Jun 3, 2018 | commentary, dollar, economy, investment, markets, policy

Zimbabwe’s 2009 $100 trillion hyperinflation note

In the news this week was a story about the Reserve Bank of Zimbabwe touting the adoption of Chinese currency for general use in the country as circulating currency.

Zimbabwe’s economy has seen wild swings between massive inflation and significant economic stagnation that has caused currency fluctuations so bad that the country has given up managing its own currency. The economic problems have created a hyperinflation currency with notes printed with denominations as high as 100 Trillion Zimbabwean Dollars. So many of these notes were printed that any collector can buy them for $5-10 each.

Because of trade restrictions, Zimbabweans turned to United States currency smuggled from outside of the country. The supply of United States currency was so limited that some had begun the practice of cleaning the paper because people were carrying their currency in their underwear and new notes were difficult to come by.

Following negotiations with the United States, the RBZ was able to obtain new currency notes and offered an exchange to its residents. But that is where the negotiations ended. Upon the change of administrations, the current Department of the Treasury stopped negotiating with Zimbabwe and other African nations to introduce additional trade in United States dollars.

As the United States began to abandon these countries, the Chinese stepped in. The Chinese government has been negotiating with these countries and have made several inroads, especially in Africa. Zimbabwe is just the latest to announce that they could adopt the Yuan as their currency.

Although Zimbabwe is not an influential economy, it expands the Chinese economic base in Africa. By chipping away at the United States economic influence, it reduces the impact of the dollar on the continent that could have an effect on numismatics.

Africa continues to have the largest deposits of precious metals. Southern African regions have the world’s most active gold, silver, and platinum mines that if the United States loses influence in the region could have a negative effect on worldwide precious metals prices.

It is not a matter of the golden rule, “He who has the gold rules,” it is a matter of who controls the flow of gold from those mines. If the Chinese control the economic engine that runs those mines, they can use that influence to make or break the markets as they see fit. The ripple effect could not only bring higher precious metals prices but worldwide economic instability.

History has taught us that market manipulating does not work except if the manipulators have a backup plan. In this case, the Chinese are using their treasury as the backup plan. They are amassing economic power that could manipulate markets to the point that would cause prices to rise.

Currently, precious metals prices are set by arrangement with the London Bullion Market Association (LBMA) based on the daily auction prices in London. This is known as the London Fix Price. The market uses United States dollars for its pricing. However, if the dollar loses its economic power because the Chinese are controlling the markets where the metals are mined, it will affect the cost of everything.

In the short term, economic factors will affect the price of bullion being produced by the U.S. Mint since those prices are based on LBMA price averages. Collectors and investors will be hit first. After that, it would be a short time before economic instability hits everyone else.

And now the news…

May 27, 2018

If you visit Stones River National Battlefield and Cemetery, you'll likely see coins on the top of many tombstones. According to park workers, the small mementos are a way some choose to pay their respects to the fallen soldier, and each kind of coin has a different meaning.  → Read more at newschannel5.com

→ Read more at newschannel5.com

May 27, 2018

In this edition of East Idaho Newsmakers, Nate Eaton speaks with Randy’L Teton. Teton is a Fort Hall native and is featured on the US Sacagawea dollar gold coin. She is the only living person to currently appear on a United States coin. During their conversation, Teton shares the fascinating story of how she ended …  → Read more at eastidahonews.com

→ Read more at eastidahonews.com

May 28, 2018

TOKYO (Jiji Press) — The Finance Ministry said Friday that it will issue a silver coin to commemorate the 150th anniversary of the 1868 start of the country’s Meiji period, which ended in 1912.  → Read more at the-japan-news.com

→ Read more at the-japan-news.com

May 29, 2018

Ahmed Mohamed Fahmy Yousef has spent the last academic year at the University of Colorado conducting research on learning technologies and instructional design in computer science education.  → Read more at dailycamera.com

→ Read more at dailycamera.com

May 29, 2018

Tawanda Musarurwa, Harare Bureau The adoption of Renmimbi/Yuan as a reserve currency, will help the country repay loans and grants from China, the Reserve Bank of Zimbabwe has said.  → Read more at chronicle.co.zw

→ Read more at chronicle.co.zw

June 1, 2018

Archaeologists in Egypt have unearthed a 2,200-year-old gold coin depicting the ancient King Ptolemy III, an ancestor of the famed Cleopatra.  → Read more at foxnews.com

→ Read more at foxnews.com

June 1, 2018

An ancient Egyptian coin discovered in far north Queensland has researchers questioning how it got there.  → Read more at abc.net.au

→ Read more at abc.net.au

June 3, 2018

The Royal Canadian Mint unveiled their first-ever panda-themed coin at the Calgary Zoo.  → Read more at thestar.com

→ Read more at thestar.com

Oct 1, 2017 | markets, news, palladium

Adolph Alexander Weinman

(1870-1952)

Pre-sale prices are averaging $85-200 over the spot price, which is currently $928.00 on the world market. Since the U.S. Mint only sells coins to authorized dealers, those dealers will act as wholesalers down the chain. Each time a coin changes hands, there will be a markup. A coin can pass through a few hands before being offered for sale to the public.

And these prices are before the dealers rush to slab these coins. I am sure those grading MS-70 will go for significant premiums!

If you are interested in buying the coin, I would recommend shopping around. However, if you have a favorite dealer and there is not much of a difference between an online price and the dealer, you may want to consider supporting your local dealer!

And now the news…

September 25, 2017

Shoppers have been reminded by the Royal Mint that the deadline for using the round pounds is October 15, before they are replaced forever by a 12-sided coin. → Read more at dailymail.co.uk

September 26, 2017

After more than a thousand years of service, the Paris mint has thrown its doors open to the public with a vast exhibition of treasures, collectors' coins and a view of the craftsmen in their workshops. → Read more at reuters.com

September 26, 2017

Congressman Richard Neal has been leading the effort to mint the coin celebrating the sport’s anniversary. → Read more at wwlp.com

September 26, 2017

When I become the Supreme Overlord of the Earth and all its satellites, or Secretary of the Treasury (I plan on becoming one of those … → Read more at nevadasagebrush.com

September 27, 2017

A new 50p coin celebrating Sir Isaac Newton can now be snapped up by people visiting his birthplace and family home. Just 375 of the coins are being released into tills at Woolsthorpe Manor in Lincolnshire. → Read more at standard.co.uk

September 28, 2017

A Sheffield man who collects rare banknotes and coins says South Yorkshire people can make plenty of money as Britain makes the switch to polymer currency. → Read more at thestar.co.uk

Sep 24, 2017 | bullion, commentary, markets, news

On Monday, the U.S. Mint will begin selling palladium bullion coins to authorized purchasers. The opening price will probably be $976.44 per coin, which is 6.25-percent over the spot price of $919 per troy ounce.

On Monday, the U.S. Mint will begin selling palladium bullion coins to authorized purchasers. The opening price will probably be $976.44 per coin, which is 6.25-percent over the spot price of $919 per troy ounce.

Metal prices have not followed a path that market watchers are familiar with. Platinum is usually more expensive per troy ounce than gold but has been less while palladium usually tracks at half of the price of gold.

With all of the turmoil in the world, the price of gold is relatively flat with spikes for various activities in the news. But an investor who bought at the beginning of the year “complains” that the price is up only 12-percent for the year despite fundamentals that suggest a larger gain. Recent events have caused the price to jump, but one investor told me that gold is a safe bet but it is not a good bet if you are looking to make money.

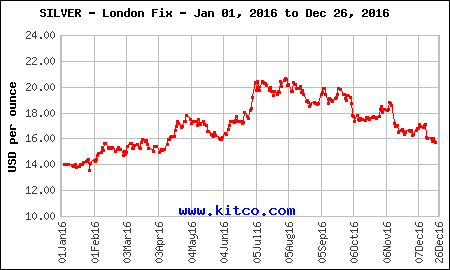

A dealer that sells silver has called the market schizophrenic. There are swings in the prices that defy market logic. With stricter regulation, higher demand, and flat production growth, the price of silver should be climbing. But it is relatively flat for the year with a 6.4-percent grown.

Some are even suggesting that the silver market is being manipulated.

I do not know if the market is being manipulated, but the experts are telling me that something is not right.

September 15, 2017

Even coin production mints make mistakes. If you have a coin that’s a product of one of these mistakes, it’s probably worth way more than face value. → Read more at rd.com

September 17, 2017

Summary There is considerable evidence that silver is subject to considerable manipulation. Revelations of manipulation from regulatory investigations and lawsuits in recent years have led to the introduction of stricter regulations and oversight. → Read more at seekingalpha.com

September 18, 2017

The second batch of commemorative coins minted for the funeral of His Majesty the late King Bhumibol Adulyadej have proved very popular after being available for reservations on Monday. Long queues were seen since early in the morning at designated venues nationwide. → Read more at nationmultimedia.com

September 23, 2017

HYDERABAD: Hyderabad of yore had carved a niche of its own in the spheres of culture, commerce, language and festivals. → Read more at timesofindia.indiatimes.com

Jan 9, 2017 | bullion, coins, commentary, Federal Reserve, investment, markets, news

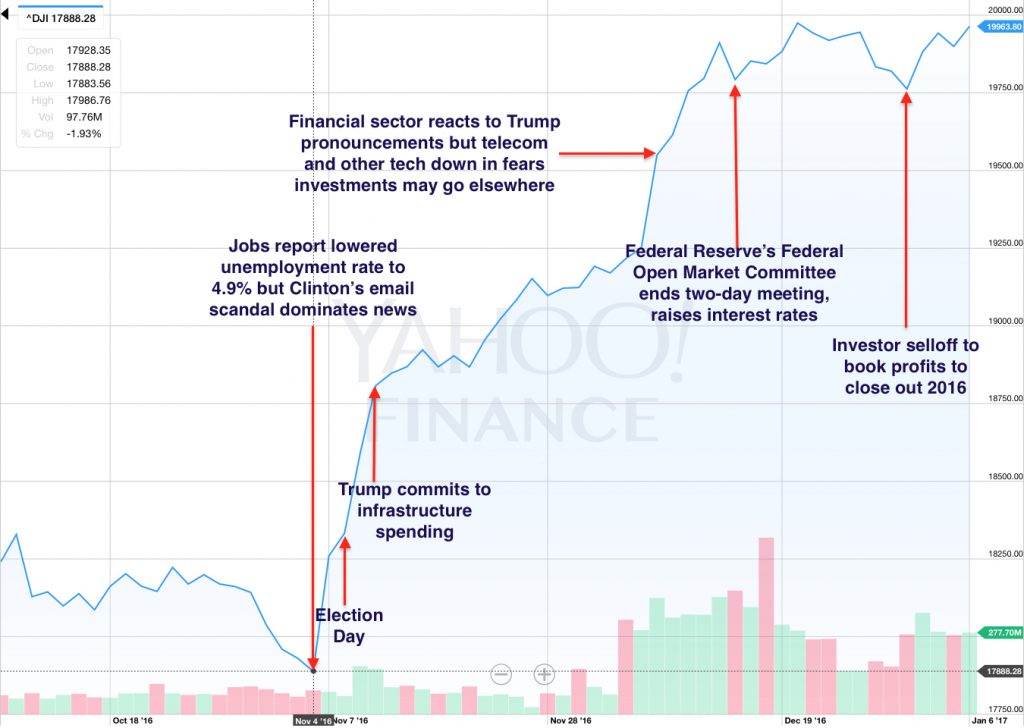

Since the election, there have been a number of stories about the “Trump Effect” on the markets. The narrative is that the economic bounce is tied specifically to the election of Trump.

The premise is that the market is reacting to the election of Donald Trump and is the direct cause for the change in the economic factors in the markets. Unfortunately, the narratives being promoted is shortsighted. Markets are not reacting to the election of Trump. The markets are reacting to the certainty that the election is settled.

Markets hate uncertainty. When there is uncertainty, the markets tend to react to everything and sometimes in an exaggerated manner. Fortunately, the economic indicators have been good and the markets have reacted accordingly with exaggeration.

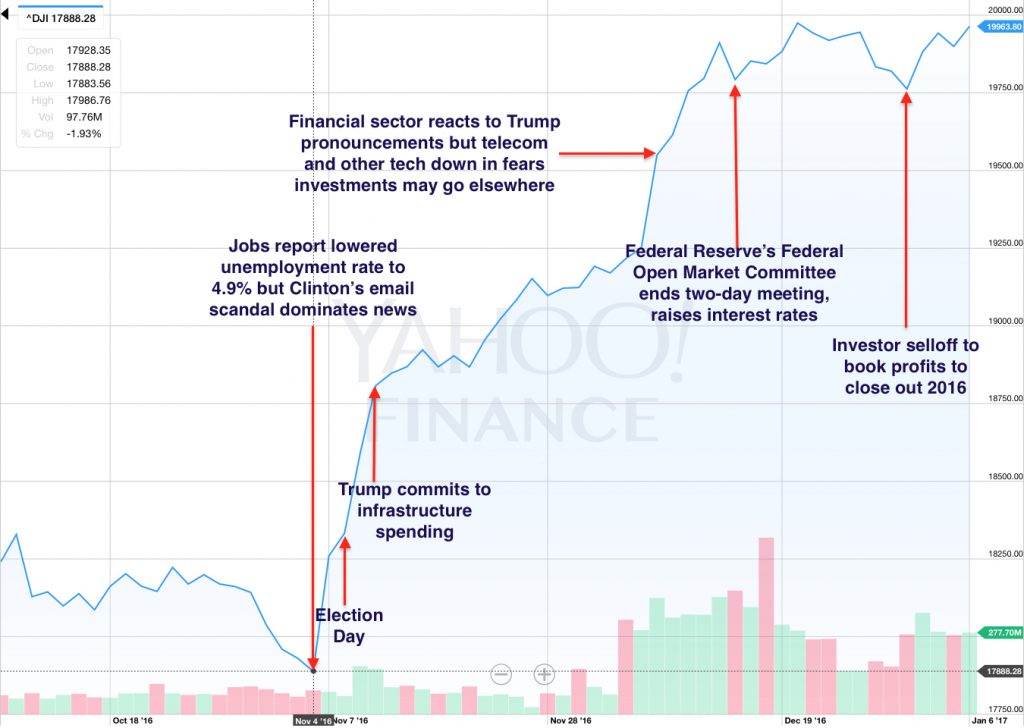

How the markets have reacted to uncertainty in economic news

When looking at the collecting markets, whether it is numismatics or antiques, you can look at the precious metals markets as a key indicator. In basic terms, the price of precious metals is indirectly proportional to the strength of the markets and economy. It translates to if the economy is strong making investing less of a risk, then the precious metals markets will be weaker. it means there is more cash circulating creating discretionary income that buyers use to spend on non-essentials, like hobbies.

A strong market and economy means that investments in businesses are a better bet. Strong employment numbers and the movement of goods and services mean that there is money to be made by investing in business. If there are good investment opportunities, it does not make sense for investors to tie money up in precious metals.

Investment in metals makes sense when investing in their value is better than the expected rate of return on business investments. Once investors turn to precious metals, the price is based purely on supply and demand. Since the supply stream is relatively constant, demand mostly influences the price of metals. If the demand is high and the supply cannot keep up with the demand, the price will rise. What helps regulate the price is that there continues to be a supply but the demand has been known to outpace the supply.

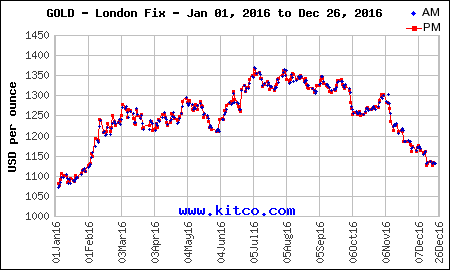

The fact of the matter is that economic indicators have improved. Prices of metals have been steadily dropping since August as the investment in stocks been going up. Even before the election, the markets were in growth mode but skittish with uncertainty.

All the election brought was a certainty. Markets know who the next president will be, who will be in congress, and who will control the state houses. If markets hate uncertainty then the currency that fueled the rally was the removal of uncertainty.

After the week following the election, the markets leveled off with the next goal to figure out what the Federal Reserve would do. With the uncertainty surrounding the December Federal Open Market Committee (FOMC) meeting, the drive to record levels stalled. When the FOMC announced the increase in interest rates, rather than reacting negatively, the reactions was as if the markets were saying, “It’s about time.” with the uncertainty of what the FOMC would do, the markets reacted by climbing to record levels.

Market reactions to various news and economic events

In the meantime, the metals markets have been on a steady decline. Since the capital markets are providing a good return on investments, there is no incentive to invest in metals. Although people are buying, the fewer buyers are beating the prices down making bullion-based collectibles cheaper.

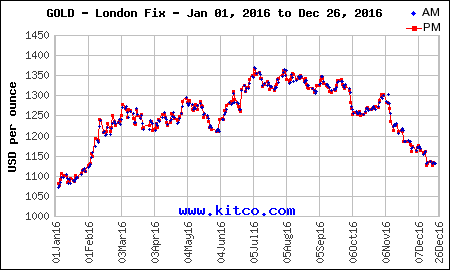

Gold free fall began on Election Day 2016

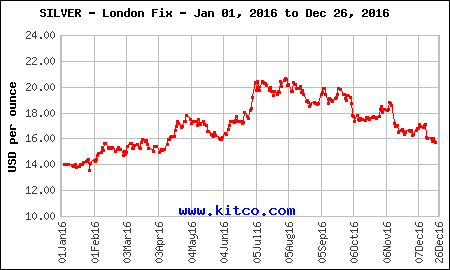

Silver downward trend started on Election Day

What does that have to do with higher end collectibles such as rare coins?

When capital markets are adding to the general wealth of the investor community, they will look for different places to invest their winnings. The new money will start to buy high-end items to supplement their other investments. This is why the collector market thrives during good economic times. Prices of fine art, prime real estate, collector cars, and even rare coins rise.

Rare coins have been resilient since the decline in markets. Rare coins became a safer bet and have attracted new investors which has bucked the trends of the past. This was not lost on the broader investing community who may be looking for diversity in their portfolios.

In review, the markets have been on a six-year rise as the economy has recovered from the Great Recession. Economic indicators are on an extended positive run. The election created certainty in the future of the government and the Federal Reserve created certainty when it raised interest rates. Since markets like certainty, the reaction is not because of the result of the election it is that the election is over.

Certainty is driving the markets, not the details of the results.

Credits

- Dow Jones Industrial Average charts courtesy of Yahoo! Finance.

- Gold and silver charts courtesy of Kitco.

Dec 28, 2016 | administrative, coins, markets, news, US Mint

Last I reported, I had travelled to Philadelphia to see the students at Juaniata Park Academy that we raised money to visit the U.S. Mint and Federal Reserve. I did make it to the school despite the flat tire and other problems my Chevy Avalanche experienced along the way. We did have a one-hour visit to talk about coins, currency, and the history they reveal. I had a lot of fun. Rather than talk about it in this update, I will write a longer post soon.

Last I reported, I had travelled to Philadelphia to see the students at Juaniata Park Academy that we raised money to visit the U.S. Mint and Federal Reserve. I did make it to the school despite the flat tire and other problems my Chevy Avalanche experienced along the way. We did have a one-hour visit to talk about coins, currency, and the history they reveal. I had a lot of fun. Rather than talk about it in this update, I will write a longer post soon.

Counterfeiting is on the rise. The number of reported arrests for counterfeiters has increased. Some of it may be attributed to the largest seizure of counterfeit currency in Peru. Although not confirmed, there is speculation that the arrests in Peru provided leads into the distribution network. The Peru notes are amongst the best counterfeits produced outside of the United States. Unfortunately, there is no simple way to determine if you have one of these notes. The U.S. Secret Service has been advising cash-related businesses to be wary of people making unusual large cash purchases.

The U.S. Mint is preparing for an increase in sale of bullion American Eagle coins. Gold is down over $230 since its high in July or $151 since the election. Even with the strong dollar, the lower price of gold and the trust in the American Eagle coin is driving buyers to authorized dealers. One dealer said that 2017 pre-orders are their highest in a while.

The market for silver is facing a similar downward slide. From the $20.17 close in the beginning of August, the price as this is being written is $15.90. A 21-percent drop in silver spot prices is quite large over this period and greater than the 17-percent drop in the gold spot price.

-

-

Year-to-date Gold Chart as of Dec 27, 2016

-

-

Year-to-date Silver Chart as of Dec 27, 2016

Lower spot prices may be driving speculators to the market. Since the Federal Reserve Board increased the discount rate, the rate they charge for overnight loans to their large customers that are required to have a certain amount of liquidity at market close, by 250 basis points (.25 percent), there are some that believe that the markets are getting ready for a shift. Precious metals are always used as a hedge against inflation investments and may be a sign that some are expecting an economic crash.

A future post will discuss the coin-op industry’s reaction (albeit late reaction) to the GAO Report U.S. Coins: Implications of Changing Medal Compositions (GAO-16-177, Dec. 10, 2015). It appears to be an attempt for the coin-op industry to fight composition changes in U.S. coinage. Although most of their argument reads like a complaint that they do not want to undergo the cost of converting machines, they do make a point in that some of the alternatives has the potential to create a market for counterfeiting coins that would hurt the economy. One example they site is that it may be easier to counterfeit plated steel coins because the technology that checks for electromagnetic signatures of the coins would not be able to detect a real coin from a slug.

Following my post about the scrap industry not being able to return mutilated coins to the U.S. Mint I was contacted by someone in the industry who thanked me for the story. I was asked to emphasize that although the current court case involves companies based in China, the problems affect scrap dealers throughout the United States. Following this conversation, I was able to speak with a broker who has been buying scrap coins from smaller companies who said that the U.S. Mint has been discussing a way forward but in a way that makes it sound like they are not happy with having to deal with this situation. The U.S. Mint will not comment as long as there is an active case in federal courts.

The Apollo 11 50th Anniversary Commemorative Coin Act is now Public Law 114-282. Although I am not a collector of commemorative coins other than for topics that interest me, I am interested in this topic. Although I am a fan of silver coins, I am going to try to buy the gold Apollo 11 commemorative coin. I have two years to save my pennies!

Finally, I am working on creating a weekly newsletter opt-in containing numismatic-related stories from non-numismatic media sources from around the world. I will curate the news that appears in the newsletter but want to automate some of the processes. Automation of the workflow is in progress. Watch for the signup process to appear here soon!

Oct 11, 2016 | cash, coins, commentary, currency, markets

Cash seems to be the new 4-lettered word.

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

Last May, the European Central Bank announced will stop printing the €500 banknote by the end of 2018 when the €100 and €200 banknotes of the Europa series are planned to be introduced. Although the announcement did not quote the Summers article, the announcement had addressed some of the issues he addressed.

In June, Sweden became the first nation to announce a formal policy to become a cashless society within five years. According to reports, Riksbank, the Swedish central bank, claims that just under 2-percent of all transactions are made by cash. They expect that number to drop to one-half of one-percent by 2020. Most shops report that 20-percent of sales are made using cash.

Sweden may be an outlier. Globally about 75-percent of all sales are made using cash.

In the United States, it is being reported that some higher-end retailers have stopped taking cash.

Retailers have been looking to the convenience industries as an example of the future. There are parking lots that no longer take coins in their parking meters. Pay stations now only accept credit cards. Some toll roads now require a special transponder to be mounted in your car because there are no booths to collect tolls. Those transponders must be linked to a credit card. Airlines no longer take cash when you buy beverages or snacks on the plane because handling the change is too difficult.

New payment options have entered the market. Smartphone-based Apple Pay, Samsung Pay, and MasterCard Master Pass have worked to make it easier to separate you from your money by allowing you to wave your phone at the reader and pay. For most retailers, there is little they have to do in order to accept these payment methods as long as they are accepting chip-based transactions. Since the transaction cost to the retailer does not change, it is an incentive for them to accept these types of electronic payments.

Although electronic payment options make up 13-percent of all cashless transactions you have to remember that this market barely existed a few years ago.

Even as banks and large retailers push to increase the number cashless transaction, there are problems that society faces when moving to a cashless retail system.

The biggest problem is one of scale. The United States makes more money, spends more money, trades more money, and has more economic impact than any other country in the world. It is the world’s single largest economy with a strong capitalistic culture where most of the commerce is done with small businesses. Amongst all business, 55-percent of retail merchants are cash-only enterprises. They are too small to consider paying the 3-to-5 percent fees for using a credit card, known as the “swipe fee.” Of those that do take credit cards, at least 36-percent require a minimum purchase.

Once you get past the problem of scale, then there are the issues of the poor who do not have bank accounts. Aside from not having the economic power to work with the banks, there are some communities that are culturally opposed to the banking system. Even if they can afford to have a bank account, many choose not to open one. The near failure of large financial institutions in 2008 did not help in the trust factor.

Of course, the one cultural issue that cannot be ignored is privacy. Cash transactions are private. Only the buyer and seller knows the details of the transaction (unless the buyer volunteers their loyalty or rewards account information). With the problems of hacking around the world, how do you know that your credit card transaction are safe? Should we ask the victims of the computer hacks on Target and Home Depot?

Aside from privacy, credit cards can be costly to the customer. High-interest rates, debilitating debt, and collection issues see the use of consumer credit dropping when there is an economic downturn. During the Great Recession that began in 2008, spending went down and, when the economy began to improve, savings went up. When wages began to rise in 2010, more money was being spent paying down debt than adding to the economy. Rather than stimulating the economy, this creates a stagnant effect since the economy thrives more on the selling of goods and not by the managing of cash.

It seems that every six months there is yet another “Chicken Little” story that either we are or should stop using cash. But when society seems to be set in using cash even when there is anecdotal evidence that makes it appear that we are on the brink of a cashless society, they become quiet as if they ended up in Foxey Loxey’s den!

Reports of cash’s eventual demise appear to be as amusing as it is greatly exaggerated. For numismatists, this means that our hobby will continue to grow with new, fresh material for years to come. Happy collecting!

Sep 22, 2016 | copper, history, markets, tokens

Have you noticed that every election “is the most important in our history?” Or that “you have no clearer choice” than whatever any of the candidates are selling? There are so many clichés that it would require its own blog post.

But what does that have to do with numismatics?

Long-Stanton Manufacturing Company was founded in 1862 by John Stanton to make copper tokens that were used by merchants in the Cincinnati area when money was in short supply during the Civil War. Before starting his company, Stanton owned a company that provided the illustrations and dies that were used to make advertising tokens for the 1860 election.

The Election of 1860 preceded the outbreak of the Civil War. It featured fractured party nominees arguing over the future of the union. The Republican Party, formed out of the ashes of the Whig Party, nominated former representative from Illinois Abraham Lincoln. The Democratic Party nominated Illinois Senator Stephen A. Douglas. But the Democrats were split along the issue of slavery. Pro-slavery southern Democrats formed their own party and nominated then Vice President John C. Breckinridge from Kentucky. A few other candidates were nominated but these were the three that were the focus of the election.

One thing that is considered a highlight of this campaign were the famous debates between Abraham Lincoln and Stephen Douglas. The main theme of the seven debates was slavery. Primarily, Lincoln was anti-slavery and maintaining the union. Douglas was not pro-slavery but favored new territories to choose their own paths. Lincoln argued in his “House Divided” speech that Douglas wanted to nationalize slavery. This came following Douglas’s sponsoring of the Kansas-Nebraska Act that repealed the ban on slavery in the new territories passed as part of the Missouri Compromise.

Although the use of language was more refined in 1858, the issues were just as divisive.

Seven debates were not enough for the public. Manufacturers, such as the one that Stanton provided illustration and die making services for, struck tokens for the candidates and their supporters to give away to gain support. Lincoln won the Election of 1860 with a majority of the electoral votes carrying 18 of 33 states while gaining only 39.8-percent of the popular vote.

Some say the election of 2016 is the most divided in our history. If we do not count the Election of 1824 in which nobody received a majority of electoral votes and the results had to be decided by the House of Representatives, it could be one of the more contentious election since the 1976 Carter-Ford race.

The folks at Long-Stanton thinks there is an indecision in this election, although the polls show that the country is about evenly split. They think to celebrate the 156 years since John Stanton created his tokens the company created their Indecision 2016 token.

Indecision 2016 token is 39mm and made of brass. Portraits of each of the candidates are on either side. If you are undecided, you can flip the token to choose who you will vote for.

Unfortunately, the portraits barely represent the candidates. While the TRUMP side of the token is passible the CLINTON side would not be recognizable if it was not marked. While I do not consider either candidate physically attractive these portraits are worse.

Since it is expensive to produce tokens and medals to just give away, the tradition of striking these types of pocket pieces are no longer part of the campaign. If you have ever read Warman’s Political Collectibles: Identification and Price Guide, you would see all the interesting trinkets that would be produced in support of the candidates. Nowadays, those who collect political memorabilia would be hard pressed to find something more than a button or lapel pin.

Having received the Brexit token, I decided to purchase one of the Long-Stanton Indecision 2016 tokens for my collection. Although the token looks better in hand since it has a proof-like strike, a close-up view of the portraits are about as bad as the images on Long-Stanton’s website. For $8.95 for a single token, including shipping, it is not a bad deal. They do offer discounts for buying more than a few.

-

-

Long-Stanton Indecision 2016 Token – Donald Trump side

-

-

Long-Stanton Indecision 2016 Token – Hillary Clinton side

Included in the package was an aluminum token from Long-Stanton that is “GOOD FOR 50 IN MERCHANDISE.” It does not identify the exact value of 50 whether it means cents or dollars, but it does not matter since it is unlikely to be redeemed from my collection. At 31mm it is smaller than the Indecision 2016 token but it is a throwback to times when tokens were created for store credit before paper coupons became ubiquitous.

-

-

Aluminum Long-Stanton Manufacturing Token

-

-

Aluminum Long-Stanton Manufacturing Token reverse offering “50 IN MERCHANDISE”

Rather than go with my numismatic collection, this token will go along with a small collection I have of political memorabilia. It will join other numismatic-related items that are related to my favorite president Teddy Roosevelt. I hope he is not insulted by either of these candidates. Somehow, I think T.R., George Washington, Thomas Jefferson and Abraham Lincoln might not be happy if they were around today.

Jun 22, 2016 | Britain, economy, markets, medals, news

While there is enough going on with U.S. politics to make one’s head spin, on Thursday, June 23 the United Kingdom will hold a nationwide vote on whether the U.K. should leave the European Union. The last time the U.K. held a referendum on joining the E.U. was in 1975, which predates the modern European Union. It is called “Brexit,” a portmanteau of the term “Britain Exit,” as in should Britain exit the E.U.?

The European Union was formed after World War II in various forms in an attempt to collectively rebuild Europe by integrating their resources. The first formal attempt was the Treaty of Rome in 1957 signed by Belgium, France, Italy, Luxembourg, the Netherlands and West Germany to create the European Economic Community (EEC) and established a customs union. What we know today as the European Union was established when the Maastricht Treaty became effective in 1993.

As part of the integration under the E.U. is the common currency known as the Euro. First distributed in 1999 with 14 participating nations, now includes 19 of the 28 nations plus the Vatican, Monaco, and San Marino who are not formally members of the E.U. The United Kingdom (England, Northern Ireland, Scotland, and Whales) continues to use the pound sterling, sometimes referred to the Great Britain Pound. Ireland, sovereign from the United Kingdom, uses the euro.

British Prime Minister David Cameron

Interestingly, many of the arguments for leaving the E.U. are similar to those being applied by the apparent nominee for the Republican Party in the United States while those campaigning to remain in the E.U. are similar to the apparent Democratic Party nominee. It just goes to prove that regardless of which side of the pond you live, politics is polarizing.

For those of us Yanks who want to learn more, BBC News has published a good overview with links to more in-depth that you can click here to read it, if interested.

So why is this significant for a coin collector’s blog? We do look at economic matters affecting collecting including those whose collection are being put together for speculation including the purchase of bullion-based numismatics. Also, the outcome could not only affect the world economic system but could also have an impact for those who collect foreign coins.

If the U.K. votes to remain in the E.U. then the status quo remains. The British will go back to their partisan politics and scratch their heads over the U.S.’s partisan politics known as the 2016 presidential election. Markets that have tightened in anticipation of what Brexit may mean could see this as a temporary reprieve.

If the U.K. votes to leave the E.U. the markets may not like it and the economy can go into a freefall. Markets do not like uncertainty and a vote for the U.K. to leave the E.U. would bring about the uncertainty of “what happens next?” and “now what?” Business leaders, who are largely in favor of remaining the in E.U., has noted that it makes it easier for them to move money, people and products around the world. What happens when those doors are closed?

As we have seen when economies are uncertain, markets react by selling off speculative assets, like stocks, and running to safer investments like trustworthy bonds and precious metals. In the last three weeks in the run up to Brexit, gold is up $56 (4.6-percent) in the last three weeks and silver is up $1.41 (8.8-percent). Both are off their annual highs set on June 16 when published polls are suggesting that Stay has a lead greater than the margin of error over Leave.

-

-

June gold prices through June 22

-

-

June silver prices through June 22

NOTE: Charts do not update

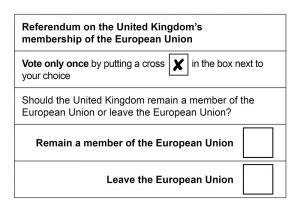

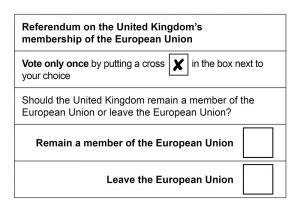

Sample of the ballot that will be used for the EU Referendum “Brexit” vote

Market watchers can watch what happens to the Tokyo Nikkei 225 market index and Hong Kong’s Hang Seng Index. Both are the major indexes in the Asia/Pacific region and will be around their midday trading sessions on Friday.

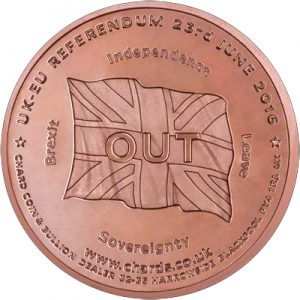

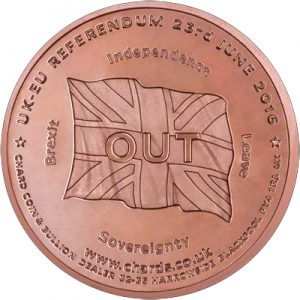

Collectors looking for something numismatic to add to their collection might want to consider the In/Out UK EU Referendum Medallion produced by Chard(1964), a British metals dealer. These copper medals were produced for the Britons who were undecided. Flip the medal before you vote to decide whether to remain or leave. The Remain side has the E.U. flag surrounded by “Remain,” “Better Together,” “United,” and “Stronger in Europe.” The Leave side has the British Union Jack with “Brexit,” “Independence,” “Leave,” and “Sovereignty.”

Medals are 31mm in diameter and weighs 14 grams. They come in pure copper or Abyssinian Gold, a type of brass made of 90-percent copper and 10-percent zinc that has a gold-like color. They can be purchased for £2.95 each ($4.33 at the current exchange rate) plus shipping (estimated at £6.00 or $8.80) directly from Chard’s website.

-

-

Chard Brexit Medal “In” side

-

-

Chard Brexit Medal “Out” side

Credits

- Brexit combined flags image: Credit Philippe Wojazer/Reuters via the New York Times.

- Image of PM Cameron is an official photo downloaded from Wikipedia.

- Static metals graphs courtesy of Kitco.

- Referendum Ballot image courtesy of Wikipedia.

- Brexit Medal images courtesy of Chard.

Oct 22, 2015 | coins, markets, news, values

Earlier this year, Shane Downing, editor and publisher of the Coin Dealer Newsletter, better known and “The Greysheet” died of colon cancer on Jun 18, 2015. Shane became publisher following the death of his father, Ron Downing, in 1997.

Earlier this year, Shane Downing, editor and publisher of the Coin Dealer Newsletter, better known and “The Greysheet” died of colon cancer on Jun 18, 2015. Shane became publisher following the death of his father, Ron Downing, in 1997.

The Downings have been running The Greysheet since 1884 when Ron and Shane’s grandmother Pauline Miladin purchase the publication from its original owners.

The Downings expanded the publication to include quarterly supplements, The Currency Dealer Newsletter (Greensheet) for currency, Certified Coin Dealer Newsletter (Bluesheet) for certified coins, and special monthly supplements highlighting specific coins. In recent years, CDN has been available online as a PDF file in a program they call CDNi.

Early last month it was announced that an ownership group led by John Fiegenbaum, formerly president of David Lawrence Rare Coins (DLRC), has purchased CDN Publishing. The ownership group includes Steve Halprin and Steve Ivy, co-founders of Heritage Auctions; Mark Salzberg, Chairman of Numismatic Guaranty Corporation; Steve Eichenbaum, CEO of the Certified Collectibles Group, the parent company of NGC. Fiegenbaum has retired from DLRC to dedicate his time to running CDN with the assurance that CDN will remain an independent entity. The other owners will remain in their current positions.

John Feigenbaum receives 2014 Abe Kosoff Founder’s Award from the Professional Numismatic Guild

CDN will be moving from California to the east coast. Although the press release does not specify the location, it is likely that CDN will be located in Virginia Beach, Virginia where Fiegenbaum has been running DLRC for over 30 years.

One of the benefits of Fiegenbaum running CDN would be to improve online access to their publications. Under Fiegenbaum, DLRC has moved from mail and phone bid auctions to a successful online auction system. Their auction website is very user friendly and getting better as they receive feedback from users. DLRC’s website rivals that of Heritage Auctions, led by Halprin and Ivy, for ease of use and accessibility to the auction items. This is a powerful backing for better electronic access.

Using the resources of NGC and Heritage Auctions, CDN could produce an online almanac of coinage including history and prices that would rival anything currently available. Making it accessible to collectors and dealers on both a free and paid basis could keep CDN viable for many years to come. Such a service could even surpass the every-ten-year effort by CoinWorld and the multi-volume effort by Whitman Publishing.

While running DLRC, Feigenbaum has shown how embracing the Internet could benefit his company and the collecting community. If he can embrace electronic publishing by bringing existing resources to the Internet and look for expansion with specialty collectors, CDN could become the go-to resource for people interested in learning all about their collections by making it more accessible to the emerging market of Gen X’ers and Millennials. That would benefit the numismatic community more than phonebook sized volumes of dead trees or glossy pages with pretty red covers.

Image of The Greysheet cover courtesy of CDN Publications.

Image of John Feigenbaum courtesy of David Lawrence Rare Coins.

Apr 4, 2015 | coins, commentary, markets, news, other

Click on graphic to see full survey

One of the problems I had with writing about this is that I did not know what to say. While it was fun to participate, what can I add to the survey? Rather than just reporting, I decided I would share my answers with some commentary.

Question #1: What is your favorite individual coin?

My answer: 1955 Double Die Obverse Lincoln cent

Prior to the appearance of the 1955 DDO Lincoln cent, there was almost no interest in error coins or that coins with errors can be collectible. After the discovery of the 1955 DDO, it was a number of years before error collecting was considered acceptable—I found a 1960 referenced to “spoiled 1955 pennies.” It is a historic coin in that it is the only coin that can be pointed to that started a type of collecting. That is what makes it so cool!

Question #2: What is your favorite coin series?

My answer: Peace dollars

I love the design of the Peace dollar. The image of Liberty on the front is, in my opinion, the one of the best images on U.S. coins. For collectors, it is the one set of silver coins that may be the most affordable for average collectors with the 1928 and 1938-S being the most expensive. It is also the only complete set of silver coins I own.

Question #3: What coin is most overpriced on the market right now?

My answer: Any coin in a slab with a CAC sticker

I have previously written of my dislike for CAC and how I feel they are practicing market manipulation. There are too many people willing to blindly accept CAC as an authority and some cannot explain why. While that CAC may have helped force PCGS and NGC to improve their processes, I have seen coins with CAC stickers I just did not like.

Question #4: What are some examples of undervalued coins?

My answer: Almost any commemorative coin

I should have clarified this answer to say that almost any modern commemorative coin. There are many commemoratives that did not sell well and not worth much more than their bullion value and a small numismatic premium. Even though they were not popular, they do have artistic value. A dedicated collector could put together a nice collection of modern commemorative coins for not a lot of money.

Question #5: What is the hardest coin to locate and purchase in the US?

My answer: A solid, mid-grade Liberty Head nickel

While most of the people taking the survey left this question blank, I was thinking about my own experiences. Not including rare coins, it is not that difficult to find key and semi-key dates. But if you really want to search for coins that are not easy to find, try to put together a set of extra-fine to almost uncirculated Liberty Head nickels. You can find a lot of lower grade nickels and higher grade nickels. Finding these solid mid-grade nickels can be more difficult than finding a 1913-S Type 2 Buffalo nickel.

Question #6: Do you think the penny will ever be phased out? If so, what year?

My answer: No. Never.

Although I am not in favor of eliminating the one-cent coin, I do not think it will ever be eliminated because of the dysfunction of congress. Congress would not be able to come to any consensus and neither side of the aisle does not have the intestinal fortitude to make a stand one-way or another.

Question #7: What President deserves to be on a coin/bill that hasn’t previously been featured?

My answer: Not counting the presidential dollars, Theodore Roosevelt

In this political climate, I knew what the dominant answer would be. Rather than thinking about the political, I was considering what president had the single largest impact on U.S. coinage. No other president had the impact on coin design than Theodore Roosevelt. While his “pet crime” was directly responsible for the designs by Bela Lyon Pratt, Augustus Saint-Gaudens, and Victor D. Brenner, it was the seed he planted for the renaissance of coin design. Remember that James Earle Fraser and Adolph A. Weinman were Saint-Gaudens’ students and added notable coin designs of their own.

Question #8: Do you think the US will ever introduce a brand new denomination?

My answer: No.

For the same reason that congress would never be able to vote on legislation to eliminate the one-cent coin, the same dysfunction will prevent new denominations from every being created.

Question #9: Which of the following phased out coins/bills do you think the US will begin minting in the near future?

- Kennedy Half dollar

- Susan B Anthony silver dollar coin

- Sacagawea dollar coin

- Two dollar bill

- None

My answer:

All items in the list are being produced except for the Susie B’s. There is no correlating law to authorize the U.S. Mint to produce the Susie B thus it could never be produced unless congress changes the laws. Kennedy halves and Sac dollars are being produced for the collector markets, but there are correlating laws to allow them to be produced. Authorization is codified in 31 U.S. Code § 5112.The $2 Federal Reserve Note is different in that the law (

12 U.S. Code § 411) authorizes the Federal Reserve to determine what notes are produced. The way the law is written, the Bureau of Engraving and Printing is not as regulated as the U.S. Mint. The only legal consideration is that the Fed could only have notes produced based on the denominations codified in

12 U.S. Code § 418. The law does not say these denominations have to be produced. Section 411 lets the Fed decide. In 1969, the Fed decided to stop producing large denomination currency. By the Fed’s definition, large denominations are FRNs larger than $100. Currently, the $2 FRN is being produced. The Fed does not order many and the rest are produced for the collectors market.

Yes, that was my answer and I’m sticking to it!

Question #10: If you didn’t collect coins, what would you collect?

My answer: Cars, sports memorabilia, lapel pins

In reverse order, I do collect lapel pins from situations meaningful to me. I have a collection that includes past professional activities, interests, places I have visited, and more. While I have some sports memorabilia, I am jealous of the collections I have seen of people who just pickup items as they go along. Of course those people are like Penny Marshall who have a phenomenal collection but also has access.

When I mention cars, I am not talking about a Jay Leno-like collection, but I wouldn’t mind his collection. I am just looking for a few cars to have some fun with. While I own a

1974 Plymouth Gold Duster with a 225 cu. in. Slant 6 engine (memories of my youth), I want other classics. A few great examples come to mind like a 1959 Cadillac convertible in red (Eldorado or Series 62, I don’t care which), a 1968-70 Dodge Charger R/T with the 426 Hemi engine in Plum Crazy purple, and a 1930s 4-door car to create a hotrod (yes, I know 2-doors are more popular, but I have an interesting idea). Every so often I see

movie or television-related cars that come up for sale that I think would be cool to own.

But I digress. While I am looking for a token with a cut-out “Q” as part of its design (it does not have to be a transportation token since none were made like that), you can

check out the survey and compare my answers with those from the other experts.

Infographic courtesy of International Precious Metals.

→ Read more at newschannel5.com

→ Read more at newschannel5.com → Read more at eastidahonews.com

→ Read more at eastidahonews.com → Read more at the-japan-news.com

→ Read more at the-japan-news.com → Read more at dailycamera.com

→ Read more at dailycamera.com → Read more at chronicle.co.zw

→ Read more at chronicle.co.zw → Read more at foxnews.com

→ Read more at foxnews.com → Read more at abc.net.au

→ Read more at abc.net.au → Read more at thestar.com

→ Read more at thestar.com

Last I reported, I had travelled to Philadelphia to see the students at Juaniata Park Academy that we raised money to visit the U.S. Mint and Federal Reserve. I did make it to the school despite the flat tire and other problems my Chevy Avalanche experienced along the way. We did have a one-hour visit to talk about coins, currency, and the history they reveal. I had a lot of fun. Rather than talk about it in this update, I will write a longer post soon.

Last I reported, I had travelled to Philadelphia to see the students at Juaniata Park Academy that we raised money to visit the U.S. Mint and Federal Reserve. I did make it to the school despite the flat tire and other problems my Chevy Avalanche experienced along the way. We did have a one-hour visit to talk about coins, currency, and the history they reveal. I had a lot of fun. Rather than talk about it in this update, I will write a longer post soon.

Earlier this year,

Earlier this year,