Dec 16, 2018 | coins, commemorative, dollar, news, US Mint

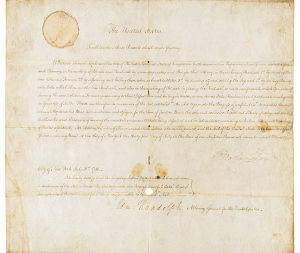

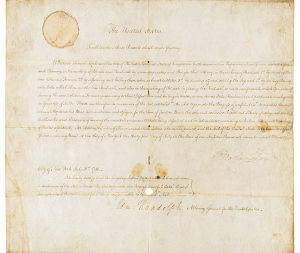

Patent X1 issued to Samuel Hopkins and signed by President George Washington on July 31, 1790 (USPTO Image)

On July 31, 1790, Samuel Hopkins was granted patent number X00001 for this method “in the making of Pot ash and Pearl ash by a new Apparatus and Process.” In June of this year, the U.S. Patent and Trademark Office (USPTO) issued Patent #10,000,000 based on the current numbering system that began in 1836. According to the USPTO, there were 9,433 patents issued from 1790 through 1835.

The other news from the U.S. Mint was the first strike ceremony for the Apollo 11 50th Anniversary Commemorative Coins at the Philadelphia Mint. Children of the three astronauts who flew on Apollo 11 represented their fathers at the ceremony: Mark Armstrong, Andrew Aldrin, and Ann (Collins) Starr.

Coins will be offered for sale to the public on January 24, 2019. The money raised from this commemorative coin program will benefit the Astronauts Memorial Foundation, the Astronaut Scholarship Foundation and the Smithsonian National Air and Space Museum’s “Destination Moon” gallery.

A pair of 5-ounce silver proof $1 coins struck during the First Strike Ceremony at the U.S. Mint (photo courtesy of collectSPACE.com)

And now the news…

December 10, 2018

Cash use has plummeted in Australia over the last few years but Eric Eigner isn't worried. "People will want to collect something that appears to be more scarce," he says. "I think it's a good thing to a certain extent."  → Read more at smh.com.au

→ Read more at smh.com.au

December 10, 2018

The patterns on Guangxi commemorative coins reveal special cultural elements and how the region has developed in the past 60 years.  → Read more at news.cgtn.com

→ Read more at news.cgtn.com

December 10, 2018

Museum intern Roo Weed ’18.5, a physics major, is using digital solutions to make the College’s rare coin collection more accessible to the public.  → Read more at middlebury.edu

→ Read more at middlebury.edu

December 11, 2018

"> <META PROPERTY=  → Read more at miningnewsnorth.com

→ Read more at miningnewsnorth.com

December 14, 2018

From Alexander the Great to the Byzantium and the Middle Ages until the modern era all periods are covered in an exhibition featuring a rare collection of gold coins. This collection contains coins that are considered to have paved the way for the use of coins in world history and is being staged by the …  → Read more at cyprus-mail.com

→ Read more at cyprus-mail.com

December 14, 2018

The United States Mint reveals a new coin collection to commemorate the 50th anniversary of the Apollo 11 moon landing. Item includes great video of striking coins in the mint  → Read more at myhighplains.com

→ Read more at myhighplains.com

December 15, 2018

The U.S. Mint has struck its initial coins commemorating the 50th anniversary of the first moon landing. You could say it was one small strike for the Mint, one not-so-giant press for Apollo history. The coins were stamped as part of a "first strike" ceremony.  → Read more at collectspace.com

→ Read more at collectspace.com

December 15, 2018

The finds are "of great benefit" in helping understand Wales' "unique history", National Museum Wales says.  → Read more at bbc.com

→ Read more at bbc.com

Dec 14, 2018 | coins, dollar, US Mint

Later today, the U.S. Mint will have a ceremony to begin the American Innovation $1 Coin Program. The ceremony is scheduled for 11:30 am at the U.S. Mint’s headquarters at 801 9th Street NW in Washington, D.C.

The American Innovation $1 Coin Program will issue four dollar coins a year in recognition of the significant innovation and pioneering efforts of individuals or groups from each of the 50 States, the District of Columbia, and the United States territories. Coins will be issued in the order that the states entered the union followed by the District of Columbia, Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands.

As allowed by law (Public Law 115-197), the U.S. Mint is producing an introductory coin for the program that will be presented as part of the launch.

The obverse of the coin, which will be featured throughout the series, is a view of the Statue of Liberty in profile. The view of the upper third of her body with the torch extended to the edge of the coin with a plain background gives the image a quiet elegance that is not usual for a U.S. Mint design. It was designed by Justin Kunz of the Artistic Infusion Program with credit to the Citizens Coinage Advisory Committee for pushing the U.S. Mint to come up with something different.

The reverse design of this introductory coin provides hope that the future of this program will not be mired in trite designs. It honors American Innovation by recognizing the first U.S. patent signed by President George Washington that was issued to Samuel Hopkins on July 31, 1790, for developing a process for making potash. The gears representing innovation appears next to Washington’s autograph.

The year, mint mark, and E PLURIBUS UNUM (Out of many, one) will appear on the edge of the coin as it does with all $1 coins since 2007.

Although it is a fantastic design worthy of a collection that includes the Native American Dollar designs, it will have the same impact as all dollar coins issued in the 21st century. It is a coin that will barely circulate and will not grab the attention of the U.S. public without its circulation.

Even though Congress creates these programs and has been told that this program will be a failure because the coins will not circulate alongside the paper dollar, they continue as if nothing is wrong. Even the Government Accounting Office, their own agency that helps with investigations and oversight of the federal government, has recommended eliminating the one-dollar note.

I will collect these coins as I have done for all of the special series introduced in the 21st century. But I will not be as enthusiastic about this series as I should be until something is done to make these coins circulate.

Nov 27, 2018 | cash, coins, Federal Reserve, markets, state quarters, US Mint

It never ceases to amaze me that even the most seasoned and esteemed numismatists do not understand how United States coinage goes from manufacturing to circulation.

It never ceases to amaze me that even the most seasoned and esteemed numismatists do not understand how United States coinage goes from manufacturing to circulation.

Recently, Harvey Stack wrote a column that appeared as a Viewpoint in Numismatic News (November 18, 2018). In the column, he blamed the U.S. Mint for problems with the distribution of the 50 State Quarters program. In the article Stack wrote that “the distribution of the new designs did not get full nationwide distribution. The Mint sent to most banks nationwide whatever they had available, with some districts getting large quantities of the new issue and other districts getting relatively few, if any.”

The U.S. Mint does not distribute circulating coins to any United States bank except the Federal Reserve. At the end of every production line is a two-ton bag made of ballistic materials that collect every coin produced on the line. When the bag is full it is sealed and later transported to a processing center designated by the Federal Reserve.

The U.S. Mint is a manufacturer. When they complete making the product, it is packaged in bulk and the customer, the Federal Reserve, picks up the product. Once the product is delivered to the client, that product’s distribution is no longer in the U.S. Mint’s control.

During the time of the 50 States Quarters program, the U.S. Mint had an agreement with the Federal Reserve to distribute the new coins first in order to get them into circulation. When the new coins were transferred to the various Federal Reserve cash rooms in the 12 districts, the Federal Reserve did circulate the new coins first.

What gets left out of the discussion is the logistics of transferring the coins from the cash rooms to the banks. The Federal Reserve does not deliver. Like many government agencies, the Federal Reserve relies on contractors to carry out that job. The Federal Reserve “sells” the coins to the logistics companies that bag and roll the coins and eventually deliver the coins to in armored vehicles to the banks.

In order to save money, these logistics companies keep their own supply of coins. This supply comes from the Federal Reserve cash room operations or excess they are given by the banks. Sine the logistics companies were not part of the deal that the U.S. Mint made with the Federal Reserve, a bank that asked for a delivery of quarters may have received quarters from the logistic company’s stock rather than new issues from the Federal Reserve.

Logistics is the coordination of complex operations and it is the job of these logistics companies to fulfill the inventory needs of the bank in the most efficient manner possible. It was more efficient to supply the banks in less densely populated areas with coins from current stock than transporting large amounts of coins from one of the Federal Reserve cash room operations that may be hundreds of miles away.

The U.S. Mint may do many things that collectors might take exception to, but the distribution of circulating coins is not their responsibility.

Coin image courtesy of the U.S. Mint.

Sep 21, 2018 | bullion, coins, Eagles, palladium, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is last article of a 4 part series:

The American Palladium Eagle coin is the newest addition to the American Eagle program. The bill to create the program was introduced by Rep. Denny Rehberg (R-MT), the representative-at-large from Montana. Montana is home of the Stillwater Mining Company, the only producer of palladium in the United States. Stillwater also owns platinum mines that supply the U.S. Mint with platinum for American Eagle Bullion coins.

In the world of metal investing, palladium is behind gold, silver, and platinum in demand. Palladium is not as popular in the United States as it is in other countries. Palladium sells better than silver in Canada and Europe. It is rarer than gold, but a little more abundant than platinum but has the silky look of platinum while being almost as ductile as silver. Artists in Europe and Asia are beginning to use palladium instead of platinum for their higher-end designs.

The American Eagle Palladium Bullion Coin Act (Public Law 111-303) originally requested that the secretary study the feasibility of striking palladium coins and mint them if the study shows a market demand. Although the study showed that there is a market, it was not overwhelming. Based on the wording of the law, the U.S. Mint opted not to strike palladium coins.

In December 2015, Rehberg added an amendment to the Fixing America’s Surface Transportation Act or the FAST Act (Public Law 114-94, 129 STAT. 1875, see Title LXXXIII, Sect. 73001) that took away the U.S. Mint’s option. The first American Palladium Eagle bullion coins were struck in 2017.

Source of Metals

The law requires that the U.S. Mint purchase palladium from United States sources at market values. It allows the U.S. Mint to purchase palladium from other sources to meet market demands.

A difference between the authorizing law for the American Palladium Eagle and other coins in the American Eagle program is that there is no requirement for the U.S. Mint to produce proof coins. It will be up to the U.S. Mint to determine whether there is a collector demand and strike proof coins accordingly. How this differs from the rest of the American Eagle program will be tested the next time metals experience high investor demand.

The American Palladium Eagle Design

By law, the obverse of the American Palladium Eagle coin features a high-relief likeness of the “Winged Liberty” design used on the obverse of Mercury Dime. It is an acclaimed classical design as created by Adolph A. Weinman.

The law requires that the reverse used to bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal. The AIA medal was also designed by Weinman. It is the first time that this design is featured on a legal tender coin.

-

-

Obverse features the Winged Liberty “Mercury” Dime design by Adolph A. Weinman

-

-

Reverse is the design used on the 1907 American Institute of Architects medal designed by Adolph A. Weinman

American Palladium Eagle coins are made from one troy ounce of .9995 palladium. The balance is copper. These coins are produced so that each coin states its weight and fineness and has a denomination of $25.

Bullion American Palladium Eagle Coins

The American Palladium Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but do not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Palladium Eagle bullion coins are subject to taxes when sold and may be held in Individual Retirement accounts. Please consult your financial advisor or tax professional for the tax implications for your situation.

Collector American Palladium Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Palladium Eagle coins are produced only as proof coins.

The U.S. Mint began selling American Palladium Eagle Proof coins in 2018 with a limited production of 15,000 coins. The coins sold by the U.S. Mint are stored in a specially made capsule and that capsule is placed in a package similar to that used for other coins in the American Eagle program.

Since this program is new, there have been no special issues or the discovery of errors. As time passes, that will likely change.

Sep 20, 2018 | bullion, coins, Eagles, platinum, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is third article of a 4 part series:

The Platinum American Eagle coins were an addition to the American Eagle bullion program to satisfy the needs of the domestic platinum mining industry. Work to create the program began in 1995 with Platinum Guild International Executive Director Jacques Luben working with Director of the United States Mint Philip N. Diehl and American Numismatic Association President David L. Ganz to pursue the appropriate legislation.

As with a lot of legislation, it was added to an omnibus appropriations bill (Public Law 104-208 in Title V) passed on September 30, 1996. Since the bill was necessary to keep the government functioning, it was signed by President Bill Clinton that same day.

The first platinum coins were issued in 1997.

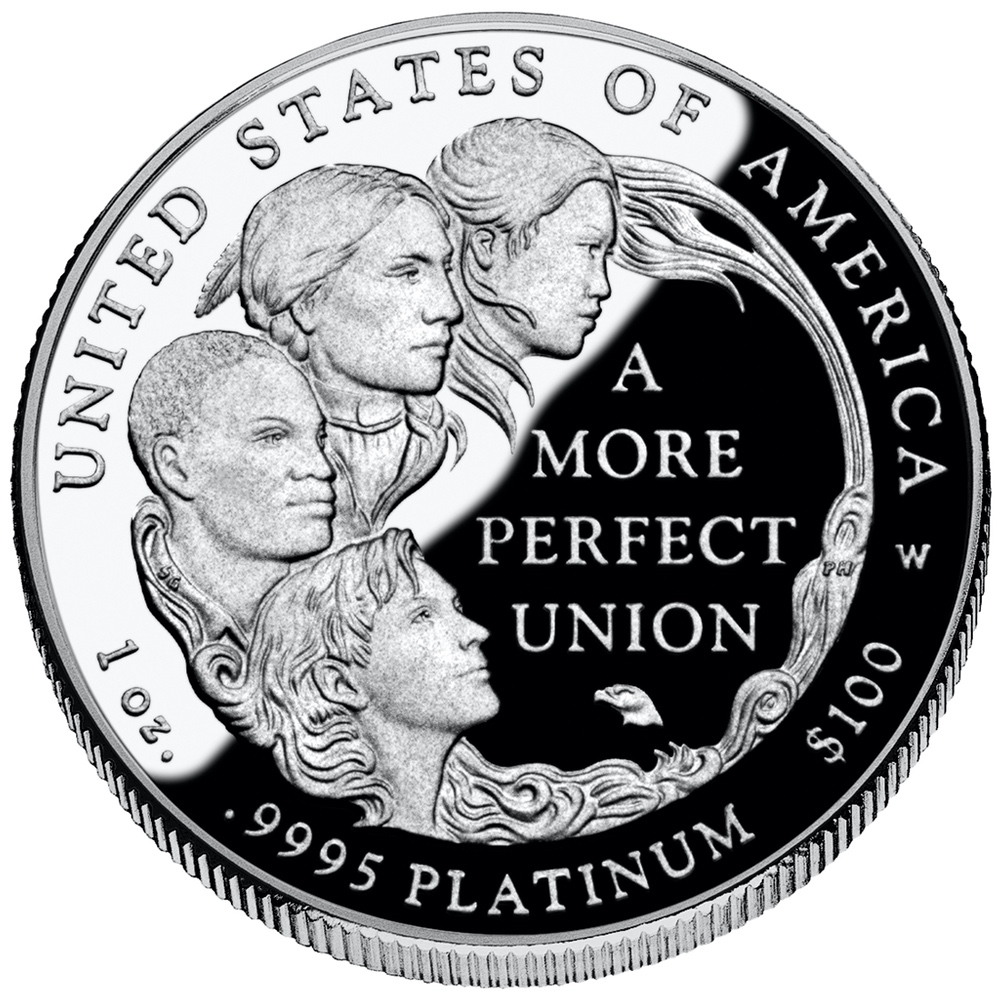

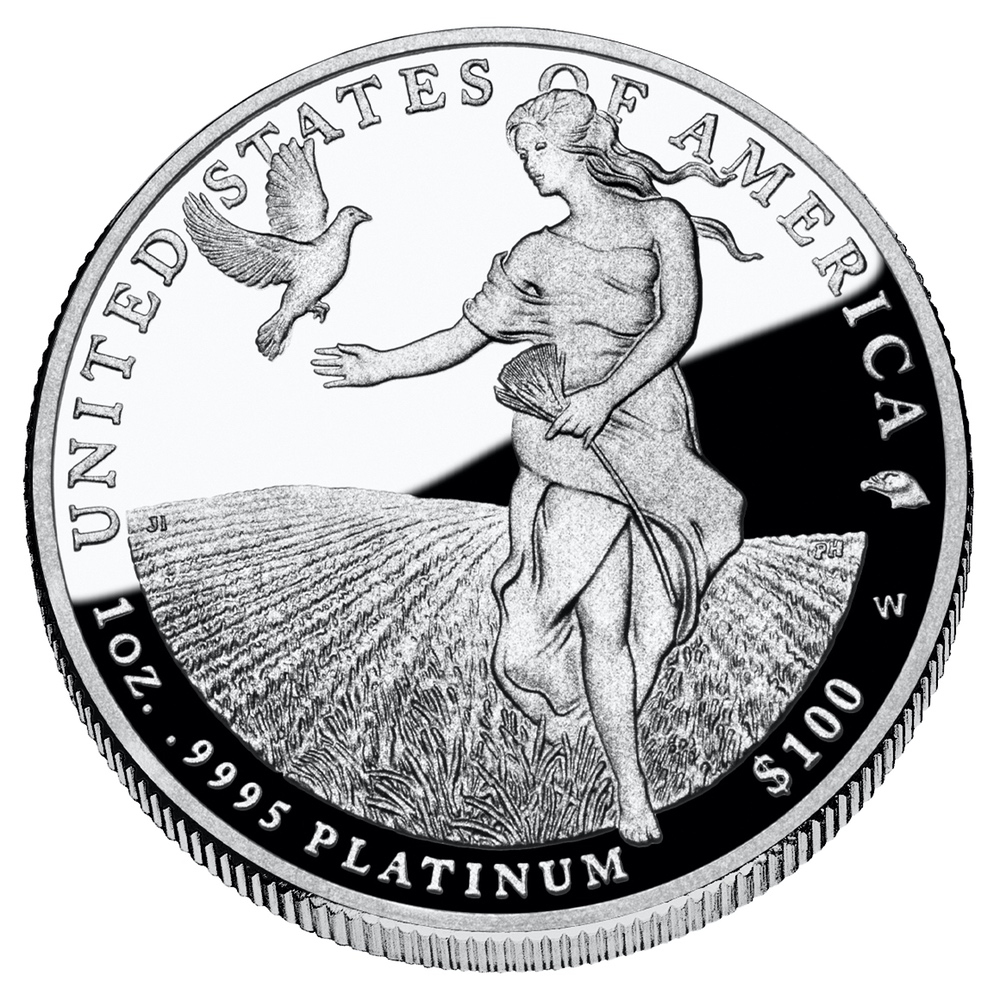

Platinum American Eagle coins are the only bullion coins struck by the U.S. Mint that use a different reverse design for the proof coins than the uncirculated bullion coins. The reverse of the proof coins featured different themes that have largely gone unnoticed by collectors. Beginning in 2018, the Preamble to the Declaration of Independence series will introduce all new designs for both the obverse and reverse of the proof coin.

American Platinum Eagle Design

The obverse design of the American Platinum Eagle features a front-facing view of the Statue of Liberty from the shoulders designed by John Mercanti. Mercanti also designed the obverse of the 1986 Statue of Liberty Commemorative Silver Dollar.

The reverse features a bald eagle soaring above the earth with a rising sun in the background. It was designed by Thomas D. Rodgers Sr. The reverse also includes the weight of the coin and its denomination.

-

-

Obverse of the American Platinum Eagle coin was designed by John Mercanti

-

-

Reverse of the original American Platinum Eagle and still used on the bullion coins was designed by Thomas D. Rodgers Sr.

The reverse designs of the proof coins were by different artists and discussed below.

American Platinum Eagle Coins are offered in four different sizes with each size being of different legal tender face value. The different coins are as follows:

- One-ounce American Platinum Eagle: $100 face value, is 32.7 mm in diameter, contains one troy ounce of platinum and weighs 1.0005 troy ounces,

- One-half ounce American Platinum Eagle: $50 face value, is 27 mm in diameter, contains 0.5000 troy ounce of platinum and weighs 0.5003 troy ounce,

- One-quarter ounce American Platinum Eagle: $25 face value, is 22 mm in diameter, contains 0.2500 troy ounce of platinum and weighs 0.2501 troy ounce,

- One-tenth ounce American Platinum Eagle: $10 face value, is 16.5 mm in diameter, contains 0.1000 troy ounce of platinum and weighs 0.1001 troy ounce.

All coins are struck with reeded edges.

Each coin is made from .9995 platinum. The composition is comprised of 99.95% platinum and 0.05% of an unspecified metal, likely copper. American Platinum Eagle coins are produced so that each size contains its stated weight in pure platinum. This means that the coins are heavier than their pure platinum weight to account for the other metals in the alloy.

Bullion American Platinum Eagle Coins

The American Platinum Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Platinum Eagle bullion coins are subject to taxes when sold and may be held in Individual Retirement accounts. Please consult your financial advisor or tax professional for the tax implications for your situation.

Bullion coins of all four weights were struck from 1997-2008. Beginning in 2014, the U.S. Mint has only struck the one-ounce $100 American Platinum Eagle for the bullion market.

Collector American Platinum Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Platinum Eagle are different from other coins in the American Eagle series in that every year they are produced the U.S. Mint struck them in different designs and are only available as proof strikes.

In addition to the changing designs, the U.S. Mint sold uncirculated coins with a burnished (satin) finish using the design of the business (bullion) coins were struck 2006-2008 at West Point in all four weights.

The collector American Platinum Eagle may be one of the most under-appreciated series of coins produced by the U.S. Mint. Since its introduction in 1997, the U.S. Mint has produced four series of proof coins with the reverse honoring different aspects of the nation with plans for two more beginning in 2018 and 2021.

What distinguishes these coins are the well-executed reverse designs that few get to see or pay attention. It may be difficult for the average collector to consider collecting these coins because of the price of platinum has been either on par or higher than the price of gold. Also, platinum is not as well regarded as gold or silver as a precious metal causing it to be overlooked.

Following the proof coins issued in 1997 with the design used on the bullion coin, the reverse design has featured the following themes:

- Vistas of Liberty Reverse Designs (1998-2003):

- 1998 Eagle Over New England

- 1999 Eagle Above Southeastern Wetlands

- 2000 Eagle Above America’s Heartland

- 2001 Eagle Above America’s Southwest

- 2002 Eagle Fishing in America’s Northwest

- 2003 Eagle Perched on Rocky Mountain Pine Branch

-

-

1998 Eagle Over New England

-

-

1999 Eagle Above Southeastern Wetlands

-

-

2000 Eagle Above America’s Heartland

-

-

2001 Eagle Above America’s Southwest

-

-

2002 Eagle Fishing in America’s Northwest

-

-

2003 Eagle Perched on Rocky Mountain Pine Branch

- 2004 Proof reverse design: Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City.

- 2005 Proof reverse Design: Heraldic Eagle

-

-

2004 Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City

-

-

2005 Heraldic Eagle

- Branches of Government Series:

- 2006 “Legislative Muse” representing Legislative Branch

- 2007 “American Bald Eagle” representing Executive Branch

- 2008 “Lady Justice” representing Judicial Branch

-

-

2006 “Legislative Muse” representing Legislative Branch

-

-

2007 “American Bald Eagle” representing Executive Branch

-

-

2008 “Lady Justice” representing Judicial Branch

- Preamble Series (2009–2014):

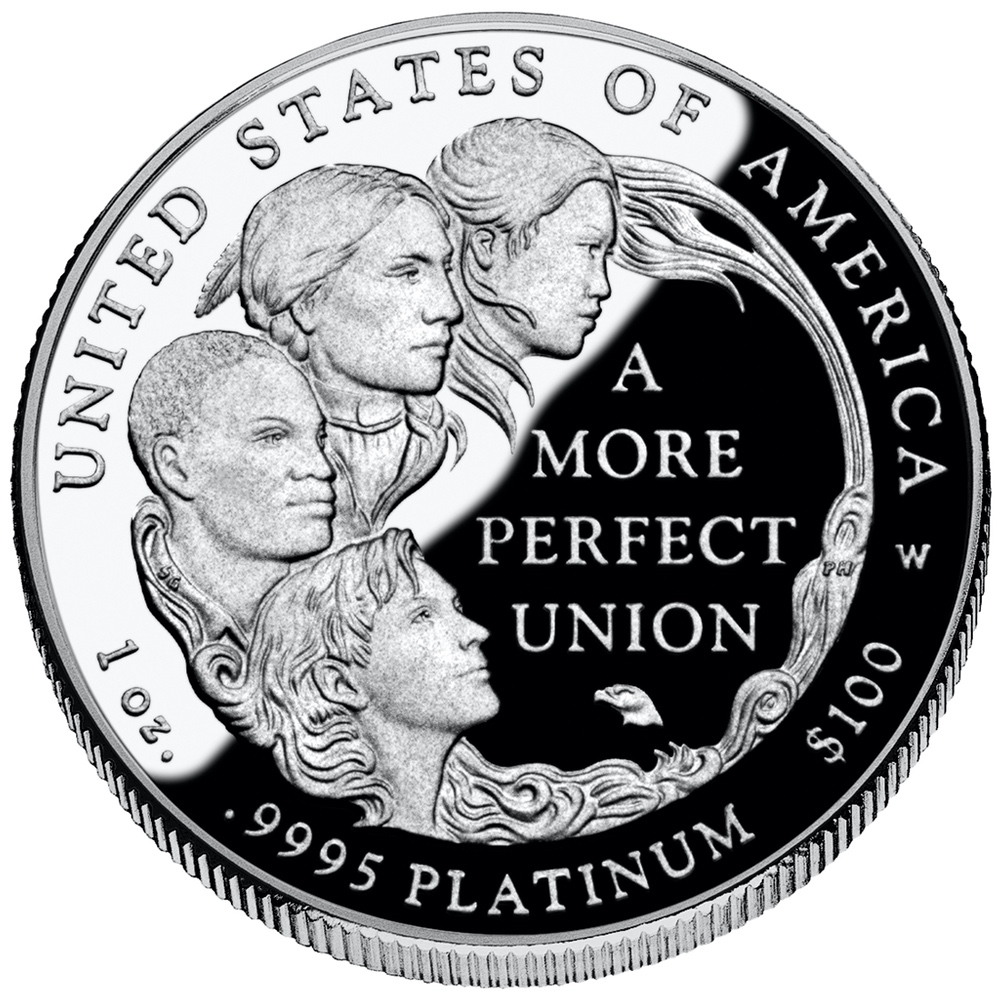

- 2009 “To Form a More Perfect Union”

- 2010 “To Establish Justice”

- 2011 “To Insure Domestic Tranquility”

- 2012 “To Provide for the Common Defence”

- 2013 “To Promote the General Welfare”

- 2014 “To Secure the Blessings of Liberty to Ourselves and our Posterity”

-

-

2009 “To Form a More Perfect Union”

-

-

2010 “To Establish Justice”

-

-

2011 “To Insure Domestic Tranquility”

-

-

2012 “To Provide for the Common Defence”

-

-

2013 “To Promote the General Welfare”

-

-

2014 “To Secure the Blessings of Liberty to Ourselves and our Posterity”

- Nations Core Values (2015-2016):

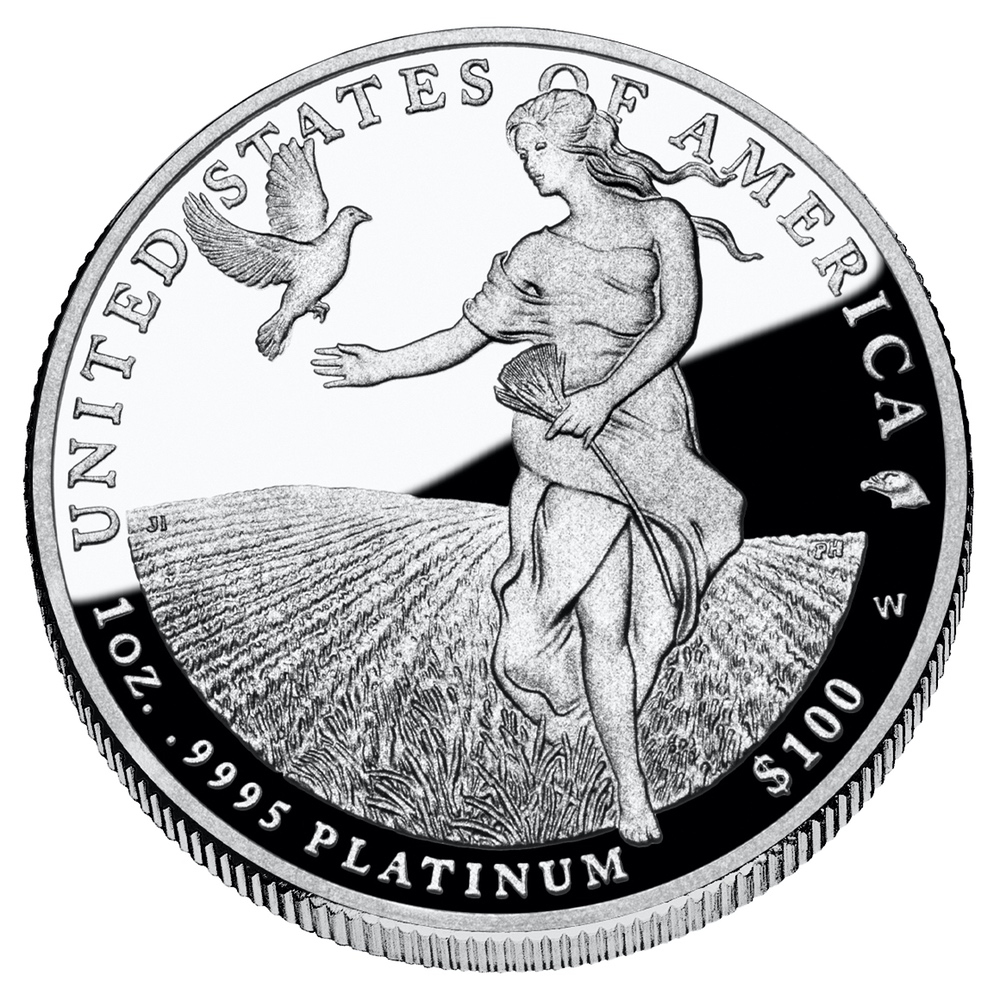

- 2015 “Liberty Nurtures Freedom”

- 2016 “Liberty and Freedom”

-

-

2015 “Liberty Nurtures Freedom”

-

-

2016 “Liberty and Freedom”

- 2017 depicted the original reverse designed by Thomas D. Rodgers Sr.

Beginning in 2018, the U.S. Mint will introduce two themes that will feature new obverse designs with a new common reverse with the following themes:

- 2018-2020 Preamble to the Declaration of Independence Series

- 2018 “Life”

- 2019 “Liberty”

- 2020 “Pursuit of Happiness”

-

-

Obverse of the 2018-W American Platinum Eagle Proof coin “Life.”

-

-

For the Declaration of Independence Series beginning in 2018, the common reverse designed by Patricia Lucas-Morris of the Artistic Infusion Program.

- 2021-2025 Five Freedoms Guaranteed Under the First Amendment Series

- 2021 “Freedom of Religion,”

- 2022 “Freedom of Speech,”

- 2023 “Freedom of the Press,”

- 2024 “Freedom to assemble peaceably,”

- 2025 “Freedom to Petition the Government for a Redress of Grievances.”

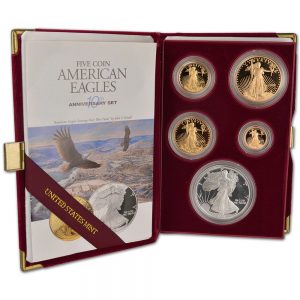

Tenth Anniversary American Platinum Eagle Set

As part of the Tenth Anniversary of the American Platinum Eagle, the U.S. Mint issued a special set to celebrate this milestone. The set featured two one-half ounce platinum proof coins using the American Bald Eagle design representing Executive Branch by Thomas Cleveland and was struck at the West Point Mint. One was struck as a standard proof with mirrored fields and frosted designs. The other was struck as a reverse proof with mirrored designs and frosted fields.

The set was announced November 2007 and scheduled to go on sale in mid-December. and remain on sale until December 31, 2008, with several interruptions.

During the sale, the price of platinum greatly fluctuated. At one point the price of platinum was greater than the price of the set. The U.S. Mint had suspended the sale of the coins in February 2008. They were priced higher when they were offered for sale again a month later. Sales were suspended again when the price of platinum fell dramatically. When the coins were brought back for sale, their final price was less than the set’s initial offer price.

Although the U.S. Mint set a maximum mintage of 30,000 sets, the final sales figure showed they sold 19,583 sets.

2007 “Frosted Freedom” Variety

For a very low production series that is handled differently than other coins, it is unusual for there to be a variety or error. In 2011, the Numismatic Guarantee Corporation announced that they certified a variety that was given the name “Frosted Freedom.”

On the proof strike of the 2007 American Platinum Eagle coin with the bald eagle design to celebrate the executive branch of the government, there is a shield in front of the eagle’s breast. Draped across the shield is a ribbon with the word “FREEDOM”. On the coins issued in 2007, the incuse word “FREEDOM” has the same mirrored finish as found on the coin’s fields. On the variety found by NGC, the word appears frosted with the same finish found on the coin’s raised devices.

In a statement by the U.S. Mint, these coins were pre-production strikes that had been inadvertently released into the production stream. They were struck to verify the look of the coin.

According to the U.S, Mint, the total number of “Frosted Freedom” coins potentially distributed to collectors includes 12 one-ounce coins, 21 half-ounce coins, and 21 quarter-ounce coins. As this is being written, only two one-ounce, one half-ounce, and one quarter-ounce coin have been certified by the major grading services.

In our next installment, we look at the American Palladium Eagles.

Sep 19, 2018 | bullion, coins, Eagles, gold, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is second article of a 4 part series:

During the debate of the law that created the American Silver Eagle program, the gold mining interests began to lobby congress to pass a bill to allow the U.S. Mint to mint bullion coins using gold mined in the United States. A few months later, congress passed the Gold Bullion Coin Act of 1985 that created the American Eagle Gold Bullion Program.

The key provisions of the Gold Bullion Coin Act are that the gold used in the coins be purchased from United States mining sources at prevailing market value and that the coins would be produced using 22-karat gold. It was decided to produce the using 22-karat gold to allow the U.S. Mint to compete with the Krugerrand, which was produced using 22-karat gold.

American Gold Eagle Design

The obverse of the coin used the design of the $20 Double Eagle coin designed by Augusts Saint-Gaudens. This design is considered by many the most beautiful of all coins produced by the U.S. Mint.

The reverse features a male bald eagle carrying an olive branch flying above a nest containing a female eagle and her hatchlings. It was designed by Miley Frances Busiek.

-

-

-

Reverse of the 2018 American Gold Eagle Proof coin feating the design my Miley Busieck

American Gold Eagle Coins are offered in four different sizes with each size being of different legal tender face value. The different coins are as follows:

- One ounce American Gold Eagle: $50 face value, is 1.287 inches (32 mm) in diameter, contains one troy ounce of gold and weighs 1.0909 troy ounces,

- One-half ounce American Gold Eagle: $25 face value, is 1.063 inches (27 mm) in diameter, contains 0.5000 troy ounce of gold and weighs 0.5455 troy ounce,

- One-quarter ounce American Gold Eagle: $10 face value, is 0.866 inch (22 mm) in diameter, contains 0.2500 troy ounce of gold and weighs 0.2727 troy ounce,

- One-tenth ounce American Gold Eagle: $5 face value, is 0.650 inch (16.5 mm) in diameter, contains 0.1000 troy ounce of gold and weighs 0.1091 troy ounce.

All coins are struck with reeded edges.

Each coin is made from 22-karat gold. The composition is comprised of 91.67% gold, 3% silver, and 5.33% copper. The coins are produced so that each size contains its stated weight in pure gold. This means that the coins are heavier than their pure gold weight to account for the silver and copper.

Bullion American Gold Eagle Coins

The American Gold Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins they are not produced or marketed for the collector market. As with other investments, American Gold Eagle bullion coins are subject to taxes when sold. Please consult your financial advisor or tax professional for the tax implications for your situation.

It is important to note that there have been attempts to determine where the bullion coins have been struck. Collectors have tried to use shipping records from the U.S. Mint, shipping labels, and other means to try to investigate the origin of the coins. Although some believe that these methods have identified some coins, the U.S. Mint has said that the shipping records that are being relied upon are not correct and do not reliably show the branch mint of origin.

Collector American Gold Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Gold Eagle coins are produced only as proof coins.

American Gold Eagle Poof coins are sold individually or in a four-coin set. The coins sold by the U.S. Mint are stored in a specially made capsule and that capsule is placed in a special folder-like packaging. The folders are distributed in a brown box with a Certificate of Authenticity.

OGP vs. GRADED

2018-W American Gold Eagle Proof in Original Government Package

Collector American Gold Eagle coins may have been removed from its original government package in order to be sent to a third-party grading service for grading. Most of the time, the original government package may have been discarded. Some dealers will sell the package without the coin for a few dollars, but for collectors of graded coins, this is not a priority.

1999-W Bullion Eagles Struck with Unfinished Proof Dies

In 1999, there was an incredible demand for gold bullion. In the rush to produce $5 one-tenth ounce and $10 one-quarter ounce bullion coins to satisfy market demand, the West Point Mint mistakenly struck coins using unfinished dies made that were supposed to be for proof coins.

These dies were considered unfinished because they did not receive their final finishing treatment that would be used for proof coins.

As a result, about 4,000-6,000 American Gold Eagle 1999 bullion coins were struck with the "W" mintmark and the higher relief of proof coins. Since most of these coins may be in bullion holdings, experts are not sure how rare these coins may be. However, few have been seen for sale on the secondary market.

SPECIAL SETS

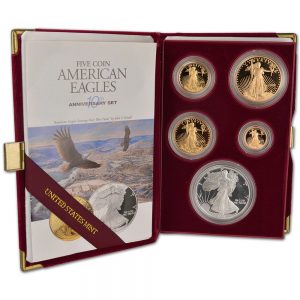

Tenth Anniversary American Eagle Set

As part of the celebration of the 10th anniversary of the American Eagle program, the U.S. Mint created the 10th Anniversary American Eagle set. The set contained a four 1995-W American Gold Eagle Proof coins (one-tenth, one-quarter, one-half, and one troy ounce coins) and a 1995-W American Silver Eagle proof coin. This set is significant for the 1995-W American Silver Eagle proof coin since it was not made available to collectors not buying the set.

Most of the sets have been split up to take advantage of the fluctuating metal prices and the rarity of the 1995-W American Silver Eagle. Finding the entire set with the American Gold Eagle coins and the American Silver Eagle Proof coin in the original government package can set you back $8,000 and higher.

Twentieth Anniversary American Eagle Set

To celebrate the 20th anniversary of the American Eagle bullion program, the U.S. Mint issued two different using gold coins in celebration.

The American Gold Eagle three-coin 20th Anniversary Set contained three coins: a 2006-W Proof Gold Eagle, a 2006-W Uncirculated Gold Eagle, and a 2006-W Reverse Proof Gold Eagle.

The 2006-W American Gold Eagle Reverse Proof was unique to the 20th Anniversary set. The raised design elements of the coin are mirrored and the background fields are frosted. This is the reverse of the typical cameo proof finish. Because of this, many of these sets were broken up and the coins encapsulated in third-party grading service holders.

A second 20th Anniversary Set included a one-ounce 2006-W American Gold Eagle Uncirculated coin and 2006-W American Silver Eagle Uncirculated coin. Both coins were treated giving them a burnished finish. Since both coins were available to be purchased individually with over 19,000 produced, it is easier to find a set in its original government packaging.

Annual Collector Coins and Sets

During the course of the American Gold Eagle Program, the U.S. Mint has offered proof coins for the collector they sold directly through their sales channels. Collectors could purchase each coin individually in a presentation case or all four coins as a set.

When searching for American Gold Eagle Proof coins on eBay, be careful not to buy a lot with just the original government package (OGP) and no coins. It is common for collectors to remove the coins from the OGP and send them to a third-party grading service for encapsulation. Collectors and dealers will try to sell the OGP without the coins for people who have the coins but not the package.

The OGP without the coins have no collector value.

Starting in 2006, the U.S. Mint has offered an uncirculated American Silver Eagle coins struck on specially burnished gold blanks. The burnishing gives the coin a satin finish that distinguishes this version from the bullion coin. These coins were offered from 2006-2008 and 2011 to present. Because of the increased demand for the gold bullion coins in 2009 and 2010, the U.S. Mint did not produce burnished collector coins so that the blanks can be used for fulfilling the bullion demand.

Similar to the proof collector coins, many of these coins were removed from their OGP and encapsulated by third-party grading services. The warning about sellers offering the OGP for sale without coins applies for the uncirculated burnished coins.

Rolls and the Monster Box

When the U.S. Mint sells bullion coins to their authorized resellers, the coins are packaged in 20-coin hard plastic rolls and 25 rolls are placed in a specially designed box that contains 500 troy ounces of silver. Rolls are topped with red caps and the boxes storing the rolls are red.

Although you may be able to find rolls and monster boxes of American Gold Eagle for sale, the price will be commensurate with the price of the coins. However, some dealers have tried to sell the boxes to anyone interested.

In our next installment, we look at the American Platinum Eagles.

Sep 18, 2018 | bullion, coins, Eagles, silver, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is first article of a 4 part series:

EDITOR’S NOTE: This post was updated on May 11, 2020. Please read the new version → here.

The American Silver Eagle program was created to provide a way for the United States government to sell off silver that was saved in the Defense National Stockpile. Following the Coinage Act of 1965 that removed silver United States coinage the amount of silver being used was building up a supply that far exceeded the needs for the national stockpile.

Following several years of discussion that almost led to the bulk auction and sale of the silver, it was decided to use the silver to create a silver investment coin. The program was so successful that when the Defense National Stockpile was depleted in 2002, the original law was changed to continue the program by purchasing silver from U.S.-based mines at market prices to be used for future production.

American Silver Eagle Design

The obverse of the coin is the much-beloved design of that was used on the Walking Liberty Half-Dollar coin from 1916 to 1947. It was designed by Adolph A. Weinman, a former student of Augustus Saint-Gaudens.

The reverse features a heraldic eagle using a design by John Mercanti who would become the 12th Chief Engraver of the U.S. Mint. Mercanti engraved both sides of the coin that including copying Weinman’s original design.

Each coin contains one troy ounce (31.103 grams) of .999 fine silver with the balance of copper. American Silver Eagle coins are 40.6 mm (1.598 inches) in diameter and 2.98 mm (0.1173 inches) thick with reeded edges. The coins are assigned a face value of $1.00 to give them legal tender status.

-

-

-

2018-W American Silver Eagle Proof reverse

Bullion American Silver Eagle Coins

The American Silver Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Silver Eagle bullion coins are subject to taxes when sold. Please consult your financial advisor or tax professional for the tax implications for your situation.

It is important to note that there have been attempts to determine where the bullion coins have been struck. Collectors have tried to use shipping records from the U.S. Mint, shipping labels, and other means to try to investigate the origin of the coins. Although some believe that these methods have identified some coins, the U.S. Mint has said that the shipping records that are being relied upon are not correct and do not reliably show the branch mint of origin.

Collector American Silver Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Silver Eagle coins are produced as proof and uncirculated coins.

The U.S. Mint sells American Silver Eagle proof coins in a specially made capsule and that capsule is placed in a blue velvet-covered case. The case was distributed in a blue box with a Certificate of Authenticity.

Beginning in 2006, the U.S. Mint has produced an uncirculated, business strike coin for the collector market. Most uncirculated American Silver Eagle collector coins are struck in West Point and bear the “W” mintmark. Following striking, the coins are then burnished, a process by treating the surface with fine particles to give the surface a smooth, satin finish. Collector versions of the American Silver Eagle are also placed in a capsule for sale to the public. Packaging has varied from year to year including special collectibles.

When looking for collector American Silver Eagle coins, note that the American Silver Eagle proof coin was not struck in 2009 and the uncirculated burnished coins were not struck in 2009-2010. These years were skipped because the demand for bullion American Silver Eagle coins became higher than the available supply of silver planchets. To satisfy the demand, the U.S. Mint decided not to produce these collector coins.

OGP vs. GRADED

2018-W American Silver Eagle Proof in Original Government Package

Collector American Silver Eagle coins may have been removed from its original government package in order to be sent to a third-party grading service for grading. Most of the time, the original government package may have been discarded. Some dealers will sell the package without the coin for a few dollars, but for collectors of graded coins, this is not a priority.

2007 Reverse Variety

In 2008, the U.S. Mint updated the reverse dies of the American Silver Eagle giving it a slightly different appearance. The reverse die was only supposed to be used on collector American Silver Eagle coins in 2008 before being used for bullion coins in 2009.

However, as a result of the human factor required with operating the minting equipment at the West Point Mint, the reverse dies that were used for the 2007 American Silver Eagle coins were mated with 2008 collector coins creating a new variety for collectors. This is known as a 2008-W Silver Eagle Reverse of 2007 Variety.

The 1995-W

Tenth Anniversary American Eagle Set

Most of the sets have been split up to take advantage of the fluctuating metal prices. The gold coins have been sold while the gold prices rose since 1995, but the limited availability has caused the 1995-W American Silver Eagle to rise significantly on the secondary market. Cost to purchase this coin averages about $5,000, depending on the grade. Finding the entire set with the American Gold Eagle coins in their original government package can set you back $8,000 and higher.

Special Sets

In 1993, the U.S. Mint offered The Philadelphia Set, which was issued to commemorate the 200th anniversary of the striking of the first official U.S. coins at the Philadelphia Mint. This special set included each of the Proof American Gold and Silver Eagles struck at the Philadelphia Mint and containing the “P” mint mark. The 1993-P Proof Silver Eagle was included in the set along with the one-half ounce, one-quarter ounce, and one-tenth ounce 1993-P Proof Gold Eagles. Also included was a silver Philadelphia Bicentennial Medal, which specially produced for this numismatic product.

To mark the launch of the new American Platinum Eagle bullion and collector coin series, the US Mint offered the 1997 Impressions of Liberty Set. This set contained the one ounce 1997-W Proof Platinum Eagle, one ounce 1997-W Proof Gold Eagle, and one ounce 1997-P Proof Silver Eagle. Adding some special allure to the set, production was limited to just 5,000 units, which were individually numbered. The serial number for each set was engraved on a brass plate affixed to the wooden display case.

In 2004, the U.S. Mint worked with the United Kingdom’s Royal Mint to create a numismatic product containing the silver bullion coins from each country. The Legacies of Freedom Set contained one 2003 American Silver Eagle bullion coin and one 2002 British Silver Britannia bullion coin. The two coins were placed in special packaging which highlighted the importance of the two national icons.

To celebrate the 150th anniversary of the founding of the Bureau of Engraving and Printing and the 220th anniversary of the United States Mint the two bureaus joined together to release the 2012 Making American History Coin and Currency Set. The set contained a 2012-S American Silver Eagle Proof coin and a $5 note with a serial number beginning in “150”.

As part of the 2016 Ronald Reagan Coin and Chronicles Set the U.S. Mint included a 2016 Proof American Silver Eagle along with a 2016 Ronald Reagan Presidential reverse proof dollar, and a Nancy Reagan Bronze Medal. To complete the set, it included a presidential portrait produced by the Bureau of Engraving and Printing and an informational booklet.

Annual Sets

To extend the product line, the U.S. Mint began to create special annual issue sets to entice people to collect U.S. Mint products. The first annual set containing an American Silver Eagle coin was the Annual Uncirculated Dollar Coin Set. First offered in 2007, the set includes the issued uncirculated Presidential dollar coins, an uncirculated Native American dollar coin, and an uncirculated American Silver Eagle. Since the Presidential Dollar Program ended in 2016, it is unclear whether the U.S. Mint will issue the set in 2017.

Since 2012, the U.S. Mint has been producing the Limited Edition Silver Proof Set that contains 90% silver versions of the year’s five America the Beautiful Quarters, Kennedy Half Dollar, and Roosevelt Dime, along with the standard annual Proof American Silver Eagle. Sets are limited to 50,000 units annually.

Starting in 2013, the U.S. Mint has been producing the Congratulations Set as part of a new line of products targeted towards gift giving occasions. The This set included the standard annual Proof Silver Eagle within specially designed packaging which allowed a personalized message to be written the recipient.

Anniversary Sets

2011 American Silver Eagle 25th Anniversary Set

The Anniversary sets issued are as follows:

- 1995 American Eagle 10th Anniversary Set included a 1995-W American Silver Eagle Proof coin and four American Gold Eagle coins.

- 2006 20th Anniversary American Silver Eagle Set was a special three-coin box set included a 2006-W American Silver Eagle with a burnished (satin) finish, a 2006-W American Silver Eagle Proof coin, and a 2006-P American Silver Eagle Reverse Proof coin.

- 2011 25th Anniversary American Silver Eagle Set was a five-coin box set that contained five different coins. The U.S. Mint produced only 100,000 sets that sold out within the first 10 minutes they were offered online. This extremely popular set is averaging $800 on the secondary market in the original government package. The set includes the following coins:

- 2011-W (West Point) American Silver Eagle Uncirculated coin

- 2011-S (San Francisco) American Silver Eagle Uncirculated coin

- 2011-W (West Point) American Silver Eagle Proof coin

- 2011-P (Philadelphia) American Silver Eagle Reverse Proof coin

- 2011 (no mintmark) American Silver Eagle Bullion coin

- 2012 American Eagle San Francisco Two Coin Silver Proof Set was issued to celebrate the 75th anniversary of the current San Francisco Mint. The set included a 2012-S American Silver Eagle Proof coin and a 2012-S American Silver Eagle Reverse Proof Coin.

- 2013 West Point American Silver Eagle Set was issued to celebrate the 75th anniversary of the facility in West Point, New York. The set included a 2013-W American Silver Eagle Reverse Proof coin and a 2013-W American Silver Eagle Enhanced Uncirculated coin. This was a popular set since it was the first appearance of the Enhanced Uncirculated finishing process.

Although the U.S. Mint did not issue a set to celebrate the 30th Anniversary of the American Silver Eagle in 2016, the collector issues of the coins were issued with special edge lettering. Rather than the edge being reeded it was smooth with “30TH ANNIVERSARY” struck into the edge. Both the proof and burnished uncirculated coins were produced at West Point include the “W” mintmark and the edge lettering.

Rolls and the Green Monster Box

When the U.S. Mint sells bullion coins to their authorized resellers, the coins are packaged in 20-coin hard plastic rolls and 25 rolls are placed in a specially designed box that contains 500 troy ounces of silver. Because the box is green in color and sealed by the U.S. Mint, the package is nicknamed the Green Monster Box.

Resellers sell Green Monster Boxes with the intent of selling to investors. They also sell complete rolls from the Monster Box.

Sealed Green Monster Boxes have the benefit of being unsearched and unhandled since leaving the U.S. Mint. Additionally, the cost per coin is usually the lowest available since the coins are being purchased in bulk. These boxes are usually offered for sale by bullion dealers at a small premium over the current market (spot) price of silver.

In the next installment, we look at the American Gold Eagle coins.

All images courtesy of the U.S. Mint unless otherwise noted.

Sep 13, 2018 | Baltimore, celebration, coins, commemorative, US Mint

On this day 204 years ago, Francis Scott Key was awakened aboard the HMS Tonnant in Baltimore Harbor to see the tattered, but still present flag flying over Fort McHenry. Today’s LOOK BACK talks about the history of that day and, rather than talking about the legislation, add a little information about the Star Spangled Banner commemorative coin.

Fort McHenry (via Wikipedia)

On Skinner’s way to meet Vice Admiral Alexander Cochrane, Rear Admiral Sir George Cockburn, and Major General Robert Ross on the HMS Tonnant, he stopped at the home of noted lawyer Francis Scott Key and asked for his assistance.

Col. Skinner and Key were welcomed by the British command on September 13, 1814 and was invited to stay for dinner. After secure the release of Dr. Beanes but were not allowed to return to Baltimore. The British felt that Col. Skinner and Key had learned too much about the British forces. Col. Skinner, Key, and Dr. Beanes were provided guest accommodations on the HMS Tonnant.

The Battle of Baltimore began after dinner and raged overnight through the next morning. On September 14, 1814, when the smoke cleared, Key saw the Stars and Stripes still flying over Fort McHenry. Following the battle. Col. Skinner, Key, and Dr. Beanes were allowed to return to Baltimore on their own boat. During the trip, Key wrote a poem entitled “The Defence of Fort McHenry”

On September 20, 1814, Key had the poem published in the newspaper Patriot. After publication, Key set the poem to the tune of John Stafford Smith’s “The Anacreontic Song,” a popular drinking song written for London’s Anacreontic Society. The combination was renamed “The Star Spangled Banner.”

“The Star Spangled Banner” was first recognized by the Navy in 1889. In 1916, President Woodrow Wilson signed an executive order to recognize “The Star-Spangled Banner” as the national anthem. Finally, President Herbert Hoover singed a congressional bill officially making the song the United State’s National Anthem (36 U.S.C. §301).

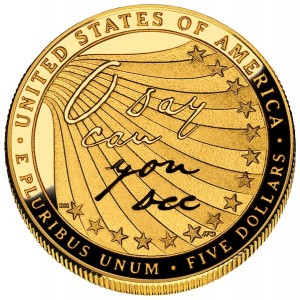

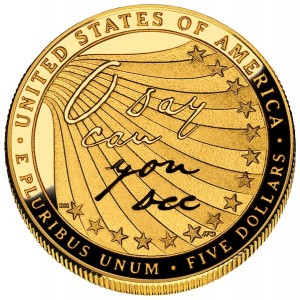

In 2012, the U.S. Mint issued two coins as part of the Star-Spangled Banner Commemorative Coin Program (authorized by Public Law 111-232). The $5 gold coin “depicts a naval battle scene from the War of 1812, with an American sailing ship in the foreground and a damaged and fleeing British ship in the background” on the obverse and “the first words of the Star-Spangled Banner anthem, O say can you see, in Francis Scott Key’s handwriting against a backdrop of 15 stars and 15 stripes, representing the Star-Spangled Banner flag.”

-

-

2012 Star-Spangled Banner Gold Commemorative Obverse depicts a naval battle scene from the War of 1812, with an American sailing ship in the foreground and a damaged and fleeing British ship in the background. Designed by Donna Weaver and engraved by Joseph Menna.

-

-

2012 Star-Spangled Banner Gold Commemorative Reverse Depicts the first words of the Star-Spangled Banner anthem, O say can you see, in Francis Scott Key’s handwriting against a backdrop of 15 stars and 15 stripes, representing the Star-Spangled Banner flag. Designed by Richard Masters and engraved by Joseph Menna.

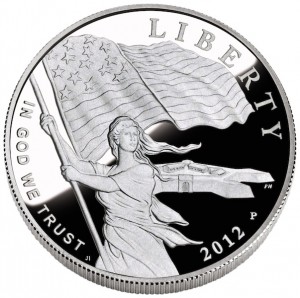

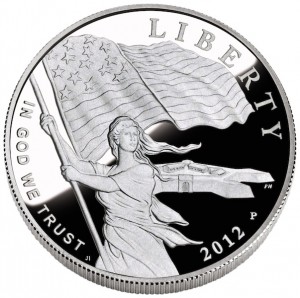

The obverse of the silver $1 coin “depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background.” The reverse shows the waving of a modern American Flag.

-

-

2012 Star-Spangled Banner Silver Commemorative Obverse depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background. Designed by Joel Iskowitz and engraved by Phebe Hemphill.

-

-

2012 Star-Spangled Banner Silver Commemorative Reverse depicts a waving modern American flag. Designed by William C. Burgard III and engraved by Don Everhart.

The official launch of the 2012 Star-Spangled Banner Commemorative Coin Program was launched at Fort McHenry in Baltimore. You can read about that launch here.

You can read the original article

here.

All coin images are courtesy of the U.S. Mint.

Aug 28, 2018 | coin design, commentary, US Mint

On Monday, the U.S. Mint announced that on September 3, they will begin accepting applications for the Artistic Infusion Program. Judging by the last round of artwork submitted to the Citizens Coinage Advisory Committee to review for the new American Innovation $1 Coin, they need the help.

For those who did not read the stories, the U.S. Mint submitted a design for the obverse that is supposed to be “a likeness of the Statue of Liberty extending to the rim of the coin and large enough to provide a dramatic representation of Liberty,” similar to the reverse of the Presidential $1 coins. According to reports, the U.S. Mint claimed that they could not work on a better design because of time constraints.

Time constraints are a legitimate issue. The bill was signed into law on July 20, 2018, leaving the U.S. Mint less than six months until the program begins in 2019. However, that does not mean that the program has to begin on January 2. In fact, the law does not specify at what point during the year that the coins are to be produced.

They also could have anticipated their responsibility. Once the bill was passed by the Senate on June 20, it was only a matter of time that the difference between the House and Senate versions were resolved before being signed by the president. It was not a surprise. They had two months to come up with something prior to the CCAC meeting.

Although U.S. Mint Director David Ryder has not been on the job long, he has to take responsibility for not providing the leadership necessary to impress on the artists and whoever directed them not to try to take the easy way out. If they have not learned by now, most of the CCAC members take their jobs much more seriously than previous committees (this is a good thing) and are very outspoken in a very constructive manner.

One person that should respond to this call for artists is current CCAC member Heidi Wastweet. An accomplished medalist and sculptor, her term with the CCAC is about to expire. She is well qualified since her work is phenomenal! You can see for yourself on her website. Imagine what an artist with her talent and knowing what the CCAC is looking for can add to the U.S. Mint.

Having never met Ms. Wastweet, I am not in a position to try to talk her into applying. However, if you are acquainted with her, please let her know that not only would it be of great service to the U.S. Mint but that she has at least one endorsement—for whatever that is worth!

There are so many great medals on Heidi Wastweet’s site it is difficult to select one to highlight. But I always seem to focus on this one called a Zombuck.

Aug 8, 2018 | BEP, coins, commentary, currency, Federal Reserve, US Mint

Following the introduction of the Presidential $1 Coin program and the discussion about replacing the Federal Reserve Note with a coin,

I wrote an article explaining how the situation will not change. Not much has changed in 10 years!

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Regardless of the questions asked, the only way to increase the circulation of the dollar coin is to stop printing the one-dollar Federal Reserve Note and begin to withhold it from circulation. It is a move that will force the people to use the coin as the population of the paper currency is reduced.

There are many emotional arguments on both sides of the issue. Whether one is for or against the printing of the one-dollar note, the US is one of the extreme few first-world countries issue its unit currency on paper. Looking beyond the emotional arguments, each side has dominant arguments to support their positions.

Those who want to eliminate the one-dollar note use at the cost of is production and the savings to the government as the dominant reasons. According to the Bureau of Engraving and Printing, 95-percent of all Federal Reserve Note printed for circulation are used to replace damaged and worn notes that are being taken out of circulation. Using BEP’s 2017 production report, 2,425,600,000 one-dollar notes were printed. With 95-percent being replacement notes, 2,304,320,000 notes were printed just to maintain circulation levels. With it costing 4.385-cents to produce one note of any denomination, the cost to just replace notes removed from circulation was $100,422,265.60 in 2017.

Rather than printing paper dollars, if the US Mint strikes coins the cost to replace those 2.4 billion notes would cost 21-cents per coin (according to the U.S. Mint’s 2014 Annual Report, the last documenting seigniorage for the dollar coin). The total production cost would be $483,907,200.

But do not let the 381-percent increase in cost fool you. For the real picture, the costs have to be predicted over time. According to the BEP and the Federal Reserve, the lifespan of a one-dollar Federal Reserve Note is 5.8 years. When the U.S. Mint makes plans for circulating coinage, they accept that the lifespan of a coin is 30-years. To help with the calculation, it will be assumed that the price of manufacturing coins and currency s will stay constant. In order to keep the $2.4 billion of one dollar notes in circulation for 30 years, it will cost the BEP $522.6 million dollars.

By comparison, since the U.S. Mint will be striking new coins for circulation and (theoretically) not replacement coins (not including the coins already in storage), the U.S. government would save about $117 million over 30 years. The following table illustrates these costs:

| Denomination |

Production Total |

Number of Replacement Notes |

Cost of Production for Replacements |

Cost of Replacements over 30 years |

| Paper Dollar (2008) |

4,147,200,000 |

3,939,840,000 |

$177,292,800 |

$1,772,928,000 |

| Paper Dollar (2018) |

2,425,600,000 |

2,304,320,000 |

$101,044,432 |

$522,643,614 |

| Coin Dollar (2008) |

N/A |

3,939,840,000 |

$626,434,560 |

$626,434,560 |

| Coin Dollar (2018) |

N/A |

2,425,600,000 |

$509,376,000 |

$509,376,000 |

While this might be a compelling argument to stop printing one dollar notes, such a move has political ramifications for some powerful members of Congress. With over 1500 people working in the Eastern Currency Facility in downtown Washington, DC, they are represented by several leaders of both parties. When it comes to jobs in their districts, members of Congress will not allow anything that will reduce the production capacity of the Bureau of Engraving and Printing and where constituents could lose jobs.

Before Congress changes the law to stop the printing of the one-dollar note (31 U.S.C. §5115(a)(2)), the BEP will have to supplement production in order to protect jobs. The way this could be done would be to print foreign currency. However, it seems that the BEP is having problems selling their services to foreign governments.

Although the Bureau of Engraving and Printing has experimented with polymer notes and other printing substrates, the Federal Reserve has said that it does not consider these alternatives viable for United States currency. However, the Federal Reserve and Bureau of Engraving and Printing has been testing rag-based paper from companies that can produce new anti-counterfeiting features.

If there was a change to the supplier of currency paper, that would raise concern by the Massachusetts congressional delegation whose constituents include Crane Currency, the subsidiary of Crane & Company. Crane has been the exclusive supplier of currency paper to BEP since 1879. Although BEP has tried to open the competition for purchasing currency paper (see GAO Report GAO-05-368 [PDF]), the cost of entry into the market has prevented other manufacturers from competing for the business. If BEP would stop printing over 2 million one dollar notes without replacing it with similar paper production, the Massachusetts-based company could lose significant business.

Regardless of the measures taken by the US Mint to increase the circulation of the one-dollar coin, public perception is that the one-dollar paper note is easier to use than the coin. Unless key congressional leaders agree that ending the printing of the one-dollar note is in the best interests of everyone, including their political careers, the political reality is that printing of the one-dollar note is here to stay until a significant event causes a change in policy.

The original post can be read

here.

→ Read more at smh.com.au

→ Read more at smh.com.au → Read more at news.cgtn.com

→ Read more at news.cgtn.com → Read more at middlebury.edu

→ Read more at middlebury.edu → Read more at miningnewsnorth.com

→ Read more at miningnewsnorth.com → Read more at cyprus-mail.com

→ Read more at cyprus-mail.com → Read more at myhighplains.com

→ Read more at myhighplains.com → Read more at collectspace.com

→ Read more at collectspace.com → Read more at bbc.com

→ Read more at bbc.com

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.