An Update from the United States Mint

The United States Mint, a federal bureau in the United States Department of the Treasury, issued a statement via social media regarding the failure of their systems to handle the ordering load for their most recent release:

COMMENTARY: Wash, rinse, and repeat.

We have heard this in the past and they have done nothing.

If the U.S. Mint is using a contractor to maintain their ordering system, the contractor must be terminated for cause.

Has the U.S. Mint addressed the failure of the Contracting Officer (CO) or Contracting Officer’s Technical Representative (COTR)?

It is time to address these failures to the Treasury Office of the Inspector General and other government oversight organizations.

Good morning Philadelphia

Hello from Philadelphia!

Hello from Philadelphia!

I am in Philadelphia to attend the U.S. Mint’s Numismatic Forum. According to the U.S. Mint, “The purpose of the event is to gather leaders and stakeholders of the numismatic community to explore ways to stimulate and revitalize the hobby. As we approach the U.S. Mint’s 225th anniversary next year, we hope this unique opportunity to examine and discuss the Mint’s past, present and future will help move all the elements of the numismatic industry forward.”

I do not know who will be there but I am sure that I will see many of the regulars of the numismatic community. From the U.S. Mint, we will probably hear from the current Principal Deputy Director Rhett Jeppson and others from the Mint’s staff. Here is an overview of the schedule:

- Arrival and welcome from the U.S. Mint along with introductions.

- Recognizing the past:

- U.S. Mint Heritage Assets overview

- Smithsonian Numismatic Collection overview

- The Present:

- Mint product update and marketing initiatives update

- “Invigorating the Coin Collecting Hobby” panel discussion

- The Future: Workgroup discussions with reports from the workgroups

- Visit to the Philadelphia Mint

For those of you who will not be there and would like to follow along, you can follow @coinsblog on Twitter as I send out periodic updates. The widget on the upper-right side of the page can also be used to follow the progress. Also, when I can post pictures, they will be copied to the Pinterest on the board “Numismatic Forum” or watch the widget below.

Of course, there will be a report posted over the weekend!

Cash is being called spooky!

Cash seems to be the new 4-lettered word.

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

Last May, the European Central Bank announced will stop printing the €500 banknote by the end of 2018 when the €100 and €200 banknotes of the Europa series are planned to be introduced. Although the announcement did not quote the Summers article, the announcement had addressed some of the issues he addressed.

In June, Sweden became the first nation to announce a formal policy to become a cashless society within five years. According to reports, Riksbank, the Swedish central bank, claims that just under 2-percent of all transactions are made by cash. They expect that number to drop to one-half of one-percent by 2020. Most shops report that 20-percent of sales are made using cash.

Sweden may be an outlier. Globally about 75-percent of all sales are made using cash.

In the United States, it is being reported that some higher-end retailers have stopped taking cash.

Retailers have been looking to the convenience industries as an example of the future. There are parking lots that no longer take coins in their parking meters. Pay stations now only accept credit cards. Some toll roads now require a special transponder to be mounted in your car because there are no booths to collect tolls. Those transponders must be linked to a credit card. Airlines no longer take cash when you buy beverages or snacks on the plane because handling the change is too difficult.

New payment options have entered the market. Smartphone-based Apple Pay, Samsung Pay, and MasterCard Master Pass have worked to make it easier to separate you from your money by allowing you to wave your phone at the reader and pay. For most retailers, there is little they have to do in order to accept these payment methods as long as they are accepting chip-based transactions. Since the transaction cost to the retailer does not change, it is an incentive for them to accept these types of electronic payments.

Although electronic payment options make up 13-percent of all cashless transactions you have to remember that this market barely existed a few years ago.

Even as banks and large retailers push to increase the number cashless transaction, there are problems that society faces when moving to a cashless retail system.

The biggest problem is one of scale. The United States makes more money, spends more money, trades more money, and has more economic impact than any other country in the world. It is the world’s single largest economy with a strong capitalistic culture where most of the commerce is done with small businesses. Amongst all business, 55-percent of retail merchants are cash-only enterprises. They are too small to consider paying the 3-to-5 percent fees for using a credit card, known as the “swipe fee.” Of those that do take credit cards, at least 36-percent require a minimum purchase.

Once you get past the problem of scale, then there are the issues of the poor who do not have bank accounts. Aside from not having the economic power to work with the banks, there are some communities that are culturally opposed to the banking system. Even if they can afford to have a bank account, many choose not to open one. The near failure of large financial institutions in 2008 did not help in the trust factor.

Of course, the one cultural issue that cannot be ignored is privacy. Cash transactions are private. Only the buyer and seller knows the details of the transaction (unless the buyer volunteers their loyalty or rewards account information). With the problems of hacking around the world, how do you know that your credit card transaction are safe? Should we ask the victims of the computer hacks on Target and Home Depot?

Aside from privacy, credit cards can be costly to the customer. High-interest rates, debilitating debt, and collection issues see the use of consumer credit dropping when there is an economic downturn. During the Great Recession that began in 2008, spending went down and, when the economy began to improve, savings went up. When wages began to rise in 2010, more money was being spent paying down debt than adding to the economy. Rather than stimulating the economy, this creates a stagnant effect since the economy thrives more on the selling of goods and not by the managing of cash.

It seems that every six months there is yet another “Chicken Little” story that either we are or should stop using cash. But when society seems to be set in using cash even when there is anecdotal evidence that makes it appear that we are on the brink of a cashless society, they become quiet as if they ended up in Foxey Loxey’s den!

Reports of cash’s eventual demise appear to be as amusing as it is greatly exaggerated. For numismatists, this means that our hobby will continue to grow with new, fresh material for years to come. Happy collecting!

What do you think it’s worth?

Finding coins in pocket change can be a lot of fun. Then there are those who find hoards of coins buried in the ground or just stored somewhere that people forgot. From shipwrecks to treasure hunts, we all dream of finding the next jackpot somewhere.

Finding coins in pocket change can be a lot of fun. Then there are those who find hoards of coins buried in the ground or just stored somewhere that people forgot. From shipwrecks to treasure hunts, we all dream of finding the next jackpot somewhere.

On your great grandfather’s farm, a worker was plowing the field and found a silver medal. It has the image of President James Madison on one side and what looks like a peace medal on the other. Rather than letting go, great grandpa traded three hogs for the medal.

The medal gets handed down from generation to generation until one of his ancestors takes the medal to Antiques Roadshow to find out what it is worth.

You are told that it is a silver James Madison Indian Peace Medal. The 1809 medal was designed by assistant engraver John Reich and struck at the U.S. Mint in Philadelphia. It is not the largest of the medals but at 2½-inches, it is a fairly significant medal.

What is it worth? See what Jason Preston of Jason Preston Art Advisory & Appraisals of Los Angeles said about the medal on Antiques Roadshow:

Did you guess right?

FUNDED!!

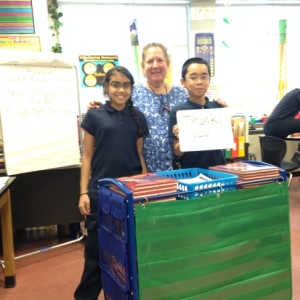

With many thanks to my readers and the numismatic community, the DonorsChoose.org campaign to fund the trip for Mrs. Janas of Juniata Park Academy class to visit the Philadelphia Mint and Federal Reserve has been funded!

With many thanks to my readers and the numismatic community, the DonorsChoose.org campaign to fund the trip for Mrs. Janas of Juniata Park Academy class to visit the Philadelphia Mint and Federal Reserve has been funded!

It will be a great experience for the class to be able to visit both the Mint and Fed.

I had previously contacted Mrs. Janas and offered to travel to Philadelphia to give her students a presentation about numismatics in daily life. Now that the project is funded, I will make the arrangement to visit her class to provide a more hands on the convergence between numismatics, math, and economics. I will bring some “gifts” for the class so that they can have in-hand examples.

There aren’t the words to express how thrilled I am that this project was funded.

September 2016 Numismatic-related Legislation

Congress returned to work right after Labor Day, not that you would have noticed. Aside from the legislation that renames most offices or other federal structures in honor of someone most of us have never hear about, congress was locked in a battle over the federal budget that was to expire on September 30. Of course, the fights were based on partisan politics. Rather than doing what is right for the nation, these hacks broke down into partisan bickering. A continuing resolution, not a real budget, was passed on September 29. They have until December 9 to fix their problems.

Congress returned to work right after Labor Day, not that you would have noticed. Aside from the legislation that renames most offices or other federal structures in honor of someone most of us have never hear about, congress was locked in a battle over the federal budget that was to expire on September 30. Of course, the fights were based on partisan politics. Rather than doing what is right for the nation, these hacks broke down into partisan bickering. A continuing resolution, not a real budget, was passed on September 29. They have until December 9 to fix their problems.

In another part of my life, I write a monthly newsletter for the Gold & Silver Political Action Committee. The PAC was started by former American Numismatic Association President Barry Stuppler to help be a voice for issues facing the numismatic and bullion industry. As part of my research into issues, I speak with staffers and other contacts on Capitol Hill to provide background information on the PAC’s issues.

This past month I used an opportunity to have a discussion about the state of congress with two lobbyists. Both are former staffers working with members on opposite sides of the aisle and have been working in the halls of congress since early in the Clinton administration. Neither were optimistic that congress would accomplish anything, even during the lame duck session after the election. With the budget battle looming and the unsettle Supreme Court nomination, neither of these professionals were optimistic.

For some of us, watching congress is a sport. While it might be as painful as watching the 1962 New York Mets or the 2003 Detroit Tigers or waiting for the Cubs to win the World Series, I will continue to report potential legislation that may affect modern collecting.

Only one bill was introduced in September:

H.R. 6025 American Innovation $1 Coin Act

This bill can be tracked at https://www.govtrack.us/congress/bills/114/hr6025.