Jul 8, 2016 | coins, commentary, dollar, Federal Reserve, US Mint

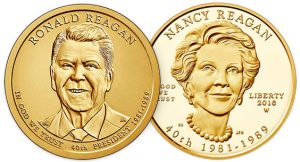

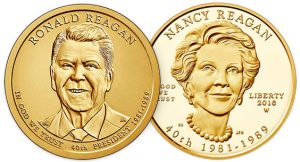

2016 Ronald Reagan dollar & 2016-W Nancy Reagan $10 gold coin

On the Friday before the Independence Day celebration weekend, the U.S. Mint released the Ronald Reagan dollar and Nancy Reagan first spouse coin marking the end of the program.

The Presidential Dollar program has had an interesting history. Passed by congress in December 2005 and later signed by President George W. Bush, the Presidential $1 Coin Act (Pub. L. 108-145) ordered the U.S. Mint to create a $1 coin to commemorate the Nation’s past Presidents and an accompanying $10 gold coin to commemorate the President’s spouse (First Lady). Coins appeared in order that the president served and the president must be deceased for two year prior to the coin’s issue. Since Jimmy Carter is still living, he was bypassed and the last coin was for Ronald Reagan.

2012 First Spouse coin featuring Alice Paul

For the first time in the modern era the date, mintmark, and mottos “E Pluribus Unum” and “In God We Trust” struck into (incuse) the edge of the coin. The last time edge lettering was used on circulating U.S. coinage was in the 1790s.

With the edge lettering a new process for the U.S. Mint, it was no surprised that coins left the Mint without the mottos stamped in the edge. Dubbed the “godless dollar” the error caused an uproar over some people suggesting that the government was conspiring against religion by leaving the motto off of the coin. This was described as either a willful omission or a way to attack religion. There was no narrative that accepted that this was just a mistake.

Our national nightmare ended when congress updated the law (Pub. L. 110-161) to move the motto from the edge to the obverse of the coin. E Pluribus Unum, the date and mintmark was left on the edge.

Then there was the breathless story by National Public Radio that decried the tax dollars being wasted by the approximately $1.4 Billion of dollar coins being stored in the Federal Reserves’ vaults. The story was filled with partial truths and did not properly explain the situation. When I tried to reach out to NPR, I was rebuffed by a reporter who decided a low-level Treasury staffer who did not have the first clue about reality was more credible

While the media was blaming the U.S. Mint and the Federal Reserve, they forgot to read the law. According to the law, there were mintage minimums that congress wrote into the law including the one that said the Sacagawea dollar was to comprise one-third of the dollar coin production. As part of the legislation, the U.S. Mint and Federal Reserve were supposed to promote the coin’s use and provide educational materials for the public.

Congress, who wrote and passed the original legislation, was tripping all over themselves to introduce bills to end the program while pounding their collective chests claiming they were acting in the public interest.

This nightmare ended when then Treasury Secretary Tim Geithner ordered a reduction in the production of all dollar coins. None of the bills introduced to eliminate the dollar coin were ever heard in committee and died at the end of the 113th congress.

But the series couldn’t continue without one more controversy. The way the law was written, it was interpreted that it would end with the first living president. In this case, the program would have ended with the coin honoring Gerald Ford since Jimmy Carter is still living. This did not sit well with the fans of Ronald Reagan who have spent the time since his convalescence and death trying to plaster his name all over everything including an airport that employed air traffic controllers he fired placing the nation’s skies at risk.

The same members of congress that introduced bills to eliminate the program were now demanding the program be extended by one president. Ironically, they waited until after the resignation of Mint Director Edmund Moy and approached the acting Director Richard Peterson. Although Peterson was named acting director, he was a career government employee with impeccable credentials but had to have a different relationship with the politicians than an appointed director would. The matter was deferred to Treasurer Rosie Rios and Secretary of the Treasury Jack Lew who approved the extension of the program.

Presidential Dollars

- 2007:

- George Washington, John Adams, Thomas Jefferson, James Madison

- 2008:

- James Monroe, John Quincy Adams, Andrew Jackson, Martin Van Buren

- 2009:

- William Henry Harrison, John Tyler, James K. Polk, Zachary Taylor

- 2010:

- Millard Fillmore, Franklin Pierce, James Buchanan, Abraham Lincoln

- 2011:

- Andrew Johnson, Ulysses S. Grant, Rutherford B. Hayes, James Garfield

- 2012:

- Chester A. Arthur, Grover Cleveland, Benjamin Harrison, Grover Cleveland

- 2013:

- William McKinley, Theodore Roosevelt, William Howard Taft, Woodrow Wilson

- 2014:

- Warren Harding, Calvin Coolidge, Herbert Hoover, Franklin D. Roosevelt

- 2015:

- Harry S Truman, Dwight D. Eisenhower, John F. Kennedy, Lyndon B. Johnson

- 2016:

- Richard M. Nixon, Gerald Ford, Ronald Reagan

First Spouse Gold $10 Coins

- 2007:

- Martha Washington, Abigail Adams, Thomas Jefferson’s Liberty,† Dolley Madison

- 2008:

- Elizabeth Monroe, Louisa Adams, Andrew Jackson’s Liberty,† Martin Van Buren’s Liberty†

- 2009:

- Anna Harrison, Letitia Tyler,‡ Julia Tyler,†† Sarah Polk, Margaret Taylor

- 2010:

- Abigail Fillmore, Jane Pierce, James Buchanan’s Liberty,* Mary Lincoln

- 2011:

- Eliza Johnson, Julia Grant, Lucy Hayes, Lucretia Garfield

- 2012:

- Alice Paul,¶ Frances Cleveland (first term), Caroline Harrison,‡ Frances Cleveland (second term)

- 2013:

- Ida McKinley, Edith Roosevelt, Helen Taft, Ellen Wilson,‡ Edith Wilson††

- 2014:

- Florence Harding, Grace Coolidge, Lou Hoover, Anna Eleanor Roosevelt

- 2015:

- Elizabeth Truman, Mamie Eisenhower, Jacqueline Kennedy, Claudia Taylor “Lady Bird” Johnson

- 2016:

- Patricia Ryan “Pat” Nixon, Betty Ford, Nancy Reagan

Footnotes:

- †

- President was widowed prior to inauguration

- ‡

- First Spouse died during the president’s term

- ††

- Married the president during the president’s term

- *

- James Buchanan was the only bachelor president

- ¶

- President Chester Arthur was widowed prior to inauguration. However, the authorizing law gives the coin honor to Alice Paul, a suffragette who was born during Arthur’s administration

When the Reagan dollar was issued, 39 presidents representing 40 terms were issued.

Along with Nancy Reagan, 35 other first spouses were honored (Frances Cleveland appeared twice), four different Liberty coins were issued, and one was issued to honor suffragette Alice Paul.

President Reagan horseback riding at Rancho del Cielo with Freebo (his daughter’s dog) and Victory the golden retriever following.

As the program now quietly rides off into the proverbial sunset, maybe it is time to let the America the Beautiful Quarters® complete their run through 2021 and give the circulating commemoratives a rest.

Credits

- Coin images courtesy of the U.S. Mint

- Reagan on horsback “April 4, 1986 photo courtesy Ronald Reagan Presidential Library and Museum.” Downloaded from PresidentialPetMuseum.com

Jul 2, 2016 | coins, commemorative, legislative, US Mint

It has been another head scratching month for us policy wonks who watch congress for more than the political theater, although both sides of the aisle provided quite a sideshow this month. With the ever eroding sense of civility, there was a few numismatic-related items that occurred. Introduced as a matched, related bills are proposals for commemoratives in 2020 and 2021:

It has been another head scratching month for us policy wonks who watch congress for more than the political theater, although both sides of the aisle provided quite a sideshow this month. With the ever eroding sense of civility, there was a few numismatic-related items that occurred. Introduced as a matched, related bills are proposals for commemoratives in 2020 and 2021:

H.R. 5598 Plymouth 400th Anniversary Commemorative Coin Act of 2016

Sponsor: Rep. William Keating (D-MA)

• Introduced: June 28, 2016

• Referred to the House Financial Services Committee

This bill can be tracked at https://www.govtrack.us/congress/bills/114/hr5598.

S. 3105 Plymouth 400th Anniversary Commemorative Coin Act of 2016

Sponsor: Sen. Edward “Ed” Markey (D-MA)

• Introduced: June 28, 2016

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

This bill can be tracked at https://www.govtrack.us/congress/bills/114/s3105.

The bill calls for 100,000 $5 gold coins, 500,000 $1 silver coins, and 750,000 clad half-dollar with the usual surcharges ($35, $10, and $5 respectively), to be divided up between five related organizations surrounding the landing of the settlers at Plymouth Rock including 50-percent Plymouth 400, Inc., the organization formed by the Commonwealth of Massachusetts to manage the celebration.

Similarly, Sen. Markey and Rep, Keating are sponsoring bill (S. 3104 and H.R. 5599) “To establish the Plymouth 400th Commemoration Commission.” Not sure why this is necessary since it looks like Massachusetts’ “Plymouth 400” seems to have things covered.

Finally, the Senate Appropriations Committee reported on S. 3067, the Financial Services and General Government Appropriations Act, 2017 which will allow the U.S. Mint to withdraw up to $20 million from the U.S. Mint Public Enterprise Fund for its operations.

Jun 16, 2016 | bullion, coins, Eagles, US Mint, video

American Silver Eagle Monster Box

Another of my guilty pleasures is How It’s Made on the Science Channel. How It’s Made is simply a show that will demonstrate how every day and other items are manufactured. I am fascinated by seeing the process of manufacturing. Some of the machines that are created to make our everyday items is fascinating. Take something simple as a pencil and think about how a company makes thousands over the course of a day and the non-standard machines required to do this.

The U.S. Mint infrequently posts videos about their coins, people and operations. What I find fascinating is the How It»s Made like videos that shows how they deal with the basic manufacturing process. In the latest video, the U.S. Mint shows how they package American Silver Eagle bullion coins into tubes for shipping to dealer.

The machine is called an Auto Tuber and can be found at the West Point branch mint where bullion coins are struck. After the coins are struck, they are laid flat on trays with the trays being stacked on a rack. From the rack, a machine takes one of the trays, places it next to the Auto Tuber, and pours the coins into the tracks. Using a suction cup fingers, the machine lifts the coins and places them into tube. The tubes are capped, weighed, packaged, inventoried, and sent for shipping.

At the end of the line is a human worker who picks up the packed green boxes you might have seen some dealers advertise for sale as “Monster Boxes” and places them on a pallet for shipping. That is where the one-minute journey ends.

BONUS VIDEO

Similar to the standard production videos is the proof set production video from the U.S. Mint in San Francisco that includes a similar machine that places the coins in the holders.

Credits

- Monster box image courtesy of Wikipedia.

- Videos courtesy of the U.S. Mint.

Apr 24, 2016 | coins, gold, US Mint

As luck would have it, the day I published my post about my predicted price of the 2016 Mercury Dime Centennial Gold Coin, the U.S. Mint published their prices for all of the centennial celebration coins in the Federal Register. Typical of the way the government does things, the table is too cluttered. As a service to my readers I reproduced the table in a more human-readable form.

As luck would have it, the day I published my post about my predicted price of the 2016 Mercury Dime Centennial Gold Coin, the U.S. Mint published their prices for all of the centennial celebration coins in the Federal Register. Typical of the way the government does things, the table is too cluttered. As a service to my readers I reproduced the table in a more human-readable form.

Price is based on the average price of gold based on the afternoon price of gold as set by the London Bullion Market Association (LBMA). The U.S. Mint uses a Thursday-to-Wednesday week for the average which means that it is highly likely that the Standing Liberty and Walking Liberty gold coins will also be released on a Thursday.

I will add a link to this table under the Collector’s Reference on the menubar for your future reference.

| LBMA Gold Price weekly average |

Mercury Dime Centennial Gold Coin (1/10 ounce) |

Standing Liberty Centennial Gold Coin (¼ ounce) |

Walking Liberty Centennial Gold Coin (½ ounce) |

| $950.00 to $999.99 |

$180.00 |

$397.50 |

$740.00 |

| $1,000.00 to $1,049.99 |

185.00 |

410.00 |

765.00 |

| $1,050.00 to $1,099.99 |

190.00 |

422.50 |

790.00 |

| $1,100.00 to $1,149.99 |

195.00 |

435.00 |

815.00 |

| $1,150.00 to $1,199.99 |

200.00 |

447.50 |

840.00 |

| $1,200.00 to $1,249.99 |

205.00 |

460.00 |

865.00 |

| $1,250.00 to $1,299.99 |

210.00 |

472.50 |

890.00 |

| $1,300.00 to $1,349.99 |

215.00 |

485.00 |

915.00 |

| $1,350.00 to $1,399.99 |

220.00 |

497.50 |

940.00 |

| $1,400.00 to $1,449.99 |

225.00 |

510.00 |

965.00 |

| $1,450.00 to $1,499.99 |

230.00 |

522.50 |

990.00 |

Image courtesy of the U.S. Mint.

Apr 22, 2016 | commentary, gold, US Mint

Obverse of the Mercury Dime 2016 Centennial Gold Coin

Although I was in a meeting, I tried to purchase this coin using the U.S. Mint app on the iPhone. Basically, the U.S. Mint app on the iPhone does nothing more than distill the mobile version of the U.S. Mint website on the iPhone. Since the app was not working properly, I opened Safari and tried to use the website directly. By the time I was able to get the system to respond, the coin sold out.

Even though the U.S. Mint revamped the website, hired a new integrator, and added more capacity to the communications lines that lead to the server, the website failed to be able to handle the requests. The U.S. Mint hired a new contractor to make these improvements but still cannot get it right. Their website is not programmed to handle the crush of a popular product.

As someone who has worked in the government for many years, we usually have to undergo a review of recent events to learn about what went wrong in order to fix the problems for next time. These reviews look at every aspect of the process and recommend changes. It appears that if the U.S. Mint performed these after action reviews they did not learn their lessons from past mistakes.

Now is the time for the U.S. Mint to get out of the e-commerce business and hire a company that understands how to manage peak volumes. Services like Amazon and eBay have figured out how to manage users flooding their systems. I am sure that sales related to the U.S. Mint would not approach the traffic that comes on shopping holidays like Cyber Monday.

Does Ticketmaster sell e-commerce solutions? The software they use that adds you to a queue to wait until you can order because the system has been flooded. In the cases when I used Ticketmaster or Live Nation, their sister site, to buy tickets to popular shows, I was forced to wait on the virtual line before being able to purchase tickets.

Regardless of the model the U.S. Mint uses, they must do something. Either they need to figure it out or maybe a discussion with the Treasury Office of Inspector General may be worth the effort.

NOTE: The U.S. Mint sent a note to the media saying that they would have a statement regarding the sellout on Friday (today). At the time of this writing the U.S. Mint has not released a statement.

Apr 15, 2016 | bullion, coin design, coins, gold, US Mint

If you read my Baltimore show report, you might have noticed that I included images of the Mercury Dime 2016 Centennial Gold Coin. According to the U.S. Mint, the coin is scheduled to go on sale on April 21, 2016 at noon Eastern Time.

Obverse of the soon to be released Mercury Dime 2016 Centennial Gold Coin

Reverse of the soon to be released Mercury Dime 2016 Centennial Gold Coin

With a mintage limit of 125,000 and struck in West Point, the coin will be struck on a 24-karat (.999 pure) gold planchet. It will differ from the original Mercury Dime in that it will be dated 2016. On the reverse the coin will have the “W” mintmark since it will be struck in West Point, include “AU 24K” and “1/10 OZ.” to note that the coin will contain one-tenth ounce of gold. Otherwise, it looks exactly like Adolph A. Weinman’s design that was used from 1916 through 1945.

At 16.50 mm in diameter, the gold coin will be a little smaller than the 17.91 mm silver dime. The gold coin will be heavier (3.11 g) than the original that was made from 90-percent silver (0.7234 troy ounces).

To make this coin, the U.S. Mint is exploiting a loophole in the law that authorized the American Buffalo 24-Karat Bullion Gold Coins program (31 U.S.C. § 5112(q)). According to the law, after the first year of issue (2007), the Secretary can change the design of the coin as long as the design is reviewed by the Commission of Fine Arts and Citizens Coinage Advisory Committee. The U.S. Mint used this law to authorize the 2009 Ultra High Relief coin and the fifty year celebration of the Kennedy half dollar in 2014 with the dual date.

The original Winged Liberty “ Mercury” Dime was a silver coin produced as a result President Theodore Roosevelt’s “pet crime” where he thought U.S. coin design was hideous. Weinman was Augustus Saint-Gaudens’ student who is credited with finishing the work on Saint-Gaudens coin designs after the master sculpture’s death. It was not one of Weinman’s favorite works but it is beloved by collectors.

As a collector who has an almost complete collection of Mercury dime (missing the 1916-D), I was skeptical about the visual appeal of the coin in gold. When I open the folder, I see 30 years of silver coins. Since I try to keep my collection at extra fine (XF) or better, you can get used to seeing that beautiful silver color. When I saw the gold coin in a size that is close to the original dime in the presentation box at the Whitman Expo, I thought it made for a beautiful tribute.

Pricing of the coin will depend on the London Bullion Market Association (LBMA) afternoon price of gold on Wednesday, April 20. That number will be plugged into their pricing grid to determine the opening price of the coin. For example, the LBMA PM price of gold on April 14 is $1,233.85 per troy ounce. If this was the basis of the opening price, we would look up in the table for the price range $1,200.00 to $1,249.99. Since this is an uncirculated business strike coin struck under the American Buffalo act, the table shows that the coin would open at $194.00.

Using my example, this would give the coin a $70.61 or 36-percent numismatic premium over the spot price, which also takes into account U.S. Mint production costs (materials, labor, packaging, etc.).

If the LBMA PM price goes over $1,250 then the opening price of the coin will be $199.00. Being under $200.00 may give the market a psychological boost that may promote quicker sales. Then again, if the price of gold dips below $1,200.00, the coin will open at $189.00.

Putting on my prognosticator’s hat, I predict that the price of gold will go up enough that the opening price will be $199.00.

NOTE: I am just a blogger making a prediction. If you want a better market analysis, ask a professional advisor. They may have a more informed opinion, but we are all just throwing ideas up against the wall trying to figure out what will stick!

Apr 13, 2016 | auction, Baltimore, coins, medals, US Mint

Whitman Spring 2016 Expo looking into Hall C

Those who followed me on Twitter knows that I had a late start. We working stiffs do have weekend responsibilities that have to be taken care of before we can go out to play. Once I was able to complete my errands, I was able to travel north to Baltimore.

I may be one of the few people who are not from Baltimore who likes Baltimore. But going to Baltimore’s Inner Harbor area can be a lot of fun, even if it is frustrating trying to find parking. Then again, show me any city that does not have a parking problem and I will show you a city that is not as fun.

Once I was able to find parking I walked to the convention center. After entering in the early afternoon on Saturday I was struck by the number of empty tables that could be seen from the entry door. In all areas of the three convention center halls, the number of empty tables was surprising. I was also surprised to see a number of shared tables being half used.

As I walked around the convention center floor I was struck by the number of tables that were either never occupied or the dealer did not show up at all on Saturday. You can tell these tables from the others by the number of fliers left on the table. Some tables had rental cases with the keys in them showing that these tables were either unused or the dealer left early.

Dealer attendance inside Hall B

Another view of the dealer attendance on Saturday

I recently learned that a table for the Baltimore show costs $750. Add the cost of travel, food, lodging, and the inventory, does the costs justify leaving and not trying to make money? When I discussed this with a regular dealer, I was told that some that are not having a good show will leave early to cut their losses.

Of the dealers that were left, there was a nice mix of items. For once, I did not get the impression that one type of coin was more popular than the other. In fact, I think this is the first show where bullion and bullion-related coins were not the focus. I was able to find American Silver Eagles without problem but finding some of the foreign bullion coins was a little more challenging.

Obverse of the to be released 2016 Mercury Dime Centennial Tribute

Reverse of the to be released 2016 Mercury Dime Centennial Tribute

Medals on display at the U.S. Mint booth

Shawnee National Forest 5 ounce silver coin

Whitman, the sponsor of the show, had their own booth and was actually selling discounted items. In prior years, Whitman would sell their own products at full price but this time offered some discount. And they had a clearance table. I did not buy from the clearance table because they did not have anything I wanted but there were some nice and current items that were worth the value.

Sale at the Whitman Booth!

There were good collectors guide books on the sale table

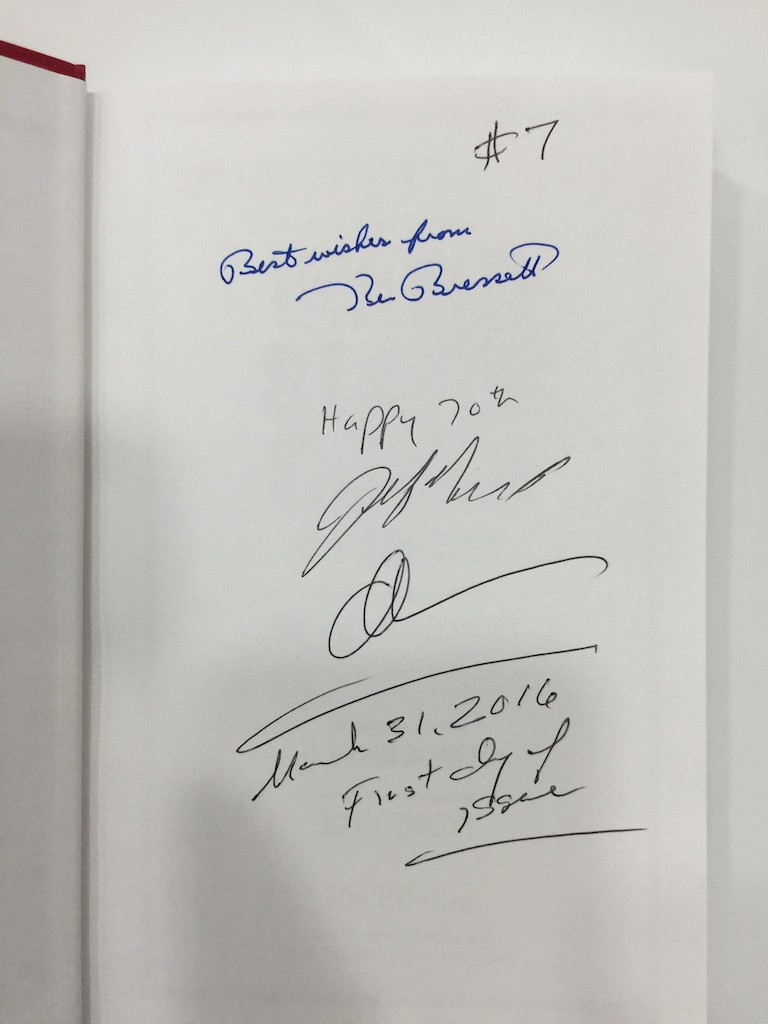

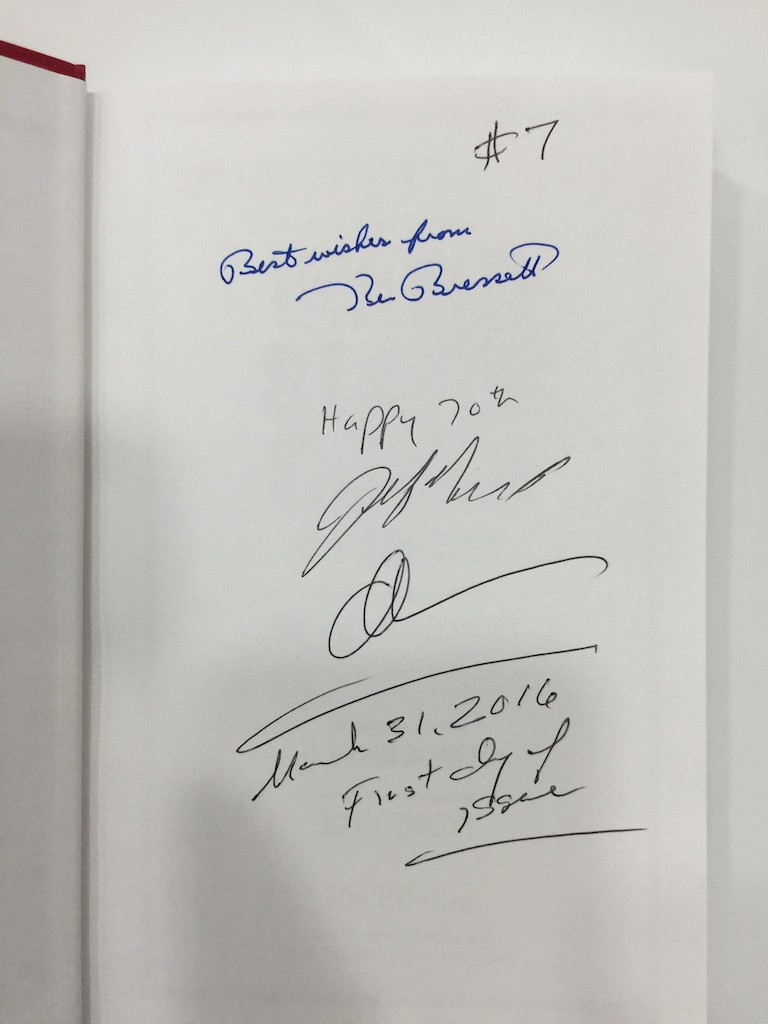

One thing Whitman did was to give away hardcover copies of the 70th Edition of the Red Book autographed by Ken Bressett and Jeff Garrett. All I had to do was fill out a ticket at the Whitman booth, return to the booth at the time of the drawing, and wait for them to give away the eight books being offered on Saturday. I think I was the fourth book given away.

Drawing for the autographed Red Book

I WON! It looks like I received lucky #7.

Previously, I noted that the choices of numismatic literature has diminished. While the death of numismatic book dealer John Burns is a tragic story in and of itself, what has not happened is that someone has not stepped into that market. Aside from being intelligent and a character with a sharp wit, his inventory was so varied that I was always able to find something a little off-beat or out of the ordinary that was intriguing. If someone wants to move into numismatics but wants to occupy a different space, this might be something for you to get into.

Swimming in the pools of inexpensive slabs.

Every show I try to find one neat item that is out of the ordinary. As I approached one table I noticed there were a few large brass medals on the table. I am intrigued by brass medals both for their size and a lot of the artwork. I have seen many brass medals with art that rival anything produced on canvas for their beauty. But this one was different in that it bore the local of Carnegie Mellon University, where I went to graduate school.

Carnegie Mellon was formed in 1967 when the Carnegie Institute of Technology (Carnegie Tech, founded in 1900) merged with the Mellon Institute of Industrial Research (founded in 1913). I earned a masters degree in one calendar year 1999-2000. Although I was an older student, it was a great experience for me and my (late) first wife.

The reverse of the medal is an image of Hamerschlag Hall, the first permanent building of Carnegie Tech and the home of the current College of Engineering. Around the rim celebrates the 50 Year Reunion with a space for the college which is having the reunion and the year being celebrated. Since the date engraved on the reverse is 1938, it was given to its previous owner in 1988. But that does not bother me. The front has the Carnegie Mellon logo and a great reminder of my good year in Pittsburgh.

Obverse of the Carnegie Mellon University medal features the school’s logo

Reverse of the Carnegie Mellon University medal features Hamerschlag Hall and proclaims the 50th Anniversary reunion Class of 1938.

The next Whitman Expo will be July 14-17. I hope the dealers that show up will be there if I have to spend the morning running errands.

Gallery of images

This slideshow requires JavaScript.

Mar 26, 2016 | coins, education, US Mint, video

Since the beginning of the year, the U.S. Mint has been issuing a lot of video content primarily videos regarding the launch of America the Beautiful Quarters coins and B-Roll video. This past week, the U.S. Mint issued a new “How Coins Are Made… For Kids!” video as part of their H.I.P. (History In your Pocket) Pocket Change educational program.

Since the beginning of the year, the U.S. Mint has been issuing a lot of video content primarily videos regarding the launch of America the Beautiful Quarters coins and B-Roll video. This past week, the U.S. Mint issued a new “How Coins Are Made… For Kids!” video as part of their H.I.P. (History In your Pocket) Pocket Change educational program.

As opposed to prior videos, rather than have the entire video animated, it uses a combination of animation and the B-Roll video the U.S. Mint published last month. It is done in a way that tells a very coherent story without being cheesy. Everyone will enjoy this video, even if they are just a kid at heart.

If you have an interest in good videos that have been issued by the U.S. Mint you should subscribe to their YouTube Channel. Some of the recent videos that I recommend include an interview with Cassie McFarland, design contest winner for the 2014 National Baseball Hall of Fame Commemorative Coin; B-Roll showing the sculptor-engravers at the Philadelphia Mint; Episode 1 of their “My Favorite” where they interview San Francisco employees about their favorite coins; and “Maryland Quarter in Space” interview with William Krawczewicz, designer of the Maryland State Quarter after Maryland and Florida coins traveled aboard the New Horizons spacecraft.

What is B-Roll

“B-Roll” is a television term for background video that is interspersed within a story. It received its name from the days of editing video segments on film where the primary film that contained the story with the reporter talking was on the “A” or primary roll of film. During the story, there would be other elements cut in with background and other video that was on another reel called the B-Roll. The term has survived through the video and now digital era. Modern B-Roll is now called stock footage.

Mar 17, 2016 | cents, coins, commentary, legal, news, US Mint

1974-D Experimental Lincoln cent pattern made using an aluminum planchet (J2151)

In 1974, as part of the effort to find a composition that would replace the 95-percent copper planchet for the one-cent coin that was used at the time, the U.S. Mint struck 1.4 million as patterns with the intent on destroying all of the coins struck when completed.

Congress did not like the concept fearing that their silver color would confuse them with other coins. Additionally, the aluminum composition could not be detected in vending machines nor would show up on an x-ray if swallowed. The coins were melted down.

Patterns that were struck for this test were made entirely in Philadelphia.

Which brings us to the story of the 1974-D cent pattern in this story.

Harry Lawrence who retired as deputy superintendent of the Denver Mint in 1979 owned this coin. Lawrence died in 1980. Harry’s son, Randall, discovered the coin in 2013 after moving to La Jolla from Denver and selling a bag of his father’s old coins to Michael McConnell at the La Jolla Coin Shop.

McConnell had the coin graded by Professional Coin Grading Service as MS-63 and determined it to be a genuine pattern. They were going to offer the coin for auction when the government stepped in to stop the sale and demanded its return.

Michael McConnell (left) and Randy Lawrence (right) returned the rare 1974-D penny made from aluminum back to the U.S. Treasury Department Thursday afternoon. — Nelvin C. Cepeda

There is one caveat to this story: there is no record of Denver ever striking such a coin. According to Randy Lawrence, the coin was given to his father when he retired from the Denver mint.

When Lawrence and McConnell sued the government to end the demand order, it is reported that Alan Goldman, former interim Mint director who headed the aluminum cent project, speculated in his deposition that the coin might have been made as part of a practical joke. Goldman allegedly named a suspect whose name was not released but is reported to be deceased.

The ensuing lawsuit lasted about two years and was settled today with McConnell returning the coin to the U.S. Mint on March 17, 2016.

The precedence this ruling is more dangerous for the hobby than people think. The most important issue is that it puts into jeopardy the status of the five 1913 Liberty Head nickels. Created under allegedly similar circumstances, the U.S. Mint has no record that these coins were ever produced. Although the government has tacitly agreed not to pursue that coin, there may be a time when someone with a more parochial view might use this situation to recover alleged chattel as property of the state.

Rulings like this will likely keep any surviving 1964-D Peace dollars hidden from the public. This will partially bury the history of turmoil in the coinage markets of the early 1960s. Hiding history is never good for anyone.

Mar 15, 2016 | news, policy, US Mint

Rhett Jeppson, nominated to be the 39th Director of the U.S. Mint

Edmund C. Moy, the 38th Director of the U.S. Mint, resigned effective January 9, 2011, about nine months short of completing his five-year term.

Following Moy’s departure, Treasurer Rosie Rios became acting director and served until Richard Peterson was hired as Deputy Director on January 25, 2011. Peterson was acting director until Jeppson was hired in January 2015. Since then, Peterson and Jeppson were government employees as part of the Senior Executive Service.

Prior to Jeppson’s hiring, Bibiana Boerio was nominated in September 2012, right before the midterm election. But as congress was trying to put the fun in dysfunctional, Boerio’s nomination was not heard by the Senate. By senate rules, the nomination was returned to the president when the 112th congress adjourned for the final time on January 3, 2013.

Although there should be no problems with the nomination, one can never know what will happen with this congress. When the cameras are turned on, members of congress are prone to grandstanding for whatever cause they feel is necessary regardless of whether it is germane to Jeppson’s nomination. I will predict that the cost to strike the one-cent coin and what to do with dollar coins will come up at this hearing even though the real decision makers are the ones asking the question.

Sometimes I wonder how these people get and stay elected!

If you are interested in attending the hearing, it will be held at 10:00 on the Ides of March, Tuesday, March 15, 2016, in Room 538 in the Dirksen Senate Office BuildingDirksen Senate Office Building located on First Street NE between C Street NE and Constitution Avenue NE.

Those who attend the meeting are welcome to share their comments below!

It has been another head scratching month for us policy wonks who watch congress for more than the political theater, although both sides of the aisle provided quite a sideshow this month. With the ever eroding sense of civility, there was a few numismatic-related items that occurred. Introduced as a matched, related bills are proposals for commemoratives in 2020

It has been another head scratching month for us policy wonks who watch congress for more than the political theater, although both sides of the aisle provided quite a sideshow this month. With the ever eroding sense of civility, there was a few numismatic-related items that occurred. Introduced as a matched, related bills are proposals for commemoratives in 2020

As luck would have it, the day I published

As luck would have it, the day I published