Aug 2, 2018 | coins, dollar, errors, ethics, scams, US Mint, varieties

This week’s LOOK BACK is my take at the stir made over the positioning of the edge letters on the newly struck George Washington Dollar coins in 2007.

If you search the online auction sites, you will find less than honest sellers trying to sell variations in the positioning of edge lettering of the new George Washington Dollars errors or varieties. Letters that are pointed up, or the top of the letters towards the obverse, are considered “normal” by these sellers. Letters that are pointed downward, or the top of the letters closer to the reverse of the coin, have been called errors or varieties. They are neither.

Exasperating the issue is that one third-party grading service added a designation to their labels with the orientation of the edge lettering.

-

-

According to one third-party grading service, Presidential Dollars With The Tops The

Edge Lettering Facing the Reverse Are Designated As “Position A.”

-

-

Those With The Tops Of Their Letters Facing The Obverse Are “Position B.”

An accepted definition of a variety “is any variation in the normal design of a given coin, usually caused by errors in the preparation or maintenance of the coin dies.” They are also errors caused in the striking process. But these definitions do not account for the differences in the orientation. The problem is that after the planchets are struck into coins by the high-speed coining machines, they are mechanically collected and fed into a machine that will press the lettering into the edge of the coins.

The machine that adds the edge lettering uses a three-part collar to impress the incuse lettering does this without regard to position. not only could the edge lettering face any direction, but the lettering can appear at any position along the edge. The U.S. Mint confirms this by saying that because of “the minting process used on the circulating coins, the edge-incused inscription positions will vary with each coin.”

Since the Mint is saying that the process can vary, these variations are normal for the design. Since these are normal variations, they are not numismatic varieties or errors. Thus, the coins with variations of orientation edge lettering are not worth the premiums being sought online. They are worth their face value of $1.

There have been errors found with the edge lettering. The most infamous has been called the “Godless Dollars” for coins missing their edge lettering and the motto “In God We Trust.” Most of these coins were minted in Philadelphia and discovered in Florida. Others have found doubling of edge letters and what looks like breaks in the three-part collars where letters have moved out of place. These are legitimate errors and worth a premium above face value. Orientation variations of the edge lettering are not errors.

If you want to consider these varieties, please save your money and visit your local bank. You can purchase these coins for face value without shipping and handling fees. If you purchase a 25-coin roll, you can spend the coins you do not want since they are legal tender.

The original article can be read

here.

Jul 5, 2018 | coins, commentary, legislative, US Mint

Since the introduction of the 50 State Quarters Program, there have been several changing design series on circulating coinage. All of the programs have been created to honor and celebrate the nation’s history in some way. It started in 1999 with the issuance of the quarter honoring Delaware, the first state to ratify the Constitution granting it the designation of being the first state to enter the Union.

Since the introduction of the 50 State Quarters Program, there have been several changing design series on circulating coinage. All of the programs have been created to honor and celebrate the nation’s history in some way. It started in 1999 with the issuance of the quarter honoring Delaware, the first state to ratify the Constitution granting it the designation of being the first state to enter the Union.

Since 1999, there has been the following coin series issued by the U.S. Mint:

- 2009 Lincoln Bicentennial One Cent Program

- Westward Journey Nickel Series™

- 50 State Quarters Program

- 2009 District of Columbia and U.S. Territories Quarters Program

- America the Beautiful Quarters® Program

- Native American $1 Coin

- Presidential $1 Coins

Although none of these series produced rare coins with the exception of errors and varieties, such as the 2004 Wisconsin extra leaf quarter and the 2005 Minnesota quarter with an extra tree, the only excitement was the novelty generated in 1999 with the new series.

Soon, the American Innovation $1 Coin will join this list. When the American Innovation $1 Coin Act (H.R. 770) finishes its procedural trek through Congress, it will be sent to the other end of Pennsylvania Avenue for the President’s signature. There is no indication that the President will veto this bill.

The 14-year program will honor “American innovation and significant innovation and pioneering efforts of individuals or groups from each of the 50 States, the District of Columbia, and the United States territories.” Four one-dollar coins will be issued each year and issued alongside the Native American Dollar.

Although there is a bias in the numismatic industry against modern coinage, there is a fun aspect of the changing coin designs. Aside from breaking up the monotony, there is an educational aspect that people should take advantage of, even if you have college degrees.

2015-W Native American Dollar Enhanced Uncirculated Reverse celebrating the Mohawk Iron Workers

Mohawk ironworkers were there following the attacks of September 11, 2001, to help clean up and rebuild the World Trade Center site. This is something I would not have known had they not appeared on the coin and asking why.

Regardless of the historical significance of these coins and the underappreciated beauty of the designs, the numismatic industry has not taken the opportunity to promote coin collecting using these changing programs. There is only one reason for the lack of interest from the community: ECONOMICS!

The American Numismatic Association is largely run by dealers who make their living by buying and selling rare coins and bullion. The trade in modern coinage, many items that anyone could find in pocket change, does not have a high rate of return. Therefore, most dealers are not interested.

Although dealers do have the right to earn a living the way they see fit, as part of the overall hobby, they tend to steer away from the modern coins and even downplay their significance to the hobby. This tends to perpetuate a myth that you cannot be a legitimate collector if you collect modern coins.

This attitude is a wasted opportunity for the industry. Aside from being an opportunity to promote the hobby but give people an outlet to learn something more than what they see on the cable news channels.

One of the problems with this program can also make it a positive is what will each of the states choose to represent innovation in their state or territory? Promoting numismatics as “history in your hand” can also be a lesson in history to help each state decide what to chose to best represent them on a coin. This is the best opportunity to use numismatics to promote the hobby and history by providing a conduit for discussion in each state.

One of the problems with this program can also make it a positive is what will each of the states choose to represent innovation in their state or territory? Promoting numismatics as “history in your hand” can also be a lesson in history to help each state decide what to chose to best represent them on a coin. This is the best opportunity to use numismatics to promote the hobby and history by providing a conduit for discussion in each state.

What would constitute a state’s great innovation or innovator? Will New Jersey choose Thomas Edison? Will Alexander Graham Bell be Massachusetts’ choice? And what about Pennsylvania? There could be an interesting discussion about honoring Benjamin Franklin, George Westinghouse, or even Andrew Carnegie especially since neither of these men were born in the United States.

There will be a lot of innovation to chose from because there has been a lot of innovation during the country’s 242 years of existence. If you missed the announcement by the United States Patent and Trademark Office (USPTO), they issued the 10 millionth patent on Tuesday, June 19, 2018. And that does not count the patents issued before 1836 when the numbering system was reset by the Patent Act of 1836.

However, the most significant problem with the Innovation $1 Coin is that it is a one-dollar coin. As long as Congress continues to not listen to reason and stops issuing the paper dollar, it does not matter what they do with the coin, it is not going to generate enough interest because the coin will not circulate.

Regardless of how many Government Accountability Office (GAO) reports are issued (GAO-13-164T) or the number of experts that endorse the elimination of the paper dollar for the coin, Congress refuses to address the issue. They point to surveys that show that most of the people older than 50 are against removing the paper dollar. Since this population constitutes the majority of the voters and, more significantly, campaign donors, the politicians are not about to make those people upset.

Regardless of how many Government Accountability Office (GAO) reports are issued (GAO-13-164T) or the number of experts that endorse the elimination of the paper dollar for the coin, Congress refuses to address the issue. They point to surveys that show that most of the people older than 50 are against removing the paper dollar. Since this population constitutes the majority of the voters and, more significantly, campaign donors, the politicians are not about to make those people upset.

In many cases, the Innovation $1 Coin will be a repeat of history. Its potential popularity will fail as Congress hopes to socially engineer excitement in the way they tried to do for the Presidential dollar coins. That was deemed a failure that forced then-Treasury Secretary Tim Geithner to order the U.S. Mint to reduce the production of these coins. This was after certain members of Congress showed its collective stupidy by introducing a bill to prematurely end the program.

There is so much potential for the Innovation $1 Coin to be a great program and to generate publicity for the hobby. But as long as the coin does not circulate and Congress refuses to deal with the situation appropriately, it will be a coin that only existing collectors will take interest in and become a lost opportunity for everyone.

Jul 2, 2018 | coins, commemorative, dollar, legislative, US Mint

Sometimes watching specific legislation to make its way through Congress is like watching paint dry. We know the paint will eventually dry but it takes a lot longer than we have time to wait. With the exception of bills that are proposing useful things like eliminating the paper dollar for a coin, there is no point to check daily.

But that is what I do. I wrote a program to download the bill information produced by the Government Printing Office on behalf of the Congress and store it in a database so that it can be reported here. This process does not become interesting until something happens.

The last two weeks in June looks like it was the equivalent of a wild ride. First, the American Innovation $1 Coin Act (H.R. 770) appeared on the agenda in the House of Representatives where the only “debate” was Rep. Jim Himes (D-CT), the bill’s sponsor, and the day’s floor manager, Rep. Sean Duffy (R-OH) speaking in favor of passage. Then it followed the regular course of passage by the House, passage by the Senate with a change, followed by the House agreeing with the amendment. Next month it should be signed into law by the President.

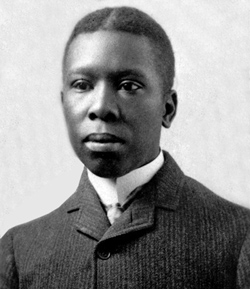

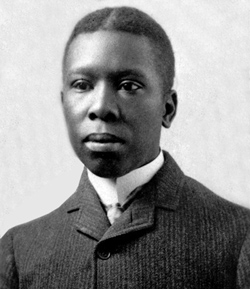

Paul Laurence Dunbar, circa 1890

Paul Laurence Dunbar (1872-1906) was an American poet, novelist, and playwright. Dunbar was very popular in his day whose work was known for its colorful language and conversational tone that made his work seem lyrical. Dunbar, who was born in Dayton, Ohio as a child of former slaves, was famous for writing in the “Negro dialect” that was associated with the antebellum south.

Dunbar had briefly worked at the Library of Congress before resigning to concentrate on his writing. His home in the LeDroit Park neighborhood of Washington, DC still stands today. In 1904 he returned to Dayton to be with his ailing mother but ended up contracting tuberculosis and dying in 1906.

Carson City Mint (1866)

The Carson City Mint opened in 1870 primarily in response to the Comstock Lode. It started as an Assay Office in 1963 but did not gain Mint status until 1870. It was in operation from 1870-1885 and 1889-1893. It is the only branch of the U.S. Mint to have used a two-letter mint mark.

Today, the building is a branch of the Nevada State Museum.

Since the text of both bills has not been published, details of the programs are unknows except it is safe to assume that the Carson City 150th Anniversary commemorative coin program will occur in 2020.

H.R. 770: American Innovation $1 Coin Act

Summary: (Sec. 2) This bill directs the Department of the Treasury, over a 14-year period beginning in 2019, to mint and issue “American Innovation” $1 coins commemorating innovation and innovators from each state, each U.S. territory, and the District of Columbia. Treasury shall issue four coins per year, in alphabetical order by jurisdiction, until a coin has been issued for each jurisdiction. Treasury may mint and issue a $1 coin in 2018 to introduce the series. Neither the bust of any person nor the portrait of any living person may be included in the design of the coins.The bill instructs Interior to continue to mint and issue $1 coins honoring Native Americans and their contributions.

Motion to reconsider laid on the table Agreed to without objection. — Jun 27, 2018

On motion that the House agree to the Senate amendment Agreed to without objection. (text as House agreed to Senate amendment: CR H5786-5787) — Jun 27, 2018

Mr. Hensarling asked unanimous consent to take from the Speaker’s table and agree to the Senate amendment. — Jun 27, 2018

Message on Senate action sent to the House. — Jun 21, 2018

Passed Senate with an amendment by Voice Vote. — Jun 20, 2018

Measure laid before Senate by unanimous consent. — Jun 20, 2018

Senate Committee on Banking, Housing, and Urban Affairs discharged by Unanimous Consent. — Jun 20, 2018

Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jan 17, 2018

Motion to reconsider laid on the table Agreed to without objection. — Jan 16, 2018

On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jan 16, 2018

DEBATE – The House proceeded with forty minutes of debate on H.R. 770. — Jan 16, 2018

Considered under suspension of the rules. — Jan 16, 2018

Mr. Duffy moved to suspend the rules and pass the bill, as amended. — Jan 16, 2018

Referred to the House Committee on Financial Services. — Jan 31, 2017

H.R. 6214: To require the Secretary of the Treasury to mint commemorative coins in recognition of Paul Laurence Dunbar.

Referred to the House Committee on Financial Services. — Jun 25, 2018

H.R. 6221: To require the Secretary of the Treasury to mint coins in commemoration of the Carson City Mint 150th anniversary, and for other purposes.

Referred to the House Committee on Financial Services. — Jun 26, 2018

All images courtesy of Wikimedia Commons.

Jun 28, 2018 | coins, dollar, legislative, US Mint

Presidential $1 Coin Common Reverse

The next step is that the bill is engrossed, which means that it will be printed in its final form and signed by the Speaker of the House, Paul Ryan (R-WI), and the President Pro Tempore of the senate, Orrin Hatch (R-UT), certifying that the printed bill has been approved by both chambers of commerce.

Once signed, the bill is sent to the White House for the President’s signature.

If this bill was not on your radar, it requires the coins use the same Manganese-Brass composition as all dollar coins struck since 2000 with the edge lettering consisting of the year, mintmark, and the national motto E PLURIBUS UNUM. The obverse will be “a likeness of the Statue of Liberty extending to the rim of the coin and large enough to provide a dramatic representation of Liberty.” The reverse will be emblematic of an innovation, innovator, or a group of innovators significant to that state or territory.

If the president signs this bill, and there is no reason why he would veto this biil, then the program will begin in 2019.

Jun 1, 2018 | coins, commentary, gold, US Mint

One of the ten 1933 Saint-Gaudens $20 Double Eagle gold coins from the Longbord Hoard confiscated by the U.S. Mint

Coin World reported that the previous owner, who wishes to stay anonymous, turned in the coin because he did not want to be caught with the coin that federal courts ruled was stolen government property. Department of the Treasury and U.S. Mint officials have been instructed by the Department of Justice not to go into any further details about the case.

Since it has been assumed that 25 of these coins were taken from the Philadelphia Mint, that leaves four left at large.

According to Coin World, “The Secret Service still has on its books a directive to seize any extant 1933 double eagles as stolen government property.” However, other coins, patterns, and fantasy pieces including the five 1913 Liberty Head Nickels and the 1974 Lincoln Cent trial strike made from aluminum are still in private hands.

As long as this bogus double standard remains the policy of the federal government, we will likely never know whether the rumored 1964 Peace Dollars are real.

May 29, 2018 | coins, dollar, history, US Mint

Randy’l Teton interview on East Idaho Newsmakers (screen grab)

Since there are no known images of Sacagawea, Goodacre searched for someone she could model her design on. Goodacre found Randy’L He-Dow Teton is a member of the Shoshone-Cree tribe to be the model. Teton was a student at the University of New Mexico majoring in art history and was working for the Institute of American Indian Arts Museum in Santa Fe when Goodacre visited looking for information about the Shoshone tribe. While talking with the museum’s curator, Goodacre was shown a picture of the curator’s daughter, Randy’L, and decided to work with her to create the Sacagawea design.

Recently, Teton sat with Nate Eaton of EastIdahoNews.com for his series East Idaho Newsmakers. Although they cover other topics, most of the video is about Teton’s experience as being the model for Sacagawea.

EastIdahoNews.com does not provide the ability to embed the video elsewhere on the web. To watch the video and hear the story from Teton’s point of view you can visit the site: Newsmakers: The fascinating story of how this local woman ended up on the dollar gold coin.

May 22, 2018 | coins, commentary, gold, legal, US Mint

The ten 1933 Saint-Gaudens Double Eagles confiscated by the government from Joan Lanbord, daughter of Israel Switt.

For those who have not read Illegal Tender by David Tripp or Double Eagle by Allison Frankel, aside from both being worth reading, they claim that 25 of these coins were illegally removed from the Philadelphia Mint. Of those 25 coins, nine were confiscated during the 1940s and 1950s by the Secret Service, ten are from the Langbord Hoard stored at the Bullion Depository at Fort Knox, and one is the Farouk-Fenton example which is the subject of the books.

That leaves five left.

During the Pennsylvania Association of Numismatics (PAN) spring show, U.S. Mint Senior Legal Counsel Greg Weinman said that he knows where one is located in the United States, one is in Europe, and a third is somewhere else. The location of the last two is not known.

It can be speculated that the “somewhere else” may be in Egypt. On February 8, 2008, the Moscow News Weekly reported that a version of the coin was found in Egypt in an old box that was owned by the discoverer’s father (web archive link). Although there had been a lot of speculation that coin might not be genuine, there has been no further reports as to the disposition of this coin.

Weinman said that there are no plans to go after the three coins where the U.S. Mint knows their location.

Why?

Following the trial in 2011 with a jury verdict against the Langbords. After the ruling, Assistant U.S. Attorney Jacqueline Romero, the government’s lead attorney in the case, came out with a courthouse statement, “People of the United States of America have been vindicated.”

If the country is to be vindicated and the government has consistency in its argument that the coins are “chattel,” according to Weinman, then it is their legal obligation to have the U.S. Secret Service pursue the three known examples.

Otherwise, it could be said that the government has undergone selective prosecution and has given up its right to the ten in its possession or the five that are still in public hands.

It is these inconsistencies of policies with regard to these coins that could drive collectors away. While most people may never find or own one of these rare coins, what happens to those who might get lucky.

While the 1913 Liberty Head Nickels were not considered chattel because they were never struck for circulation, the government fought the finding of the 1974-D Aluminum cent forcing its return. The circumstances for the striking of both coins are similar but the government has treated each issue differently.

This is not a matter of integrity of the hobby. It is the integrity of the U.S. Mint and their bogus argument of what is or is not something they produced for whatever the reason. The integrity of the U.S. Mint can be questioned when they applied 21st century operating standards to the U.S. Mint of the 1930s in order to convince a “jury of peers,” none of which probably had a numismatic background questioning their ability to be peers, that these coins belonged to the government for it to hold like some almighty savior of us from the depths of fraudulence.

Do you still feel vindicated?

May 6, 2018 | Canada, coins, news, US Mint

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

Last week, the Royal Canadian Mint issued its financial reports for 2017. The headline of the report said that the Royal Canadian Mint paid $93.2 million ($72.553 million USD) in dividends to the government of Canada in 2017. To compare this with the U.S. Mint, whose fiscal years end on September 30th, paid a total of $265 million back to the government.

Numismatic sales are an important part of the Royal Canadian Mint’s sales. This is evident by visiting their website to see the number of programs they have for sale. With all of the options, the Royal Canadian Mint revenue for those numismatic items was $25.7 million ($20 million USD). Even with the complaints about how horrible the U.S. Mint is and its programs are not priced according to someone’s perception of the market, they sold $1.755 billion in numismatics. This number includes about $2.4 million in numismatic sales of circulating coins, such as bags and rolls.

Finally, even though bullion sales have decreased as the economy strengthened and both mints saw a reduction in sales. The Royal Canadian Mint had a net revenue of $1.35 billion ($1.05 billion USD), representing a 40.7-percent decrease in sales from 2016. The U.S. Mint had revenues of $1.378 million representing a decrease of 33.8-percent from 2016.

There may be some who like to complain about the U.S. Mint, this government bureau continues to be the world’s largest manufacturer of circulating and collectible coinage. Although bullion sales have decreased and the Royal Canadian Mint has performed well in the bullion markets in recent years, when it comes to whom the market turns to, the U.S. Mint continues to outperform other world mints.

And now the news…

April 29, 2018

A new 50 cent coin featuring a red poppy will be issued by the Reserve Bank in October to commemorate Armistice Day. Reserve Bank governor Adrian Orr said the coin would have significance for those whose relatives served in the First World War.  → Read more at stuff.co.nz

→ Read more at stuff.co.nz

April 29, 2018

The CBM has been selling gold coins in weights of one tical, half-tical and quarter-tical since 1991. One tical is equivalent to around 16 grams. Currently, one-tical coins bear a single star, while the half and quarter-tical coins have a ploughing farmer and logging elephant engraved, respectively.  → Read more at mmtimes.com

→ Read more at mmtimes.com

April 30, 2018

Cebu City — The Bangko Sentral ng Pilipinas (BSP) will launch the New Generation Currency (NGC) series during its anniversary in July. Leonides Sumbi, regional director of BSP in Central Visayas, said the release of the new coins is not meant to create confusion as BSP will soon demonetize the old coins.  → Read more at news.mb.com.ph

→ Read more at news.mb.com.ph

May 1, 2018

Ian Vogler/Mirrorpix/Newscom With less than three weeks before the royal wedding, Britain’s Royal Mint today released a special commemorative coin to mark the occasion. A new British five-pound coin (about $6.88) celebrates Prince Harry and Meghan Markle’s upcoming wedding May 19.  → Read more at abcnews.go.com

→ Read more at abcnews.go.com

May 2, 2018

LISBON, May 2 (Xinhua) — The Bank of Portugal bought 272 million 1 and 2 cent coins from the Bank of Ireland in 2017, the Publico newspaper reported on Wednesday. Specifically, the Bank of Portugal purchased 148.8 million 2 cent coins and 123.2 million 1 cent coins.  → Read more at xinhuanet.com

→ Read more at xinhuanet.com

May 3, 2018

Getty Images Overall global gold demand fell to its lowest first-quarter level since 2008, driven by a slump in demand for gold bars and exchange-traded funds backed by the precious metal, according to a report from the World Gold Council released Thursday.  → Read more at marketwatch.com

→ Read more at marketwatch.com

May 3, 2018

OTTAWA, May 3, 2018 /CNW/ – The Royal Canadian Mint (the "Mint" or the "Company") is pleased to release its 2017 financial results, which provide insight into our activities, the markets influencing our businesses and our expectations for the year ahead.  → Read more at markets.businessinsider.com

→ Read more at markets.businessinsider.com

May 3, 2018

While credit cards were once reserved for large purchases across Australia, more people than ever are using plastic for items as cheap as a morning coffee.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

May 5, 2018

A late revolt bronze coin discovered where rebels sought refuge in a cave near Modiin indicates geographically widespread Jewish backing of the ultimately bloody Jerusalem uprising  → Read more at timesofisrael.com

→ Read more at timesofisrael.com

Apr 15, 2018 | coins, news, US Mint

David J. Ryder, 39th Director of the U.S. Mint

The U.S. Mint has been without an appointed director since Edmund C. Moy resigned as the director effective on January 9, 2011, although he had vacated his office earlier. Moy’s term was to expire on September 5, 2011. He was one of the few officials from the George W. Bush administration to work under Barack Obama.

Moy will be remembered for the problems with the U.S. Mint’s website ablity to meet collector demand and the debacle over not having enough bullion planchets to meet demands of investors and collectors.

Ryder comes to the U.S. Mint after holding the position of Global Business Development Manager and Managing Director of Currency for Honeywell Authentication Technologies. As part of his work, Ryder worked with the Royal Mint during their development of the security technology that they are currently being used for the new one-pound coin.

During his confirmation, Ryder was asked about counterfeit technologies and how it could help in the United States. Although counterfeiting is a concern, current circulating coins are not the counterfeiter’s targets. For coins, the targets are the older collectible coins with an overwhelming target being Morgan and Trade dollars.

This is a return for Ryder who served as the 34th Director from September 1992 to November 1993 during the administration of President George H.W. Bush. His experience with running the U.S. Mint in the past and his work with Honeywell should help him be successful.

Welcome, Mr. Ryder and good luck!

And now the news…

April 11, 2018

Football fans were shocked to learn that Patriots tight end Rob Gronkowski is a coin collector. On Wednesday night ESPN Sports Business Reporter Darren Rovell tweeted a new detail about Gronkowski's $1million home being burglarized on February 5, the night the Patriots lost to the Philadelphia Eagles in Super Bowl LII.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

April 11, 2018

To mark the 20th anniversary of Astana and the 25th anniversary of the national currency, the National Bank of Kazakhstan will issue a new series of commemorative coins. This is great news for numismatists of many countries.  → Read more at kazakh-tv.kz

→ Read more at kazakh-tv.kz

April 12, 2018

Bank tellers beware! A coin con man may be on a roll, warn North Vancouver RCMP – literally. The inventive fraudster recently bilked a bank in North Vancouver by cashing in what the teller believed were more than 45 toonies and leaving significantly lighter, pocketing $2,600 in bills.  → Read more at nsnews.com

→ Read more at nsnews.com

April 13, 2018

A junk dealer in Turkey returned 100 gold coins he found hidden away in an old stove, state run Anadolu news agency reported on Friday. Asir Ozturk, 36, has been making a living by collecting and selling junk materials in Burdur for the last 20 years, according to the report.  → Read more at thenews.com.pk

→ Read more at thenews.com.pk

April 14, 2018

In 1974, Reno stock investor and real estate man, Lavere Redfield, passed away at the age of 77 years. Lavere was born in Utah and his father died when Lavere  → Read more at elkodaily.com

→ Read more at elkodaily.com

Apr 10, 2018 | coins, commentary, education, US Mint, values

I write this blog from the perspective of a collector. I champion the collector. I think that collectors are the most qualified to determine the direction of the hobby. The collector is the consumer and the consumer is almost always right.

When it comes to helping with the direction of the hobby dealers should also have a say. Their input is important. But they should be there to support the collector because without collectors the dealers have no business. Dealers should not be dictating the direction of the hobby.

Are these sets hurting the hobby? Should the U.S. Mint stop producing them? (U.S. Mint image)

Regular listeners to The Coin Show knows that Matt is not a fan of modern coins and the products of the U.S. Mint. In fact, during the last show, he admitted to not carrying American Eagle coins because he does not want to support the U.S. Mint in damaging the hobby.

During the podcast, Mike came to the defense of U.S. Mint collectors but that defense was tempered when he said that collecting U.S. Mint products was for beginner collectors and that it was a way to start before the collector “graduate” to other collectibles.

I have questioned Matt and Mike in the past on Facebook but this time I felt their statements crossed a line. My regular readers know I can get hyperbolic but I try to remain respectful. As it happens on Facebook and anywhere else on the Internet, people cannot take the words at face value and have to read something into them.

This time I emphasized that not only do I collect U.S. Mint items but have not “graduated” to the type of collectibles Mike and Matt proclaim to be real collectibles. New readers can go through this blog and see how my collection can be classified as normal to eclectic.

After a lot of angry discussions (you will see a sample below) and some churlish responses from others (not Matt or Mike), I finally coaxed out the reasons for Matt’s hatred of modern U.S. Mint products. Unfortunately, it seems his reasons have more to do with the industry than the U.S. Mint.

According to Matt, the U.S. Mint is harming numismatics by selling annual sets like proof and mint sets at the prices they set. During the Facebook discussion, Matt and Sam Shafer, another Indianapolis-area dealer, said that they believe the U.S. Mint’s prices are too high.

From their perspective as dealers, they claim it is the U.S. Mint’s fault for the differences between the manufacturer’s suggested retail price the secondary market.

Using that logic, can I blame Chevrolet for the secondary market price of the 2014 Silverado I just purchased? If I tried, General Motors would laugh me under the tonneau cover of the truck! Yet, coin dealers are applauded for applying the same logic. This does not make sense.

How can you blame the manufacturer for the secondary market’s reaction?

Matt wrote, “I feel like the depreciation seen in modern sets is much more harmful to potential collectors or beginning collectors.”

I guess if General Motors followed that logic, they would stop making trucks!

But we are talking about collectibles. In that case, Topps, Fleer, and Upper Deck should stop producing baseball cards.

This is only an argument by dealers who would rather sell what they like and not take a broader view of the collecting market. In my new life, I am a collectibles and antiques dealer. The items I buy are either from the secondary market or I buy new items from manufacturers such as comic book and baseball card publishers.

This 1901 $10 Dollar Lewis and Clark Bison note (Fr# 122) was sold by a dealer at an antiques show by a dealer not complaining about the collecting market.

The vast majority of dealers are very good and very reasonable. Many do understand the view of the collector and work with them. However, there is a subset of dealers that can be some of the most stubborn business people I know. They refuse to change with the market. Even if the market is not looking for their niche, they will not adapt to the market. Their mind is made up do not confuse them with facts.

They are also the most vocal in their opposition to market forces. Their usual retort is “you don’t understand, you’re not a dealer!”

With all due respect, I do not need to be a dealer to know that not changing with the times is doing more to hurt the hobby than the U.S. Mint is by doing its job.

Did you know that the Pobjoy Mint struck this coin under the authority of the British Virgin Islands. Is this good for the hobby? (Pobjoy Mint image)

The U.S. Mint does not offer dozens of non-circulating legal tender (NCLT) coins. U.S. Mint coins are struck and not painted. The U.S. Mint does not offer piedfort version of circulating coins or even coins guilt in gold or palladium. The U.S. Mint does not make deals with movie production companies, comic book publishers, or soft drink manufacturers to issue branded coins.

Every coin that the U.S. Mint offers for sale has an authorizing law limiting what they could produce. According to those laws, the U.S. Mint has to recover costs and is allowed to make a “reasonable” profit.

But what is reasonable? This is a question that has a lot of valid arguments on both sides. However, the U.S. Mint is subject to oversight by the Treasury Office of the Inspector General (OIG) and, occasionally, review by Congress’s Government Accountability Office (GAO). Neither oversight agency has produced a report saying that the U.S. Mint’s prices are unreasonable.

The U.S. Mint is selling what they manufacture at a price that the competent oversight agencies have not complained about. The only one complaining is by the dealers in the secondary market.

Why are these dealers complaining?

We get to the crux of the problem when Sam Shafer responds, “I would rather sell a customer a Morgan dollar than a set of glorified shiny pocket change.”

It does not take a rocket scientist to understand why a dealer would write that. A dealer makes more money selling Morgan dollars than modern coins. It is about business, not about what the U.S. Mint is doing. It is also a very reasonable response if the dealer would own up to the fact that it is about the impact to their business. Blaming the U.S. Mint is like crashing into a wall and blaming the wall for being there!

But Sam must have had some bad experiences: “How about you come down from your pedestal, put your loudspeaker up your rectum and work in a shop for a few years where you can witness the devastation of families first hand for a few years.”

This is a strong statement, even if you discount the placement of inanimate objects into bodily orifices they do not belong. What has the U.S. Mint done to cause “devastation?” The U.S. Mint sells products to those who want to buy them. You are not forced to buy from the U.S. Mint.

Sam continues, “While your [sic] at it maybe you can take up your glorious cause of finding homes for the 50 billon [sic] sets the government produced and bulk sold over the years to the collectors who assumed that 5 sets would better than 1.”

By Sam’s logic, it is the U.S. Mint’s fault that someone speculated and the investment did not pan out? Whose fault is that? Who told someone that buying these sets would be a good investment? Not the U.S. Mint! Where does the U.S. Mint say in any of its publications or website that coins make a solid investment? How could these speculators have come to this conclusion?

2018 Fiji Coca-Cola Bottle Cap-shaped coin is not a U.S. Mint product. It contains 6 grams of silver (about $3.20) and costs $29.95. Is this good for the hobby? (Modern Coin Mart image)

The U.S. Mint does not even acknowledge historical and aftermarket pricing for the items they manufacture.

The U.S. Mint sells collectible coins. They do not sell investments.

Over the years, I have received more complaints about dealers than allegedly worthless State Quarters or the U.S. Mint’s annual sets. But why are coins allegedly worthless?

Did the U.S Mint make claims that these one-time-only coins are really special and that they would be the greatest thing since sliced bread?

This is not a U.S. Mint Product! (Danbury Mint image)

Did the U.S Mint create books, boards, folders, albums, maps, touting this as a once-in-a-lifetime way to collect?

All this came from the secondary market. Who runs the secondary market? DEALERS!

DEALERS set the values for the coins based on what they sell them for.

DEALERS take coins and entomb them in sonically sealed plastic holders saying that this is how you should be collecting. They tell you one encapsulating service is better than another and then make you pay different prices if you use a service they do not like even if the number assigned as a grade is the same on both pieces of plastic.

DEALERS have convinced an entire class of collectors that if they do not have a plastic holder with this new, whiz-bang label that their collection is not complete.

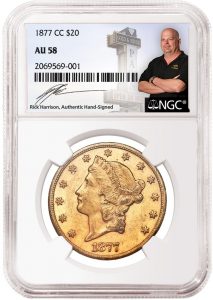

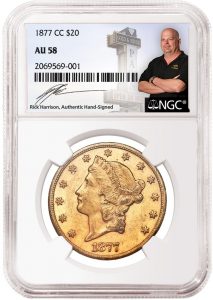

Tragedy grips the industry when a Pawn Star is featured on a plastic holder’s label! (NGC image)

DEALERS genuflect when someone puts a shiny green sticker on a plastic holder as if it was blessed by some deity. They prostrate themselves if the plastic holder is granted that divine gold sticker! After preaching this gospel to their flock, you are considered a heretic if you question the validity of the sticker and the motives of the sticker maker.

While the U.S. Mint is not perfect, the problems with the numismatic market have not been created by a tightly regulated government bureau. The problems come from the secondary market whether they are overstating the values of these items or demeaning collectibles that they cannot make a hefty profit on.

Maybe it is time for dealers to look in the mirror and ask whether the U.S. Mint is hurting the hobby or maybe they are refusing to recognize the problem is right in front of them.

→ Read more at

→ Read more at