Oct 7, 2014 | BEP, coins, counterfeit, currency, gold, policy, US Mint

Prior to the public disclosure of secret documents, administrations have declassified documents at various levels for many different reasons that those of us who worked in these areas did not understand what was to be classified at what levels and for how long. Each department and agency had its own rule. However, everything that was classified was supposed to be declassified after 50 years.

In 2009, President Obama issued Executive Order 13526 to try to create some order out of this chaos. Aside from defining the classification levels, document marking requirements, it also allowed agencies to apply to keep documents classified and for longer periods than previous reviews. The purpose was to protect national interests and security while preventing controversial declassification of documents.

Whenever trying to instill a new policy on the government, there will be many barriers to this change. While there are fewer areas of confusion, chaos remains. Of course the disclosures by Chelsea (neé Bradley) Manning and Edward Snowden did not help.

So what does this have to do with numismatics? Both the U.S. Mint and the Bureau of Engraving and Printing applied and were granted exemption from automatically declassifying documents.

Treasury Department, Procurement Division, Public Buildings Branch, Fort Knox – United States Bullion Depository (1939)

What information could these agencies possibly have that would be classified?

According to Steven Aftergood, Director of the Federation of American Scientist Project on Government Secrecy, who interviewed John P. Fitzpatrick, director of the ISOO, the exemption for the U.S. Mint is for “security specifications from the U.S. Bullion Depository at Fort Knox, which was built in the late 1930s.”

In a comedic turn, Mr. Fitzpatrick told Aftergood, “Think ‘Goldfinger’.”

Then why does the Bureau of Engraving and Printing need an exemption from declassification for 25-years? A source familiar with the filing said that the exemption covers counterfeiting information. According to sources, there are anti-counterfeiting measures added to currency that have been planned for many years that have not been advertised. These are used by the United States Secret Service and other law enforcement organizations to detect counterfeiting. Many of the documents cover the planning for the changes that began in the 1990s.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

And you thought all the U.S. Mint and Bureau of Engraving and Printing did was manufacture money!

Sep 12, 2014 | bullion, coins, gold, halves, US Mint, values

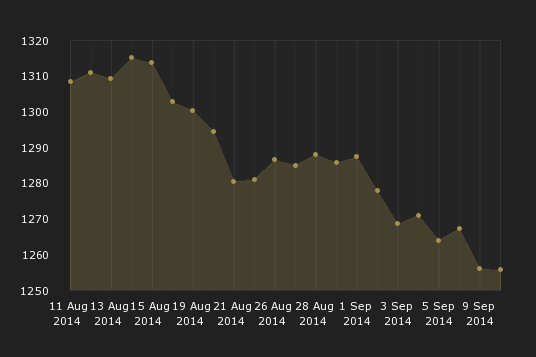

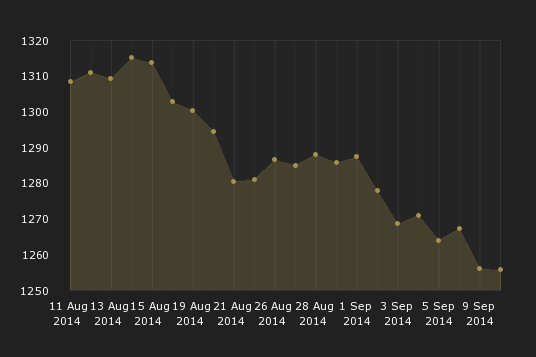

If you have not seen what has been going on in the gold market, the prices have been falling. The financial press has not provided a single reason as to why the gold market is going down but there is a consistent view that the United States economy showing strength with unemployment dropping and low inflation may be alleviating fears in the markets. Stocks are rising and it is suspected that investors are selling their gold shares in order to participate in the bull market.

For collectors it means that the U.S. Mint could adjust the prices of precious metal products. In particular, the price is coming down that could affect the price of the Kennedy gold half-dollar. Based on the table published in the Federal Register [PDF], if the London Fix price of gold falls below $1,250 per troy ounce, the price of the coin will drop to $1,202.50 or $37.50 below the $1,240 issue price.

The London Fix is now managed by The London Bullion Market Association. Gold prices are set by an auction that takes place twice daily by the London Gold Fixing Company at 10:30 AM and 3:00 PM London time. Auctions are conducted in U.S. dollars. The benchmark used by the U.S. Mint is the PM Fix price on Wednesday.

On September 10, 2014, the London PM Fix was $1,251.00 which will leave the price of the Kennedy gold half-dollar $1,240.

London PM Gold Fix for the month leading up to September 10, 2014

London PM Fix on September 10 was $1,251.00

Prices are in U.S. dollars

A strong economy is good for many reasons. In this case, when the price of gold drops the price of gold coins also drops. While this is not good for investors, it benefits collectors who will buy one or two coins for their collections. It also means that the value of the inventory that the dealers who spent a lot of money and effort in order to be first will be worth less than previously. After all, if the U.S. Mint is going to produce as many coins as the demand, then the public is better off saving money and buy from the U.S. Mint.

As anyone who has invested money will tell you that it is dangerous to try to time the market. I am sure that if you can figure out when the price of gold will be at its lowest while the U.S. Mint is still selling the Kennedy gold half-dollar, I know a bunch of people on Wall Street who want to talk with you. That being said, I have a feeling that the trends are in favor of waiting to see what happens. Although I have not decided whether I will buy a coin, I am going to wait to see what the market does. If the price of gold continues to fall, I could be convinced to buy one of these coins for myself.

Pricing for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin

As published in the Federal Register (

79 FR 38127)

on July 3, 2014

| London PM Fix |

Item |

Sale Price |

| $1000.00 to $1049.99 |

¾ Troy oz |

$1,052.50 |

| $1050.00 to $1099.99 |

¾ Troy oz |

$1,090.00 |

| $1100.00 to $1149.99 |

¾ Troy oz |

$1,127.50 |

| $1150.00 to $1199.99 |

¾ Troy oz |

$1,165.00 |

| $1200.00 to $1249.99 |

¾ Troy oz |

$1,202.50 |

| $1250.00 to $1299.99 |

¾ Troy oz |

$1,240.00 |

| $1300.00 to $1349.99 |

¾ Troy oz |

$1,277.50 |

| $1350.00 to $1399.99 |

¾ Troy oz |

$1,315.00 |

| $1400.00 to $1449.99 |

¾ Troy oz |

$1,352.50 |

| $1450.00 to $1499.99 |

¾ Troy oz |

$1,390.00 |

| $1500.00 to $1549.99 |

¾ Troy oz |

$1,427.50 |

| $1550.00 to $1599.99 |

¾ Troy oz |

$1,465.00 |

| $1600.00 to $1649.99 |

¾ Troy oz |

$1,502.50 |

| $1650.00 to $1699.99 |

¾ Troy oz |

$1,540.00 |

Fixing chart courtesy of London Gold Fixing Company.

Sep 11, 2014 | history, medals, news, US Mint

Congressional Gold Medal Awarded to the Fallen Heroes of September 11, 2001

WASHINGTON – Three Congressional Gold Medals were awarded today in honor of the men and women who perished as a result of the terrorist attacks on the United States on September 11, 2001. The ceremony took place in Emancipation Hall in the U.S. Capitol Visitor Center.

The United States Mint prepared and struck the three gold medals—one each for the World Trade Center, the Pentagon, and Flight 93 in rural Pennsylvania—in accordance with the authorizing legislation, Public Law 112-76, the Fallen Heroes of 9/11 Act. Each medal bears a unique design.

The New York Medal

The medal’s obverse (heads side) features an abstract representation of two towers. The abstract lines flowing downward symbolize loss while the lines moving upward represent rising above, hope, and deliverance from that loss. This configuration also suggests the World Trade Center’s Twin Towers. The numbers 93, 77, 175, and 11 represent the four planes involved in the tragic events of 9/11 and are positioned as if on a clock, representing the times of the crashes. The words “Always Remember” are set upon a stone wall similar to the wall that bears the names of the victims at the memorial.

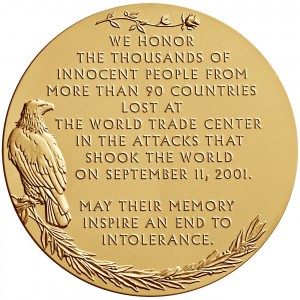

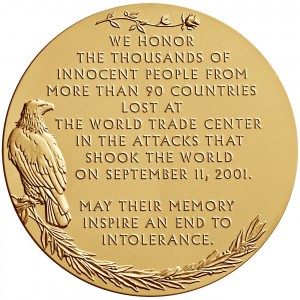

The reverse (tails side) features a single rose protruding from an edge at the top, an echo of the memorial in New York where a white rose is placed through the name of each victim on his or her birthday. The inscription reads: WE HONOR THE THOUSANDS OF INNOCENT PEOPLE FROM MORE THAN 90 COUNTRIES LOST AT THE WORLD TRADE CENTER IN THE ATTACKS THAT SHOOK THE WORLD ON SEPTEMBER 11, 2001. MAY THEIR MEMORY INSPIRE AN END TO INTOLERANCE. The design also includes a bald eagle standing sentinel and clasping branches of laurel signifying an eternal honoring of those who perished in the tragedies.

The obverse of the World Trade Center Fallen Heroes’ medal was designed by Artistic Infusion Program artist Joel Iskowitz and executed by United States Mint Sculptor-Engraver Jim Licaretz. The reverse was designed and executed by United States Mint Sculptor-Engraver Phebe Hemphill.

Obverse of the New York Fallen Heroes Medal designed by Joel Iskowitz and engraved by Jim Licaretz

Reverse of the New York Fallen Heroes Medal designed and engraved by Phebe Hemphill

The Pentagon Medal

The medal’s obverse depicts the rebuilt façade of the Pentagon where Flight 77 crashed. The angle of view is the angle of the flight path. A single candle and a small bouquet of flowers and greens signify a sacred memorial at the site. The American flag flies overhead in a united and patriotic embrace.

The reverse features 184 stars on a raised border around the edge of the design, one star for each of the victims of the tragedy. The inscription reads: WE HONOR THOSE ON FLIGHT 77 AND THOSE IN THE PENTAGON WHO PERISHED ON SEPTEMBER 11, 2001. WE WILL NEVER FORGET THEIR SACRIFICE AS WE UNITE IN MEMORY. The design also features a bald eagle standing sentinel and clasping branches of laurel signifying an eternal honoring of those who perished in the tragedies.

The obverse and reverse of the Pentagon medal were designed and executed by Ms. Hemphill.

Obverse of the Pentagon Fallen Heroes medal designed and engraved by Phebe Hemphill

Reverse of the Pentagon Fallen Heroes medal designed and engraved by Phebe Hemphill

The Flight 93 Medal

The medal’s obverse features the hemlock groves behind the boulder at the Flight 93 Memorial, a simple reminder of loss and healing.

The reverse features 40 stars on a raised border around the edge of the design, one star for each victim. The inscription is WE HONOR THE PASSENGERS AND CREW OF FLIGHT 93 WHO PERISHED ON A PENNSYLVANIA FIELD ON SEPTEMBER 11, 2001. THEIR COURAGEOUS ACTION WILL BE REMEMBERED FOREVER. The design also features a bald eagle standing sentinel and clasping branches of laurel signifying an eternal honoring of those who perished in the tragedies.

The obverse of the Flight 93 medal was designed and executed by United States Mint Sculptor- Engraver Joseph Menna, and the reverse was designed and executed by Ms. Hemphill.

Obverse of the Flight 93 Fallen Heroes medal designed and engraved by Joseph Menna

Reverse of the Flight 93 Fallen Heroes medal designed and engraved by Phebe Hemphill

Public Law 112-76, which requires the United States Mint to strike the Fallen Heroes of 9/11 Congressional Gold Medal, also authorizes the bureau to strike and sell bronze reproductions of the medals. The medals will be available for purchase beginning noon Eastern Daylight Time (EDT) Sept. 11, 2014, via the bureau’s online catalog at http://www.usmint.gov/catalog and at 1-800-USA- MINT (872-6468). Hearing and speech-impaired customers with TTY equipment may call 1-888-321-MINT (6468). The three-inch medals—product codes FH1 (New York Medal), FH3 (Flight 93 Medal), FH5 (Pentagon Medal)—will be priced at $39.95.

Images and text courtesy of the U.S. Mint.

Sep 10, 2014 | US Mint, video, web

After a few years of playing with the look-and-feel of their website, the U.S. Mint is in the process of redesigning and reprogramming their online catalog.

After a few years of playing with the look-and-feel of their website, the U.S. Mint is in the process of redesigning and reprogramming their online catalog.

Face it, the U.S. Mint has not been the paragon of customer service. Their website and fulfillment process has been severely lacking. There were times when the site would crash after releasing high demand products including the limited edition American Eagle anniversary coins. Other than the re-skinning of the site, the U.S. Mint web presence has been a disaster.

Beginning in fiscal year 2014 (October 2013), the U.S. Mint awarded a contract to PFSweb to streamline fulfillment and re-design the web-based catalog and ordering service. The new website is due to be released at the beginning of fiscal year 2015 (October 2014). However, the impact of PFSweb has been felt with the better processing of online and telephone orders.

On September 9, the U.S. Mint released a video giving a preview of the new website. It maintains the color scheme the U.S. Mint has been using while adding flatter elements that have become the in-style of today’s website. According to the video, there will be a virtual tour coming soon. I will keep an eye out for that announcement.

In the mean time, here is the U.S. Mint video:

Sep 8, 2014 | cents, legal, US Mint

Experimental 1974-D Lincoln cent made struck on an aluminum planchet

The argument is over a 1974-D Lincoln cent made of aluminum that was to be auctions by Heritage Auctions during the April 2014 Central States Numismatic Society auction. Rather than being auctioned, the U.S. Mint requested its return as government property even though it was reported that no records of the coin’s production exist.

According to an updated report appearing in Coin World, the coin was given to Harry Lawrence, a former Denver mint assistant superintendent, as part of a retirement gift in 1979. Upon his death, his possession were willed to his son Randall Lawrence.

Randall Lawrence and Michael McConnell, a San Deigo-area dealer working with Lawrence, consigned the coin to Heritage in hopes to be able to donate at least $100,000 from the sale to charities helping the homeless in San Deigo. Heritage had estimated the coin to be worth $250,000. Lawrence and McConnell are asking the federal court to determine the coin’s ownership.

U.S. Mint does not have records of the aluminum cent being struck in Denver. There are records of 1 million coins struck in Philadelphia. Nearly all were destroy.

The U.S. Mint’s mishandling of their own records are legendary. Some of the more famous coins that have escaped official record include the 1933 Saint-Gaudens double eagle and the five 1913 Liberty Head nickels. Numismatic researcher Roger Burdette has documented significant gaps in the way the U.S. Mint has historically mishandled their own documents. Even in recent years, the U.S. Mint has played fast-and-loose even with required documentation during previous director’s term because the narrative of the annual report would make the U.S. Mint’s performance look less than stellar.

Unfortunately for the U.S. Mint, Coin World reporter Paul Gilkes was able to interview former Denver Mint employee Benito Martinez “who said he personally struck fewer than a dozen of these coins as a die setter on aluminum planchets provided by the Philadelphia Mint.” Martinez said that these coins eventually made its way to the U.S. Mint headquarters in Washington, D.C.

Aside from the bad precedent this would create for all pattern coins and trial strikes, this has the potential to undo whatever good will the U.S. Mint has built with the collecting public in the last few years. Problems with the Kennedy gold coin not withstanding, the work that the U.S. Mint has done after the departure of Director Edmund Moy to build a more collector-friendly can be undone by continuing this fight.

Maybe it is time that the lawyers at the U.S. Mint and the Department of the Treasury stop trying to flex its muscles and realize the goodwill that would be created by changing policies and attitudes. After all, like all lawyers it is possible to interpret the law in a manner that would be more helpful while protecting the U.S. Mint and the U.S. government.

Image courtesy of Coin World.

Sep 5, 2014 | ANA, coins, news, US Mint

When the calendar flips to August, my wife begins to complain about the humidity and wanting to go “home” to Maine where she grew up. For me, the kid from south Brooklyn, August begins the last push to the end of the federal government’s fiscal year. With congress out of town, many agencies stop worrying about policy shifts and prepare for the new fiscal year. August is the calm before the policy storms.

When the calendar flips to August, my wife begins to complain about the humidity and wanting to go “home” to Maine where she grew up. For me, the kid from south Brooklyn, August begins the last push to the end of the federal government’s fiscal year. With congress out of town, many agencies stop worrying about policy shifts and prepare for the new fiscal year. August is the calm before the policy storms.

This year has been unusual in that the weather has been more moderate than usual and world events have changed the tenor for those of us who work for the federal government. These events are not limited to areas of conflict. Those of us working in computer security have noticed an uptick in online criminal activity beyond what you read in the headlines.

With nothing happening on Capitol Hill, let’s look at the news generated by the U.S. Mint.

Following the issues during the sales at all locations for the Kennedy Half-Dollar gold tribute coin, the U.S. Mint suspended sales early and will re-evaluate their process for over-the-counter sales of coins. Sources at the U.S. Mint were surprised with the reaction since there are no mintage limits on the coin.

Subsequently, American Numismatic Association Executive Director Kim Kiick announced that sales of newly released coins by the U.S. Mint would be suspended indefinitely because of security concerns.

As an interesting side note, the price of gold has dropped and is close to the price that would lower the purchase price if ordered from the U.S. Mint.

Later in the month, the U.S. Mint announced that the Philadelphia facility broke a single day production record by producing 42.44 million coins for circulation. They beat their previous record of 32.28 million coins set in October 2013. The U.S. Mint produced a total of 1.33 billion coins for circulation in July with more than half of those being produced in Philadelphia.

The branch mint in Philadelphia is the world’s largest coin factory. No other mint in the world can produce the number of coins that can be struck at Philadelphia. The second largest coin factory is the branch mint in Denver.

Record production is more than an accomplishment for the U.S. Mint. They are being struck to fulfill orders for circulating coins from the Federal Reserve. This means that the Fed needs the coins to place into circulation which is a good sign for the economy. If the economy was slower, as it was a few years ago, the demand for coins would have slowed to where the U.S. Mint would have to reduce production.

The U.S. Mint has hired Naxion Research of Philadelphia to poll customers “to share [their] insights on new U.S. Mint products for 2015.” Customers were chosen at random to participate. Those who ordered products from the U.S. Mint via their website were sent an email invitation to take the survey. A separate group who ordered products by the telephone or by mail order was sent a paper survey form.

Survey results are due by September 15, 2014 regardless of the format used.

Aug 13, 2014 | ANA, coins, commemorative, commentary, ethics, gold, shows, US Mint

From the raw video of people dashing across the street at the Denver Mint

The media reported that those waiting for to purchase the coins were not collectors. Most were being paid by dealers to be on the line in order to get around the U.S. Mint purchasing limits. As part of their attempt to game the system, these dealers put collectors and the general public in danger by handing large amount of cash to needy people who did not conduct themselves in a manner that is consistent with the ANA Code of Ethics. Since those behaving badly were being paid by the dealers, they are representatives of the dealers, making the dealers responsible for the action of those they employ.

In case those dealers have forgotten, according to the ANA Code of Ethics:

As a member of the American Numismatic Association, I agree to comply with the following standards of conduct:

- To conduct myself so as to bring no reproach or discredit to the Association, or impair the prestige of the membership therein.

This applies directly to the dealers whose action caused problems at the World’s Fair of Money. Since sales of the coin were made at the U.S. Mint’s booth on the bourse floor, this is a case where the dealers who participated in this discredited the Association by creating an environment that potentially jeopardized the security of the show. By putting the security in jeopardy and bringing this negative publicity to the World’s Fair of Money, the participating dealers impaired the prestige of the membership especially when they had to put the U.S. Mint and the ANA Executive Director in the position to have to act as a parent to dealers acting like impetuous children.

- To base all of my dealings on the highest plane of justice, fairness and morality, and to refrain from making false statements as to the condition of a coin or as to any other matter.

Although the launch of the 2014 National Baseball Hall of Fame commemorative coin during the Whitman Baltimore Expo was a success, there was a feeling that the sales format did not give collectors a chance to purchase the coin. In order to promote the broader sales of the coin, the U.S. Mint adjusted its sales requirement to limit over-the-counter sales in order to give more collectors the opportunity to purchase the new Kennedy gold coin. How could the U.S. Mint or the ANA know that the sales of a coin that does not have any mintage limits would cause problems when the sales of a commemorative coin with mintage limits went without significant issue?

Unfortunately, the intent of the U.S. Mint was impeded by some dealer’s plane of justice by their action. By immorally trying to get around the U.S. Mint’s sales limits by using questionable methods to unfairly stack the line against the collector, the dealers were making false statements to a government entity, and thus the public it represents, as to their eligibility to purchase the coin.

The appalling images provided by Denver television news (see below) of the behavior of those described as homeless on behalf of the dealers trying to get around the sales limits not only is not only unjust to legitimate purchasers and immoral, but as ANA members discredits themselves as ANA members.

Therefore, I am accusing ALL of the ANA members who hired these people that acted on their behalf of the ANA dealers with violation of the ANA Code of Ethics. The ANA Board of Governors must take action to restore the organization’s credibility by suspending those involved as per the ANA Bylaws!

Images of the shameful display caused by ethically challenged and greedy dealers courtesy of

ABC 7News Denver.

Aug 6, 2014 | coins, gold, halves, US Mint

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Watching the scene from afar gives it a reality television-like feel. Just like reality television, I find it difficult to understand the appeal of having to be the first or one of the first to purchase the coin. In this case the people who bought the first coin had the coin slabbed and was paid $20,000 for the coin, what about the people standing in line behind them? Were they expecting to resell the coin to a dealer desperate to have the coin in their inventory? Was the line there representing dealers who will advertise that they have the coin from the first day of issue and mark up the price for those who collect the labels and not the coin?

If you are interested in purchasing the coin and not worried about the hype, I recommend that you buy the coin directly from the U.S. Mint. First, the U.S. Mint has already announced that there will not be a production limit. While there are initial sales limit, the U.S. Mint will strike as many as ordered. Second, those coins purchased at the U.S. Mint booth at the World’s Fair of Money will likely be removed from the U.S. Mint packaging and entombed in one of the third party grading company’s hunk of plastic. The price will be overly inflated.

When you buy the coin from the U.S. Mint, the price you will pay is the market price of three-quarters of a troy ounce of gold, the full cost of manufacture, and the packaging. According to the U.S. Mint, “The coins are encapsulated and packaged in a single custom-designed, brown mahogany hardwood presentation case with removable coin well and are accompanied by a Certificate of Authenticity.” That mahogany hardwood presentation case is probably not cheap. If it is the same case that has been used for past special coin programs, then it is a nice package and should display the coin nicely. You will probably not receive the presentation case from the dealer that slabbed the coin. In fact, some dealers have started to sell the empty presentation cases without the coin—essentially, double-dipping at the expense of the purchaser of the coin.

The final reason to buy the coin directly from the U.S. Mint online or via the telephone is that there is a limit of five coins per household. When you buy the coin at one of the U.S. Mint facilities or this week at the World’s Fair of Money, you are limited to buying one coin and that there is a daily sales limit of 500 coins at each location.

With no offense intended to dealers who will have plenty of opportunities to make money on this coin in the future, I recommend that Coin Collectors Blog readers who want to purchase a coin for their own collection to buy it directly from the U.S. Mint. Even if the price of gold rises, the U.S. Mint pricing table [PDF] for these coins shows that the difference is about $35 per pricing band. I suspect that it will be less than the premium that many dealers will add to the price of the coin at the same time it is available from the U.S. Mint, except that they can sell you the coin now and you will not have to wait.

First Day Sales Figures

The U.S. Mint released their first day sales figures for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin:

| Online/Call Center Sales |

54,825 |

| ANA World’s Fair of Money |

493 |

| U.S. Mint Headquarters, Washington, DC |

376 |

| Philadelphia Branch Mint |

500 |

| Denver Branch Mint |

500 |

| All sites |

56,694 |

Coin image courtesy of the U.S. Mint.

Aug 3, 2014 | BEP, coins, currency, Federal Reserve, US Mint

While doing my monthly review of the numismatic-related political news for the Gold & Silver Political Action Committee, I came across a bill that seems to have missed the numismatic press. One reason it was missed might be that the provisions are buried in a larger bill and has a name that might not be as noticeable. However, there are two issues buried in a larger bill. The bill is as follows:

H.R. 5196: Unified Savings and Accountability Act (or USA Act)

Sponsor: Rep. Mike Coffman (R-CO)

• To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

• Introduced: July 24, 2014

• Referred to several committees based on jurisdiction of the provision.

Track this bill at https://www.govtrack.us/congress/bills/113/hr5196

Buried within the bill are two provision that may be of interest to collectors.

Sec. 203. Prohibition on non-cost-effective minting and printing of coins and currency.

If passed, Section 203 would require that the U.S. Mint stop striking any coin that costs more to manufacture than its face value four years following the passage of this bill. Using current standards, the U.S. Mint would be required to stop producing one- and five-cent coins by late 2018 because they cost more than their face value to produce. One of the problems with this bill is what would happen if the price of copper and zinc, the drivers in the price of both coins, were to fall and the costs were reduced to below face value? Would the coins be struck again?

Sec. 205. Replacing the $1 note with the $1 coin.

As the title suggests, Section 205 will replace the one-dollar Federal Reserve Note with the dollar coin. The section begins with requiring the Federal Reserve to “sequester” Susan B. Anthony dollars to remove them from circulation. There is a provision for their value as numismatic collectibles.

The plan to remove the $1 FRN is just to stop issuing the notes and replace them with coins as the notes come out of circulation after a one-year educational period. The Federal Reserve would continue to use the notes alongside the coins until 600 million coins are in circulation or for four years, whichever comes first. The bill allows the Bureau of Engraving and Printing to continue to print the $1 FRN for collectors.

Given the current state of congress, the likelihood of this bill passing is slim-to-none, and, as a friend liked to say, “Slim just left town.” Some of the other provisions of this bill might be introduced into an omnibus budget bill following the November elections, but it is doubtful that these sections will make it past this introduction.

Then again, who knows? Congress has surprised us in the past!

Jul 31, 2014 | coins, gold, halves, US Mint

According to the U.S. Mint:

According to the U.S. Mint:

Because of the expected overwhelming response, dialog with our customers and many others interested in the 50th Anniversary Kennedy Half-Dollar Gold Proof Coin, the United States Mint is reducing the over-the-counter purchase limit to one unit per customer.

This change in the purchase limit will give more members of the public an opportunity to purchase this popular coin, essentially doubling the number of customers able to purchase it. The number of units available at each retail location (Philadelphia and Denver facilities, Washington, D.C., headquarters and Chicago ANA World’s Fair of Money) will remain the same. There will be 500 units available initially at each United States Mint location (Philadelphia, Denver and Washington) and an additional 100 units per day for the first three days after the product launch. There will be 2,500 at the ANA, 500 available per day of the convention.

The household ordering limit of five will remain the same.

UPDATE: The price effective for the August 5 opening day of sales for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof is $1,240. See the U.S. Mint’s online catalog for more information.

NOTE: Usually I do not post press releases directly since there are many other places to see these announcements. Since there has been a lot of interest in these coins, I am posting this as a service to my readers.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

After a few years of playing with the look-and-feel of their website, the

After a few years of playing with the look-and-feel of their website, the

According to the

According to the