Apr 30, 2017 | BEP, currency, news

Jovita Carranza

The following biographical note was released by the White House:

Ms. Carranza currently is the Founder of JCR Group which provides services to companies and non-governmental organizations. She previously served as Deputy Administrator of the U.S. Small Business Administration (SBA) under President George W. Bush, after receiving unanimous confirmation. Prior to her service in SBA, Carranza had a distinguished career at United Parcel Service where she started as a part-time, night-shift box handler and worked her way up to be the highest ranking Latina in company history where she served as president of Latin America and Caribbean operations. Ms. Carranza earned her MBA from the University of Miami in Florida. She also has received executive, management and financial training at the INSEAD Business School in Paris, France; Michigan State University; and the University of Chicago.

When confirmed Carranza will be the 44th Treasurer of the United States succeeding Rosie Rios who resigned on July 8, 2016.

Since the Series 2017 notes will carry Carranza and Secretary of the Treasury Steven T. Mnuchin’s signature, here is a view of what you might expect:

Rather ordinary considering the fun we had discussion Jack Lew’s Lewpts!

Mar 31, 2017 | BEP, coins, currency, dollar, news

Sen. John McCain (R-AZ) once again introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act). Similar to the same bill he introduced in the last congress, the COINS Act (S. 759) proposed to end the production of the $1 Federal Reserve Note, reduce the production cost of the five cent coin by changing its composition, and eliminating the one cent coin. Mike Enzi (R-WY) is a co-sponsor.

Sen. John McCain (R-AZ) once again introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act). Similar to the same bill he introduced in the last congress, the COINS Act (S. 759) proposed to end the production of the $1 Federal Reserve Note, reduce the production cost of the five cent coin by changing its composition, and eliminating the one cent coin. Mike Enzi (R-WY) is a co-sponsor.

“With our country facing $20 trillion in debt, Congress must act to protect the American taxpayer,” in a statement issued by McCain’s staff. “By reforming and modernizing America’s outdated currency system, this commonsense bill would bring about billions in savings without raising taxes.”

Of course “common sense” has a very different definition in Washington than the rest of the country. The first attempt to introduce a bill to end the production of the $1 note started in 1991 by then Rep. Jim Kolbe (R-AZ) and died at the end of the 102nd Congress. Kolbe introduced the legislation every session until his retirement in 2007 following the adjournment of the 109th congress. McCain has introduced the bill in the last three sessions of congress.

“Change can be hard sometimes, but switching to a dollar coin could save our country $150 million a year,” Enzi said. “Our country is in a difficult financial position because we didn’t value the cost of the dollars we spent. We can’t afford to keep that up, and these innovative opportunities are a way to save taxpayer money that is really just being wasted with each new dollar we print and penny we mint.”

I am sure that the usual arguments about eliminating the paper dollar will come up again. Even though a GAO report has shown that eliminating the paper dollar could save the government about $4.4 billion in production and handling costs, economic surveys have claimed a potential $16-18 billion benefit for the government.

When the public is asked about eliminating the paper dollar, the arguments usually line up along generational lines. Surveys have shown that Baby Boomers (those born before 1964) and those older are overwhelmingly not in favor of eliminating the the paper note. The GenXers, those born 1965-1980, are almost evenly divided while the Millenials, those born since 1980, do not care because they are mostly tied to their credit and debit cards.

The Baby Boomer that writes this blog is in favor of eliminating the paper dollar. In the past, he was in favor of eliminating the one cent coin but is beginning to have second thoughts.

For the longest time, the Massachusetts delegation have held these types of bills back. This is because the Dalton, Massachusetts based Crane & Co., the maker of currency paper, has been the exclusive currency paper supplier to the Bureau of Engraving and Printing since 1879. Although Elizabeth Warren (D-MA) has become a more powerful figure in the Senate, she is not a favorite amongst the majority and is tolerated by the more centrist members of her own party. Sen. Ed Markey (D-MA) does not have the gravitas either of his predecessors, the late Ted Kennedy and John Kerry, to yield influence. The only power the Senators have would be to filibuster any measure that would eliminate the $1 note. Sen. Warren has railed against military-related spending for non-essential equipment so that members of congress could keep these jobs in their districts. Would she be willing to follow her lead that could reduce the revenue of a company in her home state?

Mar 17, 2017 | BEP, Britain, celebration, coins, education

2016 Canada Lucky Four-Leaf Clover 1 oz Silver Coin

Patrick was not welcomed when he arrived but worked with the society to convert them to Christianity. Although most of his writings portrayed that he was probably more successful than he was, but after working with the people, first in the northern regions of Ireland, he did find success. He once wrote that he baptized thousands of people and some have written that he baptized hundreds on a single day. Using the native three-leaf shamrock to describe the Holy Trinity, Patrick was promoted bishop and apostle of Ireland. He died on March 17, 461 in Saul, where he founded his first church.

For thousands of years, the Irish have observed the day of Saint Patrick’s death as a religious holiday, attending church in the morning and celebrating with food and drink in the afternoon. The first St. Patrick’s Day parade was celebrated in 1762 when Irish soldiers serving in the English military marched through New York City.

With Saint Patrick’s Day, talk about “the luck of the Irish” and associate the shamrock of four-leaf clover as a lucky symbol. I was thinking if there are coins or currency that would bring you luck. After searching around online for lucky coins there was a common theme: something that is special to you. Here is a composite of the types of lucky coins:

- Coins from the year of your birth: I have helped several people buy proof and mint sets of coins from the year they were born. On one of my father’s milestone birthdays, I bought uncirculated coins from the year of his birth and had them slabbed in an NGC multi-coin holder when they were still being offered.

- Coins from a country special to you: On one of my wife’s milestone birthdays, I purchased a Canadian proof set from the year of her birth. Although she was born in the United States, her parents were from Canada and it has become a special collectible.

- Coins that have a special meaning: A friend keeps a Morgan Dollar in his top desk drawer. The desk used to belong to his grandfather who kept that coin as his “emergency dollar” during the Great Depression.

- Coins found during a happy or coincidental time: A client once showed me a 1958 Cuban peso that he found on the street in Miami that he keeps as a pocket piece. He decided that since it was the same year his family fled Cuba, it was a fortuitous find.

- Coins of a specific design: Sometimes the design may be added to the coin. I once met someone who had several Love Tokens from his relatives he says it is his family’s way of watching over him.

A silver sixpence in her shoe

1962 British Sixpence

Feng Shui

Feng Shui Coins

The number of coins tied together is important. One coin is believed to promote loneliness and will leave you empty. Two is better but does not have the power of rebirth that three does. Three coins tied together represents the heavens, earth, and mankind. Four represents death and not something that would promote Feng Shui. The Chinese do not know why five is not lucky but this is accepted. While three is considered proper Feng Shui, making it more powerful would be three-times-three, or nine, coins.

For luck, you can hang Feng Shui coins on the on the inside of your front door, not the outside. You want the luck inside. Do not hang your Feng Shui coins on your back door because it will luck to leave your house.

You can place three Feng Shui coins on top of items to bring them luck. When you do this, it is important to place the Yang side facing up to invite the luck to protect your item. The Yang side is the side with the four characters.

When giving a gift, attach three Feng Shui coins to the package to bring double happiness. It tells the recipient that with the gift you are also wishing them wealth, prosperity, and happiness. Doing this will add to your Feng Shui for giving generous and unselfish wishes.

Numerology and currency

Numerology is the belief in the divine or mystical relationship between numbers and the physical world. Many people practice a mild form of numerology called a “lucky number.” For those who believe in some type of numerology can turn to the serial number of currency to add to their collection.

One of the more expensive aspects of notaphily is the collection of patterns numbers. Typical patterns are as follows:

- Solid: every digit the same

- Ladder: numbers that count up, like 12345678, or down, like 98765432

- Low or High numbers

- Radar numbers: when the serial number repeats forward and backward, like 12344321

- Repeater numbers: when the serial number is repeated, like 12341234

- Super Repeater: pairs of numbers that repeat four times, like 36363636

- Double Quad: two pairs of four numbers, like 88889999

- Seven of a kind: both in a row or seven of the same number

Notes that represent dates can bring luck such as one that has your birthdate. For someone born on March 17, 1977, finding a note with the serial number 03171977 or even 19770317 could be very lucky. Since the numbers reset for every series and there are 12 Federal Reserve branches used as a prefix, you have quite a few chances of finding these.

$1 Lucky 777 Note

The BEP also sells lucky money that includes the Lucky 7 set. These notes have a serial number that begins with three 7s. You can also buy notes in special Chinese holders with serial numbers that begin with “8888” and “168.” In Chinese, the “eight” sounds similar to the word for “prosper” or “wealth.” Selling the Lucky 8888 note is to help promote prosperity and wealth.

The “168 Prosperity Forever” note plays on the Mandarin pronunciation of the number that sounds similar to “prosperity forever.” If the BEP used the Cantonese pronunciation, they would have the use the serial numbers beginning “768.”

Go find your lucky coin and may you have health and prosperity.

Credits

- Canadian coin image courtesy of the Royal Canadian Mint

- Sixpence image courtesy of Wikipedia

- Feng Shui coins image courtesy of eBay user “technology-onsale“

- Lucky 777 Note courtesy of the Bureau of Engraving and Printing

Feb 25, 2017 | BEP, books, Canada, counterfeit, history

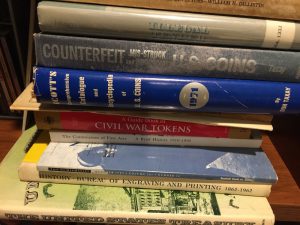

An adage of numismatics is “Buy the book before the coin.” It was first used by numismatist and dealer Aaron Feldman in an advertisement that appeared in the March 1966 issue of The Numismatist. Aside from being used to sell books, this sound advice tells collectors to enhance their knowledge of the hobby.

An adage of numismatics is “Buy the book before the coin.” It was first used by numismatist and dealer Aaron Feldman in an advertisement that appeared in the March 1966 issue of The Numismatist. Aside from being used to sell books, this sound advice tells collectors to enhance their knowledge of the hobby.

Education is important because helps build the skills and tools they need to navigate the world. Education helps us read, write, calculate and communicate. Without education, we would not be able to perform our jobs competently, accurately and safely. Education also gives us a view of the world which we live and provides a context to how we arrived at society today.

Numismatic education is important because it teaches us how to understand the and navigate the world of money and the economics that made it necessary. Without numismatic education coins, currency, bonds, tokens, and medals are just objects to be ogled without context. We would not know why these items are important or how to collect them. Numismatic education not only teaches us about how to identify these items and collect them but provides the background into history that explains how these items represent today’s society.

The areas I find interesting are the history and policies that have led to how things are today. History gives us the lessons learned as to how it was once done and the evolution of the policies that govern the way any institution is run. This is no different for the money manufacturing apparatus of the United States.

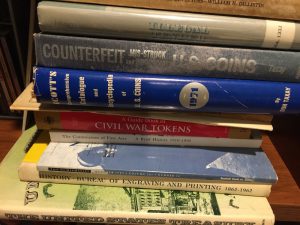

I have been on a book buying binge. If I find a book that will add to my curiosity, then it will become part of my growing library. Over the last few months, I have probably spent more on books than coins. With the exception of the few review copies (that I really should review), most of the books I buy are older and have information that I have not found anywhere else.

There are books from my new stack of older books I would like to highlight.

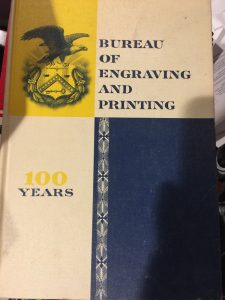

History of the Bureau of Engraving and Printing

Bureau of Engraving and Printing, 100 Years

It is a beautifully produced book that stands out for its quality in both production and writing. The history of the BEP is well written with images of the process with images of some of the printing element interspersed throughout the text. Also included are intaglio printed images from the Bureau of Engraving and Printing archives. Between the pages with the intaglio prints is a tissue-like paper to help protect and preserve the images.

Although there are many good online histories of the Bureau of Engraving and Printing none of them are complete and does not include the other security printing history of the agency including bonds and stamps.

Three on Counterfeiting Currency

The most read post on the Coin Collectors Blog is “How easy is it to pass counterfeit currency.” I am fascinated that since I published that post there it has logged over 5,000 unique hits. I am sure that the post is being picked up by search engines and shown to people who are looking for illicit information. They are probably disappointed that the post is not an instruction manual, but I am fascinated that so many people would be interested.

It made me curious about the history of counterfeiting in the United States. Since I am on a book buying binge, it was time to find some interesting titles:

- Illegal Tender, Counterfeiting and the Secret Service in Nineteenth-Century America by David R. Johnson. To save money, this is a former library book in very good condition. I have skimmed this book and it looks like it will provide a good background as to the evolution of the U.S. Secret Service. The U.S. Secret Service is a unique agency. It was formed to investigate and deter counterfeiting of U.S. currency starting in 1865. They were so well respected that they were asked to protect President Theodore Roosevelt following the assassination of President William McKinley in 1901. Although many countries have divisions of their law enforcement services that investigate counterfeiting, the United States is the only country that has an agency whose mission to protect the currency from counterfeiting.

Banknote Reporters and Counterfeit Detectors from 1949

- Bank Note Reporters and Counterfeit Detectors, 1826-1866, by William H. Dillistin. Published by the American Numismatic Society in 1949, this book is a survey of experts in counterfeit detection that describes what to look for. It is also a catalog of publications in counterfeit detection and the authors. An interesting exercise may be to work on trying to find the papers and pamphlets listed in this book. I also liked the images in the back of the book that shows what to look for to detect counterfeits.

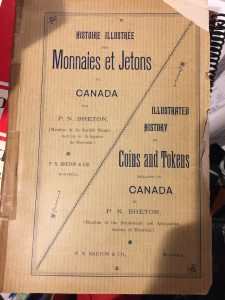

Illustrated History of Coins and Tokens Relating to Canada

Illustrated History of Coins and Tokens Relating to Canada by P.N. Breton

I have to admit to “picking” this book during a sale of books from my local coin club. The club is selling off items in its library that there seems to be little interest. Periodically, a few books are brought to a meeting and sold by silent auction. When Illustrated History of Coins and Tokens Relating to Canada, I did not pay attention. I was drawn that it was an older book about Canadian coins and that it is written in both French and English. What made this book stand out is that each page had two columns with the French text on the left and the English on the right. The format was fascinating I bid and won the book. Only after I started to go through my pile this past week to prioritize my reading list did I realize what I had purchased.

Although this is not a priority read, to have a contemporary reference about Breton Tokens written by P.N. Breton should make a fascinating read.

So… what’s on your bookshelf?

Jan 20, 2017 | BEP, Federal Reserve, news, US Mint

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.

Also, as of noon, Obama’s appointments to Executive Branch positions will resign from their position to be filled by the new president’s appointment. Of the people resigning are Secretary of the Treasury Jacob “Jack” Lew and Principal Deputy Director of the U.S. Mint Matthew Rhett Jeppson. Jeppson was nominated to be the 39th Director but the nomination died with the end of the 114th congress.

Attempts to contact the U.S. Mint to ask them about the bureau’s leadership starting Friday has gone unanswered.

The position of Treasurer of the United States would have also resigned but is currently vacant after the July 2016 resignation of Rosie Rios. Treasurer of the United States is a presidential appointment that does not require Senate confirmation.

The Bureau of Engraving and Printing is not affected by a change in administrations because the position of the director is a career appointment. Len Olijar will remain Director of the BEP as long as he is a government employee in good standing.

Members of the Federal Reserve Board are appointed but they are not considered part of the Executive Branch. The Fed is independent and the Fed Chair, the Federal Reserve Board, and the president of the regional Federal Reserve Banks are appointed to four-year terms irrespective of political timelines. Janet Yellen, Chair of the Federal Reserve, has announced she will serve her full her full four-year term that will expire on February 3, 2018.

The Plum Book, which documents more than 9,000 Federal civil service leadership and support positions in the executive and legislative branches, lists quite a number of positions that supports numismatic production. Of course, significant changes will be reported here!

Nov 12, 2016 | BEP, legislative, news, policy, US Mint

Rhett Jeppson, nominated to be the 39th Director of the U.S. Mint

The immediate impact of the election results is that Rhett Jeppson will not be confirmed to become the Director of the U.S. Mint. Even though the Senate Banking Committee held a hearing for his nomination on March 15, the chance of the GOP-led Senate confirming any of President Obama’s appointment nominations are non-existent.

Jeppson was hired in January 2015 as Principal Deputy Director. Jeppson was hired as a member of the government’s Senior Executive Service (SES) program. In July, it was announced that Jeppson would be nominated as the Director. Since the nomination will likely die in committee, Jeppson will remain on the U.S. Mint staff as a government employee. Although he has not announced his intentions, Jeppson is likely to continue as Principal Deputy Director.

It is unlikely that the next administration will nominate Jeppson or anyone in the near future. Considering that there has not been political appointee running the U.S. Mint since January 2011, maybe President Obama could use his power to convert the term appointment into a permanent government employee. This way, the U.S. Mint can be run by competent managers rather than a pol who might do something like not ordering enough planchets to maintain a major bullion program.

The Bureau of Engraving and Printing is not affected by a change in administrations because the position of the director is a permanent government employee. Len Olijar will remain Director of the BEP as long as he is a government employee in good standing.

As for any of the pending legislation, do not count on anything being passed. Given the results of the election, sources say that the partisan rancor is so fervent that even the most cordial relationships have turned icy. These feelings are not limited to cross-party relationships. There is a growing divide between ideological members in both parties that could almost split the congress into four parties.

To suggest that the partisan bickering to escalate during the lame duck session would be an understatement. Remember, congress passed a continuing resolution, not a real budget, in late September that will expire on December 9. If a budget is not passed by December 9 then the government will have to be shutdown.

The 114th congress will adjourn being one of the most ineffective congress on record.

For the 115th congress that will convene on January 3, 2017, there will be 239 Republicans and 193 Democrats with three runoffs pending (two in Louisiana). Although the Republicans lost 7 total seats, they continue to hold a majority. Currently, Rep. Jeb Hensarling (R-TX) is the Chairman of the House Committee on Financial Services. Although it is not known if Hensarling will remain as chair of this committee, it is likely the new leadership will continue the previous policies. If the attitudes of this committee do not change, there may be very few commemorative coin programs that get through this committee.

Although revenue generating bills are required to be introduced in the House of Representatives (U.S. Constitution, Article I, Section 4), the Senate has been known to introduce commemorative coin bills without argument from their House counterparts. For the 115th congress, the Senate will have 51 Republicans and 48 Democrats with a runoff in Louisiana scheduled for December 10. However, Senate rules make the composition somewhat irrelevant because of their ability to filibuster.

Under the Senate’s filibuster rules (Senate Rule XXII), a senator can inform the presiding member that they intend to filibuster the debate. At that point, the presiding member will set the bill aside to allow other business to continue because the Senate can only work on one item at a time. This means that a filibuster stops all other floor actions. By setting the bill aside and not bringing it to the floor, this allows for other senate business to continue while the leadership tries to gather support for a cloture vote.

Cloture, or closure, is the act to end the free-flow debate of the senate and apply restrictions, such as a 30 hour limit on debate. Cloture requires a three-fifths vote of the senate (60 votes) to agree on cloture. Anyone who remembers some of the past discussions on the composition of the senate, when one party controls 60 seats, they called that a “filibuster-proof majority.” Otherwise, any senator can threaten a filibuster and have that measure buried.

Although it is unlikely that the senate would filibuster the vote on a commemorative coin bill, but it would be obstructed by the another bill ahead of it in the queue.

Even though I would like for the Apollo 11 50th Anniversary Commemorative Coin Act (H.R. 2726 and S. 2957) to pass, I will not be holding my breath during the lame duck session this year or a new version introduced anytime next year.

Jul 8, 2016 | BEP, news, US Mint

Former Treasurer of the United States Rosie Rios

“Rosie Rios joined the Treasury team nearly eight years ago, during the presidential transition. Since then, she has been a thoughtful steward of two important Treasury bureaus — the Bureau of Engraving and Printing and the Mint — and has been an advocate for women and girls including, for example, her leadership of the Treasury Women in Finance symposium.

“I am particularly grateful for her creativity and leadership in the effort to redesign our paper currency and to ensure that future notes reflect, for the first time in 120 years, the important role of women in shaping our democracy. I thank her for her service and wish her all the best in her future endeavors.”

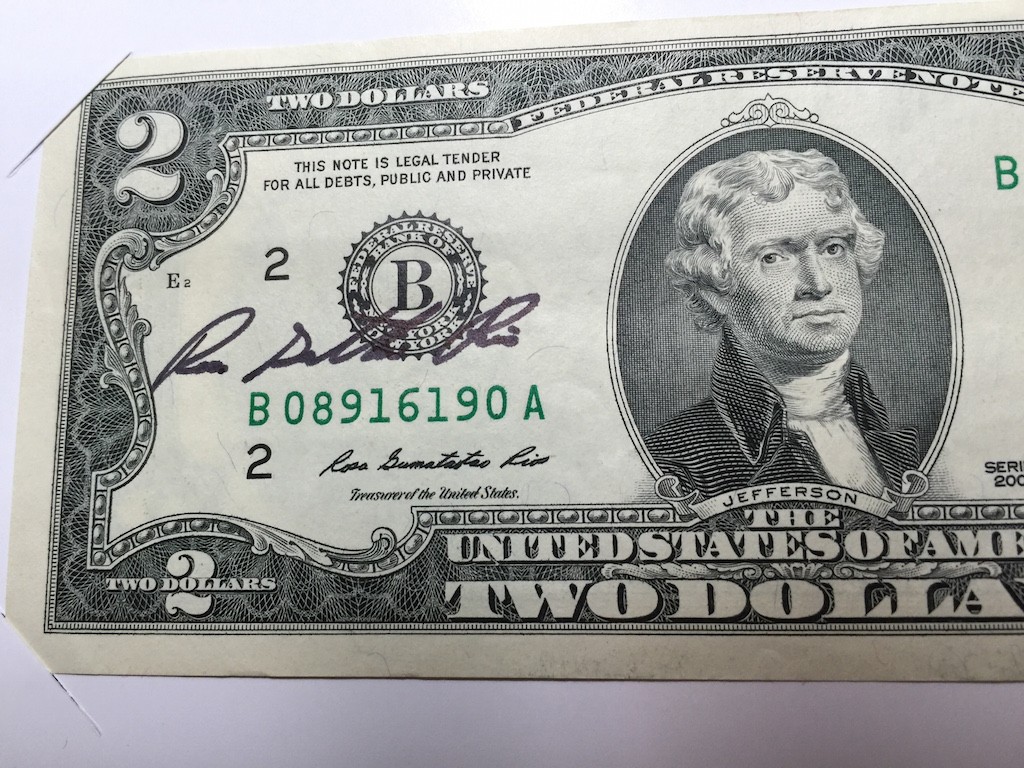

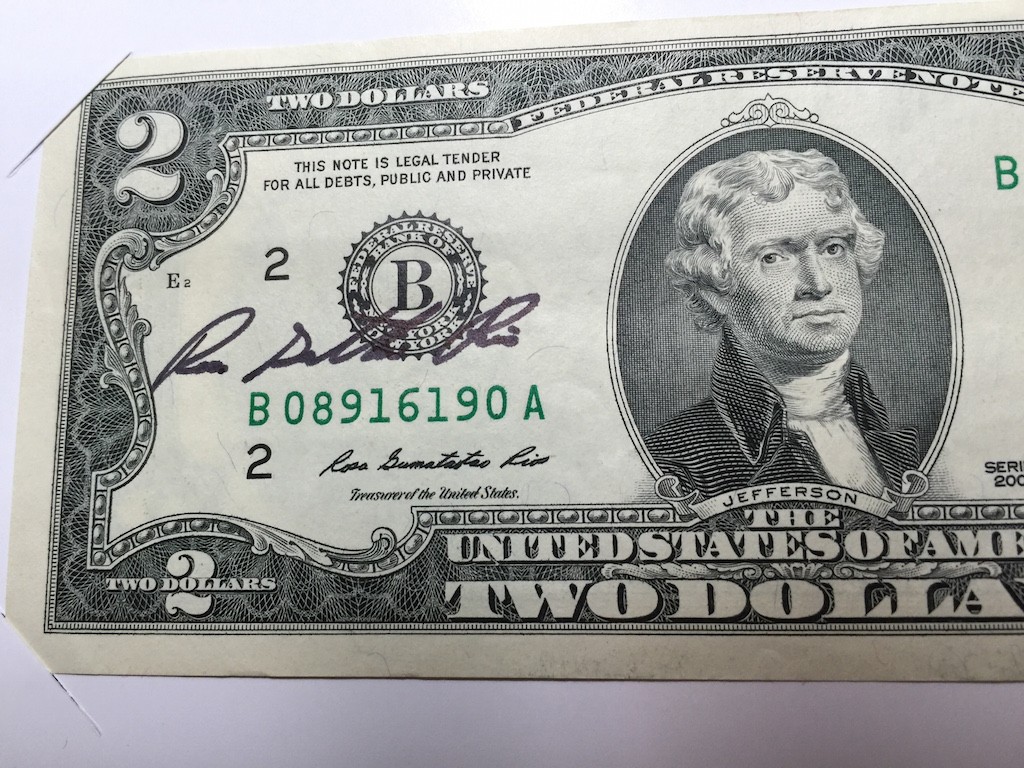

As the 43rd Treasurer, Rios has been an advocate for everything regarding her oversight of the U.S. Mint and Bureau of Engraving and Printing including her participation at shows. Aside from her signature appearing on every Federal Reserve Note since the 2009 Series, she continued to autograph notes for collectors at conventions. She jokingly calls them “Rosie Dollars.”

Series 2009 Federal Reserve Note autographed by Treasurer of the U.S. Rosa Gumataotao Rios

Rios has worked as a business executive prior to working on the Obama campaign in 2008 in Virginia. She was hired to work with the transition team on matters concerning the Treasury Department and then was nominated as Treasurer. Rios has been serving as Treasurer since August 8, 2009.

Her future plans were not announced.

Aside from being a tough act to follow, the position may stay vacant for a while. Given the hyper-partisan nature of congress and that we are heavy into this election cycle, it is highly unlikely that the Senate would consider confirming an Obama appointment. Currently, Rhett Jeppson is waiting for a vote to confirm his appointment to be the 39th Director of the U.S. Mint. Jeppson’s nomination was sent to the Senate for “advise and consent” on July 9, 2016. A hearing about his nomination was held on March 15, 2016. The nomination remains in committee waiting for the Senate to do their job and hold a vote.

May 14, 2016 | BEP, currency, dollar, video

Obverse of the 2009-present Native American Dollar featuring the portrait of Sacagawea

I will go into the more details of the changes at a later date, but during my travels around the interwebs I came across a television news report from KIFI, the ABC affiliate in Fort Hall, Idaho. Although it is like every other news story it has one feature that no other news outlet was able to add to their story: an interview with Randy’L Teton.

Randy’L Teton is a member of the Shoshone-Cree tribe who was the model for Glenna Goodacre’s design for the Sacagawea dollar coin. Teton was a student at the University of New Mexico majoring in art history and was working for the Institute of American Indian Arts Museum in Santa Fe when Goodacre visited looking for Shoshone woman to be her model since no images of Sacagawea exist. Teton was chosen for as the model.

For anyone who has not seen or heard Ms. Teton, here is the video of KIFI’s report:

Feb 9, 2016 | BEP, currency, news

iBill® Talking Banknote Identifier

The iBill currency reader is a product of Orbit Research. Retailing at $119.00, iBill is a pocket-sized reader that can identify all Federal Reserve Notes in circulation. Orbit Research claims that “most bills are identified in less than one second” and can announce “the denomination in a clear female voice; tone and vibration modes protect privacy.” It requires one AAA battery that is included.

The Meaningful Access Program came about as the result of a settlement between the government and the American Council of the Blind who brought suit claiming that U.S. currency violated Section 504 of the Rehabilitation Act. This was first confirmed by the courts in 2006 and subsequent appeals had judges requesting a settlement. Following the 2009 settlement, the BEP began to work on meaningful access programs.

IDEAL Currency Identifier

BEP developed EyeNote

According to the BEP Meaningful Access mobile application page, the BEP worked in collaboration with the Department of Education to have the IDEAL Currency Identifier that works on Android devices. This app can be found on the Google Play Store.

A more impressive app is the LookTel Money Reader available for iOS and the Mac. For the visually impaired traveler, not only can Money Reader recognize U.S. currency, but the currency of 20 other countries including the Australian Dollar, British Pound, Canadian Dollar, Euro, Indian Rupee, Japanese Yen, and Saudi Arabian Riyal. Money Reader is faster at identifying currency than EyeNote and can identify fragments, as I found in my last review.

LookTel Money Reader

If you think you, a relative, or someone you care for qualifies, download and fill out the simple form and send it to the BEP address on the form&rsqou;s instructions. It will take up to eight weeks for you to receive your free iBill currency reader.

As an aside, this is not a taxpayer funded venture. BEP earns its funding from their business operations. Most of their money is earned from printing money for Federal Reserve. They also earn a smaller amount of profit from sales to collectors.

Credits

- iBill image courtesy of Orbit Research.

- IDEAL Currency Identifier screenshot courtesy of IDEAL Group Inc. on the Google Play Store.

- All other images are property of the author.

Jan 24, 2016 | BEP, cash, coins, currency, education, US Mint

Marriner S. Eccles Building where the Federal Reserve Board is located

The process begins when the Federal Reserve places their annual order with the U.S. Mint for coins and the Bureau of Engraving and Printing for currency. Like any organization that deals with inventory, the Federal Reserve will estimate its order based on a projection of demand.

Inventory management for the Federal Reserve requires them to know how much currency is in circulation, how much will be required based on world-wide economic factors, and what would be required to replace the current currency supply. Since the Federal Reserve ships U.S. currency world wide, especially the $100 Federal Reserve Notes, someone has to project what the world is going to demand based on economic factors that it has no participation in.

Life Expectancy of U.S. Currency

| Denomination of Bill |

Life Expectancy (Years) |

| $ 1 |

5.9 |

| $ 5 |

4.9 |

| $10 |

4.2 |

| $20 |

7.7 |

| $50 |

3.7 |

| $100 |

15 |

Not only does the Federal Reserve has to track the amount of money in circulation but they also have to account for the different denominations in order to replace torn and worn notes. For instance, it was once estimated that 90-percent of the order for $1 Federal Reserve Notes were delivered to replace worn notes in circulation.

Once the order is placed by the Federal Reserve, the U.S. Mint and the Bureau of Engraving and Printing work to fulfill that order. The U.S. Mint strikes the coins and has they placed in one-ton ballistic bags for delivery. The Bureau of Engraving and Printing bundles the currency in packs. Multiple packs make a brick. Bricks are then piled on pallets that are used for delivery.

From Philadelphia and Denver, the coin bags are loaded onto secured trucks and transferred to the Federal Reserve for distribution. A similar transfer happens at the Bureau of Engraving and Printing in Washington and Fort Worth where the pallets are shipped to the Federal Reserve.

Although there may be a few warehouses and other distribution processes involved, the coins and currency are shipped to one of 26 “cash rooms” around the country based on need. These cash rooms are special warehouses operated by the Federal Reserve branch that store the physical currency before being distributed to the member banks.

Federal Reserve Bank of New York

Before currency can enter circulation, a member bank places an order with the Federal Reserve. It is then delivered to them from the closest cash room with the appropriate inventory necessary to fulfill the order.

Your personal bank is like the corner store in the ordering system. When the shelves are bare or threatening to go bare, they order the inventory of currency they need. The corner bank just do not order money from the Federal Reserve. Banking companies work on behalf of their branches to manage inventory. The big bank may have their own cash management operations that help ensure that they not only have the appropriate amount of currency available but they do not have too much in storage. Like product inventories, idle money is not good for business.

Federal Reserve Bank of Richmond Baltimore Coin Storage

Federal Reserve Bank of Atlanta Cash Operations

Many banks hire logistics companies to help with the flow of their currency inventory. These companies are the ones driving the armored trucks you see around town that delivers currency on order. While these logistic companies are registered currency distribution services and have permits to pick up inventory from the Federal Reserve cash rooms on behalf of the member banks, they also provide storage and delivery services.

Although your corner bank has a vault, each banking company limits the amount of currency they keep on site because of security concerns. When they need additional currency or have an excess that needs to be stored, they call the logistics company to physically move the inventory.

Four of the largest cash logistics companies

Depending on how fast the currency is needed to circulate by your corner bank, existing currency can circulate through the logistics processing center long before the new inventory is placed into circulation.

During the recent downturn in the economy, the banks’ inventories of coins increased as people emptied jars, jugs, and bottles of coins for necessities. As the coins were returned to the bank the inventories rose beyond what they needed for circulation reducing the requirement for the banks to order more coins from the Federal Reserve. This is why it was not surprising that many people did not see current year coins until as early as April.

It is more difficult to gauge when currency reaches circulation unless there is a change in the series designation. The Series of a note is the date followed by a letter indicating that there is a change, usually to the autograph of the Treasurer or the Secretary of the Treasury. Although there is no rule, the Series date changes with an administration and the letter is added and changes as the autographs changes. Sometimes, the series date changes with the design of the currency. These are recent conventions and not the rule. All printing and design decisions are made by the Federal Reserve, Bureau of Engraving and Printing, and the U.S. Secret Service as a team.

If you want to know when the 2016 coins will reach circulation, the answer is “I don’t know.” Considering the economy is in better shape than in years past, money continues to circulate, and the U.S. Mint has produced more coins in a single year than any other in its history, if you have not seen a 2016 coin in your pocket change soon, then my best guess will be in mid-February—if the weather holds up!

Credits

- Eccles Building image courtesy of the Federal Reserve.

- Federal Reserve Bank of New York building courtesy of the Federal Reserve Bank of New York.

- Image of the Federal Reserve Bank Baltimore Coin Room courtesy of NPR.

- Image of the Atlanta Federal Reserve Bank Cash Operations courtesy of Glassdoor.com.

- Armored vehicle image courtesy of Prinéa.

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.