Weekly World Numismatic News for March 7, 2021

Prices are rising.

Whether you talk about the price of groceries, gas, or collectibles, prices are rising. So are the price of the collectibles markets, including numismatics.

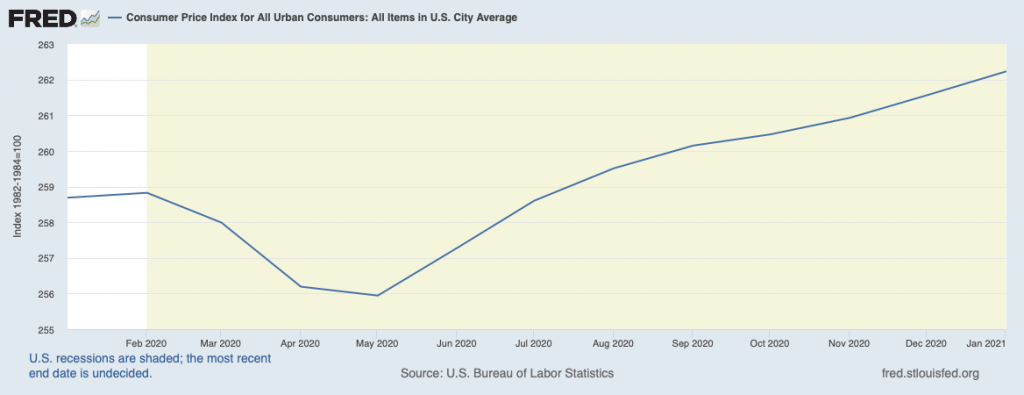

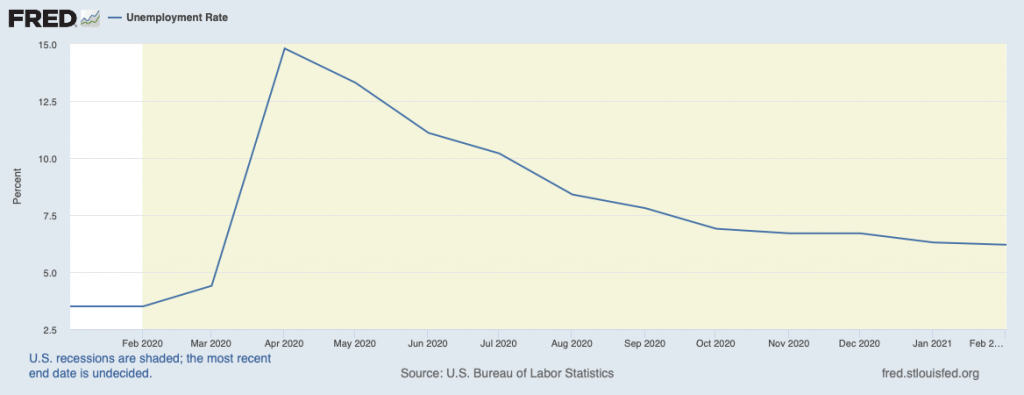

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) has been steadily rising for six months. While the prices are rising, unemployment has dropped from the beginning of the pandemic high of 14-percent to the 6.2-percent rate, BLS recently announced.

-

Charting the Consumer Price Index during the pandemic

(Chart courtesy of the St. Louis Fed)

-

Charting the Unemployment rate during the pandemic

(Courtesy of the St. Louis Fed)

With all of this economic stress, why are collectibles, especially numismatics, are seeing rising prices?

An auction industry source said that there is a pent-up demand for something resembling normal. Instead of the everyday routine, those with means are buying. In the last six months, the industry reports that prices realized for all sectors have risen at rates higher than seen in many years. Estate auctions are attracting new customers looking for unique items.

Numismatics is in the middle of the trend, with collectors and investors looking for something to do. Collectors are spending more time with their collections and looking to expand. Investors see the rise in values because of the rise in precious metal prices and have driven the market higher.

-

One year gold spot price

(Graph courtesy of PCGS)

-

One year silver spot price

(Graph courtesy of PCGS)

One of the areas where the price changes are noticeable is in the markets for precious metals. While the spot price for gold and silver has been relatively steady, the numismatic spread for coins has climbed. Dealers are reporting that generic gold and silver for numismatic items increased over the last six months.

(graphs courtesy of PCGS)

- One year trend of generic gold coin prices

- One year trend of Morgan and Peace Dollar prices

- One year trend of 20th Century coin prices

Several industry reports note a higher demand for physical ownership of precious metals, putting pressure on the markets. But rather than buying bullion, investors are purchasing coins. Demand for American Eagle products has outpaced many dealer’s abilities to purchase supplies. When bullion coins were not available, investors purchase coins produced for the collector market, including proof and special issues coins.

Recently, the U.S. Mint set a 99 coin limit when they released the 2021-W American Silver Eagle Proof coin with the original reverse. The coin sold quickly. When asked, the U.S. Mint claimed they did not have the statistics about the number of 99 coin purchases they fulfilled. Collectors report that they were shut out of coin purchases while dealers have been slabbing and selling the coins mostly to investors.

If the predictions are true, economists believe that there will be a roaring 2020s similar to the roaring 1920s following the Spanish Flu Pandemic. Considering the current trends, the secondary market for numismatics may make it too expensive for the average collector to participate in the market.

And now the news…

→ Read more at lancasteronline.com

→ Read more at lancasteronline.com

→ Read more at tweaktown.com

→ Read more at tweaktown.com

→ Read more at hurriyetdailynews.com

→ Read more at hurriyetdailynews.com

→ Read more at scoop.co.nz

→ Read more at scoop.co.nz

→ Read more at bangordailynews.com

→ Read more at bangordailynews.com

Will Greece create new numismatic collectibles?

Collecting numismatic items from distressed times can present an interesting challenge. While we have heard about Hard Times Tokens being a popular collectible, sales tax tokens produced during the Great Depression so that people could pay the exact fractions of a tax on low-value purchases.

Two of the more recent examples of numismatics based on distressed economic conditions are the Zimbabwe hyperinflation currency and the State of California’s Registered Warrants (IOUs). Although both have different origins from the Greek crisis, both show different ways of handling the situation.

When a country controls its own currency, it can manage that currency to maintain its value. In the United States, that is done by the Federal Reserve. It uses many programs from buying debt from its member banks to setting what it calls the Discount Rate, the rate that its member banks can borrow overnight to meet its liquidity requirements. In Zimbabwe, the central bank did not have the business and circulation in order to make this type of policy work because of the strife caused by wars and other ugliness. Their only choice was the print more money. The more money printed, the less it is worth. The less the money is worth the more it takes to buy daily goods and services. This result is that the more money that is added to the economy the higher inflation goes.

Zimbabwe gave us the hyper-inflated currency ranging from Z$10 to Z$100 trillion. It has become fun to own a note that makes you a billionaire or a trillionaire even though the actual value of the currency is worth less than the paper which it is printer. Since Zimbabwe has converted their system to the U.S. dollar, Zimbabweans will be converting the old inflation currency at the rate of Z$175 quadrillion (175,000,000,000,000,000) for US$5. An enterprising Zimbabwean could buy them for double and make more money selling the notes as souvenirs than converting them to U.S. dollars.California was a different story. It was a self-made crisis of politics in 2009 between the Republican Governor Arnold Schwarzenegger and the Democratic-controlled legislature. Since neither side could agree on a budget, Schwarzenegger declared a fiscal emergency and ordered the printing of IOUs to pay for state debts.

Officially called Registered Warrants, the first of these IOUs were issued to pay personal tax refunds. They carried a 3.75-percent interest rate and were redeemable when the budget was passed or in early October, which ever came first. The crisis was averted when Schwarzenegger signed the budget on September 3 and redemption began on September 4. California State Comptroller’s Office stopped redeeming warrants as of November 10, 2010.A friend who was living in California at the time was issued an IOU for a small personal tax refund. Rather than be burdened with the rigors of cashing the warrant, the paper is now part of his collection. However, since the warrants were addressed to specific people, it is not likely that these items will be immediately collectible. Many years from now it is probable that these warrants will be a curious collectible like the old Series E or War Bonds.

Greece does not control its own currency nor does it have any potential backing to issue warrants. Since Greece has not been seen as creditworthy, it cannot issue bonds at any interest rate because the markets are not interesting in buying Greek debt. Unless a deal can be struck with the rest of the European Union, Greece may not have a choice but exit the pact that uses the Euro as the common currency.

Exiting the Euro will bring back the Greek drachma.

2000 Greece 20 Drachma coin features Dionysios Solomos, a poet and author of the Greek national anthem.

Before you search your ten pound bag of foreign coins looking for pre-Euro drachma, it is likely that Greece will keep those coins demonetized and not recognize them as official currency. If Greece wants to be able to control the amount of currency in circulation, then they will have to issue new coins and notes.

If Greece goes this route, experts are saying that the Greek government will allow the Euro to circulate alongside whatever is added to the market. Some people think it may take over a year to strike enough coins and print enough notes to be able to remove the Euro from circulation.

What will Greece do in the interim? Does the Greece Central Bank issue warrants like California did? If so, will the warrants become something that would become a collectible?

10,000 drachma note issued by the Bank of Greece in 1995 features the image of Dr. George Papanicolaou, inventor of the Pap smear

- Greek 1€ coin courtesy of EuroCoins.co.uk.

- California Warrant courtesy of MyMoneyBlog.com

- Zimbabwe $100 trillion note courtesy of Wikimedia Commons.

- 20 drachma coin courtesy of Numista.

- 10,000 drachma note courtesy of the Bank of Greece.

ANA Election Results

American Numismatic Association Executive Director Kim Kiick announced the official election results. Since the president and vice president ran unopposed, these offices are as follows:

American Numismatic Association Executive Director Kim Kiick announced the official election results. Since the president and vice president ran unopposed, these offices are as follows:

For the Board of Governors, there were four incumbents running who were re-elected. Of the three other seats vacated by Gary Adkins (who became Vice President), Scott Rottinghaus, Jeff Swindling and Laura Sperber (who did not seek re-election), one is making a return to the Board of Governors, the current president rejoins the Board, and the board adds one new member. The ANA Board of Governors is as follows:

Dr. Donald H. Kagin (Tiburon, CA) – 3,451 votes

Walter Ostromecki Jr. (Encino, CA) – 3,319 votes

Dr. Ralph Ross (Sugar Land, TX) – 3,222 votes

Greg Lyon (St. Louis, MO) – 2,982 votes

Thomas A. Mulvaney (Lexington, KY) – 2,746 votes

Paul Montgomery (Oklahoma City, OK) – 2,407 votes

The candidates that were not elected are as follows:

- Brian Hendelson (Bridgewater, NJ) – 2,221 votes

- Christopher Marchase (Colorado Springs, CO) – 2,006 votes

- Oded Paz (Arco, ID) – 1,950 votes

- Richard Jozefiak (Madison, AL) – 1,872 votes

- Steve D’Ippolito (Peyton, CO) – 1,844 votes

In the event that any of the new board members cannot serve, the next-highest vote-getter will fill that seat for the rest of the two-year term.

The new board members will be sworn-in at the annual ANA Banquet on Friday, Aug. 14, at the World’s Fair of Money in Rosemont, Ill. Garrett will become the Association’s 59th president, succeeding current President Walter Ostromecki.

Finally, if you want to see the announcement, you can watch it here:

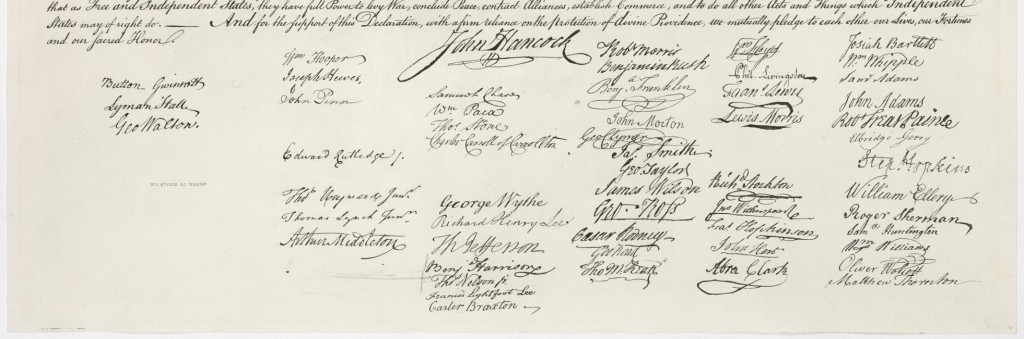

Celebrating Independence

The unanimous Declaration of the thirteen united States of America

After each state cast one vote in favor of the Declaration before the Committee of the Whole, the committee was adjourned. The measure was brought before the full First Continental Congress with the majority voting in favor of the Declaration. Although independence was declared from England it would not be fully realized until 1783 when the Treaty of Paris was signed.

We, therefore, the Representatives of the united States of America, in General Congress, Assembled, appealing to the Supreme Judge of the world for the rectitude of our intentions, do, in the Name, and by Authority of the good People of these Colonies, solemnly publish and declare, That these United Colonies are, and of Right ought to be Free and Independent States; that they are Absolved from all Allegiance to the British Crown, and that all political connection between them and the State of Great Britain, is and ought to be totally dissolved; and that as Free and Independent States, they have full Power to levy War, conclude Peace, contract Alliances, establish Commerce, and to do all other Acts and Things which Independent States may of right do. And for the support of this Declaration, with a firm reliance on the protection of divine Providence, we mutually pledge to each other our Lives, our Fortunes and our sacred Honor.

Summary of June 2015 coin-related legislation

Reverse of the $2 Federal Reserve Note features an engraved modified reproduction of the painting The Declaration of Independence by John Trumbull.

On June 11, rather than let Jefferson continue his draft, the Continental Congress elected the Committee of Five to write the full document. John Adams, whose role in the Continental Congress would be that of the Majority Leader today, was a member of the Committee of Five but insisted that most of the writing be done by Jefferson. The other members of the Committee of Five were Ben Franklin, Roger Sherman, and Robert Livingston.

The committee presented the document to the Continental Congress on June 25. For the next seven days, the document went through the first ever mark-up session where members applied their edits to the document. Debate began on July 1 and by July 2 everyone who wanted to speak has their say before the vote. With each delegation allowed one vote, the final tally was 9 in favor of independence, 2 against (Pennsylvania and South Carolina), and one abstention (New York, their delegation did not have their legislature’s authority to cast a vote).

But if you thought that this was the end of the debate, you failed to remember that this was the beginnings of congress! The vote was conditional on Jefferson revising the document before it was adopted. The rewrite was completed and presented the final copy to the Continental Congress on July 4, 1776 where it passed with the same vote. Adams felt that July 2 should be considered Independence Day. A combination of the day that the text was adopted and what we would consider in today’s environment to be a clerical error, the Declaration of Independence was signed (on August 2, 1776) saying that independence was declared on July 4, 1776.

The moral of this story is that no matter how ridiculous the bill or idea, it is not law until the final version of the bill is approved and signed.

Congress had a busy June with regard to coin-related legislation. The bills that saw action were as follows:

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

H.R. 2726: Apollo 11 50th Anniversary Commemorative Coin Act

Track this bill at https://www.govtrack.us/congress/bills/114/hr2726

H.R. 1698: Bullion and Collectible Coin Production Efficiency and Cost Savings Act

Track this bill at https://www.govtrack.us/congress/bills/114/hr1698

H.R. 893: Boys Town Centennial Commemorative Coin Act

Track this bill at https://www.govtrack.us/congress/bills/114/hr893

H.R. 2906: To require the Secretary of the Treasury to mint coins in recognition of the 50th anniversary of the Texas Western College National Collegiate Athletic Association men’s basketball championship.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2906

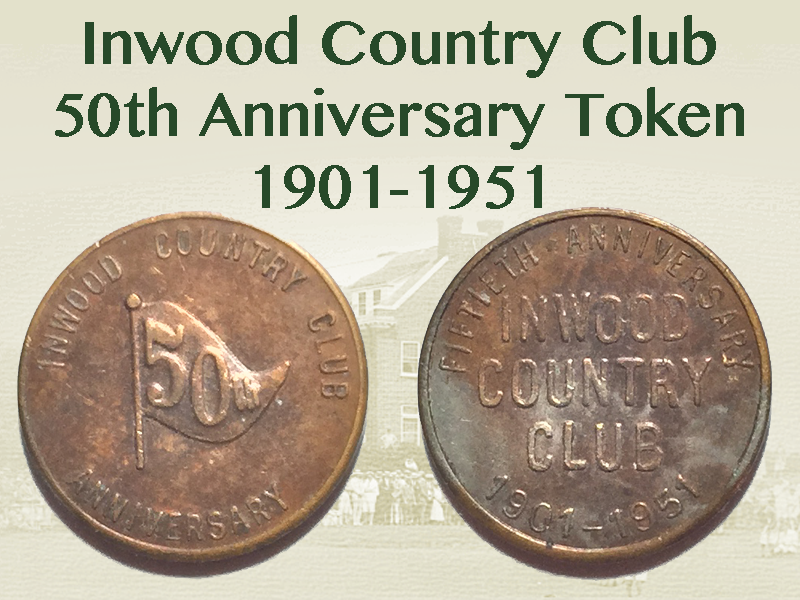

Hometown collecting

In the 1960s when my parents’ first child was becoming old enough to be enrolled in school, they decided it was time to move out of Brooklyn for the better schools of Long Island. One day, my father found an advertisement in the newspaper for some new homes being built in an old hamlet on Long Island called Inwood. In New York-speak, a hamlet is not an official location but a section of a larger village or township named for jurisdictional purposes. Hamlets are very much like any other area but without its own formal government.

In the 1960s when my parents’ first child was becoming old enough to be enrolled in school, they decided it was time to move out of Brooklyn for the better schools of Long Island. One day, my father found an advertisement in the newspaper for some new homes being built in an old hamlet on Long Island called Inwood. In New York-speak, a hamlet is not an official location but a section of a larger village or township named for jurisdictional purposes. Hamlets are very much like any other area but without its own formal government.

Inwood was one of the Five Towns along with Lawrence, Cedarhurst, Woodmere, and Hewlett. Each had its own character, divisions, points of interest but were together geographically, socially, and and as a larger community. Some of that has changed over the years, but the Five Towns still exists as a central part of life in that area. Although identified as a hamlet, Inwood had its own identity from the rest of the Five Towns. Inwood was more working class than the rest of the Five Towns. It is the home to two schools that were part of the Lawrence-Cedarhurst Public Schools (now just the Lawrence Public Schools), P.S. #4 was the kindergarten and P.S. #2 was the elementary school (then Grades 1-6). There was some industry in an area we called “the factories” and some offices. Not too far was a bowling alley, a few gas stations, and the A&P. A few churches, a synagogue (that no longer exists), the VFW Hall, and the volunteer fire department was all part of daily life.

Many of us have gone in own directions but we cannot forget what made Inwood home for us. One of the ubiquitous parts of Inwood was the golf course. Officially, it is called the Inwood Country Club. Aside from being a private club where many of us were not allowed to enter, it dominated the entire length of Donahue Avenue that was our major route when we walked to school. There were no sidewalks on that side of the street. Trees hung over the shoulder and in the spring and fall you can see and hear the men playing golf.

The last time I visited Inwood, I noticed that the road was better paved and the shoulder that we walked along was no longer available. The fence line came to the edge of the road and a distinct curb was added. The trees were thinner and he shrubbery that dominated the fence when I walked that road was gone. You can now see the golf course from the street.

Although I never went into the Inwood Country Club until I found someone to invite me in the 1980s, its presence looms large in my memory. Our backyard backed up into a swamp-like area owned by the club that would flood when Jamaica Bay overflowed. It was a buffer between the bay and the golf course. The only other landmark in the area that dominated as much as the Inwood Country Club was Kennedy Airport across the bay.

Inwood Country Club was opened in 1901 by Jacob Wertheim because there were few places to play golf on Long Island. Its claim to fame for the golf world is that it was the host to the 1921 PGA Championship that was won by Walter Hagen and the 1923 U.S. Open Championship won by Bobby Jones. The 1923 U.S. Open was Jonse’s first major championship of his professional career. Jones won with what was then considered one of the finest shots on the 18th hole of the playoff that was then called “the shot heard around the world.”

Whenever I find something about Inwood that finds its way for sale I usually try to buy it. Souvenirs from Inwood are not plentiful and numismatic-related souvenirs are even rarer. But when a token honoring the 50th Anniversary of the Inwood Country Club came along, I was a strong bidder. I might have overbid, but I had to make this token part of my collection.

It looks like it is made of a white metal, maybe zinc, coated with copper based on the wearing on the reverse. It is 16.75 mm in diameter making it smaller than a dime, which is 17.9 mm in diameter. But it has survived well for being that small and 64 years old.

This goes to show that you do not have to collect coins to have fun in numismatics!