Feb 13, 2016 | coins, commemorative, news, US Mint

Have you ever looked at a coin and wondered where the design ideas come from? Have you ever said to yourself that you could do a better job? Then here is your chance!

Beginning February 29, 2016, the U.S. Mint is having an open competition to design the 2018 World War I Centennial Commemorative silver dollar.

Beginning February 29, 2016, the U.S. Mint is having an open competition to design the 2018 World War I Centennial Commemorative silver dollar.

There is a caveat: you have to be an artist of some type and a U.S. citizen 18 years of age or older. Phase I of the competition is the evaluation of up to five examples of your work submitted digitally to the U.S. Mint who is hosting the competition committee. You have to be able to submit a digital portfolio. Even if your work is good and you think you can be part of the competition, you either have to be able to take a good picture of your work or find a photographer who can help.

The “expert jury” will review your portfolio and select no more than 20 artists for the second phase.

Phase II, those selected artists will be asked to submit one design along with a plaster model of both the obverse and reverse for the proposed coin. Only one artist’s design will be selected

The winning artist will receive $10,000 and have your name etched in numismatic lore for being the designer of the coin. For this, your initials will appear on the coin, the Certificate of Authenticity, and in places like the Red Book!

“Artists are expected to distill the program’s design theme to its essence, representing a complicated subject on a very small palette.” A silver dollar is 38 millimeters in diameter!

Application deadline is April 28, 2016.

Cassie McFarland holds up Baseball Hall of Fame Commemorative Dollar with her design

Artists are always looking for a something to add to their portfolio. McFarland has had her picture in nearly every major newspaper throughout the United States and the image here has made the rounds on social media. I hope she has been able to boost her career with this. She definitely deserves any attention she receives.

Think about it… your design on thousands of coins in the hands of collectors, preserved forever. Cassie’s design is. How about you?

Images courtesy of the U.S. Mint.

Feb 3, 2016 | administrative, coins, education, US Mint

Recently, I was notified that the company whose notebook-like program decided to close its virtual doors. Its concept was simple: act like a notebook that you can stuff anything into. Although other programs passed it in some features, it was still a solid way of keeping a digital notebook. Now that they are out of business, I do not want to rely on what we call “abandonware.”

Recently, I was notified that the company whose notebook-like program decided to close its virtual doors. Its concept was simple: act like a notebook that you can stuff anything into. Although other programs passed it in some features, it was still a solid way of keeping a digital notebook. Now that they are out of business, I do not want to rely on what we call “abandonware.”

As I was reviewing a few of the notebooks I created, I found now with a lot of numismatic notes. This notebook contains lists, ideas, and other items of numismatic information. Rather than keep them hidden from the public on my disk, I will start to publish what I find as part of my Collector’s Reference section.

Today begins with two additions:

- Key Date Coins is a list of coins that may be considered key dates for their series. Determining key date coins sometimes is a matter of opinion, especially on older series. My notes had several lists which I used a basic polling system, mintage statistics, and third-party grading company’s population reports to determine what to add. This list only does this for non-gold coins. I will try to find similar references for gold coins and add them in the future.

- Mints and Mintmarks documents every branch mint operated by the U.S. Mint and provides a little information paragraph about them including the branch mint in Manila while the Philippines was a colony of the United States.

I hope you find this helpful. As always, you can always send me additions or corrections. Other comments are welcome below.

Jan 28, 2016 | celebration, coins, dollar, education, history, US Mint

2016 Native American Dollar celebrates the contributions of the Native American Code Talkers in World War I and World War II

The reverse designs has represented some of the best work by the artists working with the U.S. Mint with the 2016 design continuing the record. Celebrating the Native American Code Talkers who were instrumental in using their native language to communicate troop movements and enemy positions, the reverse of the coin celebrates their work.

As someone who has made a career in technology and information security, the concept of using something as low-tech as a language that nobody else can translate to openly communicate secret information is an elegant solution. It proves that technology is an answer but not the only answer. It makes these people heroes for their service to a country that has not treated their people fairly over the course of history.

Learning and honoring the history of Native Americans was the goal of the Native American $1 Coin Act. It is a simple yet effective way to bring history to the masses. Although the dollar coin does not circulate well, it is still a nice way for the country to teach and honor history.

I don’t think JFK would mind using the reverse to honor U.S. history!

As I consider writing a draft version of the bill to send to my representatives in congress, I know that any good coinage program in the United States should have some guidelines. Far be it for congress to tell the U.S. Mint to do what it thinks is right. In order to satisfy something that congress would adopt and create a meaningful program, how about a Half-Dollar history program as follows:

- The obverse will remain unchanged, the edge will continue to be reeded, and the coin will remain a half-dollar

- Reverse design changes annually and only one design per year

- Half-dollar can be made for circulation and the U.S. Mint can create collector versions including silver collectibles and different finishes

- Theme for the reverse must be from 50 years prior to the year of circulation and older with anniversary dates being divisible by 25 (i.e., 50 years ago, 75, 100, 125, 150, etc.)

- Theme will be selected by the U.S. Mint in collaboration with the CCAC and the Smithsonian Institute National Museum of American History

- The U.S. Mint creates the design for the theme selected by either using in-house artists, AIP members, or may hold an open competition

- The CCAC will review the designs

- The program will have no end date

Although there was no such thing as having a minor when I went to college, I did use some of my elective credits to take some classes in history and political science. Add my masters in public policy and some people wonder why I don’t run for office (I hate the idea of begging for campaign contributions). With that background, I was able to think of a few historical events that could be honored over the next few years:

2017: The 150th anniversary since the U.S. purchased the Alaska territory from Alexander II of Russia by Secretary of State William H. Seward in 1867. This was so unpopular at the time it was called “Seward’s Folly.”

2018: World War I ended on the 11th hour of the 11th day of the 11th month of 1918.

2019: “What hath God wrought” was the message of the first telegram message. It was sent from the U.S. Capitol to the B&O Railroad depot in Baltimore 175 years ago.

2020: The 100th anniversary of the passage of the 19th Amendment granting suffrage for women

2021: The 50th anniversary of the passage of the 29th Amendment that lowered the voting age to 18.

2022: Celebrating 75 years of technical innovation. In 1947, Dr. Edwin Land introduced the Polaroid Land Camera, broadcast of the first World Series game, the USS Newport became the first warship that was fully air conditioned, Chuck Yeager breaks the sound barrier, and Bell Labs scientists introduces the first semiconductor are just some of the innovations to celebrate.

Purposely missing from this list is the 75th anniversary of Jackie Robinson’s becoming the first African-American to appear in a Major League Baseball game in 1947. I fully expect that a commemorative coin will be issued for that event. If it is not, then congress should be ashamed of itself for not doing so.

Coin images courtesy of the U.S. Mint.

Jan 24, 2016 | BEP, cash, coins, currency, education, US Mint

Marriner S. Eccles Building where the Federal Reserve Board is located

The process begins when the Federal Reserve places their annual order with the U.S. Mint for coins and the Bureau of Engraving and Printing for currency. Like any organization that deals with inventory, the Federal Reserve will estimate its order based on a projection of demand.

Inventory management for the Federal Reserve requires them to know how much currency is in circulation, how much will be required based on world-wide economic factors, and what would be required to replace the current currency supply. Since the Federal Reserve ships U.S. currency world wide, especially the $100 Federal Reserve Notes, someone has to project what the world is going to demand based on economic factors that it has no participation in.

Life Expectancy of U.S. Currency

| Denomination of Bill |

Life Expectancy (Years) |

| $ 1 |

5.9 |

| $ 5 |

4.9 |

| $10 |

4.2 |

| $20 |

7.7 |

| $50 |

3.7 |

| $100 |

15 |

Not only does the Federal Reserve has to track the amount of money in circulation but they also have to account for the different denominations in order to replace torn and worn notes. For instance, it was once estimated that 90-percent of the order for $1 Federal Reserve Notes were delivered to replace worn notes in circulation.

Once the order is placed by the Federal Reserve, the U.S. Mint and the Bureau of Engraving and Printing work to fulfill that order. The U.S. Mint strikes the coins and has they placed in one-ton ballistic bags for delivery. The Bureau of Engraving and Printing bundles the currency in packs. Multiple packs make a brick. Bricks are then piled on pallets that are used for delivery.

From Philadelphia and Denver, the coin bags are loaded onto secured trucks and transferred to the Federal Reserve for distribution. A similar transfer happens at the Bureau of Engraving and Printing in Washington and Fort Worth where the pallets are shipped to the Federal Reserve.

Although there may be a few warehouses and other distribution processes involved, the coins and currency are shipped to one of 26 “cash rooms” around the country based on need. These cash rooms are special warehouses operated by the Federal Reserve branch that store the physical currency before being distributed to the member banks.

Federal Reserve Bank of New York

Before currency can enter circulation, a member bank places an order with the Federal Reserve. It is then delivered to them from the closest cash room with the appropriate inventory necessary to fulfill the order.

Your personal bank is like the corner store in the ordering system. When the shelves are bare or threatening to go bare, they order the inventory of currency they need. The corner bank just do not order money from the Federal Reserve. Banking companies work on behalf of their branches to manage inventory. The big bank may have their own cash management operations that help ensure that they not only have the appropriate amount of currency available but they do not have too much in storage. Like product inventories, idle money is not good for business.

Federal Reserve Bank of Richmond Baltimore Coin Storage

Federal Reserve Bank of Atlanta Cash Operations

Many banks hire logistics companies to help with the flow of their currency inventory. These companies are the ones driving the armored trucks you see around town that delivers currency on order. While these logistic companies are registered currency distribution services and have permits to pick up inventory from the Federal Reserve cash rooms on behalf of the member banks, they also provide storage and delivery services.

Although your corner bank has a vault, each banking company limits the amount of currency they keep on site because of security concerns. When they need additional currency or have an excess that needs to be stored, they call the logistics company to physically move the inventory.

Four of the largest cash logistics companies

Depending on how fast the currency is needed to circulate by your corner bank, existing currency can circulate through the logistics processing center long before the new inventory is placed into circulation.

During the recent downturn in the economy, the banks’ inventories of coins increased as people emptied jars, jugs, and bottles of coins for necessities. As the coins were returned to the bank the inventories rose beyond what they needed for circulation reducing the requirement for the banks to order more coins from the Federal Reserve. This is why it was not surprising that many people did not see current year coins until as early as April.

It is more difficult to gauge when currency reaches circulation unless there is a change in the series designation. The Series of a note is the date followed by a letter indicating that there is a change, usually to the autograph of the Treasurer or the Secretary of the Treasury. Although there is no rule, the Series date changes with an administration and the letter is added and changes as the autographs changes. Sometimes, the series date changes with the design of the currency. These are recent conventions and not the rule. All printing and design decisions are made by the Federal Reserve, Bureau of Engraving and Printing, and the U.S. Secret Service as a team.

If you want to know when the 2016 coins will reach circulation, the answer is “I don’t know.” Considering the economy is in better shape than in years past, money continues to circulate, and the U.S. Mint has produced more coins in a single year than any other in its history, if you have not seen a 2016 coin in your pocket change soon, then my best guess will be in mid-February—if the weather holds up!

Credits

- Eccles Building image courtesy of the Federal Reserve.

- Federal Reserve Bank of New York building courtesy of the Federal Reserve Bank of New York.

- Image of the Federal Reserve Bank Baltimore Coin Room courtesy of NPR.

- Image of the Atlanta Federal Reserve Bank Cash Operations courtesy of Glassdoor.com.

- Armored vehicle image courtesy of Prinéa.

Jan 20, 2016 | coins, commentary, news, policy, US Mint

United States Branch Mint in Denver. In 2015, Denver produced over 8 billion coins, more than any other mint!

On January 11, 2016 the U.S. Government Accountability Office (GAO) release a report (GAO-16-177) about the “Implications of Changing Metal Compositions.” The GAO, an agency of the Legislative Branch, is supposed to be an independent, nonpartisan agency that investigates how the government spends taxpayer dollars and reports their findings to congress. It is important to remember that the GAO does not investigate for the sake of investigating agencies. They are asked by members of congress for a report about the implementation of specific policies. This report was requested by Rep. Bill Huizenga (R-MI), Chairman of the Subcommittee on Monetary Policy and Trade under the Finance Committee.

NON-NEWS FLASH: The U.S. Mint spends more money on the metals used to strike one- and five-cent coins than their face value.

“Wait,” you say. “That’s not news.” Of course you are right because you are an astute collector and a reader of the Coin Collectors Blog! Unfortunately, those who write news stories point to this GAO report to show that they are correct for proposing their narratives supporting changes to be made at the U.S. Mint. By focusing on the metals costs misses the entire story.

Experimental test strikes of the 5-cent denomination using Martha Washington/Mount Vernon nonsense dies were produced on planchets of the same copper-plated zinc composition used for the current Lincoln cents.

Changing coinage metals will not translate into instant savings. In fact, for the first two-to-three years it might show a loss greater than if congress would leave the metals composition the same. It is not clear whether the current die making and coining presses would work with a different planchets. And we are not talking about a few presses. Can you imagine how many presses were needed in Philadelphia and Denver to produce over 8 billion coins in each location in 2015?

If I remember correctly from my last visit to the Philadelphia Mint, there were 20 presses in one row of presses in Philadelphia. Four rows were used to strike one-cent coins in three 8 hour shifts. There were two rows striking five-cent coins. Change the composition of these coins and that means the U.S. Mint will have to make changes to 120 presses!

That only covers the physical changes to the presses. Since most of the alternative alloys are harder than the current cupronickel alloy, dies will have to be replaced more often, the presses will require additional maintenance, and the processing will have to change. There are annealing machines, upsetting mills, and internal transportation systems that would have to be changed for the new alloys.

I spoke with a friend who works for a major manufacturer with facilities all over the world. During the discussion I was reminded of the usual changes in manufacturing that causes interruptions but are significant to think about. For example, oil refineries can close for two-weeks to a month in order to be retooled in order to change the production of fuel blended for cold weather driving to those for warmer weather driving. These costs are built into the prices you pay at the gas pump.

Similarly, an automobile manufacturer that changes model designs have to close to retool and retrain employees on the new designs. Making simple changes are easy. Change a body style and the entire line has to close at a cost to manufacturing.

Coining machines striking one-cent coins at the U.S. Branch Mint in Philadelphia.

The other story missed is that the GAO claims that the coin-operated industry over estimated their estimation on the costs to the industry if change is changed. The GAO report cites a 2014 study provided to the U.S. Mint by the National Automatic Merchandising Association (NAMA), the $45 billion per year vending industry trade association in the United States, which says it will cost from $100 to $500 per machine to convert them to accept new coinage while the old coinage continues to circulate.

While trying to justify the over estimation claim, the GAO actually strengthens the NAMA argument by not controverting the per machine cost.

The GAO does not consider that the NAMA does not represent the entire coin-op industry. The American Amusement Machine Association (AAMA) represents coin-op games (video, pinball, etc.), fair operators, gum ball machine manufacturers, jukebox manufacturers, and similar businesses. When the report was first discussed, then AAMA President John Schultz was reported to have said to leave the coinage alone “because it works, rather than risk the costly consequences.” AAMA has not provided an estimate for those costly consequences.

Another consequence would be changes that the government would have to undergo to support new coinage alloys. Any location that the government relies on cash transactions would have to be updated accordingly. While the Postal Service has eliminated most of their vending machines in favor of automated kiosks, this change will hasten a complete removal of those vending machines that continue to operate in areas where electronically connected kiosks cannot be supported. This could leave people in remote communities without particular services they rely on.

Aside from parking meters, how many vending machines, coin-op washers and dryers, change machines, even vending machines will have to be updated at your expense?

Someone my say to just eliminate the one-cent coin. Why not? Canada did it, why can’t the U.S. do the same? The most significant problem is that this would change an economy that is over 9-times the size of the Canadian economy. Using the Gross Domestic Product (GDP), the total cost of goods and services, as a benchmark converted to U.S. dollar, the World Bank reports that the GDP of $1.5183 trillion in 2010, the last year statistics are available. Similarly, the U.S. GDP in 2010 was $13.9631 trillion.

Even if someone was able to figure out how this change will impact an economy that produces over $15 trillion in goods and services (2014 data), there are also the ancillary costs of changing machines, systems, services, and anything else that could be impacted.

Although it might seem easy to change the alloys used for coins or eliminate the lowest denominations, the impact reaches far beyond all analysis including that of the GAO. To tell everyone to “just deal with it” is an expensive proposition that will have to be paid for. Are you ready to pay more taxes for governments to “just deal with it?” More fees for services? Or dealing with a loss of services because in order to “just deal with it” because the service provider decided that it is better to stop providing the service than convert?

Credits

- Image of Denver Mint courtesy of Wikipedia.

- Image of Martha Washington trial strikes courtesy of the U.S. Mint via Coin World.

- Image of the Philadelphia Mint was published in a Numismatic Bibliomania Society E-Sylum newsletter provided by Sandy Pearl.

- Parking meter image courtesy of Parkifi.

Jan 15, 2016 | coins, commemorative, gold, silver, US Mint

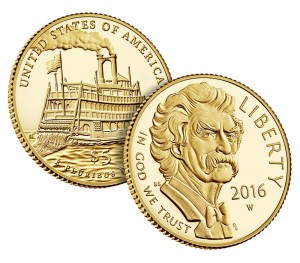

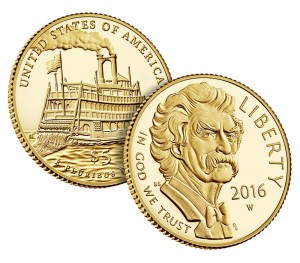

2016 Mark Twain Commemorative Silver Dollar

Originally, both the press release and apparently the COA from the U.S. Mint announced that the reverse design included Jim and Huck from the Adventures of Tom Sawyer. This error seemed to pass a lot of people who read the books, including me. Jim, who was Miss Watson’s slave who befriended Huckleberry Finn, appeared in the Adventures of Huckleberry Finn. Oops!

Apparently, someone forgot to proof read everything and the COAs were printed with the same information. Rather than distribute the wrong COA, which would have been interesting, the U.S. Mint had them reprinted. Citing an inventory issue, they delayed the sale of the silver dollar. It was not the inventory of coins that was the problem. It was the inventory of the complete package including the COA that caused the delay.

Packaging errors usually do not bring a premium. While they can be amusing, collectors have treated packaging errors as a nuisance. This would have been a fun error to keep around.

As an aside, I noticed that the 2016-W Mark Twain $5 Gold Proof Coin is listed as “Currently Unavailable” on the U.S. Mint’s website. The uncirculated coin is still available. Although there is a mintage limit of 100,000 gold coins regardless of strike type, there is no indication if this is the result of a sell out or a lack of inventory. Stay tuned.

2016-W Mark Twain $5 Commemorative Gold Coin

Images courtesy of the U.S. Mint.

Jan 6, 2016 | coins, Eagles, legislative, palladium, policy, silver, US Mint

Congress ended the calendar year with a proverbial bang. Aside from actually passing a budget, they passed a comprehensive transportation bill that not only has the possibility of raising our infrastructure grade from a D– to a D (hey… it’s an improvement), but in a few short words will have a big impact on the U.S. Mint.

Congress ended the calendar year with a proverbial bang. Aside from actually passing a budget, they passed a comprehensive transportation bill that not only has the possibility of raising our infrastructure grade from a D– to a D (hey… it’s an improvement), but in a few short words will have a big impact on the U.S. Mint.

H.R. 22: Fixing America’s Surface Transportation Act

Sponsor: Sen. Rodney Davis (R-IL)

• Introduced: January 6, 2015

• Passed House of Representatives on January 6, 2015

• Passed Senate with amendments on July 30, 2015

• Conference report presented to Senate on November 5, 2015

• Conference committee convened November 18, 2015

• Conference report agreed on by the House and Senate on December 3, 2015

• Signed by the President on December 4, 2015 to become Public Law 114-94

Read the details of this law at https://www.govtrack.us/congress/bills/114/hr22

If you want to read my analysis of the impact to the U.S. Mint from this law, see the following four-part series:

- Transportation drives numismatic changes

- Now with more silver

- Palladium arcadium

- Transportation silver eagles

Dec 29, 2015 | coins, Eagles, legislative, silver, US Mint

At the end of my last report on how the recent transportation bill will have an effect on coin collectors, I said that I would discuss how the new law will impact American Silver Eagle collectors. After taking a little time off for holiday festivities, we are going to look at the impact and unintended consequences of congress.

At the end of my last report on how the recent transportation bill will have an effect on coin collectors, I said that I would discuss how the new law will impact American Silver Eagle collectors. After taking a little time off for holiday festivities, we are going to look at the impact and unintended consequences of congress.

To review, earlier this month congress passed and the president signed the Fixing America’s Surface Transportation Act or the “FAST Act” (H.R. 22; now Public Law 114-94). It is a comprehensive transportation bill that is over 490 pages long with one third of those paged dedicated to items other than transportation. Buried deep in the document is Title LXXIII, “Bullion and Collectible Coin Production Efficiency and Cost Savings” section. For today’s post, we look at Section 73002:

Sec. 73002. American Eagle Silver Bullion 30th Anniversary

Proof and uncirculated versions of coins issued by the Secretary of the Treasury pursuant to subsection (e) of section 5112 of title 31, United States Code, during calendar year 2016 shall have a smooth edge incused with a designation that notes the 30th anniversary of the first issue of coins under such subsection.

If you are not familiar with “subsection (e) of section 5112 of title 31, United States Code” (31 U.S.C. § 5112(e)), it is the part of the law that authorizes the American Silver Eagle program. It says that these coins are to 40.6 millimeters in diameter containing 31.103 grams (one troy ounce) of .999 fine silver with a symbolic design of Liberty on the obverse and an eagle on the reverse.

Along with the prescribed elements the coin will have a reeded edge. It is this reeded edge requirement that may be causing a problem.

As written, Section 73002 does not say that the 2016 coin with a smooth edge with an inscription designating as the 30th anniversary of the first issue is for a special collectible. It is written as a blanket statement for all coins issued in 2016. Because of the word issued, the U.S. Mint is going to cancel the 2015 Limited Edition Silver Proof set.

2014 Limited Edition Silver Set (LS3) will be on sale until December 30, 2015 at noon.

However, that word “issued” causes a problem. If the coins are part of a packaging production, the coins may not have been struck in 2016 but the sets are being issued in 2016, then the 2015 could be violating the law. It is that ambiguity in a law passed by congress that will cause the 2015 Limited Edition Silver Proof set from being released.

Sausage making at its finest!

Images courtesy of the U.S. Mint

Dec 24, 2015 | bullion, coins, legislative, palladium, US Mint

Our final saga of How the Congress Turns (our stomachs), we will finish looking at the technical changes added to the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Back to Title LXXIII, Section 73001 we find:

Title 31, United States Code, is amended —

(1) in section 5112 —

. . .

(C) in subsection (v) —

(i) in paragraph (1), by striking Subject to and all that follows through the Secretary shall and inserting The Secretary shall;

(ii) in paragraph (2)(A), by striking The Secretary and inserting To the greatest extent possible, the Secretary;

(iii) in paragraph (5), by inserting after may issue the following: collectible versions of; and

(iv) by striking paragraph (8);

Remembering that technical changes instructs the Office of the Law Revision Counsel how to correct the law, to understand this change we have to look at the law (31 U.S.C. § 5112(v)) to find that this is a correction to the law about minting palladium bullion coins.

Palladium Nugget

The very first edit is to take away the wording that says to do the study and strike if there is a market to saying that palladium coins will be struck using as much palladium as can be found from United States sources. If there is a higher demand, the U.S. Mint can use sources outside of the U.S. to purchase palladium.

Finally, the last correction not only requires the U.S. Mint to strike palladium bullion coins but to also create collector versions.

-

-

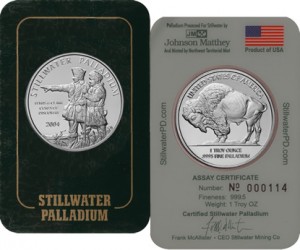

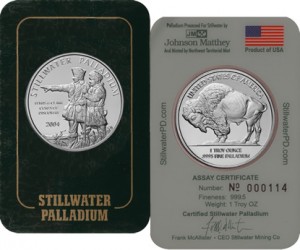

2004 Stillwater Palladium Rounds

-

-

2005 Canada Palladium Maple Leaf

Palladium is a soft silvery metal like platinum. It is lighter than platinum (atomic number 46 versus 78) and similar to silver (atomic number 47). It has similar uses as silver including in electronics, compounded catalysts, jewelry, and coins. Palladium commands a higher price than silver because it is less available but less expensive than platinum, which is more difficult to mine.

The primary source of palladium in the United States is the Stillwater Mine in Montana. The mines, which also provides the U.S. supply of platinum group metals (PGM), is owned and operated by the Stillwater Mining Company. The American Eagle Palladium Bullion Coin Act was introduced by Rep. Dennis “Denny” Rehberg (R), Montana’s only member in the House of Representatives.

The final entry will discuss how the transportation bill and bad timing will affect American Silver Eagle collectors.

Dec 23, 2015 | coins, legislative, news, silver, US Mint

In our short saga of How the Congress Turns (our stomachs), we are going to look at the next and last provision of how the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Returning to Title LXXIII, Section 73001 we find:

In our short saga of How the Congress Turns (our stomachs), we are going to look at the next and last provision of how the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Returning to Title LXXIII, Section 73001 we find:

Title 31, United States Code, is amended —

(1) in section 5112 —

. . .

(B) in subsection (t)(6)(B), by striking 90 percent silver and 10 percent copper and inserting not less than 90 percent silver; and

. . .

(2) in section 5132(a)(2)(B)(i), by striking 90 percent silver and 10 percent copper and inserting not less than 90 percent silver.

The result of the corrections is to change the requirement to strike silver coins with a composition that contains 90-percent silver, to the requirement that the coins must contain at a minimum 90-percent silver. By making these changes, it allows the U.S. Mint to use pure silver planchets to strike coins.

The U.S. Mint has been asking congress to end the practice of requiring silver coins to be 90-percent silver. Earlier, it was learned that pure silver planchets would be cheaper to produce than to find the few suppliers who would create “dirtied” blanks.

Congress finally listened (for a change).

The change in the law happens in two parts. Paragraph (B) makes the change for the balance of the America the Beautiful Quarters Program including the 5-ounce bullion coin. Section (2) changes the Administrative part of the code (31 U.S.C. § 5132(a)(2)(B)(i)) that covers all other coins. A problem with the way these corrections were written it does not affect commemorative coin programs unless the U.S. Mint’s general counsel feels that this law covers all coins. While the U.S. Mint is likely to interpret the law the way that benefits them, the wording does not cover commemoratives.

The change in the law happens in two parts. Paragraph (B) makes the change for the balance of the America the Beautiful Quarters Program including the 5-ounce bullion coin. Section (2) changes the Administrative part of the code (31 U.S.C. § 5132(a)(2)(B)(i)) that covers all other coins. A problem with the way these corrections were written it does not affect commemorative coin programs unless the U.S. Mint’s general counsel feels that this law covers all coins. While the U.S. Mint is likely to interpret the law the way that benefits them, the wording does not cover commemoratives.

Missing from these corrections the similar language for gold coins. Unless the U.S. Mint will interpret the gold coin changes as permission to change the commemorative coin programs, gold coins will remain 90-percent gold.

As I write this I am reminded about famous quote by the first Chancellor of Germany Otto von Bismarck: “Laws, like sausages, cease to inspire respect in proportion as we know how they are made.”

Next, we introduce another collectible that congress has mandated to be produced by the U.S. Mint.

Mount Rushmore quarter image courtesy of the U.S. Mint.

Beginning February 29, 2016, the U.S. Mint is having an open competition to design the 2018 World War I Centennial Commemorative silver dollar.

Beginning February 29, 2016, the U.S. Mint is having an open competition to design the 2018 World War I Centennial Commemorative silver dollar.

Recently, I was notified that the company whose notebook-like program decided to close its virtual doors. Its concept was simple: act like a notebook that you can stuff anything into. Although other programs passed it in some features, it was still a solid way of keeping a digital notebook. Now that they are out of business, I do not want to rely on what we call “abandonware.”

Recently, I was notified that the company whose notebook-like program decided to close its virtual doors. Its concept was simple: act like a notebook that you can stuff anything into. Although other programs passed it in some features, it was still a solid way of keeping a digital notebook. Now that they are out of business, I do not want to rely on what we call “abandonware.”

Congress ended the calendar year with a proverbial bang. Aside from actually passing a budget, they passed a comprehensive transportation bill that not only has the possibility of raising our infrastructure grade from a D– to a D (hey… it’s an improvement), but in a few short words will have a big impact on the

Congress ended the calendar year with a proverbial bang. Aside from actually passing a budget, they passed a comprehensive transportation bill that not only has the possibility of raising our infrastructure grade from a D– to a D (hey… it’s an improvement), but in a few short words will have a big impact on the