May 6, 2018 | Canada, coins, news, US Mint

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

Last week, the Royal Canadian Mint issued its financial reports for 2017. The headline of the report said that the Royal Canadian Mint paid $93.2 million ($72.553 million USD) in dividends to the government of Canada in 2017. To compare this with the U.S. Mint, whose fiscal years end on September 30th, paid a total of $265 million back to the government.

Numismatic sales are an important part of the Royal Canadian Mint’s sales. This is evident by visiting their website to see the number of programs they have for sale. With all of the options, the Royal Canadian Mint revenue for those numismatic items was $25.7 million ($20 million USD). Even with the complaints about how horrible the U.S. Mint is and its programs are not priced according to someone’s perception of the market, they sold $1.755 billion in numismatics. This number includes about $2.4 million in numismatic sales of circulating coins, such as bags and rolls.

Finally, even though bullion sales have decreased as the economy strengthened and both mints saw a reduction in sales. The Royal Canadian Mint had a net revenue of $1.35 billion ($1.05 billion USD), representing a 40.7-percent decrease in sales from 2016. The U.S. Mint had revenues of $1.378 million representing a decrease of 33.8-percent from 2016.

There may be some who like to complain about the U.S. Mint, this government bureau continues to be the world’s largest manufacturer of circulating and collectible coinage. Although bullion sales have decreased and the Royal Canadian Mint has performed well in the bullion markets in recent years, when it comes to whom the market turns to, the U.S. Mint continues to outperform other world mints.

And now the news…

April 29, 2018

A new 50 cent coin featuring a red poppy will be issued by the Reserve Bank in October to commemorate Armistice Day. Reserve Bank governor Adrian Orr said the coin would have significance for those whose relatives served in the First World War.  → Read more at stuff.co.nz

→ Read more at stuff.co.nz

April 29, 2018

The CBM has been selling gold coins in weights of one tical, half-tical and quarter-tical since 1991. One tical is equivalent to around 16 grams. Currently, one-tical coins bear a single star, while the half and quarter-tical coins have a ploughing farmer and logging elephant engraved, respectively.  → Read more at mmtimes.com

→ Read more at mmtimes.com

April 30, 2018

Cebu City — The Bangko Sentral ng Pilipinas (BSP) will launch the New Generation Currency (NGC) series during its anniversary in July. Leonides Sumbi, regional director of BSP in Central Visayas, said the release of the new coins is not meant to create confusion as BSP will soon demonetize the old coins.  → Read more at news.mb.com.ph

→ Read more at news.mb.com.ph

May 1, 2018

Ian Vogler/Mirrorpix/Newscom With less than three weeks before the royal wedding, Britain’s Royal Mint today released a special commemorative coin to mark the occasion. A new British five-pound coin (about $6.88) celebrates Prince Harry and Meghan Markle’s upcoming wedding May 19.  → Read more at abcnews.go.com

→ Read more at abcnews.go.com

May 2, 2018

LISBON, May 2 (Xinhua) — The Bank of Portugal bought 272 million 1 and 2 cent coins from the Bank of Ireland in 2017, the Publico newspaper reported on Wednesday. Specifically, the Bank of Portugal purchased 148.8 million 2 cent coins and 123.2 million 1 cent coins.  → Read more at xinhuanet.com

→ Read more at xinhuanet.com

May 3, 2018

Getty Images Overall global gold demand fell to its lowest first-quarter level since 2008, driven by a slump in demand for gold bars and exchange-traded funds backed by the precious metal, according to a report from the World Gold Council released Thursday.  → Read more at marketwatch.com

→ Read more at marketwatch.com

May 3, 2018

OTTAWA, May 3, 2018 /CNW/ – The Royal Canadian Mint (the "Mint" or the "Company") is pleased to release its 2017 financial results, which provide insight into our activities, the markets influencing our businesses and our expectations for the year ahead.  → Read more at markets.businessinsider.com

→ Read more at markets.businessinsider.com

May 3, 2018

While credit cards were once reserved for large purchases across Australia, more people than ever are using plastic for items as cheap as a morning coffee.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

May 5, 2018

A late revolt bronze coin discovered where rebels sought refuge in a cave near Modiin indicates geographically widespread Jewish backing of the ultimately bloody Jerusalem uprising  → Read more at timesofisrael.com

→ Read more at timesofisrael.com

May 1, 2018 | coins, commemorative, dollar, legislative

The first of the month is when I usually report about the introduction or progress of numismatic-related legislation in congress for the previous month. For April 2018, there is nothing to report.

The first of the month is when I usually report about the introduction or progress of numismatic-related legislation in congress for the previous month. For April 2018, there is nothing to report.

Thus far, the 115th Congress passed The American Legion 100th Anniversary Commemorative Coin Act (Pub. L. 115-68) which allows for a gold $5, silver dollar, and clad half-dollar coins to commemorate the American Legion in 2019.

There have been no authorizing laws passed for commemoratives after 2019.

Two bills have passed the House of Representatives and are waiting in committees in the Senate for action:

- The Naismith Memorial Basketball Hall of Fame Commemorative Coin Act (H.R. 1235) would allow the minting of q gold $5, silver dollar, and clad half-dollar coins in honor of the 60th anniversary of the Hall of Fame in Springfield, Massachusetts.

- The American Innovation $1 Coin Act (H.R. 770) would be a 14-year $1 coin program that would issue coins commemorating innovation and innovators representing each state, the District of Columbia, and U.S. territories.

Just because these bills passed in the House does not mean the Senate will do anything about them. Both can die in committee without any consideration.

So that the record is complete, here are the numismatic-related bills introduced in the House of Representatives waiting in committee:

- Muhammad Ali Commemorative Coin Act (H.R. 579)

- Duty First Act (H.R. 1582)

- National Purple Heart Hall of Honor Commemorative Coin Act (H.R. 1683)

- Cents and Sensibility Act (H.R. 2067)

- Christa McAuliffe Commemorative Coin Act of 2017 (H.R. 2256)

- Currency Optimization, Innovation, and National Savings Act of 2017 (H.R. 2299)

- United States Coast Guard Commemorative Coin Act of 2017 (H.R. 2317)

- President John F. Kennedy Commemorative Coin Act (H.R. 3274)

- 75th Anniversary of the End of World War II Commemorative Coin Act (H.R. 4044)

- Plymouth 400th Anniversary Commemorative Coin Act of 2017 (H.R. 4539)

- National Law Enforcement Museum Commemorative Coin Act (H.R. 4732)

- Women’s History and Nineteenth Amendment Centennial Quarter Dollar Coin Program Act (H.R. 5308)

- To define the dollar as a fixed weight of gold. (H.R. 5404)

Not to be outdone, here is the list for the Senate:

- Saint-Gaudens National Historical Park Redesignation Act (S. 312)

- Currency Optimization, Innovation, and National Savings Act of 2017 (S. 759)

- Duty First Act (S. 921)

- United States Coast Guard Commemorative Coin Act of 2017 (S. 1021)

- American Innovation $1 Coin Act (S. 1326)

- Naismith Memorial Basketball Hall of Fame Commemorative Coin Act (S. 1503)

- President John F. Kennedy Commemorative Coin Act (S. 1568)

- Muhammad Ali Commemorative Coin Act (S. 166)

- 75th Anniversary of the End of World War II Commemorative Coin Act (S. 1718)

- Plymouth 400th Anniversary Commemorative Coin Act of 2017 (S. 2189)

- American Innovation $1 Coin Act (S. 2399)

Apr 29, 2018 | coins, gold, news

“Find of the Century,” a rare 1854-S $5 Half Eagle authenticated and graded by NGC

The coin was discovered by a New England man who wishes to remain anonymous, asked several dealers about the coin before sending it to Numismatic Guarantee Corporation for authentication. NGC investigated the coin, found it to be authentic with a grade of XF-45

It is one of only four coins known to exist. One is in the Smithsonian, another is in the Pogue collection, and there is one that was stolen in 1967 that has never been found.

All of the stories covering this find have been about the coin and little is known of the current owner. Borris Tavrovsky, a co-owner of Oxbridge Coins in San Francisco, said that the coin could be worth $3-4 million based on the sale of other coins from the Gold Rush-era. Of course, if it goes to auction and if you have two people who desperately want the coin, it could sell for more.

“I think he’s going to be quite rich,” Tavrovsky was quoted as saying. “I can see why he wants to remain a mystery man. Some people who win the lottery don’t want to reveal their identity for fear those cousins start badgering you.”

What would you do if you found a rare coin?

And now the news…

April 24, 2018

It's only one of four known to exist — and one of those went missing after it was stolen by masked gun-wielding robbers in 1967. A small gold coin originally thought to be a fake was authenticated in April by experts as an 1854 California Gold Rush coin, one of 268 struck at the San Francisco Mint that year.  → Read more at sfgate.com

→ Read more at sfgate.com

April 25, 2018

The South African Mint has officially launched two new coins which pay tribute to president Nelson Mandela.  → Read more at businesstech.co.za

→ Read more at businesstech.co.za

April 25, 2018

Share the love  → Read more at lovemoney.com

→ Read more at lovemoney.com

April 25, 2018

What: Historic Coins and Medals, Featuring Morgan Silver Dollars from the Collection of Ralph and Lois Stone Where: Sotheby's, 1334 York Ave, New York, NY 10021, USA When: 21 May  → Read more at blouinartinfo.com

→ Read more at blouinartinfo.com

April 25, 2018

NEW YORK/LONDON (Reuters) – U.S. retail investors are losing their appetite for physical gold as buoyant stock markets offer tempting alternatives, sending sales of newly minted coins to their lowest in a decade.  → Read more at reuters.com

→ Read more at reuters.com

April 28, 2018

Hint: You’ve definitely spotted it on Instagram.  → Read more at glamour.com

→ Read more at glamour.com

April 28, 2018

BRITONS can keep spending their pennies for years to come.  → Read more at dailystar.co.uk

→ Read more at dailystar.co.uk

Apr 24, 2018 | coins, fun, values, video

Passing the time after 10:00 PM on Monday night, the television found its way to the History Channel for the return of Pawn Stars, the reality show about a pawn shop in Las Vegas. While the first show of the hour was just interesting it was the second show that started at 10:33 PM that was more intriguing.

Although the show was marked as “NEW” on the visual guide, it first aired last January. To make sure I was able to study the coins more, I found the episode on the History Channel website. It is also available on YouTube at https://youtu.be/yTKbcAKbQtU. (embedded below)

Opening the show, a seller name Walter walked in with two rare coins. The first coin was a 1792 Half Disme and the other a silver Libertas Americana. Two coins dating back to the earliest days of the country’s history.

If you recognize Walter his full name is Walter Husak. In 2008, Husak sold his extraordinary collection of large cents at an auction held during that year’s Long Beach Expo. For this show, he was selling the two coins.

The 1792 Half Disme was graded MS-65 by Numismatic Guarantee Corporation who lists the coin as a TOP POP, meaning no coin has graded higher. There are only two half dismes graded MS-65 by NGC and one appeared on Pawn Stars.

-

-

1792 Half Disme obverse graded NGC MS-65 TOP POP (screen grab)

-

-

1792 Half Disme reverse graded NGC MS-65

(screen grab)

The Libertas Americana is one of the rare silver versions and was graded MS-61 by Professional Coin Grading Service

-

-

obverse of the silver Libertas Americana graded MS-61 by PCGS (screen grab)

-

-

Reverse of the silver Libertas Americana

(screen grab)

As with a lot of these purchases, Rick calls in an expert for assistance. This time, the expert is Jeff Garrett, the founder of Mid-American Rare Coin Galleries in Lexington, Kentucky and immediate past president of the American Numismatic Association.

Jeff Garrett stands next to Walter Husak as they examine the Half Disme and Libertas Americana on Pawn Stars (screen grab)

I noted that Garrett’s firm is in Lexington since the location of the television show is in Las Vegas. While doing a little online investigation into the prices and to see if there was more information, there was a note on the Collectors Universe forums suggesting that the segment was not a reality, but it had been staged.

According to user “cardinal,” he wrote:

Jeff Garrett is one of the experts that gets brought in to evaluate numismatic items for the show. For this specific episode, Jeff was looking for both a half disme and a Libertas medal, and Jeff was able to locate them and had the respective owners’ permission to have them appear on the show. The half disme is pedigreed to the Garrett Collection, and the silver Libertas medal was one that Jeff Garrett had sold some years back. (This particular Libertas medal has been in the Cardinal Collection for the past 6 years.)

I believe Ccardinal is the anonymous person behind the Cardinal Collection who has collected some of the finest coins in the PCGS registry.

Following a discussion on the actual Libertas Americana used for the show, he ends with:

During the show, the half disme was a no-sale. The Libertas medal was shown as sold at $150K on camera. That being said, the piece was not actually sold, even though Rick actually did want to buy it for $150K.

I have heard stories as to how some segments are real and some are staged. When I spoke with Charmy Harker about her appearance in 2012, I was under the impression that her attempt at selling a World War II-era aerial bomber camera was not overly staged. That does not seem to be the case in this episode.

My one complaint is that these two esteemed numismatists mispronounced the name of the coin. Everyone kept pronouncing disme as “DIZ-ME.” In reality, disme is pronounced as if the “s” was not included in the word. Disme is derived from the French term for tenth but pronounced dime—which is why the “s” was dropped after the first issues of 1792 coins.

Oh well… it was a fun segment to watch.

Apr 22, 2018 | Australia, Canada, coins, news

The royal mints in the Commonwealth Realm are have returned to court with the Royal Canadian Mint accusing the Royal Australian Mint of stealing the technology it uses to print coins.

In January, it was reported that the Royal Canadian Mint file a patent infringement lawsuit against the Royal Australian Mint when the Aussies issued 2012 Remembrance Day coins that the Canucks claim uses the same or similar technologies.

It is being reported that in March, the Royal Canadian Mint filed additional documents in the Federal Court of Australia claiming that the printing method on the coin that commemorates the Australian children’s book Possum Magic also infringes on their patents.

The original claim included the 500,000 coin run from 2012. With this updated filing to include other Remembrance Day coins, Olympic-themed coins, and other commemorative, the total is now 15 million Australian $2 coins. The Royal Canadian Mint wants all of the coins in the Royal Australian Mint’s possession to be turned over or “destroy(ed) under supervision.”

As part of their defense, the Royal Australian Mint is asking the courts to invalidate the patents claiming there is not enough novelty over previous methods. Those who watch technology patent fights here in the United States have heard this argument before.

A hearing is scheduled for June. More claims and counter-claims can be added to this lawsuit between now and then. Stay tune!

And now the news…

April 16, 2018

What can you give your country for its 70th anniversary? For thousands of school pupils and volunteers, the answer is the sweat of their brows as they worked to prepare a new public 70-kilometer (43-mile) walking path called the Sanhedrin Trail.  → Read more at timesofisrael.com

→ Read more at timesofisrael.com

April 16, 2018

An amateur archaeologist and a 13-year-old student have uncovered a stash of thousand-year-old coins, rings and pearls on an island in the Baltic Sea in northern Germany, including items that might be tied to Harald Bluetooth, the famous king who united Denmark.  → Read more at npr.org

→ Read more at npr.org

April 16, 2018

OTTAWA — A legal battle between the Royal Canadian Mint and its counterpart in Australia is heating up as Canada cries foul over “Possum Magic” coins. The Canadian Crown corporation is alleging the Royal Australian Mint stole its method for printing colour onto metal, and has expanded a December lawsuit over red poppies on a run of 2012 Remembrance Day coins.  → Read more at nationalpost.com

→ Read more at nationalpost.com

April 18, 2018

Maloney, author of the Purple Heart Hall of Honor Commemorative Coin Act, commended Purple Heart Hall of Honor, Inc. after it announced its “Campaign for 290,” which aims to attract at least 290 cosponsors to Rep. Maloney’s legislation by Memorial Day.  → Read more at hudsonvalleynewsnetwork.com

→ Read more at hudsonvalleynewsnetwork.com

April 19, 2018

The "Half Eagle" is 164 years old and one of only four known  → Read more at heraldtribune.com

→ Read more at heraldtribune.com

April 19, 2018

The Royal Canadian Mint claims an Australian Possum Magic-themed coin infringes on their patent.  → Read more at bbc.com

→ Read more at bbc.com

April 19, 2018

The Ernst Badian Collection gives insight to Roman history, as well as the evolution of currency.  → Read more at njtvonline.org

→ Read more at njtvonline.org

April 19, 2018

Silver is, like gold, a commodity store of value and is free of counterparty risk, with energy-intensive replacement costs setting the lower boundary for prices (the same energy proof of value that underlies gold prices).  → Read more at goldmoney.com

→ Read more at goldmoney.com

April 19, 2018

The Royal Canadian Mint, which is the official maker of the country’s money, has said the commemorative Australian series, which celebrates the classic Mem Fox children’s book Possum Magic, ripped off its unique process of painting colour onto metal.  → Read more at news.com.au

→ Read more at news.com.au

April 20, 2018

A former Bank of Japan employee was arrested Friday for allegedly stealing gold coins worth a total of ¥200,000 ($1,850) from the central bank’s Tokyo head office, police said. Koichi Yakushiji, 54, is suspected of stealing the two gold coins on April 2, the police said.  → Read more at japantimes.co.jp

→ Read more at japantimes.co.jp

Apr 15, 2018 | coins, news, US Mint

David J. Ryder, 39th Director of the U.S. Mint

The U.S. Mint has been without an appointed director since Edmund C. Moy resigned as the director effective on January 9, 2011, although he had vacated his office earlier. Moy’s term was to expire on September 5, 2011. He was one of the few officials from the George W. Bush administration to work under Barack Obama.

Moy will be remembered for the problems with the U.S. Mint’s website ablity to meet collector demand and the debacle over not having enough bullion planchets to meet demands of investors and collectors.

Ryder comes to the U.S. Mint after holding the position of Global Business Development Manager and Managing Director of Currency for Honeywell Authentication Technologies. As part of his work, Ryder worked with the Royal Mint during their development of the security technology that they are currently being used for the new one-pound coin.

During his confirmation, Ryder was asked about counterfeit technologies and how it could help in the United States. Although counterfeiting is a concern, current circulating coins are not the counterfeiter’s targets. For coins, the targets are the older collectible coins with an overwhelming target being Morgan and Trade dollars.

This is a return for Ryder who served as the 34th Director from September 1992 to November 1993 during the administration of President George H.W. Bush. His experience with running the U.S. Mint in the past and his work with Honeywell should help him be successful.

Welcome, Mr. Ryder and good luck!

And now the news…

April 11, 2018

Football fans were shocked to learn that Patriots tight end Rob Gronkowski is a coin collector. On Wednesday night ESPN Sports Business Reporter Darren Rovell tweeted a new detail about Gronkowski's $1million home being burglarized on February 5, the night the Patriots lost to the Philadelphia Eagles in Super Bowl LII.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

April 11, 2018

To mark the 20th anniversary of Astana and the 25th anniversary of the national currency, the National Bank of Kazakhstan will issue a new series of commemorative coins. This is great news for numismatists of many countries.  → Read more at kazakh-tv.kz

→ Read more at kazakh-tv.kz

April 12, 2018

Bank tellers beware! A coin con man may be on a roll, warn North Vancouver RCMP – literally. The inventive fraudster recently bilked a bank in North Vancouver by cashing in what the teller believed were more than 45 toonies and leaving significantly lighter, pocketing $2,600 in bills.  → Read more at nsnews.com

→ Read more at nsnews.com

April 13, 2018

A junk dealer in Turkey returned 100 gold coins he found hidden away in an old stove, state run Anadolu news agency reported on Friday. Asir Ozturk, 36, has been making a living by collecting and selling junk materials in Burdur for the last 20 years, according to the report.  → Read more at thenews.com.pk

→ Read more at thenews.com.pk

April 14, 2018

In 1974, Reno stock investor and real estate man, Lavere Redfield, passed away at the age of 77 years. Lavere was born in Utah and his father died when Lavere  → Read more at elkodaily.com

→ Read more at elkodaily.com

Apr 13, 2018 | coins, commentary, ethics

EPA Administrator Scott Pruitt

Scott Pruitt, the 14th Administrator of the Environmental Protection Agency, has decided that rather than saving taxpayer money, he will spend additional money to have the EPA redesign the challenge coin that he uses on behalf of the EPA.

According to the New York Times, Pruitt wants to make the challenge coin bigger and to delete the EPA logo. According to a retired career EPA employee, it appears that Pruitt wants the coin to be all about him and not the agency.

The reverse side of the E.P.A. challenge coin conceived under Administrator Lisa P. Jackson, left, and the face of the coin issued when Gina McCarthy led the agency. (Photo Credit: Ron Slotkin/The New York Times)

“These coins represent the agency,” said Ronald Slotkin, who served as the director of the E.P.A.’s multimedia office. “But Pruitt wanted his coin to be bigger than everyone else’s and he wanted it in a way that represented him.”

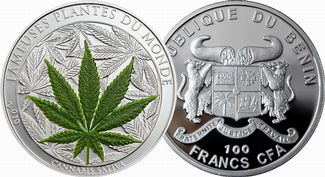

It is reported that Pruitt does not like the agency seal because (brace yourself) he felt it looks like a marijuana leaf!

-

-

Official logo of the United States Environmental Protection Agency

-

-

Leaf of the cannabis sativa plant

Pruitt is not the first agency head to extend his ego to challenge coins. Last fall, Interior Secretary Ryan Zinke commissioned his own challenge coin. At the time, it was thought to be the only Cabinet-level official to have his own challenge coin.

In order to create a new challenge coin, the manufacturer must create new dies. Making new dies does have a cost, as opposed to either using an existing die or having an existing design reworked. According to the website of Challenge Coins Plus, the company The New York Times story said was involved with making other challenge coins for the EPA, if Pruitt wants a 2.5-inch coin, the mold fees are $100 per side ($200 for both sides). Once the molds are made, 2-sided colored coins are $5.57 each for 2,000 coins ($11,140) without customizations such as custom edges and capsules.

However, Pruitt is not stopping with challenge coins. He has ordered pens, notebooks, and leather binders to exclude the logo and replaced with his name in a larger font. All at an additional charge to taxpayers.

At least when the U.S. Mint fails, it does not cost the taxpayers any money since the U.S. Mint’s operations are paid by the seignorage and not from the general treasury.

Apr 10, 2018 | coins, commentary, education, US Mint, values

I write this blog from the perspective of a collector. I champion the collector. I think that collectors are the most qualified to determine the direction of the hobby. The collector is the consumer and the consumer is almost always right.

When it comes to helping with the direction of the hobby dealers should also have a say. Their input is important. But they should be there to support the collector because without collectors the dealers have no business. Dealers should not be dictating the direction of the hobby.

Are these sets hurting the hobby? Should the U.S. Mint stop producing them? (U.S. Mint image)

Regular listeners to The Coin Show knows that Matt is not a fan of modern coins and the products of the U.S. Mint. In fact, during the last show, he admitted to not carrying American Eagle coins because he does not want to support the U.S. Mint in damaging the hobby.

During the podcast, Mike came to the defense of U.S. Mint collectors but that defense was tempered when he said that collecting U.S. Mint products was for beginner collectors and that it was a way to start before the collector “graduate” to other collectibles.

I have questioned Matt and Mike in the past on Facebook but this time I felt their statements crossed a line. My regular readers know I can get hyperbolic but I try to remain respectful. As it happens on Facebook and anywhere else on the Internet, people cannot take the words at face value and have to read something into them.

This time I emphasized that not only do I collect U.S. Mint items but have not “graduated” to the type of collectibles Mike and Matt proclaim to be real collectibles. New readers can go through this blog and see how my collection can be classified as normal to eclectic.

After a lot of angry discussions (you will see a sample below) and some churlish responses from others (not Matt or Mike), I finally coaxed out the reasons for Matt’s hatred of modern U.S. Mint products. Unfortunately, it seems his reasons have more to do with the industry than the U.S. Mint.

According to Matt, the U.S. Mint is harming numismatics by selling annual sets like proof and mint sets at the prices they set. During the Facebook discussion, Matt and Sam Shafer, another Indianapolis-area dealer, said that they believe the U.S. Mint’s prices are too high.

From their perspective as dealers, they claim it is the U.S. Mint’s fault for the differences between the manufacturer’s suggested retail price the secondary market.

Using that logic, can I blame Chevrolet for the secondary market price of the 2014 Silverado I just purchased? If I tried, General Motors would laugh me under the tonneau cover of the truck! Yet, coin dealers are applauded for applying the same logic. This does not make sense.

How can you blame the manufacturer for the secondary market’s reaction?

Matt wrote, “I feel like the depreciation seen in modern sets is much more harmful to potential collectors or beginning collectors.”

I guess if General Motors followed that logic, they would stop making trucks!

But we are talking about collectibles. In that case, Topps, Fleer, and Upper Deck should stop producing baseball cards.

This is only an argument by dealers who would rather sell what they like and not take a broader view of the collecting market. In my new life, I am a collectibles and antiques dealer. The items I buy are either from the secondary market or I buy new items from manufacturers such as comic book and baseball card publishers.

This 1901 $10 Dollar Lewis and Clark Bison note (Fr# 122) was sold by a dealer at an antiques show by a dealer not complaining about the collecting market.

The vast majority of dealers are very good and very reasonable. Many do understand the view of the collector and work with them. However, there is a subset of dealers that can be some of the most stubborn business people I know. They refuse to change with the market. Even if the market is not looking for their niche, they will not adapt to the market. Their mind is made up do not confuse them with facts.

They are also the most vocal in their opposition to market forces. Their usual retort is “you don’t understand, you’re not a dealer!”

With all due respect, I do not need to be a dealer to know that not changing with the times is doing more to hurt the hobby than the U.S. Mint is by doing its job.

Did you know that the Pobjoy Mint struck this coin under the authority of the British Virgin Islands. Is this good for the hobby? (Pobjoy Mint image)

The U.S. Mint does not offer dozens of non-circulating legal tender (NCLT) coins. U.S. Mint coins are struck and not painted. The U.S. Mint does not offer piedfort version of circulating coins or even coins guilt in gold or palladium. The U.S. Mint does not make deals with movie production companies, comic book publishers, or soft drink manufacturers to issue branded coins.

Every coin that the U.S. Mint offers for sale has an authorizing law limiting what they could produce. According to those laws, the U.S. Mint has to recover costs and is allowed to make a “reasonable” profit.

But what is reasonable? This is a question that has a lot of valid arguments on both sides. However, the U.S. Mint is subject to oversight by the Treasury Office of the Inspector General (OIG) and, occasionally, review by Congress’s Government Accountability Office (GAO). Neither oversight agency has produced a report saying that the U.S. Mint’s prices are unreasonable.

The U.S. Mint is selling what they manufacture at a price that the competent oversight agencies have not complained about. The only one complaining is by the dealers in the secondary market.

Why are these dealers complaining?

We get to the crux of the problem when Sam Shafer responds, “I would rather sell a customer a Morgan dollar than a set of glorified shiny pocket change.”

It does not take a rocket scientist to understand why a dealer would write that. A dealer makes more money selling Morgan dollars than modern coins. It is about business, not about what the U.S. Mint is doing. It is also a very reasonable response if the dealer would own up to the fact that it is about the impact to their business. Blaming the U.S. Mint is like crashing into a wall and blaming the wall for being there!

But Sam must have had some bad experiences: “How about you come down from your pedestal, put your loudspeaker up your rectum and work in a shop for a few years where you can witness the devastation of families first hand for a few years.”

This is a strong statement, even if you discount the placement of inanimate objects into bodily orifices they do not belong. What has the U.S. Mint done to cause “devastation?” The U.S. Mint sells products to those who want to buy them. You are not forced to buy from the U.S. Mint.

Sam continues, “While your [sic] at it maybe you can take up your glorious cause of finding homes for the 50 billon [sic] sets the government produced and bulk sold over the years to the collectors who assumed that 5 sets would better than 1.”

By Sam’s logic, it is the U.S. Mint’s fault that someone speculated and the investment did not pan out? Whose fault is that? Who told someone that buying these sets would be a good investment? Not the U.S. Mint! Where does the U.S. Mint say in any of its publications or website that coins make a solid investment? How could these speculators have come to this conclusion?

2018 Fiji Coca-Cola Bottle Cap-shaped coin is not a U.S. Mint product. It contains 6 grams of silver (about $3.20) and costs $29.95. Is this good for the hobby? (Modern Coin Mart image)

The U.S. Mint does not even acknowledge historical and aftermarket pricing for the items they manufacture.

The U.S. Mint sells collectible coins. They do not sell investments.

Over the years, I have received more complaints about dealers than allegedly worthless State Quarters or the U.S. Mint’s annual sets. But why are coins allegedly worthless?

Did the U.S Mint make claims that these one-time-only coins are really special and that they would be the greatest thing since sliced bread?

This is not a U.S. Mint Product! (Danbury Mint image)

Did the U.S Mint create books, boards, folders, albums, maps, touting this as a once-in-a-lifetime way to collect?

All this came from the secondary market. Who runs the secondary market? DEALERS!

DEALERS set the values for the coins based on what they sell them for.

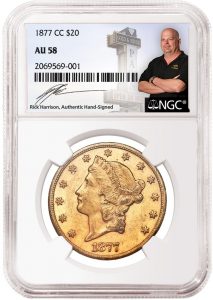

DEALERS take coins and entomb them in sonically sealed plastic holders saying that this is how you should be collecting. They tell you one encapsulating service is better than another and then make you pay different prices if you use a service they do not like even if the number assigned as a grade is the same on both pieces of plastic.

DEALERS have convinced an entire class of collectors that if they do not have a plastic holder with this new, whiz-bang label that their collection is not complete.

Tragedy grips the industry when a Pawn Star is featured on a plastic holder’s label! (NGC image)

DEALERS genuflect when someone puts a shiny green sticker on a plastic holder as if it was blessed by some deity. They prostrate themselves if the plastic holder is granted that divine gold sticker! After preaching this gospel to their flock, you are considered a heretic if you question the validity of the sticker and the motives of the sticker maker.

While the U.S. Mint is not perfect, the problems with the numismatic market have not been created by a tightly regulated government bureau. The problems come from the secondary market whether they are overstating the values of these items or demeaning collectibles that they cannot make a hefty profit on.

Maybe it is time for dealers to look in the mirror and ask whether the U.S. Mint is hurting the hobby or maybe they are refusing to recognize the problem is right in front of them.

Apr 8, 2018 | Canada, coins, commentary, nclt, news

The Royal Canadian Mint has officially Jumped the Shark!

2018 Canada $20 coin commemorates the 1967 Falcon Lake alleged UFO incident. (Source: Royal Canadian Mint)

Popular usage has been those times when a show, company, or anyone does something so outlandish to attract attention that was once lost.

One might say that the Royal Canadian Mint might have jumped the shark in the past, but they have really outdone themselves this time. They issued a one-ounce silver, $20 face-value non-circulating legal tender (NCLT) coin to commemorate an alleged UFO sighting.

When it goes on sale, the will cost $129.95 ($101.69 USD).

Aside from being 6.22-times the spot price of silver, the design is printed on the egg-shaped planchet. There appears to be nothing about the coin that is struck.

I have heard some say that things the U.S. Mint is doing is bad for the hobby. Some have targeted the American Liberty 22th Anniversary Gold Coin as being over the top. Although I have a problem with the coins having a high premium over spot prices, the coin pales in comparison to the UFO and other lenticular coins being offered by the Royal Canadian Mint.

And now the news…

April 2, 2018

Sales in March of U.S. Mint American Eagle gold fell to their lowest for the month, and silver coins dropped to their lowest in 11 years, government data showed.  → Read more at cnbc.com

→ Read more at cnbc.com

April 2, 2018

Scientists are left wondering how the coins remained hidden for so long.  → Read more at newsweek.com

→ Read more at newsweek.com

April 2, 2018

A Long Island businessman who built a textile empire by peddling irregular sweaters at local flea markets thought he had a fool-proof way to boost his assets — invest in a pal’s coin business. Bad …  → Read more at nypost.com

→ Read more at nypost.com

April 3, 2018

The oval-shaped coin immortalizes Stefan Michalak’s experience in Whiteshell Provincial Park, more than 50 years ago in what became known as the Falcon Lake incident.  → Read more at thestar.com

→ Read more at thestar.com

April 3, 2018

The Royal Canadian Mint has released a new $20 coin to commemorate one of Canada's closest encounters with a UFO.  → Read more at ctvnews.ca

→ Read more at ctvnews.ca

April 5, 2018

Now that the nation has a $1.3 trillion budget, lawmakers can resume debate about whether to pinch pennies. The threat to do away with pennies and nickels  → Read more at newsherald.com

→ Read more at newsherald.com

April 5, 2018

A trove of bronze coins, the last remnants of an ancient Jewish revolt against the Roman Empire, have been discovered near the Temple Mount in Jerusalem.  → Read more at foxnews.com

→ Read more at foxnews.com

April 5, 2018

Medieval coins dating back 800 years have been unearthed in north Shropshire.  → Read more at shropshirestar.com

→ Read more at shropshirestar.com

Apr 6, 2018 | coin design, coins, commentary

A 1979-D Susan B Anthony dollar found in change that was mistaken for a quarter.

This week, I was involved in a real-life example of this confusion.

While getting ready to retire for the evening, I empty my pockets on my dresser and look to see if there is anything interesting. Since my only trip of the day was a local grocery store, I did not expect anything. As I looked at what I thought was 78-cents something did not look right. As it turned out, one of the quarters was not a quarter.

Mixed in with the change from my single transaction of the day was a 1979-D Susan B. Anthony dollar coin. Not only did the cashier make the mistake, but when I accepted the change I did not catch the difference.

A real-life example as to the reason why the Susie B. was not a successful coin!

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces. → Read more at stuff.co.nz

→ Read more at stuff.co.nz → Read more at mmtimes.com

→ Read more at mmtimes.com → Read more at news.mb.com.ph

→ Read more at news.mb.com.ph → Read more at abcnews.go.com

→ Read more at abcnews.go.com → Read more at xinhuanet.com

→ Read more at xinhuanet.com → Read more at marketwatch.com

→ Read more at marketwatch.com → Read more at markets.businessinsider.com

→ Read more at markets.businessinsider.com → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk → Read more at timesofisrael.com

→ Read more at timesofisrael.com The first of the month is when I usually report about the introduction or progress of numismatic-related legislation in congress for the previous month. For April 2018, there is nothing to report.

The first of the month is when I usually report about the introduction or progress of numismatic-related legislation in congress for the previous month. For April 2018, there is nothing to report.