Mar 22, 2018 | legislative, news, US Mint

David J. Ryder, 39th Director of the U.S. Mint

As the Senate was processing the nominations on the Senate Executive Calendar, Ryder’s name rose to the top of the list. When the clerk read the nomination and asked for commentary from the floor, the only statement was from Cory Booker (D-NJ). It is customary that a senator from the nominee’s home state to say something in support the nominee. Since there was no objection from the floor, the Senate moved to suspend the rules and pass the nomination by voice vote.

Previously, Sen. Chuck Grassley (R-IA) threatened to block the nomination because he felt that the Department of the Treasury did not respond to inquiries to his satisfaction. When it came time to follow through with the threat, Grassley was not even in the Senate chamber during the vote.

There was no comment offered by Grassley’s office.

After 2,629 days or 7 years, 2 months, and 13 days, our long nightmare is over. The U.S. Mint now has a permanent director!

Good luck Director Ryder.

PN1355: David J. Ryder — Department of the Treasury

Date Received from President: January 8, 2018

Summary: David J. Ryder, of New Jersey, to be Director of the Mint for a term of five years, vice Edmund C. Moy, resigned.

Received in the Senate and referred to the Committee on Banking, Housing, and Urban Affairs. — Jan 8, 2018

Committee on Banking, Housing, and Urban Affairs. Ordered to be reported favorably. — Jan 17, 2018

Reported by Senator Crapo, Committee on Banking, Housing, and Urban Affairs, without printed report. — Jan 17, 2018

Placed on Senate Executive Calendar. Calendar No. 596. Subject to nominee’s commitment to respond to requests to appear and testify before any duly constituted committee of the Senate. — Jan 17, 2018

Considered by Senate. — Mar 21, 2018

Confirmed by the Senate by Voice Vote. — Mar 21, 2018

Mar 22, 2018 | commentary, legislative, US Mint

NOTE: This was written and queued for posting prior to the confirmation of David Ryder to become the 39th Director of the U.S. Mint.

Today’s “Dummy of the Day Award” goes to Rep. Alex Mooney (R-WV) (Official House of Representatives Photo)

In October, Mooney and Rep. Frank Lucas (R-OK) sent a letter to the U.S. Mint asking about what is being done to protect the integrity of U.S. coinage from counterfeiting. The letter contained a gold-plated tungsten American Gold Eagle coin. It was sent after the testimony of David Ryder during his confirmation hearing.

The letter was addressed to Acting Deputy Director David Moti (sic) and Randolph D. Alles, Director of the U.S. Secret Service.

The letter sent by Mooney and Lucas was sent to the U.S. Mint that was run by its fourth non-appointed, interim director since the resignation of Edmund Moy in January 2011. While the interim directors have the same power as political appointees, it is customary that the interim directors maintain the status quo until the Senate approves the president’s nomination.

The U.S. Mint’s response was written under the signatory of Acting Deputy Director David Motl. Motl, Motl’s response to the representative’s inquiry read exactly what can be expected from an interim appointee warming the seat. Basically, the letter said that the U.S. Mint is doing its job as defined by the law and the Acting Deputy Director is working to keep the agency going until a regular director can be approved.

Of course, these representatives did not like this response. They want the U.S. Mint to do something and even gave suggestions. There are two problems with the response that reads like an advertisement for a commercial service. First, if these representatives understood the division of responsibilities, the agency responsible for protecting the integrity of the money supply is the United State Secret Service. The U.S. Mint is the manufacturer of the money, the U.S. Secret Service is the police force that is responsible for protecting the money. One would think that members of Congress who have access to staff and a full-time research department would understand the roles of the various agencies.

Secondly, what would they want an acting director to do? If the acting director is there to make sure the bureau functions until a new director is appointed, then figure out why the U.S. Mint does not have a permanent director? If Mooney does not like the answer then why not take a walk to the other side of the capital and ask Sen. Chuck Grassley (R-IA) why he is throwing a hissy fit and holding up the nomination of a qualified candidate that could legally answer the questions.

David Croft, Acting Deputy Director of the U.S. Mint since 1-Feb-18 (U.S. Mint Photo)

To add to the fun, the U.S. Mint has a new Acting Deputy Director. Because there is a limited amount of time that a government employee can serve in an “acting” role for an appointed position, David M. Croft has been appointed to the posting as of February 1, 2018. Prior to his appointment as Acting Deputy Director, Croft was the Mint’s Associate Director of Manufacturing. Croft becomes the fifth non-appointed “acting” director since Moy’s resignation.

If there are members of Congress that are not happy with the way the U.S. Mint is being run, they need to work out the problems which they are responsible. Mooney and Lucas should take the U.S. Mint leadership issue up with Grassley. Otherwise, they are doing nothing more than spitting into the wind.

Mar 11, 2018 | Canada, coins, commemorative, news, silver, US Mint

It was announced that the Royal Canadian Mint was issuing a silver Canadian dollar commemorating the 180th Anniversary of Baseball in Canada. Being a baseball fan, I went to the Royal Canadian Mint’s website to see if the coin was worth adding to my collection. The came sticker shock!

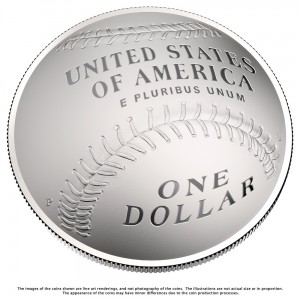

The coin is convex, similar to the 2014 Baseball Hall of Fame commemorative coins issued by the U.S. Mint. But that is where the similarities end. The reverse of the Canadian coin features a vintage baseball scene reminiscent of the 19th century inside a baseball-looking design. The obverse has the portrait of Queen Elizabeth II. It has a face value of $25 CDN.

-

-

Reverse of the 180th Anniversary of Canadian Baseball coin (Image courtesy of the Royal Canadian Mint)

-

-

Reverse design of the 2014 Baseball Hall of Fame commemorative (Image courtesy of the U.S. Mint)

Then there are the specifications. When I visited the Royal Canadian Mint’s website, I was floored when I noticed the issue price of 159.95 CAD or about $124.82 at the current exchange rate. Here is a comparison of the coins:

|

Royal Canadian Mint

180th Anniversary of Canadian Baseball |

U.S. Mint

2014 Hall of Fame Commemorative Silver Dollar |

| Mintage |

5,000 (limit) |

400,000 (actual)

Proof: 268,076

Unc: 131,924 |

| Face Value |

25.00 CAD |

1.00 USD |

| Composition |

99.99% pure silver |

90% silver

10% copper |

| Weight |

30.75 g

(0.9886 troy ounce) |

29.73 g

(0.9558 troy ounce) |

| Diameter |

36.07 mm |

38.1 mm |

Silver Value

(16.57 USD spot) |

16.38 USD |

14.25 USD |

Issue Price

(1 CAD = 0.78 USD) |

159.95 CAD

(124.82 USD) |

Proof: $56.95 (preorder: $51.95)

Unc: $52.95 (preorder: $47.95) |

If you want a baseball commemorative coin and do not want to break the bank, you can still find the 2014 Baseball Hall of Fame Commemorative Silver Dollar within 20-percent of the issue price in original government packaging (OGP). Even though the artwork is very good, the price of the Canadian coin is too high. At a premium of over 970-percent over spot, it is difficult to justify.

And now the news…

March 5, 2018

The Central Bank of Lithuania is calling on tech companies and blockchain experts from across the globe to help in the design and production of a digital collector coin. The Central Bank is organising a hackathon in May for third parties to help in the design and development of the one-off virtual currency.  → Read more at finextra.com

→ Read more at finextra.com

March 6, 2018

A new commemorative coin was unveiled Oct. 9 to mark the 100th anniversary of the end of World War I and honor those Americans who served. The silver dollar coin, authorized by Congress in 2014, features a service member holding a rifle to honor those who fought in the war from 1914 to 1918.  → Read more at wadenapj.com

→ Read more at wadenapj.com

March 6, 2018

Major League Baseball came to Canada in the 20th century with the debut of the Montreal Expos in 1969 and the Toronto Blue Jays in 1977, but that was far from the beginning of the country's history with the game.  → Read more at mlb.com

→ Read more at mlb.com

March 6, 2018

SPRINGFIELD, Ill. (WAND) – A design is needed for the Bicentennial Coin to commemorate the Illinois Bicentennial. Illinois State Treasurer Michael Frerichs announced the Bicentennial Coin Contest on Tuesday.  → Read more at wandtv.com

→ Read more at wandtv.com

March 7, 2018

Reverse of new penny design, showing Abraham Lincoln and the Illinois State Capitol in Springfield. (U.S. Mint photo)  → Read more at chicagotribune.com

→ Read more at chicagotribune.com

March 7, 2018

The Royal Mint is encouraging coin lovers to celebrate the UK “one coin at a time”. The new series of 10p coins were released into circulation on March 1 and features an A to Z of British landmarks, icons and traditions.  → Read more at dailystar.co.uk

→ Read more at dailystar.co.uk

March 8, 2018

A museum has started a bid to buy part of a gold sovereign hoard discovered hidden inside a piano. The find was made in 2016 in Shropshire when the piano's new owners had it retuned and repaired. It has since been declared as treasure.  → Read more at bbc.com

→ Read more at bbc.com

Feb 12, 2018 | commentary, medals, silver, US Mint

Silver Medal from the 2013 Theodore Roosevelt Coins and Chronicles Set

The U.S. Mint thinks that the silver medals would be a popular seller since silver coinage sells well. Using existing designs, the U.S. Mint hopes to be able to save time and money by removing the process of creating new images and not having to undergo the onerous review process of the CCAC and the U.S. Commission of Fine Arts.

I think the U.S. Mint is missing a point. Collecting commemorative silver and American Silver Eagle coins have the cache of being legal tender coins.

Although there are some very dedicated collectors of medals and other exonumia, the vast majority numismatics collectors are collecting legal tender coins.

If you look at the offering of some of the most prolific world mints like the Royal Canadian Mint, New Zealand Mint, and the Perth Mint, they offer a wide variety of offerings as legal tender coins. Countries like Niue and Somalia contract with other world mints to produce non-circulating legal tender (NCLT) coins to sell to the public.

Many of these programs are a success because they are legal tender coins. It is a mindset that the coins are worth more because they are legal tender. Even coins advertised as being legal tender from Native American Nations (tribes) gain attention.

People are drawn to the concept of collecting and/or investing in real money.

Medals are not money.

Although it sounds like a harsh assessment of the concept, the only downside that can be foreseen is if the U.S. Mint faces a planchet shortage like it did in 2009. Otherwise, I am not sure it will sell like I think the U.S. Mint is portraying.

For the first poll of 2018:

Loading ...

Feb 5, 2018 | coins, gold, palladium, platinum, US Mint

2018 American Eagle Platinum Proof obverse, Preamble to the Declaration of Independence Series — Life (U.S. Mint image)

Price for the American Gold Eagle proof coin was raised by $17.50 while the one-tenth ounce coin was raised by $2.50 across all price points (averages per troy ounce). The price for the 4-coin proof set was raised by $37.50.

The one-ounce American Gold Eagle uncirculated, American Gold Buffalo 24-karat Proof, and American Eagle Platinum proof coins were raised by $20.00 also across all price points.

The price will not change for the American Liberty Gold Proof, which will use the same design as the 2017 American Liberty 225th Anniversary Gold Proof. There will be a one-tenth ounce option that will go on sale February 8 now included in the table. If the price of gold remains steady, the opening price is expected to be $215.00.

The price for the Breast Cancer Awareness Commemorative “Pink” Gold $5 proof coin will be $6.35 more than the 2017 commemorative gold coin while the uncirculated version will be 25-cents less expensive.

You can find the U.S. Mint pricing table here (PDF).

Remember, precious metals pricing is not a matter of a table lookup. They use average prices based on the prices set by the London Bullion Market Association (also known as the London Fix Price). You can find the Pricing Criteria here (PDF).

Feb 1, 2018 | legislative, news, US Mint

Numismatically, the legislative news of the month is the hold placed on David Ryder’s nomination by Sen. Chuck Grassley (R-IA) in what amounts to a hissy fit over the Department of the Treasury not answering his inquiries. The problem is that to Secretary of the Treasury Steven Mnuchin, it does not matter.

Numismatically, the legislative news of the month is the hold placed on David Ryder’s nomination by Sen. Chuck Grassley (R-IA) in what amounts to a hissy fit over the Department of the Treasury not answering his inquiries. The problem is that to Secretary of the Treasury Steven Mnuchin, it does not matter.

Currently, David Motl is the Acting Deputy Director and the highest-ranking official at the U.S. Mint. Providing department oversight of the U.S. Mint is Treasurer of the United States Jovita Carranza, who has been in office since June 19, 2017. From Mnuchin’s perspective, there is no urgency to have a permanent director when there are two people doing the job.

A source tells me that there is a strange dynamic between Mnuchin and Congress. While he seems to get along with members of the Senate Banking Committee, there are strains in relationships with other members including Grassley, who is the Chair of the Senate Judiciary Committee. One source suggested that Mnuchin may feel that he does not have to answer to the Judiciary Committee since the Banking Committee has more direct oversight of Treasury.

Regardless of the issues, it is preventing Ryder’s nomination from moving forward.

H.R. 770: American Innovation $1 Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue “American Innovation” $1 coins commemorating an innovation, an individual innovator or pioneer, or a group of innovators or pioneers from each state, each U.S. territory, and the District of Columbia. Treasury shall issue four coins per year, in alphabetical order by jurisdiction, until a coin has been issued for each jurisdiction.

Referred to the House Committee on Financial Services. — Jan 31, 2017

Mr. Duffy moved to suspend the rules and pass the bill, as amended. — Jan 16, 2018

Considered under suspension of the rules. — Jan 16, 2018

DEBATE – The House proceeded with forty minutes of debate on H.R. 770. — Jan 16, 2018

On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jan 16, 2018

Motion to reconsider laid on the table Agreed to without objection. — Jan 16, 2018

Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jan 17, 2018

PN1355: David J. Ryder — Department of the Treasury

Date Received from President: January 8, 2018

Summary: David J. Ryder, of New Jersey, to be Director of the Mint for a term of five years, vice Edmund C. Moy, resigned.

Received in the Senate and referred to the Committee on Banking, Housing, and Urban Affairs. — Jan 8, 2018

Committee on Banking, Housing, and Urban Affairs. Ordered to be reported favorably. — Jan 17, 2018

Reported by Senator Crapo, Committee on Banking, Housing, and Urban Affairs, without printed report. — Jan 17, 2018

Placed on Senate Executive Calendar. Calendar No. 596. Subject to nominee’s commitment to respond to requests to appear and testify before any duly constituted committee of the Senate. — Jan 17, 2018

Jan 22, 2018 | commentary, news, policy, US Mint

Sen. Chuck Grassley (R-IA)

According to the notice filed in the Congressional Record:

Mr. President, I intend to object to any unanimous

consent request at the present time relating to the nomination of David J. Ryder, of New Jersey, to be Director of the Mint,

PN1355 .

I will object because the Department of the Treasury has failed to respond to a letter I sent on September 29, 2017, to a bureau within the Department seeking documents relevant to an ongoing investigation by the Senate Committee on the Judiciary. Despite several phone calls between committee staff and Treasury personnel to prioritize particular requests within that letter, the Treasury Department has to date failed to provide any documents.

My objection is not intended to question the credentials of Mr. Ryder in any way. However, the Department must recognize that it has an ongoing obligation to respond to congressional inquiries in a timely and reasonable manner.

Charles E. Grassley is a seven-term Republican Senator from Iowa. Grassley has a history of abusing† the Department of the Treasury to make it look like he’s doing something to keep his seat in the Senate. It is common for Grassley to have something to complain about without substance regardless of the ramifications of his actions.

In the meantime, the U.S. Mint remains without a permanent director while Grassley has his hissy fit.

PN1355: David J. Ryder — Department of the Treasury

Date Received from President: January 8, 2018

Summary: David J. Ryder, of New Jersey, to be Director of the Mint for a term of five years, vice Edmund C. Moy, resigned.

Received in the Senate and referred to the Committee on Banking, Housing, and Urban Affairs. — Jan 8, 2018

Committee on Banking, Housing, and Urban Affairs. Ordered to be reported favorably. — Jan 17, 2018

Reported by Senator Crapo, Committee on Banking, Housing, and Urban Affairs, without printed report. — Jan 17, 2018

Placed on Senate Executive Calendar. Calendar No. 596. Subject to nominee’s commitment to respond to requests to appear and testify before any duly constituted committee of the Senate. — Jan 17, 2018

† If you look at Grassley’s record, he has a record of making outlandish claims and using his office against Treasury bureaus regardless of the party in the White House. In 2005, I was involved with a Treasury bureau forced to a hearing in the Senate. Even though the evidence showed the contractor was clearly derelict in the performance of their contract, Grassley did everything except put on knee pads in deference to the contractor. Outside of the hearing room, I had a confrontation with one of his staffers and offered to supply the knee pads so that Grassley could complete the job. Since that hearing, I have held Grassley in contempt for being a bully and not a representative of the interests of his constituents in Iowa.

Jan 20, 2018 | BEP, news, policy, US Mint

The last time the government shutdown, because Congress did not do their job, was on September 30, 2013. Over the weekend, the major impact will be the recreational-based activities including the National Parks and the Smithsonian Museums—although many of these agencies will remain mostly open using what is called “carry-over funding” which are services whose bills are paid but the agencies are owed the services. It is an accounting trick that can help some agencies up to 72-hours during a shutdown depending on the amount of money and to whom it is paid.

The last time the government shutdown, because Congress did not do their job, was on September 30, 2013. Over the weekend, the major impact will be the recreational-based activities including the National Parks and the Smithsonian Museums—although many of these agencies will remain mostly open using what is called “carry-over funding” which are services whose bills are paid but the agencies are owed the services. It is an accounting trick that can help some agencies up to 72-hours during a shutdown depending on the amount of money and to whom it is paid.

Thankfully, the Washington, D.C. government will pick up the trash and provide basic cleanup services on the National Mall and other areas that would normally be taken care of by the National Parks Service.

Should the shutdown last through Monday, both the U.S. Mint and Bureau of Engraving and Printing will be operational. Both organizations are funded from their profits (seigniorage) which is held in their respective Public Enterprise Funds. The only responsibility that Congress has in their funding is to authorize the spending of the money. That authorization is not impacted by the shutdown because these are not (technically) taxpayer funds.

Since the U.S. Mint and Bureau of Engraving and Printing are self-funded, they are also not subject to the debt ceiling issues.

Although the U.S. Mint and Bureau of Engraving and Printing has not made a formal announcement, it is likely that facility tours will be suspended during the shutdown. This is because the security personnel are Treasury employees and not direct employees of the bureaus. Some will be designated as “essential personnel” and continue to work to help maintain security at all U.S. Mint and Bureau of Engraving and Printing facilities.

Security for the Bullion Depository at Fort Knox, Kentucky will not be impacted by the shutdown.

Since the Federal Reserve is an independent organization and not subject to congressional appropriations, they will remain open during a shutdown. The Office of the Comptroller of the Currency (OCC) will probably also remain open. OCC is funded by the Federal Reserve to help regulate banks.

All independent government organizations not subject to congressional appropriations will continue to operate including the United States Postal Service.

Representatives of these agencies may contact me to provide additional information. Government employees who work for these agencies that want to provide additional information may also contact me. Please note that I do respect the confidentiality of all sources!

NOTE: Although I no longer work as a contractor to the federal government, my views on the government have changed only in my level of disgust with their practices. I am not a member of any political party. I am a supporter of government employees who makes up a very dedicated workforce and do not deserve the way they are treated by elected and appointed officials.

Jan 17, 2018 | coins, news, policy, US Mint

Coins found in the recycling stream.

The recycling industry has complained to the Department of the Treasury and their members of Congress over the U.S. Mint’s inaction with providing new rules to restart the program. After publishing two draft rules and making adjustments based on the comments, the Final Rule was published in the Federal Register (82 FR 60309) on December 11, 2017.

The Final Rule that makes adjustments to the regulations for “Exchange of Paper Currency and Coin” (31 CFR Part 100 Subpart C) in order to add additional clarity and oversight to the process. This includes depositing worn or heavily scratch coins in a bank or other authorized depository. Bulk submission over one pound must be separated by denomination and must be identifiable. Each denomination is considered one submission and must be over one pound (e.g., one pound of nickels and one pound of dimes and one pound of quarters, etc.). Dollar coins also have to be separated by type (e.g., Eisenhower, Sacagawea, Presidential, etc.). The updated program restricts the redemption of fused, unsorted, and unidentifiable coins. Coins made of gold and silver are not accepted as part of this program.

Those needing more detailed information should consult the “Mutilated Coin Redemption Program” webpage on the U.S. Mint website (see http://bit.ly/Mutilated-Coin).

Jan 13, 2018 | legislative, news, US Mint

David J. Ryder at the hearing regarding his nomination to be the 39th Director of the U.S. Mint

Apparently, Ryder’s nomination was returned to remove the hold placed by Sen. Chuck Grassley (R-IA) in December. Grassley filed an intent to object to the nomination because “the Department of the Treasury has failed to respond to a letter I sent on September 29, 2017, to a bureau within the Department seeking documents relevant to an ongoing investigation by the Senate Committee on the Judiciary.” Grassley said that the objection was not intended to question Ryder’s credentials but as a punitive action against the Department of the Treasury for not answering his committee’s inquiry.

Ryder’s nomination was resubmitted by the President on January 8, 2018 (PN1355). As required, it was referred to the Senate Committee on Banking, Housing, and Urban Affairs. It is likely to be passed out of committee without a hearing. However, that does not mean Grassley or any other senator would not put a hold on the nomination.

Your government at work.

PN1355: David J. Ryder — Department of the Treasury

Date Received from President: January 8, 2018

Summary: David J. Ryder, of New Jersey, to be Director of the Mint for a term of five years, vice Edmund C. Moy, resigned.

Received in the Senate and referred to the Committee on Banking, Housing, and Urban Affairs. — Jan 8, 2019

→ Read more at

→ Read more at

Numismatically, the legislative news of the month is t

Numismatically, the legislative news of the month is t

The last time the government shutdown, because Congress did not do their job, was on September 30, 2013. Over the weekend, the major impact will be the recreational-based activities including the National Parks and the Smithsonian Museums—although many of these agencies will remain mostly open using what is called “carry-over funding” which are services whose bills are paid but the agencies are owed the services. It is an accounting trick that can help some agencies up to 72-hours during a shutdown depending on the amount of money and to whom it is paid.

The last time the government shutdown, because Congress did not do their job, was on September 30, 2013. Over the weekend, the major impact will be the recreational-based activities including the National Parks and the Smithsonian Museums—although many of these agencies will remain mostly open using what is called “carry-over funding” which are services whose bills are paid but the agencies are owed the services. It is an accounting trick that can help some agencies up to 72-hours during a shutdown depending on the amount of money and to whom it is paid.