Dec 24, 2014 | coins, gold, halves, silver, US Mint

Arriving in time to celebrate Festivus was my order from the U.S. Mint. The sense of timing was interesting since December 23rd was also the seventh day of Chanukah and the last of the eight candles would be lit that night and the day before Christmas Eve. Call it a celebration in a box!

In this order were my 50th Anniversary Kennedy Half-Dollar products. I first opened the 50th Anniversary Kennedy 2014 Half-Dollar Uncirculated Coin Set. Shrink wrapped, the set that sold for $9.95 was in a nice folder with a card containing two uncirculated coins in capsules embedded in the card. The half-dollars, one from Philadelphia and the other from Denver, are well struck and if I were to have them graded would probably be assigned a high grade.

Some people may balk at spending $5.00 for a half-dollar, but the presentation makes it a nice collectible even for the budget conscious.

Next was the 50th Anniversary Kennedy 2014 Half-Dollar Silver Coin Collection. The set contains four 90-percent silver half-dollars struck in four different finishes: reverse proof, proof, enhanced uncirculated, and uncirculated. This boxed set contains a presentation folder, Certificate of Authenticity from the U.S. Mint, and a booklet documenting how the Kennedy half-dollar came into being following the President’s assassination.

There is a somewhat cheesiness quality about the presentation. First, the outer cardboard sleeve that surrounds the box has a design that is repeated on the box top. The same design is on the outer flap of the folder itself. Esthetically, this type of design is visually fatiguing by the time you are to the point of opening the folder. In the past, the U.S. Mint used their logo or a heraldic eagle. It broke up the visual monotony created by using the same imprint on three different surfaces.

Another problem with the product design is that the encapsulated coins are embedded into a holder that is only one sided. In order to see the reverse of the coins they have to be removed from what holds them into the folder. Unfortunately, the fitting is so tight that it I started to pull apart the part of the folder that attaches the capsules to the folder. Eventually, I used a letter opener to gently pry the capsules out of their slots so that I could see the reverses.

-

-

Packaging of the 50th Anniversary Kennedy Half-Dollar Silver Set

-

-

The folder with all four coins in the 50th Anniversary Kennedy Half-Dollar Silver Set

-

-

A close-up of the silver half-dollars in the 50th Anniversary Kennedy Half-Dollar Silver Set

It was worth the trouble removing the capsules from their holders. All the coins were beautifully struck and looked great including the reverse proof struck in West Point. I love the look of the reverse proof coin. Aside from having Kennedy really standing out on the obverse, there is something regal looking about the heraldic eagle on the reverse.

At first glance there almost appears to be no difference between the proof coin, struck in Philadelphia, and the enhanced uncirculated coin struck in San Francisco. After placing the coins side-by-side it was evident that he proof coin was struck differently than the enhanced uncirculated coin. Proof coins are usually struck with more force and more than once. Looking at both coins together before using a loupe shows that the relief for the proof half-dollar was higher. You can really see the difference by looking at Kennedy’s hair which showed more definition in the proof coin.

Where the enhanced uncirculated coin has an impact is on the reverse. Whereas the elements on a proof coin are frosted the laser process used on the enhanced uncirculated coins allows the U.S. Mint to create the frosting effect on some of the elements. For the reverse of the enhanced uncirculated half-dollar, the U.S. Mint selectively frosted elements of the heraldic eagle giving a “pop” that would not be possible using any other method. By frosting some of the higher relief areas, especially around the eagle’s shield, it provides a visual cue of more depth which makes for a nice refresh of a 50 year-old design.

-

-

The obverse of the 2014-W reverse proof in the 50th Anniversary Kennedy Half-Dollar Silver Set

-

-

The reverse of the 2014-W reverse proof in the 50th Anniversary Kennedy Half-Dollar Silver Set

-

-

-

The reverse of the 2014-S enhance uncirculated Kennedy silver Half-Dollar

As I write this, the London Fix price of gold is $1,170 per troy ounce. If the PM Fix of gold stays below $1,200, the price of the 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin will drop to $1,165, down from its current $1,202 and will be $75 less than its first issued price of $1,240. Although it is not a good idea to try to time the market, I wonder if all those dealers who caused problems during the coin’s initial release are worried about their profit margins now that the price of gold is going down!

Nov 6, 2014 | bullion, coins, commentary, gold, US Mint

Every Thursday morning, the U.S. Mint looks at the afternoon London Fix price of gold and adjust their bullion-related coins based on their published tables. This morning, the U.S. Mint adjusted prices after noting that the afternoon London Fix priced gold at $1,145.00 per troy ounce. Based on the table published in the Federal Register, the price of the 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin was reduced to $1,165.00!

Every Thursday morning, the U.S. Mint looks at the afternoon London Fix price of gold and adjust their bullion-related coins based on their published tables. This morning, the U.S. Mint adjusted prices after noting that the afternoon London Fix priced gold at $1,145.00 per troy ounce. Based on the table published in the Federal Register, the price of the 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin was reduced to $1,165.00!

Please pardon me as I laugh at all of those dealers whose questionable ethics caused despicable scenes in Philadelphia, Washington, Denver, and Rosemont at the ANA World’s Fair of Money when the introduction price was $1,240. Those who have waited to order the coin directly from the U.S. Mint for a coin that does not have a mintage limit will have saved $75 from the issue price. And by buying from the U.S. Mint, you do not have to pay the alleged “numismatic premium” dealers will apply for the special label encased on the plastic they paid to have the coin entombed in.

Regardless of what the politicians say, some business pundits recognize that the economy is moving forward and the stronger dollar will continue to push prices lower.

If the price of gold drops below $1,100 by next Wednesday afternoon’s London Gold Fix, the price of the Kennedy gold halves will drop to $1,127.50. If that happens, I will be back to laugh even more!

Oct 31, 2014 | ANA, CCAC, coin design, coins, commemorative, commentary, gold, halves, medals, policy, silver, US Mint

It has been a few years since I did an All-Hallows-Eve numismatic trick-or-treat that it seems like a good time to do add one. Here are my numismatic tricks and treats for this past year.

It has been a few years since I did an All-Hallows-Eve numismatic trick-or-treat that it seems like a good time to do add one. Here are my numismatic tricks and treats for this past year.

Girl Scouts need a values adustment

TRICK: It was announced in January that the 2013 Girl Scouts commemorative coin did not generate enough sales for the U.S. Mint to provide a payout of seignorage. This is the first time this has happened. Part of the problem was that the Girl Scouts are stuck in the 1950s mindset that does not see collecting coins as a girl’s hobby. Although values are important, this shows that he Girl Scouts’ values are behind the times and will not be the catalyst behind helping expand the hobby. They should be ashamed for contributing to this failure.

ANA Willfully Gives up its Premier Status

TRICK:The Professional Numismatists Guild and the American Numismatic Association announced in January that “the first” PNG-ANA Numismatic Trade Show the weekend prior to the 2014 World’s Fair of Money in Rosemont that it will be open to the public. While making it sound exciting it made the entire show 8-days long. This was a bad move because of the length and because it makes the ANA play second to PNG. If the ANA wants to be the premier numismatic organization, the one that anyone wanting to learn about and be about numismatics, The ANA should not play second fiddle to any other organization.

There are coin treats!

TREAT:In creating a tribute to the 50th anniversary of the Kenney half-dollar, the U.S. Mint has made a coin that is not really circulated into something interesting for the collector. The dual-dated gold coin became an instant hit before the price of gold dropped and the silver sets are reportedly selling well. This was a good move by the U.S. Mint.

TREAT:For the most part, commemorative coins are sales do not meet expectation. While there are a few exceptions like 2005 Marine Corps 230th Anniversary silver dollar, most commemoratives do not come close to their maximum mintage. But the 2014 National Baseball Hall of Fame commemoratives appear to have hit a home run. The combination of the subject and the curve of the coin may be a significant factor in the coin’s success. The $5 gold and silver dollar coins are both sold out. There are some of the clad half-dollars available.

TREAT:Speaking of cool stories, what about the Saddle Ridge Hoard? After a couple found the hoard of gold coins while walking their dog, it spawned an interest in metal detectors and searching for buried treasure. It was such an amazing story that it even found its way into the national news cycle. But like everything else, another shiny story diverted the media’s attention and the coins went on sale to the general public on Amazon.com.

Not all coins are treats

TRICK: Colored and coins with gimmicks are proliferating in the market. So far, the U.S. Mint and the Royal Mint are resisting colored and other gimmicks while the Royal Candian Mint and New Zealand Mint are at a race to the bottom for gimmick coins.

Numsimatics and technology

TREAT: The ANA launched its new website with new technology ready for growth on time and under budget. This is the website that ANA Governor Laura Sperber said, “I can’t wait to see what a disaster the ANA new web site will be.” So far, there has not been a follow up from Sperber while the new site has been a success.

TREAT: More recently, the U.S. Mint had a great launch to their new website. After years of frustration with the online ordering of what would be popular items, the new site handled the launch of the 50th Anniversary Kennedy 2014 Half-Dollar Silver Coin Collection with no issues.

Failure to launch

TRICK: The U.S. Mint launched the Baseball Hall of Fame commemorative coin at the Whitman Show in March not anticipating its popularity with fewer coins that there was a demand. It was as if the U.S. Mint had a blind spot with how popular this coin would be.

TRICK: The dealers who paid less than desireable people uninterested in anything other than a quick buck to mob the lines at the Denver Mint and the World’s Fair of Money. I continue to belive that their ethics must be questioned and appropriate actions taken by the ANA even though I do not think that will happen.

TREAT: With the drop in the price of gold, the current price of the gold Kennedy half-dollar tribute is less than what is was at launch. Teach these greedy dealers a lesson and buy the coins for less directly from the U.S. Mint!

U.S. Government hands out coal

TRICK: Because the U.S. Mint can only do what the laws that congress pass tells them they can do and congress is so dysfunctional they cannot even pass laws for issues they agree on, the United States was the only country involved with the Allies on D-Day NOT to issued a commemorative to honor the 70th anniversary of D-Day.

TRICK: In the name of political correctness, the State Department’s Cultural Property Advisory Committee (CPAC) continues to make it difficult for ancient coin collectors to participate in its hobby by allowing countries to ask the State Department to overreach on the enforcement on the Cultural Property Implementation Act. It is turning ancient coin collectors into criminals even for collecting common coins. Their actions are rediculous.

CCAC is the CCAC

TREAT: The Citizens Coinage Advisory Committee suggested creating American Arts medals that will feature the artistic ability of the U.S. Mint’s artist.

TRICK: The arts medals are medals, not coins. Even with the beauty of medals like the 9/11 silver medal, it did not sell like coins would. In fact, it grossly under performed without raising significant sums for the 9/11 Memorial at the site of the Twin Towers in New York. But this is what the CCAC is face with because of congressional dysfunction (see above).

So goodbye everybody, and remember the terrible lesson you learned tonight. That grinning, glowing, globular invader of your living room is an inhabitant of the pumpkin patch, and if your doorbell rings and nobody’s there, that was no Martian… it’s Hallowe’en.

— Orson Welles, The War of the Worlds, CBS Radio, October 30, 1938

Hobo Ike and Jefferson courtesy of Darth Morgan posted at

Coin CommunityOct 16, 2014 | CCAC, coins, First Spouse, gold, news, US Mint

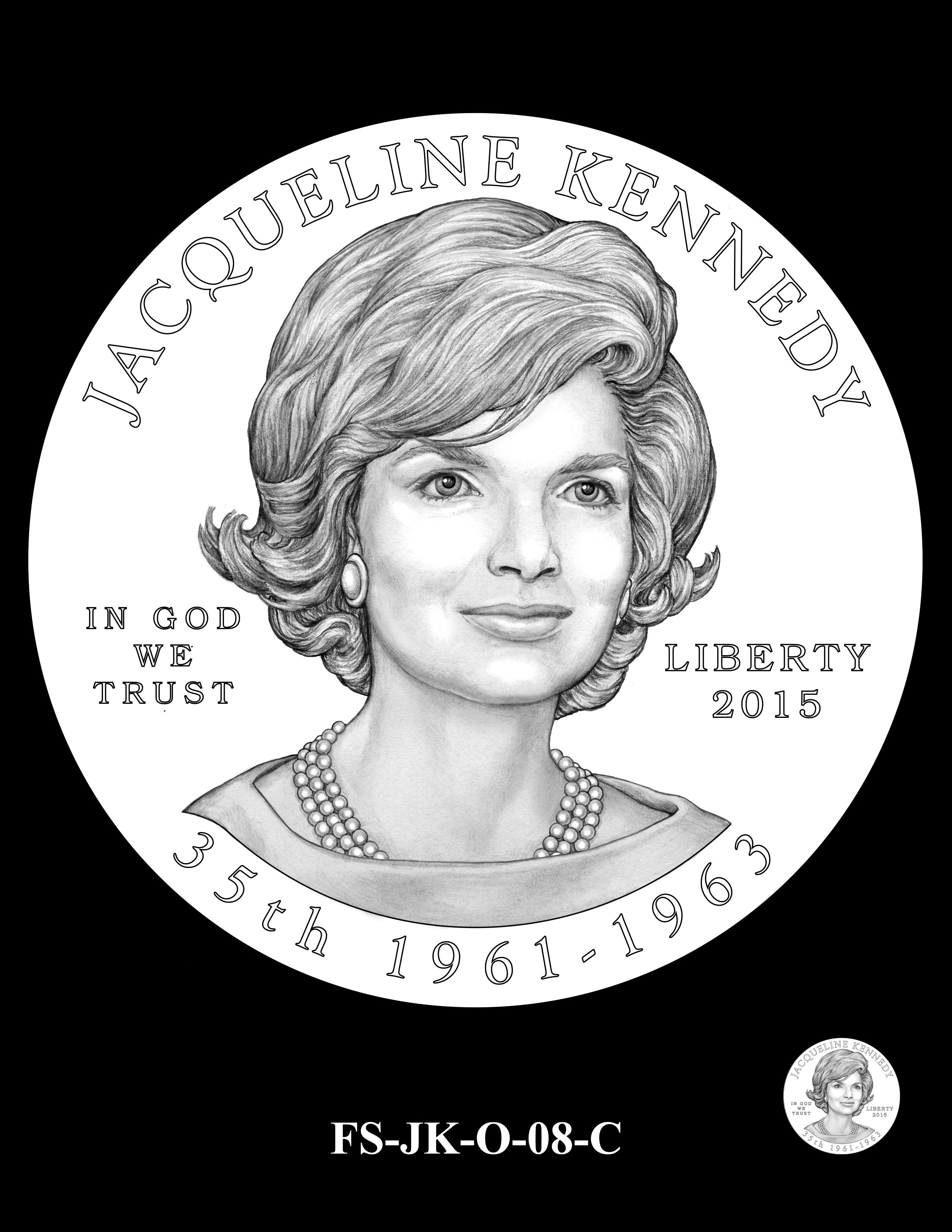

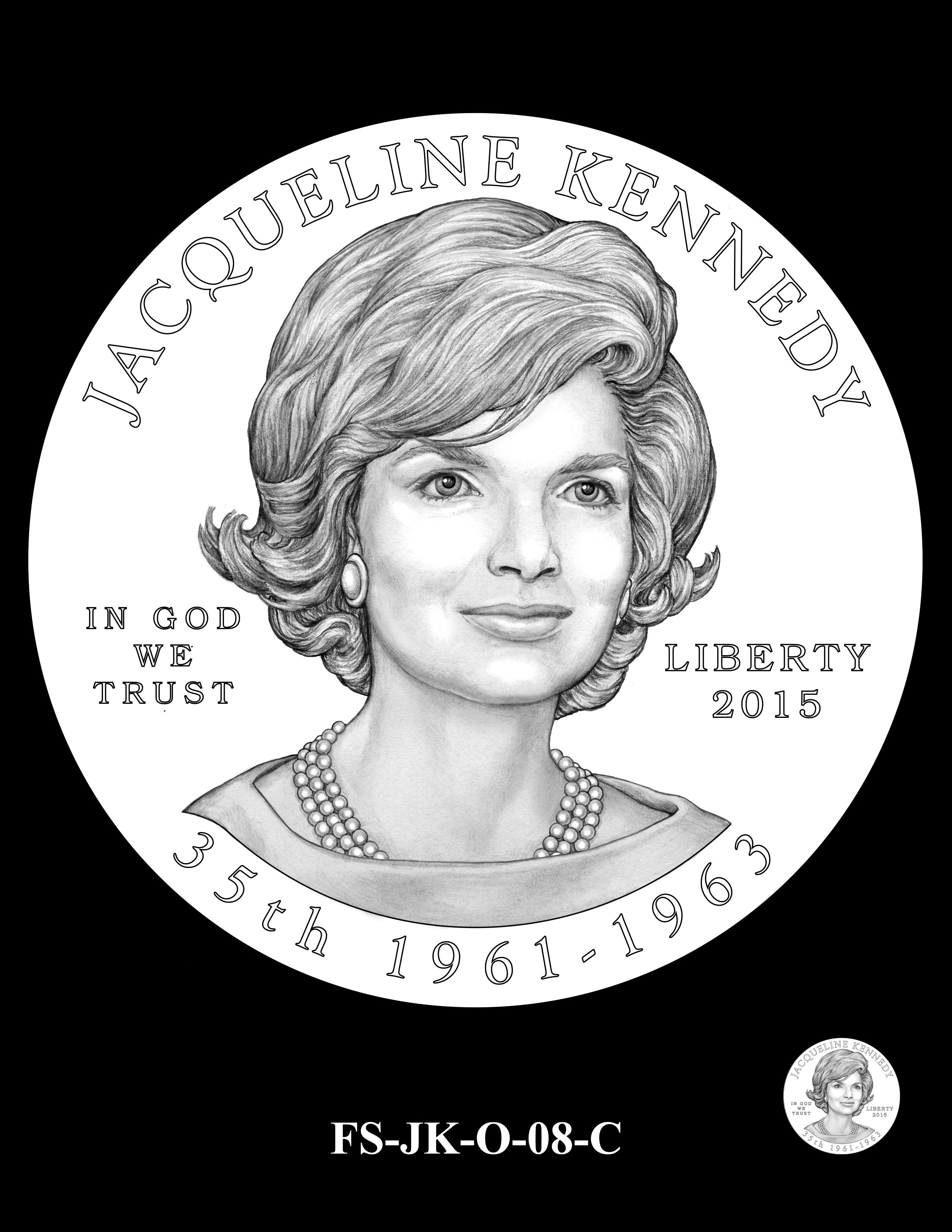

The obverse design selected by the CCAC for the Jacqueline Kennedy First Spouse Gold Coin

For Kennedy, in addition to being renown, the release of the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin may cause a sharp increase in demand from customers seeking to make special Kennedy gold sets using both the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin and the 2015 Jacqueline Kennedy First Spouse Gold Proof Coin. To account for this potential variable, we believe a maximum issuance of 30,000 coins would allow flexibility to increase production should customer demand exceed forecasted sales volumes for the other designs. These maximum mintage limits will be divided between coins with proof and uncirculated finishes based on consumer demand.

The Mint is not obligated to mint, and will not mint, to the maximum mintage limits unless it is supported by public demand. The production process and maximum mintages give us flexibility should there be a surge in demand over previous years.

Oct 7, 2014 | BEP, coins, counterfeit, currency, gold, policy, US Mint

Prior to the public disclosure of secret documents, administrations have declassified documents at various levels for many different reasons that those of us who worked in these areas did not understand what was to be classified at what levels and for how long. Each department and agency had its own rule. However, everything that was classified was supposed to be declassified after 50 years.

In 2009, President Obama issued Executive Order 13526 to try to create some order out of this chaos. Aside from defining the classification levels, document marking requirements, it also allowed agencies to apply to keep documents classified and for longer periods than previous reviews. The purpose was to protect national interests and security while preventing controversial declassification of documents.

Whenever trying to instill a new policy on the government, there will be many barriers to this change. While there are fewer areas of confusion, chaos remains. Of course the disclosures by Chelsea (neé Bradley) Manning and Edward Snowden did not help.

So what does this have to do with numismatics? Both the U.S. Mint and the Bureau of Engraving and Printing applied and were granted exemption from automatically declassifying documents.

Treasury Department, Procurement Division, Public Buildings Branch, Fort Knox – United States Bullion Depository (1939)

What information could these agencies possibly have that would be classified?

According to Steven Aftergood, Director of the Federation of American Scientist Project on Government Secrecy, who interviewed John P. Fitzpatrick, director of the ISOO, the exemption for the U.S. Mint is for “security specifications from the U.S. Bullion Depository at Fort Knox, which was built in the late 1930s.”

In a comedic turn, Mr. Fitzpatrick told Aftergood, “Think ‘Goldfinger’.”

Then why does the Bureau of Engraving and Printing need an exemption from declassification for 25-years? A source familiar with the filing said that the exemption covers counterfeiting information. According to sources, there are anti-counterfeiting measures added to currency that have been planned for many years that have not been advertised. These are used by the United States Secret Service and other law enforcement organizations to detect counterfeiting. Many of the documents cover the planning for the changes that began in the 1990s.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

And you thought all the U.S. Mint and Bureau of Engraving and Printing did was manufacture money!

Sep 12, 2014 | bullion, coins, gold, halves, US Mint, values

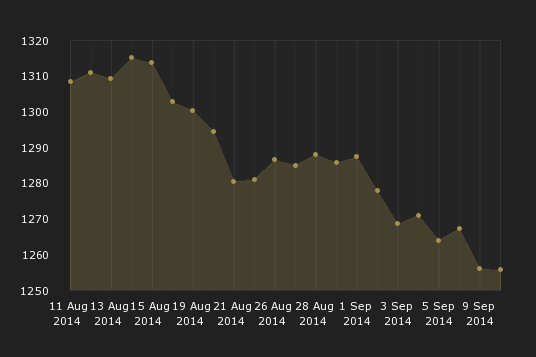

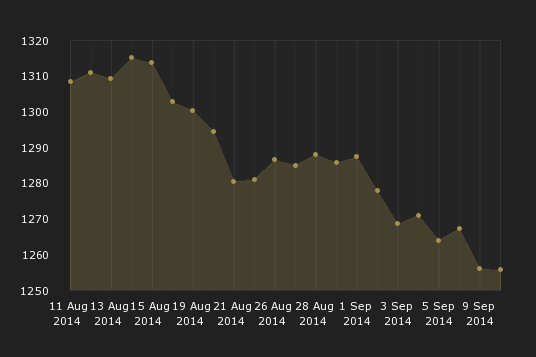

If you have not seen what has been going on in the gold market, the prices have been falling. The financial press has not provided a single reason as to why the gold market is going down but there is a consistent view that the United States economy showing strength with unemployment dropping and low inflation may be alleviating fears in the markets. Stocks are rising and it is suspected that investors are selling their gold shares in order to participate in the bull market.

For collectors it means that the U.S. Mint could adjust the prices of precious metal products. In particular, the price is coming down that could affect the price of the Kennedy gold half-dollar. Based on the table published in the Federal Register [PDF], if the London Fix price of gold falls below $1,250 per troy ounce, the price of the coin will drop to $1,202.50 or $37.50 below the $1,240 issue price.

The London Fix is now managed by The London Bullion Market Association. Gold prices are set by an auction that takes place twice daily by the London Gold Fixing Company at 10:30 AM and 3:00 PM London time. Auctions are conducted in U.S. dollars. The benchmark used by the U.S. Mint is the PM Fix price on Wednesday.

On September 10, 2014, the London PM Fix was $1,251.00 which will leave the price of the Kennedy gold half-dollar $1,240.

London PM Gold Fix for the month leading up to September 10, 2014

London PM Fix on September 10 was $1,251.00

Prices are in U.S. dollars

A strong economy is good for many reasons. In this case, when the price of gold drops the price of gold coins also drops. While this is not good for investors, it benefits collectors who will buy one or two coins for their collections. It also means that the value of the inventory that the dealers who spent a lot of money and effort in order to be first will be worth less than previously. After all, if the U.S. Mint is going to produce as many coins as the demand, then the public is better off saving money and buy from the U.S. Mint.

As anyone who has invested money will tell you that it is dangerous to try to time the market. I am sure that if you can figure out when the price of gold will be at its lowest while the U.S. Mint is still selling the Kennedy gold half-dollar, I know a bunch of people on Wall Street who want to talk with you. That being said, I have a feeling that the trends are in favor of waiting to see what happens. Although I have not decided whether I will buy a coin, I am going to wait to see what the market does. If the price of gold continues to fall, I could be convinced to buy one of these coins for myself.

Pricing for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin

As published in the Federal Register (

79 FR 38127)

on July 3, 2014

| London PM Fix |

Item |

Sale Price |

| $1000.00 to $1049.99 |

¾ Troy oz |

$1,052.50 |

| $1050.00 to $1099.99 |

¾ Troy oz |

$1,090.00 |

| $1100.00 to $1149.99 |

¾ Troy oz |

$1,127.50 |

| $1150.00 to $1199.99 |

¾ Troy oz |

$1,165.00 |

| $1200.00 to $1249.99 |

¾ Troy oz |

$1,202.50 |

| $1250.00 to $1299.99 |

¾ Troy oz |

$1,240.00 |

| $1300.00 to $1349.99 |

¾ Troy oz |

$1,277.50 |

| $1350.00 to $1399.99 |

¾ Troy oz |

$1,315.00 |

| $1400.00 to $1449.99 |

¾ Troy oz |

$1,352.50 |

| $1450.00 to $1499.99 |

¾ Troy oz |

$1,390.00 |

| $1500.00 to $1549.99 |

¾ Troy oz |

$1,427.50 |

| $1550.00 to $1599.99 |

¾ Troy oz |

$1,465.00 |

| $1600.00 to $1649.99 |

¾ Troy oz |

$1,502.50 |

| $1650.00 to $1699.99 |

¾ Troy oz |

$1,540.00 |

Fixing chart courtesy of London Gold Fixing Company.

Aug 13, 2014 | ANA, coins, commemorative, commentary, ethics, gold, shows, US Mint

From the raw video of people dashing across the street at the Denver Mint

The media reported that those waiting for to purchase the coins were not collectors. Most were being paid by dealers to be on the line in order to get around the U.S. Mint purchasing limits. As part of their attempt to game the system, these dealers put collectors and the general public in danger by handing large amount of cash to needy people who did not conduct themselves in a manner that is consistent with the ANA Code of Ethics. Since those behaving badly were being paid by the dealers, they are representatives of the dealers, making the dealers responsible for the action of those they employ.

In case those dealers have forgotten, according to the ANA Code of Ethics:

As a member of the American Numismatic Association, I agree to comply with the following standards of conduct:

- To conduct myself so as to bring no reproach or discredit to the Association, or impair the prestige of the membership therein.

This applies directly to the dealers whose action caused problems at the World’s Fair of Money. Since sales of the coin were made at the U.S. Mint’s booth on the bourse floor, this is a case where the dealers who participated in this discredited the Association by creating an environment that potentially jeopardized the security of the show. By putting the security in jeopardy and bringing this negative publicity to the World’s Fair of Money, the participating dealers impaired the prestige of the membership especially when they had to put the U.S. Mint and the ANA Executive Director in the position to have to act as a parent to dealers acting like impetuous children.

- To base all of my dealings on the highest plane of justice, fairness and morality, and to refrain from making false statements as to the condition of a coin or as to any other matter.

Although the launch of the 2014 National Baseball Hall of Fame commemorative coin during the Whitman Baltimore Expo was a success, there was a feeling that the sales format did not give collectors a chance to purchase the coin. In order to promote the broader sales of the coin, the U.S. Mint adjusted its sales requirement to limit over-the-counter sales in order to give more collectors the opportunity to purchase the new Kennedy gold coin. How could the U.S. Mint or the ANA know that the sales of a coin that does not have any mintage limits would cause problems when the sales of a commemorative coin with mintage limits went without significant issue?

Unfortunately, the intent of the U.S. Mint was impeded by some dealer’s plane of justice by their action. By immorally trying to get around the U.S. Mint’s sales limits by using questionable methods to unfairly stack the line against the collector, the dealers were making false statements to a government entity, and thus the public it represents, as to their eligibility to purchase the coin.

The appalling images provided by Denver television news (see below) of the behavior of those described as homeless on behalf of the dealers trying to get around the sales limits not only is not only unjust to legitimate purchasers and immoral, but as ANA members discredits themselves as ANA members.

Therefore, I am accusing ALL of the ANA members who hired these people that acted on their behalf of the ANA dealers with violation of the ANA Code of Ethics. The ANA Board of Governors must take action to restore the organization’s credibility by suspending those involved as per the ANA Bylaws!

Images of the shameful display caused by ethically challenged and greedy dealers courtesy of

ABC 7News Denver.

Aug 6, 2014 | coins, gold, halves, US Mint

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Watching the scene from afar gives it a reality television-like feel. Just like reality television, I find it difficult to understand the appeal of having to be the first or one of the first to purchase the coin. In this case the people who bought the first coin had the coin slabbed and was paid $20,000 for the coin, what about the people standing in line behind them? Were they expecting to resell the coin to a dealer desperate to have the coin in their inventory? Was the line there representing dealers who will advertise that they have the coin from the first day of issue and mark up the price for those who collect the labels and not the coin?

If you are interested in purchasing the coin and not worried about the hype, I recommend that you buy the coin directly from the U.S. Mint. First, the U.S. Mint has already announced that there will not be a production limit. While there are initial sales limit, the U.S. Mint will strike as many as ordered. Second, those coins purchased at the U.S. Mint booth at the World’s Fair of Money will likely be removed from the U.S. Mint packaging and entombed in one of the third party grading company’s hunk of plastic. The price will be overly inflated.

When you buy the coin from the U.S. Mint, the price you will pay is the market price of three-quarters of a troy ounce of gold, the full cost of manufacture, and the packaging. According to the U.S. Mint, “The coins are encapsulated and packaged in a single custom-designed, brown mahogany hardwood presentation case with removable coin well and are accompanied by a Certificate of Authenticity.” That mahogany hardwood presentation case is probably not cheap. If it is the same case that has been used for past special coin programs, then it is a nice package and should display the coin nicely. You will probably not receive the presentation case from the dealer that slabbed the coin. In fact, some dealers have started to sell the empty presentation cases without the coin—essentially, double-dipping at the expense of the purchaser of the coin.

The final reason to buy the coin directly from the U.S. Mint online or via the telephone is that there is a limit of five coins per household. When you buy the coin at one of the U.S. Mint facilities or this week at the World’s Fair of Money, you are limited to buying one coin and that there is a daily sales limit of 500 coins at each location.

With no offense intended to dealers who will have plenty of opportunities to make money on this coin in the future, I recommend that Coin Collectors Blog readers who want to purchase a coin for their own collection to buy it directly from the U.S. Mint. Even if the price of gold rises, the U.S. Mint pricing table [PDF] for these coins shows that the difference is about $35 per pricing band. I suspect that it will be less than the premium that many dealers will add to the price of the coin at the same time it is available from the U.S. Mint, except that they can sell you the coin now and you will not have to wait.

First Day Sales Figures

The U.S. Mint released their first day sales figures for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin:

| Online/Call Center Sales |

54,825 |

| ANA World’s Fair of Money |

493 |

| U.S. Mint Headquarters, Washington, DC |

376 |

| Philadelphia Branch Mint |

500 |

| Denver Branch Mint |

500 |

| All sites |

56,694 |

Coin image courtesy of the U.S. Mint.

Jul 31, 2014 | coins, gold, halves, US Mint

According to the U.S. Mint:

According to the U.S. Mint:

Because of the expected overwhelming response, dialog with our customers and many others interested in the 50th Anniversary Kennedy Half-Dollar Gold Proof Coin, the United States Mint is reducing the over-the-counter purchase limit to one unit per customer.

This change in the purchase limit will give more members of the public an opportunity to purchase this popular coin, essentially doubling the number of customers able to purchase it. The number of units available at each retail location (Philadelphia and Denver facilities, Washington, D.C., headquarters and Chicago ANA World’s Fair of Money) will remain the same. There will be 500 units available initially at each United States Mint location (Philadelphia, Denver and Washington) and an additional 100 units per day for the first three days after the product launch. There will be 2,500 at the ANA, 500 available per day of the convention.

The household ordering limit of five will remain the same.

UPDATE: The price effective for the August 5 opening day of sales for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof is $1,240. See the U.S. Mint’s online catalog for more information.

NOTE: Usually I do not post press releases directly since there are many other places to see these announcements. Since there has been a lot of interest in these coins, I am posting this as a service to my readers.

Jul 22, 2014 | CCAC, coins, Eagles, gold, medals, silver, US Mint

Proposed reverse for the 2015 Ultra High Relief gold coin

Along with the gold coin will be a companion silver coin struck on the one-ounce planchet that is used for the American Silver Eagle. Although it was not specifically addressed, it is assumed that silver coin will be of the same or similar relief of the gold coin.

This afternoon I was able to break away from my daily activities to attend the CCAC meeting via conference call. This is the first time I attended one of their meetings and came away a little surprised and a little appalled.

What surprised me with the meeting is how in lock-step the committee is on everything. There appears to be no disagreement or questioning of what the U.S. Mint had proposed. Granted the committee members may have history with the issues beyond this meeting, but I was surprised that alternatives were not recommended or discussed.

The committee was excited because the proposal was somewhat in alignment with a motion they passed last April to create a Liberty Medal series. According to Gary Marks, chairman of the CCAC, the Liberty Medal Series would be an arts medal produced by the U.S. Mint to foster new design and innovation. It is to encourage the artists to have artistic impression beyond what they are allowed to do as part of the coin programs.

I do not know if it was previously discussed but according to the authorizing law for the American Silver Eagle bullion program (31 U.S.C. § 5112(e)(3)) the coins must have a design “symbolic of Liberty on the obverse side” and “of an eagle on the reverse side.” The law does not say that the obverse must be Adolph Weinman’s Walking Liberty design and it does not say that the reverse must be a heraldic eagle. Why has the committee not considered using the existing American Silver Eagle program to create a Liberty design program?

In discussing the overall medallic arts program, the CCAC decided to create a study group to come up with a plan to recommend to the U.S. Mint. Aside from the “American Liberty Silver Medal Program,” as described by Marks, he also proposed Freestyle Medal of an American theme. This would be one medal per year that would be artistic representations.

CCAC Member Heidi Wastweet said that the arts medal will allow for experimenting; allow the artist and designers to “expanding our wings” for future projects. As a result, it will let future stakeholders know what is possible so that it would inspire better designs.

While a medals program is a good idea, what seems to be missing is the subject matter. If the Liberty design can be leverage through the American Eagle bullion program, why not have medals used to honor history? Why is it when nations around the world issued commemorative coins honoring D-Day, the United States, whose mint is overly regulated by intransigent politicians, did not issue any commemorative item on the 70th anniversary of an event that changed world history?

Expanding the medals program in this manner would be the perfect way to honor history when congress has failed to remember they represent a country rather their owners… I mean donors!

Where I was appalled was what I saw as over-the-top cult-like patriotic gushing by some of the members over the proceedings. I thought the CCAC was supposed to be an oversight organization; at least that is how it appears to be described in the authorizing law (31 U.S. Code § 5135). There should not be a problem with supporting the work of the U.S. Mint and support the artists whom everyone agrees should be treated better. However, there were some comments that sounded more like members were wrapping themselves in the flag rather than working on an oversight committee.

As part of his closing remarks, Chairman Marks said, “I believe that this is the single most impactful idea that the Mint can pursue at this point in time in the United States.” Unfortunately, I wish this was the case. It appears to be another missed opportunity by the CCAC similar to previous missed opportunities by this committee.

I will have more commentary in the coming days.

Background from the U.S. Mint

Potential Products

2015 24-karat Gold Ultra High Relief Coin

2015 Silver Medal

Background

- As a result of the success and popularity of the 2009 Ultra High Relief Double Eagle Gold Coin, the United States Mint (Mint) is considering producing a 2015 24-karat Gold Ultra High Relief (UHR) Coin.

- The CCAC recommended a new eagle design for the reverse of the American Eagle Silver One Ounce Coin, a change the Mint is not pursuing, opting instead to consider showcasing the beauty and intricacies of the recommended design on a 2015 24k Gold UHR Coin.

- To compliment such a reverse, the Mint would consider featuring a new, modern rendition of Liberty on the obverse of the 2015 24k Gold UHR Coin.

- If developed, a 2015 24k Gold UHR Coin would be comparable to the 2009 Ultra High Relief Double Eagle Gold Coin, in that it would also be one troy ounce. The denomination would also have to be determined.

- To make such a design accessible to various ranges of collectors, the Mint is considering the possibility of producing a medal, struck in silver, bearing the same design as a 2015 24k Gold UHR Coin. Striking these medals in silver would provide an additional opportunity to showcase the intricacy of the design features and the beauty of the artwork.

- If this concept is pursued, the United States Mint would seek Secretary of the Treasury approval to strike this gold coin under authority of 31 U.S.C. § 5112(i)(4)(C).

- If this concept is pursued, the United States Mint would seek Secretary of the Treasury approval to strike this silver medal under authority of 31 U.S.C. § 5111 (a)(2).

Design History

- In 2009, the United States Mint fulfilled the original vision of Augustus Saint-Gaudens with the release of the 2009 Ultra High Relief Double Eagle Gold Coin; closing one chapter of American coin design and beginning a new one.

- If produced, 2015 24k Gold UHR Coins could be viewed as a follow up to the 2009 Double Eagle UHR, contrasting classic American coin design with modern American coin design.

Image courtesy of the U.S. Mint.

According to the

According to the