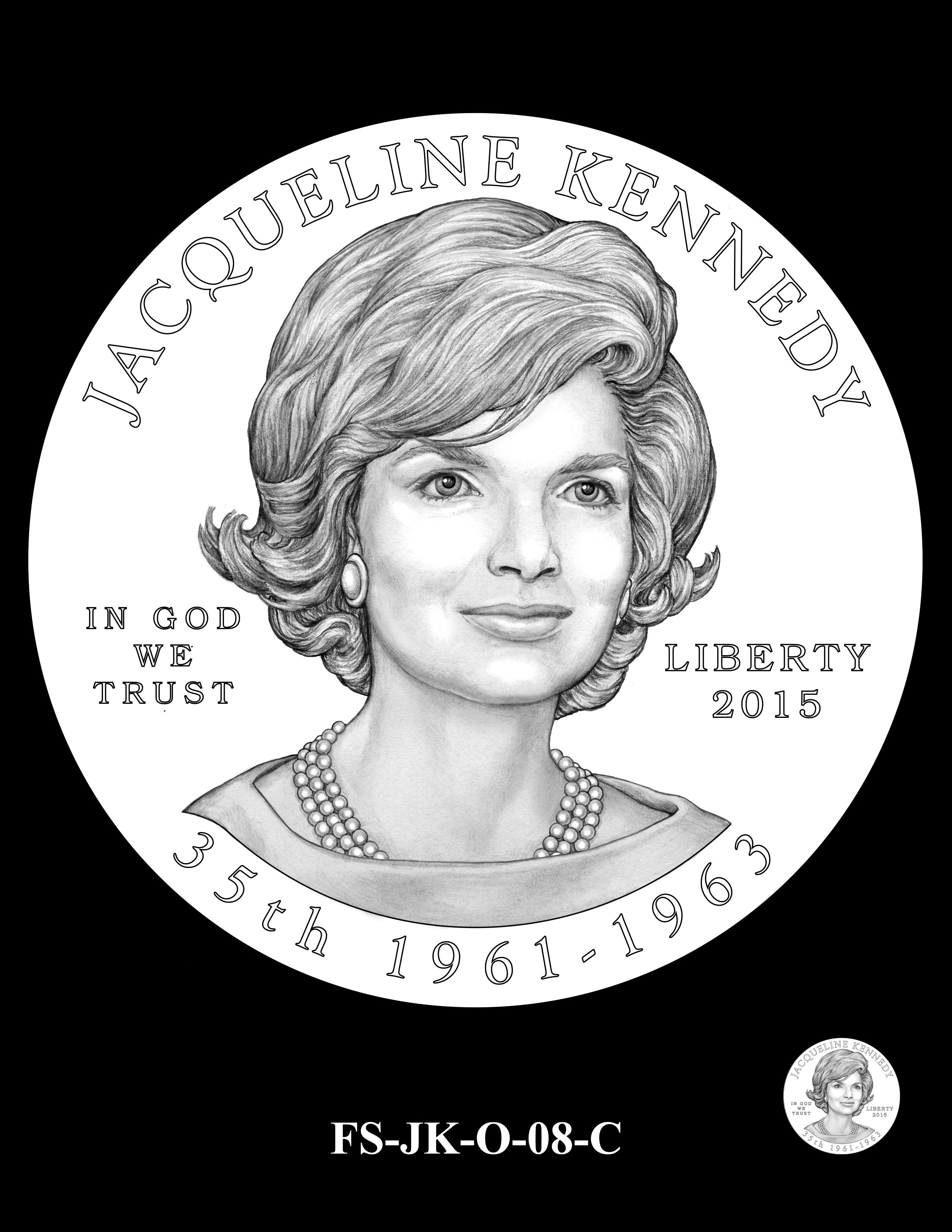

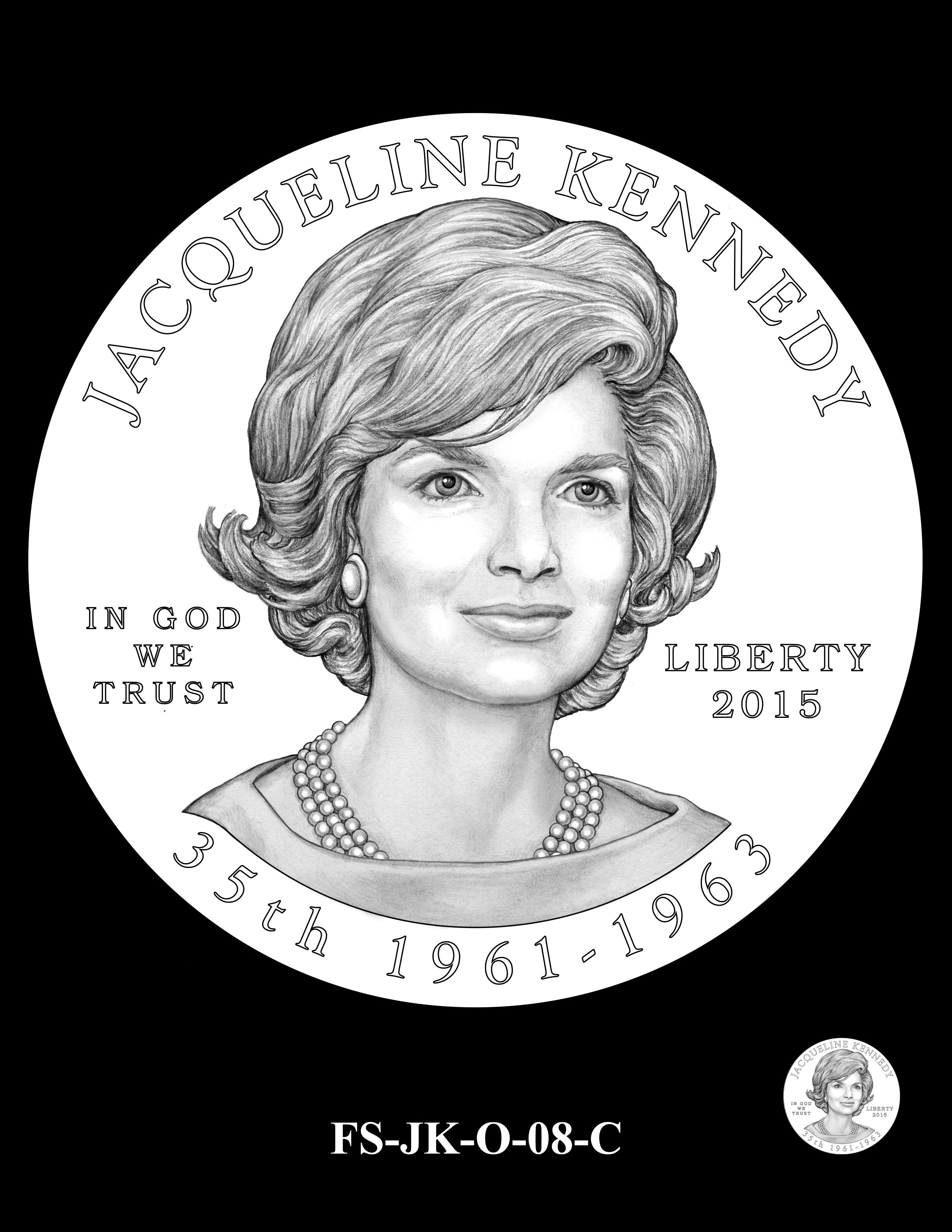

Oct 16, 2014 | CCAC, coins, First Spouse, gold, news, US Mint

The obverse design selected by the CCAC for the Jacqueline Kennedy First Spouse Gold Coin

For Kennedy, in addition to being renown, the release of the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin may cause a sharp increase in demand from customers seeking to make special Kennedy gold sets using both the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin and the 2015 Jacqueline Kennedy First Spouse Gold Proof Coin. To account for this potential variable, we believe a maximum issuance of 30,000 coins would allow flexibility to increase production should customer demand exceed forecasted sales volumes for the other designs. These maximum mintage limits will be divided between coins with proof and uncirculated finishes based on consumer demand.

The Mint is not obligated to mint, and will not mint, to the maximum mintage limits unless it is supported by public demand. The production process and maximum mintages give us flexibility should there be a surge in demand over previous years.

Oct 10, 2014 | coins, commentary, currency

Collecting is a progressive addiction. It might start innocently with a friend introducing us to collecting and even giving us a few freebies. We dabble into buying more, especially items that tie us to our youth. We progress in collecting more from those childhood years putting together sets that we could not afford them. That feels pretty good, and soon we are tempted into expanding our collection into earlier and later years.

Collecting is a progressive addiction. It might start innocently with a friend introducing us to collecting and even giving us a few freebies. We dabble into buying more, especially items that tie us to our youth. We progress in collecting more from those childhood years putting together sets that we could not afford them. That feels pretty good, and soon we are tempted into expanding our collection into earlier and later years.

We get hooked on the high that comes from completing sets we only learned existed when we discover there are more cool items we never heard about before. We buy at flea markets, estate sales, from online classified advertisements, auctions, and dealers in cramped stores. Eventually, we are completely addicted and start bidding furiously on everything related to our collection including items in better condition than what we already have.

The collectors’ eyes start to glaze over as they move into progressive rounds of the addiction. Related collectibles appear on den and basement shelves. Second and third sets accumulate. Family members enable the addicts by covering up for them when they miss family events to visit yard sales or dealers instead. Soon the addicts are looking for obscure pieces and those one-of-a-kind items desired only by the select few who are as addicted.

This was adapted from a section in the article “

Baseball Cards: You Can’t Collect Everything, Right?.” When I read this in the section with the title “The signs of addiction” it was something that had to be applied to collecting in general. It is something to think about as we begin a three-day weekend!

Oct 7, 2014 | BEP, coins, counterfeit, currency, gold, policy, US Mint

Prior to the public disclosure of secret documents, administrations have declassified documents at various levels for many different reasons that those of us who worked in these areas did not understand what was to be classified at what levels and for how long. Each department and agency had its own rule. However, everything that was classified was supposed to be declassified after 50 years.

In 2009, President Obama issued Executive Order 13526 to try to create some order out of this chaos. Aside from defining the classification levels, document marking requirements, it also allowed agencies to apply to keep documents classified and for longer periods than previous reviews. The purpose was to protect national interests and security while preventing controversial declassification of documents.

Whenever trying to instill a new policy on the government, there will be many barriers to this change. While there are fewer areas of confusion, chaos remains. Of course the disclosures by Chelsea (neé Bradley) Manning and Edward Snowden did not help.

So what does this have to do with numismatics? Both the U.S. Mint and the Bureau of Engraving and Printing applied and were granted exemption from automatically declassifying documents.

Treasury Department, Procurement Division, Public Buildings Branch, Fort Knox – United States Bullion Depository (1939)

What information could these agencies possibly have that would be classified?

According to Steven Aftergood, Director of the Federation of American Scientist Project on Government Secrecy, who interviewed John P. Fitzpatrick, director of the ISOO, the exemption for the U.S. Mint is for “security specifications from the U.S. Bullion Depository at Fort Knox, which was built in the late 1930s.”

In a comedic turn, Mr. Fitzpatrick told Aftergood, “Think ‘Goldfinger’.”

Then why does the Bureau of Engraving and Printing need an exemption from declassification for 25-years? A source familiar with the filing said that the exemption covers counterfeiting information. According to sources, there are anti-counterfeiting measures added to currency that have been planned for many years that have not been advertised. These are used by the United States Secret Service and other law enforcement organizations to detect counterfeiting. Many of the documents cover the planning for the changes that began in the 1990s.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

And you thought all the U.S. Mint and Bureau of Engraving and Printing did was manufacture money!

Oct 6, 2014 | coins, commemorative, legislative

With apologies for my absence, the end of the federal fiscal year has made me very busy. I have a few posts I am getting ready to queue up that I hope will be of interest. I appreciate your patience and hope to provide you with something interesting to read soon. In the mean time, here’s what congress did that is of interest to the numismatic community:

H.R. 2866: Boys Town Centennial Commemorative Coin Act

Sponsor: Rep. Lee Terry (R-NE)

• To require the Secretary of the Treasury to mint coins in commemoration of the centennial of Boys Town.

• Passed by the House of Representatives on September 15, 2014

• Received in the Senate on September 16, 2014

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/113/hr2866

Sep 23, 2014 | books, coins, commentary

Most of the time I do not like repeating press releases or reporting on press releases. Press releases are written by or for the company issuing them. By design, they are written so that the announcement shows the company in a good light. I would rather use the product and report about it based on my own experience. But I am going to make an exception because of the long term implications.

Most of the time I do not like repeating press releases or reporting on press releases. Press releases are written by or for the company issuing them. By design, they are written so that the announcement shows the company in a good light. I would rather use the product and report about it based on my own experience. But I am going to make an exception because of the long term implications.

Whitman Publishing issued a press release to announce the release of the first volume of the Whitman Encyclopedia of Mexican Money, by Don and Lois Bailey. The first volume of a planned four-volume series starts the series with an overview and history of Mexican coinage and currency covers pre-Columbian money to the colonial era, the independence movement, revolutions, modern coinage reforms, commemorative programs, and silver, gold, and platinum bullion.

Numismatic Cataloging Systems

Krause-Mishler (KM#)

Created by: Chet Krause and Cliff Mishler Cataloging system of foreign coins, primarily used by the Krause Publications’ Standard Catalogs

PCGS

Created by: Professional Coin Grading Service PCGS maintains its own cataloging system for United States coins

Pick (P#)

Created by: Albert Pick Pick was a German notaphilist who developed a cataloging system for currency

VAM

Created by: Leroy Van Allen and George Mallis Developed by the authors in 1965 to catalog die varieties of Morgan and Peace dollars

Yeoman (Y#)

Created by: Richard S. Yeoman Original author of A Guidebook of United States Coins (The Red Book) developed a cataloging system primarily for Asian coins

Significant in the announcement is that this book introduces the cataloging of Mexican coinage with the Bailey-Whitman numbering system. The press release called this a comprehensive cataloging that is cross-referenced to “older systems.” Although I have not seen the actual book, page scans sent by Whitman as part of the press release shows that the older cataloging system being cross-referenced is the Krause-Mishler (KM) numbers used in Krause Publications’ Standard Catalog of World Coins.

Those of us who study and collect foreign coins have come to rely on KM numbers to help identify coins. The KM system has not only been unable to keep up with the proliferation of modern non-circulating legal tender coins (NCLT), especially from Canada, but is severely lacking when it comes to cataloging varieties.

Aside from omissions, the Standard Catalogs are riddled with errors that sometimes are never corrected. In the case of the Standard Catalog of World Paper Money, which is also known as the “Pick” catalog since it is organized by Albert Pick’s numbering scheme, it is so riddled with problems that Owen Linzmayer has produced his own catalog with better pictures and details called The Banknote Book. In fact, you can buy the book as a four-volume set or individual chapters representing different countries. I highly recommend Linzmayer’s books over all others. Go to banknotenews.com to learn more.

While I am not a collector of Mexican money, the sample pages provided by Whitman make the book look very compelling. It is difficult to review a book based on selected sample pages from the publisher, but it looks like something that could be used as a model for similar treatment of other countries. It would be nice to see similar books for Canadian, English, and Chinese coins.

If Whitman continues and provides comprehensive catalog information for other coins, it will be good for the industry. Between Whitman and Owen Linzmayer’s work, it should force Krause to fix their issues and provide better and more complete information to the collector. As we know, the more you know about your collection the better you enjoy collecting. This is why competition is good!

Click on any image to see the larger version.

All images courtesy of Whitman Publications.

Sep 12, 2014 | bullion, coins, gold, halves, US Mint, values

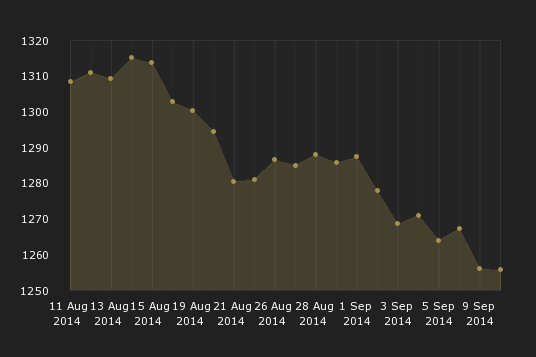

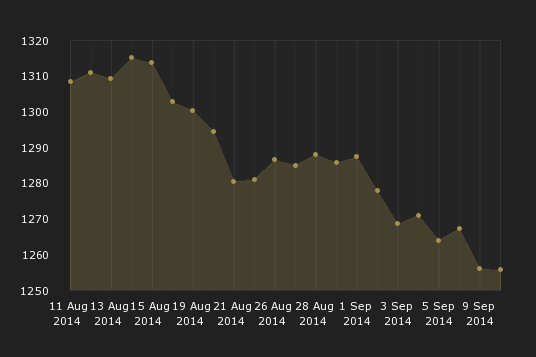

If you have not seen what has been going on in the gold market, the prices have been falling. The financial press has not provided a single reason as to why the gold market is going down but there is a consistent view that the United States economy showing strength with unemployment dropping and low inflation may be alleviating fears in the markets. Stocks are rising and it is suspected that investors are selling their gold shares in order to participate in the bull market.

For collectors it means that the U.S. Mint could adjust the prices of precious metal products. In particular, the price is coming down that could affect the price of the Kennedy gold half-dollar. Based on the table published in the Federal Register [PDF], if the London Fix price of gold falls below $1,250 per troy ounce, the price of the coin will drop to $1,202.50 or $37.50 below the $1,240 issue price.

The London Fix is now managed by The London Bullion Market Association. Gold prices are set by an auction that takes place twice daily by the London Gold Fixing Company at 10:30 AM and 3:00 PM London time. Auctions are conducted in U.S. dollars. The benchmark used by the U.S. Mint is the PM Fix price on Wednesday.

On September 10, 2014, the London PM Fix was $1,251.00 which will leave the price of the Kennedy gold half-dollar $1,240.

London PM Gold Fix for the month leading up to September 10, 2014

London PM Fix on September 10 was $1,251.00

Prices are in U.S. dollars

A strong economy is good for many reasons. In this case, when the price of gold drops the price of gold coins also drops. While this is not good for investors, it benefits collectors who will buy one or two coins for their collections. It also means that the value of the inventory that the dealers who spent a lot of money and effort in order to be first will be worth less than previously. After all, if the U.S. Mint is going to produce as many coins as the demand, then the public is better off saving money and buy from the U.S. Mint.

As anyone who has invested money will tell you that it is dangerous to try to time the market. I am sure that if you can figure out when the price of gold will be at its lowest while the U.S. Mint is still selling the Kennedy gold half-dollar, I know a bunch of people on Wall Street who want to talk with you. That being said, I have a feeling that the trends are in favor of waiting to see what happens. Although I have not decided whether I will buy a coin, I am going to wait to see what the market does. If the price of gold continues to fall, I could be convinced to buy one of these coins for myself.

Pricing for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin

As published in the Federal Register (

79 FR 38127)

on July 3, 2014

| London PM Fix |

Item |

Sale Price |

| $1000.00 to $1049.99 |

¾ Troy oz |

$1,052.50 |

| $1050.00 to $1099.99 |

¾ Troy oz |

$1,090.00 |

| $1100.00 to $1149.99 |

¾ Troy oz |

$1,127.50 |

| $1150.00 to $1199.99 |

¾ Troy oz |

$1,165.00 |

| $1200.00 to $1249.99 |

¾ Troy oz |

$1,202.50 |

| $1250.00 to $1299.99 |

¾ Troy oz |

$1,240.00 |

| $1300.00 to $1349.99 |

¾ Troy oz |

$1,277.50 |

| $1350.00 to $1399.99 |

¾ Troy oz |

$1,315.00 |

| $1400.00 to $1449.99 |

¾ Troy oz |

$1,352.50 |

| $1450.00 to $1499.99 |

¾ Troy oz |

$1,390.00 |

| $1500.00 to $1549.99 |

¾ Troy oz |

$1,427.50 |

| $1550.00 to $1599.99 |

¾ Troy oz |

$1,465.00 |

| $1600.00 to $1649.99 |

¾ Troy oz |

$1,502.50 |

| $1650.00 to $1699.99 |

¾ Troy oz |

$1,540.00 |

Fixing chart courtesy of London Gold Fixing Company.

Sep 6, 2014 | coins

The American Numismatic Association issued a statement on August 28 about the 2014 World’s Fair of Money. As part of the statement, the fiasco of the Kennedy half-dollar gold coin was addressed.

The American Numismatic Association issued a statement on August 28 about the 2014 World’s Fair of Money. As part of the statement, the fiasco of the Kennedy half-dollar gold coin was addressed.

Before I add my commentary, I do not blame the ANA or the U.S. Mint for the problems at the Kennedy Half-Dollar gold tribute sales. The ANA, U.S. Mint and those responsible for security at the show site did what they could in order to make this a smooth process. As I have said in the past, I blame the dealers who were responsible for hiring the people who caused the problems.

Let’s look at the statement:

“When the U.S. Mint announced the sale of its dual-dated gold Kennedy commemorative coin at the World’s Fair of Money, the ANA was hopeful that the release of such a popular coin would be a boost to the hobby and increase public interest in numismatics,” said ANA Executive Director Kim Kiick. “Unfortunately, the challenges created by the mass of people trying to buy the coin became a concern for public safety, both at our show and at the U.S. Mint’s retail sites in Philadelphia, Denver and Washington, D.C.”

As I investigated further, there appears to have been less of a problem at the Washington, D.C. headquarters because the dealers involved hired actors to stand in line for them. Although the actors were not told what the “audition” was about, witnesses say that the actors were better behaved than the other line standers.

The image of the situation in Denver is haunting in regard to security. People lining up for a three-quarter ounce of gold that was selling for $1,240 and even more on the secondary market would make anyone nervous.

Public safety was the ANA’s top concern after the U.S. Mint announced that it would debut the coin at the World’s Fair of Money. Kiick commended the efforts of PPI Security, the staff of the Donald E. Stephens Convention Center, the Rosemont Police Department and ANA staff and volunteers for maintaining order. She also expressed disappointment that many of the coins were bought by people paid to stand in line.

Given the millions, if not billions of dollars in coins, currency, and other merchandise in the convention center, it is amazing that nothing else happened. Reports suggested that the crowd standing in line at the Stephens Convention Center were not collectors and their behavior was not what would be expected at an ANA show.

“The intent of the U.S. Mint was to sell its allotment of 2,500 coins to 2,500 different people, putting these coins into as many different hands as possible,” Kiick said. “The hiring of proxies to stand in line and receive the coin for somebody else not only went against the spirit of the sale, it hurt the ANA. The ANA is responsible for paying for extra security and damages to the exterior of the convention center brought on by these crowds.”

In an article by Dave Harper of Numismatic News, this is not the first time that this type of situation has occurred. Harper recalls the story by California dealer Ron Gillio who purchased 1968 proof sets in Denver using college students.

I had two thoughts after reading this. First, the dealers did not use college students in 2014 and placed them in an enclosed space at the World’s Fair of Money creating a situation where extra security was required. Second, to borrow a quote from my late mother, “two wrongs don’t make a right.” It was not the right thing to do at that time and it was not the right thing to do today.

While the U.S. Mint has announced that it plans to continue offering new coin releases at the World’s Fair of Money, Kiick said any future sales are contingent on whether the Mint and the ANA can put together a security and sales plan that will address the concerns raised from the Kennedy sales.

“We love having the U.S. Mint at all of our shows, and we certainly enjoy seeing the Mint bring exciting new products to the marketplace that will increase public interest in the hobby,” Kiick said. “However, the problems we experienced this year far outweigh the benefits. There will be no onsite sales in the future unless we can come up a new sales process to avoid the problems encountered at the various U.S. Mint sales locations.”

One way to control the sales at the ANA shows is to limit the sales to ANA members. ANA members have membership numbers and their membership information stored in an ANA database. If you are a member and want to purchase a newly released U.S. Mint product, you register with the ANA and receive a ticket. The ticket would be printed with your membership number and would identify you should something happen. The ticket would be non-transferrable.

Once the ticket is issued, it will be the responsibility of the member whose number is on the ticket to act in accordance with the ANA Code of Ethics. If the member transfers the ticket, the member remains responsible for the behavior of the person holding the ticket. If the ticket holder disrupts the proceedings, the member whom the ticket was issued to is responsible. That member would then be subject to appropriate disciplinary actions including legal action, if necessary.

Before anyone argues what is “right&rdqui; or “fairness,” the ANA can and should do what is in the best interest of the ANA. It is the ANA’s show and the ANA can run the show way it sees fit. If the ANA wants to limit access to members, as a membership-only organization, they can limit access to the bourse floor, even to the U.S. Mint.

If you do not like it, look at the video of what happened in Denver and blame the dealers who created this issue.

Sep 5, 2014 | ANA, coins, news, US Mint

When the calendar flips to August, my wife begins to complain about the humidity and wanting to go “home” to Maine where she grew up. For me, the kid from south Brooklyn, August begins the last push to the end of the federal government’s fiscal year. With congress out of town, many agencies stop worrying about policy shifts and prepare for the new fiscal year. August is the calm before the policy storms.

When the calendar flips to August, my wife begins to complain about the humidity and wanting to go “home” to Maine where she grew up. For me, the kid from south Brooklyn, August begins the last push to the end of the federal government’s fiscal year. With congress out of town, many agencies stop worrying about policy shifts and prepare for the new fiscal year. August is the calm before the policy storms.

This year has been unusual in that the weather has been more moderate than usual and world events have changed the tenor for those of us who work for the federal government. These events are not limited to areas of conflict. Those of us working in computer security have noticed an uptick in online criminal activity beyond what you read in the headlines.

With nothing happening on Capitol Hill, let’s look at the news generated by the U.S. Mint.

Following the issues during the sales at all locations for the Kennedy Half-Dollar gold tribute coin, the U.S. Mint suspended sales early and will re-evaluate their process for over-the-counter sales of coins. Sources at the U.S. Mint were surprised with the reaction since there are no mintage limits on the coin.

Subsequently, American Numismatic Association Executive Director Kim Kiick announced that sales of newly released coins by the U.S. Mint would be suspended indefinitely because of security concerns.

As an interesting side note, the price of gold has dropped and is close to the price that would lower the purchase price if ordered from the U.S. Mint.

Later in the month, the U.S. Mint announced that the Philadelphia facility broke a single day production record by producing 42.44 million coins for circulation. They beat their previous record of 32.28 million coins set in October 2013. The U.S. Mint produced a total of 1.33 billion coins for circulation in July with more than half of those being produced in Philadelphia.

The branch mint in Philadelphia is the world’s largest coin factory. No other mint in the world can produce the number of coins that can be struck at Philadelphia. The second largest coin factory is the branch mint in Denver.

Record production is more than an accomplishment for the U.S. Mint. They are being struck to fulfill orders for circulating coins from the Federal Reserve. This means that the Fed needs the coins to place into circulation which is a good sign for the economy. If the economy was slower, as it was a few years ago, the demand for coins would have slowed to where the U.S. Mint would have to reduce production.

The U.S. Mint has hired Naxion Research of Philadelphia to poll customers “to share [their] insights on new U.S. Mint products for 2015.” Customers were chosen at random to participate. Those who ordered products from the U.S. Mint via their website were sent an email invitation to take the survey. A separate group who ordered products by the telephone or by mail order was sent a paper survey form.

Survey results are due by September 15, 2014 regardless of the format used.

Aug 26, 2014 | coin design, coins, commemorative, foreign, web

Proposed design of the Yorkshire (UK) Challenge Coin.

Think about how you would feel to help a community create a challenge coin for itself. In the process of helping the community, you can collect one of these challenge coins for yourself. If you provide enough assistance, then you can own one of the lowest numbered challenge coin.

Buried in my inbox was a note about a KickStarter project to create a challenge coin for Yorkshire, U.K. For as little as £6, (currently $9.94) you can own a coin numbered between 100 and 999. If you can afford £20 ($33.14), you can own a coin numbered between 10 and 20. Sorry, but the lower numbers have been purchased. All you have to do is go to KickStarter and fund the project.

For those not familiar with KickStarter, it is a website used to allow interested people to fund projects of their choosing. Kickstarter projects are mostly creative endeavors or involve some creativity in art, music, and technology where you receive awards for your level of funding. The financing model is called “crowd sourcing” and has been used effectively to launch films for the Sundance Film Festival, a skate park in Philadelphia, a photo exhibit on the site of the Berlin Wall, and the Fitbit smart watch.

KickStarter uses and all or nothing model meaning that if the project only receives the money if it is fully funded. If it does not, your credit card will not be charged and you will not receive your premium, of course. For the Yorkshire challenge coin, they are asking for £3,000 ($4,970.52). Currently, there is £220 pledged ($364.50) with 3 days to go. The funding drive ends on Saturday, August 30 at 1:36 AM EDT.

What the heck… it seems like a very cool idea. Let’s see if we can help put the project over the top and get it funded. Even if you do not want the coin, you can spare £3 (about $5) to help!

Note that there are extra postage requirements for shipping outside of the United Kingdom.

Aug 13, 2014 | ANA, coins, commemorative, commentary, ethics, gold, shows, US Mint

From the raw video of people dashing across the street at the Denver Mint

The media reported that those waiting for to purchase the coins were not collectors. Most were being paid by dealers to be on the line in order to get around the U.S. Mint purchasing limits. As part of their attempt to game the system, these dealers put collectors and the general public in danger by handing large amount of cash to needy people who did not conduct themselves in a manner that is consistent with the ANA Code of Ethics. Since those behaving badly were being paid by the dealers, they are representatives of the dealers, making the dealers responsible for the action of those they employ.

In case those dealers have forgotten, according to the ANA Code of Ethics:

As a member of the American Numismatic Association, I agree to comply with the following standards of conduct:

- To conduct myself so as to bring no reproach or discredit to the Association, or impair the prestige of the membership therein.

This applies directly to the dealers whose action caused problems at the World’s Fair of Money. Since sales of the coin were made at the U.S. Mint’s booth on the bourse floor, this is a case where the dealers who participated in this discredited the Association by creating an environment that potentially jeopardized the security of the show. By putting the security in jeopardy and bringing this negative publicity to the World’s Fair of Money, the participating dealers impaired the prestige of the membership especially when they had to put the U.S. Mint and the ANA Executive Director in the position to have to act as a parent to dealers acting like impetuous children.

- To base all of my dealings on the highest plane of justice, fairness and morality, and to refrain from making false statements as to the condition of a coin or as to any other matter.

Although the launch of the 2014 National Baseball Hall of Fame commemorative coin during the Whitman Baltimore Expo was a success, there was a feeling that the sales format did not give collectors a chance to purchase the coin. In order to promote the broader sales of the coin, the U.S. Mint adjusted its sales requirement to limit over-the-counter sales in order to give more collectors the opportunity to purchase the new Kennedy gold coin. How could the U.S. Mint or the ANA know that the sales of a coin that does not have any mintage limits would cause problems when the sales of a commemorative coin with mintage limits went without significant issue?

Unfortunately, the intent of the U.S. Mint was impeded by some dealer’s plane of justice by their action. By immorally trying to get around the U.S. Mint’s sales limits by using questionable methods to unfairly stack the line against the collector, the dealers were making false statements to a government entity, and thus the public it represents, as to their eligibility to purchase the coin.

The appalling images provided by Denver television news (see below) of the behavior of those described as homeless on behalf of the dealers trying to get around the sales limits not only is not only unjust to legitimate purchasers and immoral, but as ANA members discredits themselves as ANA members.

Therefore, I am accusing ALL of the ANA members who hired these people that acted on their behalf of the ANA dealers with violation of the ANA Code of Ethics. The ANA Board of Governors must take action to restore the organization’s credibility by suspending those involved as per the ANA Bylaws!

Images of the shameful display caused by ethically challenged and greedy dealers courtesy of

ABC 7News Denver.

Collecting is a progressive addiction. It might start innocently with a friend introducing us to collecting and even giving us a few freebies. We dabble into buying more, especially items that tie us to our youth. We progress in collecting more from those childhood years putting together sets that we could not afford them. That feels pretty good, and soon we are tempted into expanding our collection into earlier and later years.

Collecting is a progressive addiction. It might start innocently with a friend introducing us to collecting and even giving us a few freebies. We dabble into buying more, especially items that tie us to our youth. We progress in collecting more from those childhood years putting together sets that we could not afford them. That feels pretty good, and soon we are tempted into expanding our collection into earlier and later years.

The

The  When the calendar flips to August, my wife begins to complain about the humidity and wanting to go “home” to Maine where she grew up. For me, the kid from south Brooklyn, August begins the last push to the end of the federal government’s fiscal year. With congress out of town, many agencies stop worrying about policy shifts and prepare for the new fiscal year. August is the calm before the policy storms.

When the calendar flips to August, my wife begins to complain about the humidity and wanting to go “home” to Maine where she grew up. For me, the kid from south Brooklyn, August begins the last push to the end of the federal government’s fiscal year. With congress out of town, many agencies stop worrying about policy shifts and prepare for the new fiscal year. August is the calm before the policy storms.