not allow legal exports of Cypriot coins from other EU countries?

Be forceful, but polite. We can and should disagree with what the State Department bureaucrats and their allies in the archaeological establishment are doing to our hobby, but we should endeavor to do so in an upstanding manner. Please submit comment just once, before the deadline on September 30, 2016.

Thank you for your help,

Peter,

Peter K. Tompa,

Executive Director

Ancient Coin Collectors Guild

Aug 1, 2016 | celebration, legislative, policy, US Mint

As we do every month, we look back at the previous month’s activity in congress that will affect us numismatically. July started with congress on their 4th of July break coming back for a one week session before leaving to attend their respective conventions.

As we do every month, we look back at the previous month’s activity in congress that will affect us numismatically. July started with congress on their 4th of July break coming back for a one week session before leaving to attend their respective conventions.

Prior to leaving, congressed passed the United States Semiquincentennial Commission Act (Public Law 114-196). The law authorizes the formation of a commission to organize the national celebration of the 250th anniversary of the founding of the United States on July 4, 2026. It was signed by President Obama on July 22, 2016. Section 5, Paragraph (c)(2)(F) of the new law recommends that the commission encourages “Federal agencies to integrate the celebration of the Semiquincentennial into the regular activities and execution of the purpose of the agencies through such activities as the issuance of coins, medals, certificates of recognition, stamps, and the naming of vessels.”

Those of us who are old enough to remember, this was the first time in the modern era that circulating commemoratives were issued. The quarter, half-dollar, and dollar coins all had special reverse designs that were issued in 1975 and 1976. These coins remain popular amongst collectors and an interesting curiosity when non-collectors find the quarter with the drummer boy reverse in their pocket change. Although circulating commemoratives are not a new concept since the advent of the 50 State Quarters series, there is an opportunity to consider something interesting to celebrate on all U.S. coinage rather than just certain denominations.

The only other piece of legislation legislation of concern was that the Financial Services and General Government Appropriations Act of 2017 passed the House on July 7, 2016. The bill authorizes the U.S. Mint to withdraw up to $30 million from the Public Enterprise Fund for its operations. This is an increase of $10 million from when the bill was originally submitted in June.

If you missed my previous explanation on the funding of the U.S. Mint, you can read “No Taxpayer Money Is Used by the US Mint” at your leisure.

May 31, 2016 | coins, commemorative, legislative, policy

When I went to graduate school for a degree in public policy, I had no idea that the basic tenants of politics would change so drastically. Watching what congress is saying, what they are doing, and the response by the media and public has been something that historians will have a good time with in the future. Today, it is difficult to keep up with policy issues that are not discussed in sound bites or come with bumper sticker-sized slogans. Thankfully, there are Internet resources for those of us to keep track of our pet issues.

When I went to graduate school for a degree in public policy, I had no idea that the basic tenants of politics would change so drastically. Watching what congress is saying, what they are doing, and the response by the media and public has been something that historians will have a good time with in the future. Today, it is difficult to keep up with policy issues that are not discussed in sound bites or come with bumper sticker-sized slogans. Thankfully, there are Internet resources for those of us to keep track of our pet issues.

On the Coin Collectors Blog we watch coin-related legislation because the U.S. Mint cannot do anything without congressional approval. My favorite site for watching legislation is Govtrack.us. Although they use the same information as Congress.gov, I like the look and feel of Govtrack.us.

Clearing the smoke and other debris, I found two pieces of numismatic-related legislation that were introduced in May:

H.R. 5168 Christa McAuliffe Commemorative Coin Act of 2016

Sponsor: Rep. Fred Upton (R-MI)

• Introduced: May 6, 2016

• Referred to the House Financial Services Committee

Summary:

- Design with image of Christa McAuliffe with reverse depicting her legacy as a teacher

- Issued in the year 2018

- Mintage Limit: 350,000 Silver dollars in uncirculated or proof

- Surcharge of $10 per coin payable to the FIRST robotics program

This bill can be tracked at https://www.govtrack.us/congress/bills/114/hr5168.

S. 2957 Apollo 11 50th Anniversary Commemorative Coin Act

Sponsor: Sen. Bill Nelson (D-FL)

• Introduced: May 19, 2016

• Referred to the Senate Banking, Housing and Urban Affairs Committee

Summary:

This bill can be tracked at https://www.govtrack.us/congress/bills/114/s2957.

Apr 25, 2016 | ancient, coins, commentary, policy

Over the last few years, I have asked readers to sign various petitions and write to the Department of State to stop restrictions on ancient coins.

Over the last few years, I have asked readers to sign various petitions and write to the Department of State to stop restrictions on ancient coins.

Once again, the Ancient Coin Collectors Guild (ACCG) needs your help. This time, the Greek government has requested changes to the Memoranda of Understanding that can hurt ancient coin collectors.

Please read the following letter that was sent by ACCG President Peter Tompa. If you would like to help, please use the links in his letter. Thank you!

Dear Fellow ACCG Member:

The State Department’s Cultural Property Advisory Committee is soliciting public comments for the upcoming renewal of a Memorandum of Understanding with the Hellenic Republic. Current restrictions exempt certain ancient Greek Trade coins, including Athenian Tetradrachms, Corinthian Staters and Tetradrachms of Alexander the Great and his father, Philip, as well as later Roman Imperial and Byzantine coins. On the other hand, many other ancient Greek coins are restricted, including larger denomination coins of many Greek City states and smaller denomination silver and bronze coins of Alexander and his successors.

Please write CPAC expressing concerns about the current restrictions and any effort to expand the current designated list. Comments should focus on how import restrictions have damaged collecting, the preservation of coins, the study of the history they represent, the appreciation of other cultures, and the people to people contacts collecting brings.

While it’s easy to be cynical that public comments are ignored, silence will be taken as acquiescence about the State Department’s actions which have already diminished the supply of ancient coins available on the market.

Comments are due on or before 11:59 PM on May 9th. For a direct link to comment on the government website, go to https://www.regulations.gov/#!documentDetail;D=DOS-2016-0009-0001 and click on the blue “comment now” button in the upper right hand corner of the screen.

For additional background along with suggestions on what to say, see http://culturalpropertyobserver.blogspot.com/2016/03/please-comment-on-proposed-renewal-of.html

For details about what coins are currently restricted, please see https://www.gpo.gov/fdsys/pkg/FR-2011-12-01/html/2011-30905.htm

Sincerely,

Peter K. Tompa

Mar 15, 2016 | news, policy, US Mint

Rhett Jeppson, nominated to be the 39th Director of the U.S. Mint

Edmund C. Moy, the 38th Director of the U.S. Mint, resigned effective January 9, 2011, about nine months short of completing his five-year term.

Following Moy’s departure, Treasurer Rosie Rios became acting director and served until Richard Peterson was hired as Deputy Director on January 25, 2011. Peterson was acting director until Jeppson was hired in January 2015. Since then, Peterson and Jeppson were government employees as part of the Senior Executive Service.

Prior to Jeppson’s hiring, Bibiana Boerio was nominated in September 2012, right before the midterm election. But as congress was trying to put the fun in dysfunctional, Boerio’s nomination was not heard by the Senate. By senate rules, the nomination was returned to the president when the 112th congress adjourned for the final time on January 3, 2013.

Although there should be no problems with the nomination, one can never know what will happen with this congress. When the cameras are turned on, members of congress are prone to grandstanding for whatever cause they feel is necessary regardless of whether it is germane to Jeppson’s nomination. I will predict that the cost to strike the one-cent coin and what to do with dollar coins will come up at this hearing even though the real decision makers are the ones asking the question.

Sometimes I wonder how these people get and stay elected!

If you are interested in attending the hearing, it will be held at 10:00 on the Ides of March, Tuesday, March 15, 2016, in Room 538 in the Dirksen Senate Office BuildingDirksen Senate Office Building located on First Street NE between C Street NE and Constitution Avenue NE.

Those who attend the meeting are welcome to share their comments below!

Feb 25, 2016 | cash, currency, dollar, errors, news, policy

The latest attack on the money in your pocket is the talk about eliminating the highest denomination banknotes. This discussion was intensified in the political policy world with the article by Lawrence Summers that appeared in The Washington Post. Summers is a professor at Harvard and had once been the Secretary of the Treasury and Director of the White House’s National Economic Council.

Summers cites a paper by Peter Sands of Harvard and students that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption.

Crime is mostly a cash-based enterprise. Criminals do not use gold, checks, or credit cards. As those of us who use cash over other payment types understand, cash is more anonymous. Cash transactions can be used to perform untraceable transaction that could be used to evade taxes. Criminals use cash to avoid law enforcement and terrorists use cash to fund their activities outside of the monitoring of financial transactions. In fact, Sands notes that these criminals have nicknamed the €500 note the “Bin Laden.”

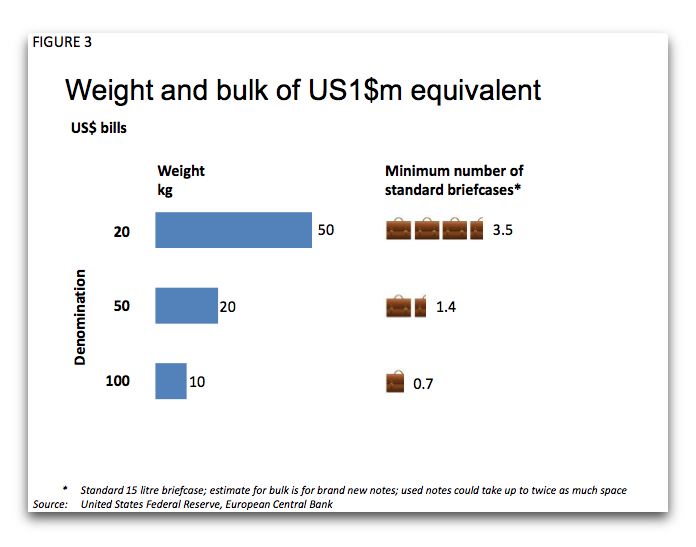

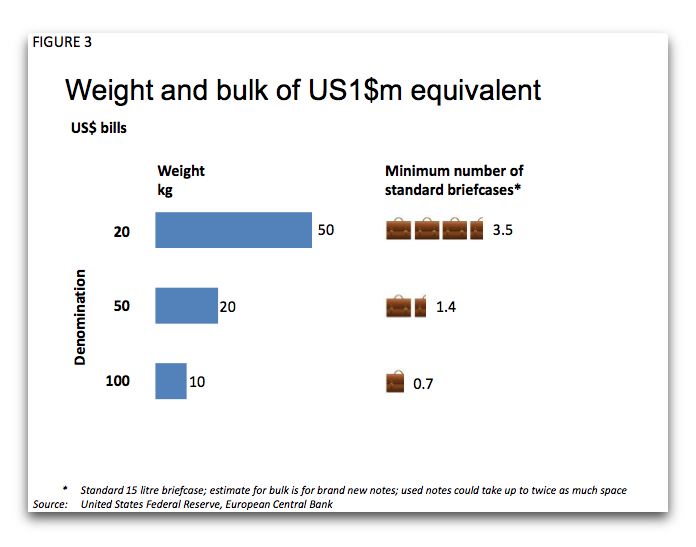

In order to carry out cash-based transactions is the ability to carry the cash. Sands’ paper and Summers’ article both say that lower denomination currency will make it difficult to carry large volumes of currency in order to make these transactions. Considering the weight of United States currency, carrying $1 million worth of $100 Federal Reserve Notes would weigh about 10 kilograms (22.0462 pounds). Using a 15 liters (just under 4 gallons) as the “standard” briefcase capacity, you could carry $1 million in 0.7 cases.

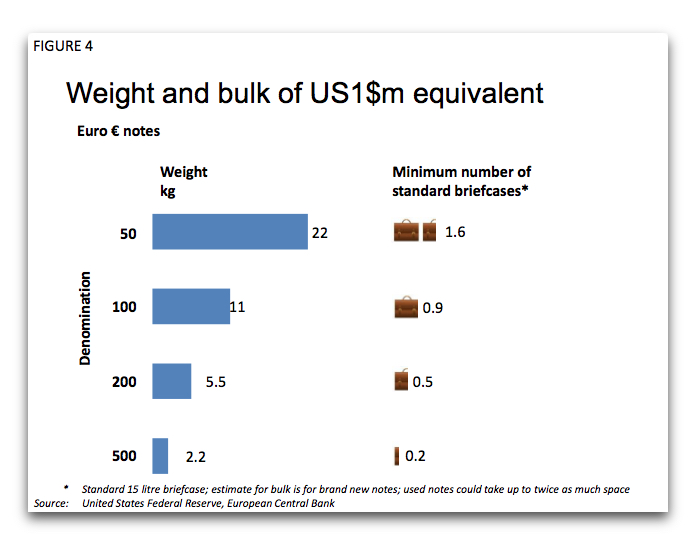

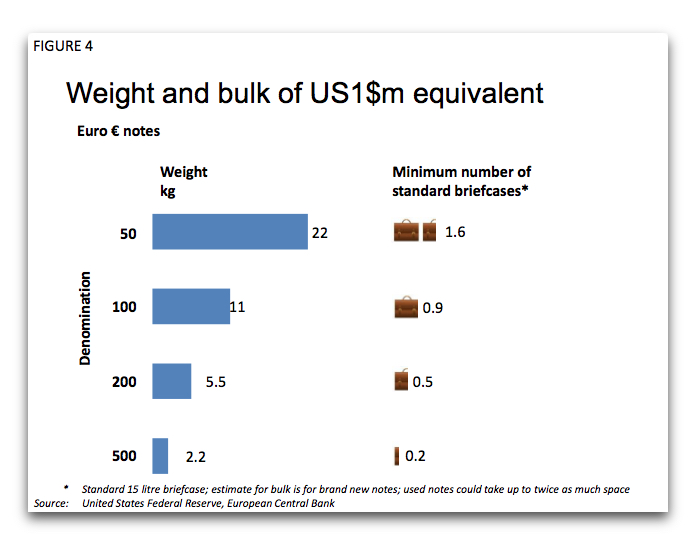

As a comparison, $1 million worth of $50 Federal Reserve Notes would require 1.4 briefcases and 3.5 briefcases when using $20 notes. If the $1 million was being paid using €500 notes, it would weigh 2.2 kilograms or about 4.85 pounds that takes up a quarter of a briefcase.

Comparison of the weight of the equivalent of $1 million using U.S. Federal Reserve Notes

Comparison of the weight of the equivalent of $1 million using euro currency

Sands says:

By eliminating high denomination, high value notes we would make life harder for those pursuing tax evasion, financial crime, terrorist finance and corruption. Without being able to use high denomination notes, those engaged in illicit activities – the “bad guys” of our title – would face higher costs and greater risks of detection. Eliminating high denomination notes would disrupt their “business models”.

Summers agrees with Sands and even suggests that the baseline currencies, specifically the dollar and the euro, should “stop issuing notes worth more than say $50 or $100.” Both consider demonetizing these high denomination notes a step in the right direction.

$207 Million in $100 notes seized as part of a drug raid in 2007

In the world of policy analysis there is the concept of the three-legged stool. The first leg is to identify the policy, which is what Sands’ paper does. Next would be to translate the policy idea into something that could be used as the basis for a law. The final step is something to drive the policy to be considered by the lawmakers in order to do something with the policy.

This is how the one cent coin went from being 95-percent copper to being copper-covered zinc. There was the idea to change the composition of the coin in order to save money. After the idea, there was the research and the law writing that went into changing the composition. As part of that second-leg exercise was the creation of the 1974 aluminum cent pattern. Finally, by 1982, the costs were so out of line that it became the driver that forced action.

Although the article and report has been well discussed as part of the financial press it is not likely to be acted on in the near future. It is only the first leg. It will take time before this stool gets its two other legs.

Images were copied from the report “Making it Harder for the Bad Guys: The Case for Eliminating High Denomination Notes,” by Peter Sands, et. al.

Jan 20, 2016 | coins, commentary, news, policy, US Mint

United States Branch Mint in Denver. In 2015, Denver produced over 8 billion coins, more than any other mint!

On January 11, 2016 the U.S. Government Accountability Office (GAO) release a report (GAO-16-177) about the “Implications of Changing Metal Compositions.” The GAO, an agency of the Legislative Branch, is supposed to be an independent, nonpartisan agency that investigates how the government spends taxpayer dollars and reports their findings to congress. It is important to remember that the GAO does not investigate for the sake of investigating agencies. They are asked by members of congress for a report about the implementation of specific policies. This report was requested by Rep. Bill Huizenga (R-MI), Chairman of the Subcommittee on Monetary Policy and Trade under the Finance Committee.

NON-NEWS FLASH: The U.S. Mint spends more money on the metals used to strike one- and five-cent coins than their face value.

“Wait,” you say. “That’s not news.” Of course you are right because you are an astute collector and a reader of the Coin Collectors Blog! Unfortunately, those who write news stories point to this GAO report to show that they are correct for proposing their narratives supporting changes to be made at the U.S. Mint. By focusing on the metals costs misses the entire story.

Experimental test strikes of the 5-cent denomination using Martha Washington/Mount Vernon nonsense dies were produced on planchets of the same copper-plated zinc composition used for the current Lincoln cents.

Changing coinage metals will not translate into instant savings. In fact, for the first two-to-three years it might show a loss greater than if congress would leave the metals composition the same. It is not clear whether the current die making and coining presses would work with a different planchets. And we are not talking about a few presses. Can you imagine how many presses were needed in Philadelphia and Denver to produce over 8 billion coins in each location in 2015?

If I remember correctly from my last visit to the Philadelphia Mint, there were 20 presses in one row of presses in Philadelphia. Four rows were used to strike one-cent coins in three 8 hour shifts. There were two rows striking five-cent coins. Change the composition of these coins and that means the U.S. Mint will have to make changes to 120 presses!

That only covers the physical changes to the presses. Since most of the alternative alloys are harder than the current cupronickel alloy, dies will have to be replaced more often, the presses will require additional maintenance, and the processing will have to change. There are annealing machines, upsetting mills, and internal transportation systems that would have to be changed for the new alloys.

I spoke with a friend who works for a major manufacturer with facilities all over the world. During the discussion I was reminded of the usual changes in manufacturing that causes interruptions but are significant to think about. For example, oil refineries can close for two-weeks to a month in order to be retooled in order to change the production of fuel blended for cold weather driving to those for warmer weather driving. These costs are built into the prices you pay at the gas pump.

Similarly, an automobile manufacturer that changes model designs have to close to retool and retrain employees on the new designs. Making simple changes are easy. Change a body style and the entire line has to close at a cost to manufacturing.

Coining machines striking one-cent coins at the U.S. Branch Mint in Philadelphia.

The other story missed is that the GAO claims that the coin-operated industry over estimated their estimation on the costs to the industry if change is changed. The GAO report cites a 2014 study provided to the U.S. Mint by the National Automatic Merchandising Association (NAMA), the $45 billion per year vending industry trade association in the United States, which says it will cost from $100 to $500 per machine to convert them to accept new coinage while the old coinage continues to circulate.

While trying to justify the over estimation claim, the GAO actually strengthens the NAMA argument by not controverting the per machine cost.

The GAO does not consider that the NAMA does not represent the entire coin-op industry. The American Amusement Machine Association (AAMA) represents coin-op games (video, pinball, etc.), fair operators, gum ball machine manufacturers, jukebox manufacturers, and similar businesses. When the report was first discussed, then AAMA President John Schultz was reported to have said to leave the coinage alone “because it works, rather than risk the costly consequences.” AAMA has not provided an estimate for those costly consequences.

Another consequence would be changes that the government would have to undergo to support new coinage alloys. Any location that the government relies on cash transactions would have to be updated accordingly. While the Postal Service has eliminated most of their vending machines in favor of automated kiosks, this change will hasten a complete removal of those vending machines that continue to operate in areas where electronically connected kiosks cannot be supported. This could leave people in remote communities without particular services they rely on.

Aside from parking meters, how many vending machines, coin-op washers and dryers, change machines, even vending machines will have to be updated at your expense?

Someone my say to just eliminate the one-cent coin. Why not? Canada did it, why can’t the U.S. do the same? The most significant problem is that this would change an economy that is over 9-times the size of the Canadian economy. Using the Gross Domestic Product (GDP), the total cost of goods and services, as a benchmark converted to U.S. dollar, the World Bank reports that the GDP of $1.5183 trillion in 2010, the last year statistics are available. Similarly, the U.S. GDP in 2010 was $13.9631 trillion.

Even if someone was able to figure out how this change will impact an economy that produces over $15 trillion in goods and services (2014 data), there are also the ancillary costs of changing machines, systems, services, and anything else that could be impacted.

Although it might seem easy to change the alloys used for coins or eliminate the lowest denominations, the impact reaches far beyond all analysis including that of the GAO. To tell everyone to “just deal with it” is an expensive proposition that will have to be paid for. Are you ready to pay more taxes for governments to “just deal with it?” More fees for services? Or dealing with a loss of services because in order to “just deal with it” because the service provider decided that it is better to stop providing the service than convert?

Credits

- Image of Denver Mint courtesy of Wikipedia.

- Image of Martha Washington trial strikes courtesy of the U.S. Mint via Coin World.

- Image of the Philadelphia Mint was published in a Numismatic Bibliomania Society E-Sylum newsletter provided by Sandy Pearl.

- Parking meter image courtesy of Parkifi.

Jan 10, 2016 | cash, coins, currency, Federal Reserve, policy

Could the call to end the 1p and 2p coins in the UK have an effect in the US?

Not necessarily the end of money but the end of physical currency.

With all the talk about ending the production of low value coins, whether it is the one-cent coin here in the United States, or the one or two pence coins in Great Britain, there seems to be movement to reduce the dependence of coinage.

Amongst the examples cited by those looking to make these changes are Canada, who ended the production of their one-cent coin in 2012, and Sweden, where physical currency makes up 3-percent of the economy.

Could the DC Metro’s Smartrip Card be the future of a cashless society?

But could a cashless society work in the United States?

A key measure of the power of an economy is the Gross Domestic Product, the total cost of goods and services produced by the economy. As of 2012, the most recent statistics available, Sweden’s GDP is $184.8 billion (converted to US dollar equivalent) versus $1.56 trillion for the United States—eight times the Swedish economy. Sweden’s economy ranks 28th and the U.S. 2nd only behind the combined European Union.

For the record, China’s 2012 GDP, third on the list, was $8.36 trillion, just over half of the U.S. GDP.

The United States makes more money, spends more money, trades more money, and has more economic impact than any other country in the world.

The first problem with trying to replicate what Sweden is doing is one of scale. The United States has the single largest economy in the world. While the European Union has a larger GDP, it is made up of cooperating countries with their own sovereign interests. While some might say that it is the same as the 50 states, the federal structure of a single republic versus several cooperating republics of Europe makes like the equivalent of swallowing the ocean in one gulp versus several gulps controlled by cooperating governments in Europe. Even when European governments do not cooperate, they can individually work better than what has been going on in the United States.

Another key indicator is the poverty rate. It is important to consider those in poverty because they usually do not have the resources to participate in the advanced structures of society. People living in poverty do not have access to credit regardless of where they live, even if they do have some access to the technologies that support cashless access. Although companies are giving away smartphones in many poverty stricken areas, those customers continue to have problems paying their bills. These are the people who rely on cash.

What may account for Sweden’s low use of cash is their low percentage of its citizens in poverty. With a poverty rate of 3.97-percent, this may account for the 3-percent average currency usage. Poverty in the United States is 5-times more than Sweden at 20.59-percent. While this in itself may not be a definitive indicator, it could explain why there is a vocal opposition of anti-poverty groups when discussion turn to eliminating the cent or a cashless society.

Those who preach a cashless society and point to Sweden also fails to consider one factor that only few countries have faces: the United States has probably one of the most diverse populations. Current politics notwithstanding, the United States has historically been more open to immigration than most other nations. Sweden, while a wonderful place, has a lesser and more homogenous population. Swedes are rightfully proud of themselves, their heritage, and history and has a culture more conducive to working together.

When was the last time that we saw the United States all together? Even after the attacks of September 11, 2001, there were segments of the population that has called it a hoax and said that the government bombed itself to press an agenda.

1853 Braided Hair Half Cent Obverse – The last lowest denomination coin eliminated by the congress.

In 2015, the U.S. Mint and Bureau of Engraving and Printing produced more coins and currency than ever. Both government agencies produce their main products because it was ordered by the Federal Reserve, the central banking organization of the United States. Even though paper currency may be exported, most coins are circulated in the United States for domestic use.

If there is any indication that the United States is moving to a cashless society, then why is currency production at its highest in history?

Interestingly, 2015 was the 50th Anniversary of clad, non-silver coinage except for the half-dollar that was produced with 40-percent silver until 1969. To this day there are people to decry the use of fiat money.

Regardless of what pundits say, the United States economy is more broad, diverse, and not as easy to control as in Sweden. If the United States ever gets to the point where it can support a cashless society, it might not be during the lifetime of anyone reading this today. These pundits do not see beyond their caramel macchiatos to understand the Real World.

Keep collecting this coins. Your great grandchildren may enjoy them but their grandchildren may find them interesting curiosities.

Jan 6, 2016 | coins, Eagles, legislative, palladium, policy, silver, US Mint

Congress ended the calendar year with a proverbial bang. Aside from actually passing a budget, they passed a comprehensive transportation bill that not only has the possibility of raising our infrastructure grade from a D– to a D (hey… it’s an improvement), but in a few short words will have a big impact on the U.S. Mint.

Congress ended the calendar year with a proverbial bang. Aside from actually passing a budget, they passed a comprehensive transportation bill that not only has the possibility of raising our infrastructure grade from a D– to a D (hey… it’s an improvement), but in a few short words will have a big impact on the U.S. Mint.

H.R. 22: Fixing America’s Surface Transportation Act

Sponsor: Sen. Rodney Davis (R-IL)

• Introduced: January 6, 2015

• Passed House of Representatives on January 6, 2015

• Passed Senate with amendments on July 30, 2015

• Conference report presented to Senate on November 5, 2015

• Conference committee convened November 18, 2015

• Conference report agreed on by the House and Senate on December 3, 2015

• Signed by the President on December 4, 2015 to become Public Law 114-94

Read the details of this law at https://www.govtrack.us/congress/bills/114/hr22

If you want to read my analysis of the impact to the U.S. Mint from this law, see the following four-part series:

- Transportation drives numismatic changes

- Now with more silver

- Palladium arcadium

- Transportation silver eagles

As we do every month, we look back at the previous month’s activity in congress that will affect us numismatically. July started with congress on their 4th of July break coming back for a one week session before leaving to attend their respective conventions.

As we do every month, we look back at the previous month’s activity in congress that will affect us numismatically. July started with congress on their 4th of July break coming back for a one week session before leaving to attend their respective conventions.