May 26, 2015 | books, coins, gold, history, US Mint

With the court ruling against Joan Langbord and forcing her to surrender the ten 1933 Saint-Gaudens Double Eagle gold coins she claims to have found, there remains only one legally to own 1933 Saint-Gaudens Double Eagle coin.

With the court ruling against Joan Langbord and forcing her to surrender the ten 1933 Saint-Gaudens Double Eagle gold coins she claims to have found, there remains only one legally to own 1933 Saint-Gaudens Double Eagle coin.

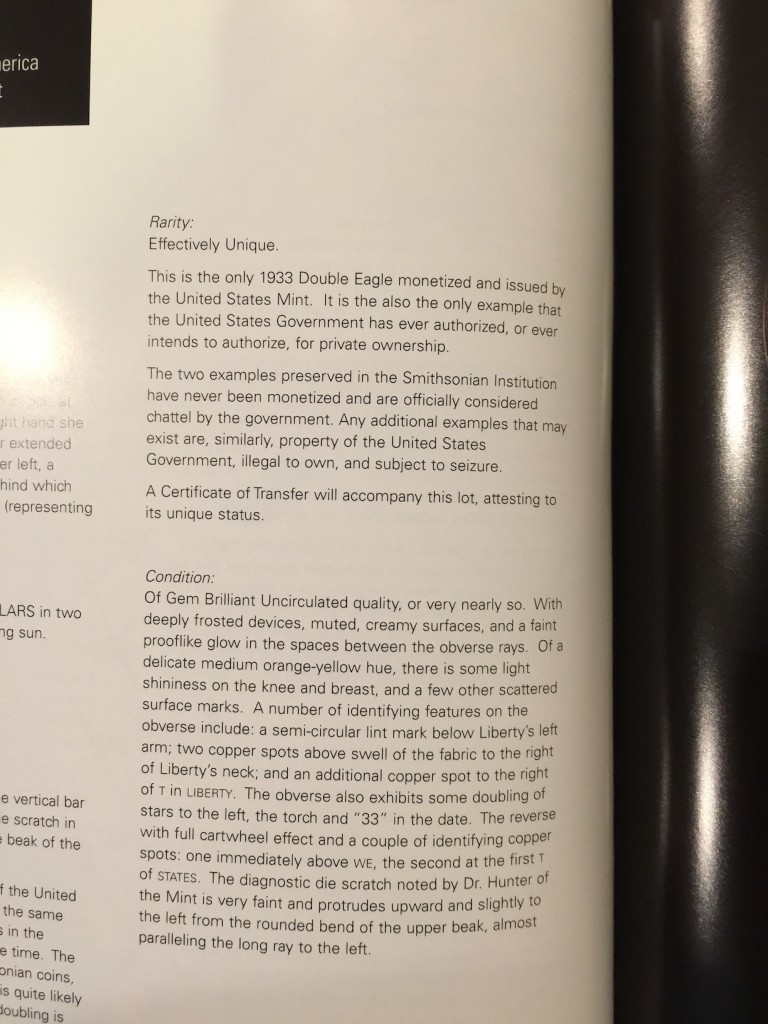

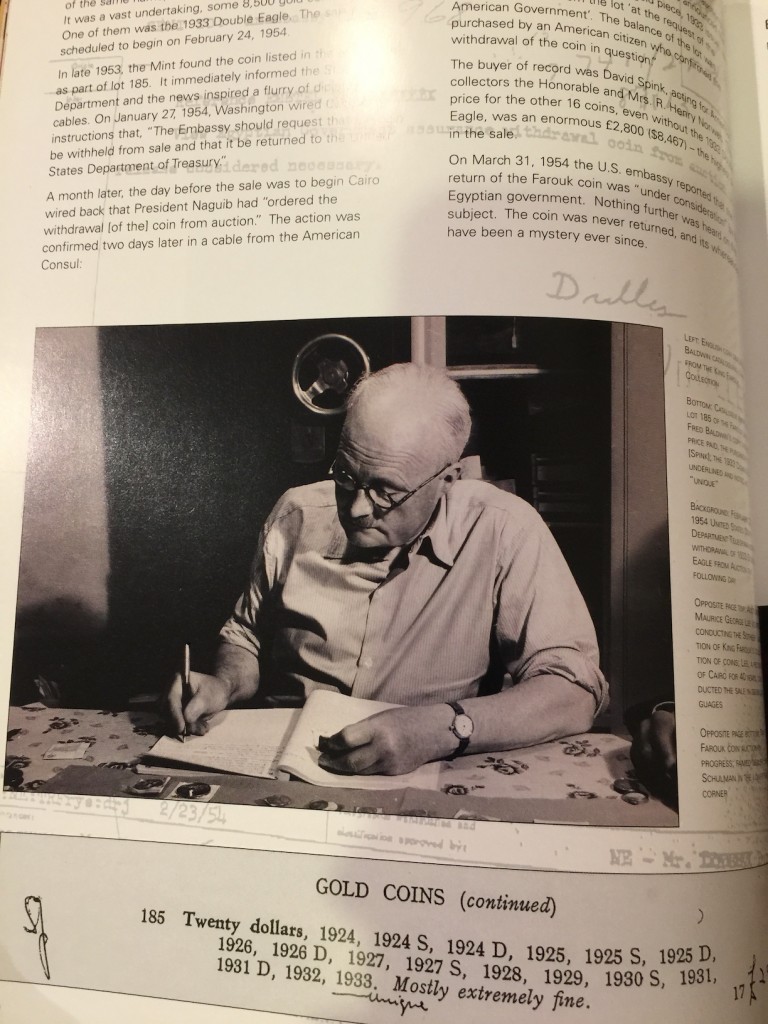

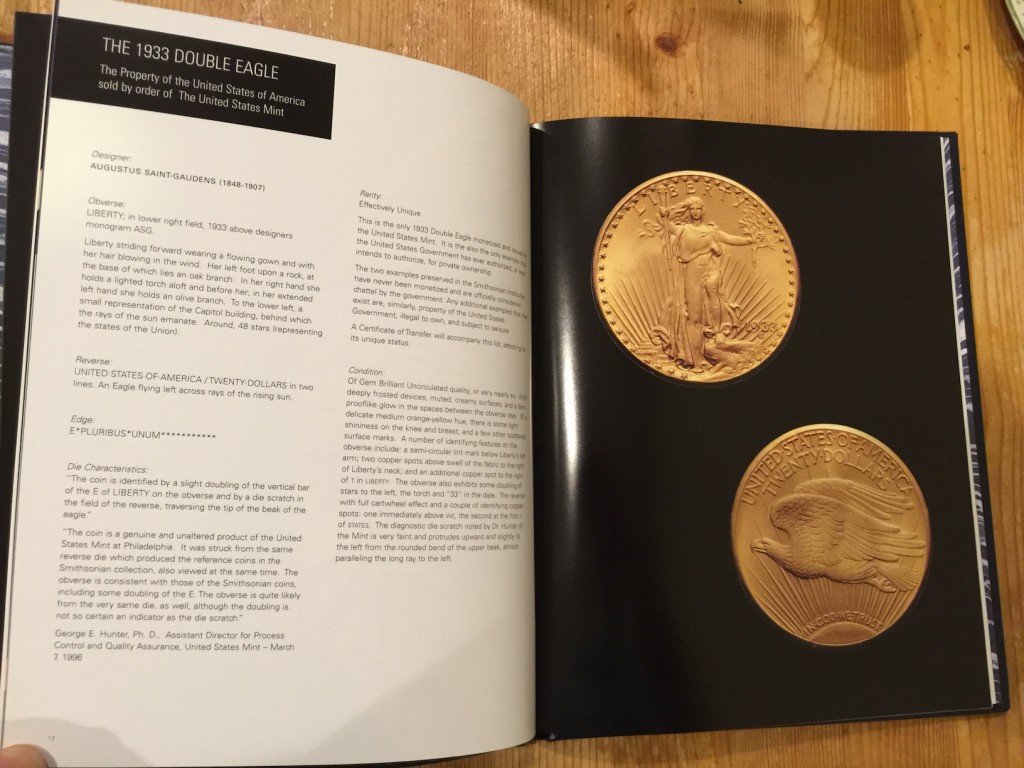

Currently, there is only one example of this coin that is legal to own. Dubbed the Farouk-Fenton 1933 Saint-Gaudens Double Eagle, researchers traced the coin was legally exported to Egypt for King Farouk.

In 2002, the coin sold at auction for $7,590,020 to a private collector. As part of the settlement that made the auction necessary, the proceeds were divided between the United States government and British coin dealer Stephen Fenton. The FBI arrested Fenton trying to sell the coin at the Waldorf Astoria Hotel in 1998.

The sale price stood as the most paid for a single coin until the sale of the 1794 silver dollar sold for $10,016,875 in January 2013. While the 1794 silver dollar had a great story, nothing compares to the sale of the coin known as the Farouk-Fenton Double Eagle.

The coin’s colorful history is documented in two books that span the coin’s history from the conditions of their beginning to the auction sale, including being removed from storage at the World Trade Center before its destruction on September 11, 2001.

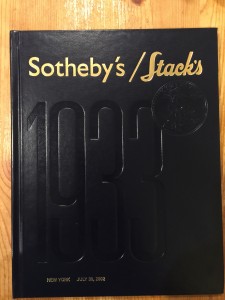

It is not a coin that an ordinary collector can own. Rather than owning the coin, why not own the auction catalog from that sale?

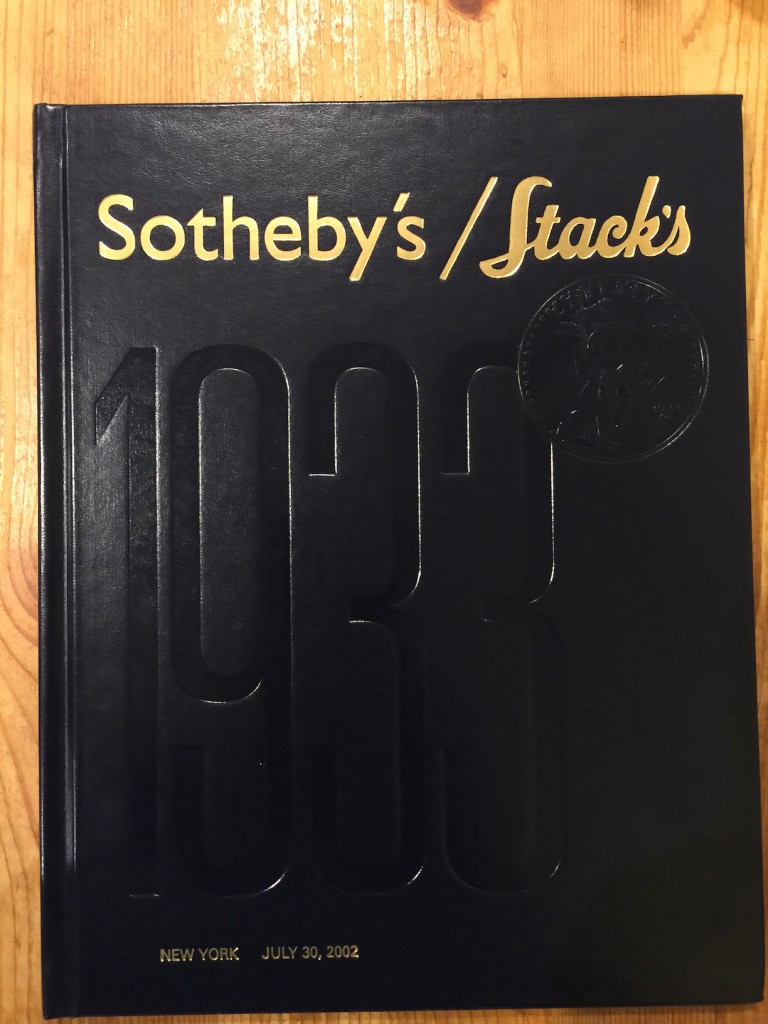

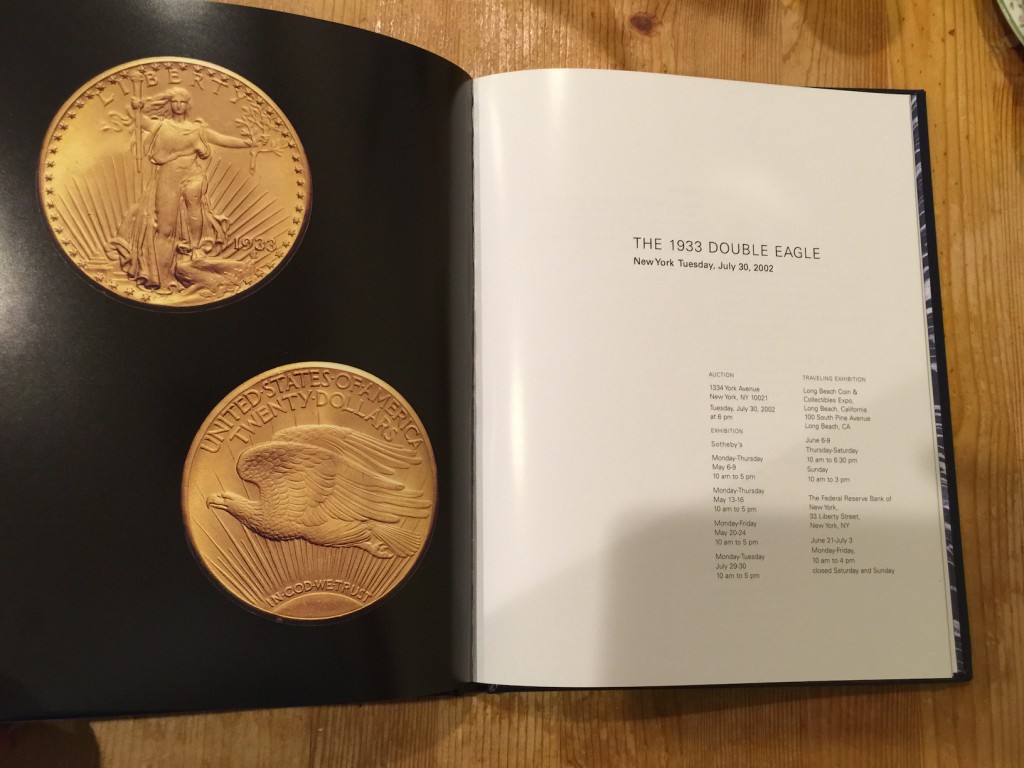

Stack’s partnered with Sotheby’s to auction the coin. It was the only lot in the auction held at Sotheby’s New Yor headquarters at 6:00 PM on Tuesday, July 30, 2002. The highest bid was $6.6 million when the hammer fell. A 15-percent buyer’s premium made the sale price $7,590,000. To monetize the coin, the government required the $20 face value payment that the Federal Reserve would have paid in 1933.

I purchased the auction catalog from Kolbe & Fanning during a recent sale. It is a special hardbound edition with over 50-pages about the coin, this sale, and its history. Most of the contents were written by David Tripp, who was then the director of Sotheby’s coin, tapestry, and musical instrument departments. Tripp later expanded on what he wrote for the catalog and published Illegal Tender: Gold, Greed, and the Mystery of the Lost 1933 Double Eagle.

It was a beautifully produced auction catalog. Even though the catalog is a summary of Tripp’s book, it is a piece of numismatic history. And since I cannot afford the coins, I bought the book instead of the coin.

Updated on March 12, 2021

May 6, 2015 | BEP, coins, commemorative, currency, Federal Reserve, legislative, policy, US Mint

For those of us who are political junkies, April was a relatively quiet month. At least there was something to watch that was more related to the hobby than the usual partisan bickering. Here are the coin and currency-related legislation moving through congress:

S. 925: Women on the Twenty Act

Sponsor: Sen Jeanne Shaheen (D-NH)

• A bill to require the Secretary of the Treasury to convene a panel of citizens to make a recommendation to the Secretary regarding the likeness of a woman on the twenty dollar bill.

• Introduced: April 14, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s925

S. 95: A bill to terminate the $1 presidential coin program

Sponsor: Sen. David Vitter (R-LA)

• Introduced: January 7, 2015

• Discharged from Senate Committee on Homeland Security and Governmental Affairs by Unanimous Consent on April 14, 2015

• Referred to the Senate Committee on Banking, Housing, and Urban Affairs on April 14, 2015

Track this bill at https://www.govtrack.us/congress/bills/114/s95

S. 985: United States Coast Guard Commemorative Coin Act

Sponsor: Sen. Christopher Murphy (D-CT)

• To require the Secretary of the Treasury to mint coins in commemoration of the United States Coast Guard.

• Introduced: April 16, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s985

Apr 18, 2015 | coins, gold, legal, news, US Mint

The ten 1933 Saint-Gaudens Double Eagles confiscated by the government from Joan Lanbord, daughter of Israel Switt.

The original suit was filed in the U.S. District Court in Philadelphia by Barry H. Berke on behalf of Joan Langbord, the surviving daughter of jeweler Israel Switt, and her sons Roy and David. Berke is no stranger to these types of law suits. He represented the plaintiffs in the case that resulted in the sale of the Farouk coin in 2002. In July 2011, the jury returned a verdict declaring the coins to be government property.

1974-D Aluminum Cent (J2151)

This case is different since it is further along and about what was to be a circulating coin.

The ruling, written by Judge Marjorie O. Rendell,† centers around the government’s use of Civil Asset Forfeiture Reform Act of 2000 (CAFRA). CAFRA was passed as a “eact[ion] to public outcry over the government’s too-zealous pursuit of civil and criminal forfeiture” and as an “effort to deter government overreaching.” The government said that the Langbords did not file their suit within the 90-day time period. However, the ruling says that it does not imply because “Congress has specifically enumerated theft or embezzlement of government property as one of the crimes to which CAFRA applies.” Since the government called the assets stolen and then ignored the Langbords’ claim for the government to return the coins, they did not prove that the assets were embezzled and CAFRA does not apply.

In the areas where CAFRA did apply, the government did not respond to the Langbords’ request for return of the assets within the 90-days required by law. “The Langbords are correct in urging that we reject these arguments. The Government was required either to return their property or to institute a judicial civil forfeiture proceeding within 90 days of the Langbords’ submission of a seized asset claim.”

The three judge panel concluded “he Langbords are entitled to the return of the Double Eagles.” The appeal overturns the lower court’s ruling and the Appeals Court “will remand for the District Court to order the Government to return the Double Eagles to the Langbords.”

This may not be the end of the story. The government can ask for a temporary stay of the order in order to file an appeal. At that point the government attorneys can either appeal the ruling by the three-judge panel to the full Appellate Court (a full 9 judge panel) or directly to the Supreme Court.

My opinion: considering how the government has behaved throughout the saga of these coins, I think they will try to appeal this ruling to the full Third Circuit. It drags the case out longer and allows the government to put its considerable heft against the the Langbords. I do not think the government will settle this suit in a similar manner that the King Farouk coin was settled. However, if I understand the procedures correctly, the Langbords can claim that the case has significant public interest and ask for it to be heard by the Supreme Court. The Supreme Court then will decide to hear the case or let it be heard by the Third Circuit first. Regardless, I think the next stop is the Supreme Court where the most fascinating story in U.S. numismatics will be settled.

Or will it?

† Judge Rendell was appointed by President Bill Clinton in 1997. She was also the First Lady of Pennsylvania during the term of her then husband

Ed Rendell (2003-2011). The Rendells have since “

amicably separated.”

Image of the 10 Double Eagles courtesy of the U.S. Mint.

Image of the Aluminum cent originally from the Smithsonian Institute.

Apr 10, 2015 | cents, coin design, coins, economy, news, US Mint

The U.S. Mint has sent out a press alert saying that CBS Sunday Morning will air two segments this Sunday, April 12th, that may be of interest to collectors. The first segment will focus on the artists and engravers in Philadelphia and the role they play in the coin-making process. The segment will also look at some of the Philadelphia Mint’s history.

The U.S. Mint has sent out a press alert saying that CBS Sunday Morning will air two segments this Sunday, April 12th, that may be of interest to collectors. The first segment will focus on the artists and engravers in Philadelphia and the role they play in the coin-making process. The segment will also look at some of the Philadelphia Mint’s history.

A second segment will look at the penny and the debate about whether or not it should be eliminated.

Anthony Mason

CBS Sunday Morning is usually hosted by Charles Osgood and airs at 9 am Eastern Time. Check your local listings to see when it airs in your region.

Mar 30, 2015 | Baltimore, BEP, books, coins, commemorative, Red Book, tokens, US Mint

As it does three times per year, Whitman rolls into the Baltimore Convention Center for the Whitman Baltimore Expo. This time, rather than the showing being in Halls A and B it was held in E and F. The new location within the building was not as intuitive to find as walking to the end and Whitman did not do as good of a job as they could have in placing their signs. But for general access, which is was off of South Sharp Street, it provided a little better access than off of West Pratt Street, which is a main artery as it passes in front of the Inner Harbor.

As it does three times per year, Whitman rolls into the Baltimore Convention Center for the Whitman Baltimore Expo. This time, rather than the showing being in Halls A and B it was held in E and F. The new location within the building was not as intuitive to find as walking to the end and Whitman did not do as good of a job as they could have in placing their signs. But for general access, which is was off of South Sharp Street, it provided a little better access than off of West Pratt Street, which is a main artery as it passes in front of the Inner Harbor.

Although there were the same number of booths, the space felt smaller. Lights were brighter since these halls seem to have been converted to using LED lighting—the brighter space made the convention center seem less cavernous. Aisles were not as wide and some of the layout changed, but it seemed to have the same number of dealers. Some of the dealers who had larger spaces did downsize and the one vendor of supplies that is not Whitman did not set up at the show. It is not known if they decided not to attend or were not invited to attend. Since Whitman does not carry all books and supplies, it would be nice if they had another supplier.

On thing I have noticed is that since the death of numismatic book dealer John Burns in early 2014 there seems to be fewer numismatic book offerings at some of the east coast shows. Aside from missing his sharp wit, I was always able to find something a little off-beat or out of the ordinary amongst the books he had for sale. While there was a book dealer at this show, the items were more toward what I would consider ordinary. I hope someone steps in with some interesting items.

As I walked the floor and spoke to many of the dealers (late Friday afternoon), they all said that they were doing well. With the area still a bit chilly and no sports to take over the downtown Baltimore area (home opener for the Baltimore Orioles is on Friday, April 10), visitors to downtown Baltimore had plenty of time to visit. For those of us who like access to a major coin show, it is good to hear. If the dealers are doing well then they will keep coming back. If the dealers come back, the show goes on.

Both the U.S. Mint and Bureau of Engraving and Printing had booths at the show. While the U.S. Mint was showing current products, the Bureau of Engraving and Printing had some historical information. Although it is good to see the U.S. Mint at the show, it might be nice to see some historical artifacts. Since most of the U.S. Mint’s collection was given to the Smithsonian Institute, maybe they can be convinced to bring an exhibit to the show. Having the Smithsonian there would be very different than other shows since they have a different type of collection than the American Numismatic Association, for example.

2015 March of Dimes Commemorative Proof set will cost $61.95 when released

Another interesting find was the First Edition of the Red Book Deluxe Edition. While flipping through it at the show, it looks like the Red Book on steroids. There is more information, more detail on pricing, and some other features. A first impression is that it extends the Red Book franchise a bit beyond what they called their Professional Edition. While there is a lot of information, my first impression is that I wish it was more of a cross between the Professional Edition and the Coin World Almanac. Both books have their places, but to combine the pricing and information that is updated yearly (the Coin World Almanac is updated every 10 years) would be a great resource. Hopefully, I will get my hands on one to review.

Finally, no show would be complete with out my one cool find. After walking the floor for a few hours I finally stat at the table of Cunningham Exonumia and had a nice chat with Paul Cunningham while searching for something New York. While I have not given up coins or Maryland Colonial Currency, I seem to be having more fun trying to find tokens and other exonumia from New York City and my hometown of Brooklyn. I have seen Paul at many other shows and have purchased from him. He always has a great selection. For me, I may have exhausted some of his inventory. This time, the pieces he was offering this weekend I already have in my collection.

But it did not stop me from looking. Tokens are very interesting. They are alternatives to money and are more tied to the culture of the community than money. For me, a New York Subway token not only represented a ride on the subway, but it also represents a different part of my life. It makes collecting very person. Although I have a collection of subway tokens I continue to look because you never know what you can find—especially an error.

What I found was a large token with an error. It was sold as the “Large Y” token where the “Y” was supposed to be cutout. Those tokens were used from 1970-1978 and two fare increases starting out at 30-cents in 1970, 35-cents in 1972, then 50-cents in 1975. But what I found is not that token. After examine the token carefully and some others I have, this is an error to the “Solid Brass NYC” Token. Introduced with the 60-cent fare in 1980, the “Y” was part of the raised design and not cutout. The clue as came when examine the obverse (the side that says “New York City Transit Authroity”). Between the “N” and the “C” is the tail of the “Y” but without its top. That tail would not have existed on the earlier tokens because they would have been cut out. Instead, the is a die issue where only the tail of the “Y” on one side was struck.

Large Brass “NYC Token” used from 1980-1985 with partial “Y” (obverse)

Large Brass “NYC Token” used from 1980-1985 with missing “Y” (reverse)

It might not be the error I expected, but it is an error nonetheless! It also does not make it any less fun or valuable because it will fit nicely in my collection.

If you were not able to make it Baltimore, here are some of the pictures I had taken at the show:

Mar 21, 2015 | bullion, gold, markets, news, palladium, platinum, US Mint

Last day at the London Fix market

The move to an electronic system followed the revelation that in June 2012 an employee of Barclays Bank manipulated the gold fixing process. Unfortunately, it was not an isolated incident. When Barclays was investigated, it was revealed that there were such system and control failures that members of the bank had been manipulating gold prices since they started hosting the market. In May 2014, the Financial Control Authority, the British equivalent Commodity Futures Trading Commission, fined Barclays £26 million for not properly managing the market.

What made the old system susceptible to manipulation was that it was still widely a human controlled process with bidding arbitrarily controlled behind then scenes. Even as the market moved toward a more technological approach, it was as if the technology was being used as the proxy with a human still doing the arbitration. Think of it as if the computers would provide the bidding but there was still an human auctioneer managing the bids.

The new market is electronically run and monitored in cooperation with the LBMA. Rather than a single source being responsible for all of the benchmark prices, the LBMA Gold price auctions are held twice daily by the ICE Benchmark Administration (IBA) at 10:30 AM and 3:00 PM London time in U.S. dollars. IBA is an independent subsidiary of the Intercontinental Exchange (ICE) responsible for the end-to-end administration of benchmark prices. They do not buy or sell commodities but manage the transactions and setting rates based on market forces.

To further diversify the market, the LBMA Silver price auction is operated by the CME Group, a Chicago-based market maker, and administered by Thompson Reuters. The London Metals Exchange administers the platinum and palladium price market. Silver auctions are held once per day at noon London time.

Proponents of the new market system touts its stronger oversight and detailed audit trail capabilities to support the new regulations as making this market more trustworthy than the previous system. Detractors wonder if the new electronic system could create market inequities that was seen in U.S. markets with programmed trading.

News reports suggest that the new market operated without problems on its opening day. In fact, the market saw a rise in all metals by the afternoon auction.

Snapshot of the bullion market on March 20, 2015 (static image, will not update)

Since the U.S. Mint sets its price based on the London market, they sent the following note to Authorized Purchases of bullion products on March 18, 2015:

This is to inform you that on Friday, March 20, 2015 the U.S. Mint will start using the LBMA Gold Price (PM) to price and settle all of its gold bullion coin orders. The new gold price replaces the London Gold Fix and will be managed by the ICE Benchmark Administration (IBA). We do not anticipate any transition issues. Moving forward all gold bullion transactions with the United States Mint will utilize the new LBMA Gold Price (PM) in place of the (PM) London Gold Fix.

While the move will make the markets more transparent and possibly open it to more participants, it is uncertain how this will affect the price of metals in the long term. For that, my crystal ball does not compute!

London Metals Exchange market images courtesy of

Mining.comLondon gold price snapshot courtesy of

Kitco.

Feb 7, 2015 | coins, commentary, dollar, legislative, US Mint

“Give ’em hell Harry!”

Case-in-point, Sen. David Vitter (R-LA) introduced S. 95, a bill “[To] Terminate the $1 presidential coin program.” Like the knee jerking to copy and paste old bills, Vitter dusted off his previous attempt (S. 94 in the 113th Congress and S. 1385 in the 112th Congress) and dropped it in the hopper more in an attempt to make it look like he is doing something when all he is doing is annoying collectors.

By anyone’s measure, the Presidential $1 Coin program has not been a success. While it was fundamentally a great idea, the problem with having it gain wider circulation is that congress did not pass the appropriate laws to discontinue printing and distribution of the one dollar Federal Reserve note. When given a choice, people have chosen to carry the note rather than the coin.

In 2011, National Public Radio published a story complete with errors that caused a public outcry. But one aspect of the story was true: because the presidential dollar did not circulate, they were accumulating in the coin storage rooms at the Federal Reserve. When the story went vial, members of congress from both sides of the aisle seemed to fall all over themselves to appear like they were doing something and introduced go-nowhere bills to end the program.

Acting as the only adult in the room, then Secretary of the Treasury Tim Geithner, ordered that the production of all dollar coins, including the Native American dollar, be reduced to levels to only satisfy the collector market unless the Federal Reserve ordered more coins.

Four years later, the U.S. Mint is in the second-to-last year of the program. In 2015, the U.S. Mint is scheduled to release coins honoring Presidents Harry S. Truman, Dwight D. Eisenhower, John F. Kennedy, and Lyndon B. Johnson. In fact, the Kennedy dollar and First Spouse gold coin featuring Jacqueline Kennedy are anticipate being so popular, the U.S. Mint will produce more of those coins including additional of the accompanying Jacqueline Kennedy medals.

At this point, the Presidential Dollar, First Spouse gold coins, and the First Spouse medals are a collector’s series that is near its end. In 2016, the U.S. Mint is scheduled to issue coins in honor of Presidents Richard M. Nixon and Gerald R. Ford. By law, because President Jimmy Carter is still living, he is not allowed to appear on a coin. Even though President Ronald Reagan is deceased, the coins have to be in order making the program end with Ford.

With six coins to go in the series and four years after the fury, why is Vitter introducing this bill now? Costs have been contained with the reduction of circulation. In fact, reviewing the annual reports, the Presidential $1 program has increased in sales as more of the better known 20th Century presidents have been featured.

Rather than leave well enough alone, Vitter joins the others in congress of not thinking and dropping a bill into the hopper that he might think has value to a small percentage of a perceived base but fails to look at the bigger picture. This is part of their collective myopia that keeps congress’s approval ratings in the single digits.

If Vitter did this for show, he has wasted the time of his staff for having to prepare the bill for submitting; he wasted the time and resources of the Senate clerk for having to record the bill; and he wasted the resources that will have to go into the various mechanisms for tracking the bill. Anytime a member of congress wastes resources they are wasting money.

As a federal government employee, Vitter, his staff, and the congressional support services are paid for out of your taxpayer dollars while the U.S. Mint is making more profit by maintain this program than it would otherwise. If members of congress would look beyond any ideology they pretend to profess and engage their brains when they do something like this, then maybe they might find their approval ratings at least higher than the current temperature in Washington, D.C.

Truman dollar image courtesy of the U.S. Mint.

Feb 6, 2015 | bullion, coins, commemorative, commentary, gold, policy, silver, US Mint

Reverse of the 2015 US Marshal Service 225th Anniversary Commemorative Coins

Time and again, we hear that congress wants the government to save money. They want agencies to reduce costs and build efficiencies. How can agencies save money when members of congress introduce legislation that is counter to those goals?

Congress has been told that the U.S. Mint could save money if they standardized gold coins to 24-karat coins and silver to at least .999 fine quality. Aside from making the coins more attractive to more buyers including investors, the U.S. Mint does not have to pay more for someone to “dirty” the metals to create planchets that contain 90-percent of the metals.

Modern manufacturing methods are geared to process mined metals to create purer metals. In order for the gold or silver to be used to make the 90-percent alloy, it has to be dirtied with another metal, such as copper, before creating the planchets. While it makes the metals cheaper, the process increases the costs per planchet because of the extra work involved.

Congress exasperates this problem by not listening to the U.S. Mint and doing a virtual copy-and-paste from previous bills that says $5 gold commemoratives be made from 90-percent gold and silver dollars from 90-percent silver.

Rather than listening to the U.S. Mint, Rep. Sean Maloney (D-NY), or a non-responsive staffer in his office, did a copy-and-paste of previous commemorative bills to introduce the National Purple Heart Hall of Honor Commemorative Coin Act (H.R. 358) that calls for a 90-percent gold $5 coin and a 90-percent silver dollar.

Regardless of how one feels about the use of commemorative coins for fundraising, if congress is going to authorize a commemorative coin, why not allow the U.S. Mint to take advantage to more efficient manufacturing and stop making them dirty the metals?

It is possible that if the U.S. Mint could create commemorative coins worthy of being on par with investor grade coins, not only could they save money in the manufacturing process which could lower the costs of the coins, but they could sell more coins. If the U.S. Mint sells more coins they could collect more of the surcharges to benefit their intended causes.

If congress really cared about saving money and increasing efficiency in the government, members like Rep. Maloney will look beyond rhetoric and actually do something, no matter how simple it is.

Up next, why some members of congress should leave well enough alone!

Image courtesy of the U.S. Mint.

Feb 4, 2015 | coins, policy, silver, US Mint

2015-W American Silver Eagle Proof

Although the price of silver is up from the beginning of the year ($15.71 on January 2 to $17.22 on February 2), the price is down from the $19.94 on January 2, 2014. Silver climbed as high as $22.05 on February 24, 2014 to as low as $15.28 on November 6, 2014. Silver prices have been on a steady climb this year with a recent peak of $18.23 on January 23, 2015.

I attach no meaning to these number except that it has allowed the U.S. Mint to lower the price of silver coins.

The changes that were announced are as follows:

| Product |

2015 Retail price |

| American Eagle One Ounce Silver Proof Coin |

$ 48.95 |

| American Eagle One Ounce Silver Uncirculated Coin |

39.95 |

| Congratulations Set |

50.95 |

| United States Mint Proof Set® |

32.95 |

| United States Mint Uncirculated Set® |

28.95 |

| America the Beautiful Quarters Circulating Coin Set™ |

7.95 |

| Annual Uncirculated Dollar Coin Set |

46.95 |

| America the Beautiful Five- Ounce Silver Uncirculated Coin™ (5 issues) |

149.95 |

This year, the U.S. Mint has started selling the 2015-W American Silver Eagle Proof collectors coin earlier than in previous years. In fact, I have already received my coin.

Feb 3, 2015 | BEP, coins, currency, Federal Reserve, policy, US Mint

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In short, both money production bureaus will be able to withdraw the money from their respective funds to fully support their operations.

Department of the Treasury requested that the BEP be allowed to withdraw $863 million for operations. The BEP have a total outlay of $918 million but will leverage $50 million from their current operating funds to make up the difference. Using projections from the previous years, the BEP anticipates an order for 8.3 billion notes or a 15-percent increase. Of the area that the BEP will be concentrating on includes additional research into anti-counterfeiting methods, make currency more accessible to the visually impaired, and modernizing the production process in Washington, D.C.

The budget does mention that the BEP was given legal authority to print currency for foreign countries with the approval of the State Department in 2005. However, the BEP has yet to be contracted by any country for this service. Many countries appear more interested in using the polymer substrate produced by the Reserve Bank of Australia than continuing to use cotton-fiber paper, which is favored in the United States.

Funding for the U.S. Mint is different in that while the Federal Reserve pays a fixed fee per currency note to the BEP, they pay face value for the coins they purchase from the U.S. Mint. Even though it costs more than face value to produce the one-cent and five-cent coins, the deficit is more than made up on the quarter dollar, the workhorse of the U.S. coin economy.

To fund its $3.59 billion operation, the U.S. Mint will be allowed to withdraw up to $20 million from their Public Enterprise Fund. That appropriation is only a cushion in case there is a shortfall in the anticipated $4.14 billion revenues. Although the U.S. Mint is now being run by Principal Deputy Director Rhett Jeppson, the organization is unlikely to reverse the production improvements implemented by former Deputy Director Richard Peterson.

One notable statement says, “The 2016 Budget includes a proposal to require the silver coins in United States Mint Silver Proof Sets to contain no less than 90 percent silver. Under current law, the half-dollar, quarter-dollar and dime coins in these sets “shall be made of an alloy of 90 percent silver and 10 percent copper.” Allowing the Mint to have flexibility in this composition will improve efficiency in the production process, lowering the costs for these products.” It appears that the U.S. Mint is asking congress to allow them to use another metal than copper while not changing the silver content. With the cost of copper rising to historic levels, using a less expensive metal on a coin that is not intended for circulation could be a cost savings.

While there will be political fireworks over other aspects of the president’s budget, those of us concerned with the money production by the Department of the Treasury can sit back and worry about other issues.

With the court ruling against Joan Langbord and forcing her to surrender the ten 1933 Saint-Gaudens Double Eagle gold coins she claims to have found, there remains only one legally to own 1933 Saint-Gaudens Double Eagle coin.

With the court ruling against Joan Langbord and forcing her to surrender the ten 1933 Saint-Gaudens Double Eagle gold coins she claims to have found, there remains only one legally to own 1933 Saint-Gaudens Double Eagle coin.