May 7, 2013 | coins, currency, Federal Reserve, financial documents

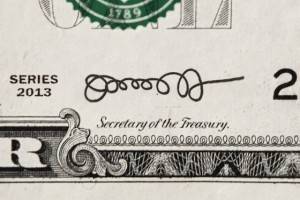

Although new currency with the autograph of Secretary of the Treasury Jacob “Jack” Lew have yet to be issued, Treasury documents signed by Lew have been seen with a new autograph.

Although new currency with the autograph of Secretary of the Treasury Jacob “Jack” Lew have yet to be issued, Treasury documents signed by Lew have been seen with a new autograph.

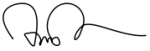

During his confirmation hearings, it was reported that Lew told Sen. Max Baucus (D-Montana) that he made to the president “to make at least one letter legible.” It looks like he has made more than one letter legible based on the image broadcast by MSNBC.

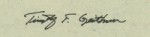

Lew is not the only Treasury Secretary to change his autograph. Timothy Geithner did the same on his appointment. When asked about his autograph, Geithner said, “Well, I think on the dollar bill I had to write something where people could read my name. That’s the rationale.”

-

-

Tim Geithner’s autograph before becoming Treasury Secretary.

-

-

Tim Geithner’s signature as it appears on U.S. currency

Not every autograph on U.S. currency could be considered legible. You can see all of the autographs on small size currency (since 1928) on this page at uspapermoney.info.

I wish Lew kept his lewpts!

A mock-up of what Jack Lew’s original signature would look like on a one-dollar note

Jack Lew autograph examples courtesy of MSNBC.

Tim Geithner autograph examples courtesy of American Public Media

Apr 24, 2013 | BEP, currency, Federal Reserve, news, video

Earlier today, the Federal Reserve issued a press release announcing that the redesigned $100 Federal Reserve Note will be issued on October 8, 2013.

Earlier today, the Federal Reserve issued a press release announcing that the redesigned $100 Federal Reserve Note will be issued on October 8, 2013.

The redesign of the $100 note was announced with a press release that was to be held on April 21, 2010 at the Department of the Treasury Cash Room with all of the usual suspects: then Secretary of the Treasury Timothy Geithner, Chairman of the Board of Governors of the Federal Reserve System Ben Bernanke, Treasurer of the United States Rosie Rios, and the since retired Director of the United States Secret Service Mark Sullivan.

The date of the announcement, the Bureau of Engraving and Printing and Federal Reserve announced that Chairman of the Federal Reserve Board Ben S. Bernanke said, “When the new design $100 note is issued on February 10, 2011, the approximately 6.5 billion older design $100s already in circulation will remain legal tender.”

Throughout the summer of 2010, the BEP and Federal Reserve released a lot of training and education materials in anticipation of the release of the new notes.

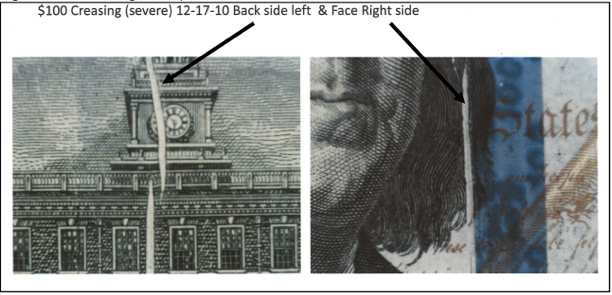

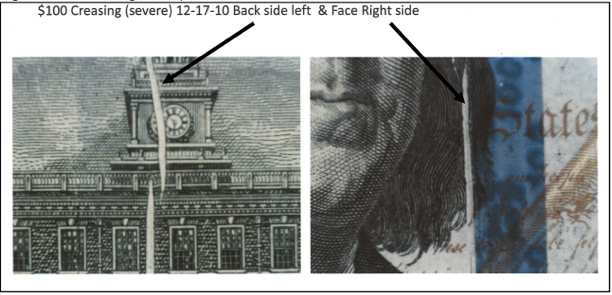

Everything seemed to be going well until October 1, 2010 when the Federal Reserve “announced a delay in the issue date of the redesigned $100 note.” The Federal Reserve and BEP said that there was a problem with creasing of the paper during the printing process. That was the last we heard from the Federal Reserve until today’s announcement.

Magnified images of the creasing showing up on the new $100 notes.

In the mean time, the Treasury Office of the Inspector General issued a report (OIG-12-038 [PDF]) that said the BEP did not handle this process properly. The report said:

We consider the delayed introduction of the NexGen $100 note to be a production failure that potentially could have been avoided and has already resulted in increased costs. We found that BEP did not (1) perform necessary and required testing to resolve technical problems before starting full production of the NexGen $100 note, (2) implement comprehensive project management for the NexGen $100 note program, and (3) adequately complete a comprehensive cost-benefit analysis for the disposition of the approximately 1.4 billion finished NexGen $100 notes already printed but not accepted by FRB. [Federal Reserve Board]

After the report noted that the BEP basic responded by saying that they were sorry and are looking into it, the OIG caved and said that even though the BEP was bad, the corrective actions “are responsive to our recommendations.”

Then nothing. No follow up by the OIG or the Government Accountability Office. In fact, we have not heard from the GAO since their 2005 report suggesting whether a second supplier of currency paper is needed (see GAO-05-368).

Of course it is easy for the BEP to say that Crane & Co., the Dalton, Massachusetts company that has been the exclusive currency paper supplier since 1879, because it would be easy to justify. Some of the arguments against finding a second supplier includes the cost of entering the market and the established relationship with Crane who the BEP allows to “own” the innovations paid with taxpayer money. There was also the case of having two of the most powerful senators, Ted Kennedy and John Kerry, there to protect Crane. Neither are the senators from Massachusetts today.

While the BEP has been struggling with rag-bond paper, countries have been moving to using polymer “paper.”. The polymer “paper” was developed by the Reserve Bank of Australia to enhance the durability of the notes and to incorporate security features not possible with paper or rag-based paper. RBA has been distributing polymer notes since 1992. While the polymer substrate costs little more and the production is only marginally more expensive, the benefit will come from the reduction in counterfeiting and the durability of the note. Polymer will last three-to-six times longer than rag-based paper.

The Bank of Canada has reissued its C$100, C$50, and C$20 notes using the polymer paper and will issue the new C$5 and C$10 notes later this year.

Switching to polymer notes, especially for higher denominations, would be a better decision. It will reduce counterfeiting and reduce the costs over the lifetime of the note. And there is no law that would prevent the Federal Reserve from using the polymer paper.

Considering the Bureau of Engraving and Printing’s previous performance with the $100 notes, this should not be consider the time to celebrate. Especially since a pre-solicitation notice asking for information about purchasing a Single Note Inspection System is still open at FedBizOpps.gov and the BEP has not issued a request for proposal (RFP) to purchase such a system. Let’s wait for the BEP to deliver the notes to the Federal Reserve for distribution before considering this a success.

While waiting, enjoy this video announcement narrated by Federal Reserve Deputy Associate Director Michael Lambert about the new release date.

Images courtesy of the Bureau of Engraving and Printing.

Video courtesy of the Federal Reserve.

Apr 2, 2013 | BEP, coins, currency, dollar, Federal Reserve, fun, US Mint

Based on some responses in my Twitter feed and via email, a number of people forgot what day it was and did not read yesterday’s post carefully.

To understand the post’s true condition, you have to consider the following:

- The Chairman of the Federal Reserve is Ben S. Bernanke. His first name is really Ben, not Benjamin.

- The law requires the Federal Reserve to distribute the one-dollar note. Only congress can vote to stop producing the note.

- The Acting Director of the U.S. Mint is Richard A. Peterson, not Pederson.

- Seignorage is deposited in the Public Enterprise Fund. No, the leaving out of the “d” in the original post was not a typo because I was having fun!

- The Director of the Bureau of Engraving and Printing is Larry Felix. I do not know a Larry Felinks. Maybe he is a long lost cousin of the director?

- The company that supplies currency paper to the BEP is “Crane and Company.” The Sandhill Crane Company does not exist, but there is a bird called the sandhill crane. There is also a blue crane, but I am reasonably sure that there is no such person as Violet “Blue” Crane; or at least there is not one associated with Crane and Company. Maybe there is a Blue Crane working for Sandhill Crane? There is a joke in there that can use “Whooping Crane” which I will leave as an exercise to the reader!

- Finally, when was the last time you heard the Fed Chairman concerned with coin collectors? The last line was added to emphasize the date.

In other words:

Besides, who is giving a blogger an exclusive story that does not appear elsewhere? Like the Orson Well’s broadcast of The War of the Worlds, all you had to do is change the channel (or check another source).

That was fun!

Now back to our regular numismatic content.

Dec 27, 2012 | base metals, BEP, bicentennial, bullion, coins, commemorative, copper, currency, dollar, Euro, Federal Reserve, First Spouse, gold, halves, legislative, nclt, news, nickels, policy, silver, US Mint

We end numismatic 2012 almost the same way as we began, discussing what to do about the one-dollar coins. The over production lead to a quite a number of bills introduced in congress to try to fix the perceived problem but none ever made it to a hearing, let alone out of a hearing. Rather, the U.S. Mint hired Current Technologies Corp. (CTC) to perform an alternative metals study required by congress.

When the U.S. Mint finally published the report and a summary they made a recommendation to study the problems further because they could not find suitable alternatives to the current alloys used. While reading the summary gives the impression that the request is reasonable, the full 400-page report describes the extensive testing and analysis that the U.S. Mint and CTC performed leaving the reader curious as to why they were unable to come to some sort of conclusion—except that there is no “perfect” solution. This is a story that will continue into 2013 and be on the agenda for the 113th congress when it is seated on January 3, 2013.

The other part of the discussion is whether or not to end the production of the one-dollar Federal Reserve Note. It was the last hearing before the House Financial Services subcommittee on Domestic Monetary Policy and Technology for Rep. Ron Paul (R-TX) and the 112th congress that will certainly carry over into 2013.

This does not mean the Bureau of Engraving and Printing is without its controversy. In order to comply with the court order as part of American Council for the Blind v. Paulson (No. 07-5063; D.C. Cir. May 20, 2008 [PDF]) and the subsequent injunction (No. 02-0864 (JR); D.C. Cir. October 3, 2008 [PDF]), the BEP has been working to provide “Meaningful Access” to United States currency.

Secretary of the Treasury Timothy F. Geithner approved the methods that will be used to assist the blind and visually impaired to U.S. currency on May 31, 2011. In addition to examining tactile features, high contrast printing, and currency readers, the BEP issued a Request for Information for additional information to implement their plan. The BEP will be participating at stakeholder organization meetings to socialize and refine their plans. There will probably be few announcements before the conventions of the National Federation of the Blind and American Council of the Blind this summer.

Another building controversy from the BEP is whether the redesigned $100 notes will find its way into circulation. Introduced in April 2010, full production has been delayed because of folding during the printing process. The situation has to be so severe that the BEP has not announced a new release date and delayed releasing the 2011 CFO Report [PDF] to the end of Fiscal Year 2012 while finding a way to bury the scope and costs of the delays. Will the redesigned $100 Federal Reserve Note be issued in 2013? Stay tuned!

Staying with currency issues, there should be a new series of notes when a new Secretary of the Treasury is appointed. It is known that the current Secretary Timothy F. Geithner wants to pursue other options. If the BEP follows its past practice, notes with the new Secretary of the Treasury’s signature would be Series 2009A notes. There have been no reports as to whether Treasurer Rosie Rios will continue in her position.

As for other products, the BEP will continue to issue specially packaged notes using serial numbers that are either lucky numbers (i.e., “777”) or ones that begin with “2013” as part of their premium products. Of course they will continue to issue their sets of uncut currency.

Another carry over from 2012 will be whether the U.S. Mint will issue palladium coins that were authorized by the American Eagle Palladium Bullion Coin Act of 2010 (Public Law No: 111-303 [Text] [PDF]). The law requires that the U.S. Mint study of the viability of issuing palladium bullion coins under the Act. That report was due to congress on December 14, 2012 but has not been made public at this time.

Bibiana Boerio was nominated to be the Director of the U.S. Mint.

Other than the higher prices for silver products, the U.S. Mint should not generate controversies for its 2013 coin offerings. There will be no changes for the cent, nickel, dime, and half dollar with the half dollar only being struck for collectors since it has not been needed for circulation since 2002. These coins will be seen in uncirculated and proof sets with silver versions for the silver sets.

For the sets with the changing designs, the reverse of the 2013 America the Beautiful Quarters Program will honor:

There has been no confirmation from the U.S. Mint whether they will strike San Francisco “S” Mint quarters for the collector community as they did in 2012.

The 2013 Presidential $1 Coins ends the 19th century and begins the 20th century with some of the more interesting Presidents of the United States in history:

If we honor the Presidents we have to honor their spouses. In 2013, the First Spouse Gold Coins will honor:

- Ida McKinley

- Edith Roosevelt

- Helen Taft

- Ellen Wilson (died 1914)

- Edith Wilson (married Woodrow Wilson 1915)

The U.S. Mint has not released designs for these coins at the time of this writing.

2013 Native American Dollar Reverse Design

Congress has authorized two commemorative coin programs for 2013:

American Eagle coin programs will continue with the bullion, collector uncirculated, and proof coins for both the silver and gold. The American Eagle Platinum bullion coin will continue to use its regular reverse while the American Eagle Platinum Proof will continue with the Preamble Series. The Preamble Series is a six year program to commemorate the core concepts of the American democracy as outline in the preamble of the U.S. constitution. For 2013, the reverse will be emblematic of the principle “To Promote the General Welfare.” The U.S. Mint has not issued a design at this time.

Currently, there are no announced special products or sets using American Eagle coins and no announced plan for special strikings such as reverse proofs or “S” mint marks.

Finally, we cannot forget the American Buffalo 24-Karat Gold Coins that will be available as an uncirculated coin for the bullion/investor market and a proof coin for collectors.

And I bet you thought that 2013 would be a mundane numismatic year!

Dec 9, 2012 | BEP, coins, dollar, Federal Reserve, legislative, news, US Mint

Obverse of the 2009-present Native American Dollar

Let’s look at the drivel about eliminating the dollar coins:

Replacing the dollar bill with a coin will not save money.

A summary of these arguments could be read on the Wonk Blog at The Washington Post. As I read the argument against, there is a lot of phrases with qualifiers like “if” and “may” that does not provide a solid feeling of deep analysis.

The bottom line is that for every dollar coin the U.S. Mint strikes, the government collects 72½ cents per coin. On the other hand, the Bureau of Engraving and Printing prints each note for around 8 cents per note but does not charge the Federal Reserve $1 for each note. By cost, the U.S. government makes more on seigniorage for the coin than the currency.

Converting to coins from the paper currency will cost the Fed more to purchase the dollar coin over printing currency. However, the Fed is not a government agency and does not use taxpayer money for its operations. It uses money earned off of its banking operations and turns over a percentage of its profits to the United States Treasury. While this will lower the amount of profit, it will be made up by the additional seigniorage.

People have not forgotten the Susan B. Anthony dollar coin… failed to wean Americans from the dollar bill because it looked too much like a quarter.

When I read this in an editorial from my hometown The New York Times, I scratched my head and wondered what happened to The Old Grey Lady. What used to be a forward thinking newspaper sounds like the elderly neighbor chewing his gums yelling at you to “get off my lawn.” What The Times forgot is that following the problems the design of the Susie B’s caused, congress authorized changes to prevent those issues from reoccurring by changing the coin’s color and using a smooth edge rather than a reeded edge.

I challenge The Times editorial board to handle a quarter and a post-2000 dollar while reconsidering their misguided editorial.

Why worry about the dollar because more people are using credit cards

A story in Bloomberg points out the savings may be limited because of the reduced number of dollar notes being produced. The writer credits the increased use of credit cards as a reason. However, reports show that consumer credit card debt has gone down every month since October 2008 until the first rise in October 2012.

The record shows that Americans have used their credit cards less and the use of cash has increased until these last few months while the Bureau of Economic Analysis reports wages have increased modestly during the slow recovery. In other words, the Bloomberg report does not hold up against facts.

It will not save the government money because it is a transfer costs.

Once again, some “analyst” at National Public Radio over thinks the issue with wrong data. NPR’s Jacob Goldstein writes that it is not a cost savings to the government because of shift from the production by the Bureau of Engraving and Printing to the U.S. Mint. However, his conclusion is based on the assumption that the seigniorage is the same for printing the note as it is for striking the coin. It is not, as we discussed earlier.

A better way to save money is by eliminating 1-cent coins entirely.

An interesting thing happens when the government tries to tackle an issue is that you get alleged pundits like Mike Rosen making irrelevant arguments based on an tangential premiss. The reason why Rosen’s writing is inconsequential is that the discussion is replacing one form of a dollar for another not eliminating a denomination. If the time comes to discuss the elimination of a denomination, then we can learn from the 1856 discussion that lead to the elimination of the half-cent. Otherwise, trying to justify eliminating a denomination using the discussion to replace the representation of another is an exercise in twisted logic.

That fancy money clip you inherited from your grandfather would be useless.

From Boston, Jon Keller writes that it is not culturally possible to change from notes to coins. Keller is indicative of alleged analysts who are thinking with their head up the past and not providing anything but his emotional reasoning for not making the change.

This goes along with the arguments that Americans do not want to change that will put more change in their pocket. These people say that Americans do not want the coin and will resist this move. But if you look at reality, Americans are all about change. In the last 50 years we gave up our silver coinage, went from muscle cars to more fuel efficient cars, brought in and (thankfully) dumped disco, changed the Lincoln cent from copper to copper-plated zinc, handled the end of the Cold War while ushering in the era of terrorism, and adapted to life post 9/11/01. There have been floods, droughts, hurricanes, tornadoes, mega-storms, and earthquakes that has show the resiliency of the American people. To ask Americans to adapt to using coins instead of notes is a pittance compared to everything else.

Take away our dollar bills, and our assault rifles will be next.

I do not believe in conspiracy theories but there some who are not afraid to spout this insolence. It is an argument based on false equivalency based on being unaware of the legal mechanisms of how the government works.

If anyone has a real reason based on documented fact to support saving the paper dollar for the coin, I welcome their argument below.

Oct 12, 2012 | bullion, Federal Reserve, gold, history, review

Prior to the very entertaining Vice Presidential Debate, the National Geographic Channel aired a show titled “America’s Money Vault” that was part of their “Behind the Scenes” week. The show was hosted by Jake Ward, editor-in-chief of Popular Science magazine.

The show is centered around the Federal Reserve and primarily the operations of the Federal Reserve Bank of New York. After opening the show at Times Square, we are transported downtown to the New York Fed where they are accepting a deposit of over 1 ton of gold. Following an explanation that the New York Fed is the most trusted handler of gold in the world and has 25-percent of the world’s gold on deposit, we watch the transfer process.

As part of the transfer process, the cameras are brought into the vault and the viewers are show “walls” of gold bars. Unlike the images in the 1995 movie Die Hard: With a Vengeance, it appears that the vault that is more solid than the jail-like bars shown in the movie.

Ward visited with Federal Reserve Chairman Ben Bernanke to talk about the Fed’s roll in the markets. While in Washington Ward visits the Bureau of Engraving and Printing to show some of the process in currency printing. There was also a discussion with the United States Secret Service about anti-counterfeiting.

One of the more interesting visuals was when Ward visited the East Rutherford Operations Center (EROC), one of the New York Fed’s currency operations. Viewers were shown rows of currency and coins being stored on shelves throughout the building. And in a scene to warm my technical heart, the robotic inventory system was profiled.

According to NatGeo TV, the next time America’s Money Vault will air is on Thursday, October 18, 2012 at 4:00 PM Eastern Time. If you will be away at that time, it is worth setting the DVR (or VCR for those still going old school) to record this show.

Oct 4, 2012 | Australia, BEP, currency, Federal Reserve, policy

Last year I asked why the United States would not consider using polymer notes after the Bank of Canada made their announcement that they will transition to using the polymer substrate. Not only are polymer notes very difficult to counterfeit, they last longer reducing printing costs and overhead to both the Bureau of Engraving and Printing and the Federal Reserve.

The

Spink Auction was held on October 2, 2012 in their London offices. None of the nine Canadian test notes printed on DuraNote were sold.

After it was announced that Spink of London will auction sheets of DuraNote trial printings from the Bank of Canada, BEP told CoinWorld that they printed as many as 40,000 sheets of Federal Reserve Notes using the DuraNote substrate.

DuraNote was a product of Mobil Chemical and AGRA Vadeko of Canada. Trials of DuraNote were not successful and the project was abandoned. Patents for DuraNote were sold following the Exxon-Mobil merger.

Around the same time, the Reserve Bank of Australia (RBA) developed a polymer substrate with a different formula that went into production in 1992. Since then, Australia has been successfully printing polymer notes.

In the mean time, there continues to be issues with folding of the paper specially designed for the new $100 Federal Reserve Note. Since the October 1, 2010 announcement by the Fed of the folding issue, the Fed and BEP has less than forthcoming on the status of the new note including the BEP withholding their annual report for fiscal year 2011 so they do not have to disclose how many of these notes they have in inventory.

The paper being used by the BEP is manufactured by Crane & Company who has had the exclusive contract with the BEP since 1879.

Where DuraNote failed RBA succeeded in creating a workable technology that is being adopted world wide. With the new $100 note having printing problems, why has the BEP not looked into the RBA polymer substrate for U.S. currency? Why does the Federal Reserve, BEP, and Secret Service cling to 19th and 20th century printing technologies in the 21st century? Or is this a matter of the influence being purchased [PDF] by Crane & Company in order to maintain its monopoly.

Maybe it is time for the Fed and the BEP to re-examine their commitment to paper and stop wasting time and money with failed technologies.

Sep 28, 2012 | BEP, coins, currency, economy, Federal Reserve, legislative, policy, US Mint

Those of us here in the Washington, DC area who work with or for the Federal Government knows that this week is the home stretch to the end of the fiscal year. Many of us who work for the government are not directly involved with the political infighting that makes the national news. Federal employees are prohibited to be involved with politics by law and contractors usually have employer policies that limit their political activities.

One thing we worry about is the funding issues that have not been resolved. Although the news reported that congress has passed a continuing resolution to fund the government for six months, what the reports did not say is that the continuing funding are only at the levels negotiated last year which rolled back funding to Fiscal Year 2007 (FY07) levels. FY07 dollars do not have the same buying power as today’s dollars and the amount of work required by the laws passed by congress have increased.

You might have heard about the budget “sequestration.” Sequestration is the mechanism that was instituted as part of the Budget Control Act of 2011 to force congress to negotiate a budget or automatic, across the board cuts totaling $1.2 trillion will go into effect on January 1, 2013. Sequestration has made a lot of people in the DC area nervous because it will cause contractors to cut jobs. In fact, with the uncertainty of sequestration, large contractors, like Lockheed-Martin, are providing 90 day layoff notices they are required to give employees when defense and other security-related contracts are ended early.

For the money manufacturing operations under the Department of the Treasury, there should not be any problems from sequestration because the U.S. Mint and the Bureau of Engraving and Printing are profitable agencies that uses their profits for operations. If there are shortfalls in providing funding for operations, the Secretary of the Treasury is allowed to withdraw funds from the Public Enterprise Funds (the accounts where the profits are deposited).

Problems remain for both agencies. The most significant of the issues are the problems with printing the new $100 Federal Reserve Notes. BEP continues to report that the new notes have folding issues that have delayed their release for two years. Inquiries by numismatic industry news outlets have reported that the problems are still under investigation and that no new release date has been set.

The U.S. Mint recently reported striking problems with the First Spouse Gold Coins. Apparently, the design caused metal flow problems in trial strikes that caused delays in releasing the coins. While the U.S. Mint has said they rectified the problems, the coins have not been issued.

In addition to the coining problems, the U.S. Mint also suspended its attempt to update its technology infrastructure. After receiving the responses from a formal Request For Information (RFI), the U.S. Mint pulled back on its attempt to update its infrastructure and online ordering services to re-examine the requirements and the business processes that would be part of that contract. The U.S. Mint press office said that they had no further information other than what has been published. They did confirm that the RFI responses will not be released because they contain proprietary information that is protected from public release.

It is difficult to know whether the federal budget situation will effect the U.S. Mint and BEP or whether the attempt to reduce costs in order to ensure they do not access more money from their respective Public Enterprise Funds. This is because money in excess of budgeted operations plus a reserve must be withdrawn from these Public Enterprise Funds and deposited in to the general treasury accounts at the discretion of the Secretary of the Treasury (31 U.S.C. § 5136 for the U.S. Mint and 31 U.S.C. § 5142 for the BEP). It is reasonable to question the management of these funds in the light of the federal budget situation.

Right now, the way the BEP and the Federal Reserve has handled the situation with the new $100 note suggests there is more to that issue than meets the eye. Nether the BEP or the Fed are answering question and the BEP did not issue an annual report for 2011 which would have to report on the production of the $100 notes. Inquiries to the BEP were returned with a reply that the report “is not ready.”

The annual reports for both these bureaus will make for interesting reading, if the BEP produces one for 2012.

May 17, 2012 | commentary, dollar, Federal Reserve, policy

Following up on the lobbying efforts by Crane & Company’s to maintain its business producing currency paper for the Bureau of Engraving and Printing to continue to print the $1 Federal Reserve Note, according to the public filing [PDF] by the Gephardt Group, Crane & Company spent $60,000 for these services.

According to the filing, the specific issue being lobbied for is “preservation of the dollar bill; S.1624, Currency Efficiency Act of 2011.” The Currency Efficiency Act of 2011 was introduced in the Senate by Massachusetts Senator Scott Brown (R) and co-sponsored by Senator John Kerry (D) on behalf of the Dalton, Massachusetts-based Crane & Company. No companion bill has been introduced in the House of Representatives.

The unique provision of S.1624 is that it declares the $1 coins being held in the Federal Reserve be declared as surplus. According to the bill, “Surpluses of $1 coins which can be most efficiently eliminated through destruction shall be deemed to consist of ‘obsolete and worn coins withdrawn from circulation’ under section 5120(a) of title 31, United States Code.”

It is uncertain what the impact of eliminating the $1 Federal Reserve Note will have on Crane and Company. I reached out to Crane and Company for comment and their spokesperson declined to comment.

Crane & Company, BEP, and the Federal Reserve continues to try to resolve a creasing issue discovered during the production of the new $100 Federal Reserve Note. The release of this note has been delayed twice before being delayed indefinitely. When contacted for comment, a BEP spokesperson referred the question to the Federal Reserve. A spokesperson for the Federal Reserve provided a standard response that included no additional information.

Jul 19, 2011 | commentary, dollar, Federal Reserve, US Mint

According to the website at National Public Radio, “The mission of NPR is to work in partnership with member stations to create a more informed public – one challenged and invigorated by a deeper understanding and appreciation of events, ideas and cultures.” Unfortunately, it looks like NPR drowned in the shallow end when it published its story “$1 Billion That Nobody Wants.”

While the Federal Reserve is holding about $1 billion in dollar coins in its coin vaults, its assertion that, “Some 2.4 billion dollar coins have been minted since the start of the program in 2007, costing taxpayers about $720 million,” is false. To quote myself:

NO TAX DOLLARS ARE USED IN THE MANUFACTURE OF COINS AND FEDERAL RESERVE NOTES IN THE UNITED STATES!

The U.S. Mint can strike trillions of coins that will sit in the Federal Reserve’s vaults, but none of the money used to strike the coins comes from taxpayer dollars. For our friends at NPR, money used by the U.S. Mint is withdrawn from the United States Mint Public Enterprise Fund (PEF). The PEF is the account where the seigniorage, the profit from selling the coins, is deposited. As sales are deposited in the PEF, the law requires that the U.S. Mint use the money in the PEF for budgetary reasons like to manufacture coins, maintain facilities, pay employees, etc. No tax money is deposited in the Public Enterprise Fund.

While the NPR story says, “The government has made about $680 million in profit by selling some 1.4 billion dollar coins to the public since the program began,” they failed to mention that this profit comes from the money paid by the Federal Reserve to buy the coins. Excess profit over and above the U.S. Mint’s operations funds are returned to the Treasury general fund.

Wait! Did you say that the program actually made a profit?

Yes, I did and so did the NPR story. And it did not cost the taxpayer anything to make that profit. Not one red cent!

But what about the $1 billion in the Federal Reserve’s vaults?

Those coins were not purchased from the U.S. Mint using taxpayer money. Each and every dollar coin in those vaults were paid for by the Federal Reserve at face value. Since it costs the U.S. Mint about 30-cents to strike one dollar coin, the U.S. Mint made a profit (seigniorage) of 70-cents per coin. The money was paid by the Federal Reserve and NOT taxpayer money.

Think about it: the U.S. Mint is generating 70-percent profit for striking $1 coins with most of that money will eventually make its way to the Treasury general fund.

If it is not taxpayer money, then whose money is it?

It is the money earned by the Federal Reserve through its banking operations as the United States central banking infrastructure. Deposits made to the Federal Reserve are made by member banks. Fees are paid by those banks for cash services, check clearing, and transfer services. The Federal Reserve also earns its money from making loans made to member banks. Some Federal Reserve branches make money on other services. For example, the New York Fed stores gold for foreign countries and sells currency overseas.

But it’s our money, right?

Yes, it is the money that is the heart of the economy of the United States. It is not classified as taxpayer money because no tax dollars were collected in order to fill its coffers.

You don’t make it sound like a problem. Why did the story go viral?

Actually, the $1 billion in coins sitting in the Federal Reserve’s vaults is a problem. It represents $1 billion of working capital that is not circulating in the economy. It is money that cannot be invested by loaning it to other banks or be used in other banking operations. In a tight economy, it is not a good idea to have $1 billion sitting idle. Unfortunately, the NPR story and subsequent follow-ups by various news outlets made it sound like it was $1 billion of taxpayer money being wasted by the government. On the contrary, the federal government earned $680 million!

If those dollar coins sitting in the Fed’s vaults is a problem, what can be done about it?

Stop printing $1 paper notes! The United States is the only “first world” country still producing its unit currency in paper. Two currencies whose value has stood up against the dollar during the current economic crisis, the British Pound and Euro, use coins for their unit currency and not paper. In fact, European Union use coins for the 1 Euro and 5 Euro denominations.

I know that “public sentiment” says to keep the $1 note. But when is governing about bowing to public sentiment. I thought government was supposed to do what is in the nation’s best interest. If it will save money in the long term, then let’s drop the paper for coins. American’s are resilient, they will get used to it.

Although new currency with the autograph of Secretary of the Treasury Jacob “Jack” Lew have yet to be issued, Treasury documents signed by Lew have been seen with a new autograph.

Although new currency with the autograph of Secretary of the Treasury Jacob “Jack” Lew have yet to be issued, Treasury documents signed by Lew have been seen with a new autograph.