Mar 31, 2017 | BEP, coins, currency, dollar, news

Sen. John McCain (R-AZ) once again introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act). Similar to the same bill he introduced in the last congress, the COINS Act (S. 759) proposed to end the production of the $1 Federal Reserve Note, reduce the production cost of the five cent coin by changing its composition, and eliminating the one cent coin. Mike Enzi (R-WY) is a co-sponsor.

Sen. John McCain (R-AZ) once again introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act). Similar to the same bill he introduced in the last congress, the COINS Act (S. 759) proposed to end the production of the $1 Federal Reserve Note, reduce the production cost of the five cent coin by changing its composition, and eliminating the one cent coin. Mike Enzi (R-WY) is a co-sponsor.

“With our country facing $20 trillion in debt, Congress must act to protect the American taxpayer,” in a statement issued by McCain’s staff. “By reforming and modernizing America’s outdated currency system, this commonsense bill would bring about billions in savings without raising taxes.”

Of course “common sense” has a very different definition in Washington than the rest of the country. The first attempt to introduce a bill to end the production of the $1 note started in 1991 by then Rep. Jim Kolbe (R-AZ) and died at the end of the 102nd Congress. Kolbe introduced the legislation every session until his retirement in 2007 following the adjournment of the 109th congress. McCain has introduced the bill in the last three sessions of congress.

“Change can be hard sometimes, but switching to a dollar coin could save our country $150 million a year,” Enzi said. “Our country is in a difficult financial position because we didn’t value the cost of the dollars we spent. We can’t afford to keep that up, and these innovative opportunities are a way to save taxpayer money that is really just being wasted with each new dollar we print and penny we mint.”

I am sure that the usual arguments about eliminating the paper dollar will come up again. Even though a GAO report has shown that eliminating the paper dollar could save the government about $4.4 billion in production and handling costs, economic surveys have claimed a potential $16-18 billion benefit for the government.

When the public is asked about eliminating the paper dollar, the arguments usually line up along generational lines. Surveys have shown that Baby Boomers (those born before 1964) and those older are overwhelmingly not in favor of eliminating the the paper note. The GenXers, those born 1965-1980, are almost evenly divided while the Millenials, those born since 1980, do not care because they are mostly tied to their credit and debit cards.

The Baby Boomer that writes this blog is in favor of eliminating the paper dollar. In the past, he was in favor of eliminating the one cent coin but is beginning to have second thoughts.

For the longest time, the Massachusetts delegation have held these types of bills back. This is because the Dalton, Massachusetts based Crane & Co., the maker of currency paper, has been the exclusive currency paper supplier to the Bureau of Engraving and Printing since 1879. Although Elizabeth Warren (D-MA) has become a more powerful figure in the Senate, she is not a favorite amongst the majority and is tolerated by the more centrist members of her own party. Sen. Ed Markey (D-MA) does not have the gravitas either of his predecessors, the late Ted Kennedy and John Kerry, to yield influence. The only power the Senators have would be to filibuster any measure that would eliminate the $1 note. Sen. Warren has railed against military-related spending for non-essential equipment so that members of congress could keep these jobs in their districts. Would she be willing to follow her lead that could reduce the revenue of a company in her home state?

Mar 24, 2017 | Britain, currency, foreign, news

There are times that while we are having fun collecting coins, currency, exonumia, and the like, there is a real world out there with real issues. For some, this hobby can be an escape from that reality.

There are times that while we are having fun collecting coins, currency, exonumia, and the like, there is a real world out there with real issues. For some, this hobby can be an escape from that reality.

On Wednesday, the Bank of England announced that they were looking into the issue where their new polymer notes contain traces of tallow. According to the supplier of the pellets that are used to make the polymer substrate, tallow is used in the resin it sources from a supplier to make those polymer pellets. It was a low-key response to an issue that was made bigger by the British vegan community.

While writing a snarky response, my Twitter feed blew up with the news of the attack on the Westminster Bridge and near Parliament Square in London. I stopped writing and turned on the news. Having once walked on that bridge there was a sinking feeling I could not shake.

We know that five people have died, including a police officer and the attacker. One was a man from Utah on the last leg of a 25th Anniversary trip with his wife. She was amongst the reported 50 people injured and one of the 31 requiring hospital treatment. One woman was so scared she jumped off the bridge and into the Thames River

MI5, the United Kingdom’s internal security force, arrested seven men and four women on terrorism charges. One of the women posted bail, the other 10 are still in custody. They have collected over 2,700 pieces of evidence that they will be studying.

Although I am not a “run-and-hide” type, I find it difficult to be snarky given the recent events, even if the story deserves that type of treatment. I am sure that the heartbreak of tallow will return to the news and will give me a chance to have fun at their expense. But for now, let’s wish the best for the people who were injured and the families of those who are mourning.

Mar 10, 2017 | advice, coins, currency

How would you like to find one of these at a flea market?

Estate Sales and Auctions

In my current business, I am able to buy inventory from estate sales and estate auctions. Most estate sales are either the lifetime accumulation of a deceased loved one or a forced sell-off of assets mainly as part of a court-ordered restructuring. An estate sale company will come into a home, stage it for a sale, add prices to everything and open the house for the public to buy what they want.

Adding prices mean tagging the items with a price that the company running the estate sale thinks is a fair price for the item. This tagging also has these sales also called Tag Sales. When it comes to tagging, some companies are better than others. After they pick the better items, the rest of the house is tagged either at prices too low or prices too high because most of the estate sales company do not know about the items they sell. They might use an average price of similar items they sold in the past or they just pull prices out of the air.

Estate sale companies have little to know expertise with coins and currency which is reflected in their prices. I cannot tell you how many times that I have walked into an estate sale and seen common date Morgan and Peace dollars priced at over market value.

Case of foreign coins at a flea market

When I presented my offer, I told him that I understood the coin market and would explain how I came up with the price. I showed him the Numismedia Fair Market Value pricing guide and explaining that it is a retail price guide. Confused by the differences in grade pricing he questioned how to grade coins, I show him the condition of the coins compared to the images in the PCGS Photograde app. After being confused by everything he said that he would take a chance on his price and turned down my offer.

I returned to the estate sale on Sunday afternoon about a half-hour before closing and noticed that none of the coins sold. I lowered my offer to a small percentage above its melt value. The offer was declined. A week later I found out that the coins were brought to a local coin shop. Imagine their surprise when they were offered a price between my two prices.

If you go estate sale shopping for coins, be prepared to be patient. Even though it is not their merchandise, they act as if it is their personal property. Most will be reasonable if you are reasonable with them. I would recommend reviewing the “Negotiating” section in my post “How Are Coins Priced (Part II).”

Silver halves and Peace dollars found at a recent flea market

In my experience, gold and U.S. Mint packaged items usually sell at prices greater than fair market value. I cannot tell you why a 1977 Proof Set would sell for $15 when it is valued at $8, but it happens at these auctions.

If you are not involved in this market, there is a world of online estate auctions that hides in the open. Online estate auctions are hosted on sites that are not quite well known outside of those of us who work and shop in this world. These auctions are simply a company imaging and posting the inventory online, managing the auction, collecting money, and making sure everyone is paid. Most companies will hold absolute auctions that run for 7-10 days with all items starting at $1.00.

For those who do not know, an absolute auction is one where the lots sell at whatever the price is when bidding ends, also known as the hammer price in reference to a hammer that is used during live auctions. Winners will also pay a buyer’s fee which average 15-percent of the hammer price.

Although it is possible to find bargains in these estate auctions, many times I have seen numismatic items sell for more than fair market value. This is not good if you are a re-seller but sellers are doing well.

Antique Shows and Flea Markets

I go to a lot of antique shows and flea markets. I will set up a table at a few flea markets in a month and do a big show at least every month. One big I regularly participate is D.C. Big Flea, the mid-Atlantic’s largest antiques show and flea market. The show attracts 400-700 vendors, depending if they can use the entire center, with a variety of antique, vintage, and collectible items.

German Notgeld found at a flea market

Buying numismatic items at these large shows can be problematic. One of the biggest problems is that the vendor might have bought the item at full price and has overpriced it to gain a profit. There was also the time that a vendor had bought a roll of American Silver Eagles, placed them into AirTite holders and was selling them at a premium similar to the collectible Eagles struck at West Point with the “W” mintmark. When I questioned his prices and showed him that he was charging a 100-percent markup based on the per-roll price at a known distributor, he bluntly told me how unhappy he was with my questioning.

Most dealers will not try to swindle you based on a false narrative of value. In fact, many appreciate the education including the pointer to online resources. They will negotiate, and if you are fair with them, they will be fair with you. Sometimes, you can find items that you might not see on a bourse floor. During the last show I attended, one dealer had a case with a lot of German Notgeld, most in Extra Fine and Uncirculated condition.

During a previous show, I found a dealer who emptied boxes of tokens, trinkets, buttons, and medals on a large table. It was a treasure hunter’s dream! Although I did not have time to do an extensive search, I did find a few small New York-related items that I had never seen before including a merchant token for a business I know existed into the 1970s.

Although estates sales and auctions, antiques shows, and flea markets could present problems because most of the dealers are not as knowledgeable, if you come armed with knowledge, patience, and be on your best behavior, you can find some good bargains.

Jan 3, 2017 | Britain, commentary, currency, news

Bank of England £5 Polymer note

To be a vegan means that you do not use or consume any animal product. It is a movement that began in the 16th century but organized in the 19th century as part of a philosophy to reject the commodity status of animals. In fact, the term “vegan” did not enter the language in 1944 when Donald Watson co-founded the Vegan Society in England. Fundamentally, I do not have a problem with vegans or veganism but it has recently crossed the line where my tolerance is being tested.

In September, the release a new £5 polymer note featuring the portrait of former Prime Minister Winston Churchill. Even though there were concerns raised at the time of the release, in November, a vegan activist names Steffi Rox asked the Bank of England if the new £5 polymer note contains tallow on Twitter. The Bank of England responded that “there is a trace of tallow in the polymer pellets used in the base substrate of the polymer £5 notes.”

Which was followed up by Ms. Rox asking “what consideration was given to #vegans & their human rights in the making of these?”

This exchange reverberated around the world to all countries that use polymer notes including Australia that has been circulating polymer notes since 1992.

The Bank of England issued a statement confirming that the pellets used to make the polymer substrate contains trace amounts of tallow.

The new notes are produced on a product called Guardian manufactured by Innovia Security. Innovia is the company formed in Australia following the research and production of the polymer substrate by the Reserve Bank of Australia. Although Innovia has not issued a formal statement, press reports note that the company admits that tallow is used in the resin it sources from a supplier to make the polymer pellets used by the banks in the manufacture for the substrate that is printed for currency.

Tallow is made from suet, the fatty deposits around the organs of cows and sheep. It is a byproduct of the process of butchering a cow for its meat and hides. In its natural form, suet is only useful for cooking and some preservation. When it is rendered (by boiling) into tallow, it is used to manufacture soap, candles, and lubricants. The use of tallow in even the most synthetic lubricant is ubiquitous. Machines used to harvest crops or grease moving parts in automobiles have tallow in them.

Tallow is part of using the whole animal rather than killing it for parts and discarding the rest. It is the concept that animal rights activists preach. On this, I agree with their position.

But it isn’t like the Bank of England or Innovia is dumping tallow into its manufacturing process. Based on what how it was explained to me by a chemist familiar with polymer manufacturing but not associated with Innovia or the polymer banknote process, tallow is likely used in the resin as part of the pellet manufacturing process. The resin acts as a binder but has to manufactured in a way that prevents it from sticking to everything. Small amounts of tallow are used as a lubricant to make the resin to prevent it from sticking to the machinery. Trace amounts of tallow remain in the resin in the same manner oil would remain on your tires if you rolled over an oil slick on the street.

Just because there is oil on your tires does not mean your tires are made of oil. But the oil remains a trace element on your tires and continues to exist until removed using some type of friction. But it is such a small trace, you never notice.

The same can be said of the tallow. The chemist said that if there are more than 5 parts per million of tallow in the notes then that the manufacturing process should be questioned. Aside from suggesting the process is dirty the proportions may make the polymer unstable and less useful to use as currency. Its 25-year usage in circulation suggests that there are no problems in the manufacturing process.

To understand what 5 parts per million would mean, you can also think of it as one-two thousandth of one percent.

With all due respect to vegans, you are probably breathing more dander in a single day than you are touching tallow in all of the polymer banknotes that cross your paths. For those of us who know that tallow is used in all sorts of lubrication products, especially those used in transportation, you cannot get away from its use. It is everywhere. You need to better educate yourselves before taking a stand against one-two thousandth of one percent because you look like hypocrites.

Victoria Cleland, Chief Cashier at the Bank of England, presenting the Churchill War Rooms with their New Fiver

Dec 5, 2016 | books, Canada, coins, currency, review, tokens

If you are a collector of Canadian coins and looking for a standard reference, there is nothing better than The Charlton Standard Catalogue of Canadian Coins. Available in two volumes, the Charlton catalogs would be the Canadian equivalent of the Red Book Professional Edition. Charlton Press also publishes books for the Canadian currency and token collectors. All of the Charlton books are very comprehensive on their respective topic and a must for the Canadian collector.

If you are a collector of Canadian coins and looking for a standard reference, there is nothing better than The Charlton Standard Catalogue of Canadian Coins. Available in two volumes, the Charlton catalogs would be the Canadian equivalent of the Red Book Professional Edition. Charlton Press also publishes books for the Canadian currency and token collectors. All of the Charlton books are very comprehensive on their respective topic and a must for the Canadian collector.

Like the Professional Edition of the Red Book, the Charlton Catalog is not a quick or portable reference. When I am searching through coins at shows or if I am just trying to identify something I had just acquired, I want a quicker reference with some basic prices that does not require me to hunt around the other information I am not interested in at the moment. I think I found the perfect reference for Canadian numismatics.

While searching one of my favorite online coin supply retailers, I came across the 2017 by W.J. (Bill) Stanley. It is published by Canadian Wholesale Supply of Paris, Ontario. Within the book, it does not carry a copyright date and it does not have an International Standard Book Number (ISBN). It can be found at a number of online numismatic stores but not on stores like Amazon that require an ISBN.

But if you are collecting Canadian Coins, Breton Tokens, or Canadian Paper money you should have a copy of this book sitting next to your Charlton Standard Catalog. While the Charlton books are very complete with a lot of information, the pictures are in black and white. All of the coin images in the Stanley book are in color. Although you can guess what the colors are, seeing the color images on varieties and being able to compare them with coins is of great help.

Canadian Coin Section sample pages

-

-

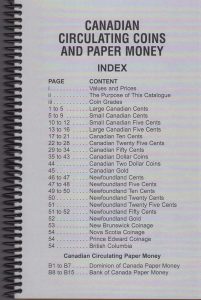

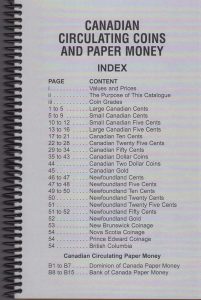

Index of the Coin and Currency Section

-

-

Bill Stanley’s purpose of this book

-

-

Sample of the Vicki Cents

-

-

Sample page showing how varieties are illustrated

Another advantage of the Stanley book is that it consists only of circulating coinage. Although the Royal Canadian Mint has expanded its catalog of non-circulating legal tender coins over the last decade, if you are just collecting circulating issues, then the other stuff is clutter. It is just the basics of what was circulated in Canada.

This book is divided into three section. The first are circulating Canadian coins, the second for Canadian currency, and final are the tokens. The coin and currency section has a single introduction, guide to reading the tables, and an index to find the particular type you might try to find. The coin section has their pages numbered beginning with page 1 with the introductory parts numbered with Roman numerals. But the currency section begins on page B-1 following page 54 of the coins.

Canadian Currency Section sample pages

-

-

Beginning of the currency section

-

-

A sample page of the currency section

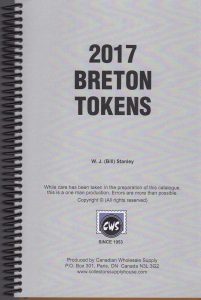

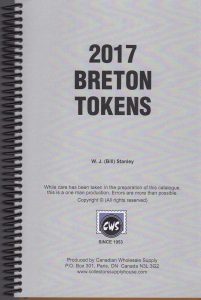

The tokens section appears as if it was a separate book bound with the coin and currency section to make one book. It has a title page followed by a similar introduction, guide to reading the information, and an index. The introductory pages are not numbered but the token listings begin on page T-1.

Breton Tokens Section sample pages

-

-

Title page of the Breton Tokens section

-

-

Index to the Breton Tokens section

-

-

A sample from the Breton Tokens section

-

-

A sample from the Breton Tokens section

If the book was bigger, these page numbering anomalies would be confusing. I only noticed this when I tried to figure out how many pages are in the book. Considering that not every page is numbered and there are some blank pages in the middle, I think there are 132 pages in total. Not very thick and spiral bound for easier handling.

Prices in the book are given for the basic grades and includes prices for significant auctions and prices gathered for rare and significant coins. As most of us are aware, most printed price books are obsolete by the time they are published. What Stanley does is use information he gathers from auctions and coin shows around Canada to determine the prices. In his introduction, Stanley admits he uses his judgment to exclude what appears to be bogus data based on bidding wars or data from untrustworthy sources. He also admits that there may be errors.

Without reaching out to Stanley, it appears he is the sole responsible person for the prices and content of this guide. Maybe that is a good thing considering the inaccuracy of similar guides from other publishers. However, after go through his guide and a number of other sources including the prices from a few Canadian dealers, this book may be more accurate than his caveat suggests.

After that, it is pages of coin listings similar to any price guide you may find. The number of coins minted is included on each line. There are images of coins, images of varieties with an arrow point to subtle differences, and prices in the most relevant grades of circulating coins.

I cannot speak about the Charlton Standard Catalog of Canadian Currency since I do not own that book, but similar to the coins’ section, the Canadian currency section is nothing but the basics. Color images are reproduced from the Bank of Canada and have “SPECIMEN” superimposed on each note. Descriptions note signature, portrait, and serial number differences (i.e., prefix types) for the notes and the prices in the most relevant grades.

Tokens are a very important part of the history of Canadian money. When coins or currency was not available, Canadian towns and provinces created tokens to act in the place of money. The history of Canadian tokens is fascinating and worth another report. It is important to note that the cataloging of tokens is based on the work Pierre Napoleon Breton in his book Illustrated History of Coins and Tokens Related to Canada originally published in 1894, since republished and updated. As part of his cataloging of tokens, he assigned them a number that is now known as Breton Numbers. Stanley lists Canadian tokens by Breton Numbers.

Although I am not a collector of Breton Tokens, I am fascinated by other areas of numismatics especially if they are different. What thrills me about this section is that the tokens are imaged side-by-side with their basic information and prices. It is not a tome on their history but if I was a collector, it would help me identify these tokens and what I might expect to pay for them. I found myself flipping through the pages looking at the tokens, what they say, and thinking about their possible history. I want to go back through my back issues of The CN Journal (publication of the Royal Canadian Numismatic Association) and find some of those stories about tokens I never read.

Flipping the pages of such as basic reference, I never thought I would learn so much. I think it is because all of the other information has been omitted, I can see the coins, images of the varieties, and the prices without distraction. Now that I have learned a number of things, I can pick up other references to learn more.

My only minor nit about this book is the page numbering scheme and the lack of coherent index or table of contents. I give it a grade of MS-68 for being a simple reference of circulating Canadian numismatics and a book that I recommend.

Oct 11, 2016 | cash, coins, commentary, currency, markets

Cash seems to be the new 4-lettered word.

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

Last May, the European Central Bank announced will stop printing the €500 banknote by the end of 2018 when the €100 and €200 banknotes of the Europa series are planned to be introduced. Although the announcement did not quote the Summers article, the announcement had addressed some of the issues he addressed.

In June, Sweden became the first nation to announce a formal policy to become a cashless society within five years. According to reports, Riksbank, the Swedish central bank, claims that just under 2-percent of all transactions are made by cash. They expect that number to drop to one-half of one-percent by 2020. Most shops report that 20-percent of sales are made using cash.

Sweden may be an outlier. Globally about 75-percent of all sales are made using cash.

In the United States, it is being reported that some higher-end retailers have stopped taking cash.

Retailers have been looking to the convenience industries as an example of the future. There are parking lots that no longer take coins in their parking meters. Pay stations now only accept credit cards. Some toll roads now require a special transponder to be mounted in your car because there are no booths to collect tolls. Those transponders must be linked to a credit card. Airlines no longer take cash when you buy beverages or snacks on the plane because handling the change is too difficult.

New payment options have entered the market. Smartphone-based Apple Pay, Samsung Pay, and MasterCard Master Pass have worked to make it easier to separate you from your money by allowing you to wave your phone at the reader and pay. For most retailers, there is little they have to do in order to accept these payment methods as long as they are accepting chip-based transactions. Since the transaction cost to the retailer does not change, it is an incentive for them to accept these types of electronic payments.

Although electronic payment options make up 13-percent of all cashless transactions you have to remember that this market barely existed a few years ago.

Even as banks and large retailers push to increase the number cashless transaction, there are problems that society faces when moving to a cashless retail system.

The biggest problem is one of scale. The United States makes more money, spends more money, trades more money, and has more economic impact than any other country in the world. It is the world’s single largest economy with a strong capitalistic culture where most of the commerce is done with small businesses. Amongst all business, 55-percent of retail merchants are cash-only enterprises. They are too small to consider paying the 3-to-5 percent fees for using a credit card, known as the “swipe fee.” Of those that do take credit cards, at least 36-percent require a minimum purchase.

Once you get past the problem of scale, then there are the issues of the poor who do not have bank accounts. Aside from not having the economic power to work with the banks, there are some communities that are culturally opposed to the banking system. Even if they can afford to have a bank account, many choose not to open one. The near failure of large financial institutions in 2008 did not help in the trust factor.

Of course, the one cultural issue that cannot be ignored is privacy. Cash transactions are private. Only the buyer and seller knows the details of the transaction (unless the buyer volunteers their loyalty or rewards account information). With the problems of hacking around the world, how do you know that your credit card transaction are safe? Should we ask the victims of the computer hacks on Target and Home Depot?

Aside from privacy, credit cards can be costly to the customer. High-interest rates, debilitating debt, and collection issues see the use of consumer credit dropping when there is an economic downturn. During the Great Recession that began in 2008, spending went down and, when the economy began to improve, savings went up. When wages began to rise in 2010, more money was being spent paying down debt than adding to the economy. Rather than stimulating the economy, this creates a stagnant effect since the economy thrives more on the selling of goods and not by the managing of cash.

It seems that every six months there is yet another “Chicken Little” story that either we are or should stop using cash. But when society seems to be set in using cash even when there is anecdotal evidence that makes it appear that we are on the brink of a cashless society, they become quiet as if they ended up in Foxey Loxey’s den!

Reports of cash’s eventual demise appear to be as amusing as it is greatly exaggerated. For numismatists, this means that our hobby will continue to grow with new, fresh material for years to come. Happy collecting!

Sep 8, 2016 | cash, counterfeit, currency, news

One of the strangest set of stories about the problem of counterfeiting was the several stories that came out at the end of August about people trying to make purchases with movie prop money. This has caused regional U.S. Secret Service across the south to issue warnings.

Prop movie money is designed to look close enough to real U.S. currency so that a moviegoer would not be able to tell the difference on screen. When these notes are examined closely, they are clearly marked with “THIS NOTE IS NOT LEGAL TENDER” and “FOR MOTION PICTURE USE ONLY.” Prop money is smaller than real U.S. currency and does not have the anti-counterfeiting features of a real Federal Reserve Note. But that has not stopped people from trying to pass these notes as real currency.

-

-

Prop Movie Money

-

-

Prop Movie Money

-

-

Prop Movie Money

Here is a sample of the reports about people trying to use prop money as real currency:

In Athens, Georgia, a 30 year-old man beat a customer with a baseball bat at a fast food restaurant when he alleged the customer bought marijuana using two prop $100 notes.

Police in the Gwinnett County, a suburb of Atlanta, are looking for two suspects who went on a spending spree by buying two cars and paying with prop money.

Prop money has shown up in Morristown, Tennessee, northwest of Knoxville.

U.S. Secret Service issued a warning in the Tampa Bay area when someone tried to buy a smartphone using prop money and noted that there has been an increase in the use of this currency.

Areas of East Texas have reported several cases in which prop money has been used. Texas Bank and Trust reported that they have seen a few of these notes were deposited into accounts at their bank.

Sources have not confirmed the source of this recent uptick in prop money usage but noted that the currency can be purchased online. Although eBay rules do not allow for this type of currency to be sold on its site, a recent search yielded several listings offering prop money. There is no restriction on Etsy where searches lead to over 300 listings of all types of prop or replica money.

Why was the criminal in the in the Dateline video attached to my post “How easy is it to pass counterfeit currency” so successful? Like he said, nobody pays attention!

Prop Movie Money

Aug 10, 2016 | Baltimore, currency, education

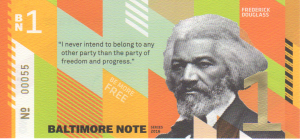

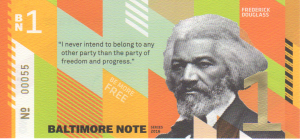

Last April, the Baltimore Green Currency Association, sponsor of the BNote, initiated an Indiegogo campaign to fund their next issue that would feature significant women in Baltimore history. Although the campaign fell a little short, an anonymous donor funded more than $10,000 of the balance to print the currency.

Notes are a local currency that can be used at participating businesses in and around Baltimore. Currently, there are over 230 businesses accepting the BNote for goods and services. Consumers can receive BNotes as change for a transaction or may visit one of the official cambios (money exchange locations) to exchange dollars for BNotes. For every $10 that is exchanged for BNotes, you will receive a 10-percent bonus, which means if you exchange $10 you will receive BN11. You can also exchange BNotes for dollars at a reverse rate (receive $10 for every BN11 in BNotes).

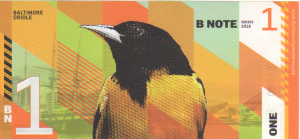

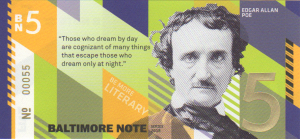

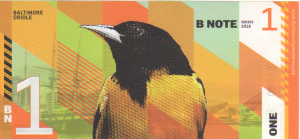

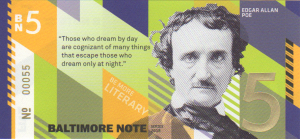

The first BNotes were issued in April 2011 featuring the designs of Fredrick Douglas on the BN1 note and Edgar Allan Poe on the BN5 note. The reverse of the notes features a Baltimore oriole (the bird, not a ball player) on the $1 BNote and a raven on the reverse of the $5 BNote. For this new issue, Douglass and Poe remain on the note but the design changed to incorporate the vertical bars of the Calvert coat of arms that is incorporated in the Maryland flag.

-

-

Baltimore BN1 BNote with portrait of Frederick Douglass

-

-

Back of Baltimore BN1 BNote featuring a Baltimore Oriole (batting leadoff)

-

-

Baltimore BN5 BNote with portrait of Edgar Allan Poe

-

-

Back of Baltimore BN5 BNote with image of a Common Raven (Nevermore!)

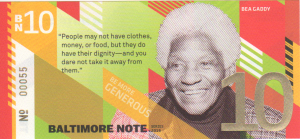

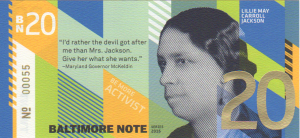

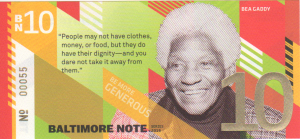

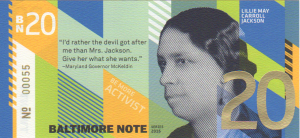

The new BN10 and BN20 notes are similar in design with new colors on the background. Bea Gaddy is featured on the front of the BN10 and the Baltimore Checkerspot Butterfly, the official Maryland State Insect, on the reverse. Lillie May Carroll Jackson appears on the front of the BN20 note and a Blue Crab, the official Maryland State Crustacean, on the reverse.

Bea Gaddy was known as the Mother Teresa of Baltimore. A single mother of five who ended up in baltimore in 1964, she was discovered by a Baltimore attorney who encouraged her to go to college. Gaddy earned her bachelor’s degree in human services from Antioch University in 1977.

-

-

Baltimore BN10 BNote with portrait of Bea Gaddy

-

-

Back of Baltimore BN10 BNote with image of a Baltimore Checkerspot Butterfly, the Maryland State Insect

Gaddy saw the need to help others and joined the East Baltimore Children’s fund where she used her own home as a distribution point for clothing and food for the poor. She founded a homeless shelter which eventually became the Bea Gaddy Family Center, which is still in operation today.

In 1981, using the $290 she won on a 50-cents lottery ticket, she bought enough food to feed 39 neighbors and eventually opened a community kitchen for the needy. From Thanksgiving dinners to opening furniture bank refurbishing used furniture and rehabbing abandoned row houses, Gaddy was a catalyst to help the poor in Baltimore. Eventually, she became an ordained minister to perform marriages and hold funerals at no cost to the families.

Gaddy was diagnosed with breast cancer in 1998. With the cancer in remission, Gaddy ran for Baltimore City Council in 1999 and won. Unfortunately, the cancer returned and she died in October 2001 at the age of 68. Even though Bea Gaddy is gone, her family and friends continue to help the poor in Baltimore using the same love and compassion Bea showed throughout her life.

Dr. Lillie May Carroll Jackson was born in Baltimore in 1889 and is consider the mother of the civil rights movement. From 1935 through 1970, Jackson was the president of the Baltimore chapter of the NAACP and at the forefront of nearly every fight to end Maryland’s Jim Crow laws. Through her leadership, the Baltimore NAACP sued to remove the color barrier from admissions to the University of Maryland Law School, won cases to force Baltimore public schools to grant equal pay to white and black teachers, and was fundamental to having Baltimore to be the first school system south of the Mason-Dixon line to integrate their schools following the landmark Brown v. Board of Education decision.

-

-

Baltimore BN20 BNote with portrait of Lillie May Carroll Jackson

-

-

Back of Baltimore BN20 BNote with image of a Blue Crab, the Maryland State Crustacean

Jackson fought for equal pay and fair employment practices even though Maryland Governor Theodore McKeldin (R) was once quoted as saying, “I’d rather have the devil after me than Mrs. Jackson. Give her what she wants.” In the end, Jackson won most of the fights.

She is also credited with playing critical roles in the passage of federal civil rights legislation in the 1960s.

Jackson died from a heard attack in 1975. After she died, her will called for her Baltimore home to be turned into a civil rights museum. The museum opened in 1978 with memorabilia from Jackson’s life and documents chronicling her life’s work. It was the only museum named after a woman and the only civil rights museum in Maryland. The museum closed in the 1990s because it was too difficult to maintain as a private facility. The museum was transferred to Morgan University who refurbished the building and reopened it on June 11, 2016.

As part of the Indigogo campaign, I selected the option to receive the a full set of the second series BNotes with matching serial numbers. The notes I received, which feels like they were printed on heavy stock paper, a type of paper my wife said was “resumé” paper. All four notes feature serial number BN00055. For all you liar’s poker players, I call a full house.

What do you mean I can’t call a full house?!

Jul 11, 2016 | coins, currency, poll

From my collection, a 2015 Canada Bugs Bunny $20 for $20 Silver Coin

I am asking for two reasons: first, I am curious. I know that my tastes are different from yours and I am curious about yours. There is no wrong answer to this question because whatever you like to collect is right for you. It should not matter what anyone thinks of your collection because it’s your collection and you are the one that has to be happy with it. I want to know what makes you happy.

The second reason is so I know a little about who is reading the my blog. It will allow me to could tailor some content to your tastes. It is good for me to stretch out of my comfort zone a bit to learn about something else. But I want to do so in a way that I can write about it and someone will have an appreciation for the content.

The poll is anonymous. The usual set of website logs are kept on the server but it does not identify you or how you voted. Comments are encouraged and moderated only to prevent spam. If you are reading this from a site that aggregates web content, you will have to visit the page on my site in order to participate.

Loading ...

Jul 3, 2016 | currency, education, Federal Reserve, news, video

5 lb. bag of shredded currency contains $10K in cash

We have seen the many packages of shredded currency. From the little packages with $5.00 of shredded currency to 5 pound bags filled with approximately $10,000 shredded money, this was the primary way currency did not just get thrown away. Since 2014, the Federal Reserve has been working with recyclers across the country to turn that shredded cash into something else useful.

According to the Federal Reserve Bank of San Francisco, the Federal Reserve pushed for more recycling of currency in 2011. Since each Federal Reserve bank manages its own cash operations each works with local recyclers to provide the cash. In most cases, the recycler hauls away the shredded cash for no charge to the bank and turns it into other products.

Examples of what is done with the cash is that the San Francisco district supports burning of the shreds for “green power,” a fitting name for recycling U.S. currency. So does the Federal Reserve Bank of Philadelphia.

The story caught my eye was about the New Orleans branch of the Federal Reserve Bank of Atlanta that provides shredded currency to a company that composts the cash, mixes it with other soil so that it is used for growing vegetables.

If compost is not your idea of fun, how about using the shreds to make art:

“Another Day, Another Dollar”

Artist: Jason Hughes

Sadat Art for Peace (2012): First Prize, Category: 2 Dimensional

Medium: American Currency

Sen. John McCain (R-AZ) once again introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act). Similar to the same bill he introduced in the last congress, the COINS Act (S. 759) proposed to end the production of the $1 Federal Reserve Note, reduce the production cost of the five cent coin by changing its composition, and eliminating the one cent coin. Mike Enzi (R-WY) is a co-sponsor.

Sen. John McCain (R-AZ) once again introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act). Similar to the same bill he introduced in the last congress, the COINS Act (S. 759) proposed to end the production of the $1 Federal Reserve Note, reduce the production cost of the five cent coin by changing its composition, and eliminating the one cent coin. Mike Enzi (R-WY) is a co-sponsor.