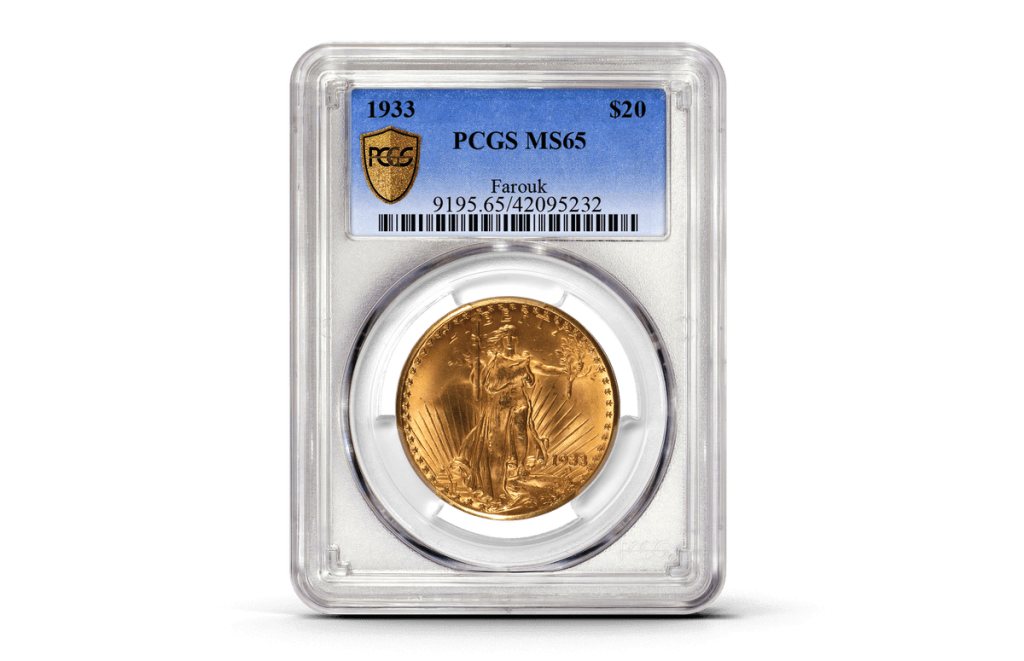

The 1933 Saint-Gaudens Double Eagle is encapsulated. Why?

Last April, PCGS announced that they had certified the 1933 Saint-Gaudens Double Eagle Gold Coin that Stuart Weitzman recently sold at auction. The coin sold for $18.9 million to an undisclosed buyer on June 8, 2021, by Sotheby’s

On July 27, 2021, PCGS announced that they entombed the most expensive coin in the world in their plastic.

- 1933 $20 Obv – The 1933 Saint-Gaudens Double Eagle is a gold coin with a $20 face value that sold for nearly $19 million in June 2021 and was graded MS65 by Professional Coin Grading Service. The obverse, seen here, depicts a striding Miss Liberty before a sunrise over the U.S. Capitol in Washington, D.C. Courtesy of Professional Coin Grading Service.

- 1933 $20 Rev – A flying eagle graces the reverse of the 1933 Saint-Gaudens Double Eagle, a gold coin with the face value of $20 that was originally designed by namesake sculptor Augustus Saint-Gaudens in 1907. Courtesy of Professional Coin Grading Service.

While I acknowledge there is a place for third-party grading services in the collecting market, certifying and encasing the most valuable coin in the world does not qualify.

Although forgeries and fakes are infesting the market, a coin like this one-of-a-kind wonder with a story that reads like a best-selling whodunit the coin is so unique that encasing it away from the world has no equivalent in other collectibles.

Art collectors spend more money for the rarest of paintings only to display them without encapsulation. For example, Salvator Mundi attributed Leonardo da Vinci sold in 2017 for a world record of $450.3 million to Prince Badr bin Abdullah of Saudi Arabia. The prince intends to display it at the Louvre Abu Dhabi. Although the display will have security, the painting will be on display for all to see, not entombed in plastic.

Slabs give coins a homogenous feeling. All slabs look the same. There is little to distinguish the coins other than the information on the label. But the label is not the coin. It hides the differences away from the admirer. A row of slabbed coins does little to enhance the fact that each is different.

Coin collectors have given up eye appeal and the emotion of seeing a beautiful coin to the third-party grading services. Collectors have become mesmerized by labels, numbers, and even stickers without truly understanding what they mean.

Recently, a friend purchased a Carson City minted Morgan Dollar that we thought should grade DMPL (deep-mirrored proof-like). The coin was beautiful but had some slight inclusions. There were bag and handling marks on the coin, but we were confident that the coin would earn the DMPL designation.

When he sent the coin to a third-party grading service for encapsulation (not my coin, so it was not my decision), we played “guess the grade.” My guess was lower than my friend’s. He was more optimistic and overlooked some of the issues I saw. Even though the coin was graded MS-62 DMPL, it did not take anything away from the coin’s beauty.

Except my friend was upset, and the coin is in plastic.

He was conditioned by the phenomenon of grading every coin that the higher the grade, the better the coin. Forget that the coin was beautiful to look at, and he paid less for the coin than if it was graded. He really wanted the coin to grade MS-64. After all, MS-64 is better than MS-62, right?

Now that the coin is encased in plastic, it has lost its luster. I am sure the coin is fine, and the third-party grading service did not damage the coin, but the plastic mutes the impressive DMPL fields. I do not have the same emotional response to the coin in the plastic.

As a result, he wants to crack out the coin and send it to the other third-party grading service to see if he can get a higher grade. I shook my head and wished him good luck.

I am worried that by encasing the only 1933 Saint-Gaudens Double Eagle Gold Coin that is legal to own in a plastic case, the coin will lose its impressive look and make it like any other coin.

Why isn’t the World’s Fair of Money being live streamed?

Ribbon cutting at the opening of the 2017 ANA World’s Fair of Money.

(L-R) Acting Director of the U.S. Mint Dave Motl, Director of the Bureau of Engraving and Printing Len Olijar, (HELP I FORGOT HIS NAME), ANA President-Elect Gary Adkins, current ANA President Jeff Garrett

Since the World’s Fair of Money has opened let me get into my annual rant:

Why isn’t the show broadcast for those of us who cannot attend?

Once again, work obligations have prevented me from traveling to attend the World’s Fair of Money. Unfortunately, it has been a few years since I was able to attend. I want to go. I want to be there. But since I am not a dealer, Real Life becomes a deterrent.

Since the American Numismatic Association Technology Committee was formed and I was asked to be a member, I have been calling for some way to bring parts of the show to the public that cannot attend.

It is not like there is a big technological barrier anymore!

Twitter has the capability to allow for streaming but I have been told that there are some technical issues that make streaming for a long time a little difficult. Minimally, a standard smartphone could be used to stream videos.

Instagram videos have a one-minute time limit that could also be used those quick hit items.

YouTube has a streaming service but there is a question about accessibility. Google makes YouTube unlimited streaming available through YouTube Red service, their paid service. There is a way to add shorter streaming content on YouTube but it is not as easy.

But if you want easy, there is always Facebook!

The easiest way to stream video on Facebook is the open the Facebook app on your favorite smart phone, go to your timeline, the press the button that says “Live” where it allows you to send an update. The app lets you adjust the camera before you press the button to go live!

Someone does not have to hold a camera. There are adapters for any smart phone that will allow one to attach the camera to a tripod.

For a little more money, a used 720p high definition camera could be purchased, interfaced with a computer, and the video streamed to both Facebook and Twitter. There is switcher-like software that will take the audio and video from the camera and broadcast it using both sites.

Someone could have broadcast the opening ceremonies.

There could be on the bourse floor interviews including at the Whitman booth where famous numismatic authors will be there for autographs.

The U.S. Mint has introduced the 225th Anniversary Enhanced Uncirculated Set. A camera could be brought to their booth to show the set.

Every Money Talks presentation can be live streamed.

Award ceremonies could also be live streamed!

For those of us who cannot attend, having access to video of the show may not be as good as being there but is a darn good substitute.

And the best thing about these videos is that they can live on forever! The broadcasts on Facebook and Twitter will remain on those sites for those who cannot watch live. The videos can be captured and posted on YouTube.

Basically, it is requesting that the ANA being accessible to everyone. It is the ANA being the numismatic resource.

Videos can be sponsored.

[FADE FROM BLACK] “We are here on the bourse floor with Joe Dealer to talk about the show.” But what you did not see is that Joe Dealer donated money to the ANA for that access. Remember, the ANA is a not for profit organization and needs the funds to do this.

Larger corporate sponsors could participate.

It is not like some of them are video streaming virgins. Both Heritage and Stacks-Bowers will be live streaming their auctions at the show. This is not the first time either company has provided these types of auctions.

Live streaming can benefit everyone. The ability to introduce more people to the hobby is invaluable. You can promote the ANA, dealers, and the hobby. If you like what you see, come join us. The more people who become interested can become members.

July 2017 Numismatic Legislation Review

As part of my bill tracking, I am including the status of the Saint-Gaudens National Historical Park Redesignation Act even though it does not have numismatic content. Given the impact of Agustus Saint-Gaudens to the numismatic world, it seems fitting to watch the status of this bill. Converting it from a National Historic Site to a National Park is being done for funding reasons. Although it will continue to be operated by the National Park Service, as a National Park there will be more money available for its operations.

As part of my bill tracking, I am including the status of the Saint-Gaudens National Historical Park Redesignation Act even though it does not have numismatic content. Given the impact of Agustus Saint-Gaudens to the numismatic world, it seems fitting to watch the status of this bill. Converting it from a National Historic Site to a National Park is being done for funding reasons. Although it will continue to be operated by the National Park Service, as a National Park there will be more money available for its operations.

H.R. 965: Saint-Gaudens National Historical Park Redesignation Act

S. 312: Saint-Gaudens National Historical Park Redesignation Act

S. 1568: President John F. Kennedy Commemorative Coin Act

H.R. 3274: President John F. Kennedy Commemorative Coin Act

Weekly Numismatic World News – July 30, 2017

The news of the week is the police in Berlin now saying that they believe that the 2007 Canadian $1 Million Gold stolen from the Bode Museum was melted.

The news of the week is the police in Berlin now saying that they believe that the 2007 Canadian $1 Million Gold stolen from the Bode Museum was melted.

Four suspects were arrested in Berlin for stealing the 100 kilograms (221 pounds) 24-karat gold coin are believed to have connections to the Lebanese Mafia. One of the suspects had started working for the museum a few weeks before the heist.

Since it is no longer a coin, it might be difficult to track down the actual gold. Although the coin was entered in the Guinness Book of World Records as the world’s purest gold coin and media estimates that it is worth $3.3 million, the actual melt value of the coin is $4,080,245.34 with the current gold spot price of $1269.10 per troy ounce.

Only nine stories are interesting enough to make the list this week.

DIEPPE, N.B. — It was officially code-named Operation Jubilee and the allied attack on the German-occupied port of Dieppe was a pivotal moment in the Second World War. But 75 years later, a battle is brewing over just what to call the bloody assault that claimed the lives of nearly a thousand Canadian soldiers. → Read more at atlantic.ctvnews.ca

ABERDEEN, SCOTLAND—The Scotsman reports that a ninth-century coin was found alongside evidence of a longhouse at Burghead Fort, a site researchers believe to have been a Pictish power center in northeast Scotland. → Read more at archaeology.org

An estimated 3% of all round pounds were considered forged – however it seems the Royal Mint may have just beat the crooks → Read more at mirror.co.uk

Amusement and vending machine firm Clearhill had to adapt all its products to accept the new 12-sided coin. → Read more at bbc.com

Coin collecting is a cherished hobby amongst collectors and often sparks many fond memories. Endless nights searching through sacks of coins and coin rolls in hopes of coming across a Wheat Penny, a Buffalo Nickel, or a Seated Liberty come to mind for some. Overall, it’s the hard work and the fulfillment of the chase once you are able to add a coin of significance to your collection. → Read more at kiro7.com

A coin and money convention, including an auction for rare currency, will hit Denver’s Colorado Convention Center Aug. 1-5. → Read more at denverpost.com

Illinoisans keep a lot of weird stuff in safety deposit boxes. Just ask state treasurer Mike Frerichs. → Read more at chicagotribune.com

Few know that one of the nation’s first gold rushes took place in Georgia during the first half of the 19th century. → Read more at onlineathens.com

NOTE: I am an alumnus of the University of Georgia (HOW BOUT THEM DAWGS!) with hopes to return to Athens to see the exhibit!

It turns out that those who stole a huge gold coin from a German museum in Berlin on March 26, are "members of a Lebanese mafia." The gold coin was the size of a car wheel, weighing a 100-kilogram and worth around $ 4 million US dollars. → Read more at english.alarabiya.net

Why collect NCLT coins?

A while ago, I received the following question from a reader:

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

The American Silver Eagle Program was the result of the Reagan Administration wanting to sell the silver that was part of the Defense National Stockpile to balance the budget. Originally, the plan was to auction the bullion. After intense lobbying by the mining industry warning that such an auction would damage their industry, the concept was changed to selling the silver as coinage.

Changing the sales to coinage allowed for market diversification. Rather than a few people attempting to corner the market at an auction, selling coins on the open market allows more people to have access to the silver as an investment vehicle.

As codified in Title II of the Statue of Liberty-Ellis Island Commemorative Coin Act (Public Law 99-61, 99 Stat. 113), the “Liberty Coin Act” defines the program as we know it today including the phrase “The coins issued under this title shall be legal tender as provided in section 5103 of title 31, United States Code.”

As a legal tender item, the coin’s basic value has the backing of the full faith and credit of the United States government. Regardless of what happens in politics and world events, the coin will be worth at least its face value. Being minted by the U.S. Mint is a guarantee of quality that is recognized around the world making worth its weight in silver plus a numismatic premium.

Coins are perceived by the market as being more desirable than medals. Medals have no monetary value except as an art object. When it comes to investments, they do not hold a value similar to that of a legal tender coin. This is because medals are not guaranteed by the United States government, a key factor in determining its aftermarket value.

Once the coin has been sold by the U.S. Mint, its value is determined by various market forces. For more on how coins are priced, see my two-part explanation: Part I and Part II.

Why do American Silver Eagles have a One Dollar face value? Because the law (31 U.S.C. Sect. 5112(e)(4)) sets this as a requirement.

Why are the coins worth more than their face value? Because the law (31 U.S.C. Sect. 5112(f)(1)) says that “The Secretary shall sell the coins minted under subsection (e) to the public at a price equal to the market value of the bullion at the time of sale, plus the cost of minting, marketing, and distributing such coins (including labor, materials, dies, use of machinery, and promotional and overhead expenses).”

Can you spend the American Silver Eagle as any other legal tender coin? In the United States, you can use any legal tender coin in commerce at its face value. This means that if you can find someone to accept an American Silver Eagle, it is worth one dollar in commerce. However, it would be foolish to trade one-ounce of silver for one dollar of goods and services.

Commemorative Coins

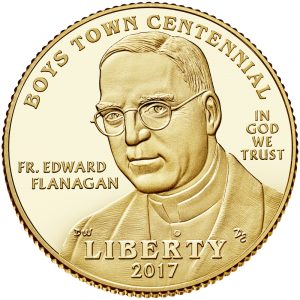

Commemorative programs are different in that the authorizing laws add a surcharge to the price of the coin to raise money for some organization. Using the 2017 Boys Town Centennial Commemorative Coin Program (Public Law 114-30) as an example, Rep. Jeff Fortenberry (R-NE) introduced a bill (H.R. 893 in the 114th Congress) to celebrate the centennial anniversary of Boys Town. As with all other commemorative bills, the bill specified the number, type, composition, and denomination of each coin.

For example, the law says that the U.S. Mint will issue no more than 50,000 $5 gold coins that weighs 8.359 grams, have a diameter of 0.850 inches, and contains 90-percent gold. The law also has design requirements including being “emblematic of the 100 years of Boys Town.” The sale price of the coin will have “a price equal to the sum of” “the face value of the coins; and, the cost of designing and issuing the coins (including labor, materials, dies, use of machinery, overhead expenses, marketing, and shipping).”As with other commemorative, the coins will include a surcharge. Each gold coin will include a $35 surcharge, $10 for a silver dollar, and $5 for each clad half-dollar coin. When the program is over, the surcharges “shall be paid to Boys Town to carry out Boys Town’s cause of caring for and assisting children and families in underserved communities across America.”

The 2017 Boys Town Centennial Uncirculated $5 Gold Commemorative Coin is selling for $400.45 and the proof coin is selling for $405.45 suggesting that the process of producing a proof coin costs the U.S. Mint $5 more than the uncirculated coin.

What goes into the price of the coin? After the face value of $5, there is a $35 surcharge added that will be paid to Boys Town, there is the cost of the metals used. Here is a workup of the cost of the gold planchet using current melt values:

| Metal | Percentage | Weight (g) | Metals Base Rate | Price (g) | Metal Value |

|---|---|---|---|---|---|

| Gold | 90% | 7.523 | 1259.00/toz | 40.48 | $ 304.52 |

| Silver | 6% | 5.015 | 16.57/toz | 0.53 | 0.27 |

| Copper | 4% | 3.344 | 2.83/pound | 0.006 | 0.00 |

| Total metal value | $ 304.79 | ||||

Even though the melt value of the coin is $304.79, there is a service charge the U.S. Mint has to pay the company that creates the planchets. Thus, before the labor, dies, use of machinery, overhead expenses, and marketing is calculated into the price, the coin will cost $344.79 even though the legal tender face value of the coin is $5.

Taking it a step further, the average profit the U.S. Mint makes from gold commemorative coins is 8-percent (based on the 2015 Annual Report). If they are charging $400.45 for the uncirculated gold coin, the coin costs $368.41 to manufacture, $373.41 for the proof version.

Why collect these coins?

Why not?!

American Silver Eagle bullion coins were created for the investment market even though the authorizing law saw the benefit of allowing the U.S. Mint to sell a collector version. All of the Eagle coins are sold for investment or because people want to collect them for their own reasons. Some collect the collector version as an investment.

Commemorative coins are collected for their design or the buyer’s affinity for the subject and to support the cause which is being sponsored by the sale of the coin. Some collect commemorative coins like others collect series of coins.

Even though modern commemorative coins are sold for more than their face value, that does not mean they are not worth collecting. After all, can you buy a Morgan Dollar, Peace Dollar, Walking Liberty Half-Dollar, or a Buffalo Nickel for its face value?

Collecting bullion, commemorative, and other non-circulating legal tender (NCLT) coins is a matter of choice. If you choose to collect these coins, know that they will be worth more than their face value. And while they are legal tender coins, they are not meant for circulation. They are collectibles.

If you like these collectibles, enjoy your collection. Along with coins produced for circulation, I own American Silver Eagle coins, commemoratives, and other NCLT because I like them.

Some of the NCLT coins in my collection

- 2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

- 2015 March of Dimes Commemorative Proof set

- 2014 National Baseball Hall of Fame commemorative proof dollar graded by PCGS PR70

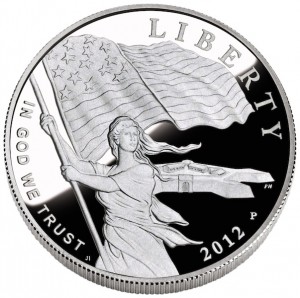

- 2012 Star-Spangled Banner Silver Commemorative Obverse depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background. Designed by Joel Iskowitz and engraved by Phebe Hemphill.

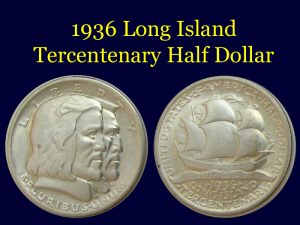

- 1936 Long Island Tercentenary Half Dollar

- Reverse of the 2016 Chinese Silver Panda coin

- 2006 Canada silver $5 Breast Cancer Commemorative Coin

- 2007 Somalia Motorcycle Coins

- 2010 Somalia Sports Cars

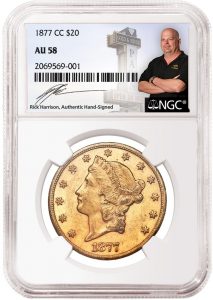

A Signed Slab Label is not what is hurting the hobby

I defended NGC’s position to produce the numismento not because I am interested in purchasing a slab with Harrison’s autograph, but because I do not see a problem with having it as part of the hobby. There are other issues that the hobby should attend to rather than worry about a reality television star and pawn shop owner signing slab labels.

However, my online correspondent, who I will keep anonymous but can respond to this post with an identification, was against the slab not because it will hurt the hobby but because of hidden meanings. When pressed on the real issue, my correspondent brought up a story of an elderly couple being taken advantage of by a company with an alleged A+ Better Business Bureau rating (although there have been questions raised about the Better Business Bureau’s ratings practice). The couple bought coins at a significantly inflated price with promises of a future gain only to learn that the coins were not worth what was promised.

The Coin Show is a podcast that is periodically produced by Mike Nottelmann and Matt Dinger. Matt owns Lost Dutchman Rare Coins in Indianapolis and is sadly not a fan of modern coins. If you are looking for a numismatic-related podcast, I would recommend The Coin Show. There are enough back episodes to keep you occupied until they produce their next show.

Unfortunately, this type of practice is not only pervasive in numismatics but there are all types of schemes where elderly are sold goods and services under fraudulent circumstances. Whether it is inflated prices of gold, the deflated prices of the hotel room gold buyers or the sets of State Quarters that are not worth thousands, these hucksters represent a problem that should be addressed.

Rather, my correspondent took the frustration of the situation on NGC and Harrison because Harrison does not represent the industry. He represents the pawn industry which does not have a high favorability rating.

My correspondent’s anger is misplaced. Rather than embrace the opportunity to use these slabs as a teaching moment and work with the industry to better educate the public, the response was to complain that this was not good for the industry because of what it allegedly represents. It is looking at the problems through a narrow prism, which is worse for the hobby than a stupid autographed slab. The perceived problems are not because a reality television star signs a slab label, the problem is that this industry has not properly represented itself and allowed those with less than moral character ruin things for everyone. The industry has let itself be denigrated by not properly getting out its message and allowing others to define the message. Industry Council for Tangible Assets (ICTA) has worked hard for the benefit of the industry the issues move faster than ICTA can keep up.

With the dysfunction in Washington lobbying efforts are turning to the state capitals where they can have a significant impact with less of a spotlight. ICTA needs help in nearly every state including California where my correspondent is from. Rather than kvetching on Facebook, I wish my correspondent and others would pick up a phone and join the battle.

Conflating the signing of slabs to the problems of an industry is myopic. If you want to fix the business problems then get look beyond the autograph to the real problems. Although I have never met NGC Chairman Mark Salzberg, his well-deserved reputation leads one to believe that he would not do anything detrimental to the business of numismatics, something he has dedicated his life to.

Unfortunately, I have a feeling that if someone walked into the shop that my correspondent owns and asked to buy the slab autographed by Rick Harrison, the business would find a way to allow the free market to reign and sell the customer what they asked for.