Apr 9, 2015 | BEP, currency, history, policy

NOTE: I am doing research into the policies that create our money. This is not a look into the economic policies but what happened after the economic policies are executed. For this series of articles, I wanted to know what happened after it was decided that the country would sell bonds in order to fund the Civil War. This is a summary of some of the research to answer one question and tie it in with history.

First of three parts.

Did you ever want to know how or why something was done but there was no answer? Or there may have been answers but nothing definitive that would make any of the answers true? It is this type of curiosity that had me searching for the answer to one question:

Why is the greenback green?

There are references that claim that the green printed back was to differentiate the currency of the United States from those from other countries. Other references call it an anti-counterfeiting mechanism. Neither claim can tie themselves to the actual events in such a way that we can say which is the truth. Or can we?

Col. Dick Taylor

Shortly after Taylor’s birth, the entire Taylor family moved to Kentucky because of exhausted lands in southern Virginia. They settled along the Ohio River outside of Louisville. In 1814, Giles moved his family Shawneetown, Illinois as one of the area’s pioneer settlers. Unfortunately, Giles died shortly thereafter leaving the family of little means.

Preferring to be called by his middle name, Taylor would be referred to by the common nickname of Dick and began travelling throughout the Midwest region to earn a living. At this time he would sign his name as “E.D. Taylor.” Dick Taylor demonstrated a lot of skill in organizing while operating as a trader on the frontier. By 1929, Taylor settled in Springfield, Illinois and married Margaret Taylor, the daughter of Col. Richard Taylor and sister of then Col. Zachary Taylor.

When the Black Hawk War broke out in 1831, he enlisted in the Illinois infantry and appointed as a colonel by the governor where he served with Jefferson Davis, General George Jones, and General Henry Dodge. Following the war he was elected to the Illinois House of Representatives then, after one term, was elected to the senate defeating a long-standing senator.

Taylor ran his senate campaign on a platform to move the capital from Vandalia to Springfield. To accomplish this, Taylor wrote a bill and worked with a representative named Abraham Lincoln, whom he met as a shopkeeper in New Salem. The bill was successful and Springfield has been the capital of Illinois since.

Taylor was a master at managing money and served the state in many capacities. In 1835, Taylor was appointed Receiver of Public Moneys in Chicago. Today, that position would be known at the comptroller. Under Taylor’s guidance, Chicago managed land sales better than any other city in the country and grew Chicago into the second largest city in the United States passing Philadelphia for that distinction. He was so well regarded in Washington, that not only did President Andrew Jackson hold a special dinner in Taylor’s honor, but appointed him to the commissions that oversaw the building of railroads in the upper Midwest.

With his connections from Springfield and working with Jackson, who is considered the father of the modern Democratic Party, Taylor became a member of the party and helped build the political machine that continues to run Chicago today. He was a friend and staunch supporter of Stephen A. Douglass and would travel the state stumping for Democratic candidates.

Taylor did not forget his friendship with Lincoln. Even though Lincoln had joined the then nascent Republican Party, he would also campaign with his friend in areas that were not strong Democratic strongholds. But for the presidential election of 1860, Taylor supported Douglas and campaigned throughout Illinois against Lincoln.

25th Secretary of the Treasury Salmon P. Chase

Knowing how Taylor turned around the finances of Chicago and then the railroad alliance, Lincoln turned to his old friend for advice. Taylor convinced Lincoln to ask congress to issue currency backed by the bonds but with no interest. Using what he learned in managing tickets sales for the railroads, Taylor provided Lincoln the outline for a currency system that was adopted with much reluctance by Chase.

First published in Abraham Lincoln, author Emil Ludwig found a letter acknowledging Taylor as the person who came up with the idea:

My dear Colonel Dick:

I have long determined to make public the origin of the greenback and tell the world that it was Dick Taylor’s creation. You had always been friendly to me. and when troublous times fell on us, and my shoulders, though broad and willing, were weak, and myself surrounded by such circumstances and such people that I knew not whom to trust, then I said in my extremity, ‘I will send for Colonel Taylor — he will know what to do.’ I think it was in January 1862, on or about the 16th, that I did so. Said you: ‘Why, issue treasury notes bearing no interest, printed on the best banking paper. Issue enough to pay off the army expenses and declare it legal tender.’ Chase thought it a hazardous thing, but we finally accomplished it, and gave the people of this Republic the greatest blessing they ever had — their own paper to pay their debts. It is due to you, the father of the present greenback, that the people should know it and I take great pleasure in making it known. How many times have I laughed at you telling me, plainly, that I was too lazy to be anything but a lawyer.

Yours Truly.

A. Lincoln

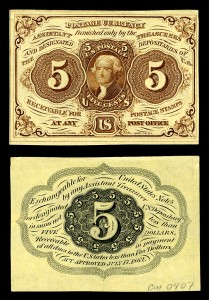

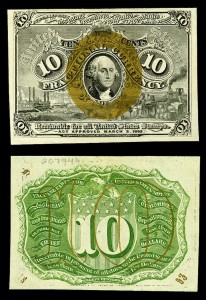

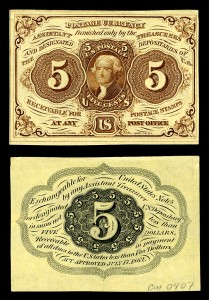

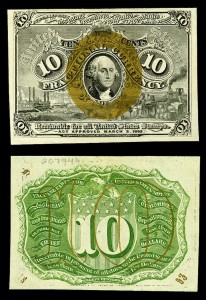

Lincoln, not one to miss an opportunity, used his executive authority to begin the production of a national paper currency in the form of Demand Notes as an extension of the Act of July 17, 1861 (12 Stat. 259) that authorized the printing of fractional currency.

Since the federal government did not have printing facilities, the law was written to allow notes to be produced by a “New York bank note company.” The first four issues fractional currency were printed by the American Banknote Company and the National Banknote Company. By the fifth issue, the new Bureau of Engraving and Printing began to print these notes.

First issue: 5-cents, Thomas Jefferson (Fr. #1231)

Second issue: 10-cents, George Washington (Fr. #1246)

Third issue: 50-cents, Francis Spinner (Fr. #1328)

To save time and money, the first series of notes were printed four and six to a sheet in New York then shipped to Washington where the Treasury set up the Office of the Currency Comptroller to manage. As par of the OCC, the National Currency Bureau was created to do the cutting, bundling, and distribution of the currency.

Fourth issue: 50-cents, Abraham Lincoln (Fr. #1374)

Fifth issue: 25-cents, Robert Walker (Fr. #1308)

The process for the United States to print its own currency had begun. While Secretary Chase was leading the plan to build a printing operation, congress authorized Treasury to establish an engraving and security printing bureau. That law was approved on July 11, 1862 (12 Stat. 532). With construction for a printing facility underway, Treasury hired James Duthie as the first engraver. Although he was a temporary engraver, he was provided a $1,600 per year salary (the equivalent to just under $38,000 in current dollars).

In Part 2 we introduce you to a little known geologist who may have developed more than the theory of the greenhouse effect.

References:

- Conrad, Howard Louis. “The Originator Of Greenback Currency: Colonel Edmund Dick Taylor.” The National Magazine, June 1892, 209-14.

- Ludwig, Emil, Eden and Cedar Paul (translators). Abraham Lincoln. Boston: Little, Brown, 1930.

- Mitchell, Wesley C. A History of the Greenbacks, with Special Reference to the Economic Consequences of Their Issue: 1862-65. Chicago: University of Chicago Press, 1903.

- History of the Bureau of Engraving and Printing, 1862-1962. Washington: Treasury Dept.; 1964.

- Gurney, G., & Gurney, C. (1978). The United States Treasury: A pictorial history. New York: Crown.

- Friedman, Morgan. “The Inflation Calculator.” Accessed April 7, 2015. http://www.westegg.com/inflation/.

Credits:

- Image of Col. E.D. Taylor from The National Magazine, June 1892.

- Image of Salmon P. Chase from the Library of Congress via Wikimedia Commons

- All fractional currency images courtesy of Wikimedia Commons

Feb 6, 2015 | bullion, coins, commemorative, commentary, gold, policy, silver, US Mint

Reverse of the 2015 US Marshal Service 225th Anniversary Commemorative Coins

Time and again, we hear that congress wants the government to save money. They want agencies to reduce costs and build efficiencies. How can agencies save money when members of congress introduce legislation that is counter to those goals?

Congress has been told that the U.S. Mint could save money if they standardized gold coins to 24-karat coins and silver to at least .999 fine quality. Aside from making the coins more attractive to more buyers including investors, the U.S. Mint does not have to pay more for someone to “dirty” the metals to create planchets that contain 90-percent of the metals.

Modern manufacturing methods are geared to process mined metals to create purer metals. In order for the gold or silver to be used to make the 90-percent alloy, it has to be dirtied with another metal, such as copper, before creating the planchets. While it makes the metals cheaper, the process increases the costs per planchet because of the extra work involved.

Congress exasperates this problem by not listening to the U.S. Mint and doing a virtual copy-and-paste from previous bills that says $5 gold commemoratives be made from 90-percent gold and silver dollars from 90-percent silver.

Rather than listening to the U.S. Mint, Rep. Sean Maloney (D-NY), or a non-responsive staffer in his office, did a copy-and-paste of previous commemorative bills to introduce the National Purple Heart Hall of Honor Commemorative Coin Act (H.R. 358) that calls for a 90-percent gold $5 coin and a 90-percent silver dollar.

Regardless of how one feels about the use of commemorative coins for fundraising, if congress is going to authorize a commemorative coin, why not allow the U.S. Mint to take advantage to more efficient manufacturing and stop making them dirty the metals?

It is possible that if the U.S. Mint could create commemorative coins worthy of being on par with investor grade coins, not only could they save money in the manufacturing process which could lower the costs of the coins, but they could sell more coins. If the U.S. Mint sells more coins they could collect more of the surcharges to benefit their intended causes.

If congress really cared about saving money and increasing efficiency in the government, members like Rep. Maloney will look beyond rhetoric and actually do something, no matter how simple it is.

Up next, why some members of congress should leave well enough alone!

Image courtesy of the U.S. Mint.

Feb 4, 2015 | coins, policy, silver, US Mint

2015-W American Silver Eagle Proof

Although the price of silver is up from the beginning of the year ($15.71 on January 2 to $17.22 on February 2), the price is down from the $19.94 on January 2, 2014. Silver climbed as high as $22.05 on February 24, 2014 to as low as $15.28 on November 6, 2014. Silver prices have been on a steady climb this year with a recent peak of $18.23 on January 23, 2015.

I attach no meaning to these number except that it has allowed the U.S. Mint to lower the price of silver coins.

The changes that were announced are as follows:

| Product |

2015 Retail price |

| American Eagle One Ounce Silver Proof Coin |

$ 48.95 |

| American Eagle One Ounce Silver Uncirculated Coin |

39.95 |

| Congratulations Set |

50.95 |

| United States Mint Proof Set® |

32.95 |

| United States Mint Uncirculated Set® |

28.95 |

| America the Beautiful Quarters Circulating Coin Set™ |

7.95 |

| Annual Uncirculated Dollar Coin Set |

46.95 |

| America the Beautiful Five- Ounce Silver Uncirculated Coin™ (5 issues) |

149.95 |

This year, the U.S. Mint has started selling the 2015-W American Silver Eagle Proof collectors coin earlier than in previous years. In fact, I have already received my coin.

Feb 3, 2015 | BEP, coins, currency, Federal Reserve, policy, US Mint

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In short, both money production bureaus will be able to withdraw the money from their respective funds to fully support their operations.

Department of the Treasury requested that the BEP be allowed to withdraw $863 million for operations. The BEP have a total outlay of $918 million but will leverage $50 million from their current operating funds to make up the difference. Using projections from the previous years, the BEP anticipates an order for 8.3 billion notes or a 15-percent increase. Of the area that the BEP will be concentrating on includes additional research into anti-counterfeiting methods, make currency more accessible to the visually impaired, and modernizing the production process in Washington, D.C.

The budget does mention that the BEP was given legal authority to print currency for foreign countries with the approval of the State Department in 2005. However, the BEP has yet to be contracted by any country for this service. Many countries appear more interested in using the polymer substrate produced by the Reserve Bank of Australia than continuing to use cotton-fiber paper, which is favored in the United States.

Funding for the U.S. Mint is different in that while the Federal Reserve pays a fixed fee per currency note to the BEP, they pay face value for the coins they purchase from the U.S. Mint. Even though it costs more than face value to produce the one-cent and five-cent coins, the deficit is more than made up on the quarter dollar, the workhorse of the U.S. coin economy.

To fund its $3.59 billion operation, the U.S. Mint will be allowed to withdraw up to $20 million from their Public Enterprise Fund. That appropriation is only a cushion in case there is a shortfall in the anticipated $4.14 billion revenues. Although the U.S. Mint is now being run by Principal Deputy Director Rhett Jeppson, the organization is unlikely to reverse the production improvements implemented by former Deputy Director Richard Peterson.

One notable statement says, “The 2016 Budget includes a proposal to require the silver coins in United States Mint Silver Proof Sets to contain no less than 90 percent silver. Under current law, the half-dollar, quarter-dollar and dime coins in these sets “shall be made of an alloy of 90 percent silver and 10 percent copper.” Allowing the Mint to have flexibility in this composition will improve efficiency in the production process, lowering the costs for these products.” It appears that the U.S. Mint is asking congress to allow them to use another metal than copper while not changing the silver content. With the cost of copper rising to historic levels, using a less expensive metal on a coin that is not intended for circulation could be a cost savings.

While there will be political fireworks over other aspects of the president’s budget, those of us concerned with the money production by the Department of the Treasury can sit back and worry about other issues.

Feb 2, 2015 | coins, legislative, policy, US Mint

The 114th Congress was gaveled into session on January 5, 2015 with an air of optimism that both ends of Pennsylvania Avenue would be able to work together. Optimism can last as long as someone does not offend their opponent or there are significant lingering issues. Let the games begin.

The 114th Congress was gaveled into session on January 5, 2015 with an air of optimism that both ends of Pennsylvania Avenue would be able to work together. Optimism can last as long as someone does not offend their opponent or there are significant lingering issues. Let the games begin.

We open February with the New England Patriots winning the Super Bowl. Two weeks after the controversy over the deflation of the Patriots’ game balls, they came from behind and won the game on a last minute goal line interception. While many of the commercials were less than memorable, the game lived up to the super name. But for congress, it is only the first minutes of the game. With 23 months to go in the 114th Congress, the insanity is just beginning.

Here are the numismatic-related bills introduced in January:

S. 95: A bill to terminate the $1 presidential coin program

Sponsor: Sen. David Vitter (R-LA)

• Introduced in the Senate on January 7, 2015

• Referred to the Senate Homeland Security and Governmental Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s95

H.R. 358: National Purple Heart Hall of Honor Commemorative Coin Act

Sponsor: Rep. Sean Maloney (D-NY)

• To require the Secretary of the Treasury to mint coins in commemoration of the National Purple Heart Hall of Honor.

• Proceeds paid to National Purple Heart Hall of Honor, Inc.

• Introduced in the House of Representatives on January 14, 2015

• Referred to the House Financial Services Committee

Track this bill at https://www.govtrack.us/congress/bills/114/hr358

H.R. 516: Cents and Sensibility Act

Sponsor: Rep. Steve Stivers (R-OH)

• To amend title 31, United States Code, to save the American taxpayers money by immediately altering the metallic composition of the one-cent, five-cent, dime, and quarter dollar coins

• Introduced in the House of Representatives on January 22, 2015

• Referred to the House Financial Services Committee

Track this bill at https://www.govtrack.us/congress/bills/114/hr516

In the days to come I will have a commentary on these bills. All three have flaws that congress keeps ignoring and it is time to take action to let them know how they can get things very wrong even on something as simple as coins. Stay tuned!

Dec 30, 2014 | coins, commemorative, commentary, legislative, policy, US Mint

And now, the end is near

And so I face the final curtain.

My friend, I’ll say it clear

I’ll state my case, of which I’m certain. . .

As we wind down the end of a very interesting 2014, we also come to the end of the 113th Congress. This congress has been as inactive as any. Sure, there was a lot of press with faces from both sides spewing scary rhetoric about topics these people seem to know little about, but even when it comes to coining money, they have done less than any congress in recent memory.

As we wind down the end of a very interesting 2014, we also come to the end of the 113th Congress. This congress has been as inactive as any. Sure, there was a lot of press with faces from both sides spewing scary rhetoric about topics these people seem to know little about, but even when it comes to coining money, they have done less than any congress in recent memory.

Other than the passing the budget bill nicknamed “CRomnibus,” the 113th Congress passed only three bills that made it to the President’s desk. President Obama signed all three bills.

Bills Signed Into Law

- Public Law 113-10 (formerly H.R. 1071: To specify the size of the precious-metal blanks that will be used in the production of the National Baseball Hall of Fame commemorative coins. This was a technical change in the law that changed how the size of the planchet was determined that were not able to be considered when the law was introduced. This bill was signed into law by the President on May 17, 2013.

- Public Law 113-212 formerly H.R. 2366): The World War I American Veterans Centennial Commemorative Coin Act requires the Secretary of the Treasury to mint coins in commemoration of the centennial of World War I. In 2018, the U.S. Mint will strike not more than 350,000 silver dollar coins “emblematic of the centennial of America’s involvement in World War I.” The $10 per coin surcharge will be paid to the U.S. Foundation for the Commemoration of the World Wars to assist the World War I Centennial Commission in commemorating the centenary of World War I. This bill was signed into law by the President on December 16, 2014.

- Public Law 113-288 (formerly H.R. 2754: the Collectible Coin Protection Act. As I previously explained, this law enhances the Hobby Protection Act by allowing law enforcement and other legal actions against distributors and handlers of counterfeit coins and grading service holders. President Obama signed this bill into law on December 19, 2014.

Bills Passed by the House of Representatives

The following bill was passed by the House of Representatives but died in committee in the Senate.

- H.R. 2866: Boys Town Centennial Commemorative Coin Act

Bills Introduced in the House of Representatives

These are the bills that were introduced in the House of Representatives but died in the various committees. While it may not be apparent from the titles, all of these bills have some impact on the coinage that would be produced by the U.S. Mint:

- H.R. 77: Free Competition in Currency Act of 2013

- H.R. 220: Stop the Coin Act

- H.R. 627: National Park Service 100th Anniversary Commemorative Coin Act

- H.R. 1218: Commemorative Coins Reform Act of 2013

- H.R. 1653: Pro Football Hall of Fame Commemorative Coin Act

- H.R. 1719: Cents and Sensibility Act

- H.R. 1905: Mother’s Day Centennial Commemorative Coin Act

- H.R. 2366: World War I American Veterans Centennial Commemorative Coin Act

- H.R. 2633: Thirteenth Amendment Commemorative Coin Act

- H.R. 2760: Panama Canal and Pan-Pacific Exhibition Centennial Celebration Act

- H.R. 2932: United States Coast Guard Commemorative Coin Act

- H.R. 3146: Savings, Accountability, Value, and Efficiency (SAVE) II Act

- H.R. 3305: Currency Optimization, Innovation, and National Savings Act

- H.R. 3680: Breast Cancer Awareness Commemorative Coin Act

- H.R. 3729: Korean Immigration Commemorative Coin Act

Bills Introduced in the Senate

Coinage bills are considered revenue bills because they earn the federal government money and are used to raise funds that are paid by the government to public and private organizations. Even though the United States Constitution requires revenue bills to begin in the House of Representatives, it is not beneath the Senate to introduce their own legislation. Sometimes, senators introduce concurrent bills—bills that are similar to the one introduced in the House as a mechanism to get one of them passed. These are the bills that were introduced in the Senate that died in committee:

- S. 94: To terminate the $1 presidential coin program

- S.203: Pro Football Hall of Fame Commemorative Coin Act

- S. 768: Sound Money Promotion Act

- S. 1011: Boys Town Centennial Commemorative Coin Act

- S. 1105: Currency Optimization, Innovation, and National Savings Act

- S. 1158: National Park Service 100th Anniversary Commemorative Coin Act

- S. 1842: Pro Football Hall of Fame Commemorative Coin Act

- S. 2303: United States Coast Guard Commemorative Coin Act

- S. 2310: Mother’s Day Commemorative Coin Act

With that, we close the books on the 113th Congress.

Oct 31, 2014 | ANA, CCAC, coin design, coins, commemorative, commentary, gold, halves, medals, policy, silver, US Mint

It has been a few years since I did an All-Hallows-Eve numismatic trick-or-treat that it seems like a good time to do add one. Here are my numismatic tricks and treats for this past year.

It has been a few years since I did an All-Hallows-Eve numismatic trick-or-treat that it seems like a good time to do add one. Here are my numismatic tricks and treats for this past year.

Girl Scouts need a values adustment

TRICK: It was announced in January that the 2013 Girl Scouts commemorative coin did not generate enough sales for the U.S. Mint to provide a payout of seignorage. This is the first time this has happened. Part of the problem was that the Girl Scouts are stuck in the 1950s mindset that does not see collecting coins as a girl’s hobby. Although values are important, this shows that he Girl Scouts’ values are behind the times and will not be the catalyst behind helping expand the hobby. They should be ashamed for contributing to this failure.

ANA Willfully Gives up its Premier Status

TRICK:The Professional Numismatists Guild and the American Numismatic Association announced in January that “the first” PNG-ANA Numismatic Trade Show the weekend prior to the 2014 World’s Fair of Money in Rosemont that it will be open to the public. While making it sound exciting it made the entire show 8-days long. This was a bad move because of the length and because it makes the ANA play second to PNG. If the ANA wants to be the premier numismatic organization, the one that anyone wanting to learn about and be about numismatics, The ANA should not play second fiddle to any other organization.

There are coin treats!

TREAT:In creating a tribute to the 50th anniversary of the Kenney half-dollar, the U.S. Mint has made a coin that is not really circulated into something interesting for the collector. The dual-dated gold coin became an instant hit before the price of gold dropped and the silver sets are reportedly selling well. This was a good move by the U.S. Mint.

TREAT:For the most part, commemorative coins are sales do not meet expectation. While there are a few exceptions like 2005 Marine Corps 230th Anniversary silver dollar, most commemoratives do not come close to their maximum mintage. But the 2014 National Baseball Hall of Fame commemoratives appear to have hit a home run. The combination of the subject and the curve of the coin may be a significant factor in the coin’s success. The $5 gold and silver dollar coins are both sold out. There are some of the clad half-dollars available.

TREAT:Speaking of cool stories, what about the Saddle Ridge Hoard? After a couple found the hoard of gold coins while walking their dog, it spawned an interest in metal detectors and searching for buried treasure. It was such an amazing story that it even found its way into the national news cycle. But like everything else, another shiny story diverted the media’s attention and the coins went on sale to the general public on Amazon.com.

Not all coins are treats

TRICK: Colored and coins with gimmicks are proliferating in the market. So far, the U.S. Mint and the Royal Mint are resisting colored and other gimmicks while the Royal Candian Mint and New Zealand Mint are at a race to the bottom for gimmick coins.

Numsimatics and technology

TREAT: The ANA launched its new website with new technology ready for growth on time and under budget. This is the website that ANA Governor Laura Sperber said, “I can’t wait to see what a disaster the ANA new web site will be.” So far, there has not been a follow up from Sperber while the new site has been a success.

TREAT: More recently, the U.S. Mint had a great launch to their new website. After years of frustration with the online ordering of what would be popular items, the new site handled the launch of the 50th Anniversary Kennedy 2014 Half-Dollar Silver Coin Collection with no issues.

Failure to launch

TRICK: The U.S. Mint launched the Baseball Hall of Fame commemorative coin at the Whitman Show in March not anticipating its popularity with fewer coins that there was a demand. It was as if the U.S. Mint had a blind spot with how popular this coin would be.

TRICK: The dealers who paid less than desireable people uninterested in anything other than a quick buck to mob the lines at the Denver Mint and the World’s Fair of Money. I continue to belive that their ethics must be questioned and appropriate actions taken by the ANA even though I do not think that will happen.

TREAT: With the drop in the price of gold, the current price of the gold Kennedy half-dollar tribute is less than what is was at launch. Teach these greedy dealers a lesson and buy the coins for less directly from the U.S. Mint!

U.S. Government hands out coal

TRICK: Because the U.S. Mint can only do what the laws that congress pass tells them they can do and congress is so dysfunctional they cannot even pass laws for issues they agree on, the United States was the only country involved with the Allies on D-Day NOT to issued a commemorative to honor the 70th anniversary of D-Day.

TRICK: In the name of political correctness, the State Department’s Cultural Property Advisory Committee (CPAC) continues to make it difficult for ancient coin collectors to participate in its hobby by allowing countries to ask the State Department to overreach on the enforcement on the Cultural Property Implementation Act. It is turning ancient coin collectors into criminals even for collecting common coins. Their actions are rediculous.

CCAC is the CCAC

TREAT: The Citizens Coinage Advisory Committee suggested creating American Arts medals that will feature the artistic ability of the U.S. Mint’s artist.

TRICK: The arts medals are medals, not coins. Even with the beauty of medals like the 9/11 silver medal, it did not sell like coins would. In fact, it grossly under performed without raising significant sums for the 9/11 Memorial at the site of the Twin Towers in New York. But this is what the CCAC is face with because of congressional dysfunction (see above).

So goodbye everybody, and remember the terrible lesson you learned tonight. That grinning, glowing, globular invader of your living room is an inhabitant of the pumpkin patch, and if your doorbell rings and nobody’s there, that was no Martian… it’s Hallowe’en.

— Orson Welles, The War of the Worlds, CBS Radio, October 30, 1938

Hobo Ike and Jefferson courtesy of Darth Morgan posted at

Coin CommunityOct 7, 2014 | BEP, coins, counterfeit, currency, gold, policy, US Mint

Prior to the public disclosure of secret documents, administrations have declassified documents at various levels for many different reasons that those of us who worked in these areas did not understand what was to be classified at what levels and for how long. Each department and agency had its own rule. However, everything that was classified was supposed to be declassified after 50 years.

In 2009, President Obama issued Executive Order 13526 to try to create some order out of this chaos. Aside from defining the classification levels, document marking requirements, it also allowed agencies to apply to keep documents classified and for longer periods than previous reviews. The purpose was to protect national interests and security while preventing controversial declassification of documents.

Whenever trying to instill a new policy on the government, there will be many barriers to this change. While there are fewer areas of confusion, chaos remains. Of course the disclosures by Chelsea (neé Bradley) Manning and Edward Snowden did not help.

So what does this have to do with numismatics? Both the U.S. Mint and the Bureau of Engraving and Printing applied and were granted exemption from automatically declassifying documents.

Treasury Department, Procurement Division, Public Buildings Branch, Fort Knox – United States Bullion Depository (1939)

What information could these agencies possibly have that would be classified?

According to Steven Aftergood, Director of the Federation of American Scientist Project on Government Secrecy, who interviewed John P. Fitzpatrick, director of the ISOO, the exemption for the U.S. Mint is for “security specifications from the U.S. Bullion Depository at Fort Knox, which was built in the late 1930s.”

In a comedic turn, Mr. Fitzpatrick told Aftergood, “Think ‘Goldfinger’.”

Then why does the Bureau of Engraving and Printing need an exemption from declassification for 25-years? A source familiar with the filing said that the exemption covers counterfeiting information. According to sources, there are anti-counterfeiting measures added to currency that have been planned for many years that have not been advertised. These are used by the United States Secret Service and other law enforcement organizations to detect counterfeiting. Many of the documents cover the planning for the changes that began in the 1990s.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

And you thought all the U.S. Mint and Bureau of Engraving and Printing did was manufacture money!

Jul 11, 2014 | ancient, coins, commentary, policy

During a time where disinformation is a product of hyper-partisanship, it is difficult to write about issues without feeding into the conspiracy theories of the day. The problem with conspiracy theories is that there are so many moving parts and so many people who would have to cooperate that when you really think about their content beyond the headline, you understand how difficult it would be for conspiracies to exist on the scale many suggest.

Conspiracy theories are not a new phenomenon. What is new is how fast they can spread and how the extremes on both side of the aisle can see the same circumstances are come up with radically different conclusions.

Rather than talk about conspiracies, we should look at the issues as more of the result of unintended consequences.

1933 Saint Gaudens Double Eagle is an example of the Law of Unintended Consequences.

For collectors of ancient coins, it is difficult to ignore the law of unintended consequences of Cultural Property Implementation Act (CPIA; 19 U.S.C. §§ 2601 et seq.) and how it is implementation by the State Department’’s Cultural Property Advisory Committee (CPAC). CPIA is the law that was created when the United States signed and the Senate approved the Convention on the Means of Prohibiting and Preventing the Illicit Import, Export and Transfer of Ownership of Cultural Property 1970, often called the 1970 UNESCO Convention. The purpose of the treaty was to stop archaeological pillaging and trafficking in cultural property. In real terms, it would prevent the filling of the British Museum in London with the artifacts from ancient Egypt, Greece, the Middle East, North Africa, and any other place where the British tried to maintain their empire.

EID·MAR Silver Coin commemorating the death of Cæsar on March 15

Although this may sound reasonable, Article 1 paragraph (e) of the treaty defines a category of cultural property as “antiquities more than one hundred years old, such as inscriptions, coins and engraved seals.” This means that any coin minted before 1914 can be considered cultural property and not only be subject to restrictions but confiscated if it cannot be proven that it was found or purchased legally prior to the convention.

With the different rules and laws around the world that has different documentation requirements that were more lax prior to the convention, how does the collector of ancient coins prove the coin that was bought in good faith from a dealer or another collector is not a country’s cultural property? A coin that could have changed hands hundreds of times since it arrived in the United States and enjoyed by its collectors may have had its more modern provenance lost to time and be subject to confiscation by the State Department and returned to the country of origin.

Although the CPAC tries to make the Memoranda of Understanding between the foreign country and the United States simple, the law and convention has a number of problems that have not been addressed in the 40 years it has been in existence. One problem is the existence of ancient Roman coins all over Europe. While the coins were minted in Rome, they were carried throughout the empire by the military, business people, and travelers that were eventually left behind. Since the coins were struck in Rome does it mean that the coins are the property of Italy or the country where they were found? If they country where they were found follows the convention to its letter, since the coins were not manufactured there are they really cultural objects and subject to these export and trade restrictions?

While those of us in the United States have been captivated by the Saddle Ridge Hoard of gold coins, people in the United Kingdom have been buying metal detectors in record number to scour the countryside looking for ancient coins left behind by their ancestors. Recently, someone found four coins dating back to the Iron Age that sparked an archeological search. The find included Roman coins that were not made in England or the land that would become England. Are these British artifacts?

As an aside, British law allows the finders to keep the coins. But since the full archeological search was managed by a British university in conjunction with the military, subsequent finds are the property of the crown since both are paid using public tax money. However, based on the wording of the 1970 UNESCO Convention, does Italy have a claim if they want to pursue those coins?

Recently, the CPAC held an open meeting to hear the new Egyptian government’s request to ban the import of artifacts dating through the time of the Ottoman Empire. Based on reporting by Richard Gierdroyc in Numismatic News, the questioning of the committee and the answers by those representing the archeological community not only would not grant an exemption for coins but would consider the confiscation of coins that could not be proven to have been legally purchased prior to the 1970 UNESCO Convention and have since fairly traded.

Recently, the CPAC held an open meeting to hear the new Egyptian government’s request to ban the import of artifacts dating through the time of the Ottoman Empire. Based on reporting by Richard Gierdroyc in Numismatic News, the questioning of the committee and the answers by those representing the archeological community not only would not grant an exemption for coins but would consider the confiscation of coins that could not be proven to have been legally purchased prior to the 1970 UNESCO Convention and have since fairly traded.

There is a very vocal crowd in the archeological community that would want to see everything dug up from the earth put into museums or otherwise locked away from the public. (Links to these people omitted on purpose) Using the pejorative “coinys” to describe collectors of ancient coins, these people have advocated for the confiscation of these coin so that they can be entombed behind display glass inside the state run museums of the world. They consider coinys profiteers who would rather trade in history than preserve history.

Collecting, in all of its forms, is a preservation of history. Whether you collect coins, stamps, political campaign buttons, old car emblems, license plates, old kitchen objects, books, toys, postcards, letters, and other ephemera, these items would be lost to time if people did not save them. Owning history helps connect us to our past and even helps us understand how the world has evolved.

History must be preserved and every country has the right to protect the property within its borders. If Egypt wants to protect its property and any future property that archeologists discover, then that should be their right. However, if Egypt wants to restrict United States collectors of coins or other artifacts that have been in circulation for many years, it is suggested that they end their hypocrisy by preying on the “we must do right by the world” policies of the United States and demand that the British Museum to return its holdings.

Jul 7, 2014 | legislative, policy

At the beginning of each month, I like to provide my readers with a progress with coin or coin industry-related legislation being considered in congress. For the third time this session, there were no new coin-related bills introduced and those that have been submitted have not seen any legislative action. Considering congress has begun their summer break, there will probably be nothing to report for this month.

At the beginning of each month, I like to provide my readers with a progress with coin or coin industry-related legislation being considered in congress. For the third time this session, there were no new coin-related bills introduced and those that have been submitted have not seen any legislative action. Considering congress has begun their summer break, there will probably be nothing to report for this month.

In similar news, on September 12, 2014, Richard A. Peterson, Deputy Director of the United States Mint provided a status to the House Financial Services Committee about the Alternative Metals Study. The only news to come out of the hearing was the recommendation by Rep. Steve Stivers (R-OH) to use steel as a coinage metal. Stivers was reported to have said, “Steel costs about $900 a ton versus some of the other metals that cost up to $5,000 a ton or $12,000 a ton.”

Prior to the hearing, the U.S. Mint extended the deadline for public comment on the Alternative Metals Study. Predictably, representatives for the vending and coin-operated machine industries called on the U.S. Mint and the congress to maintain the status quo.

Outside of Washington, there is an issue with the enforcement of a consumer protection law in Minnesota that requires dealers with more than $5,000 in sales of bullion coins to register in Minnesota. One of the problems with the definition is that the Minnesota law defines “Bullion Coin” as “any coin containing more than one percent by weight of silver, gold, platinum, or other precious metal.” (see Minnesota Stat. §80G.01 Subd. 2). This means that dealers selling more than $5,000 of Mercury dimes or Barber quarters are required to register the same way as those selling American Eagle coins.

To learn more about this issue, I recommend a reading “Dealers to reject Minnesota clients” by Pat Heller that was published in Numismatic News. There will be more on this and similar laws in other states in future posts.

In keeping with the legislative theme, the following is what has been considered by the 113th congress thus far:

Bills Signed into Law

The following has passed both the House of Representatives and Senate and has been signed by the President of the United States into law:

- Public Law 113-10 (formerly H.R. 1071: To specify the size of the precious-metal blanks that will be used in the production of the National Baseball Hall of Fame commemorative coins.

Bills Passed in the House of Representatives

The following bill passed the House and is awaiting action in the Senate:

Introduced in the House of Representatives

- H.R. 77: Free Competition in Currency Act of 2013

- H.R. 220: Stop the Coin Act

- H.R. 627: National Park Service 100th Anniversary Commemorative Coin Act

- H.R. 1218: Commemorative Coins Reform Act of 2013

- H.R. 1653: Pro Football Hall of Fame Commemorative Coin Act

- H.R. 1719: Cents and Sensibility Act

- H.R. 1905: Mother’s Day Centennial Commemorative Coin Act

- H.R. 2366: World War I American Veterans Centennial Commemorative Coin Act

- H.R. 2633: Thirteenth Amendment Commemorative Coin Act

- H.R. 2760: Panama Canal and Pan-Pacific Exhibition Centennial Celebration Act

- H.R. 2932: United States Coast Guard Commemorative Coin Act

- H.R. 3146: Savings, Accountability, Value, and Efficiency (SAVE) II Act

- H.R. 3305: Currency Optimization, Innovation, and National Savings Act

- H.R. 3680: Breast Cancer Awareness Commemorative Coin Act

- H.R. 3729: Korean Immigration Commemorative Coin Act

Introduced in the Senate

Even though financial bills are constitutionally required to begin in the House of Representatives, it is not beneath the Senate to introduce their own legislation or concurrent bills with the House. Coin-related bills introduced in the Senate are usually referred to the Senate Committee on Banking, Housing, and Urban Affairs. The bills introduced in the Senate are as follows:

- S. 94: To terminate the $1 presidential coin program

- S.203: Pro Football Hall of Fame Commemorative Coin Act

- S. 768: Sound Money Promotion Act

- S. 1011: Boys Town Centennial Commemorative Coin Act

- S. 1105: Currency Optimization, Innovation, and National Savings Act

- S. 1158: National Park Service 100th Anniversary Commemorative Coin Act

- S. 1842: Pro Football Hall of Fame Commemorative Coin Act

- S. 2303: United States Coast Guard Commemorative Coin Act

- S. 2310: Mother’s Day Commemorative Coin Act

The 114th Congress was gaveled into session on January 5, 2015 with an air of optimism that both ends of Pennsylvania Avenue would be able to work together. Optimism can last as long as someone does not offend their opponent or there are significant lingering issues. Let the games begin.

The 114th Congress was gaveled into session on January 5, 2015 with an air of optimism that both ends of Pennsylvania Avenue would be able to work together. Optimism can last as long as someone does not offend their opponent or there are significant lingering issues. Let the games begin. As we wind down the end of a very interesting 2014, we also come to the end of the 113th Congress. This congress has been as inactive as any. Sure, there was a lot of press with faces from both sides spewing scary rhetoric about topics these people seem to know little about, but even when it comes to coining money, they have done less than any congress in recent memory.

As we wind down the end of a very interesting 2014, we also come to the end of the 113th Congress. This congress has been as inactive as any. Sure, there was a lot of press with faces from both sides spewing scary rhetoric about topics these people seem to know little about, but even when it comes to coining money, they have done less than any congress in recent memory.

At the beginning of each month, I like to provide my readers with a progress with coin or coin industry-related legislation being considered in congress. For the third time this session, there were no new coin-related bills introduced and those that have been submitted have not seen any legislative action. Considering congress has begun their summer break, there will probably be nothing to report for this month.

At the beginning of each month, I like to provide my readers with a progress with coin or coin industry-related legislation being considered in congress. For the third time this session, there were no new coin-related bills introduced and those that have been submitted have not seen any legislative action. Considering congress has begun their summer break, there will probably be nothing to report for this month.