Jan 19, 2015 | BEP, counterfeit, currency, Federal Reserve

How an iodine pen reacts depends on the type of paper used.

As I was waiting to checkout, the person running the cash register was having difficulties with someone whose credit card was not being accepted. It did not matter what the problem was, the issue was holding up the line. While waiting, the gentleman next on line turned to me and said, “This is why I pay in cash.”

Apparently, my fellow line waiter and I had one thing in common, we both visited the bank prior to doing our shopping. He paid for his purchase with crisp, new currency. Just like my new currency, they were mostly $20 Federal Reserve Notes in serial number order fresh from a pack that was opened in the bank.

When the cashier counted the money, she picked up a pen and drew a line on each note. The pen was a counterfeit detection pen that contains an iodine-based ink used to determine whether the paper used is counterfeit.

These iodine pens test whether the paper is legitimate by checking if the iodine reacts with the starch that is used in commercial paper to make them look brighter. If the paper contains starch, then the ink turns dark indicating the paper is not real currency paper. Otherwise, the mark stays amber on the normal cotton bond paper.

There are two problems with this method of counterfeit detection. First, it is relatively easy to defeat the iodine pen by washing and bleaching a low denomination bill and reprinting a higher denomination on the same paper. By using legitimate currency paper, testing it with the iodine pen will not detect that it is counterfeit.

I remember there was a story on one of the television networks about how counterfeiters bleached $5 notes and passed them off as $20 notes after reprinting them. While searching, I found the following video of NBC’s Chris Hanson as he reported about this on Dateline:

Another problem with using iodine pens is that merchants that use them put their customers in danger who have iodine allergies. Those of us with severe iodine allergies can experience anaphylaxis, a serious reaction whose rapid onset can be so severe that it can cause death. As one of those people with severe iodine allergies, I watched this scene in horror.

Following a discussion with the manager, I consented to using a credit card since this was not one of those retailers that have been in the news for being hacked.

After all the Bureau of Engraving and Printing does to ensure that the new currency is more difficult to counterfeit and how the criminals are getting around these iodine pens by using real currency paper, it is incredible to think that these stores are still using tried but untrue measures for counterfeit detection.

In the meantime, the more serious counterfeiters are bleaching and overprinting $5 notes because as the criminal in the video says, nobody looks!

Dec 22, 2014 | BEP, cash, currency, Federal Reserve, video

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

According to the Federal Reserve, the number of notes they order depends on the predicted growth in demand and the predicted number of notes that have to be destroyed because they are not usable any more. Both growth and demand are predicted to include world-wide usage of the United States Federal Reserve Note as it is the standard currency for many transaction. In addition to the demand and destruction is the predicted replacement of the old $100 Federal Reserve Note with the new note that has more advanced currency features. While the Federal Reserve will not recall the old $100 notes, they are removing them from circulation as they arrive back into the Federal Reserve system.

The following table is how the Federal Reserve says they broke down their order for 2015:

| Denomination |

Number of Notes |

Dollar Value |

| $1 |

2,451,200,000 |

$2,451,200,000 |

| $2 |

32,000,000 |

$64,000,000 |

| $5 |

755,200,000 |

$3,776,000,000 |

| $10 |

627,200,000 |

$6,272,000,000 |

| $20 |

1,868,800,000 |

$37,376,000,000 |

| $50 |

220,800,000 |

$11,040,000,000 |

| $100 |

1,276,800,000 |

$127,680,000,000 |

| Total |

7,232,000,000 |

$188,659,200,000 |

Included with the order are the notes that the Bureau of Engraving and Printing will sell to collectors. These are the same notes that collectors can purchase online at moneyfactorystore.gov and when the Bureau of Engraving and Printing attends shows.

As part of the announcement, the Federal Reserve released a video explaining how they decide the amount of currency to order.

[videojs mp4=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.mp4″ ogg=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.ogg” poster=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.jpg”]

Video courtesy of the Federal Reserve and the Bureau of Engraving and Printing

Aug 3, 2014 | BEP, coins, currency, Federal Reserve, US Mint

While doing my monthly review of the numismatic-related political news for the Gold & Silver Political Action Committee, I came across a bill that seems to have missed the numismatic press. One reason it was missed might be that the provisions are buried in a larger bill and has a name that might not be as noticeable. However, there are two issues buried in a larger bill. The bill is as follows:

H.R. 5196: Unified Savings and Accountability Act (or USA Act)

Sponsor: Rep. Mike Coffman (R-CO)

• To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

• Introduced: July 24, 2014

• Referred to several committees based on jurisdiction of the provision.

Track this bill at https://www.govtrack.us/congress/bills/113/hr5196

Buried within the bill are two provision that may be of interest to collectors.

Sec. 203. Prohibition on non-cost-effective minting and printing of coins and currency.

If passed, Section 203 would require that the U.S. Mint stop striking any coin that costs more to manufacture than its face value four years following the passage of this bill. Using current standards, the U.S. Mint would be required to stop producing one- and five-cent coins by late 2018 because they cost more than their face value to produce. One of the problems with this bill is what would happen if the price of copper and zinc, the drivers in the price of both coins, were to fall and the costs were reduced to below face value? Would the coins be struck again?

Sec. 205. Replacing the $1 note with the $1 coin.

As the title suggests, Section 205 will replace the one-dollar Federal Reserve Note with the dollar coin. The section begins with requiring the Federal Reserve to “sequester” Susan B. Anthony dollars to remove them from circulation. There is a provision for their value as numismatic collectibles.

The plan to remove the $1 FRN is just to stop issuing the notes and replace them with coins as the notes come out of circulation after a one-year educational period. The Federal Reserve would continue to use the notes alongside the coins until 600 million coins are in circulation or for four years, whichever comes first. The bill allows the Bureau of Engraving and Printing to continue to print the $1 FRN for collectors.

Given the current state of congress, the likelihood of this bill passing is slim-to-none, and, as a friend liked to say, “Slim just left town.” Some of the other provisions of this bill might be introduced into an omnibus budget bill following the November elections, but it is doubtful that these sections will make it past this introduction.

Then again, who knows? Congress has surprised us in the past!

Dec 26, 2013 | Canada, currency, Federal Reserve

With the fanfare of a hard cough, the Federal Reserve released new new $100 Federal Reserve Notes on Tuesday, October 8, 2013 in the middle of the government shutdown. The launch is three years in the making following of folding problems during production at the Bureau of Engraving and Printing.

With the fanfare of a hard cough, the Federal Reserve released new new $100 Federal Reserve Notes on Tuesday, October 8, 2013 in the middle of the government shutdown. The launch is three years in the making following of folding problems during production at the Bureau of Engraving and Printing.

Earlier on 2013, a Freedom of Information request forced the government to release information as to the problems the BEP was experiencing. The BEP released images along with the report (OIG-12-038 [PDF]) from the Treasury Office of the Inspector General heavily criticizing the BEP for mismanaging the delay. The published response from the BEP was to apologize promising to do better.

As the U.S. Secret Service, Bureau of Engraving and Printing, and Federal Reserve scramble to deal with paper currency, some countries are abandoning cotton rag bond paper for polymer notes.

The polymer “paper” was developed by the Reserve Bank of Australia to enhance the durability of the notes and to incorporate security features not possible with paper or rag-based paper. RBA has been distributing polymer notes since 1992. While the polymer substrate costs little more and the production is only marginally more expensive, the benefit will come from the reduction in counterfeiting and the durability of the note. Polymer will last three-to-six times longer than rag-based paper.

Canada’s $5 Polymer banknote was issued on Nov 7, 2013

The Bank of England announced that they were going to transition to polymer currency notes. The research performed by the Bank of England can be used as a basis for the Federal Reserve to begin its own study.

Although polymer notes may be a better idea, the BEP’s long time ties to Crane & Co. along with politics from Massachusetts will prevent the United States from considering polymer as a viable option. Ironically, there is an indication that the prices of the paper may not be as low as possible. After many yeas of Crand & Co. saying that they are heavy recyclers of cotton, specifically cotton from old denim jeans, we learned that Crane has been sourcing cotton from “beyond the waste stream.” In other words, no more blue jean recycling.

Crane claims the problem is skinny jeans—the pants that many of us should not be wearing! In order to make the clothes tight but comfortable, manufacturers are adding spandex to the fabric so they appear tighter. Spandex and other synthetic fibers cannot be used to make currency because it degrades the strength of the paper. The process to remove the spandex or other “contaminants” is too expensive to be viable.

The United States has tried to use non-paper for currency in the past. In the 1980s, the American Banknote Company worked to Dupont to use its Tyvek polyethylene fiber sheets for currency. Tyvek has had a lot of uses including liners used around insulation during construction and envelopes. It is a strong material that can last much longer than paper. After a number of problems, use of Tyvek was discontinued.

As with the dollar coin, the long memory of the Tyvek failure is a significant detractor to the possibility of just researching the possible move. To paraphrase Thomas Edison, we did not fail in producing currency with plastic, we learned ways of how not to do it! It appears to be unlikely that the United States will be producing polymer notes any time soon.

Last week I went to my local bank asking if they could order the new $100 note from the Federal Reserve. Following two currency deliveries I was told that the notes were not available in the supply chain that supplies my bank in the Maryland suburbs of Washington, DC. Another order was placed with the hopes that they will be available before the end of this year.

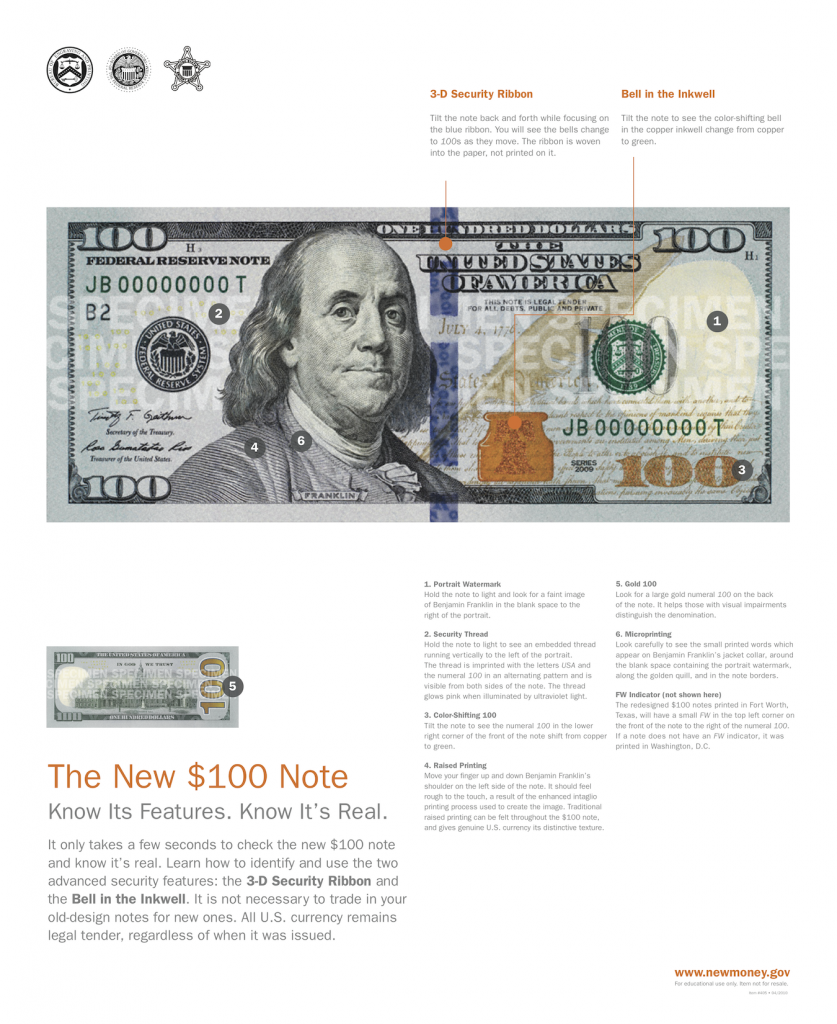

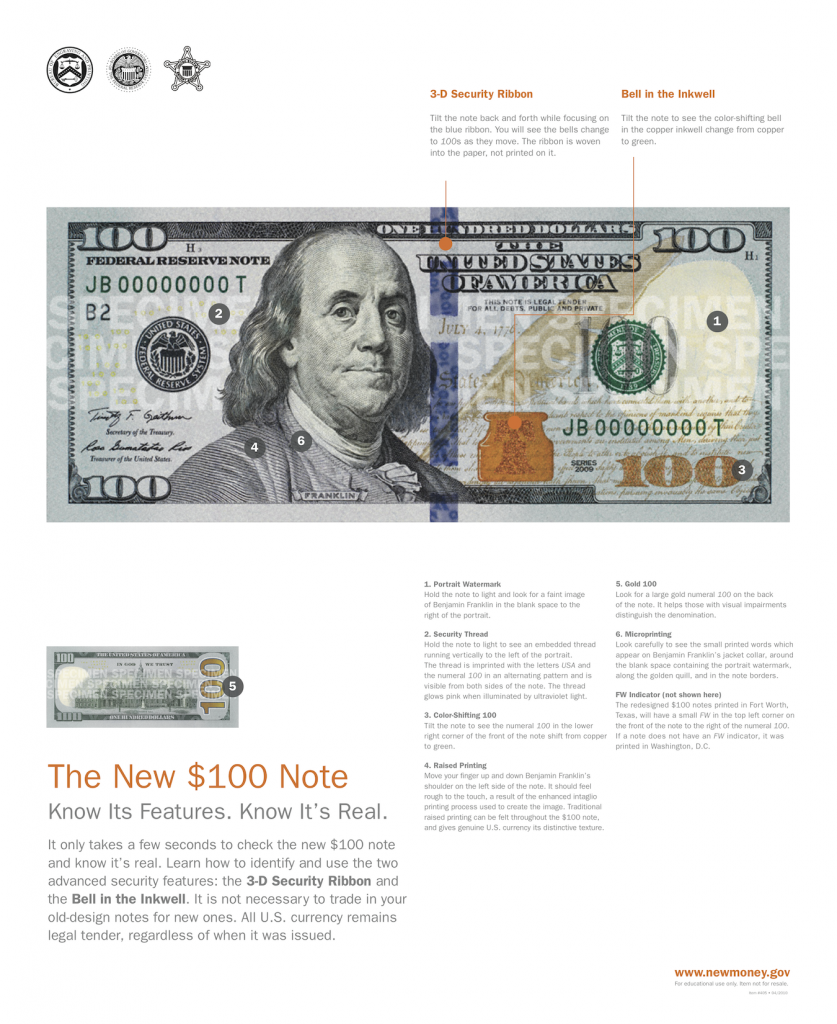

Information from the Bureau of Engraving and Printing as to how to use the new note’s security features to ensure it is not a counterfeit.

Image of new $100 note and counterfeit detection info courtesy of the Bureau of Engraving and Printing.

Image of the Canadian $5 polymer note courtesy of the Bank of Canada.

Dec 25, 2013 | base metals, cents, coins, commentary, dollar, Federal Reserve, gold, history, Morgan, Peace, silver, US Mint

Two discussions that transcended numismatics is what to do about the one dollar coin and common one-cent coin. Both coins cause different problems depending on who is doing the arguing. I find it amazing that the logic that is used to support the argument is not used consistently.

Dollar coins have been around since the beginning of the republic. In fact, the coin that currently holds the record for being the most expensive coin sold at auction is a 1794 Flowing Hair dollar. The coin is reported to be amongst the first dollar coins minted at the newly created Mint was bought by Legend Numismatics for more than $10 million. Laura Sperber, one of the principals of Legend Numismatics, was quoted as saying that she was prepared to bid higher for the coin.

If that is not enough to show how important the dollar coin has been in our history, there is always the 1804 Bust dollar, also known as “The King of Coins.” The U.S. Mint ceased to strike dollar coins in 1804 because of hoarding when the price of silver rose. The dollars that were struck in 1804 were struck using dies dated 1803 and are indistinguishable from the coins struck in 1803. The U.S. Mint continued to strike “minor coinage” to encourage circulation.

In 1834, eight dollar coins were struck with the 1804 date to include in a special set created as a gift for the King of Siam (the area known today as Thailand). One coin was included in the set, one was retained by the U.S. Mint for its collection that is now part of the National Numismatic Collection at the Smithsonian National Museum of American History, and the six others were kept as souvenirs by Mint officials and eventually landed in private collections. Between 1858 and 1860 seven more specimens were surreptitiously by U.S. Mint employee Theodore Eckfelt. It is alleged that Eckfelt created 15 coins. Six are in private collection, one is now part of the National Numismatic Collection and the others were reported to be destroyed when seized by the government.

The Coinage Act of 1873, known as “The Crime of ’73,” ended the free coining of silver and put the United States strictly on the gold standard until the western states where silver was being mined became upset. Two weeks later, congress passed the Bland-Allison Act to required the Department of the Treasury to buy the excess silver and use it to strike the Morgan Dollar. Morgan dollars, especially those struck at the branch mint in Carson City, Nevada are popular with collectors because of their ties to the days of the old west. Collectors can find quite a few nice examples of Morgan and the Peace dollars that were struck from 1921 through 1938 because many did not circulate. These coins were held as backing to silver certificates in circulation and did not get released to the general public until the GSA Hoard sales that begin in the 1960s.

Such a colorful history also has a downside that is used as fodder against the dollar. After ending the production of the Peace dollar in 1938, no dollars were struck until 1964 when the U.S. Mint struck 316,076 1964-D Peace dollars in May 1965. The coins were never put into circulation and the entire population of 1964-D Peace dollar were allegedly destroyed. There have been reports that some Peace dollars were struck using base metals (copper-nickel clad) as experimental pieces in 1970 in anticipation of the approval of the Eisenhower dollar. The same reports also presume these coins have been destroyed.

The Eisenhower dollar was not well received because of its size. The 38mm coin was seen as too big for modern commerce and with the exception of dollars struck with the special bicentennial reverse in 1975 and 1976, most coins did not circulate.

The Susan B. Anthony dollar coin was introduced in 1979 with much fanfare for being the first coin to honor a woman. The coin was a failure because it was confused with a quarter

Since the introduction of the Sacagawea dollar in 2000, the dollar coin’s size has remained the same but with the addition of manganese has a golden color to be visually different from other coins. For the visually impaired, the reeding was removed from the edges. Today, the Presidential $1 coins and the Native American $1 Coins have edge lettering that keeps it tactically different from the quarter dollar. However, people continue to bring up the Susan B. Anthony dollar as a reason not to use dollar coins.

Historically, dollar coins has been more popular in the western regions of the United States where the east prefers paper. Financial centers and big city government prefers paper for its alleged ease of handling. When circulated side-by-side, the public tends to choose paper over coin.

When we look around the world for examples of how to handle this situation, we find that the United States is the only country where the unit currency is available in both paper and coin. Other countries did not give people a choice. Rather, their governments made a decision based on overall economic benefits of using a coin with a predicted 30-year lifespan over paper currency that can last 18-24 months in circulation. Instead of the argument being of practical economics where every other country and the European Union have put on their proverbial long pants and made a decision that is in their best economic interest, factions in the United States comes up with mind boggling arguments of alleging that taking the paper dollar away is akin to taking away our freedom.

Obverse of the 2013-S Lincoln proof cent. Lincoln’s portrait, designed by Victor D. Brenner in 1909, is the longest running design of any United States coin.

The United States has a history of using its currency to boost the economic status of its citizens, aside from the various silver laws and the laws that eventually took the United States off the gold and silver standards, the creation of the half-cent was made because of the economic status of its citizens. Following Alexander Hamilton’s Treasury Secretrary’s report to congress “On the Establishment of a Mint,” Secretary of State Thomas Jefferson had another idea. Jefferson thought it would be better to tie subsidiary coins tied to the actual usage of the 8 reales coin. At the time, rather than worry about subsidiary coinage, people would cut the coin into pieces. A milled dollar cut in half was a half-dollar. That half-dollar cut in half was a quarter-dollar and the quarter-dollar cut in half was called a bit.

The bit was the basic unit of commerce since prices were based on the bit. Of course this was not a perfect solution. It was difficult to cut the quarter-dollars in half with great consistency which created problems when the bit was too small, called a short bit. Sometimes, short bits were supplemented with English pennies that were allowed to circulate in the colonies.

As an aside, this is where the nickname “two bits” for a quarter came from.

Jefferson felt that in order to convert the people from bit economy to a decimal economy, the half-cent was necessary to have 12½ cents be used instead of a bit without causing problems during conversion from allowing foreign currency to circulate as legal tender until the new Mint can produce enough coinage for commerce.

The half-cent would come into focus in the 1850s when the cost to produce the United State’s copper coins was nearly double their face value. In 1856, the Mint produced the first of the small cents, the Flying Eagle small cent, and produced 700 samples to convince congress to change to the small cent. As part of the discussion was the elimination of foreign currency from circulation making the U.S. Mint the sole supplier of coins.

There is no record of outcry from the public on the elimination of the half-cent. Its elimination came four years after the Coinage Act of 1853 that created the one-dollar and double eagle gold coins in response to the discovery of gold in North Carolina, Georgia, and California. The gold rush caused a prosperity and inflation that not only made the half-cent irrelevant but not something on the public’s mint. In that light, the Mint and congress felt that it just outlived its usefulness and would not be necessary with the elimination of foreign currency from circulation.

More controversy was generated in 1857 over the demonetizing foreign coins in the United States than the elimination of the half-cent. While the half-cent continued to circulate, it was estimated that one-third of the coins being circulated were foreign, primarily reales from Mexico. Redemption programs did not go smoothly, but in the end foreign coins were taken out of the market and the American people adapted and it could be said we prospered as a nation.

Like the 1850s, the last seven years have found that the cost of the copper used to make the one-cent coin has increased to more than the coin’s value. Combined with the labor and manufacturing costs, it costs the U.S. Mint between 1.6 and 1.8 cents for each copper-coated zinc cent struck. Although people argue that the cent is not needed and is barely useful, the U.S. Mint reports that 65-percent of its production are for one-cent coins that are ordered by the Federal Reserve to be circulated in commerce.

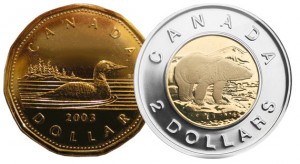

Eliminating the cent has caused controversy from those concerned with the economic welfare of the less fortunate. Many are using the same arguments that Jefferson made in 1791 to create the half-cent in order to keep the one-cent coin in circulation while others point to what other countries are doing. Canada is currently the country with the largest economy to eliminate its lowest denomination coin. Proponents of eliminating the cent point to Canada’s rocky success (withdrawal of the cent had been delayed twice) as an example of how the United States can handle the situation.

Canadian 1-dollar and 2-dollar coins. The 1-dollar coin is called a Loonie because its reverse depicts a common loon. “Toonie” is a play on the Loonie nickname.

Suggesting that if the United States follows Canada’s lead in the elimination of the cent, should the United States follow Canada’s lead and eliminate the one- and two-dollar Federal Reserve Notes in favor of one- and two-dollar coins?

This debate will continue until someone decides to act like an adult and make a definitive policy decision—especially when the Fed publishes a “working paper” that cherry picks facts to support a specific viewpoint.

Image of the Susan B. Anthony dollar and Lincoln cent courtesy of the U.S. Mint.

Image of the Canadian Loonie and Toonie courtesy of

Noticias Montreal.

Dec 23, 2013 | celebration, coins, commentary, Federal Reserve, platinum, US Mint

If there was a countdown of the idiocy of the punditocracy of this country, the discussion over the $1 Trillion platinum coin would be the number 1 story. As I previously explained, which it is feasible for the U.S. Mint to strike a $1 Trillion coin, the question remains, “Who will buy the coin?” In order for the U.S. Mint to gain from the seigniorage that would come from minting and selling this coin.

If the coin is has to be paid for by a depositor before it can become legal tender, who will buy a $1 Trillion coin?

How could the coin be used to reduce the debt? If the coin is just deposited with the Federal Reserve, there will be a $1 Trillion liability on the government’s balance sheet. In order to make the books balance, the Department of Treasury would have to sell debt bonds to make up the difference and that would add $1 Trillion to the national debt.

If the coin is bought by the Federal Reserve, then the Fed will have to pay $1 Trillion to the U.S. Mint for the coin reducing its overall working capital by $1 Trillion. Paying for a $1 Trillion that could not be used will just transfer the debt from the general treasury to the Federal Reserve. Since the Federal Reserve is in charge of managing the country’s money supply, the net effect will be to reduce the money supply by $1 Trillion that will cause the economy to shrink—any time you artificially remove money from the economy it will shrink which will also weaken the buying power of the U.S. dollar.

Transferring the debt away from the general fund might look good on paper but the effect will shrink the economy and cause more problems than even considering the constitutionality of doing this.

The bottom line is that regardless of what the U.S. Mint sells, there has to be a buyer. If there is no buyer then all the government would do is transfer balances from one balance sheet to another without any net gain.

Dallas-based Heritage Auctions, held a mock contest on Facebook for the public to design a potential $1 trillion coin. The concept of a coin was even a joke to the folks at Heritage whose mockup included famed Mad Magazine “pitchman” Alfred E. Newman.

Dec 22, 2013 | BEP, celebration, commentary, currency, Federal Reserve

It is that time of then when the pundit class of this country puts together their list of the best, worst, or most impactful stories of the year being concluded. There was even an advertisement on satellite radio about an upcoming show that will list the Top 10 moments in music for 2013. After a meeting of the Board of Directors for the Coin Collectors Blog (all three of us: me, myself, and I), the last ten days of the year will count down what we feel are the Top 10 Numismatic-Related Stories of 2013.

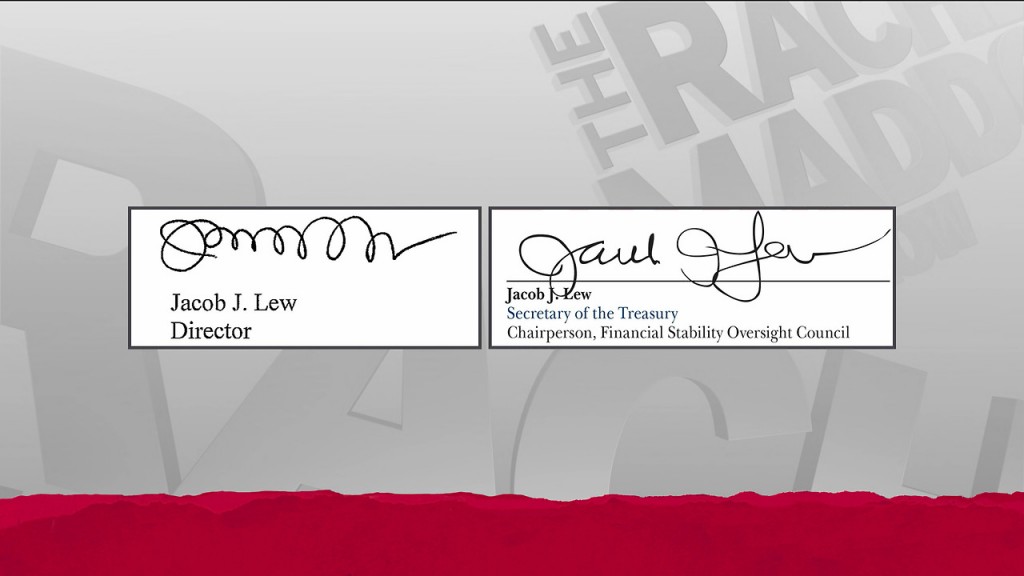

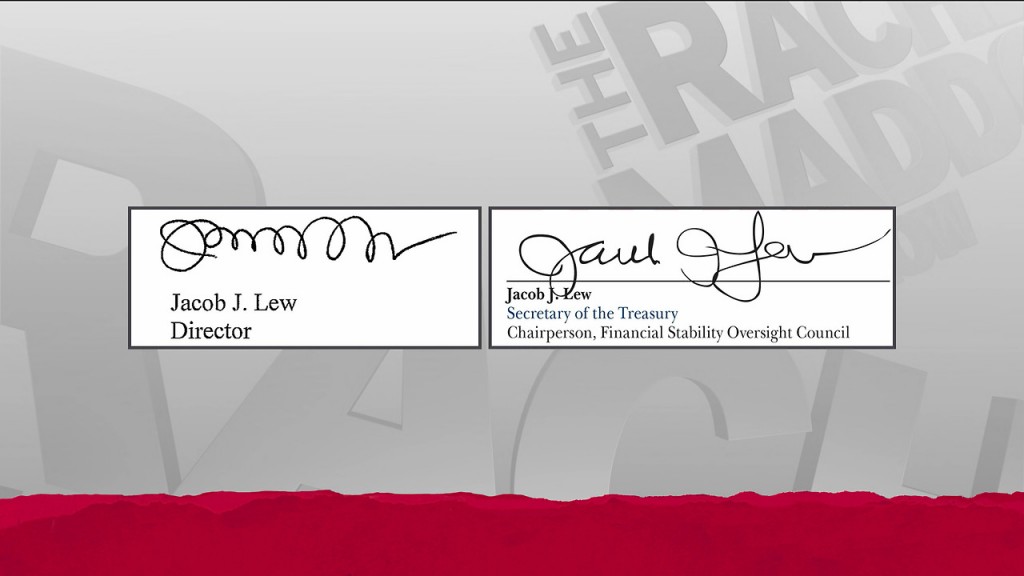

Number 10: Lew’s Lewpts

75th Secretary of the Treasury Jacob “Jack” Lew

Lew, whose autograph has been called “lewpty” and been compared to the decorative icing on a Hostess cupcake, made a promise to the president that he would do better with his penmanship. During his confirmation hearing, Lew told Sen. Max Baucus (D-MT), Chairman of the Senate Finance Committee, that he promised the president he would do better. This did not satisfy those with an ironic sense for the different when a petition appeared on the White House website to “Save the Lewpty-Lew.”

MSNBC on-air comparison of Jack Lew’s autographs: the original Lewpts on the left and what will appear on U.S. currency to the right.

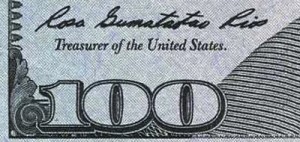

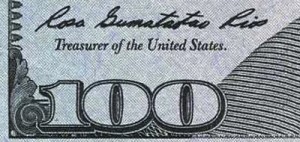

The other signature on U.S. currency is that of Rosa “Rosie” Gumataotao Rios, Treasurer of the United States. Rios was sworn in as Treasurer on August 20, 2009 and has served in that office ever since. Rios’s signature appears with former Secretary of the Treasury Timothy F. Geithner on Series 2009 notes. Ironically, Geithner also changed his signature when he became secretary.

-

-

Tim Geithner’s autograph before becoming Treasury Secretary.

-

-

Tim Geithner’s signature as it appears on U.S. currency

Rosie Rios signature on the older (Series 2009) $100 Federal Reserve Note

Notes that will include Jack Lew’s signature will appear on all Series 2009-A notes.

Glad we were able to resolve this pressing issue!

Oct 10, 2013 | BEP, currency, dollar, Federal Reserve, news, video

With the fanfare of a hard cough, the Federal Reserve released the new $100 Federal Reserve Note on Tuesday, October 8, 2013 to financial institutions. Various factors will effect how quickly these notes are seen in circulation including the demand and ordering policy of the financial institutions. In fact, the launch was introduced with a video by Sonja Danburg, Program Manager of the U.S. Currency Education Program at the Federal Reserve.

With the fanfare of a hard cough, the Federal Reserve released the new $100 Federal Reserve Note on Tuesday, October 8, 2013 to financial institutions. Various factors will effect how quickly these notes are seen in circulation including the demand and ordering policy of the financial institutions. In fact, the launch was introduced with a video by Sonja Danburg, Program Manager of the U.S. Currency Education Program at the Federal Reserve.

This launch is three years in the making as Bureau of Engraving and Printing reported problems with folding during the printing of the new notes. The announcement on April 21, 2010 said that the new notes would be released on February 10, 2011. On October 1, 2010, the Federal Reserve announced that the new note would be delayed. Later, the folding problems were revealed following a report released by the Treasury Office of the Inspector General.

The reason for the new notes are for the addition of security features. Aside from the ecurity thread, portrait watermark, color-shifting ink, microprinting, and the strategic use of color, the new note has a 3-D security ribbon and the use of color-shifting ink used to reveal a bell in the inkwell. If you look at the blue ribbon on the front of the note, tilt the note and watch the bells on the ribbon change to “100s” as the reflection of light changes. The 3-D ribbon is embedded in the paper and not printed. Looking at the copper-colored inkwell on the front of the note, tilting the note will reveal a bell that was embedded using color-shifting ink. Using these light sensitive features, the Federal Reserve hopes to significantly reduce the number of counterfeit notes, especially overseas where half of the $100 notes are known to circulate.

The Federal Reserve released a video about the new anti-counterfeiting features:

As an aside, the Bank of England recently announced that they will be transitioning to polymer banknotes by 2015.

Sep 30, 2013 | BEP, coins, currency, Federal Reserve, news, policy, US Mint

In the ongoing drama that is United States Federal government, a shutdown is looming over the shear idiocy of idiot-loges on both sides of the aisle attempting the rule and not govern. All 537 politicians elected to federal office are in need of a good spanking.

In the ongoing drama that is United States Federal government, a shutdown is looming over the shear idiocy of idiot-loges on both sides of the aisle attempting the rule and not govern. All 537 politicians elected to federal office are in need of a good spanking.

First, here are some impacts:

- According to the Office of Management and Budget, a government shutdown will cost taxpayers an extra $40-60 million per day.

- The District of Columbia is reporting that a shutdown will cost the city about $2 million per day in lost revenues.

- Maryland and Virginia has not reported their potential economic impact of a shutdown.

- UPDATE (4:40pm): Local news reports say that over 835,000 workers will be effected by a shutdown with at least 80-percent being in the Washington, D.C. metropolitan area. Some estimates are saying that it could cost the region up to $20 million per day.

What does this mean for the money manufacturing bureaus of the country?

- The U.S. Mint is not answering inquiries about pending shutdown. Media is directed to contact OMB for more information.

UPDATE (1:40pm): The U.S. Mint will not allow tours of the Philadelphia and Denver mints during a government shutdown.

- Office of Management and Budget is not answering the telephone. Rather, they requested that an email be sent with detailed questions. Email inquiries have yet to be answered.

- When calling the Bureau of Engraving and Printing, their phone is either busy or when trying to get past the voice response system for the Office of External Relations, the system says “the person you attempted to reach is unavailable.” An email was sent to the BEP’s general inquiry account and OMB asking about the operations at the BEP.

UPDATE (3:30pm): An email note was received from the BEP saying to contact a spokesperson at the Department of the Treasury. Telephone and email messages have not been returned.

UPDATE (4:10pm): Both the Washington and Fort Worth plants will not hold tours if there is a government shutdown at midnight tonight.

- Since the Federal Reserve is an independent organization and not subject to congressional appropriations, they will remain open during a shutdown. The shutdown will not affect the launch of the new $100 Federal Reserve Note planned for October 8.

UPDATE (5:30pm): According to the Treasury Department:

Operations of the following bureaus are funded from sources other than annual Congressional appropriations, and would operate normally if a government shutdown were to occur: the Office of the Comptroller of the Currency (OCC), the United States Mint, and the Bureau of Engraving and Printing (BEP).

This post will be updated as new information is provided.

Representatives of these agencies may contact me via email to provide additional information. Please note that I do respect the confidentiality of sources!

NOTE: I am not a member of any political party. I am a proponent of government employees who do not deserve the way they are being treated by the elected officials.

Jul 7, 2013 | BEP, currency, Federal Reserve, policy

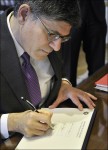

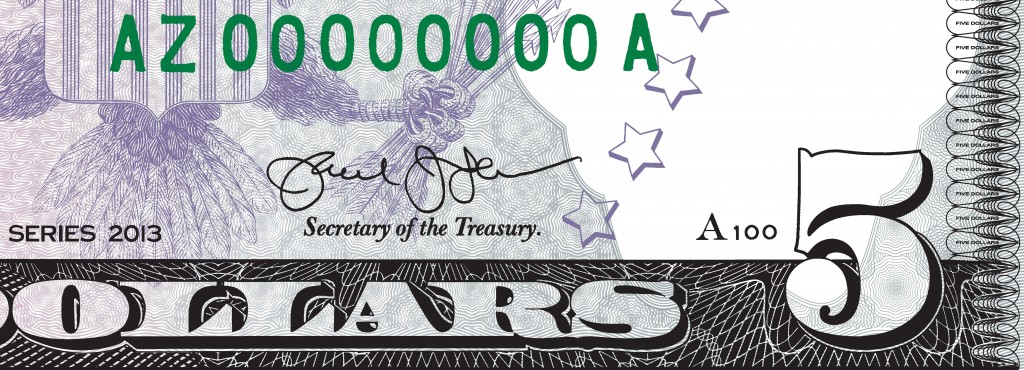

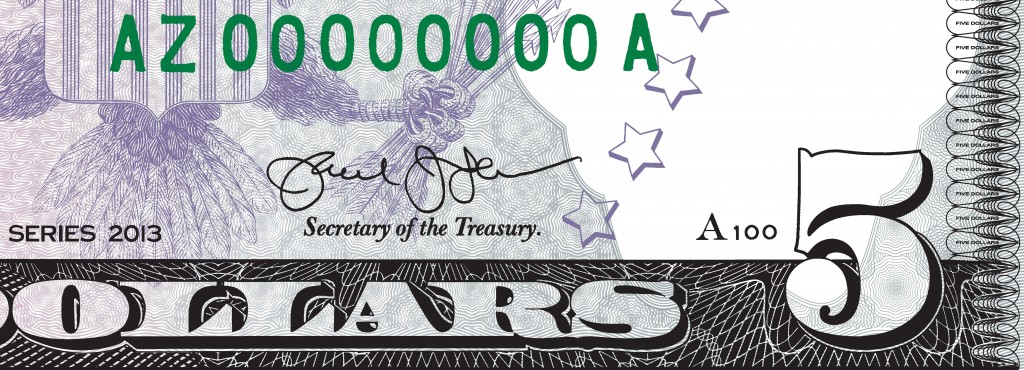

In one of those news items from while I was away, Secretary of the Treasury Jacob J. “Jack” Lew put pen to official paper and provided an autograph that will appear on United States Federal Reserve Note. Treasury reports that Lew’s signature will first appear on Series 2013 five-dollar notes that will be issued this fall. No plans were announced for other denominations.

In one of those news items from while I was away, Secretary of the Treasury Jacob J. “Jack” Lew put pen to official paper and provided an autograph that will appear on United States Federal Reserve Note. Treasury reports that Lew’s signature will first appear on Series 2013 five-dollar notes that will be issued this fall. No plans were announced for other denominations.

Lew, whose autograph has been called “lewpty” and been compared to the decorative icing on a Hostess cupcake, made a promise to the president that he would do better with his penmanship. During his confirmation hearing, Lew told Sen. Max Baucus (D-MT), Chairman of the Senate Finance Committee, that he promised the president he would do better. This did not satisfy those with an ironic sense for the different when a petition appeared on the White House website to “Save the Lewpty-Lew.”

Mock-up of how Treasury Secretary Jack Lew’s autograph will appear on the Series 2013 $5 Federal Reserve Note in the Fall.

Remember as you were growing up spending time with a piece of paper practicing your signature? I wonder if Lew was doing this in his spare time?

While Lew’s autograph lost many of his infamous lewpts at least he did not go to the extreme that of predecessor, Tim Geithner. Geithner’s autograph was very readable and lacked character. At least Lew kept some of his lewpts. It will make for interesting conversations for currency collectors in the future as they examine the autographs on their collectibles.

Images courtesy of the U.S. Department of the Treasury.

Last week, the

Last week, the